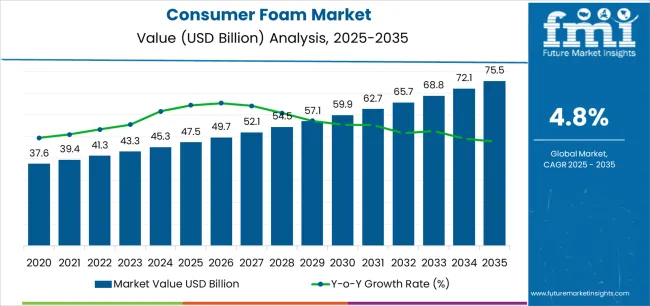

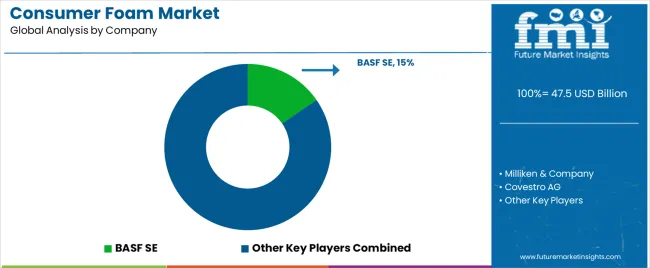

The Consumer Foam Market is estimated to be valued at USD 47.5 billion in 2025 and is projected to reach USD 75.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The consumer foam market is witnessing consistent growth, driven by rising consumer demand across furniture, bedding, packaging, and automotive applications. The increasing focus on comfort, durability, and lightweight materials has reinforced foam’s position as a preferred component in modern lifestyle and consumer goods. The market is currently characterized by strong adoption of flexible polyurethane foams due to their versatility, cushioning properties, and ease of processing.

Additionally, expanding middle-class populations, rising disposable incomes, and urbanization trends are boosting consumption of comfort-based products globally. Technological advancements in foam formulation—such as enhanced resilience, odor control, and eco-friendly alternatives-are further shaping market preferences. Regulatory pressures to reduce VOC emissions have accelerated the transition toward bio-based and recyclable foam materials.

The future outlook remains positive as sustainable manufacturing practices and smart material integration continue to redefine product development. Overall, the consumer foam market is positioned for stable long-term growth, supported by evolving lifestyle standards and expanding downstream applications.

| Metric | Value |

|---|---|

| Consumer Foam Market Estimated Value in (2025 E) | USD 47.5 billion |

| Consumer Foam Market Forecast Value in (2035 F) | USD 75.5 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

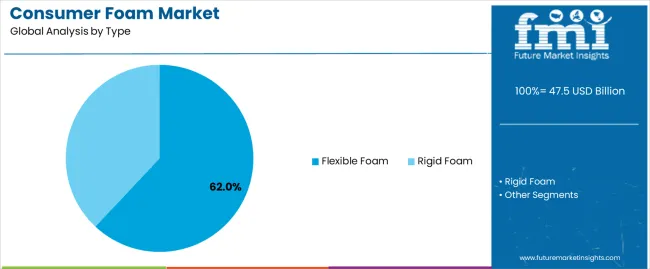

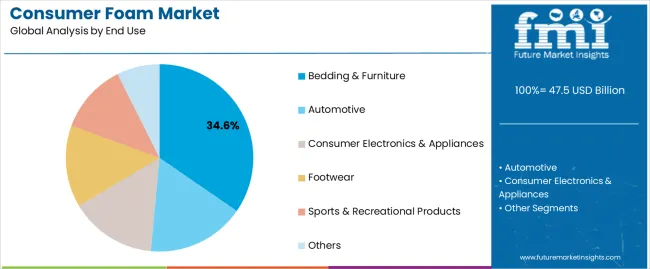

The market is segmented by Type and End Use and region. By Type, the market is divided into Flexible Foam and Rigid Foam. In terms of End Use, the market is classified into Bedding & Furniture, Automotive, Consumer Electronics & Appliances, Footwear, Sports & Recreational Products, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

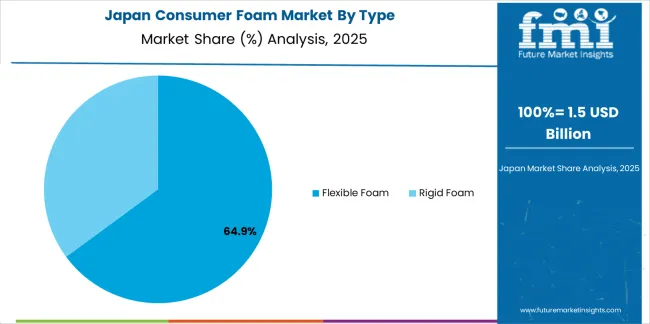

The flexible foam segment dominates the type category, holding approximately 62.0% share of the consumer foam market. This segment’s leadership is supported by its widespread use in bedding, furniture, packaging, and automotive interiors due to superior resilience and comfort properties.

Flexible foam offers easy fabrication and customizable density, allowing manufacturers to cater to diverse design requirements. The segment benefits from strong demand in consumer goods and housing sectors, where lightweight and durable materials are prioritized.

Ongoing innovations in bio-based and low-VOC foam formulations are enhancing environmental compatibility, aligning with global sustainability goals. With continued investment in product comfort and design differentiation, the flexible foam segment is expected to retain its leading position throughout the forecast period.

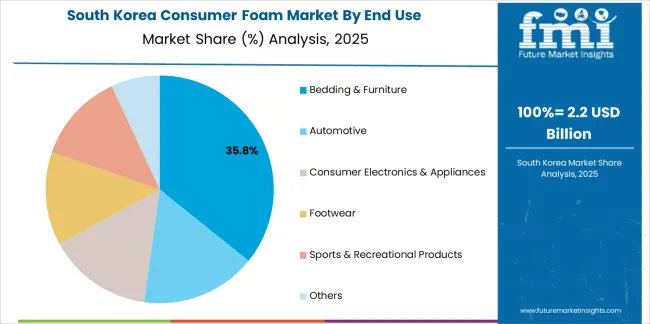

The bedding and furniture segment holds approximately 34.6% share of the end-use category in the consumer foam market. This segment’s dominance stems from growing consumer preference for comfort-enhanced and ergonomically designed furniture products.

Expanding residential construction and home renovation activities, coupled with higher discretionary spending, have stimulated demand. Foam’s superior cushioning, sound absorption, and thermal insulation capabilities make it the preferred material for mattresses, sofas, and seating solutions.

The segment’s growth is also driven by customization trends and e-commerce penetration, which have broadened access to premium foam-based furniture products. With continuous innovation in design and material technologies, the bedding and furniture segment is projected to remain the primary end-use area for consumer foam.

The historical CAGR for the sales of consumer foam stood at 6.0%, reflecting a steady and positive trajectory in the past. This growth can be attributed to various factors, including increasing consumer awareness of the benefits of foam-based products, innovations in manufacturing processes, and a growing demand for comfort-driven solutions in bedding and furniture.

| Historical CAGR | 6.0% |

|---|---|

| Forecast CAGR | 5.0% |

The sales of foam in consumer products are anticipated to rise at a CAGR of 5.0% through 2035, indicating a slight decrease compared to the historical performance.

Sustainability in Material Sourcing

A notable trend shaping consumer foam sales is the increasing emphasis on sustainability. Consumers are gravitating toward products made from eco-friendly materials, driving demand for foam that incorporates recycled or responsibly sourced components.

Manufacturers aligning with sustainable sourcing practices experience heightened consumer trust and increased sales as eco-conscious consumers prioritize environmentally friendly options.

Wellness and Health-centric Foam Products

The consumer focus on health and wellness extends to bedding and furniture choices. Foam products designed to promote better sleep, alleviate pressure points, and support overall well-being are witnessing heightened demand.

Manufacturers catering to health-conscious consumers experience increased sales as products aligning with wellness trends gain popularity in the market.

Online Retail and Direct-to-Consumer Models

The shift toward online shopping and direct-to-consumer models is influencing consumer foam sales. eCommerce platforms provide a convenient and accessible avenue for consumers to explore and purchase foam products.

Companies adopting robust online strategies experience increased sales, tapping into the convenience and accessibility preferences of modern consumers.

Innovations in Cooling Technologies

With a growing focus on sleep quality, there is a rising demand for foam products incorporating advanced cooling technologies. Innovations such as gel-infused foam or phase-change materials cater to consumers seeking temperature-regulated sleep surfaces.

Manufacturers incorporating cooling technologies in their foam products witness increased sales, especially in regions where temperature control during sleep is a significant consideration.

This section provides detailed insights into specific categories in the consumer foam industry. Rigid foam reigns supreme, boasting a projected CAGR of 4.6% between 2025 and 2035, following a steady 5.8% growth from 2020 to 2025.

This dominance stems from its versatility and durability, making it ideal for diverse applications. Also, the future holds exciting developments, with bedding & furniture poised to become a leading end-use segment, driven by its anticipated CAGR of 4.5% between 2025 and 2035.

| Top Type | Rigid Foam |

|---|---|

| CAGR % 2020 to 2025 | 5.8% |

| CAGR % 2025 to 2035 | 4.6% |

The rigid foam segment asserts its dominance in 2025 with an expected CAGR of 4.6% through 2035.

| Top End Use | Bedding & Furniture |

|---|---|

| CAGR % 2020 to 2025 | 5.6% |

| CAGR % 2025 to 2035 | 4.5% |

The bedding & furniture segment emerges as a consumer favorite through 2035, with a projected CAGR of 4.5%.

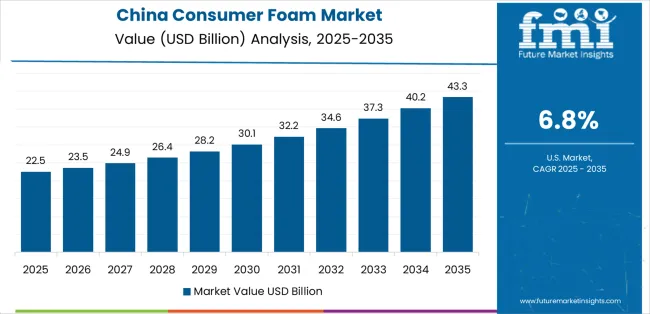

The section analyzes the consumer foam market across key countries, including the United States, United Kingdom, China, Japan, and South Korea. This segment discusses specific factors driving the demand, adoption, and sales of consumer foams in these countries.

| Countries | CAGR |

|---|---|

| United States | 5.2% |

| United Kingdom | 5.5% |

| China | 6.0% |

| Japan | 6.1% |

| South Korea | 7.5% |

The United States consumer foam market is poised for a moderate CAGR of 5.2% through 2035.

The consumer foam market in the United Kingdom is projected to rise at a CAGR of 5.5% through 2035.

Surging demand for foam in the furniture industry is comforting the market of consumer foam in China. The industry is set to witness a stable CAGR of 6.0% through 2035.

The consumer foam market in Japan projects steady growth of 6.1% through 2035.

The sales of consumer foam products in South Korea exhibit robust growth with a projected CAGR of 7.5% through 2035.

Leading foam fabricating companies focus on continuous product innovation to meet the changing demands of consumers. This includes the development of advanced foam technologies, the integration of smart features, and the creation of customizable solutions to provide a diverse range of options for consumers.

To tap into new markets and leverage emerging opportunities, key players implement global expansion strategies. This involves establishing a strong presence in key regions, forming strategic partnerships, and adapting products to meet the specific needs of diverse consumer demographics.

Environmental consciousness is a significant factor influencing consumer choices. Key industry players actively pursue sustainability initiatives, incorporating eco-friendly materials and manufacturing processes.

Companies align with consumer values by emphasizing recyclability, reduced carbon footprints, and the use of bio-based foams.

Companies invest in digital transformation to enhance their online presence as consumer behavior shifts toward online channels. eCommerce platforms play a crucial role in reaching a wider audience, providing convenient purchasing options, and showcasing a diverse range of consumer foam products.

Maintaining high-quality standards and compliance with regulations is paramount. Leading companies invest in robust quality assurance processes and adhere to international standards for consumer foam products. This commitment builds trust among consumers and enhances the credibility of the brand.

Recent Developments in the Consumer Foam Industry

The global consumer foam market is estimated to be valued at USD 47.5 billion in 2025.

The market size for the consumer foam market is projected to reach USD 75.5 billion by 2035.

The consumer foam market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in consumer foam market are flexible foam and rigid foam.

In terms of end use, bedding & furniture segment to command 34.6% share in the consumer foam market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Consumer Packaging Industry Analysis in India Forecast and Outlook 2025 to 2035

Consumer Packaging Industry Analysis in China Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Consumer Cloud Subscription Market Size and Share Forecast Outlook 2025 to 2035

Consumer Packaging Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

Consumer Electronic Accessories Market Size and Share Forecast Outlook 2025 to 2035

Consumer Facing AI Products Market Size and Share Forecast Outlook 2025 to 2035

Consumer Video Feedback Software Market Size and Share Forecast Outlook 2025 to 2035

Consumer Network Attached Storage Market Size and Share Forecast Outlook 2025 to 2035

Consumerware Market Size and Share Forecast Outlook 2025 to 2035

Consumer Metaverse Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Consumer Appliances Market Analysis by Product Type, Technology, Sales Channel, End User and Region 2025 to 2035

Consumer Electronic Sensors Market Trends - Growth & Forecast 2025 to 2035

Consumer Robotics Market Insights - Growth & Forecast 2025 to 2035

Consumer Electronics Market - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Consumer Electronics Packaging Manufacturers

Indonesia Consumer Packaging Market Trends & Forecast 2024-2034

Consumer Packaging Market Trends & Industry Growth Forecast 2024-2034

Consumer Drones Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA