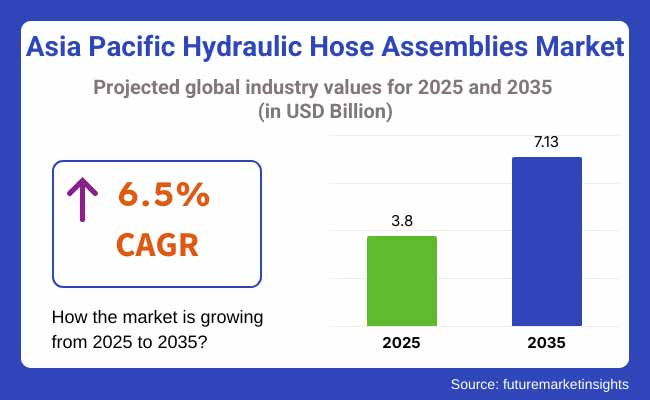

The Asia Pacific hydraulic hose assemblies industry is valued at USD 3.8 billion in 2025. According to FMI’s analysis, Asia Pacific hydraulic hose assemblies market will grow at a CAGR of 6.5% and reach USD 7.13 billion by 2035. Growing demand in construction, mining, and defense industries will propel growth. Higher automation, mechanized farming, and the use of IoT-enabled hydraulic systems will additionally support industry growth.

In 2024, the Asia Pacific hydraulic hose assemblies industry witnessed strong growth due to rapid pace of infrastructure projects, increased vehicle manufacturing, and growing automation in construction and mining industries.

Flexible, high-performance hydraulic hoses saw increased demand as industries demanded long-lasting and efficient fluid power solutions. Smart hydraulic systems picked up pace with IoT-enabled monitoring for predictive maintenance.

Moving forward in 2025, the growing adoption of automation in manufacturing, agriculture mechanization, and increased safety standards will drive demand. Pressure for lightweight, high-pressure-resistant hoses will be ongoing, to meet industries needing increased durability.

With growing digitalization and adoption of smart technology, hydraulic hose assemblies will advance, providing efficiency, reliability, and longevity to fluid transmission systems

The Asia Pacific hydraulic hose assemblies industry is following a robust growth path, propelled by growing construction, mining, and automation technologies. Rising infrastructure projects, mechanized farming, and IoT incorporation are generating new prospects, favoring producers concentrating on high-performance and intelligent hydraulic systems.

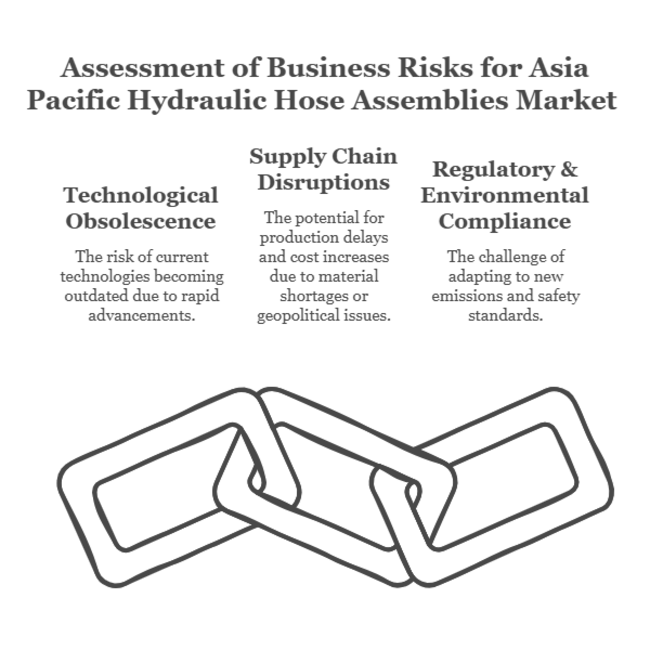

Rapid technological development in automotive and industrial equipment can pose threats to obsolete assemblies, pushing companies to innovate and remain competitive.

Invest in Intelligent & Long-Lasting Hydraulic Solutions

Firms need to focus on R&D of lightweight, high-pressure-resistant hoses with IoT-based monitoring to improve efficiency and enable predictive maintenance.

Align with Automation & Infrastructure Expansion

Growing construction, mining, and mechanized agriculture industries need tailored, high-performance assemblies, so flexibility to changing industry needs is essential.

Bolster Supply Chain & Strategic Alliances

Building strong distribution networks, local manufacturing centers, and partnerships with OEMs will guarantee quicker delivery, cost savings, and competitiveness.

| Risk | Probability & Impact |

|---|---|

| Technological Obsolescence - Quick advances in automation and industrial equipment could make current hydraulic hose assemblies obsolete. | High Probability, High Impact |

| Supply Chain Disruptions - Shortages in raw materials, geopolitical tensions, or logistical congestion may slow production and raise costs. | Medium Probability, High Impact |

| Regulatory & Environmental Compliance - More stringent emissions and safety standards can necessitate expensive adjustments in production processes. | Medium Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Regulatory Disruption Preparedness | Create a task force to monitor changing safety and environmental laws to stay compliant and acquire required certifications. |

| Supply Chain Shockproofing & Cost Mastery | Build supplier alliances and make investments in regional manufacturing facilities to minimize dependence on volatile raw material availability. |

| Tech-Driven Industry Domination | Speed up the use of smart hydraulic systems with IoT-based monitoring to enhance efficiency, safety, and predictive maintenance. |

To stay ahead, companies need to adopt intelligent hydraulic solutions, strengthen supply chains, and align with changing industry needs. Spending on IoT-based monitoring, high-durability materials, and automation-influenced designs will propel long-term competitiveness.

Regional production network strengthening will offset supply chain disturbances, while ahead-of-time compliance with regulatory changes ensures smooth industry growth. The strategy must concentrate on innovation, resilience, and strategic alliances to leverage the expanding demand for high-performance hydraulic assemblies.

The Asia Pacific hydraulic hose assemblies industry is poised for strong growth, with hydraulic hoses leading the sector.

According to FMI, hydraulic hose sales are estimated to hold leading market share, owing to their high usage in construction, mining, automotive, and industrial sectors. Spiral wire and braided hydraulic hose demand will rise due to their superior durability and pressure resistance.

Further, thermoplastic and textile-reinforced hoses will become more popular for flexible and lightweight applications. Assemblies such as fittings, adapters, seals, and protective sleeves will continue to play a vital role in providing leak-proof and effective hydraulic systems.

The increasing demand for sophisticated fluid transmission solutions will drive manufacturers towards high-performance and durable assemblies, complementing greater automation and safety regulations. Firms with an emphasis on intelligent hydraulic technologies and tailored solutions will have a competitive advantage in the changing scenario.

Rubber hydraulic hose assemblies will remain dominant, with a nearly 55% market share in 2035, as per FMI estimates. Rubber hoses are preferred due to their high degree of flexibility, resistance to very high and very low temperatures, and better resistance to pressure.

They are perfectly suited for industrial, mining, and construction activities. Thermoplastic hoses will experience consistent growth due to their light weight, corrosion resistance, and compatibility for high-performance usage. Metal-hydraulic hoses will continue to find application in industries needing high strength and endurance against harsh environments like oil & gas and aerospace.

With growing demand for sustainability, producers will pursue green alternatives and recyclable options to keep pace with regulatory changes. Increased demand for specialized hydraulic solutions will foster innovation in material science, resulting in hoses with improved longevity, efficiency, and safety features for multiple industrial uses.

Growing construction, mining, and agricultural activities will push hydraulic hose assemblies' demand in Asia Pacific. Construction will experience rising adoption as urbanization, smart cities, and mega-sized infrastructure developments pick up. Agriculture will experience growth in the use of hydraulic hoses as mechanized farming and precision agriculture methods become common.

Mining activities will be dependent on high-pressure hydraulic systems for boosting productivity and safety. In oil & gas, the deepwater drilling and offshore exploration trends of the industry will open new avenues for hydraulic hose producers.

Automotive demand will continue to be robust as electric and hybrid cars adopt sophisticated hydraulic systems. Material handling, aerospace, and marine sectors will also play their part in driving industry growth, pushed by the increasing demand for effective hydraulic solutions in multiple operating environments. Businesses that specialize in sector-specific innovation and regulatory alignment will achieve sustained growth.

The sector for ultra-high-pressure and high-pressure hydraulic hose assemblies will grow, fueled by growing needs for efficient and robust fluid transfer systems. Mining, construction, and oil & gas industries will depend on the high-pressure hose to support extreme operating conditions.

Medium-pressure hoses will continue to be important for agriculture, material handling, and industrial automation where controlled hydraulic flow is important. The increasing demand for ultra-high-pressure hydraulic hoses in heavy-duty machines and offshore environments will compel manufacturers to develop high-performance, wear-resistant materials.

Low-pressure hydraulic hoses, on the other hand, will be used in cooling, lubrication, and low-intensity industrial processes. Organizations that invest in research and development to increase durability, efficiency, and safety levels will remain competitive in an environment where industries are constantly looking for high-performance hydraulic solutions to maximize operational efficiency.

China's hydraulic hose assemblies industry is growing fast with massive industrialization, urbanization, and infrastructure growth. The nation's aggressive drive towards automation, intelligent manufacturing, and high-performance equipment is fueling demand for sophisticated hydraulic systems.

Government policies for industrial modernization and sustainability, including the "Made in China 2025" program, also influence the industry. The construction, mining, and agricultural industries are major users of hydraulic hose assemblies, with rising mechanization driving consistent demand.

Volatile raw material prices and environmental regulations are a challenge, though. FMI forecasts that China’s hydraulic hose assemblies industry will grow at a CAGR of 7.2% from 2025 to 2035.

The hydraulic industry of Japan is dominated by the high precision engineering, high quality standards, and deep technology development. The industrial base of the country is highly mechanized with the help of robots, machinery, etc., in the fields of manufacturing, automotive, and heavy engineering industries.

The demand in Japan for hydraulic hose assemblies is propelled by the increasing implementation in hydraulic systems of efficiency, reliability, and durability. The automotive sector, especially hybrids and electric, drives product innovation in this domain.

Firms are investing in compact, powerful hydraulic solutions suited for space-saving applications. FMI predicts that Japan’s hydraulic hose assemblies industry will grow at a CAGR of 5.8% from 2025 to 2035.

South Korea's hydraulic hose assemblies sector is expanding with its robust industrial foundation, high-tech manufacturing capacity, and investment in smart factories.

The automotive, shipbuilding, and heavy machinery sectors are key consumers, with rising usage of automation and robotics further boosting demand. South

Korea is also a front-runner in high-precision hydraulic components for semiconductor production and renewable energy projects.

Government support towards industrial modernization and green initiatives is prompting businesses to create more environmentally friendly and efficient hydraulic solutions. Supply chain interference and reliance on foreign raw material imports are the dampening factors.

FMI forecasts that South Korea’s hydraulic hose assemblies industry will grow at a CAGR of 6.0% from 2025 to 2035.

Indian industry is growing fast with the development of infrastructure, industrial automation, and agricultural mechanization. Initiatives by the government like "Make in India" and big infrastructure projects like the development of smart cities, roads, and metro lines are contributing to demand increase.

The increasing dependence of agriculture on hydraulic machinery is also supporting industry growth. The growth in domestic manufacturing as well as foreign investment in heavy industries is additionally fueling growth in the sector.

The construction and mining industries are also key drivers of hydraulic hose uptake. FMI predicts that India’s hydraulic hose assemblies industry will grow at a CAGR of 7.5% during the forecast period.

Thailand's hydraulic hose assemblies market is seeing consistent growth, led by its automotive and construction industries.

Thailand is a leading automotive production center in Southeast Asia, and the country's automotive demand for hydraulic systems in car manufacturing and industrial equipment is strong. Infrastructure projects such as highways, smart cities, and energy projects are also driving demand.

However, pressure from low-cost regional competitors as well as import dependency on raw materials affects cost profiles.

Being ASEAN's most important base for exports reinforces industry development further. FMI forecasts that Thailand’s hydraulic hose assemblies industry will grow at a CAGR of 6.3% from 2025 to 2035, driven by its expanding manufacturing ecosystem.

The industry for Vietnam is experiencing accelerated growth, buoyed by rising industrialization, manufacturing growth, and infrastructure developments. The nation's status as an emerging manufacturing base for electronics, textiles, and heavy machinery is fueling demand for hydraulic components.

Furthermore, the government's focus on mechanizing agriculture is propelling the use of hydraulic-powered machinery in agriculture. Foreign direct investment in Vietnam's industry continues to influence industry dynamics, with multinational players establishing production facilities.

With a fast-growing economy and an expanding manufacturing base, FMI predicts that Vietnam’s hydraulic hose assemblies industry will grow at a CAGR 6.7% of from 2025 to 2035.

The Indonesian hydraulic industry is growing on the back of increasing investments in infrastructure, mining, and industrial automation. Big-ticket government-sponsored projects in transportation, energy, and building and construction are key demand drivers.

Indonesia's increasing mining industry, especially in coal and minerals, also takes a substantial share in the consumption of hydraulic hoses. Logistical issues, regulatory risks, and volatile raw material prices, however, affect the growth of the industry.

As industrial modernization and energy-efficient equipment gain more importance, Indonesia's demand for high-performance hydraulic solutions is likely to grow. FMI forecasts that Indonesia’s hydraulic industry will grow at a CAGR of 6.4% from 2025 to 2035, driven by ongoing industrial expansion and infrastructure projects.

The industry of Malaysia is expanding, driven by its robust industrial sector and government policies encouraging automation and energy-efficient production. The construction, oil & gas, and manufacturing industries are major drivers of demand.

As Malaysia emerges as a regional trade and industrial center, hydraulic systems are increasingly being used in industrial equipment and transportation.

For competitiveness, domestic companies are focusing on product distinction and innovation. With increasing industrial activities and infrastructure upgrades, FMI predicts that Malaysia’s hydraulic hose assemblies industry will grow at a CAGR of 6.1% from 2025 to 2035.

Rest of Asia Pacific constitutes emerging and developing economies with differentiated industrialization levels and infrastructure progress. Most economies in this section are experiencing higher investments in building, manufacturing, and farming activities, which serve as the fundamental drivers of the adoption of hydraulic hoses.

Evolving trade accords and inward foreign investments continue to influence the dynamics of industries. Nevertheless, uneven regulatory measures, restricted in-country manufacturing expertise, and intensive import dependency constitute challenges.

Firms in these locations are emphasizing local production and cost-effective measures for tapping sector potential. FMI forecasts that the hydraulic hose assemblies industry in the Rest of Asia Pacific will grow at a CAGR of 6.0% from 2025 to 2035, reflecting diverse economic conditions and industrial growth patterns.

Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, and end-users in China, India, Japan, South Korea, and Australia.

Compliance with Safety & Performance Standards:

Durability & Pressure Ratings:

71% highlighted the demand for ultra-high-pressure and high-pressure hoses to supply hydraulic equipment in heavy-duty applications.

Regional Variances:

High Variance in Adoption:

Return on Investment Views:

Consensus on Rubber Supremacy:

Regional Diversity in Material Selection:

Increasing Costs of Raw Materials as a Global Issue:

Price Trends in Regions:

Pain Points of Manufacturers:

Pain Points of Distributors:

End-Users' Pain Points:

Alignment across Asia Pacific:

Regional Divergence:

Varied Regulatory Pressures:

High Consensus:

Key Differences:

Strategic Insight:

| Countries | Regulatory Impact & Certifications |

|---|---|

| China | "Made in China 2025" requires environmentally friendly, high-performance hydraulic systems. GB standards control quality and safety. |

| Japan | JIS standards guarantee durability. Compact and energy-efficient designs are given importance for automation development. |

| South Korea | KOSHA safety standards are used. Incentives from the government favor smart factories and sophisticated hydraulics. |

| India | BIS certification is obligatory. "Make in India" policy increases local production; stringent pollution norms are used. |

| Thailand | TIS standards control safety. Infrastructure projects create demand, while green policies compel low-emission products. |

| Vietnam | Conformity to ISO and CE standards is necessary for exports. Automation policies promote modernization. |

| Indonesia | SNI certification is necessary. Import restrictions promote domestic production. |

| Malaysia | DOSH regulations guarantee workplace safety. Incentives promote automation and green technology use. |

| Rest of Asia Pacific | Most nations adhere to ISO and CE standards, with trade agreements influencing conformity. |

The domain for industrial hose assemblies is dispersed with many global and regional players. The companies compete based on competitive pricing, ongoing innovation, strategic alliances, and geographical expansion to enhance their industrial positions.

In February 2024, Gates Corporation launched the Clean Master Plus hose platform, which is intended for high-pressure use in demanding industrial applications. The new hose can withstand pressures of up to 6,000 psi, with a 22% weight reduction and 50% greater flexibility than current 6,000 psi hoses. These features are intended to enhance ergonomics, improve safety, minimize worker fatigue, and increase productivity.

During last years , Parker Hannifin's Polymer Hose Division Europe introduced the 85CE-PDP crimper power unit to extend its line of portable crimper power units. The unit offers a cost-effective and portable way of crimping hoses without the need for power or air supplies, making it ideal for application in agriculture, forestry, construction, and mobile hydraulic systems. The 85CE-PDP is compatible with any commercially purchased cordless screwdriver, increasing its applicability in different uses.

Market Share Analysis

Hydraulic Hose-(Spiral Wire Hydraulic Hoses, Braided Hydraulic Hoses, Others (Thermoplastic Hydraulic Hoses, Textile Reinforced Hydraulic Hoses, etc.)),Assemblies-(Fittings, Adapters, O-Rings and Seals, Clamps, Protective Sleeves, Other

Hydraulic Hose-(Rubber, Thermoplastic, Metal, Others), Assemblies

Construction, Agriculture, Mining, Material Handling, Oil and Gas, Automotive, Others (Marine, Aerospace, etc.)

Low-Pressure (Up to 300 psi), Medium Pressure (300 to 3,000 psi), High Pressure (3,000 to 10,000 psi), Ultra High Pressure (> 10,000 psi)

China, Japan, South Korea, India, Thailand, Vietnam, Indonesia, Malaysia, Rest of Asia Pacific

Growing demand from agriculture, mining, and construction, as well as innovation and integration of automation and IoT, is driving growth.

Firms are turning to lightweight, high-strength materials, intelligent hose technology, and sustainability to improve performance and regulatory compliance.

Tighter environmental and safety regulations are compelling manufacturers to go green using environmentally friendly materials and make their products more reliable.

Increased use of AI-based monitoring, automated crimping technology, and efficient fluid transfer is transforming industrial applications.

Increased raw material prices, supply chain interruption, and the necessity of ongoing innovation to keep pace with changing end-user needs continue to be major challenges.

Table 01: Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 02: Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 03: Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 04: Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 05: Asia Pacific Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 06: Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 07: Asia Pacific Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 08: Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 09: Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 10: Asia Pacific Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 11: Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 12: Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Region

Table 13: Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Region

Table 14: Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Region

Table 15: China Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 16: China Market Volume (‘000 meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 17: China Market Volume (‘000 units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 18: China Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 29: China Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 20: China Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 21: China Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 22: China Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 23: China Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 24: China Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 25: China Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 26: China Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 27: China Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 28: China Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 29: Japan Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 30: Japan Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 31: Japan Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 32: Japan Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 33: Japan Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 34: Japan Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 35: Japan Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 36: Japan Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 37: Japan Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 38: Japan Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 39: Japan Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 40: South Korea Size (US$ Million) and Volume (Units) Analysis and Forecast By Country, 2018 to 2033

Table 41: South Korea Market Volume (‘000 meters) Analysis and Forecast By Country, 2018 to 2033

Table 42: South Korea Market Volume (‘000 units) Analysis and Forecast By Country, 2018 to 2033

Table 43: South Korea Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 44: South Korea Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 45: South Korea Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 46: South Korea Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 47: South Korea Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 48: South Korea Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 49: South Korea Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 50: South Korea Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 51: South Korea Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 52: South Korea Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 53: South Korea Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 54: India Size (US$ Million) Analysis and Forecast By Country, 2018 to 2033

Table 55: India Market Volume (‘000 meters) Analysis and Forecast By Country, 2018 to 2033

Table 56: India Market Volume (‘000 units) Analysis and Forecast By Country, 2018 to 2033

Table 57: India Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 58: India Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 59: India Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 60: India Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 61: India Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 62: India Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 63: India Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 64: India Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 65: India Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 66: India Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 67: India Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 68: Thailand Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 69: Thailand Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 70: Thailand Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 71: Thailand Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 72: Thailand Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 73: Thailand Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 74: Thailand Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 75: Thailand Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 76: Thailand Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 77: Thailand Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 78: Thailand Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 79: Vietnam Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 80: Vietnam Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 81: Vietnam Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 82: Vietnam Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 83: Vietnam Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 84: Vietnam Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 85: Vietnam Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 86: Vietnam Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 87: Vietnam Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 88: Vietnam Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 89: Vietnam Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 90: Indonesia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 91: Indonesia Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 92: Indonesia Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 93: Indonesia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 94: Indonesia Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 95: Indonesia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 96: Indonesia Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 97: Indonesia Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 98: Indonesia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 99: Indonesia Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 100: Indonesia Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 101: Malaysia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 102: Malaysia Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 103: Malaysia Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 104: Malaysia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 105: Malaysia Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 106: Malaysia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 107: Malaysia Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 108: Malaysia Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 109: Malaysia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 110: Malaysia Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 111: Malaysia Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 112: Rest of Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 113: Rest of Asia Pacific Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Product Type

Table 114: Rest of Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 115: Rest of Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 116: Rest of Asia Pacific Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material Type

Table 117: Rest of Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 118: Rest of Asia Pacific Market Volume ('000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 119: Rest of Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Users

Table 120: Rest of Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 121: Rest of Market Volume (‘000 Meters) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Table 122: Rest of Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Pressure Type

Figure 01: Market Historical Demand, 2018 to 2022

Figure 02: Market Demand Forecast, 2023 to 2033

Figure 03: Market Historical Demand, 2018 to 2022

Figure 04: Market Demand Forecast, 2023 to 2033

Figure 05: Market Historical Value (US$ Million), 2018 to 2022

Figure 06: Market Value (US$ Million) Forecast, 2023 to 2033

Figure 07: Market Absolute $ Opportunity, 2023 to 2033

Figure 08: Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 09: Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 10: Market Attractiveness by Product Type, 2023 to 2033

Figure 11: Asia Pacific Incremental $ Opportunity by Product Type, 2023 to 2033

Figure 12: Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 13: Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 14: Market Attractiveness by Material Type, 2023 to 2033

Figure 15: Asia Pacific Incremental $ Opportunity by Material Type, 2023 to 2033

Figure 16: Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 17: Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 18: Market Attractiveness by End Users, 2023 to 2033

Figure 19: Asia Pacific Incremental $ Opportunity by End Users, 2023 to 2033

Figure 20: Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 21: Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 22: Market Attractiveness by Pressure Type, 2023 to 2033

Figure 23: Asia Pacific Incremental $ Opportunity by Pressure Type, 2023 to 2033

Figure 24: Market Share and BPS Analysis By Region- 2023 & 2033

Figure 25: Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 26: Market Attractiveness By Region, 2023 to 2033

Figure 27: Asia Pacific Incremental $ Opportunity by Region, 2023 to 2033

Figure 28: China Market Share and BPS Analysis by Country - 2023 & 2033

Figure 29: China Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 30: China Market Attractiveness by Country, 2023 to 2033

Figure 31: China Market Incremental $ Opportunity By Country, 2023 to 2033

Figure 32: China Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 33: China Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 34: China Market Attractiveness by Product Type, 2023 to 2033

Figure 35: China Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 36: China Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 37: China Market Attractiveness by Material Type, 2023 to 2033

Figure 38: China Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 39: China Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 40: China Market Attractiveness by End Users, 2023 to 2033

Figure 41: China Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 42: China Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 43: China Market Attractiveness by Pressure Type, 2023 to 2033

Figure 44: Japan Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 45: Japan Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 46: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 47: Japan Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 48: Japan Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 49: Japan Market Attractiveness by Material Type, 2023 to 2033

Figure 50: Japan Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 51: Japan Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 52: Japan Market Attractiveness by End Users, 2023 to 2033

Figure 53: Japan Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 54: Japan Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 55: Japan Market Attractiveness by Pressure Type, 2023 to 2033

Figure 56: South Korea Market Share and BPS Analysis by Country - 2023 & 2033

Figure 57: South Korea Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 58: South Korea Market Attractiveness by Country, 2023 to 2033

Figure 59: South Korea Market Incremental $ Opportunity By Country, 2023 to 2033

Figure 60: South Korea Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 61: South Korea Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 62: South Korea Market Attractiveness by Product Type, 2023 to 2033

Figure 63: South Korea Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 64: South Korea Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 65: South Korea Market Attractiveness by Material Type, 2023 to 2033

Figure 66: South Korea Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 67: South Korea Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 68: South Korea Market Attractiveness by End Users, 2023 to 2033

Figure 69: South Korea Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 70: South Korea Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 71: South Korea Market Attractiveness by Pressure Type, 2023 to 2033

Figure 72: India Market Share and BPS Analysis by Country - 2023 & 2033

Figure 73: India Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 74: India Market Attractiveness by Country, 2023 to 2033

Figure 75: India Market Incremental $ Opportunity By Country, 2023 to 2033

Figure 76: India Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 77: India Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 78: India Market Attractiveness by Product Type, 2023 to 2033

Figure 79: India Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 80: India Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 81: India Market Attractiveness by Material Type, 2023 to 2033

Figure 82: India Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 83: India Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 84: India Market Attractiveness by End Users, 2023 to 2033

Figure 85: India Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 86: India Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 87: India Market Attractiveness by Pressure Type, 2023 to 2033

Figure 88: Thailand Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 89: Thailand Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 90: Thailand Market Attractiveness by Product Type, 2023 to 2033

Figure 91: Thailand Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 92: Thailand Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 93: Thailand Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Thailand Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 95: Thailand Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 96: Thailand Market Attractiveness by End Users, 2023 to 2033

Figure 97: Thailand Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 98: Thailand Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 99: Thailand Market Attractiveness by Pressure Type, 2023 to 2033

Figure 100: Vietnam Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 101: Vietnam Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 102: Vietnam Market Attractiveness by Product Type, 2023 to 2033

Figure 103: Vietnam Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 104: Vietnam Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 105: Vietnam Market Attractiveness by Material Type, 2023 to 2033

Figure 106: Vietnam Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 107: Vietnam Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 108: Vietnam Market Attractiveness by End Users, 2023 to 2033

Figure 109: Vietnam Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 110: Vietnam Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 111: Vietnam Market Attractiveness by Pressure Type, 2023 to 2033

Figure 112: Indonesia Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 113: Indonesia Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 114: Indonesia Market Attractiveness by Product Type, 2023 to 2033

Figure 115: Indonesia Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 116: Indonesia Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 117: Indonesia Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Indonesia Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 119: Indonesia Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 120: Indonesia Market Attractiveness by End Users, 2023 to 2033

Figure 121: Indonesia Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 122: Indonesia Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 123: Indonesia Market Attractiveness by Pressure Type, 2023 to 2033

Figure 124: Malaysia Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 125: Malaysia Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 126: Malaysia Market Attractiveness by Product Type, 2023 to 2033

Figure 127: Malaysia Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 128: Malaysia Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 129: Malaysia Market Attractiveness by Material Type, 2023 to 2033

Figure 130: Malaysia Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 131: Malaysia Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 132: Malaysia Market Attractiveness by End Users, 2023 to 2033

Figure 133: Malaysia Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 134: Malaysia Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 135: Malaysia Market Attractiveness by Pressure Type, 2023 to 2033

Figure 136: Rest of Market Share and BPS Analysis by Product Type- 2023 & 2033

Figure 137: Rest of Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 138: Rest of Market Attractiveness by Product Type, 2023 to 2033

Figure 139: Rest of Market Share and BPS Analysis by Material Type- 2023 & 2033

Figure 140: Rest of Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 141: Rest of Market Attractiveness by Material Type, 2023 to 2033

Figure 142: Rest of Market Share and BPS Analysis by End Users - 2023 & 2033

Figure 143: Rest of Market Y-o-Y Growth Projections by End Users, 2023 to 2033

Figure 144: Rest of Market Attractiveness by End Users, 2023 to 2033

Figure 145: Rest of Market Share and BPS Analysis by Pressure Type- 2023 & 2033

Figure 146: Rest of Market Y-o-Y Growth Projections by Pressure Type, 2023 to 2033

Figure 147: Rest of Market Attractiveness by Pressure Type, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA