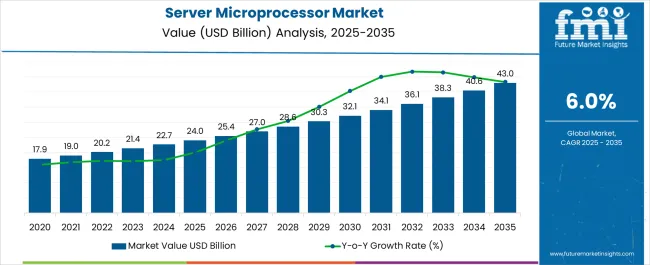

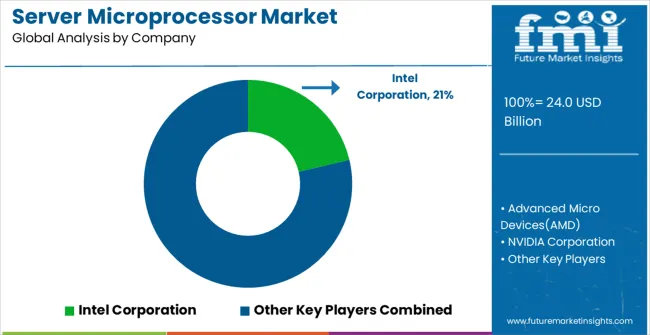

The Server Microprocessor Market is estimated to be valued at USD 24.0 billion in 2025 and is projected to reach USD 43.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Server Microprocessor Market Estimated Value in (2025 E) | USD 24.0 billion |

| Server Microprocessor Market Forecast Value in (2035 F) | USD 43.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The Server Microprocessor market is witnessing accelerated growth, fueled by rising demand for high-performance computing, cloud services, and data-intensive workloads. The increasing adoption of artificial intelligence, machine learning, and big data analytics has created strong demand for microprocessors that can handle massive parallel processing tasks with efficiency. Growth is also being reinforced by the rapid expansion of hyperscale data centers, where energy efficiency, scalability, and performance optimization are critical factors.

Advancements in semiconductor manufacturing, including smaller process nodes and improved transistor density, are enabling microprocessors to deliver higher throughput while reducing power consumption. Enterprises are prioritizing processors that can manage virtualization, real-time analytics, and secure workload distribution across complex IT ecosystems. Additionally, government and private investments in digital infrastructure are expanding the demand base across emerging economies.

With technology players focusing on architectures optimized for multitasking and heterogeneous workloads, the server microprocessor market is set to experience sustained growth Long-term opportunities will be shaped by the need for robust processing power to support future innovations such as edge computing and advanced cloud-native applications.

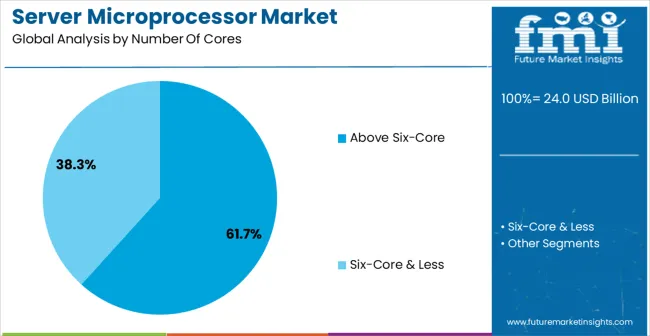

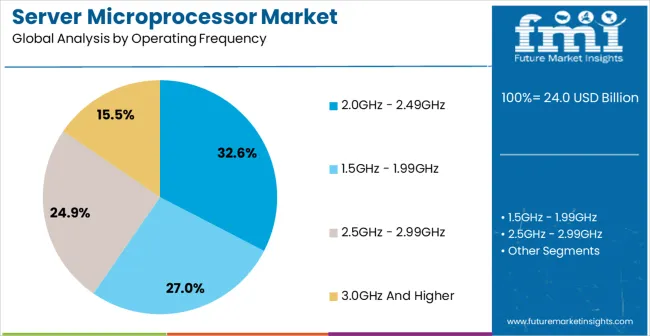

The server microprocessor market is segmented by number of cores, operating frequency, and geographic regions. By number of cores, server microprocessor market is divided into Above Six-Core and Six-Core & Less. In terms of operating frequency, server microprocessor market is classified into 2.0GHz - 2.49GHz, 1.5GHz - 1.99GHz, 2.5GHz - 2.99GHz, and 3.0GHz And Higher. Regionally, the server microprocessor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The above six-core segment is projected to account for 61.7% of the server microprocessor market revenue share in 2025, establishing it as the dominant category. This leadership is being driven by the growing requirement for parallel processing capabilities in data centers, enterprise workloads, and high-performance computing environments. Multi-core architectures allow for improved multitasking, workload balancing, and higher throughput, making them suitable for applications ranging from virtualization to artificial intelligence model training.

Organizations are increasingly adopting servers with higher core counts to manage complex computing demands efficiently. Cost efficiency is also achieved as multi-core processors allow consolidation of workloads on fewer servers, lowering operational and energy expenses. Continuous innovation in core design, including cache optimization and interconnect advancements, is further enhancing performance.

The above six-core category is also benefiting from its suitability for mission-critical applications, where reliability and scalability are paramount With enterprises seeking to future-proof infrastructure, this segment is expected to remain the backbone of server deployments in the forecast period.

The 2.0GHz to 2.49GHz segment is anticipated to hold 32.6% of the market revenue share in 2025, making it the leading operating frequency range. Growth in this segment is being supported by its ability to balance power efficiency with adequate computational performance, making it attractive for both enterprise and cloud service providers. Processors operating within this frequency range deliver stable performance for workloads such as database management, virtual machines, and general-purpose enterprise applications.

Their efficiency in handling sustained workloads without overheating contributes to lower total cost of ownership, making them a preferred choice for large-scale data centers. Furthermore, advancements in dynamic frequency scaling allow these processors to optimize power consumption based on workload intensity, ensuring cost-effectiveness without compromising performance.

The segment is also benefiting from wide availability, strong ecosystem compatibility, and proven reliability in production environments As businesses emphasize efficiency and scalability in server architecture, processors in this frequency range are expected to maintain their leadership, supported by strong demand for energy-conscious yet performance-oriented computing solutions.

Expanding number of cloud servers is the key factor drives the growth of global server microprocessor market. Server microprocessor is the central processing unit (CPU) of a server, which processing data, perform tasks, and execute instructions.

The speed of the processer depends on the number of cores and clock speed. Expanding work load and increasing operating cost are the major concern of datacentre operators, processor thermal design power (TDP) and processor performance per watt influences the purchase decisions of data centre operators.

Based on the types of workloads, the processers are available with various number threads, cores and cash memory size. Intel and AMD are the two main key players, and development of workload-specific server microprocessor designs is the growing trend in the global server microprocessor market.

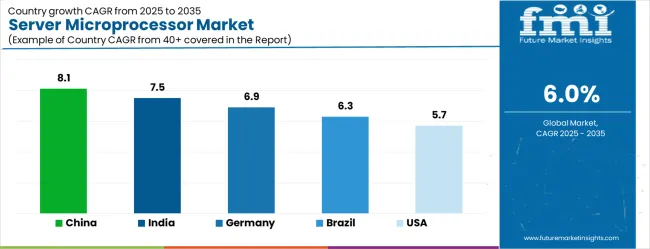

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| Brazil | 6.3% |

| USA | 5.7% |

| UK | 5.1% |

| Japan | 4.5% |

The Server Microprocessor Market is expected to register a CAGR of 6.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.1%, followed by India at 7.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.5%, yet still underscores a broadly positive trajectory for the global Server Microprocessor Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.9%. The USA Server Microprocessor Market is estimated to be valued at USD 8.2 billion in 2025 and is anticipated to reach a valuation of USD 8.2 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.2 billion and USD 793.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.0 Billion |

| Number Of Cores | Above Six-Core and Six-Core & Less |

| Operating Frequency | 2.0GHz - 2.49GHz, 1.5GHz - 1.99GHz, 2.5GHz - 2.99GHz, and 3.0GHz And Higher |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Intel Corporation, Advanced Micro Devices(AMD), NVIDIA Corporation, IBM Corporation, Qualcomm Technologies, Texas Instruments Incorporated, Hisilicon Technologies, Mediatek Inc, Toshiba Corporation, and Baikal Electronics, OJSC |

The global server microprocessor market is estimated to be valued at USD 24.0 billion in 2025.

The market size for the server microprocessor market is projected to reach USD 43.0 billion by 2035.

The server microprocessor market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in server microprocessor market are above six-core and six-core & less.

In terms of operating frequency, 2.0ghz - 2.49ghz segment to command 32.6% share in the server microprocessor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Server Less Computing Market Size and Share Forecast Outlook 2025 to 2035

Serverless Apps Market Size and Share Forecast Outlook 2025 to 2035

Server Security Market Analysis - Size, Share, and Forecast 2025 to 2035

Server and Switching Equipment Market Growth – Trends & Forecast 2024-2034

Server Operating Environments Market

Adserver software Market Size and Share Forecast Outlook 2025 to 2035

UK Server Security Market Insights – Trends, Growth & Forecast 2025-2035

SQL Server Transformation Market Size and Share Forecast Outlook 2025 to 2035

USA Server Security Market Report – Trends, Growth & Forecast 2025-2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Blade Server Market Size and Share Forecast Outlook 2025 to 2035

Japan Server Security Market Insights – Growth, Trends & Forecast 2025-2035

Cache Server Market

Cloud Server Market

Germany Server Security Market Growth – Demand, Trends & Forecast 2025-2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

White Box Server Market Size and Share Forecast Outlook 2025 to 2035

Vendor Share Analysis for ARM-Based Servers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA