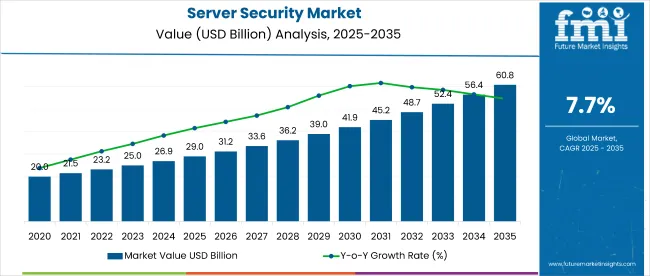

The global Server Security market is valued at USD 28.95 billion in 2025. The industry was seen to have USD 27.06 billion in 2024. The industry is projected to show a CAGR of 7.7% from 2025 to 2035. The business is set to surpass USD 60.88 billion by the end of 2035.

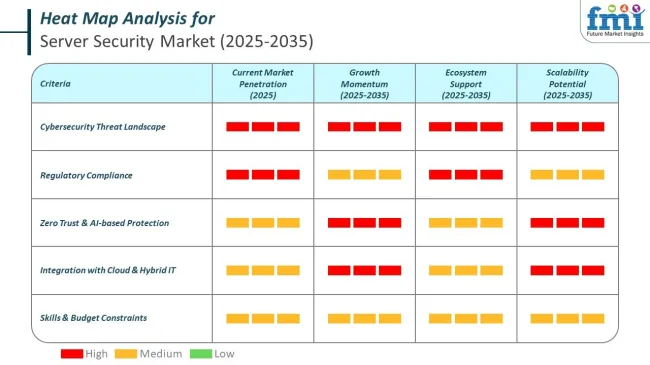

The rising demand for security solutions is anticipated to boost growth in the server security market. The advanced tools help for enhancing AI & analytics capabilities, helping businesses and organizations to improve security measures and help to streamline threat detection and response processes. The focus on protecting critical digital infrastructure intensifies, solutions help to ensure operational continuity and robust threat management are increasing.

| Attributes | Description |

|---|---|

| Historical Size, 2024 | USD 27.06 billion |

| Estimated Size, 2025 | USD 28.95 billion |

| Projected Size, 2035 | USD 60.88 billion |

| Value-based CAGR (2025 to 2035) | 7.7% |

North America has a strong presence of server security solution providers focused on investment in technological advancements propelling the market growth in the region. High adoption rates of security systems and a strong focus on cybersecurity infrastructure. Also, South Asia & Pacific region is growing due to rapid growth is boosting a large population and increasing industrialization help to grow the demand for server security solutions.

The growth in Industry 4.0 is a key factor which is propelling the server security market. The industries highlight digital transformation and automation the demand for innovative security solutions is anticipated to surge. The key drivers include the rising need for real-time monitoring, advanced threat detection and integration with IoT and smart technologies.

The server security market is being reshaped by the structural integration of AI, IoT, and Industry 4.0 technologies. Across global economies, security frameworks are evolving to match the complexity of connected systems and industrial environments.

Government frameworks in the world’s top economies are reshaping the server security landscape through strict compliance mandates, data protection laws, and trade-oriented policies. Developed nations emphasize proactive defense and cross-border controls, while emerging markets focus on data sovereignty and domestic capability enhancement.

The below table presents the expected CAGR for the global Server Security market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Server Security industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 7.2%, followed by a slightly higher growth rate of 8.0% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 7.2% (2024 to 2034) |

| H2 | 8.0% (2024 to 2034) |

| H1 | 7.5% (2025 to 2035) |

| H2 | 8.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase slightly to 7.5% in the first half and remain higher at 8.2% in the second half. In the first half (H1) the market witnessed an increase of 30 BPS and also in the second half (H2), the market witnessed an increase of 20 BPS.

Growing adoption of AI-driven AV/NGAV solutions to proactively detect and mitigate emerging threats

The traditional antivirus software is insufficient for complex cyber threats. The AI-driven AV/NGAV solutions help to leverage machine learning for identifying and neutralize emerging threats include zero-day exploits before they will inflict damage. In 2023, USA government allocated USD 1.2 billion for the next five years to enhance AI-driven cybersecurity initiatives which help to strengthen national defenses and protect critical server infrastructure.

Expanding XDR solutions into multi-cloud environments presents opportunities for broader market adoption

The organizations are shifting towards multi-cloud architectures and the need for integrated security solutions help to provide comprehensive visibility and protection across different cloud platforms. XDR solutions are commonly situated to meet the demand by offering centralized threat detection and response capabilities that span multiple cloud environments.

The expansion not only enhances security by providing a unified view of potential threats but also help to simplifies management and reduces the complexity associated with securing multi-cloud infrastructures. In 2023, European Union allocated USD 700 million funding to support the development of cloud-based security technologies. It helps to enhance cybersecurity for critical infrastructure for ensuring strong and scalable defenses against advanced cyber threats in multi-cloud environments.

Increasing reliance on MDR solutions for 24/7 monitoring and rapid incident response is becoming a standard practice

As the cyber threats become more complex and constant so many organizations face challenges to keep up with security on their own. The solutions help to offer 24/7 monitoring, threat detection and quick response to potential breaches. This continuous protection is crucial, especially in industries where any downtime or data breach could cause serious problems.

According to government of Australia invested USD 500 million for next four years to accelerate the cybersecurity for critical infrastructure. It helps to provide public and private sectors with advanced threat detection and response to minimize disruption from cyberattacks.

Integrating new security solutions with existing infrastructure can be complex, leading to potential compatibility issues and operational disruptions

The organizations are focused on adopting advanced security technologies face difficulties for making new systems for work seamlessly with their current setups. The difficulty arises because different security solutions have varying requirements, protocols and compatibility issues. A new firewall or intrusion detection system not be fully compatible with the existing network architecture and it leads to potential conflicts or disruptions in service.

The process of aligning new security tools with legacy systems requires planning and testing to avoid unexpected problems. The organizations need to invest in additional resources such as specialized IT support or consulting services for managing the integration process effectively.

From the period 2020 to 2024 the global server security market grows at a CAGR 6.2%. The growth is fuel by increasing cyber threats and the growing need for robust security measures to protect critical server infrastructures. The organization are investing in advanced security solutions such as intrusion detection systems, firewalls and encryption technologies to safeguard server environments against data breaches and cyberattacks. The focus on regulatory compliance and data privacy also contributing to the market expansion.

From 2025 to 2035 the market is expected the server security market to grow at a CAGR of 7.7%. Cyber threats, cloud-based services and AI and machine learning in security solutions are propelling the growth. More vendors are using multiple cloud environments and need to spot and deal with threats in real-time help to boosts market demand. By the end of 2034, the global server security market could hit 60,885.1 Million. This shows that companies need better security to protect their changing digital systems.

Tier 1 vendors dominating the market with global presence and strong product portfolios. Tier 1 vendors leads in innovation and set industry standards. Tier 1 vendors such as IBM, Cisco and Palo Alto Networks. Tier 1 vendors cater around 55% to 60% of the market.

Tier 2 vendors include mid-sized companies with a regional focus and niche offerings. Tier 2 vendors such as Fortinet, Check Point and Trend Micro. Tier 2 vendor cater around 10% to15% of the market competing for innovation and pricing.

Tier 3 vendors contain smaller, regional vendors with limited market reach. Tier 3 vendors focus on specific segments or geographic areas and cater around 20% to 25% of the market. The offerings are highly customized to meet the needs of small businesses and local organizations.

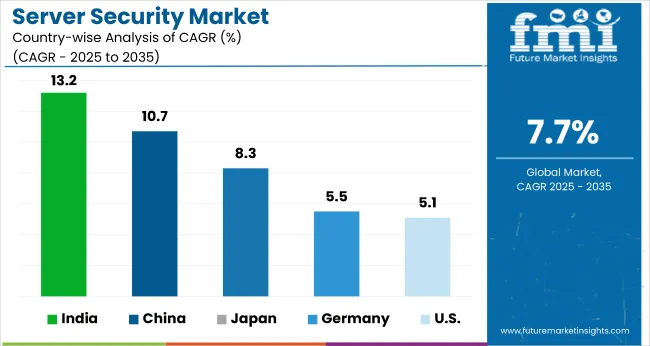

The section highlights the CAGRs of countries experiencing growth in the Server Security market, along with the latest advancements contributing to overall market development. Based on current estimates, India, China and Germany are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 13.2% |

| China | 10.7% |

| Germany | 5.5% |

| Japan | 8.3% |

| United States | 5.1% |

The need for server security solutions in the energy & utilities vertical are becoming vital. The integration of advanced technologies such as IoT devices and smart grid into urban and energy infrastructure significantly intensified the risk of cyber threats. The technology will generate large amounts of data and rely mostly on interconnected systems and makes them vulnerable to attacks that will help to disrupt essential services or compromise sensitive information.

The server security solutions evolving to offer widespread protection against cyber threats. It includes implementing advanced threat detection systems, real-time monitoring and robust encryption methods to safeguard data and to ensure system integrity. In 2023, China invested USD 1.4 billion to fuel the cybersecurity for critical infrastructure to enhance server security and protecting data in smart city and energy systems. China Server Security market is anticipated to witness substantial at a CAGR 10.7% from 2024 to 2034.

The sectors are focused on digital platforms for transactions, data management and administrative operations. The need to protect sensitive information and help to ensure operational stability becoming critical. The surge in digital services improves the risk of cyber threats such as data breaches, ransomware attacks and financial fraud and it is imposing robust security measures.

In 2023, the government of India allocated USD 250 million for next five years to propel the cybersecurity and it is focusing on advanced server security for BFSI and Government sectors. India Server Security market is anticipated to grow from 1,962.1 Million in 2024 to 6,756.4 Million by 2034.

The rapid development of technology in sector such as 5G networks and the expansion of cloud services created more interconnected environments. The increase in complexity and connectivity increases the risk of cyber threats, making robust server security essential to protect sensitive data and ensure system integrity.

In 2023, Germany market invested USD 900 million for enhancing cybersecurity in IT & Telecom sector and focusing on advanced server security technologies such as real-time threat detection and data encryption. Germany is anticipated to see substantial growth at a CAGR 5.5% from 2024 to 2034 in the Server Security market.

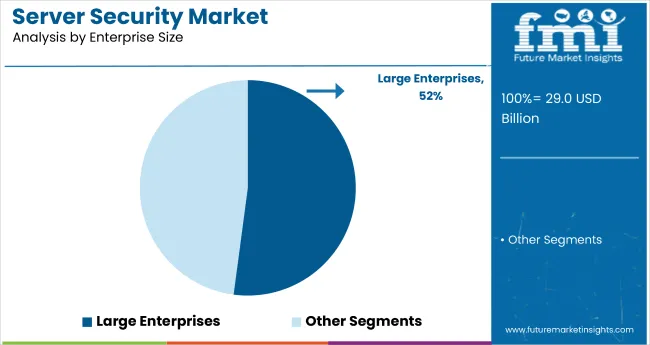

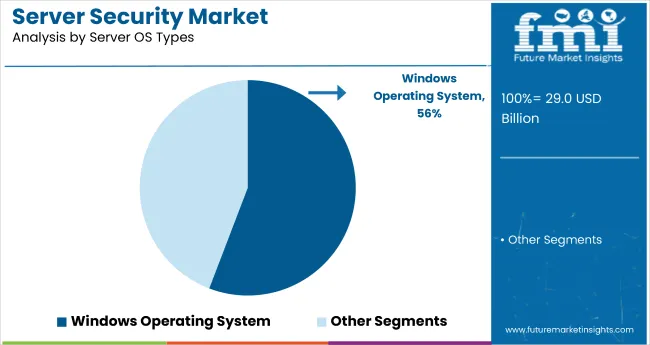

The section contains information about the leading segments in the industry. By Server OS Types, the Linux Operating System segment is estimated to grow at a CAGR of 8.4% throughout 2034. Additionally, the Small & Medium Enterprises segment is foreseen to expand at 8.1% until 2034.

| Enterprise Size | Value Share (2025) |

|---|---|

| Large Enterprises | 52.1% |

The Large Enterprises segment accounts for almost 52.1% of the share in 2024. The organizations help to manage vast networks, significant volumes of sensitive data and multiple interconnected systems all require robust security measures. The rising complexity of cyber threats and regulatory requirements accelerating need for advanced server security solutions. In 2023, European Union allocated USD 1 billion for enhancing server security for large enterprises and which will help to protect emerging threats and ensure network resilience.

| OS Server Type | CAGR (2025 to 2035) |

|---|---|

| Linux Operating System | 8.4% |

Linux open-source allows for customization and optimization and making it preferred choice for securing servers in dynamic and scalable cloud infrastructures. The robust security features such as advanced permission controls and strong encryption, help to align with the need of modern businesses and seeking to protect digital assets.

In 2023, government of USA allocated USD 500 million to boost cybersecurity for cloud infrastructure and it will help for enhancing server security in Linux systems with advanced threat detection and data protection. The Linux Operating System segment grows at a CAGR 8.4% from 2025 to 2035.

The server security market is focused on competitive with advancements from key vendors. Innovations in solution for AI-driven solutions are propelling growth and focus on strategic partnerships and global collaborations are enhancing security capabilities. Vendors are focused on integrating advanced technologies and comprehensive data protection to meet evolving cyber threats.

Industry Update

| Report Attributes | Details |

|---|---|

| Projected Market Size (2025) | USD 28.95 billion |

| Projected Market Size (2035) | USD 60.88 billion |

| CAGR (2025 to 2035) | 7.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2023 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed (Segment 1) | Anti-Virus (AV)/Next-Generation Antivirus (NGAV), Endpoint Protection Platform (EPP), Endpoint Detection and Response (EDR), Extended Detection and Response (XDR), Managed Detection and Response (MDR), Firewall, DDoS Mitigation, Others |

| System Types Analyzed (Segment 2) | Guided Park Assist System, Smart Park Assist System |

| Server OS Types Analyzed (Segment 3) | Windows Operating System, Linux Operating System, UNIX Operating System, Other Types |

| Enterprise Sizes Analyzed (Segment 4) | Large Enterprises, Small & Medium Enterprises |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | IBM, Sophos, Trend Micro, Intel, Microsoft Corporation, McAfee, Comodo, Symantec Corporation, Cisco, Nexusguard, Fortinet, Orange, Tata Communication, Cloudflare, SAP |

| Additional Attributes | Rising cloud adoption, Evolving cybersecurity threats, High demand for proactive and automated security tools |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of server security, the segment is divided into Anti-Virus (AV)/Next-Generation Antivirus (NGAV), Endpoint Protection Platform (EPP), Endpoint Detection and Response (EDR), Extended Detection and Response (XDR), Managed Detection and Response (MDR), Firewall, DDoS Mitigation and Others.

In terms of system type, the segment is segregated into s guided park assist system and smart park assist system.

In terms of Server OS Types, the segment is segregated into Windows Operating System, Linux Operating System, UNIX Operating System and Other Types.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa.

The Global Server Security industry is projected to witness CAGR of 7.7% between 2025 and 2035.

The Global Server Security industry stood at USD 28.95 billion in 2025.

The Global Server Security industry is anticipated to reach USD 60.88 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 11.3% in the assessment period.

The key players operating in the Global Server Security industry are IBM, Sophos, Trend Micro, Intel, Microsoft Corporation, Mcafee, Comodo and Symantec Corporation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Server Security Market Insights – Trends, Growth & Forecast 2025-2035

USA Server Security Market Report – Trends, Growth & Forecast 2025-2035

Japan Server Security Market Insights – Growth, Trends & Forecast 2025-2035

Germany Server Security Market Growth – Demand, Trends & Forecast 2025-2035

GCC Countries Server Security Market Growth – Demand, Size & Industry Trends 2025-2035

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Server Microprocessor Market Size and Share Forecast Outlook 2025 to 2035

Server Less Computing Market Size and Share Forecast Outlook 2025 to 2035

Serverless Apps Market Size and Share Forecast Outlook 2025 to 2035

Server and Switching Equipment Market Growth – Trends & Forecast 2024-2034

Server Operating Environments Market

Adserver software Market Size and Share Forecast Outlook 2025 to 2035

SQL Server Transformation Market Size and Share Forecast Outlook 2025 to 2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Blade Server Market Size and Share Forecast Outlook 2025 to 2035

Cache Server Market

Cloud Server Market

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

White Box Server Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA