The white top testliner market is experiencing steady expansion driven by increasing demand for sustainable and visually appealing packaging solutions. Rising consumer preference for recyclable materials and the growth of the e-commerce and food packaging industries have strengthened market fundamentals. Current dynamics reflect a transition toward eco-efficient paper products, with manufacturers investing in advanced fiber recovery technologies and surface treatment enhancements to improve printability and strength.

Regulatory emphasis on circular economy practices and waste reduction is supporting widespread adoption of testliners produced from recycled inputs. The future outlook is positive as industries prioritize environmentally responsible packaging materials that maintain aesthetic appeal and functional performance.

Technological advancements in paper coating, thickness optimization, and lightweight construction are improving operational efficiency and cost competitiveness Growth rationale is based on expanding demand from corrugated box manufacturers, the evolution of retail-ready packaging formats, and the consistent shift from virgin to recycled fibers, collectively ensuring sustained value creation across global packaging supply chains.

| Metric | Value |

|---|---|

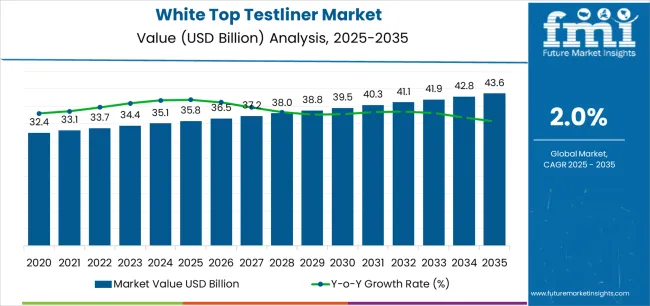

| White Top Testliner Market Estimated Value in (2025 E) | USD 35.8 billion |

| White Top Testliner Market Forecast Value in (2035 F) | USD 43.6 billion |

| Forecast CAGR (2025 to 2035) | 2.0% |

The market is segmented by Material, Liner Type, Thickness, and End Use and region. By Material, the market is divided into Recycled Fiber and Virgin Fiber. In terms of Liner Type, the market is classified into Uncoated and Coated. Based on Thickness, the market is segmented into 80 GSM to 160 GSM, Up to 80 GSM, 160 GSM to 200 GSM, and More Than 200 GSM. By End Use, the market is divided into Food And Beverage, Shipping And Logistics, E-Commerce, Electronics And Home Appliance, Pharmaceutical, Personal Care And Cosmetics, Furniture, and Other Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

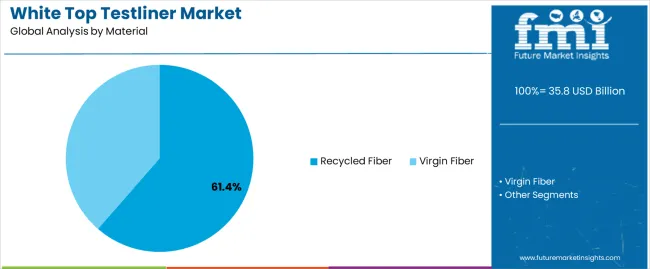

The recycled fiber segment, accounting for 61.4% of the material category, has been leading the market due to its strong alignment with sustainability trends and lower production costs compared to virgin fiber alternatives. The segment’s dominance has been reinforced by rising environmental regulations and corporate commitments toward eco-friendly packaging.

Consistent quality improvement in recycled pulp and fiber treatment technologies has enhanced durability and print performance, allowing recycled materials to match or exceed traditional specifications. Availability of advanced de-inking and refining systems has optimized resource utilization, further strengthening cost efficiency.

Global packaging producers are increasingly adopting recycled fiber-based liners to meet brand sustainability goals, ensuring continued demand The segment’s growth trajectory is expected to remain positive as recycled fiber becomes the preferred input for high-volume packaging applications worldwide.

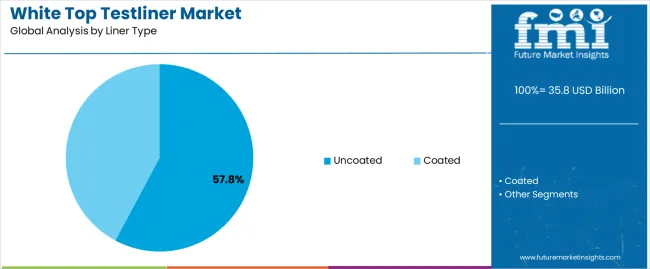

The uncoated segment, holding 57.8% of the liner type category, has maintained its leading position due to its balance between performance, print quality, and production efficiency. Market preference has been driven by cost-effectiveness and reduced chemical usage in production processes. Uncoated testliners are widely used in corrugated packaging applications where natural texture and strength are prioritized.

Manufacturers are increasingly focusing on optimizing surface smoothness and brightness through mechanical refining techniques, eliminating the need for additional coatings. Demand stability has been supported by consistent utilization in fast-moving consumer goods and transport packaging.

The segment’s share is further reinforced by its compatibility with high-speed printing and converting operations Over the forecast period, uncoated testliners are expected to retain market leadership as industries emphasize sustainability and operational cost reduction.

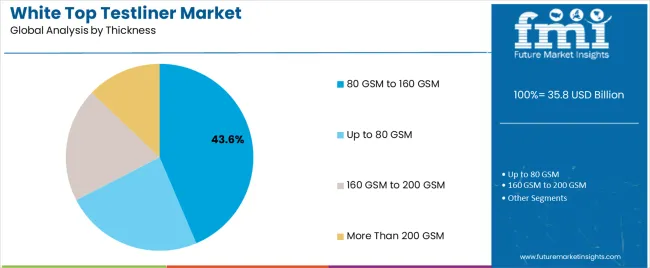

The 80 GSM to 160 GSM segment, representing 43.6% of the thickness category, has emerged as the most preferred range due to its suitability for a wide array of packaging applications. This range offers optimal balance between rigidity, flexibility, and cost efficiency, making it ideal for corrugated box liners and retail packaging.

Manufacturers are selecting this thickness range to meet structural requirements while minimizing material waste and logistics costs. Technological improvements in paper forming and drying processes have ensured consistent thickness and strength properties, enhancing end-user confidence.

The segment’s dominance is further supported by its adaptability to automated packaging systems and compatibility with lightweight packaging trends As sustainability pressures intensify, the 80 GSM to 160 GSM range is expected to maintain its leadership position, offering the best combination of performance, efficiency, and recyclability.

Increased product demand is attributed to the rise in need for white top testliner, such as silicone elastomers, particularly in the automotive and construction industries.

The market is fueled by the growing demand for corrugated packaging, as it offers a smoother, brighter surface for improved appearance and printing, contributing significantly to global market growth.

Manufacturers prefer white-top testliners due to their high recyclability and versatility in various industries such as food, beverages, electronics, and consumer durable product packaging.

The market growth is impacted by the availability and cost-effectiveness of raw materials, such as short fiber pulp and high and medium-grade recovered paper, used to produce multi-ply coated white top testliners.

The section examines the market's growth over the past five years, revealing a historical CAGR of 1.10% and a projected 2.00% CAGR through 2035.

| Attributes | Details |

|---|---|

| Historical CAGR from 2020 to 2025 | 1.10% |

The demand for white top testliners is limited due to their higher cost than traditional brown liners. Additionally, the niche application of white top testliners in premium packaging segments restricts mass-market adoption in several sectors.

Critical aspects that are anticipated to influence the demand for white top testliner through 2035. Market players are anticipated to capitalize on the growing demand for high-quality packaging solutions in the luxury goods, cosmetics, and electronics sectors.

Opportunities exist to develop demand for eco-friendly and sustainable white top testliners to cater to environmentally conscious consumers and regulatory requirements. Developing into emerging markets with increasing disposable incomes and evolving retail landscapes presents lucrative opportunities for white top testliner market growth.

Market players are going to be prudent and flexible over the anticipated period since these challenging attributes position the industry for accomplishment in subsequent decades.

Development in the eCommerce Packaging Drives the Demand for White Top Testliners

The demand for white top testliners in e-commerce packaging is growing due to the need for durable, visually appealing packaging solutions. The sustainable white top testliners provide strength, rigidity, and a printable surface for high-quality graphics and branding, enhancing brand recognition and customer experience.

The demand for white testliner packaging is high, as it offers versatility for customization and personalization, catering to different product and brand requirements. As the global e-commerce market expands, the demand for white top testliners is expected to grow further, driving the growth of the packaging industry.

Rising Demand for Premium Packaging from Various Sectors

The growing demand for premium packaging in various sectors, such as cosmetics, food and beverage, electronics, and luxury goods industries, is driving the adoption of white top testliners.

The demand for white top testliners is significant as they anticipated to offer a clean, bright surface for vibrant graphics and intricate designs while being strong and durable, ensuring product integrity and value. As the demand for premium products continues to rise, the demand for white top testliners is expected to increase, driving market growth and expansion in the forthcoming decade.

Shift towards Sustainable Packaging Trends in the White Top Testliners Market

The global demand for eco-friendly packaging, such as white top testliners, is rising due to increasing environmental awareness and regulatory pressures. The demand for eco-friendly alternatives is anticipated to be produced from recycled materials or sustainably managed forests, reducing reliance on virgin fibers and deforestation.

White top testliners are recyclable, biodegradable, and lightweight, contributing to circular economy principles. Their lightweight nature reduces transportation emissions and energy consumption. As companies meet sustainability targets, demand for sustainable white top testliners is expected to rise, promoting an environmentally friendly packaging landscape.

This section offers in-depth analyses of particular white top testliner market sectors. The two main topics of the research are the segment with the coated white top testliners and the recycled fiber as material. Through a comprehensive examination, this section attempts to provide a fuller knowledge of these segments and their relevance in the larger context of the white top linerboard market.

| Attributes | Details |

|---|---|

| Top Liner Type | Coated White Top Testliner |

| Market share in 2025 | 72.6% |

The demand for coated white top testliners is significant, accounting for a market share of 72.6% in 2025; the following aspects display the development of coated white top testliners: The demand for coated white top testliners is driven by their smoothness, brightness, and burst strength properties.

The coated white top testliners are in demand owing to primarily being made from recycled paper, enhancing packaging sustainability. Coated white top testliners are in high demand across several industries, including consumer products, electronics, electrical, and food and beverage.

| Attributes | Details |

|---|---|

| Top Material | Recycled Fiber |

| Market share in 2025 | 67.9% |

The demand from recycled fiber for development of white top testliner acquires almost 67.9% market share in 2025. The development of utilization of recycled fiber for white top testliners from the following drivers: The demand for recycled fiber in the white top testliner market is driven by a growing emphasis on sustainability and environmental responsibility.

Recycled fiber minimizes the need for virgin fiber, conserving natural resources and reducing the environmental impact of paper production. Consumers are increasingly favoring products made from recycled materials, leading to a surge in demand for white top testliners made from recycled fiber. The recycled fiber in white top testliners can provide significant cost savings compared to virgin fiber, making it a popular choice for manufacturers seeking to decrease production expenditures.

This section focuses on the growth rates of the important markets on the global stage, such as China, India, Thailand, Spain, and Italy. Through in-depth research, explore the aspects influencing these nations' acceptability and growth of white top testliner sales.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 4.1% |

| China | 3.3% |

| Thailand | 2.7% |

| Spain | 2.3% |

| Italy | 1.2% |

The consumer goods packaging in India has developed the demand for white top testliners. The market is expected to register a CAGR of 4.1% from 2025 to 2035. Here are a few of the major trends:

India's growing consumer durable sector, driven by rising disposable revenues and urbanization, is boosting the demand for white top testliners for packaging. Indian consumer durables manufacturers are enhancing product presentation and brand identity by using packaging solutions that make white top testliners attractive due to their pristine appearance and printability.

The Indian e-commerce industry is thriving, requiring efficient and attractive packaging solutions to enhance online shopping experiences, increasing demand for white top testliners for consumer durable packaging.

Demand for white top testliners in China is expected to develop at a CAGR of 3.3%. The following factors are propelling the demand for white top testliner for corrugated cardboard tray packaging in China:

China's global manufacturing status influences the demand for packaging materials such as white top testliner for corrugated cardboard tray packaging. China's international production necessitates reliable packaging solutions for safe goods transportation, and due to its high-quality packaging requirements, there is increasing demand for white top testliner.

Chinese manufacturers use white top testliner for corrugated cardboard tray packaging to improve brand visibility and product presentation, attracting domestic and international consumers. Chinese companies are adopting eco-friendly packaging materials, such as recycled or sustainably sourced fibers, which align with global sustainability trends.

The demand for white top testliners in Thailand is predicted to extend at a CAGR of 2.7% between 2025 and 2035. Some of the primary trends in the industry are:Thailand's electronics manufacturing industry necessitates high-quality packaging materials like white top testliner to safeguard electronic products during transportation and storage. The white top testliner provides a professional and clean appearance, enhancing the presentation of electrical and electronic goods and bolstering the brand image in Thailand.

Thailand's growing export market for electrical and electronic products demands reliable, high-quality packaging solutions, making white top testliner a preferred choice for manufacturers.Thai manufacturers demand white top testliners for printability. This allows customization with branding, product information, and safety instructions, catering to diverse customer preferences.

The demand for white top testliner in Spain is expected to register a CAGR of 2.3% from 2025 to 2035. Some of the primary trends are:

The growth of e-commerce platforms such as Amazon, Elcorteingles, Shein, Carrefour, and others in Spain, fueled by changing consumer preferences and convenience, drives the demand for testliner paper packaging. Spanish e-commerce companies require sturdy and reliable packaging materials, such as white top testliner paper, to transport products safely to customers' doorsteps.

White top testliner packaging offers versatility in packaging various products, from clothing and electronics to household items and groceries, catering to the diverse needs of e-commerce retailers in Spain.

The white top testliner industry in Italy is expected to register a CAGR of 1.2% through 2035. Among the primary drivers of the market are: Italy's culinary heritage and emphasis on food quality and presentation drive demand for premium packaging materials like white top testliner in the food and beverage sector.

The white top testliner in Italy offers a hygienic packaging solution for food and beverage products, ensuring freshness, integrity, and consumer trust throughout the supply chain. The white top testliner improves product visibility, enabling consumers to easily identify and appreciate the quality of Italian food and beverage products, thereby influencing purchasing decisions. White top testliner packaging in Italy embodies sophistication and premium quality, showcasing the country's reputation for fine dining and gourmet products.

In the global white top testliner market, companies face intense competition and must employ strategic approaches to gain a competitive edge. These approaches include mergers and acquisitions, expansion into new territories, and investment in product innovation.

Acquisitions allow companies to consolidate their market position, acquire new technologies, and diversify their product portfolios. Expansion strategies aim to penetrate new markets, increase production capacity, and enhance distribution networks, often through geographic expansion and partnerships.

In addition, product innovation is crucial to success in the white top testliner industry. Companies invest heavily in research and development to develop new, innovative white top testliner products that offer improved performance, sustainability features, and customization options. The goal is to differentiate their products from those of their competitors and to meet their customers' evolving needs and preferences.

To succeed in this dynamic and competitive market, market players must remain agile and adaptable to changing market trends and customer preferences. Businesses are expected to focus on developing strong partnerships with suppliers and distributors, embrace sustainable practices, and invest in innovation. By employing such strategies, companies are anticipated to gain a competitive advantage and thrive in the global white top testliner market.

Recent Developments in the White Top Testliner Market

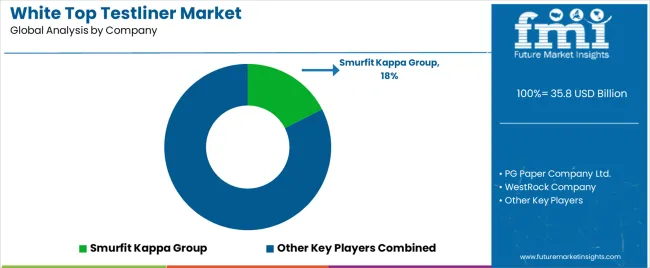

The global white top testliner market is estimated to be valued at USD 35.8 billion in 2025.

The market size for the white top testliner market is projected to reach USD 43.6 billion by 2035.

The white top testliner market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in white top testliner market are recycled fiber and virgin fiber.

In terms of liner type, uncoated segment to command 57.8% share in the white top testliner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Uncoated White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

White Inorganic Pigment Market Size and Share Forecast Outlook 2025 to 2035

Top Loading Cartoning Machine Market Forecast and Outlook 2025 to 2035

Topical Anti-infective Drugs Market Size and Share Forecast Outlook 2025 to 2035

White Matter Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

White Tea Extract Market Size and Share Forecast Outlook 2025 to 2035

Whitening Gold Peptide Complex Market Size and Share Forecast Outlook 2025 to 2035

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Topical Antibiotic Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

White Box Server Market Size and Share Forecast Outlook 2025 to 2035

Top Coated Direct Thermal Printing Films Market Size and Share Forecast Outlook 2025 to 2035

White Mulberry Leaves Extract Market Growth - Product Type & Form Insights

White Charcoal Powder Market Size, Growth, and Forecast for 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

White Sneakers Market Insights - Size & Forecast 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Topical Bioadhesives Market - Trends & Forecast 2025 to 2035

White Pepper Market Analysis by Product Type, Form, Application and Distribution Channel Through 2035

White Mineral Oil Market Analysis by Food, Pharmaceutical, Technical Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA