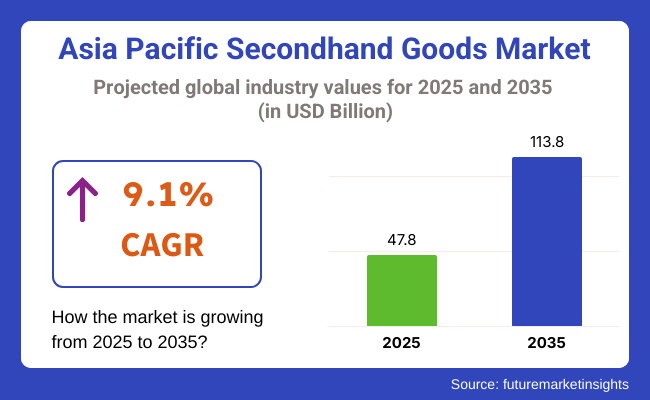

The Asia Pacific secondhand goods market size was USD 47.8 billion in 2025 and is expected to progress at a CAGR of 9.1% during the period 2025 to 2035. The regional industry is expected to increase up to USD 113.8 billion in 2035. This growth mainly arises due to changing consumer attitudes toward affordability, sustainability, and the emergence of online reselling websites providing easy access to used products as well as acceptability.

At a regional level, population patterns like an expanding youth demographic, higher digital literacy, and greater cost-sensitiveness are driving demand for secondhand products. Buyers are becoming more conscious of the sustainability value of circular consumption, yet another factor solidifying marketplace appeal for secondhand fashion, electronics, home decor, and luxury items.

The post-pandemic economy has, moreover, driven thrift and resale culture into the mainstream, especially in urban areas. Online platforms and mobile applications are the backbone of the industry growth, providing curated lists, authentication, and peer-to-peer trading platforms.

Firms such as Carousell, Mercari, and local platforms in China, India, and Southeast Asia are building solid ecosystems that bridge convenience, trust, and social commerce. AI-based pricing technologies, logistics integration, and consumer-to-consumer models have pushed resale from an unofficial business to a legitimate industry.

Both sustainability and style drive demand for secondhand fashion and electronics. Millennials and Generation Z lead the way for a move to secondhand as a lifestyle decision rather than an economic necessity. Luxury resale continues to grow with technologies for authentication, enabling consumers to access branded products within attainable prices while sellers tap residual value.

The cultural and economic diversity of the Asia-Pacific creates distinct micro-markets. Condition and quality are paramount in Japan and South Korea, while price and availability rule in Southeast Asia and India. Digitization, the infrastructure of trust, and evolving consumer values with a focus on reuse instead of replacement will fuel growth as much as the presence of regulatory issues and the informal sector remain.

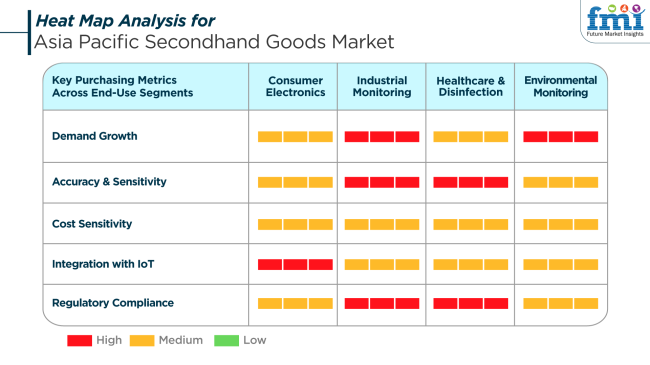

Functionality and trust in condition at the product level are of utmost significance in the secondhand consumer electronics industry. Refurbished accessories, laptops, and smartphones account for a substantial portion, driven by low-cost savings and high-tech trends. Purchasers desire third-party assured quality and guarantees, while vendors benefit from simplified resale programs and trade-in promotions.

In medical goods and disinfection products, resale is left for non-perishable goods or secondhand medical equipment under tight regulations. The products must be of satisfactory safety and hygiene standards, with documentation necessary to obtain buyer confidence. Institutional customers such as clinics and NGOs often shop on certified sites to satisfy equipment needs at discounted prices.

Secondhand environmental monitoring gear and industrial equipment are increasingly recycled and resold by auction or niche B2B sites. Value-for-money asset recovery and circular economy initiatives are the best bet in these niches. While price is no longer a key driver, buying decisions also tend to be greatly influenced by useful life, re-certification, and system compatibility with new gear in the interest of environmentally friendly reuse.

The industry is also prone to some serious risks, the most salient of which is quality verification and counterfeiting. Since price becomes a driving influence in this marketplace, the threat of misrepresented or non-functional products can ruin trust and deny repeat business. Establishing credible verification systems and third-party certification is thus essential to mitigate this risk.

Regulatory inconsistency across countries is another problem. Without common standards for resale, taxation, and compliance with safety regulations, scalability is discouraged for regional platforms. In sectors like electronics and medical devices, strict import/export controls and liability concerns can suppress cross-border trade and institutional buyer involvement.

There is a cultural stigma for secondary consumption in a few groups where used goods are perceived as inferior or unacceptable. Although this belief is declining, especially among young consumers, piercing these attitudinal barriers will require sustained branding effort and influencer-driven normalization. Businesses failing to make resale desirable and value-added risk facing limited mainstream adoption in more traditional segments.

From 2020 to 2024, the industry developed strongly on the basis of increasing environmental consciousness, increasing incomes, and the trend towards sustainability. The COVID-19 pandemic was one of the prime drivers in shifting consumer behavior, with consumers becoming increasingly conscious of their spending and more likely to seek out low-cost and sustainable alternatives for new products. The introduction of online platforms such as OLX, Carousell, and Facebook Marketplace enhanced the ease and convenience with which consumers can buy and sell used products, leading to an accelerated growth in the industry.

The industry is expected to expand between 2025 and 2035 on the back of increasing digitalization, smartphone penetration, and the green movement. The youth and technologically savvy population of the region makes sure that the demand for used products will also keep growing, with luxury used goods, electronics, and clothing being the focus. Blockchain technology and NFTs can revolutionize the method of authenticating secondhand goods so that it becomes transparent and reliable. Moreover, recommendations driven by AI, along with virtual try-ons, will further boost the consumer experience so that customers are able to discover secondhand items best matching their requirements and likings.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Sustainability, affordability, e-commerce platforms, environmental awareness, and peer-to-peer resale. | Digitalization, AI-driven recommendations, blockchain authentication, and growth of luxury secondhand markets. |

| Tech-savvy, environmentally conscious consumers, younger generations, and budget-conscious buyers. | Young, high-income consumers, green consumers, and those searching for luxury, unique, and authenticated secondhand products. |

| Fashion, electronics, furniture, home furnishings, and luxury products. | High-fashion clothing, luxury products, refurbished electronics, and eco-friendly home furnishings. |

| Growth of online marketplaces, mobile apps, and digital payment solutions. | Blockchain for verifying items, personalized recommendations from AI, and fashion virtual try-ons. |

| More demand for second-hand goods in line with the sustainable movement. | Eco-packaging, circular business practices, and upcycled and vintage commodity growth. |

| Peer-to-peer web platforms, sole-purpose second-hand e-commerce platforms, and retail stores. | Omnichannel retail experiences, blockchain platforms, and second-hand virtual try-ons. |

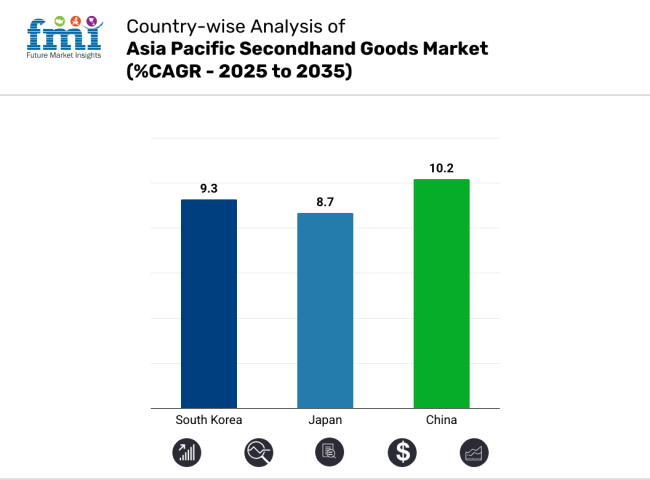

The South Korean industry will be expanding at 9.3% CAGR during the study period. Strong smartphone penetration, robust digital transformation, and growing sustainability awareness are fueling demand for secondhand products in urban and suburban regions. South Korean consumers are increasingly embracing circular economy strategies, driven by a generational change in consumption behavior and a need for value without compromising quality.

The secondary industry, previously centered on informal peer-to-peer networks, has seen structured development with the emergence of curated web platforms offering authentication, delivery services, and consumer-friendly interfaces. Technology-fashion convergence is driving high-energy momentum, particularly in the high-end apparel and electronics resale industries.

Big homegrown platforms are scaling up business, aided by tech-powered pricing algorithms and predictive analytics. Startups and retailers alike are integrating secondhand verticals within original commerce platforms, allowing consumers to recycle or exchange items directly at the point of sale. Government-backed initiatives promoting reuse as well as sustainable consumption habits are also driving industry growth.

The environment-conscious youth segment is also driving long-term demand patterns, supporting growth into deeper rural industries. Cross-border resale potential with the adjoining industries also raises the prospect. Overall, the orderly scalability of the industry, along with benign digital infrastructure, provides a high growth trajectory.

The Japanese industry will grow at 8.7% CAGR in the forecast period. Japan retains an old thrift and reuse culture, dating from economics as well as traditional values. The secondhand industry is being preferred by a consumer segment that attaches importance to product quality and upkeep, generating high-value resale stock in categories such as electronics, fashion design, collectibles, and home appliances.

Institutionalized brands have established a resale infrastructure with authentication, inspection, and internet marketplaces. Physical secondhand stores remain dominant, but online resale is gaining traction rapidly due to generational convenience and payment behavior through digital media.

The application of artificial intelligence, data-driven product recommendations, and rewards for customer loyalty is engaging more users on resale platforms. Greater emphasis on sustainability and waste reduction-aligning national environment policies with new momentum-is boosting the circular economy. Big box retail chains are also entering the resale arena, extending product lives and reducing excess inventory.

The secondhand luxury business is going through a strong growth cycle, driven by domestic demand as well as by foreign buyers interested in high-end Japanese-maintained products. Moreover, the reputation of Japan as a country with consumer confidence and quality warranties creates a solid basis for secondhand adoption. With well-developed logistics and digital infrastructure backing it up, the business is expected to grow steadily until 2035.

China's industry will advance at 10.2% CAGR during the study period. As one of the fastest-growing economies in the region, China's secondhand industry is undergoing swift change, driven by shifting consumer behavior, technological advancement, and growing sustainability awareness. Younger generations are embracing resale as a lifestyle and economic choice, opting for platforms that offer convenience, transparency, and reliability. Urban centers such as Shanghai, Beijing, and Shenzhen are at the forefront of adoption, with resale surging in activity across fashion, electronics, and lifestyle product categories.

Online retail titans and technology firms are also propelling scaling in the marketplace through embedded resale functionality, user verification, and recommendation through AI. Policy reform in favor of waste reduction and recycling is aiding in propelling a favorable policy framework for resale firms. Moreover, rising disposable incomes and access to global resale culture are propelling a cultural move towards mindful consumption.

The luxury and tech gadget resale industries are increasing especially robustly, driven by a digitally aware population. As logistics networks expand into rural areas, access to secondhand platforms is also expanding, expanding the user base and industry coverage. The convergence of massive digital infrastructure, consumer openness, and regulatory encouragement places China as the leading driver for the expansion of the regional secondhand industry.

Beauty and health products will occupy a leading share of 19.8% in the Asia Pacific second-hand goods industry in 2025, immediately followed by apparel/fashion at 17.4%.

Most of the second-hand sales in the Asia Pacific are attributed to the use of beauty and health. That's why many consumers are now gaining the impetus to try out old or overstocked beauty products--mostly unopened or slightly used--compared to the price at which many other people bought them.

Within Carousell (Singapore), Mercari (Japan), and Xianyu (China). Brands such as Estée Lauder, The Ordinary, or Laneige frequently feature platforms on which consumers resell their unused stock or gift sets because they were inspired by the rising trend of minimalist consumption and decluttering (inspired by Marie Kondo's KonMari method).

Apparel and fashion account for 17.4% of the industry, a primary pillar supporting the second-hand industry in the Asia Pacific. Platforms that further this cause include Zalora Pre-Loved (Southeast Asia), Zozoused (Japan), and YCloset (China), through which Gen Z and Millennials are increasingly adopting circular economies.

Typical second-hand items include clothing, handbags, and shoes regarded as high-value brands, including but not limited to Uniqlo, Zara, Gucci, or Nike. This booming fashion is fueled by the combined effect of making luxury and high street affordable while awakening the consciousness of most people to saving the planet. It even finds a sustaining hand through social media influencers of thrifting and online thrift hauls who normalize the act of second-hand fashion as one of the trendy things to do.

In the Asia Pacific, between 2025 and 2035, it is projected that online marketplaces will account for 38.5% of the second-hand goods industry share across the region, while thrift/resale stores will capture 30% of the same.

There are five online marketplaces: Mercari of Japan, Xianyu of Alibaba (China), Carousell (Singapore), and OLX (in and for countries within Southeast Asia), which have changed the environment for goods resale. These portals have a highly mobilized front end, a payment gateway industry, product recommendations based on artificial intelligence, and social rating and chat features, which all facilitate the transactions between buyers and sellers.

Consumers do not have to scour numerous physical sites to browse tons of used products, such as but not limited to fashion, electronics, beauty goods, and baby products, with more transparency and assurance. In addition, the popularity of livestream commerce and influencer-led second-hand good promotions on sites like TikTok and WeChat is hastening the acceptance of digital resale. Top brands such as Patagonia and Lululemon work with the revised media resale platforms or even take a step deeper by initiating their re-commerce movement to drive people towards buying certified pre-owned articles by direct online means.

At 30%, it is solidly incorporated as an essential offline channel- through thrift and resale stores- in countries like Japan, South Korea, and Australia, where much of the culture is based on physical shopping. BookOff, 2nd STREET (Japan), and Savers (Australia) are typical stores that offer well-known, sometimes high-end fashion accompanied by refurbished electronics up for resale in third locations. The sensation of "try before you buy," coupled with memories and excitement from "thrifting," keeps appealing to a younger industry and those searching for bargains within urban areas.

Advancing under the power of digitalization, environmental awareness, and cost factors appealing across consumer industries, the industry is doing very well. At the top of this industry is Carousell, where one can find all sorts of secondhand wares, from electronics to clothes, on a platform that can quickly create and sustain brand loyalty across Southeast Asia.

Then, there is OLX and Tokopedia, which get into the game, taking advantage of their mammoth consumer base and the diversity of their listing inclusions. The rest is Amazon Marketplace, which keeps on expanding its secondhand product assortments into renewed goods and refurbished offerings modeled from its existing e-commerce advantage.

There are niche players such as Reebelo and Cashify functioning in the secondhand electronics industry: quality assurance and warranty give them credibility in the minds of buyers. In highly specialty niches, for instance, BookMooch caters to bookaholics, while PetSmart and Pet Lovers Centre handle the supplies industry for secondhand pets.

As for Yahoo! Auctions Japan, it continues to be the greatest authority in the resale industry in Japan, with an extensive list of secondhand items. In value terms, however, competitive differentiation is increasingly based on the credibility and ease of use of the platform, integrated logistics solutions, and buyer-seller trust mechanisms. Companies around the Asia-Pacific have invested enormously in technology improvements and strategic partnerships to strengthen their marketplace ecosystems as a result of rising consumer interest in value-based and sustainable shopping.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Carousell | 16 - 19% |

| OLX | 13 - 16% |

| Tokopedia | 11 - 14% |

| Amazon Marketplace | 9 - 12% |

| Yahoo! Auctions Japan | 8 - 10% |

| Other Players | 30 - 36% |

Key Company Insights

Carousell takes the lead in the APAC secondhand goods industry, with shares estimated between 16 and 19%. Its dominant regional location in Southeast Asia, category expansion, and acquisition of OLX Philippines and 701Search have given the company an edge. Carousell's localized approach, combined with technological improvements like AI recommendations and seller authentication tools, strengthens its position in the industry.

Both shared some huge parts of the industry by offering category mixes extensively; OLX and Tokopedia reserved approximately 13-16% and 11-14% shares, respectively. Its hold is strengthened by the 9-12% Amazon Marketplace expanding aggressively even on refurbished consumer electronics. Yahoo! Auctions Japan, on the other hand, is still a force in Japan with its loyal auction-happy consumer base. Investments in AI moderation, end-to-end logistics, and seller training programs are key competitive levers across leading players.

By product type, the industry is segmented into apparel/fashion (women’s, men’s, baby/kids), house, garden, do-it-yourself, consumer electronics, media and entertainment, consumer appliances, beauty and health, toys, leisure, sports, and fitness, and pet supplies.

By sales channel, the industry is categorized into thrift stores/resale stores, online market places, consignment shops, and other channels.

The industry is expected to reach USD 47.8 billion in 2025.

The industry is projected to grow to USD 113.8 billion by 2035.

The industry is expected to grow at a CAGR of approximately 9.1% during the forecast period.

Beauty and health products are a key segment in the industry.

Key players include Carousell, Amazon Marketplace, OLX, Tokopedia, Reebelo, Sangeetha Mobiles, Cashify, Hamleys, BookMooch, Qoo10, My Toys, Nykaa, Flipkart, PetSmart, Pet Lovers Centre, Anchanto, Rakuten, SaSa, Kakaku.com, Toy R Us, and Yahoo! Auctions Japan.

Table 1: Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 2: Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 3: Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 4: Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 5: Value (US$ million) Analysis By Country, 2019 to 2034

Table 6: Volume (US$ million) Analysis By Country, 2019 to 2034

Table 7: China Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 8: China Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 9: China Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 10: China Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 11: Japan Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 12: Japan Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 13: Japan Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 14: Japan Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 15: India Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 16: India Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 17: India Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 18: India Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 19: South Korea Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 20: South Korea Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 21: South Korea Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 22: South Korea Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 23: Indonesia Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 24: Indonesia Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 25: Indonesia Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 26: Indonesia Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 27: Thailand Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 28: Thailand Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 29: Thailand Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 30: Thailand Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 31: Singapore Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 32: Singapore Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 33: Singapore Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 34: Singapore Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 35: Malaysia Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 36: Malaysia Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 37: Malaysia Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 38: Malaysia Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 39: Hong Kong Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 40: Hong Kong Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 41: Hong Kong Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 42: Hong Kong Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 43: Australia and New Zealand Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 44: Australia and New Zealand Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 45: Australia and New Zealand Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 46: Australia and New Zealand Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 47: Rest of Value (US$ million) Analysis By Product Type, 2019 to 2034

Table 48: Rest of Volume (US$ million) Analysis By Product Type, 2019 to 2034

Table 49: Rest of Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table 50: Rest of Volume (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 01: Value (US$ million) and Volume (Units) Analysis, 2019 to 2023

Figure 02: Value (US$ million) and Volume (Units) Forecast, 2024 to 2034

Figure 03: Value (US$ million) Analysis, 2019 to 2023

Figure 04: Value (US$ million) Forecast, 2024 to 2034

Figure 05: Absolute $ Opportunity Value (US$ million), 2024 to 2034

Figure 06: Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 07: Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 08: Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 09: Attractiveness By Product Type, 2024 to 2034

Figure 10: Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 11: Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 12: Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 13: Attractiveness By Sales Channel, 2024 to 2034

Figure 14: Value (US$ million) Analysis By Country, 2019 to 2034

Figure 15: Volume (Units) Analysis By Country, 2019 to 2034

Figure 16: Y-o-Y Growth (%) Projections, By Country, 2024 to 2034

Figure 17: Attractiveness By Country, 2024 to 2034

Figure 18: China Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 19: China Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 20: China Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 21: China Attractiveness By Product Type, 2024 to 2034

Figure 22: China Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 23: China Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 24: China Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 25: China Attractiveness By Sales Channel, 2024 to 2034

Figure 26: Japan Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 27: Japan Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 28: Japan Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 29: Japan Attractiveness By Product Type, 2024 to 2034

Figure 30: Japan Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 31: Japan Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 32: Japan Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 33: Japan Attractiveness By Sales Channel, 2024 to 2034

Figure 34: India Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 35: India Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 36: India Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 37: India Attractiveness By Product Type, 2024 to 2034

Figure 38: India Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 39: India Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 40: India Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 41: India Attractiveness By Sales Channel, 2024 to 2034

Figure 42: South Korea Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 43: South Korea Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 44: South Korea Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 45: South Korea Attractiveness By Product Type, 2024 to 2034

Figure 46: South Korea Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 47: South Korea Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 48: South Korea Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 49: South Korea Attractiveness By Sales Channel, 2024 to 2034

Figure 50: Indonesia Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 51: Indonesia Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 52: Indonesia Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 53: Indonesia Attractiveness By Product Type, 2024 to 2034

Figure 54: Indonesia Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 55: Indonesia Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 56: Indonesia Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 57: Indonesia Attractiveness By Sales Channel, 2024 to 2034

Figure 58: Thailand Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 59: Thailand Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 60: Thailand Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 61: Thailand Attractiveness By Product Type, 2024 to 2034

Figure 62: Thailand Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 63: Thailand Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 64: Thailand Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 65: Thailand Attractiveness By Sales Channel, 2024 to 2034

Figure 66: Singapore Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 67: Singapore Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 68: Singapore Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 69: Singapore Attractiveness By Product Type, 2024 to 2034

Figure 70: Singapore Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 71: Singapore Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 72: Singapore Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 73: Singapore Attractiveness By Sales Channel, 2024 to 2034

Figure 74: Malaysia Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 75: Malaysia Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 76: Malaysia Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 77: Malaysia Attractiveness By Product Type, 2024 to 2034

Figure 78: Malaysia Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 79: Malaysia Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 80: Malaysia Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 81: Malaysia Attractiveness By Sales Channel, 2024 to 2034

Figure 82: Hong Kong Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 83: Hong Kong Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 84: Hong Kong Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 85: Hong Kong Attractiveness By Product Type, 2024 to 2034

Figure 86: Hong Kong Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 87: Hong Kong Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 88: Hong Kong Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 89: Hong Kong Attractiveness By Sales Channel, 2024 to 2034

Figure 90: Australia and New Zealand Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 91: Australia and New Zealand Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 92: Australia and New Zealand Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 93: Australia and New Zealand Attractiveness By Product Type, 2024 to 2034

Figure 94: Australia and New Zealand Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 95: Australia and New Zealand Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 96: Australia and New Zealand Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 97: Australia and New Zealand Attractiveness By Sales Channel, 2024 to 2034

Figure 98: Rest of Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 99: Rest of Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 100: Rest of Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 101: Rest of Attractiveness By Product Type, 2024 to 2034

Figure 102: Rest of Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 103: Rest of Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 104: Rest of Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 105: Rest of Attractiveness By Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA