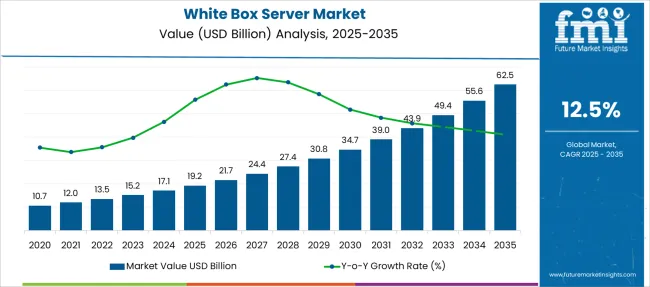

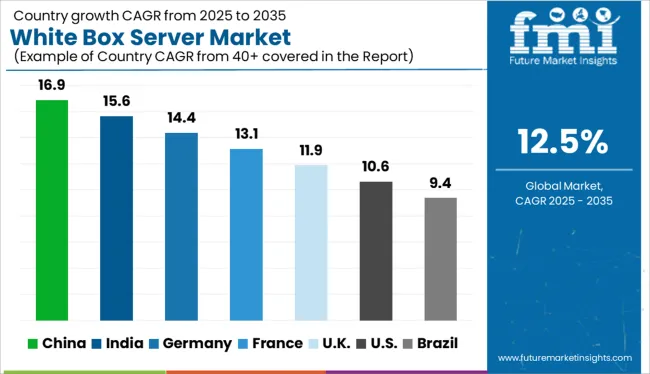

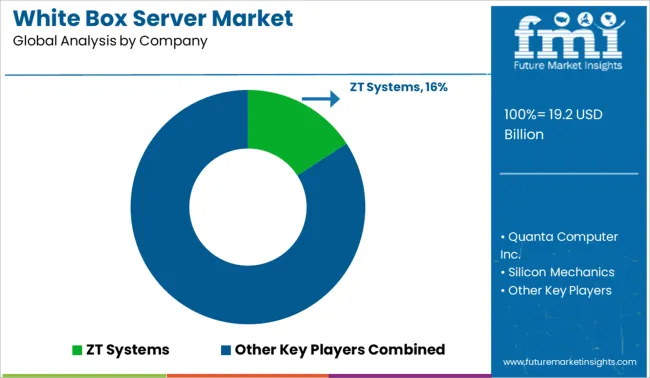

The White Box Server Market is estimated to be valued at USD 19.2 billion in 2025 and is projected to reach USD 62.5 billion by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

| Metric | Value |

|---|---|

| White Box Server Market Estimated Value in (2025 E) | USD 19.2 billion |

| White Box Server Market Forecast Value in (2035 F) | USD 62.5 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

The white box server market is growing rapidly, driven by the expanding demand for customizable and cost-effective server solutions across various industries. The rise of cloud computing and digital transformation has led organizations to seek flexible infrastructure that can be tailored to specific workloads.

Increasing adoption of open hardware and software standards has fueled the popularity of white box servers among enterprises looking to avoid vendor lock-in and optimize operational costs. Data centers are expanding their capacity to handle growing volumes of data and complex processing requirements, while cloud service providers continue to invest heavily in infrastructure to support scalable and resilient services.

Additionally, the push for energy-efficient and space-saving designs has encouraged the deployment of rackmount white box servers. The market outlook remains positive as demand for flexible, high-performance computing continues to rise. Segmental growth is expected to be led by the Rackmount server type, Cloud Service Providers as the main market, and Data Centers as the dominant business type.

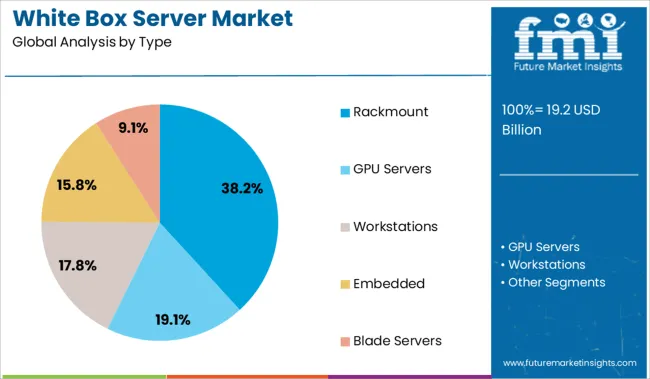

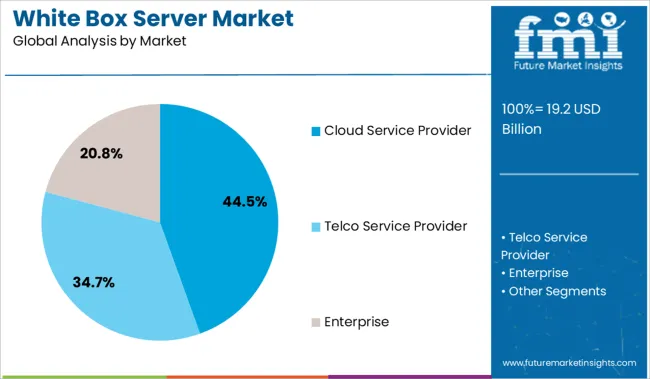

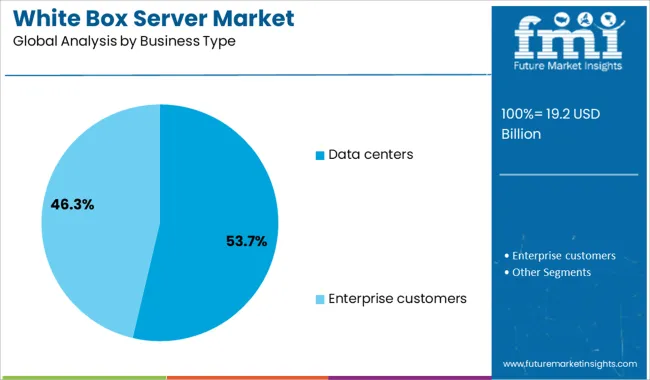

The market is segmented by Type, Market, and Business Type and region. By Type, the market is divided into Rackmount, GPU Servers, Workstations, Embedded, and Blade Servers. In terms of Market, the market is classified into Cloud Service Provider, Telco Service Provider, and Enterprise. Based on Business Type, the market is segmented into Data centers and Enterprise customers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Rackmount segment is projected to hold 38.2% of the white box server market revenue in 2025, maintaining its position as the leading server type. The popularity of rackmount servers stems from their modular design, which allows for efficient use of data center space and simplified maintenance.

Organizations have favored rackmount configurations for their ability to support high-density computing environments and scalable infrastructure. The ease of integration into existing racks and compatibility with various networking and storage components further contribute to this segment’s growth.

As data centers strive to maximize compute power while minimizing footprint, the rackmount type remains the preferred choice.

The Cloud Service Provider segment is expected to contribute 44.5% of the white box server market revenue in 2025, solidifying its leadership in the market. Growth in this segment is driven by the increasing demand for scalable cloud infrastructure to meet growing customer workloads.

Cloud service providers require flexible and customizable server solutions to optimize cost and performance for diverse application needs. The shift toward hybrid and multi-cloud strategies has also increased investments in white box servers, allowing providers to manage infrastructure across various environments.

As cloud adoption accelerates globally, this segment is expected to maintain strong momentum.

The Data Centers segment is projected to account for 53.7% of the white box server market revenue in 2025, establishing it as the dominant business type. Data centers continue to expand in response to surging data volumes and the proliferation of cloud and edge computing.

The need for customizable and scalable server infrastructure to support various workloads has driven demand in this segment. Data center operators are increasingly adopting white box servers to reduce capital expenditures and improve operational flexibility.

Additionally, energy efficiency and thermal management considerations have pushed data centers toward innovative server designs. The ongoing growth in internet traffic and digital services is expected to sustain the demand from data centers in the white box server market.

The major factor driving the demand for white box servers is their capability to run major operating systems. The server deploys clustering techniques to provide high availability and lower risk of unexpected downtime and is highly being adopted by the software industries.

The white box server is the computer structure in the huge data centers that offer high functionality to the enterprise resources boosting the white box server market opportunities.

It is anticipated that there is likely to be a rapid rise in demand for public cloud services, which has prompted cloud service providers to engage in fierce competition for the best pricing terms to gain more users. The white box servers are reducing operational and capital expenditures, and less cost and more functionality fuel the global growth of the white box server.

It is expensive and a viable alternative for cloud giants like Amazon and Google, as hyper-scalers paying a premium for OEM servers result in huge expenditures. It is projected that a rising usage of the internet and networking globally has increased the demand for more cloud space, which further propels the demand for more data centers, and subsequently fuels the demand for white box servers.

Large corporations are only willing to pay for their use and efficiently utilize the resources. Hence, white box servers are being highly adopted by them over OEM servers that are expensive; lower cost is driving the white box server market growth along with the white box server adoption trends on a large scale.

In addition to that, flexibility and customization are crucial factors spurring the growth of the white box server market, and demand for off-the-shelf cloud services providers such as Microsoft Azure, AWS, and Google are driving the white box server market expansion and also the white box server market key trends and opportunities.

It is expected that besides the driving factors, certain aspects are likely to curb the white box server market growth and white box server market opportunities. It is projected that the white box servers are majorly home-built and unbranded; the branded products can easily take over these ODMs (Original Design Manufacturers).

The white box servers have an unreliable life span; no assurance on the life span after installation of these servers can act as a major restraint in the white box server market opportunities and hinder the white box server market growth.

Based on the current market scenario, it is projected that North America is likely to lead the white box server market in the long run. Currently, the North American regions are accountable for 32.1% of the total white box server market share.

Due to this region witnessing an increase in the number of data centers for cloud computing services, and data analytics, the region is projected to propel the white box server market growth during the forecast period.

North America is owing to a notable white box server market share because it is home to numerous large corporations that are installing white box servers to deliver a faster and more reliable user experience (UI) and boost the white box server market's future trends.

The European white box server market size is also on the rise, following North American regions. Europe is projected to hold 23.7% of the total white box server market share. The increase in demand for white box servers and white box server market size in Europe is owing to the increased usage of internet applications, which require scalable data storage facilities.

Several ODMs in the European region have developed switching products and white box servers as they are more energy-efficient and cost-effective, which in turn is boosting the white box server market growth and the white box server adoption trends.

The start-up ecosystem in the white box server market is intense, with frequent innovations being made. Start-ups in the white box server market are focusing on improvising the devices with the integration of new facilities for faster results and convenience for the end-users, with reliable, more secure, and cost-effective means. Some of the start-up companies in the white box server market are Inspon, Cisco, Sugon Server, Quanta, and others.

The biggies in the white box server market include Quanta Computer Inc., Servers Direct, Stack Velocity Group, Silicon Mechanics, Super Micro Computer Inc., Inventec Corporation, Wistron Corporation, Penguin Computing, and Hyve Solutions.

The white box server market manufacturers are deploying the best means to improvise the features of white box servers. They are investing in new technologies to produce innovative products. Government initiatives to help these key players are driving the white box server market. Initiatives are being taken for further enhancement of user experience and more flexibility in the adoption of white box servers.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 12.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Server Type, Business Type, Service Provider, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled | Quanta Computer Inc.; Servers Direct; Stack Velocity Group; Silicon Mechanics; Super Micro Computer Inc.; Inventec Corporation; Wistron Corporation; Penguin Computing; Hyve Solutions |

| Customization | Available Upon Request |

The global white box server market is estimated to be valued at USD 19.2 billion in 2025.

The market size for the white box server market is projected to reach USD 62.5 billion by 2035.

The white box server market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in white box server market are rackmount, gpu servers, workstations, embedded and blade servers.

In terms of market, cloud service provider segment to command 44.5% share in the white box server market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

White Inorganic Pigment Market Size and Share Forecast Outlook 2025 to 2035

White Matter Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

White Tea Extract Market Size and Share Forecast Outlook 2025 to 2035

Whitening Gold Peptide Complex Market Size and Share Forecast Outlook 2025 to 2035

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

White Mulberry Leaves Extract Market Growth - Product Type & Form Insights

White Charcoal Powder Market Size, Growth, and Forecast for 2025 to 2035

White Sneakers Market Insights - Size & Forecast 2025 to 2035

White Pepper Market Analysis by Product Type, Form, Application and Distribution Channel Through 2035

White Mineral Oil Market Analysis by Food, Pharmaceutical, Technical Through 2035

Leading Providers & Market Share in White Mushroom Industry

Competitive Overview of White Cement Market Share

Whiteness Meter Market

White Line Chipboard Market

White Sack Kraft Paper Market

White Rice Flour Market

TV White Space Spectrum Market Report - Growth & Forecast 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA