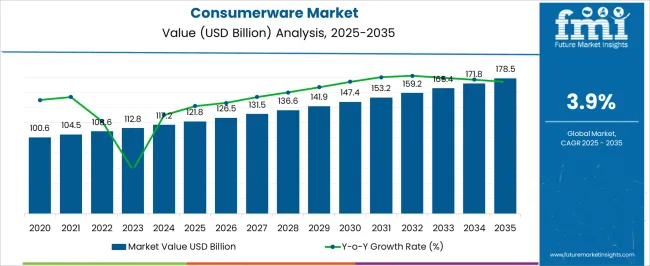

The consumerware market is projected to grow steadily from USD 121.8 billion in 2025 to USD 178.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.9%. Over the next decade, the market will expand from USD 121.8 billion in 2025 to USD 171.8 billion by 2030. This growth is driven by increasing demand for household products, kitchenware, and personal care items, as consumers seek durable, practical, and aesthetically pleasing solutions for everyday living.

The rising focus on premium consumerware products, offering both functionality and design, is expected to be a major factor in the market’s expansion, with manufacturers emphasizing quality and innovation. The steady demand for consumerware items across various sectors, including home appliances, kitchen tools, and personal care products, is expected to support the market’s growth trajectory. As consumers continue to prioritize convenience, durability, and aesthetics in their purchasing decisions, the consumerware sector will see sustained demand.

The growth in emerging markets, along with increased disposable income in certain regions, is expected to contribute to the steady rise in market value. As preferences shift towards higher-quality products and brands continue to innovate, the consumerware market will likely experience steady growth, offering continued opportunities for stakeholders.

| Metric | Value |

|---|---|

| Consumerware Market Estimated Value in (2025 E) | USD 121.8 billion |

| Consumerware Market Forecast Value in (2035 F) | USD 178.5 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The consumerware market holds a specialized yet significant position within its parent markets. Within the broader Consumer Goods Market, the Consumerware segment accounts for approximately 4% of the total market share, reflecting its niche application in everyday household items. In the Home Goods Market, which encompasses a wide range of products for the home, the Consumerware segment comprises about 6% of the market share, indicating its role in enhancing home living experiences.

Within the Kitchenware Market, the Consumerware segment holds a share of approximately 8%, driven by the demand for functional and aesthetically pleasing kitchen tools and accessories. In the Household Products Market, which includes various items for household maintenance and care, the Consumerware segment represents about 5% of the market share, highlighting its contribution to daily household activities.

The Consumerware market is experiencing steady expansion as evolving consumer lifestyles and shifting purchasing preferences drive demand for diverse product categories. The growth trajectory is being shaped by heightened focus on functionality, design appeal, and sustainable material use. Advances in manufacturing technologies and supply chain efficiency are enabling brands to offer a wider range of products at competitive price points.

Consumer awareness regarding product quality and durability, along with the influence of social trends on home and lifestyle choices, is also fueling demand. As online and omnichannel retail platforms strengthen product accessibility, the market is benefitting from rising household spending and gifting culture.

Increasing emphasis on personalization and premium aesthetics, balanced with affordability, is creating opportunities for both established and emerging players Looking ahead, product innovation, eco-friendly material adoption, and price segmentation strategies are expected to be key growth enablers for the global Consumerware market.

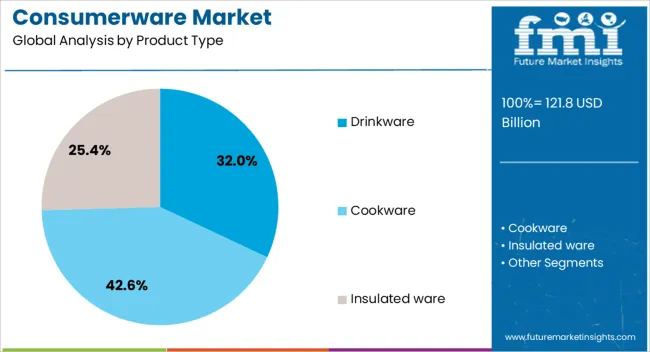

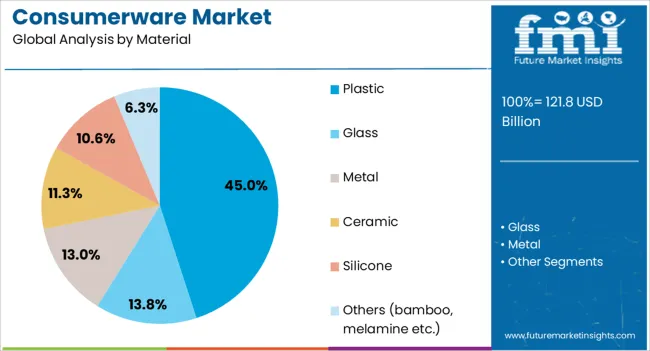

The consumerware market is segmented by product type, material, price, end use, distribution channel, and geographic regions. By product type, consumerware market is divided into Drinkware, Cookware, Insulated ware, Serveware, Bathware, and Others (flatware etc.). In terms of material, consumerware market is classified into Plastic, Glass, Metal, Ceramic, Silicone, and Others (bamboo, melamine etc.).

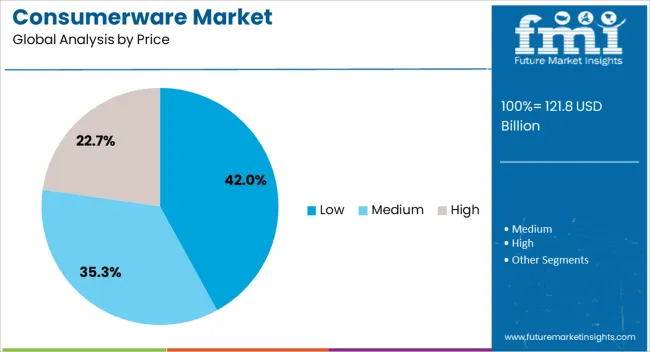

Based on price, consumerware market is segmented into Low, Medium, and High. By end use, consumerware market is segmented into Residential, Commercial, HoReCa, Offices, Hospitals, and Others (schools etc.). By distribution channel, consumerware market is segmented into Offline, Online, E-commerce, Supermarkets & hypermarkets, Specialty stores, and Others (department stores etc.).

Regionally, the consumerware industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The drinkware segment is projected to account for 32% of the Consumerware market revenue share in 2025, making it the leading product type. Growth in this segment has been influenced by the consistent demand for functional and aesthetically appealing products that cater to both household and on-the-go consumption. The versatility of drinkware in accommodating various designs, sizes, and functionalities has enabled its widespread adoption across different consumer demographics.

This segment’s leadership position has also been supported by innovations in materials, insulation technologies, and ergonomic designs that enhance user convenience. The expansion of lifestyle-driven marketing and gifting trends has further elevated demand.

As manufacturers increasingly focus on premium finishes and customization options, drinkware products are appealing to consumers seeking both utility and style Moreover, their compatibility with sustainable materials and reusability trends positions them favorably in markets where eco-conscious purchasing behavior is on the rise, reinforcing the segment’s dominant role in the Consumerware industry.

The plastic material segment is expected to hold 45% of the Consumerware market revenue share in 2025, emerging as the most widely used material category. Its dominance has been supported by the cost-effectiveness, lightweight nature, and versatility of plastic in producing a wide array of consumerware products. Manufacturers have favored plastic due to its ease of molding into diverse shapes and its compatibility with various design aesthetics, enabling mass production at competitive prices.

The durability and low breakage risk of plastic products have contributed to their popularity in both household and commercial settings. Recent advancements in recyclable and food-grade plastic formulations have further strengthened the segment’s position by aligning with sustainability trends.

The adaptability of plastic to incorporate vibrant colors, textures, and finishes has also enhanced its appeal among consumers As the market continues to balance affordability with eco-friendly innovation, the plastic segment is anticipated to retain its leadership through consistent demand and material evolution.

The low price segment is anticipated to represent 42% of the Consumerware market revenue share in 2025, making it the largest price category. This dominance has been driven by the broad consumer base seeking affordable yet functional products for everyday use. Cost-sensitive markets, particularly in emerging economies, have shown a strong preference for competitively priced consumerware that meets basic performance and aesthetic requirements.

The availability of a wide variety of designs at low price points has expanded market penetration and encouraged frequent product replacement cycles. Large-scale manufacturing efficiencies and material cost optimization have allowed producers to maintain affordability without compromising on essential quality.

The growth of discount retail chains and e-commerce platforms has further amplified accessibility for low-priced products As value-driven purchasing behavior remains prominent in many regions, the low price segment is expected to sustain its lead, supported by continuous product variety, mass-market targeting, and the ability to cater to high-volume demand.

The consumerware market is expanding, fueled by growing demand for home convenience products and the rising middle class in emerging economies. Opportunities exist for companies to tap into these regions and offer products that align with modern consumer preferences. However, challenges like rising production costs and intense competition require companies to adapt swiftly. As trends shift towards multifunctionality and e-commerce growth, the consumerware market is set to evolve with dynamic and diverse offerings, ensuring its position in the global retail landscape.

The consumerware market is experiencing robust growth, primarily driven by increasing demand for home convenience products. Consumers are seeking items that simplify daily routines, improve lifestyle comfort, and enhance the aesthetic appeal of living spaces. From kitchen gadgets to storage solutions, consumerware is evolving to meet these needs, offering functionality and design in a competitive marketplace. As consumer preferences shift towards multifunctional products, the demand for smart and space-efficient consumerware is expected to remain strong, contributing to market growth.

Emerging economies present significant growth opportunities for the consumerware market. With rising disposable incomes and a growing middle class, consumers in regions like Asia-Pacific and Latin America are increasingly investing in household products that offer value, quality, and durability.

The trend of modernizing home spaces is driving the demand for contemporary consumerware, while local manufacturing provides cost-effective solutions. As consumer expectations evolve, companies can capitalize on these opportunities by offering localized products and expanding distribution networks to meet the growing demand.

Several trends are reshaping the consumerware market, with eco-consciousness and minimalistic designs gaining traction. Consumers are gravitating toward multifunctional and compact products that blend seamlessly into modern living spaces. The demand for customization in design and functionality is also on the rise, particularly in areas like furniture and kitchenware. Moreover, the increasing preference for online shopping is driving e-commerce growth in consumerware. Manufacturers are embracing these trends to cater to changing consumer preferences, positioning themselves as market leaders in an increasingly competitive space.

Despite its growth, the consumerware market faces challenges related to rising production costs and supply chain disruptions. The cost of raw materials, particularly for high-quality consumerware items, has been fluctuating, which affects the overall pricing structure. Moreover, the market is witnessing intense competition with both established brands and new entrants vying for market share. These factors make it difficult for companies to maintain profitability while meeting the diverse and evolving needs of consumers, creating a need for strategic product positioning and cost-efficient operations.

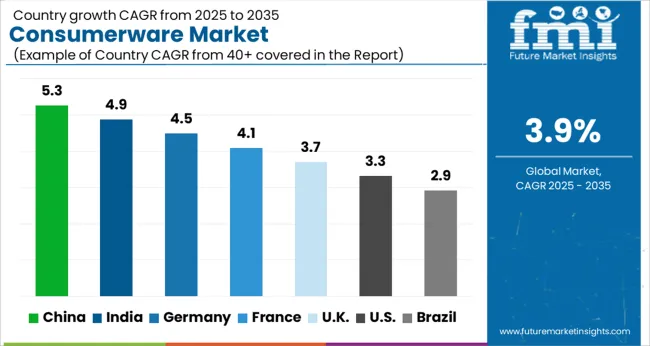

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The global consumerware market is projected to grow at a CAGR of 3.9% from 2025 to 2035. China leads with a growth rate of 5.3%, followed by India at 4.9%, and France at 4.1%. The United Kingdom records a growth rate of 3.7%, while the United States shows the slowest growth at 3.3%. The demand for consumerware products, including kitchenware, home accessories, and lifestyle goods, is driven by increased consumer spending, urbanization, and evolving consumer preferences. Emerging markets such as China and India are experiencing higher growth due to expanding middle-class populations, while mature markets like the USA and the UK continue to focus on premium and innovative consumerware products. This report includes insights on 40+ countries; the top markets are shown here for reference.

The consumerware market in China is projected to grow at a CAGR of 5.3%. The growth is driven by the country’s rapidly expanding middle class, increasing disposable incomes, and growing demand for high-quality kitchenware, home accessories, and lifestyle products. China’s booming e-commerce sector has also provided a platform for consumerware brands to reach a wider audience, further boosting sales. Additionally, as consumers continue to prioritize both functionality and aesthetics in their household products, demand for innovative and premium consumerware continues to rise.

The consumerware market in India is expected to grow at a CAGR of 4.9%. The market’s expansion is fueled by the rising urban population, increasing disposable incomes, and changing consumer lifestyles. With a growing preference for modern, stylish, and durable products, India’s demand for premium consumerware, particularly kitchen and home accessories, is increasing. Additionally, the rapid adoption of online shopping platforms and the rise of influencer-driven marketing have significantly impacted consumer purchasing behavior, further accelerating demand.

The consumerware market in France is projected to grow at a CAGR of 4.1%. French consumers continue to prioritize quality and design, driving demand for innovative and stylish kitchenware, home accessories, and lifestyle products. The growing trend of cooking at home and the increasing focus on home décor also contribute to the market's growth. Furthermore, the increasing number of online shopping platforms and rising consumer interest in sustainable and eco-friendly products are supporting the expansion of the consumerware market in France.

The consumerware market in the UK is projected to grow at a CAGR of 3.7%. The market in the UK continues to be driven by consumers’ desire for high-quality, aesthetically pleasing, and functional products. With a significant portion of sales occurring through online platforms, e-commerce remains a vital channel for brands. As consumer spending in the UK remains stable, the demand for premium consumerware products, particularly in kitchenware and home décor, is expected to continue growing, despite relatively slow overall growth compared to emerging markets.

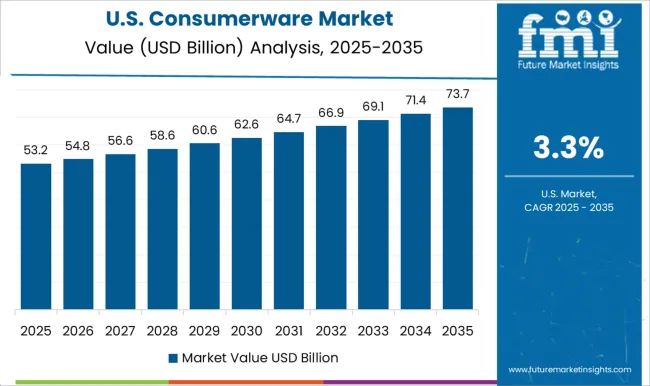

The consumerware market in the USA is projected to grow at a CAGR of 3.3%. Although growth in the USA. market is slower compared to other regions, the demand for premium, innovative, and eco-friendly consumerware products remains strong. Consumers continue to prioritize sustainability and functionality in their household items, contributing to steady demand. The USA market is also driven by the increasing trend of home renovations and the growing popularity of smart and sustainable home products, which further supports the market’s growth.

The consumerware market is dominated by companies like Tupperware Brands, Lock&Lock, and Zwilling Group, which have built strong reputations through their focus on high-quality and innovative product designs. Tupperware Brands continues to lead with its iconic food storage solutions, offering durable and eco-friendly options for everyday consumers. Lock&Lock has also established itself as a top contender with its airtight containers that promise long-lasting freshness and convenience.

Zwilling Group, known for its premium kitchenware, leverages its experience in manufacturing high-end kitchen products, expanding its consumerware portfolio to meet the demand for functional yet stylish storage solutions. Corelle (Corning), IKEA, and Sistema further contribute to the market by offering diverse consumerware products tailored to various consumer preferences. Corelle’s commitment to producing break-resistant dinnerware has positioned the brand as a household name in kitchens worldwide, while IKEA focuses on combining affordability with design innovation in its consumerware range. Sistema’s specialization in food storage containers, particularly its easy-to-use and leak-proof solutions, caters to the needs of modern households. These players continue to drive market growth through product diversification and strategic expansion, responding to increasing consumer demand for both practical and aesthetically pleasing consumerware items. The competition in this sector remains intense as brands continuously innovate to meet evolving consumer expectations for quality, sustainability, and value.

| Item | Value |

|---|---|

| Quantitative Units | USD 121.8 Billion |

| Product Type | Drinkware, Cookware, Insulated ware, Serveware, Bathware, and Others (flatware etc.) |

| Material | Plastic, Glass, Metal, Ceramic, Silicone, and Others (bamboo, melamine etc.) |

| Price | Low, Medium, and High |

| End Use | Residential, Commercial, HoReCa, Offices, Hospitals, and Others (schools etc.) |

| Distribution Channel | Offline, Online, E-commerce, Supermarkets & hypermarkets, Specialty stores, and Others (department stores etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tupperware Brands, Lock&Lock, Zwilling Group, Corelle (Corning), IKEA, and Sistema |

| Additional Attributes | Dollar sales by product type (kitchenware, tableware, home décor, storage), Dollar sales by material (ceramic, glass, plastic, metal), Trends in eco-friendly and sustainable consumerware adoption, Growth in demand for multifunctional and space-saving designs, Regional patterns of consumer preferences for aesthetics and durability in homeware products. |

The global consumerware market is estimated to be valued at USD 121.8 billion in 2025.

The market size for the consumerware market is projected to reach USD 178.5 billion by 2035.

The consumerware market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in consumerware market are drinkware, _bottles, _jugs, _flasks, _tumblers, _others (sippy cups etc.), cookware, _pans, _cookers, _pots, _others (bakeware etc.), insulated ware, _lunch boxes, _casseroles, _coffee cup, _others (insulated mug etc.), serveware, _plates, _serving bowls, _kitchen tray, _others (serving platter etc.), bathware, _tub, _bucket, _mug, _stool, _others (soap & lotion accessories etc.) and others (flatware etc.).

In terms of material, plastic segment to command 45.0% share in the consumerware market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA