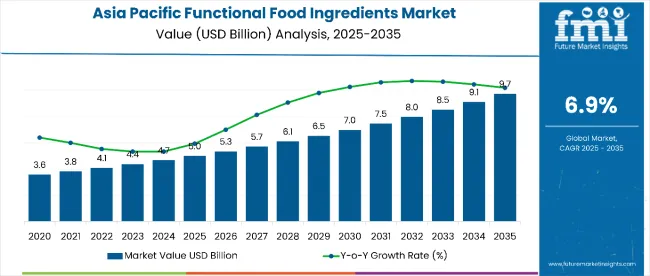

The Asia Pacific functional food ingredients market is projected to grow from USD 5.0 billion in 2025 to USD 9.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.9%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.0 billion |

| Industry Value (2035F) | USD 9.7 billion |

| CAGR (2025 to 2035) | 6.9% |

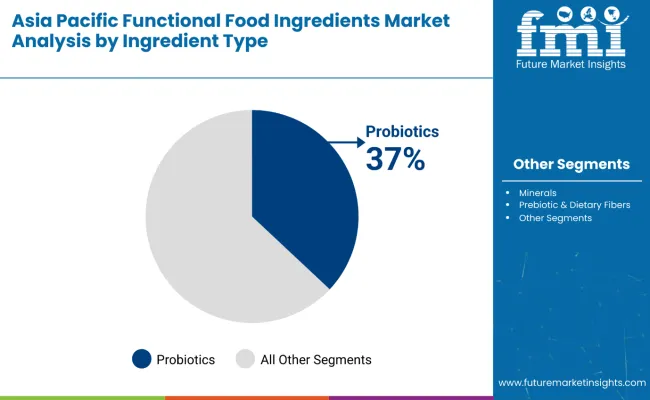

The market is anchored by strong demand in key countries like China, Japan, and India, where rising health consciousness and rapid urbanization fuel consumer interest in functional foods. Probiotics are expected to dominate the ingredient segment with a substantial market share, while bakery and confectionery applications lead among end-use sectors.

The market is estimated to generate an absolute dollar opportunity of USD 4.7 billion over the forecast period, nearly doubling its value in ten years. Growth is steady and spread throughout the decade, supported by expanding middle-class populations embracing healthier lifestyles and nutritional innovations. Key companies such as Cargill, Nestlé, and Kerry Group are actively driving product development centered on probiotics, vitamins, and prebiotic fibers ingredients favored for their functional health benefits.

By 2030, the market is likely to reach around USD 7.0 billion, adding USD 2.0 billion over the first half of the period. The market is projected to add an absolute dollar growth of USD 4.7 billion between 2025 and 2035. Continued momentum is expected into the latter half, with approximately USD 2.7 billion in incremental value driven by new ingredient launches and wider adoption across bakery, dairy, and beverage applications. Innovation around natural bio-actives, clean-label formulations, and ingredient delivery technologies will be critical factors underpinning accelerated growth in the Asia Pacific region.

The market holds approximately 38% of the region’s specialty health ingredients market, driven by increasing consumer awareness of nutrition, preventive healthcare, and demand for natural additives in food and beverages. It accounts for around 30% of the Asia Pacific nutraceutical ingredients market, supported by its key role in immunity-boosting, digestive health, and fortification in daily diets. The market contributes nearly 22% to the region’s overall food ingredients sector, particularly through the expansion of probiotics, vitamins, and functional proteins in bakery, dairy, and beverage categories. Probiotics alone maintain a leading position, representing 37% of ingredient share, reflecting preferences for gut health and active nutrition among consumers in China, Japan, and India.

The market is undergoing dynamic structural change driven by the need for clean-label products, new bioactive ingredient launches, and tailored solutions for different age groups and health priorities. Advanced formulation techniques such as microencapsulation and fermentation are enabling ingredient suppliers to enhance efficacy, stability, and consumer appeal, replacing synthetic additives with naturally derived alternatives. Leading companies are investing in new research, strategic regional partnerships, and regulatory compliance to launch differentiated ingredients that address digestive, metabolic, and cognitive health segments.

The market is growing due to increasing consumer awareness of health and wellness, coupled with a rising preference for natural and functional ingredients in everyday diets. Ingredients like probiotics, vitamins, and prebiotic fibers offer proven benefits for digestive health, immunity, and overall well-being, making them attractive alternatives to artificial additives in food and beverage products. Rapid urbanization, rising disposable incomes, and a shift toward preventive healthcare are key factors driving this demand across countries like China, Japan, and India.

Innovation in formulation technologies, such as microencapsulation and fermentation, is enhancing the stability, bioavailability, and sensory appeal of functional ingredients, promoting broader adoption in bakery, dairy, beverages, and confectionery segments. Additionally, the growing trend toward clean-label and plant-based products encourages manufacturers to develop formulations that align with consumer desire for transparency and natural origin. These dynamics are fueling product diversification and market expansion in the region.

As health-conscious consumers increasingly seek effective nutrition solutions, and regulatory frameworks evolve to support ingredient safety and efficacy, the market outlook remains strongly positive. Leading companies are investing in research, regional partnerships, and quality certifications to deliver advanced functional food ingredients that meet diverse health needs, ensuring sustained growth and innovation across the Asia Pacific functional food ingredients market.

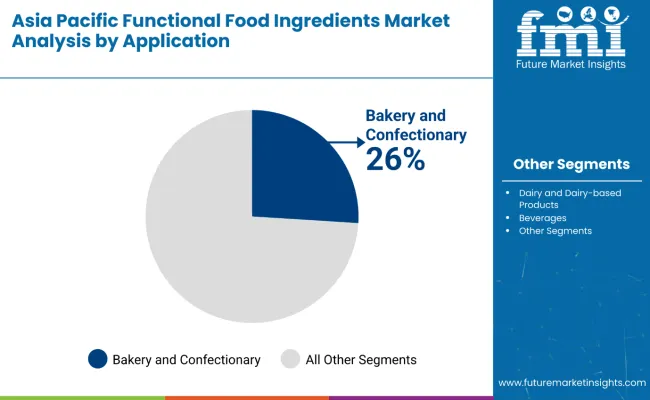

The market is segmented by ingredient type and application. By ingredient type, the market is divided into vitamins, minerals, prebiotic & dietary fibers, probiotics, carotenoids, proteins, and omega-3 fatty acids. Based on application, the market is categorized into beverages, dairy and dairy-based products, bakery and confectionery.

The probiotics segment holds a leading 37% share in the ingredient category, driven by increasing consumer focus on gut health and digestive wellness across the Asia Pacific region. Probiotics are favored for their proven benefits in enhancing immunity and overall well-being, with widespread applications in functional foods and beverages. The segment benefits from growing awareness of microbiome science and rising demand for natural, clean-label health solutions. Manufacturers are expanding probiotic strains and delivery formats to meet diverse consumer needs in key markets like China, Japan, and India.

The probiotics segment is also witnessing innovation through the development of tailored probiotic formulations targeting specific health concerns such as digestive balance, immune support, and mental well-being. Advances in strain-specific research and technology enhance the efficacy and stability of probiotic products, expanding their use beyond traditional dairy-based applications into beverages, supplements, and bakery products.

The bakery and confectionery segment holds a significant 26% share of the Asia Pacific functional food ingredients market, establishing it as one of the leading application areas. This growth is primarily driven by rising consumer demand for healthier and more nutritious snack options that align with evolving health and wellness trends. Functional ingredients such as probiotics, vitamins, prebiotic fibers, and antioxidants are increasingly incorporated into bakery and confectionery products to enhance their nutritional profile and offer added health benefits. Consumers are seeking these products as convenient, tasty alternatives that contribute to digestive health, immunity, and overall well-being.

Innovation in formulation, including clean-label and plant-based options, is further expanding the market, attracting health-conscious buyers interested in transparent sourcing and natural ingredients. Moreover, growing urbanization and busy lifestyles encourage the consumption of functional baked goods and snacks that combine indulgence with health. This dynamic environment positions the bakery and confectionery segment as a vital driver of the Asia Pacific functional food ingredients market’s ongoing expansion.

From 2025 to 2035, the Asia Pacific functional food ingredients market is expected to grow significantly, driven by increased consumer demand for natural, health-promoting food products. Food manufacturers in the region are adopting advanced formulation and delivery technologies that improve the bioavailability and efficacy of functional ingredients like probiotics, vitamins, and omega-3 fatty acids. This trend positions ingredient suppliers offering high-purity, standardized functional food additives as key partners in supporting product innovation and meeting regulatory requirements for safety and efficacy.

Rising Innovation Drives Growth in the Asia Pacific Functional Food Ingredients Market

The steady rise in research and development focused on nutrition science and health-enhancing food formulations is a key driver for growth in the Asia Pacific functional food ingredients market. In recent years, advancements in ingredient technology, such as microencapsulation and fermentation, have allowed manufacturers to deliver enhanced bioavailability and targeted health benefits through fortified foods and beverages. By 2025, companies in the region are expected to further innovate ingredient delivery systems and formulate advanced functional products to meet increasing consumer demand for effective and convenient nutrition solutions.

Advanced Ingredient Delivery and Formulation Technologies Create Expansion Opportunities

In 2024, food manufacturers began integrating cutting-edge encapsulation and stabilization technologies with functional ingredients like probiotics, vitamins, and dietary fibers to improve product efficacy and shelf life. By 2025, these advanced formulations are becoming mainstream in the Asia Pacific market, enabling personalized nutrition and targeted wellness benefits. Such innovations not only enhance consumer acceptance and health outcomes but also position manufacturers to capture premium market segments, gain regulatory approvals, and establish a competitive edge in the fast-evolving functional food landscape across Asia Pacific.

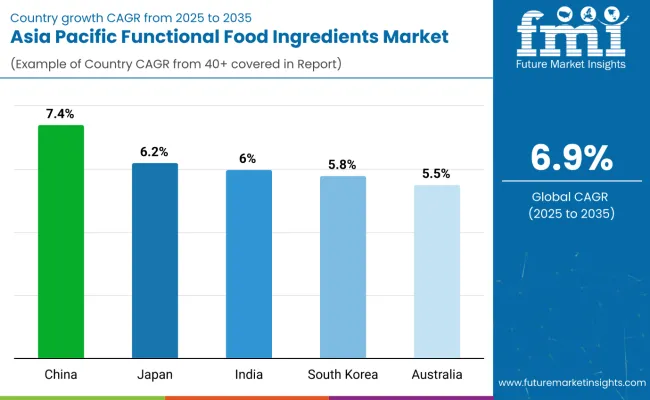

| Countries | CAGR (%) |

|---|---|

| China | 7.4 |

| Japan | 6.2 |

| India | 6.0 |

| South Korea | 5.8 |

| Australia | 5.5 |

In the Asia Pacific functional food ingredients market, China leads with the highest CAGR of 7.4%, driven by rapid urbanization, a growing middle class, and strong government support focused on food safety and preventive healthcare. India follows closely with a robust CAGR of 6.0%, fueled by expanding production capacity, rising incomes, and increasing consumer health awareness, especially in tier 2 and 3 cities. Japan and South Korea demonstrate steady growth with CAGRs of 6.2% and 5.8%, respectively, supported by aging populations, advanced ingredient technologies, and government initiatives promoting wellness foods. Australia, with a CAGR of 5.5%, experiences the slowest growth among these key markets but benefits from a well-established manufacturing sector and strong demand for natural and clean-label products.

Revenue from functional food ingredients in India is witnessing significant growth with a strong CAGR of 6.0%, driven by urbanization, rising income levels, and heightened health awareness. The country is rapidly expanding its production capacity, supported by government initiatives promoting nutrition and local ingredient sourcing. Manufacturers are investing heavily in R&D to develop new probiotic and vitamin-enriched products tailored to Indian consumer preferences. The growth of modern retail and e-commerce platforms is improving market penetration, making functional ingredients more accessible. Demand is particularly strong in dairy and bakery applications, with rising consumption in tier 2 and 3 cities. Regional players are gaining prominence alongside global companies like Cargill and Nestlé. Additionally, increasing exports of functional ingredients add to capacity expansion efforts, positioning India as a key production hub in Asia Pacific.

Sales of functional food ingredients in China are characterized by rapid output growth and a strong CAGR of 7.4%, fueled by rising consumer interest in preventive health and nutrition. Significant investments in production infrastructure and innovation have propelled China to become a central hub for ingredient manufacturing and distribution. E-commerce platforms and urbanization facilitate product accessibility, enabling functional foods fortified with probiotics, vitamins, and omega-3 fatty acids to reach a broad audience. Government policies focused on food safety and nutritional enhancement further support market expansion. Leading global and local companies such as Kerry Group and DSM are intensifying efforts to develop high-quality, standardized ingredients. The expanding middle class and aging population are key demand drivers, encouraging continuous product innovation and capacity scaling.

Demand for functional food ingredients in Japan shows steady growth with a stable CAGR of 6.2%, supported by structural adoption of advanced ingredient technologies. The aging population’s focus on wellness and immune health drives demand for customized, science-backed functional foods and supplements. Japan boasts highly regulated food safety standards that ensure premium quality products, fostering consumer trust. Innovation in ingredient extraction and formulation techniques, such as fermentation and microencapsulation, enhances bioavailability and product stability. This has resulted in broad integration of functional ingredients across dairy products, beverages, and bakery goods. Key players like Ajinomoto and Nestlé have invested in specialized R&D centers to develop targeted products. Collaboration among research institutes, government, and industry fosters continued market maturity and expansion.

Revenue from functional food ingredients in South Korea is growing steadily with a CAGR of 5.8%, driven by increasing health consciousness and government initiatives promoting functional foods. The country is focusing on innovation in ingredient formulations and new product launches to meet consumer demand for digestive health, immunity, and beauty-enhancing foods. The retail landscape, including e-commerce expansion, supports growing product availability and market penetration. Domestic companies, alongside global players, are elevating production capacity and investing in advanced technologies such as fermentation and encapsulation. Regulatory support further facilitates market expansion, making South Korea a key player in the region.

Demand for functional food ingredients in Australia is advancing with a CAGR of 5.5%, supported by consumer demand for natural, organic, and clean-label products. The country benefits from a well-established food manufacturing sector that emphasizes sustainability and health-oriented innovation. Functional ingredients like probiotics, vitamins, and omega-3 fatty acids are widely incorporated into bakery, dairy, and beverage categories. Robust regulatory frameworks ensure safety and quality standards, boosting consumer confidence. Expansion of retail channels, including health stores and e-commerce, further drives product accessibility. Industry collaborations and research initiatives are accelerating new product development and capacity growth.

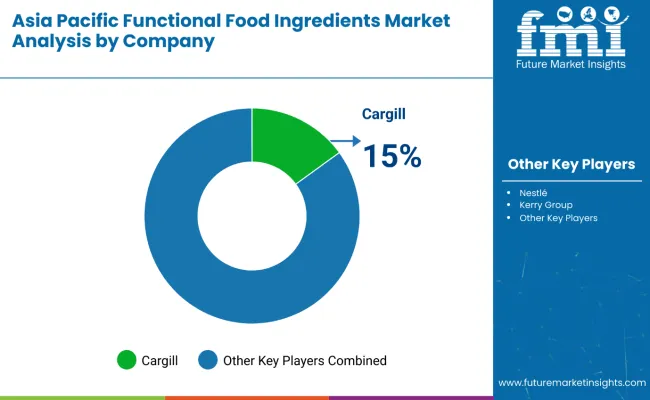

The market is moderately consolidated, characterized by a mix of global ingredient suppliers and strong regional players specializing in formulation innovation and application versatility. Leading multinational companies such as Cargill, Kerry Group, Nestlé, and DSM dominate the market with broad portfolios including probiotics, vitamins, dietary fibers, and omega-3 fatty acids. Their strengths lie in advanced R&D capabilities, regulatory compliance, and efficient supply chains that cater to both pharmaceutical-grade and consumer food applications.

Regional companies like Ajinomoto, Vitasoy, and local manufacturers emphasize market-specific product development, offering tailored formulations that meet cultural preferences and regulatory requirements. These players leverage deep domestic insights to sustain consistent quality and competitive pricing in fast-growing markets such as China, India, Japan, and South Korea.

High entry barriers persist due to stringent government regulations, the need for high-purity ingredients, and the technical complexity of functional formulations. Competitive advantage is increasingly linked to innovation, proven health benefits, certification compliance, and the ability to scale production sustainably across diverse application sectors in Asia Pacific.

| Item | Value/Details |

|---|---|

| Quantitative Units (2025) | USD 5.0 billion |

| Type | Vitamins, Minerals, Prebiotic & Dietary Fibers, Probiotics, Carotenoids, Proteins, Omega-3 Fatty Acids |

| By Application | Beverages, Dairy and Dairy-based Products, Bakery and Confectionery |

| Countries Covered | China, Japan, India, South Korea, and Australia |

| Top Companies Profiled | Archer Daniels Midland Company, BASF SE, Cargill Incorporated, Arla Foods Ingredients Group P/S, E. I. DuPont De Nemours and Company, Kerry Group PLC, Corbion N.V, Tate & Lyle PLC, AkzoNobel N.V., Jungbunzlauer Suisse AG, Ingredion Inc., Koninklijke DSM N.V., APAC Specialty Ingredients (M) Sdn. Bhd. (GSI), Supreem Pharmaceuticals Mysore Pvt. Ltd., Bio Actives Japan Corporation, FENCHEM BIOTEK LTD |

| Additional Attributes | Increased consumer focus on preventive health, growing demand for digestive and immune support, ongoing clean-label and plant-based innovation, rapid expansion of e-commerce in food and nutrition products, supportive regulatory frameworks, targeted marketing toward urban and aging populations |

The global Asia Pacific functional food ingredients market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the Asia Pacific functional food ingredients market is projected to reach USD 9.4 billion by 2035.

The Asia Pacific functional food ingredients market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in Asia Pacific functional food ingredients market are probiotics, vitamins, minerals, prebiotic & dietary fibers, carotenoids, proteins and omega-3 fatty acids.

In terms of application, bakery and confectionary segment to command 35.0% share in the Asia Pacific functional food ingredients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Asia Pacific Tartrazine Market Analysis – Trends, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA