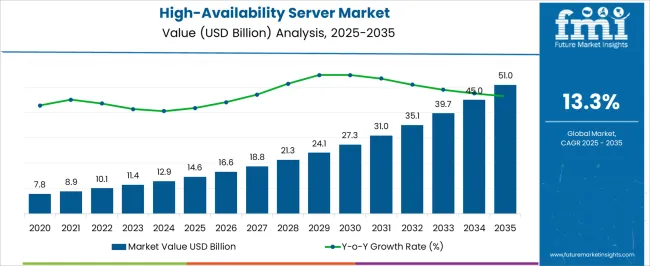

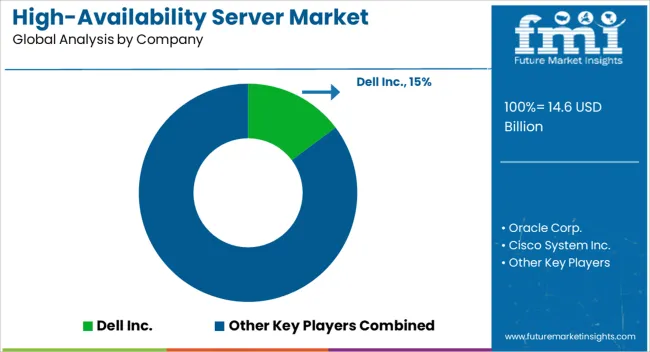

The High-Availability Server Market is estimated to be valued at USD 14.6 billion in 2025 and is projected to reach USD 51.0 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period.

| Metric | Value |

|---|---|

| High-Availability Server Market Estimated Value in (2025 E) | USD 14.6 billion |

| High-Availability Server Market Forecast Value in (2035 F) | USD 51.0 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The high-availability server market is witnessing significant growth as enterprises increasingly prioritize uninterrupted operations and minimal downtime in business-critical environments. Rising digital transformation initiatives, coupled with the adoption of cloud services, big data analytics, and edge computing, are amplifying the demand for highly reliable server infrastructure. Organizations are focusing on servers that provide continuous system availability, reduced recovery times, and seamless workload balancing to meet operational and regulatory requirements.

Growing dependence on data-intensive applications across IT, telecom, banking, healthcare, and government is further reinforcing demand for robust availability solutions. The integration of virtualization technologies, containerized applications, and automation in server management is enhancing flexibility and efficiency in deployment. Moreover, the increasing frequency of cyberattacks and system outages has emphasized the need for resilient infrastructure, accelerating adoption across industries.

As enterprises expand geographically and scale digitally, the requirement for fault-tolerant, self-healing server systems is projected to intensify Continuous innovation in hardware and software integration, along with strong investments in data center modernization, are expected to drive long-term growth opportunities in the market.

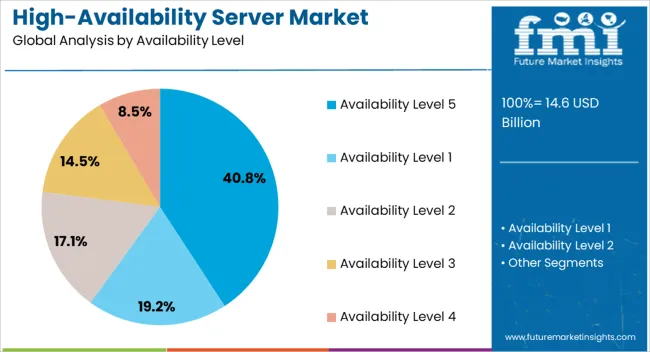

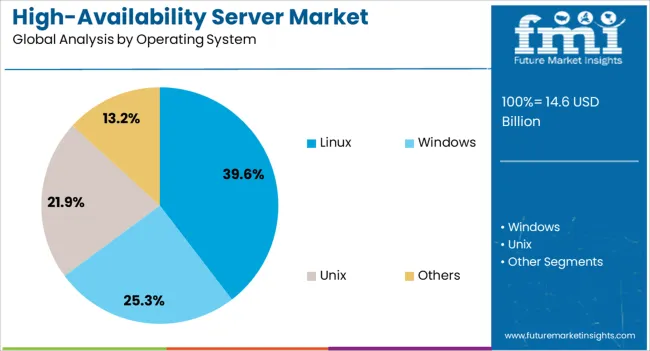

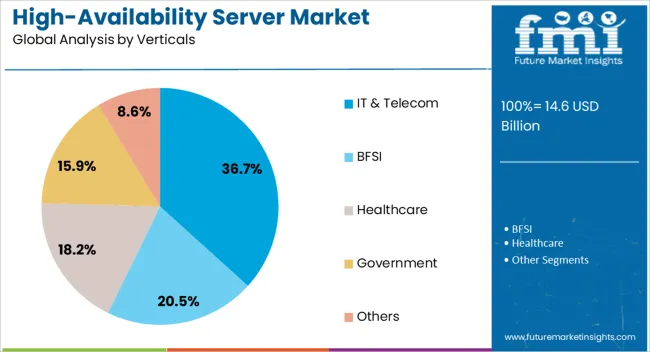

The high-availability server market is segmented by availability level, operating system, verticals, and geographic regions. By availability level, high-availability server market is divided into Availability Level 5, Availability Level 1, Availability Level 2, Availability Level 3, and Availability Level 4. In terms of operating system, high-availability server market is classified into Linux, Windows, Unix, and Others. Based on verticals, high-availability server market is segmented into IT & Telecom, BFSI, Healthcare, Government, and Others. Regionally, the high-availability server industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The availability level 5 segment is expected to hold 40.8% of the high-availability server market revenue share in 2025, positioning it as the leading availability level. This dominance is being driven by its capacity to deliver continuous uptime through advanced redundancy, failover systems, and real-time synchronization. Enterprises are increasingly adopting level 5 configurations to ensure business continuity, particularly in industries where even seconds of downtime can result in significant financial or operational losses.

The architecture enables fault tolerance by eliminating single points of failure and ensuring that systems remain accessible during maintenance or unexpected disruptions. Growing use of mission-critical applications in financial services, healthcare, and IT operations has heightened the reliance on level 5 availability to achieve performance stability and regulatory compliance.

The segment is also supported by advancements in distributed computing and clustering technologies that enhance resilience and scalability As businesses expand into global markets and adopt 24/7 operational models, availability level 5 is anticipated to remain the most preferred choice, reinforcing its leadership within the overall market.

The Linux operating system segment is projected to account for 39.6% of the high-availability server market revenue share in 2025, making it the leading operating system category. Its leadership is attributed to the open-source ecosystem, cost-effectiveness, and high adaptability offered to enterprises implementing availability solutions. Linux-based environments provide robust stability, scalability, and compatibility with clustering software and virtualization platforms, which are essential for high-availability infrastructures.

The flexibility of Linux allows organizations to tailor deployments to specific workload requirements while benefiting from strong community-driven innovation and continuous security enhancements. Increased adoption of containerization and cloud-native applications, many of which are optimized for Linux, is further supporting its market dominance.

Enterprises in sectors such as IT, telecom, and finance are preferring Linux servers to achieve high performance with lower licensing and operational costs As businesses continue transitioning to digital-first models and demand rises for agile, fault-tolerant infrastructure, Linux-based high-availability servers are expected to sustain their leadership, driven by ongoing technological evolution and widespread enterprise adoption.

The IT and telecom verticals segment is anticipated to capture 36.7% of the high-availability server market revenue share in 2025, establishing itself as the dominant vertical. Its leadership is being reinforced by the exponential growth of data usage, cloud services, and mobile connectivity that require highly reliable and continuously available infrastructure. The need to support real-time communication, data transmission, and service delivery across global networks is driving reliance on servers with advanced fault tolerance and minimal downtime.

Telecom operators and IT service providers are investing heavily in high-availability solutions to support 5G deployment, data center expansion, and the increasing complexity of digital ecosystems. The demand is further supported by enterprise clients requiring uninterrupted access to applications, databases, and communication platforms.

Additionally, rapid innovation in edge computing and IoT ecosystems is amplifying the importance of resilient server infrastructure As service providers scale operations and prioritize customer experience, IT and telecom industries are expected to remain the largest end users, ensuring strong and consistent growth for this segment in the years ahead.

The increased demand for faster processing units along with the advent of cloud computing and hybrid-processing tasks have fueled the demand for high-availability servers in multiple organizations.

The proliferating requirement of a system that works continuously without any breakdown while not jamming the flow of information, fuels the demand for high-availability servers. These servers deliver high operability for multiple functions.

The wide list of applications involve banks, telecommunications, and IT services. These services stand for the biggest consumption of the market. The high-availability server prevents system failure in big organizations while making the workflow efficient and quick.

The rising research and development activities in the enclosed think-tank of brands demand for the high-availability servers to penetrate the web and extract information that is required for the operations. High-availability servers ensure that the processes escalate without a hitch.

The key drivers responsible for growth of high-availability server market include the high adoption rate of high–availability server by banking, financial services, and insurance because of the advantageous features provided.

Businesses that demand high-availability servers are generally huge organizations that have some operation running that is not supposed to fail. The high-availability server manages the continuity of these operations. Thus, the demand for high-availability servers are rising all around the world.

In Information technology, high availability system means any system or device capable of doing continuously work for a long period of time without failure or breakdown. As server consists of various parts such as various hardware and software, therefore in order to make a server high availability server, all the parts used in server must be designed to meet high availability criteria.

These parts should be well designed and thoroughly tested before implementing in high availability server. In short, high availability server can be defined as a server that provides high flexibility, great stability, reliability and higher speed with a zero probability of system failure.

For storage purpose, redundant arrays of independent disk (RAID) approach is popular one used in high availability server and recently invented 'storage area network' (SAN) is the latest approach being used in high availability server.

High availability server has wide applications in banking, financial services and insurance, telecommunications services and others which work with a critical data all the time and the system failure in such organizations can cause big loss for the organizations.

Therefore the demand for high-availability server is increasing from different vertical and is expected to grow with a tremendous CAGR over forecast period.

There are different high-availability servers available for variation of tasks and their continuity. The configuration for high-availability servers changes with the intensity, bandwidth, and performance. Three high-availability servers are explained below that are provided by the high-availability server vendor:

This server solution is suitable for the larger computing capacity and is majorly designed to achieve maximum performance. The server consists of energy efficient and redundant power supply along with the Intel Xeon E3 or E5 series processor that also takes offsite backups.

This type of server solution involves disturbing the incoming web traffic across a group of servers without any indulgence and efficiently. This is suitable for high research and development organizations.

Providing the self-service, scalability, and elasticity through a proprietary architecture, the scalable private cloud demands more resources for the memory, storage and CPU upgrade.

Now a days, research and development is more oriented towards advanced and true fault tolerant infrastructure. The high-availability server market acquires a great potential across various applications. The key drivers responsible in the growth of high-availability server market include the high adoption rate of high–availability server by banking, financial services and insurance because of the advantageous features provided by these high–availability servers such as low or almost zero risk of system failure that enables organizations to run their business without interruptions, protect companies from lost revenue when process of accessing their business application and data resources get disrupted.

On the contrary side higher installation cost of high-availability server, lack of awareness are proving to be the key restraints hindering the growth of global high-availability server market.

Segmentation of high-availability server market is done on the basis of availability level, operating system, verticals and Geography. On the basis of availability level of high-availability server, high-availability server market is segmented into availability level 1, availability level 2, availability level 3, availability level 4 and availability level 5.

These level has been segmented on the basis of configuration of servers such as number of virtual CPUs, storage capacity of HDD and also the size of Random Access Memory (RAM), which may vary application to application.

On the basis of Geography, segmentation of high-availability server market is done as; North America, Latin America, Western Europe, Eastern Europe, Japan, Asia Pacific Excluding Japan (APEJ), and Middle East and Africa (MEA). Among which, North America is having largest market share of high-availability server and Asia Pacific is the second largest market of high-availability server & Asia Pacific is expected to become a leader of market of high-availability server by the end of forecasting period.

The key players of the high-availability server market are CenterServ, International Business Machines Corporation, Dell Inc., HP Development Company, L.P., NEC Corporation, Unisys Global Technologies, Oracle Corporation and other.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

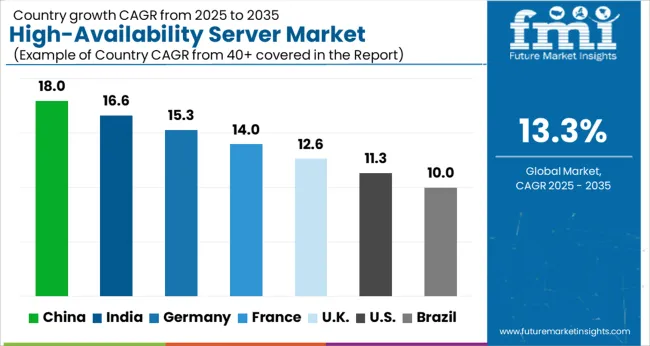

| Country | CAGR |

|---|---|

| China | 18.0% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14.0% |

| UK | 12.6% |

| USA | 11.3% |

| Brazil | 10.0% |

The High-Availability Server Market is expected to register a CAGR of 13.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 18.0%, followed by India at 16.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 10.0%, yet still underscores a broadly positive trajectory for the global High-Availability Server Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 15.3%. The USA High-Availability Server Market is estimated to be valued at USD 5.2 billion in 2025 and is anticipated to reach a valuation of USD 15.1 billion by 2035. Sales are projected to rise at a CAGR of 11.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 745.0 million and USD 446.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.6 Billion |

| Availability Level | Availability Level 5, Availability Level 1, Availability Level 2, Availability Level 3, and Availability Level 4 |

| Operating System | Linux, Windows, Unix, and Others |

| Verticals | IT & Telecom, BFSI, Healthcare, Government, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dell Inc., Oracle Corp., Cisco System Inc., Fujitsu Limited, IBM Corp., CenterServ International Ltd., NEC Corp., Unisys Corporation, Juniper Networks Inc., Hewlett Packard Enterprise Development LP, Amazon Web Services Inc., and Alibaba Cloud Computing Company |

The global high-availability server market is estimated to be valued at USD 14.6 billion in 2025.

The market size for the high-availability server market is projected to reach USD 51.0 billion by 2035.

The high-availability server market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in high-availability server market are availability level 5, availability level 1, availability level 2, availability level 3 and availability level 4.

In terms of operating system, linux segment to command 39.6% share in the high-availability server market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Server Microprocessor Market Size and Share Forecast Outlook 2025 to 2035

Server Less Computing Market Size and Share Forecast Outlook 2025 to 2035

Serverless Apps Market Size and Share Forecast Outlook 2025 to 2035

Server Security Market Analysis - Size, Share, and Forecast 2025 to 2035

Server and Switching Equipment Market Growth – Trends & Forecast 2024-2034

Server Operating Environments Market

Adserver software Market Size and Share Forecast Outlook 2025 to 2035

UK Server Security Market Insights – Trends, Growth & Forecast 2025-2035

SQL Server Transformation Market Size and Share Forecast Outlook 2025 to 2035

USA Server Security Market Report – Trends, Growth & Forecast 2025-2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Blade Server Market Size and Share Forecast Outlook 2025 to 2035

Japan Server Security Market Insights – Growth, Trends & Forecast 2025-2035

Cache Server Market

Cloud Server Market

Germany Server Security Market Growth – Demand, Trends & Forecast 2025-2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

White Box Server Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA