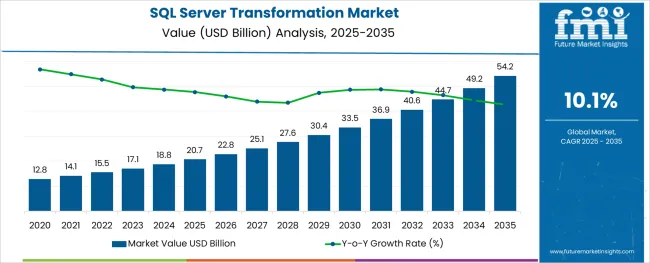

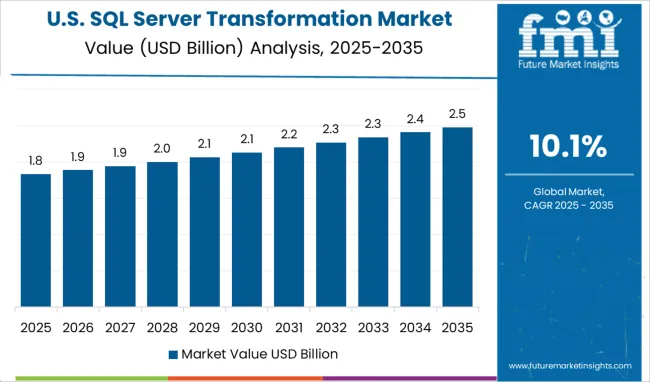

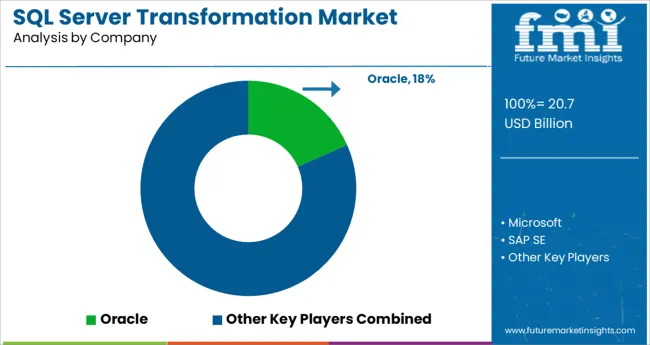

The SQL Server Transformation Market is estimated to be valued at USD 20.7 billion in 2025 and is projected to reach USD 54.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period.

The SQL Server transformation market is gaining significant traction as organizations seek to modernize legacy data infrastructures and implement scalable, cloud-compatible platforms. The shift toward hybrid and multi-cloud environments is accelerating SQL Server upgrades and migrations, with enterprises prioritizing enhanced performance, security, and automation. Modern SQL Server transformations are being driven by needs for real-time analytics, integration with data lakes and warehouses, and compliance with evolving data governance standards.

Organizations are leveraging automation, low-code migration tools, and containerized deployments to streamline transformations while minimizing downtime. Industry focus on DevOps, microservices, and agile data architectures is creating demand for flexible SQL environments that align with CI CD workflows.

Future growth is expected to be driven by investments in AI-powered query optimization, self-healing scripts, and performance analytics dashboards. As data volume and velocity continue to rise across sectors, SQL Server transformations are set to become integral to enterprise data modernization strategies.

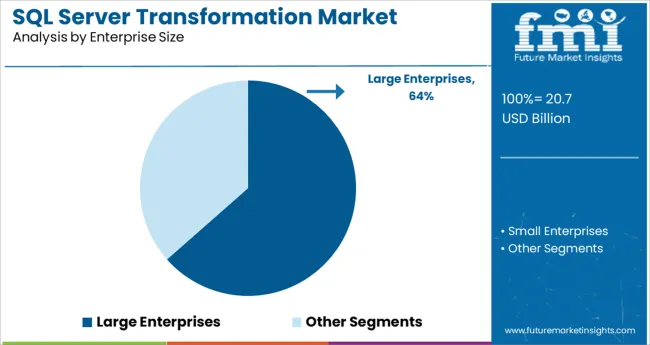

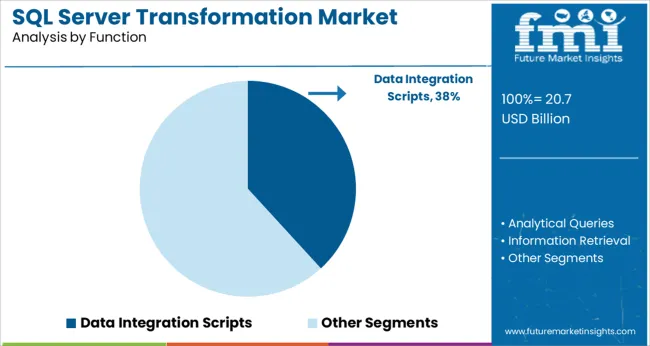

The market is segmented by Enterprise Size, Function, and Use Case and region. By Enterprise Size, the market is divided into Large Enterprises and Small Enterprises. In terms of Function, the market is classified into Data Integration Scripts, Analytical Queries, Information Retrieval, and Other Applications.

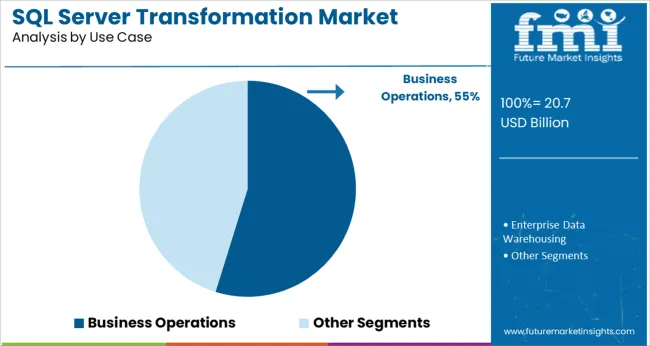

Based on Use Case, the market is segmented into Business Operations and Enterprise Data Warehousing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The large enterprises segment is projected to hold 63.5% of the overall revenue share in 2025, positioning it as the dominant enterprise size category. This leadership is attributed to the scale and complexity of data ecosystems within large organizations, which require robust transformation frameworks to ensure seamless migration, data integrity, and security compliance.

Large enterprises are prioritizing performance improvements and automation across mission-critical systems, prompting increased investments in advanced SQL Server transformation tools. These organizations often operate in regulated industries where audit trails, access control, and version management are essential, further necessitating enterprise-grade solutions.

Additionally, the need to integrate SQL Server environments with modern BI platforms, cloud-native services, and container orchestration systems has reinforced the reliance on structured transformation projects. Strategic IT modernization programs and global deployment capabilities have allowed large enterprises to lead the market in SQL Server transformation initiatives..

The data integration scripts function segment is expected to capture 38.2% of the total market revenue in 2025, making it the leading functional area within SQL Server transformations. This prominence is due to the central role that transformation scripts play in automating the migration, normalization, and cleansing of data across disparate systems.

Enterprises are leveraging these scripts to streamline ETL pipelines, enforce data consistency, and reduce the risk of manual errors during transitions. As organizations adopt hybrid data environments, scripted automation is enabling real-time integration across cloud and on-premise platforms.

SQL-based scripting remains a trusted method for embedding business rules, handling schema modifications, and maintaining referential integrity. The flexibility and repeatability of integration scripts have made them the foundation of many transformation frameworks, ensuring that they remain a key driver of market demand.

Business operations is projected to account for 54.8% of the SQL Server transformation market revenue in 2025, making it the leading use case. This is being driven by the need to modernize operational systems such as ERP, supply chain, inventory, and customer service databases that are deeply rooted in SQL-based infrastructures.

As enterprises pursue digital transformation, there is growing emphasis on real-time data access, cross-functional data sharing, and predictive operational analytics, all of which require efficient SQL Server modernization. Organizations are also prioritizing business continuity, system interoperability, and high availability, which has made SQL transformation essential to operational resilience.

Automation of batch processing, improved transaction speeds, and seamless scalability have further elevated SQL modernization as a core enabler of optimized business operations. The continuous expansion of data-driven decision-making in operations has cemented this use case as a central focus for transformation initiatives across industries.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 8.3% |

| H1,2025 Projected (P) | 8.9% |

| H1,2025 Outlook (O) | 8.5% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (-) 40 ↓ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (+) 20 ↑ |

A decrease of 40 units in BPS values was observed in the SQL server transformation market in H1, 2025 - Outlook (O) over H1, 2025 Projected (P), as per FMI analysis. Some relational database management systems have limits on their field lengths.

When the database is being designed, the developer has to specify the amount of data the client can fit into a field. Some search queries are shorter than the actual data fed into the database, and this leads to data loss. Thereby such technical limitations are restraining the solution adoption and impact market growth.

However, compared to H1, 2024 (A), the SQL server transformation market increased by 20 BPS in H1 -2025. In the healthcare, financial, educational, and IT sectors, SQL server transformation-based systems are crucial for exporting and importing data and delivering audit information with gradually changing dimensions.

Business intelligence tasks including data cleaning, text mining, and performing data mining prediction queries are carried out via SQL server transformation, which is likely to drive market growth.

Rising technological proliferation in multiple regions has created a widespread trend of digitization leading to an increase in the deployment of multiple servers and databases for data management. Demand for SQL server transformation rose at a CAGR of 7.2% from 2014 to 2024.

SQL server transformation systems also add an extra layer of security to database software, and many new SQL server transformation solutions add easy-to-use features to enable the convenient administration of databases.

Increasing focus on the digitization of businesses, rising technological proliferation, widespread digitization of multiple verticals, increasing data volume, rising demand for efficient database management, and increasing speed of SQL server transformation are some major factors that guide the SQL server transformation market potential over the forecast period.

The SQL server transformation market is anticipated to rise at a stellar CAGR of 10.1% from 2025 to 2035.

Increasing Adoption of SQL Server Transformation in Education & Retail

Digital transformation across major industry verticals has become a common trend in the past few years but this trend is evolving with verticals like education and retail providing huge opportunities for SQL server transformation. The IT sector remains a dominant industry vertical for SQL server transformation providers but they can also invest in capitalizing on the new opportunities that the retail and education sectors are predicted to offer.

Rising Popularity of NewSQL Databases to Provide New Opportunities

NewSQL solutions are addressing shortcomings of the current database software and solutions in handling a large volume of data. Large enterprises that utilize structured data are anticipated to lead the adoption of NewSQL databases. With more organizations moving towards these new databases, SQL server transformation providers are expected to have more new opportunities to cash in in the global marketplace.

Complexity & Lack of Efficiency to Negatively Influence SQL Server Transformation Demand

SQL server transformation processes were complex from the very first but have become more complex as technology has advanced in recent years. Lack of efficiency, high complexity, and lack of availability of appropriate solutions are major restraining factors that adversely impact SQL server transformation demand.

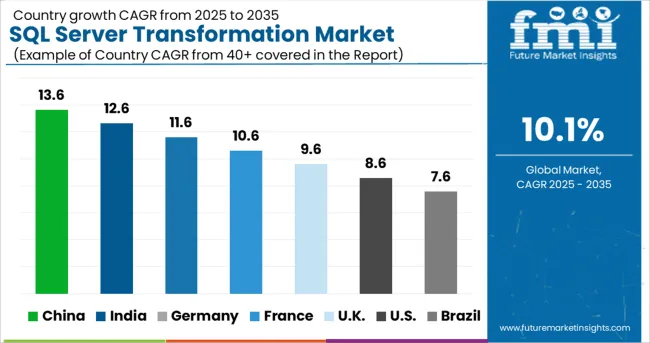

Regions such as North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA) have been assessed in this SQL server transformation market report by FMI.

The market for SQL server transformation in North America is anticipated to hold a dominant stance over the forecast period owing to rising technological advancements in the region. The USA is anticipated to be the most prominent country in this region for SQL server transformation providers. Increasing adoption of intelligent technologies such as AI, IoT, machine learning, etc.

Demand for SQL server transformation in Europe is also expected to be significant over the forecast period. Increasing adoption of cloud technology from large enterprises and SMEs is anticipated to increase the deployment of SQL servers.

Rapid digitization in regions such as East Asia, South Asia, and the Pacific regions are anticipated to guide SQL server transformation market potential over the forecast period. Increasing use of data warehousing solutions in these regions is anticipated to primarily facilitate opportunities for SQL server transformation solution providers.

The SQL server transformation market in the MEA region is predicted to provide a lucrative setting for SQL server transformation vendors. Adoption of high-performance SQL server transformation (Relational Database Management System) RDBMS in this region is expected to majorly provide lucrative opportunities for SQL server transformation companies.

Rapid Urbanization & Digitization Expected to Boost Demand for SQL Server Transformation

India is a developing economy and has proved to be a massively important market for many companies. SQL server transformation market in India is expected to have a bright outlook owing to the increase in digitization of multiple large enterprises and SME businesses. Rising technological proliferation, rapidly advancing digital transformation, and increasing adoption of cloud technologies are expected to boost market potential in India over the forecast.

Data warehousing demand is on an upward trend in India and this is anticipated to propel the adoption of SQL server transformation solutions and services.

Presence of Key SQL Server Transformation Companies to Make USA a Rewarding Market

The USA is a highly rewarding market for all technologies due to the presence of major tech giants. The increasing need for data management has led to a substantial increase in the adoption of SQL server transformation solutions. The presence of key SQL server transformation providers like Microsoft and Oracle also favors market potential in the USA

Data Integration Scripts to Have Dominant Outlook

In 2025, data integration scripts hold a huge market share of 35.9% in the global SQL server transformation market landscape and are currently the dominant sub-segment in the function segment.

Second to this is the information retrieval segment with a market share of 29.8%, which is closely followed by the analytical queries segment accounting for 26.4% in the global SQL server transformation landscape.

SQL server transformation providers are investing in the expansion of their service offerings to cater to the changing trends of large enterprises and SMEs. SQL server transformation vendors are also expected to focus on the rising popularity of NewSQL databases and develop new solutions specific to them.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, India, Indonesia, Malaysia, Singapore, Australia, New Zealand, Turkey, South Africa, and GCC Countries |

| Key Market Segments Covered | Enterprise Size, Function, Use Case, Vertical, Region |

| Key Companies Profiled | Oracle; Microsoft; SAP SE; IBM; Alphabet; Amazon Web Services Inc.; Teradata; NuoDB Inc.; MemSQL Inc.; Actian Corporation |

| Pricing | Available upon Request |

The global sql server transformation market is estimated to be valued at USD 20.7 billion in 2025.

It is projected to reach USD 54.2 billion by 2035.

The market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types are large enterprises and small enterprises.

data integration scripts segment is expected to dominate with a 38.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

No SQL Database Market

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Server Microprocessor Market Size and Share Forecast Outlook 2025 to 2035

Server Less Computing Market Size and Share Forecast Outlook 2025 to 2035

Serverless Apps Market Size and Share Forecast Outlook 2025 to 2035

Server Security Market Analysis - Size, Share, and Forecast 2025 to 2035

Server and Switching Equipment Market Growth – Trends & Forecast 2024-2034

Server Operating Environments Market

Adserver software Market Size and Share Forecast Outlook 2025 to 2035

UK Server Security Market Insights – Trends, Growth & Forecast 2025-2035

USA Server Security Market Report – Trends, Growth & Forecast 2025-2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Blade Server Market Size and Share Forecast Outlook 2025 to 2035

Japan Server Security Market Insights – Growth, Trends & Forecast 2025-2035

Cache Server Market

Cloud Server Market

Germany Server Security Market Growth – Demand, Trends & Forecast 2025-2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

White Box Server Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA