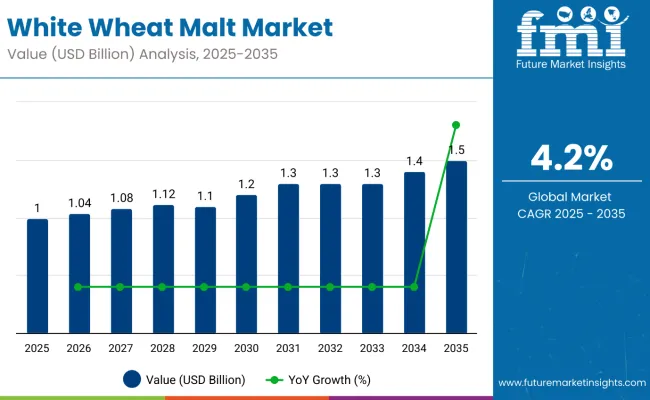

The white wheat malt market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 1.0 billion |

| Forecast Value in 2035 (F) | USD 1.5 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The market is expected to add an absolute dollar opportunity of USD 0.5 billion. This reflects a 1.50 times growth at a compound annual growth rate of 4.2%. The market evolution is expected to be shaped by rising consumer demand for specialty wheat beers, increasing craft beer production, and expanding applications in the food and distilling industries. The market shows a consistent upward trajectory, supported by trends toward natural and health-conscious ingredients and greater innovation in brewing and bakery products.

By 2030, the market is likely to reach USD 1.3 billion, reflecting steady progress through the mid-period. Growth is anticipated to accelerate in the latter half of the timeline as craft breweries expand and food manufacturers incorporate white wheat malt into a wider range of products.

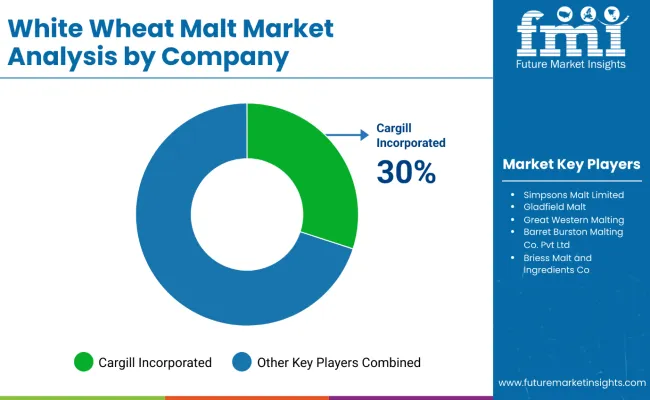

Companies such as Cargill Incorporated, Simpsons Malt Limited, and Gladfield Malt are strengthening their market positions by increasing production capacity and investing in advanced malting technologies. Their innovation pipelines focus on specialty malts, organic and natural variants, and value-added malt products tailored for premium brewing and health-focused food sectors. Market performance will also be influenced by quality control, raw material sourcing, and adherence to regulatory standards, shaping competitive dynamics across regions.

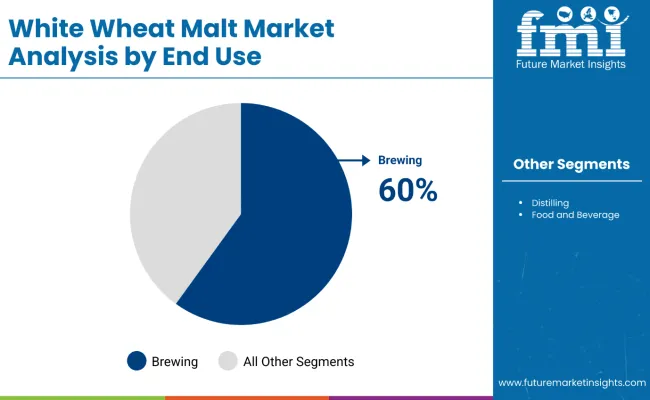

The market holds a strong position across its parent industries, reflecting its rising adoption in brewing, distilling, and food applications. Within the brewing segment, it accounts for about 60%, supported by its essential role in specialty wheat beers and craft beer production across North America, Europe, and Asia-Pacific. In the distilling segment, its share is estimated at around 28%, driven by demand for high-quality spirits such as whiskey and vodka. Within the broader food and beverage industry, it contributes nearly 22%, leveraging its natural properties and flavor-enhancing capabilities to support bakery products, snacks, and health-oriented food innovations. Across specialty malt segments, it holds close to 18%, underscoring its importance in flavor, color, and texture enhancement across artisanal and premium beverage and food offerings.

The market is evolving with advances in malting technology improving malt quality and consistency. Producers are expanding their portfolios to include organic, specialty, and value-added malt variants, supported by growing consumer interest in craft and natural products. Collaborations with craft breweries, distilleries, and food manufacturers, coupled with increased distribution through digital and specialty retail channels, are broadening market reach and reshaping traditional malt usage in brewing and food applications.

The market is expanding due to increasing consumer preference for specialty and craft beers, alongside rising demand for natural and health-oriented ingredients in food and beverages. Advances in malting technologies have improved malt quality, flavor profiles, and nutritional benefits, making white wheat malt more attractive across diverse brewing and food manufacturing segments.

Growing awareness of artisanal brewing and clean-label products is driving adoption, particularly in craft beer and premium spirit categories. The expanding use of white wheat malt in bakery, snacks, and specialty food segments is also broadening the market’s reach. Product innovation and diversification, including organic, specialty, and value-added malt variants, are further contributing to market growth by meeting evolving consumer preferences.

As global craft beer markets and foodservice sectors continue to embrace premium and specialty malts, the outlook for the white wheat malt market remains positive. Producers focusing on product quality, sustainability, and enhanced malt formulations are poised to capture greater acceptance and demand across international markets.

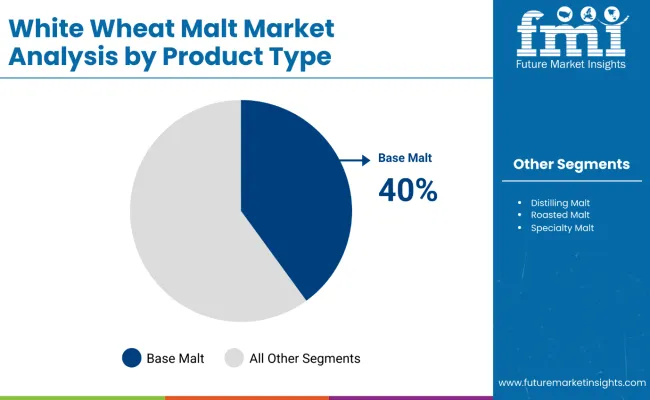

The market is segmented by product type, end use, type, and region. By product type, the market is divided into base malt, distilling malt, roasted malt, specialty malt, and others (malt extracts and customized malt blends). By end use, the market is categorized into brewing, distilling, and food and beverage. By type, the market is segmented into whole, crushed, and others (powdered and pelleted malt). Regionally, the market spans across North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The most lucrative segment in the market by product type is base malt, commanding a significant market share of 40% as of 2025. Base malt is the fundamental ingredient in brewing. It provides essential enzymes that convert starches into fermentable sugars and is indispensable for beer production, especially in the rapidly growing craft beer sector. Its versatility also extends beyond brewing to applications in distilling and food manufacturing, enhancing flavor, color, and nutritional value.

The rising consumer preference for specialty and craft beers has accelerated demand for high-quality base malts, which offer cleaner and more consistent fermentation profiles. Furthermore, innovations in malting processes have improved the efficiency and quality of base malt production, making it the preferred choice for large-scale brewers and artisanal producers alike. As craft beer consumption expands globally, particularly in North America and Asia-Pacific, the dominance of base malt in the market is expected to sustain, supported by continuous product development and diversification within this segment.

The brewing segment is the most prominent within the market, accounting for 60% of the total market share. This segment's growth is primarily driven by the expanding craft beer industry, which has seen a surge in popularity globally, especially in regions like North America and Asia-Pacific. White wheat malt is highly valued in brewing for its ability to impart distinctive flavors, aromas, and a smooth mouthfeel to specialty wheat beers.

The increasing consumer preference for unique, high-quality, and artisanal beer varieties further fuels demand in this segment. Additionally, brewers favor white wheat malt for its excellent enzymatic properties, which enhance fermentation efficiency and consistency. Innovation in brewing techniques and the rising trend of small-scale craft breweries are also amplifying demand for white wheat malt, making brewing the key driver in the market’s steady expansion.

From 2025 to 2035, the market is propelled by growing consumer preference for specialty and craft beers, alongside increasing demand for natural and health-focused ingredients in the food and beverage industry. Brewers and distillers are adopting advanced malting technologies to improve malt quality, flavor profiles, and consistency, positioning high-quality malt producers as key partners in delivering premium and artisanal products.

Rising Craft Beer Demand Drives White Wheat Malt Market Growth

The expanding craft beer segment is the primary driver for market growth, with brewers seeking malts that offer unique flavors, aromas, and enhanced fermentation properties. By 2025, craft breweries worldwide were expected to increase usage of specialty white wheat malts, responding to consumer trends favoring diversity and authenticity in beer styles. The steady rise in craft brewing and consumer interest in premium beverages ensures ongoing and reliable demand for high-quality white wheat malt.

Technological Innovations and Product Diversification Expand Market Opportunities

In recent years, malting companies have integrated innovative malting techniques and product development, including organic, specialty, and value-added malt variants. These advancements improve malt consistency, nutritional value, and flavor complexity, enhancing brewer and distiller product offerings. By 2025, these innovations supported expanding applications beyond brewing into distilling and food sectors, driving market diversification and opening new revenue streams. Producers focusing on quality, sustainability, and tailored malt formulations gain competitive advantages, reinforcing the market’s positive outlook and growth potential.

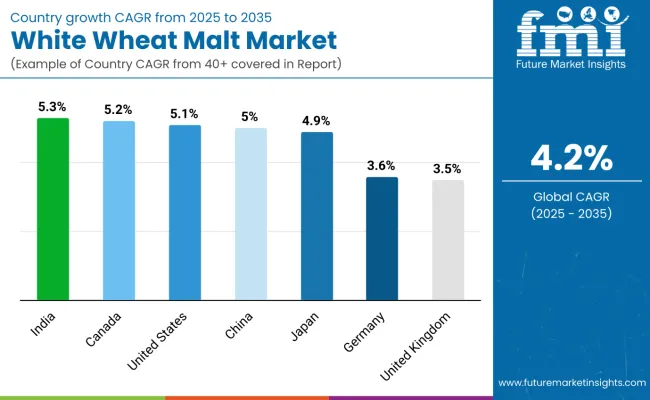

| Countries | CAGR |

|---|---|

| India | 5.3% |

| Canada | 5.2% |

| United States | 5.1% |

| China | 5.0% |

| Japan | 4.9% |

| Germany | 3.6% |

| United Kingdom | 3.5% |

The market growth varies across countries, with India leading at a CAGR of 5.3%, driven by urbanization and craft beer expansion. Canada (5.2%) and the United States (5.1%) follow closely, supported by strong craft brewing sectors and sustainable malt production. China’s market grows at 5.0%, fueled by rising incomes and modern malting facilities. Japan sees moderate growth at 4.9%, balancing tradition and innovation. Germany (3.6%) and the United Kingdom (3.5%) have slower growth due to mature markets and regulatory factors but benefit from craft beer resurgence. Emerging markets show higher growth potential compared to established regions.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Demand for white wheat malt in India is expected to expand at a CAGR of 5.3% from 2025 to 2035, driven by rising urbanization, disposable incomes, and evolving beverage preferences. The growing craft beer sector is a major catalyst, with breweries incorporating specialty malts to enhance flavor diversity. Investments in malting technologies and capacity expansions have improved product quality and supply reliability. The food and beverage industry is also adopting malt for its nutritional benefits and flavor enhancement in bakery and snack segments. Government initiatives supporting food processing and alcohol production further facilitate market growth. Increased consumer health awareness and interest in premium malt products contribute to rising demand. The market’s growth is supported by strategic collaborations and product innovations geared toward evolving consumer tastes.

Demand for white wheat malt in Canada is expected to expand at a CAGR of 5.2% from 2025 to 2035, driven by a vibrant craft beer scene and rising demand for organic and specialty malt variants. Breweries dominate malt consumption as consumer preferences shift towards unique flavors and natural ingredients. Increasing sustainability awareness also fuels the adoption of eco-friendly malt production methods. The country’s food and beverage sector includes malt more frequently for nutritional and flavor benefits. Regulatory support for sustainable production and innovation bolsters market confidence. Collaborations among malt producers and craft brewers aid in product diversification and quality enhancements. Canada's market outlook remains robust due to steady growth in premium and specialty malt demand.

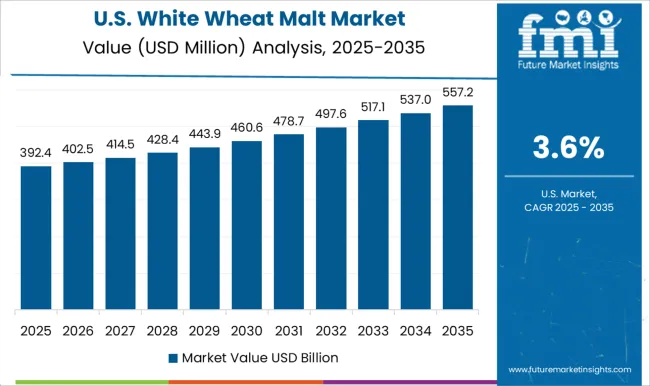

Revenue from white wheat malt in the USA is expected to grow at a CAGR of 5.1% from 2025 to 2035, driven by the thriving craft beer industry and strong consumer demand for specialty and artisanal beers. Malt producers are investing in expanding production capacities and adopting advanced malting technologies to improve malt quality, flavor consistency, and nutritional value. The proliferation of microbreweries and craft distilleries is a key driver of market expansion. Moreover, increasing consumer preference for clean-label and natural ingredients is boosting malt usage in food and beverage products. Collaborations between malt producers and beverage companies further solidify market growth. Sustainability practices and organic malt variants are becoming important to meet evolving consumer demands. The USA remains a pivotal market in driving global white wheat malt consumption.

Revenue from white wheat malt in China is projected to grow at a CAGR of 5.0% from 2025 to 2035, driven by rapid growth in craft and premium beer production. Urbanization and rising middle-class disposable income fuel demand for diverse malt-based flavors. Investments in modern malting facilities enable improved production efficiency and consistency. The food industry increasingly incorporates malt in bakery and snack formulations, broadening end-use applications. Government policies favor innovation and modernization within the alcoholic beverage and food sectors. Strategic partnerships between local and international malt producers advance market penetration. China is poised for continued growth as consumer preferences shift towards premium and artisanal malt products.

The white wheat malt market in Japan is projected to expand at a CAGR of 4.9% from 2025 to 2035, driven by a blend of traditional brewing excellence and modern craft innovation. Demand for high-quality malt is strong among specialty beer and premium spirit producers focusing on unique flavor and aroma profiles. Japan’s sophisticated brewing infrastructure supports consistent malt quality. Consumer preferences are shifting towards natural, gluten-free, and organic ingredients, expanding malt’s applications beyond brewing into food and health sectors. R&D collaborations between malt suppliers and producers foster innovation and product differentiation. The expansion of craft breweries and small-scale distilleries further encourages market growth. Japan’s market demonstrates steady adoption of advanced malt types and diversification to meet nuanced consumer demand.

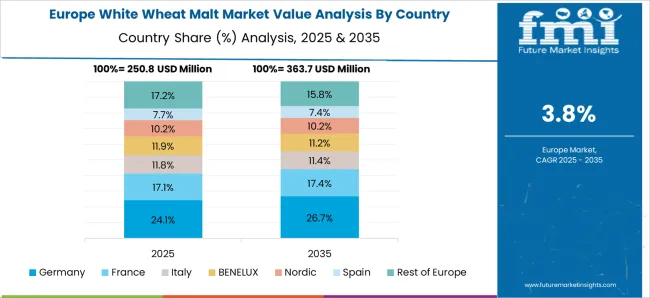

Revenue from white wheat malt in Germany is projected to grow at a CAGR of 3.6% from 2025 to 2035, driven by increasing consumer interest in organic and sustainable malt variants, which supports diversification. The market focuses on premium malt quality to maintain Germany’s global brewing reputation. Niche craft breweries and specialty malt segments are contributing to new demand streams. Investments in advanced malting technologies improve product consistency and sustainability. Export opportunities for German quality malts enhance market outlook. Overall, Germany’s market reflects steady growth balanced between tradition and innovation.

Sales of white wheat malt in the UK are expected to grow at a CAGR of 3.5% from 2025 to 2035, supported by its rich brewing heritage and emerging craft beer scene. Consumer interest in traditional ales alongside innovative craft beers drives demand for quality malt. While economic and regulatory challenges create some headwinds, the market benefits from steady innovation in malt blends and brewing techniques. The food sector increasingly adopts malt for flavor and nutritional enhancement. Growing exports of premium malt products also contribute to growth. UK producers focus on sustainability and organic malt lines to appeal to evolving consumer preferences, maintaining market resilience.

The market is moderately consolidated, with key players differentiating themselves through advanced malting expertise, product innovation, and strong regional presence. Leading companies such as Cargill Incorporated and Simpsons Malt Limited dominate due to their large-scale production capacities and extensive product portfolios, including specialty, organic, and value-added malt variants catering to diverse brewing, distilling, and food applications. Their strengths lie in technological advancements, quality control, and broad distribution networks.

Other major players focus on cost-efficient production and supply chain optimization to meet rising demand for premium and clean-label malt products globally. Regional players emphasize local sourcing, authenticity, and customization to serve niche markets, especially in North America, Europe, and Asia-Pacific. Barriers to entry include the need for sophisticated malting technology, strict adherence to food safety standards, and consistent product quality. Competitiveness increasingly relies on innovation, sustainable sourcing, and responsiveness to evolving consumer preferences and regulatory frameworks worldwide.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.0 billion |

| Product Type | Base Malt, Distilling Malt, Roasted Malt, Specialty Malt, and Others (including malt extracts and customized malt blends) |

| End Use | Brewing, Distilling, and Food and Beverage |

| Type | Whole, Crushed, and Others (powdered and pelleted malt) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Simpsons Malt Limited, Gladfield Malt, Great Western Malting, Barret Burston Malting Co. Pvt Ltd, Valley Malt, Viking Malt, Cargill Incorporated, Briess Malt and Ingredients Co., and Crisp Malting. |

| Additional Attributes | Dollar sales by product type, type, and end use; rising demand for craft and specialty malts; growth in brewing and distilling sectors; innovations in malting technology; increasing focus on organic and sustainable malt production; expanding use in premium food products; emphasis on quality control and traceability |

The global white wheat malt market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the white wheat malt market is projected to reach USD 1.5 billion by 2035.

The white wheat malt market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in white wheat malt market are base malt, distilling malt, roasted malt, specialty malt and others.

In terms of end use, brewing segment to command 55.2% share in the white wheat malt market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

White Inorganic Pigment Market Size and Share Forecast Outlook 2025 to 2035

White Matter Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

White Tea Extract Market Size and Share Forecast Outlook 2025 to 2035

Whitening Gold Peptide Complex Market Size and Share Forecast Outlook 2025 to 2035

White Box Server Market Size and Share Forecast Outlook 2025 to 2035

White Mulberry Leaves Extract Market Growth - Product Type & Form Insights

White Charcoal Powder Market Size, Growth, and Forecast for 2025 to 2035

White Sneakers Market Insights - Size & Forecast 2025 to 2035

White Pepper Market Analysis by Product Type, Form, Application and Distribution Channel Through 2035

White Mineral Oil Market Analysis by Food, Pharmaceutical, Technical Through 2035

Leading Providers & Market Share in White Mushroom Industry

Competitive Overview of White Cement Market Share

Whiteness Meter Market

White Line Chipboard Market

White Sack Kraft Paper Market

White Rice Flour Market

TV White Space Spectrum Market Report - Growth & Forecast 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA