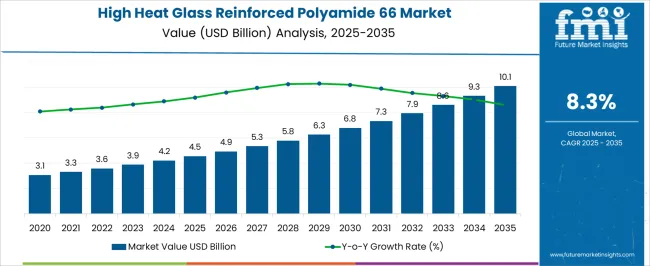

The high heat glass reinforced polyamide 66 market is expected to expand from USD 4.5 billion in 2025 to USD 10.1 billion by 2035, reflecting a CAGR of 8.3%. Early versus late growth curve analysis highlights differences in adoption velocity, technology uptake, and market penetration between the initial and later phases of the forecast period, providing insight into strategic investment and production planning.

From 2025 to 2027, the market grows from USD 4.5 billion to USD 5.3 billion, representing the early adoption phase. Growth is concentrated in automotive, aerospace, and industrial machinery applications where lightweight, high-strength, and heat-resistant components are increasingly required. Adoption during this phase is gradual, reflecting OEM hesitancy and pilot testing of advanced materials for critical components. Between 2028 and 2031, revenues rise from USD 5.8 billion to USD 7.3 billion, marking a transition to accelerated growth. Increased standardization, broader material certifications, and proven performance in high-temperature environments drive faster adoption. Investment in R&D for enhanced formulations and broader application in electric vehicles, energy storage, and industrial equipment fuels the upward trajectory.

From 2032 to 2035, the market reaches USD 10.1 billion, representing the late growth phase where adoption becomes widespread. Growth curves flatten slightly compared to earlier acceleration, but market expansion continues due to emerging geographies, new industrial applications, and mature supply chains.

| Metric | Value |

|---|---|

| High Heat Glass Reinforced Polyamide 66 Market Estimated Value in (2025 E) | USD 4.5 billion |

| High Heat Glass Reinforced Polyamide 66 Market Forecast Value in (2035 F) | USD 10.1 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The high heat glass reinforced polyamide 66 market is strongly influenced by five interconnected parent markets, each contributing uniquely to overall demand and growth. The automotive and transportation market holds the largest share at 35%, driven by engine components, under-the-hood parts, connectors, and structural applications requiring high thermal stability and strength. The electrical and electronics market contributes 25%, as connectors, insulators, switches, and housings demand materials that can withstand high temperatures and maintain mechanical integrity. The industrial machinery and equipment market accounts for 15%, with gears, bearings, and mechanical parts relying on durable, heat-resistant polyamide materials for operational efficiency and longevity. The aerospace and aviation market holds a 15% share, where aircraft, helicopters, and UAVs integrate glass-reinforced PA66 for weight reduction, thermal resistance, and structural performance. The consumer goods and appliance market represents 10%, driven by electrical appliances, power tools, and household devices requiring safety, durability, and thermal stability. Collectively, automotive, electrical, and industrial segments account for 75% of overall demand, highlighting that high-performance engineering applications remain the primary growth drivers, while aerospace and consumer appliances provide complementary opportunities for market expansion globally.

The high heat glass reinforced polyamide 66 market is gaining momentum, driven by increased demand for lightweight, high-performance engineering plastics in temperature-intensive applications. Its excellent thermal stability, dimensional accuracy, and mechanical strength make it a preferred material in critical industries such as automotive, electronics, and industrial machinery.

Regulatory shifts toward sustainability and fuel efficiency are encouraging automakers to adopt advanced polymers over traditional metals. Furthermore, ongoing R&D in resin technologies and rising acceptance of polyamide 66 in hybrid electric powertrain systems are accelerating its penetration.

Partnerships between compounders and OEMs, combined with advancements in filler dispersion and polymer modification, continue to expand its functional capabilities across end-use environments.

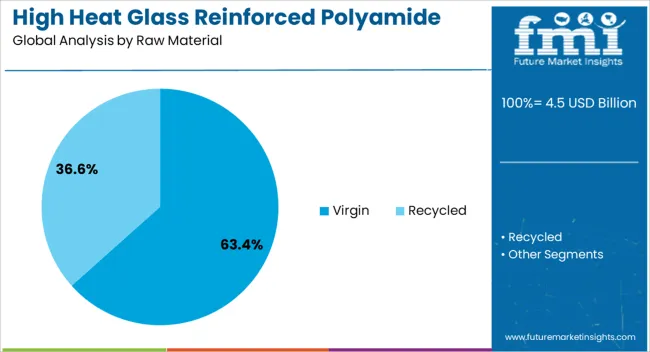

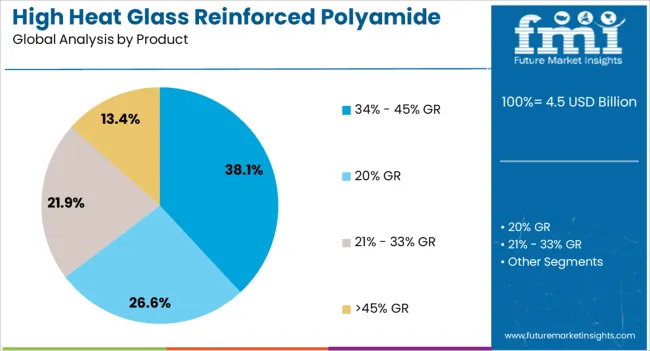

The high heat glass reinforced polyamide 66 market is segmented by raw material, product, end use, and geographic regions. By raw material, high heat glass reinforced polyamide 66 market is divided into Virgin and Recycled. In terms of product, high heat glass reinforced polyamide 66 market is classified into 34% - 45% GR, 20% GR, 21% - 33% GR, and >45% GR.

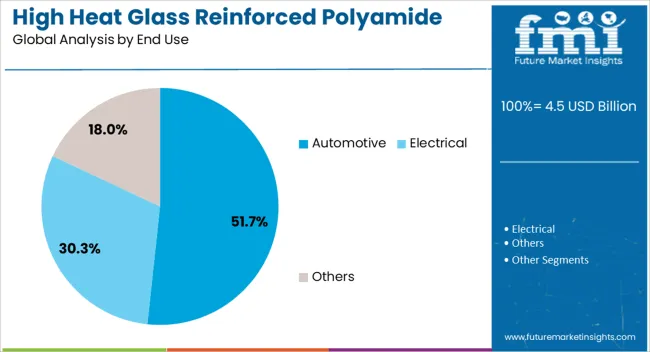

Based on end use, high heat glass reinforced polyamide 66 market is segmented into Automotive, Electrical, and Others. Regionally, the high heat glass reinforced polyamide 66 industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Virgin polyamide 66 accounts for 63.4% of the market share in 2025, making it the dominant raw material in high heat glass reinforced formulations. The preference for virgin material stems from its consistent thermal and mechanical properties, which are critical for safety and performance in regulated applications like engine components and electrical housings.

Unlike recycled alternatives, virgin PA66 offers superior long-term heat resistance and reduced variability under thermal cycling. This reliability makes it the go-to choice for manufacturers requiring high tolerances, especially in automotive, aerospace, and industrial tooling sectors.

With the growing integration of polymers into under-the-hood and structural applications, demand for virgin polyamide 66 is expected to remain robust.

The 34% - 45% glass reinforcement segment holds the highest share at 38.1% in 2025, reflecting its optimal balance between stiffness, impact resistance, and moldability. This product category is particularly well-suited for structural applications that demand both high mechanical strength and heat resistance, such as gear housings, intake manifolds, and thermostat covers.

The specified glass content range offers improved creep resistance and dimensional control under elevated temperatures, without compromising process efficiency. Its versatility allows manufacturers to tailor parts for weight reduction while maintaining durability under dynamic loads.

As performance requirements intensify across sectors, this reinforcement range is becoming the standard for heat-critical polymer components.

Automotive applications are set to dominate with 51.7% share of the high heat glass reinforced polyamide 66 market in 2025. This leadership is primarily fueled by the industry's shift toward lightweighting and thermal efficiency.

PA66 compounds are widely used in powertrain components, cooling systems, and electric vehicle connectors due to their high melting point and dimensional stability. As internal combustion and EV platforms alike demand improved thermal management, PA66’s ability to replace metal in high-stress zones offers cost, weight, and design advantages.

Additionally, compliance with fuel efficiency standards and emissions targets continues to drive the material's integration into engine and structural systems globally.

The high heat glass reinforced polyamide 66 (PA66) market is growing as automotive, electrical, and industrial manufacturers prioritize high-performance, lightweight, and heat-resistant materials. Demand is driven by applications in engine components, electrical connectors, automotive under-the-hood parts, and industrial machinery requiring thermal stability and mechanical strength.

Challenges include high raw material costs, complex compounding processes, and regional regulatory compliance. Opportunities exist in high-performance blends, flame-retardant variants, and co-polymerized solutions. Trends highlight high glass-fiber loading, precision molding, and improved dimensional stability.

Adoption is being propelled by growth in recreational towing, commercial hauling, and specialty transport where stable articulation and high pin weight capacity are required. Recreational trailers, toy haulers, and horse trailers are being paired with pickup trucks prepared at the factory for bed mounting, which simplifies dealer fitment and shortens delivery time. Construction and agriculture fleets value smooth pivoting heads, cushioned pin boxes, and tighter tolerances that limit chucking under variable loads. Quick hookup, repeatable latch feedback, and clear sight lines are being requested to reduce coupling errors.

OEM companies promote factory prep packages that accept drop in hitches without bed drilling, encouraging buyers to select approved systems during vehicle purchase. E commerce channels expand reach with fitment guides, video walkthroughs, and bundled wiring kits, reinforcing confidence for first time users. As towing activity diversifies, fifth wheel layouts are being favored for stability, control, and predictable highway manners.

The market is trending toward higher glass-fiber reinforcement, precision injection molding, and enhanced dimensional stability to meet performance demands. Advanced compounding techniques improve heat deflection, mechanical strength, and surface finish quality. Co-polymerized and flame-retardant PA66 grades are increasingly used in high-temperature automotive and electrical applications. Digital simulation and mold flow analysis are being applied to optimize part design and processing efficiency. Collaboration between material suppliers, OEMs, and molding specialists enhances product performance, reliability, and lifecycle support. Suppliers providing high-quality, technically supported, and application-ready PA66 composites are best positioned to meet evolving industry requirements and global market demand.

Constraints include high raw material costs, energy-intensive production, and variability in compounding and molding processes that affect mechanical and thermal performance. Supply chain dependencies on specialty monomers and glass fibers can impact availability. Compliance with regional standards for automotive, electrical, and industrial applications, including flame retardancy and safety certifications, adds complexity. Processing challenges such as mold flow, warpage, and surface finish consistency require specialized technical expertise. Buyers increasingly seek suppliers offering validated performance data, precise material specifications, and technical support to ensure consistent quality, reliable delivery, and compliance with stringent OEM and regulatory standards.

Opportunities exist in flame-retardant grades, high glass-fiber loading variants, and co-polymerized solutions offering superior thermal and mechanical performance. Lightweight and high-strength PA66 composites support automotive fuel efficiency, electric vehicle battery enclosures, and high-load industrial components.

Emerging applications in high-voltage connectors, electronic housings, and advanced machinery create additional growth potential. Regional markets in Europe, North America, and Asia-Pacific are witnessing adoption due to stringent automotive and electrical safety standards. Suppliers offering customizable, high-performance materials with application support and molding guidance are positioned to capture opportunities across OEMs, tier-1 suppliers, and industrial component manufacturers.

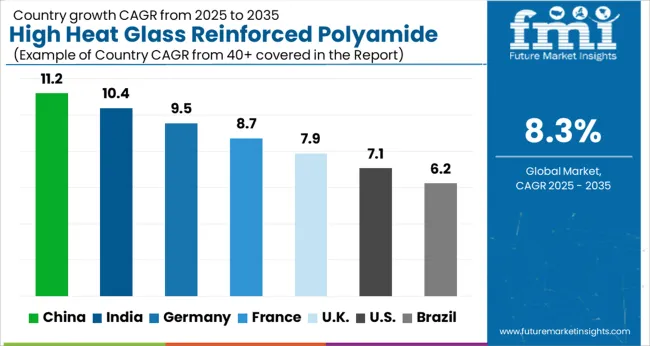

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

The global high heat glass reinforced polyamide 66 market is projected to grow at a CAGR of 8.3% from 2025 to 2035. China leads at 11.2%, followed by India at 10.4%, Germany at 9.5%, the UK at 7.9%, and the USA at 7.1%. Growth is driven by automotive, industrial, electrical, and aerospace applications requiring lightweight, high-strength, and thermally stable components.

Adoption is supported by electric and hybrid vehicles, industrial automation, and high-performance machinery. Asia shows rapid expansion due to industrialization, while Europe and North America focus on precision manufacturing, compliance, and high-performance fiber-reinforced solutions. Partnerships, R&D, and advanced compounding technologies are key growth enablers. The analysis includes over 40+ countries, with the leading markets detailed below.

The high heat glass reinforced polyamide 66 market in China is projected to grow at a CAGR of 11.2% from 2025 to 2035, driven by rapid expansion in automotive, electrical, and industrial equipment manufacturing. Demand is fueled by the material’s superior thermal stability, mechanical strength, and chemical resistance, which make it ideal for engine components, electrical housings, and industrial machinery parts. Domestic manufacturers are scaling up production and investing in advanced compounding and molding technologies to improve product performance and reliability. Automotive OEMs are increasingly adopting reinforced polyamide components for lightweight engine and powertrain solutions to enhance fuel efficiency. Partnerships with European and North American technology providers accelerate innovation in high-temperature resistant formulations.

The high heat glass reinforced polyamide 66 in India is expected to expand at a CAGR of 10.4% from 2025 to 2035, supported by automotive production, electrical equipment manufacturing, and industrial machinery growth. The demand for components capable of withstanding high temperatures and mechanical stress, such as engine covers, connectors, and brackets, is increasing. Domestic manufacturers are focusing on high-performance, reinforced polyamide 66 grades suitable for automotive, power distribution, and industrial applications. OEMs and suppliers are collaborating to integrate durable and lightweight polymer solutions in engine, electronics, and machinery components. Research into fiber reinforcement and thermal stability is expanding product offerings, while imports of high-quality polymer compounds complement domestic production.

The high heat glass reinforced polyamide 66 market in Germany is forecasted to grow at a CAGR of 9.5% from 2025 to 2035, driven by automotive, industrial machinery, and electrical equipment sectors. Automotive OEMs prefer reinforced polyamide components for engine and powertrain applications due to durability, thermal resistance, and weight reduction benefits. Industrial equipment manufacturers adopt the material for high-temperature-resistant housings, gears, and connectors. Strong R&D infrastructure supports innovations in high-performance compounds, reinforced with glass or mineral fibers. Partnerships with international polymer suppliers enable access to advanced formulations for electric vehicles, energy-efficient machinery, and consumer electronics. Focus on precision manufacturing, stringent quality standards, and compliance with European norms enhances material adoption across automotive, industrial, and electrical applications.

The UK market is expected to grow at a CAGR of 7.9% from 2025 to 2035, led by automotive, aerospace, and electrical equipment applications. Manufacturers focus on high-strength, high-temperature-resistant polymer components that replace metal in engines, powertrain assemblies, and industrial devices. Domestic players are developing reinforced polyamide 66 solutions with improved thermal stability, chemical resistance, and dimensional accuracy. Electric and hybrid vehicle programs are increasing demand for lightweight, thermally stable parts. Industrial automation and smart manufacturing systems create opportunities for durable polymer components in robotic arms, housings, and machinery. Collaborations with European and global suppliers enhance R&D capabilities and material innovation.

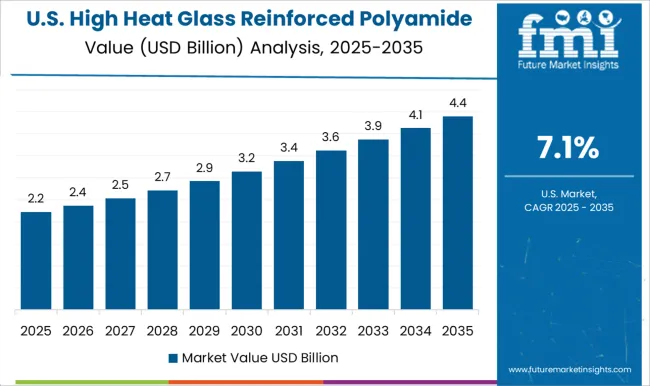

The USA market is projected to grow at a CAGR of 7.1% from 2025 to 2035, supported by automotive, aerospace, industrial, and electrical equipment sectors. Reinforced polyamide 66 is increasingly adopted for engine components, housings, connectors, and industrial machinery due to its high thermal resistance, strength, and durability. Manufacturers emphasize advanced compounding techniques, fiber reinforcement, and dimensional stability to meet stringent quality requirements. Electric and hybrid vehicle programs drive demand for lightweight, high-performance components. Collaborations with international suppliers ensure access to advanced formulations. Industrial automation, consumer electronics, and energy-efficient machinery further boost material adoption. Regulatory compliance with ASTM and ISO standards ensures safety, performance, and operational reliability in critical applications.

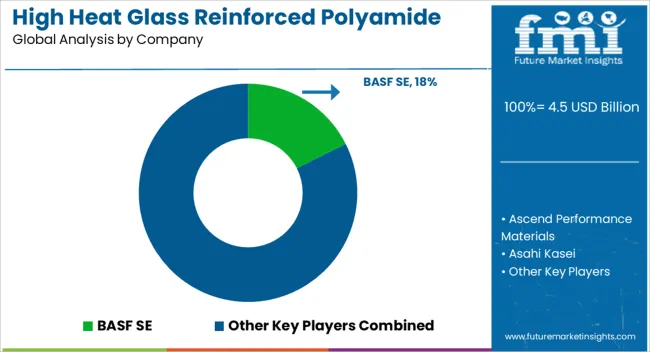

Competition in the high heat glass reinforced polyamide 66 (PA66) market is defined by thermal stability, mechanical strength, and processability for demanding automotive, industrial, and electrical applications. BASF SE leads with specialty PA66 compounds offering high heat resistance, dimensional stability, and consistent performance under continuous load. Ascend Performance Materials competes through reinforced and flame-retardant grades designed for engine components, electrical housings, and under-the-hood applications. Asahi Kasei emphasizes high-strength, low-warp formulations optimized for injection molding and precision engineering parts. DowDuPont focuses on consistent material properties, broad application support, and global distribution channels, while DSM Engineering Plastics differentiates with specialty PA66 blends featuring excellent chemical resistance and impact strength. Other market players including LANXESS, RTP Company, SABIC, Solvay, and Tenkor Apex compete through high-performance, glass-filled, or mineral-reinforced variants tailored to specific end-use requirements.

Strategies center on improving thermal endurance, dimensional stability, and filler optimization to enhance mechanical properties. Product development emphasizes lightweighting, flame-retardancy, and compliance with automotive and industrial standards such as UL, ISO, and RoHS. Partnerships with OEMs, molders, and tier-1 suppliers are leveraged to co-develop custom formulations and accelerate time-to-market for high-demand applications. Lifecycle support, technical assistance, and material testing services are marketed to facilitate adoption in complex assemblies.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Raw Material | Virgin and Recycled |

| Product | 34% - 45% GR, 20% GR, 21% - 33% GR, and >45% GR |

| End Use | Automotive, Electrical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Ascend Performance Materials, Asahi Kasei, DowDuPont, DSM Engineering Plastics, LANXESS, RTP Company, SABIC, Solvay, and Tenkor Apex |

| Additional Attributes | Dollar sales by material grade (30% glass reinforced, 50% glass reinforced, 60% glass reinforced, others), form (pellets, sheets, molded components), and application (automotive, electrical & electronics, industrial machinery, consumer goods). Demand dynamics are driven by lightweighting initiatives, high-temperature performance requirements, and growing adoption of engineering plastics in automotive and industrial sectors. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by rising automotive production, increasing electrical component demand, and focus on high-performance, durable polymer solutions. |

The global high heat glass reinforced polyamide 66 market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the high heat glass reinforced polyamide 66 market is projected to reach USD 10.1 billion by 2035.

The high heat glass reinforced polyamide 66 market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in high heat glass reinforced polyamide 66 market are virgin and recycled.

In terms of product, 34% - 45% gr segment to command 38.1% share in the high heat glass reinforced polyamide 66 market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA