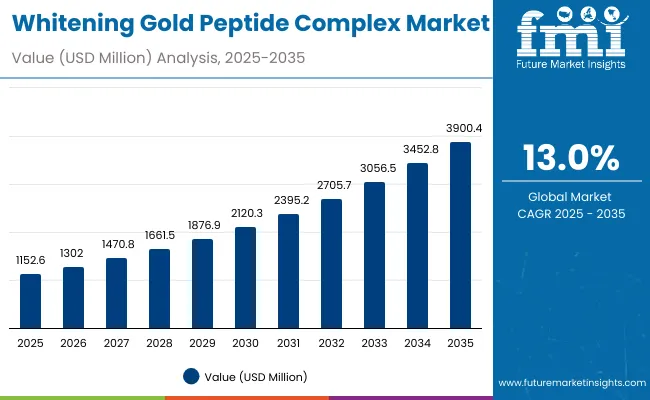

The global Whitening Gold Peptide Complex Market is expected to record a valuation of USD 1,152.6 million in 2025 and USD 3,900.4 million in 2035, with an increase of USD 2,747.8 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 13.0% and more than a 3X increase in market size.

Global Whitening Gold Peptide Complex Market Key Takeaways

| Metric | Value |

|---|---|

| Global Whitening Gold Peptide Complex Market Estimated Value in (2025E) | USD 1,152.6 million |

| Global Whitening Gold Peptide Complex Market Forecast Value in (2035F) | USD 3,900.4 million |

| Forecast CAGR (2025 to 2035) | 13.0% |

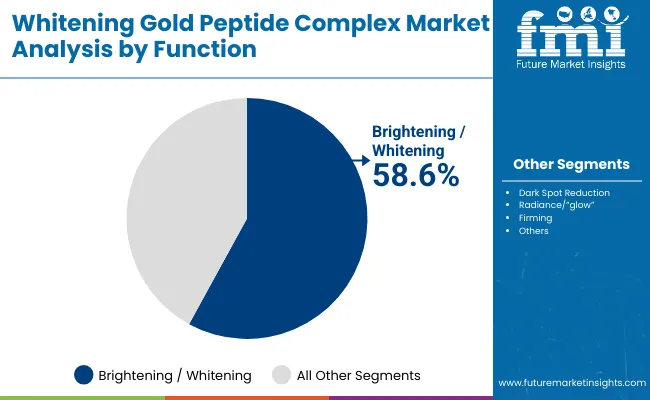

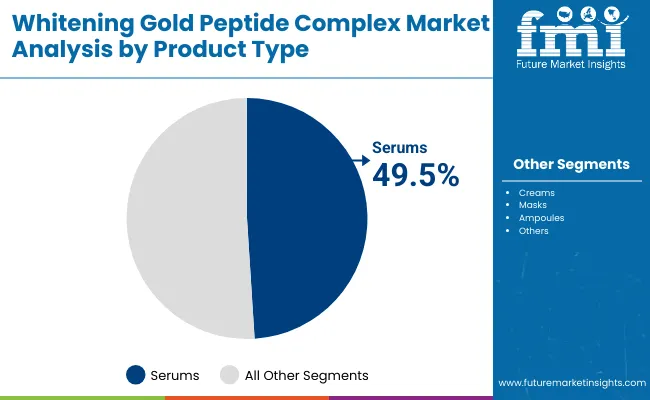

During the first five-year period from 2025 to 2030, the market increases from USD 1,152.6 million to USD 2,120.3 million, adding USD 967.7 million, which accounts for 35.2% of the total decade growth. This phase records steady adoption in premium skincare, especially in Asia’s beauty retail chains and e-commerce platforms. Brightening/whitening complexes dominate this period as they cater to over 58% of global demand, driven by consumer preference for even skin tone and reduction of dark spots. Serums, which provide high peptide absorption, lead this phase with nearly half the category value.

The second half from 2030 to 2035 contributes USD 1,780.1 million, equal to 64.8% of total growth, as the market jumps from USD 2,120.3 million to USD 3,900.4 million. This acceleration is powered by the integration of encapsulated gold systems with niacinamide complexes, supported by luxury/premium claims across e-commerce and pharmacy channels. By the end of the decade, demand consolidates in East Asia and North America, with China and India emerging as the fastest-growing markets. Dermatologist-tested, fragrance-free labels gain relevance, with clean-label positioning pushing adoption among younger demographics. The emphasis shifts from hardware-like serum vehicles alone to holistic ecosystem approaches, including masks, ampoules, and hybrid luxury formats.

From 2020 to 2024, the global Whitening Gold Peptide Complex Market grew steadily from a niche segment into a mainstream luxury skincare solution, largely driven by Asia-Pacific beauty retail chains. During this period, Japanese and Korean beauty giants such as Shiseido and Sulwhasoo dominated, supported by their regional expertise and innovation in gold-peptide integration. Competitive differentiation relied on premium positioning, clinical credibility, and sensory experience, while USA and European brands lagged in early adoption. Luxury serums and creams accounted for nearly 70% of total market growth during this phase, with ampoules gaining traction in Korea and Japan as a premium, single-dose innovation.

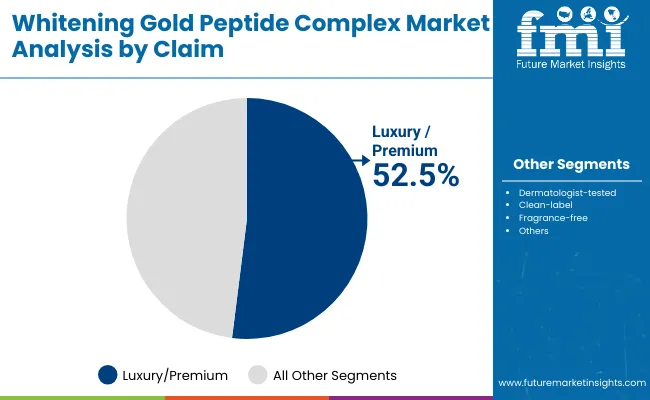

Demand for whitening gold peptide complexes will expand to USD 1,152.6 million in 2025, and the revenue mix will shift as premium and dermatologist-tested claims grow to dominate over 50% share. Traditional beauty leaders face rising competition from niche luxury entrants offering encapsulated gold delivery systems, hybrid peptide-niacinamide complexes, and fragrance-free clean formulations. Asian beauty conglomerates continue to lead global launches, while Western luxury houses like Guerlain and Peter Thomas Roth emphasize heritage-driven exclusivity. The competitive advantage is shifting away from standalone brightening serums to integrated luxury skincare systems that blend performance, dermatological validation, and aspirational branding.

Advances in peptide biotechnology and gold conjugation systems have improved skin absorption, stability, and efficacy, allowing for targeted brightening and anti-aging benefits. Serums dominate in 2025 because they deliver concentrated gold-peptide complexes directly into the skin, driving faster results. The rise of niacinamide-peptide hybrids has further boosted consumer demand, as these combinations deliver dual action of whitening and barrier repair.

Expansion of Asia’s luxury skincare retail ecosystem especially in China, Japan, and Korea has fueled early adoption, while premium USA and European consumers are embracing gold-peptide complexes as part of multi-step regimens. Innovations in encapsulation technology and 24K gold sheet masks have opened new premium categories. Segment growth is expected to be led by brightening/whitening functions, luxury/premium claims, and serums, with fragrance-free and dermatologist-tested formats accelerating adoption among millennials and Gen Z.

The global Whitening Gold Peptide Complex Market is segmented by complex type, function, product type, distribution channel, and claims. Complex types include gold-peptide conjugates, peptide + niacinamide complexes, encapsulated gold systems, and 24K gold masks/creams, highlighting the diversity in product innovation. Functions include brightening/whitening, dark spot reduction, radiance/glow, and firming, catering to both aesthetic appeal and dermatological needs. By product type, categories cover serums, creams, masks, and ampoules, with serums capturing the largest share due to their efficiency and ease of use.

Distribution channels include Asia beauty retail, e-commerce, pharmacies, and premium beauty retail, demonstrating the mix of traditional and digital sales strategies. Claims play a central role in marketing and consumer trust, with luxury/premium, dermatologist-tested, clean-label, and fragrance-free leading positioning strategies. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa, with China, India, and Japan showing the highest CAGR over the forecast period.

| Function | Value Share% 2025 |

|---|---|

| Brightening/whitening | 58.6% |

| Others | 41.4% |

The brightening/whitening function segment is projected to contribute 58.6% of the global Whitening Gold Peptide Complex Market revenue in 2025, maintaining its lead as the dominant category. This leadership is driven by ongoing consumer demand for effective skin tone enhancement, reduction of hyperpigmentation, and a desire for radiant complexions across both Asia and Western markets. Brightening formulations leveraging gold-peptide conjugates are highly valued for their dual action of whitening and anti-aging, ensuring strong consumer loyalty.

The segment’s growth is also supported by innovations such as peptide + niacinamide hybrids that deliver both whitening and skin barrier repair. As dermatologist-tested and clean-label claims gain traction, brightening complexes are being reformulated to meet higher consumer standards of safety and efficacy. With rising adoption in e-commerce and luxury retail channels, the brightening/whitening segment is expected to remain the backbone of global demand in this market.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 49.5% |

| Others | 50.5% |

The serums segment is forecasted to hold 49.5% of the market share in 2025, driven by its ability to deliver concentrated doses of gold-peptide complexes with superior absorption. Serums are favored for their lightweight formulations, fast action, and compatibility with multi-step skincare routines, making them the preferred choice in luxury beauty regimens. Their ability to integrate encapsulated gold systems has further enhanced efficacy, particularly in Asian beauty markets.

Their compact packaging, premium perception, and ease of layering within routines have fueled widespread adoption, especially among millennials and Gen Z consumers. The segment’s growth is bolstered by the increasing demand for high-performance skincare formats that deliver visible results quickly. As whitening gold peptide complexes expand into ampoules and hybrid delivery systems, serums are expected to continue dominating due to their role as the foundation of premium skincare routines worldwide.

| Claim | Value Share% 2025 |

|---|---|

| Luxury/premium | 52.5% |

| Others | 47.5% |

The luxury/premium claim segment is projected to account for 52.5% of the global Whitening Gold Peptide Complex Market revenue in 2025, securing its position as the leading claim type. This dominance reflects the deep consumer association between gold-infused skincare and prestige, indulgence, and exclusivity. Products under this claim are preferred in high-end beauty retail and e-commerce channels, where gold-peptide branding aligns with aspirational lifestyles and skincare rituals.

Its suitability for serums, creams, and masks has ensured broad applicability across product formats, particularly in East Asia where K-beauty and J-beauty trends emphasize luxury ingredients. Advancements in encapsulation and 24K gold formulations have reinforced this premium positioning. Given its combination of performance, luxury perception, and consumer willingness to pay premium prices, the luxury/premium claim segment is expected to maintain its leading role in shaping brand strategies throughout the forecast period.

Rising Demand for Brightening/Whitening Functions in Asia (58.6% Share in 2025)

The brightening/whitening segment, with a 58.6% share in 2025 (USD 673.7 Mn), remains the strongest driver of this market. Asian consumers, particularly in China, Japan, and India, exhibit heightened demand for skin-lightening, hyperpigmentation reduction, and radiant skin tone products. This cultural emphasis on complexion refinement has created a robust pipeline of luxury skincare launches, with peptide-gold conjugates offering dual whitening and anti-aging benefits. The industry is responding by launching targeted serums and ampoules with encapsulated gold complexes to deliver visible results. As Asian beauty standards continue to influence Western skincare rituals, brightening/whitening products will secure the segment’s dominance and fuel growth globally.

Luxury and Premium Positioning Strengthening Retail Expansion (52.5% Share in 2025)

The luxury/premium claim segment accounts for 52.5% of global revenues in 2025 (USD 604.4 Mn), establishing itself as a growth engine. Consumers associate gold-infused peptides with prestige, exclusivity, and self-care indulgence. This has fueled a surge in premium beauty retail formats and e-commerce adoption, especially in urban centers of the USA, Europe, and Asia-Pacific. Luxury beauty houses such as Guerlain and SK-II are leveraging this demand to expand across multi-channel distribution. The ongoing focus on luxury positioning not only drives higher margins but also sustains brand equity, making premium claims one of the most critical drivers in this market.

High Price Sensitivity and Limited Accessibility in Emerging Markets

Despite rapid growth in India (21.8% CAGR) and China (18.3% CAGR), accessibility remains a barrier. Whitening gold peptide products are priced as premium or luxury solutions, which restricts penetration among middle-income consumers in developing economies. While luxury positioning drives margins, it simultaneously creates price barriers in emerging markets where demand for affordable brightening products is high. Brands are experimenting with smaller pack sizes and e-commerce-driven discounts to expand accessibility. However, unless pricing models adapt, market growth may remain concentrated in high-income segments, limiting the industry’s full-scale expansion potential.

Growing Regulatory Scrutiny Around Whitening Claims

Governments in regions like the USA and Europe are increasingly scrutinizing skincare products that make explicit “whitening” or “lightening” claims due to cultural sensitivity and consumer protection. Regulatory frameworks are pushing brands to adopt alternative terminology such as “radiance” or “glow” instead of whitening, creating compliance costs for reformulation and rebranding. Companies investing heavily in whitening claims risk reputational challenges if regulations tighten further. As a result, firms are diversifying toward multi-functional positioning (firming + glow + anti-aging) to mitigate risks. This restraint underscores the delicate balance between market demand and ethical/regulatory compliance.

Encapsulated Gold Systems Gaining Traction in Premium Skincare

Encapsulated delivery systems are emerging as a defining trend in the global Whitening Gold Peptide Complex Market. Unlike traditional formulations, these systems protect active ingredients such as peptides and niacinamide, ensuring deeper skin penetration and prolonged stability. This innovation is particularly aligned with consumer preference for clean-label and dermatologist-tested formulations. As encapsulated complexes can combine whitening with hydration and firming, they are reshaping product launches in serums and ampoules. By 2030, encapsulated systems are expected to transition from niche offerings into mainstream luxury lines, reinforcing their role as a long-term growth trend.

Surge of E-commerce and Social Commerce Driving Consumer Reach

E-commerce, combined with social commerce platforms like TikTok and Instagram Shops, is transforming the way whitening gold peptide complexes reach consumers. Digital-first distribution offers brands direct-to-consumer channels to showcase premium claims, run influencer campaigns, and highlight before-and-after transformations. In markets like the USA (USD 232.2 Mn in 2025) and China (USD 123.9 Mn in 2025), e-commerce accounts for a rising share of retail sales, particularly among younger consumers. This trend is not only enhancing accessibility but also enabling micro-personalization and subscription-based sales, turning e-commerce into a dominant growth catalyst for the decade ahead.

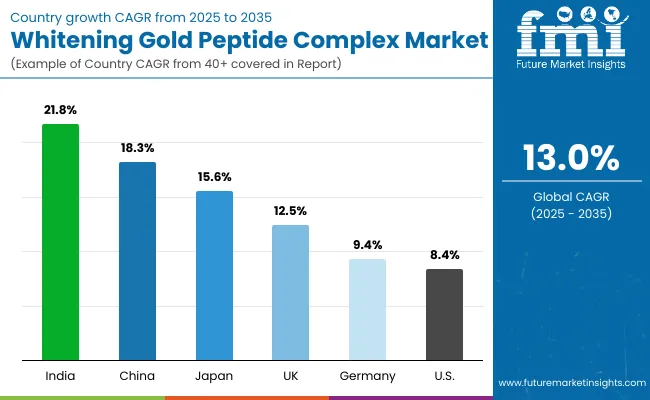

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 18.3% |

| USA | 8.4% |

| India | 21.8% |

| UK | 12.5% |

| Germany | 9.4% |

| Japan | 15.6% |

Among the leading markets, India (21.8% CAGR) and China (18.3% CAGR) are projected to record the fastest growth, underscoring Asia’s dominance in driving whitening gold peptide complex demand. The cultural preference for brightening and even-toned skin, combined with a rapidly expanding middle-class consumer base, is fueling adoption in these regions. In India, growth is further amplified by the surge of e-commerce channels and the increasing popularity of luxury K-beauty and J-beauty inspired products. China, with its strong luxury retail ecosystem and government support for domestic beauty manufacturing, continues to attract global skincare brands. Together, these markets are expected to account for a substantial portion of global incremental revenues, making Asia-Pacific the powerhouse of expansion.

Mature markets such as the USA (8.4% CAGR), Germany (9.4% CAGR), and the UK (12.5% CAGR) are projected to grow steadily, driven by premium and dermatologist-tested claims. Consumers in these regions show strong interest in anti-aging, fragrance-free, and clean-label formulations, allowing gold-peptide complexes to position as luxury science-backed solutions rather than purely whitening products. Japan (15.6% CAGR) stands out as a balanced market where innovation in encapsulated gold systems and ampoule-based skincare is accelerating adoption. Overall, the global growth pattern highlights a clear divide between high-volume demand in Asia and premium-driven steady growth in Western markets, with Japan serving as a bridge between both trends.

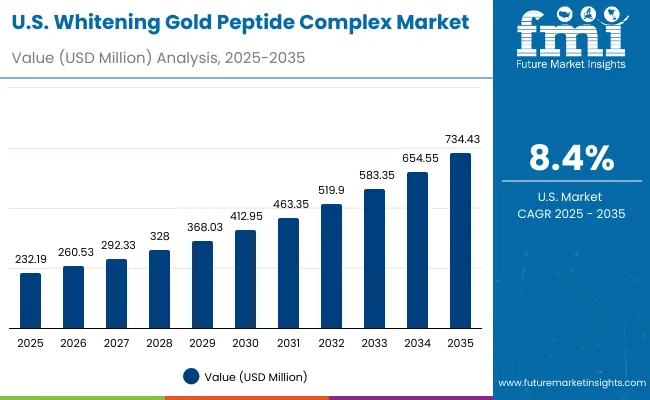

| Year | USA Whitening Gold Peptide Complex Market (USD Million) |

|---|---|

| 2025 | 232.19 |

| 2026 | 260.53 |

| 2027 | 292.33 |

| 2028 | 328.00 |

| 2029 | 368.03 |

| 2030 | 412.95 |

| 2031 | 463.35 |

| 2032 | 519.90 |

| 2033 | 583.35 |

| 2034 | 654.55 |

| 2035 | 734.43 |

The USA Whitening Gold Peptide Complex Market is projected to grow at a CAGR of 8.4%, with brightening/whitening products contributing nearly 59.9% of total revenues in 2025 (USD 139.0 Mn). Growth is led by rising consumer adoption of dermatologist-tested and fragrance-free formulations that emphasize safety alongside luxury. Premium beauty retailers and e-commerce channels are expanding their portfolios with serums and creams featuring encapsulated gold systems. Increasing demand among urban millennial and Gen Z consumers, combined with brand positioning in clean-label luxury, is boosting market penetration. Regulatory scrutiny around whitening claims is shaping repositioning strategies toward “radiance” and “glow,” further diversifying product lines.

The UK Whitening Gold Peptide Complex Market is expected to grow at a CAGR of 12.5%, supported by demand for premium whitening, glow-enhancing, and anti-aging solutions. The country’s luxury skincare sector is highly receptive to gold-peptide conjugates due to their prestige positioning and dermatologist-backed efficacy. High-end beauty retailers and department stores are key sales channels, with luxury serums and creams forming the backbone of consumption. Cultural sensitivity around whitening claims has prompted a shift toward branding centered on radiance, glow, and firming, which has resonated strongly with consumers. E-commerce-led campaigns, influencer partnerships, and clean-label certifications are further stimulating growth.

India is witnessing the fastest growth globally, with the market forecast to expand at a CAGR of 21.8% through 2035. This surge is driven by a rising middle-class population, increased beauty awareness, and deepening penetration of e-commerce platforms. Demand is concentrated in brightening/whitening complexes, but there is a growing shift toward multi-functional claims such as spot reduction and glow enhancement. Premium beauty retailers and pharmacies are expanding gold-peptide based serums and masks in tier-1 cities, while online platforms are making them accessible to tier-2 cities. With India’s youth increasingly embracing K-beauty and J-beauty inspired routines, gold peptide serums are becoming a central part of aspirational skincare.

The China Whitening Gold Peptide Complex Market is expected to grow at a CAGR of 18.3%, one of the highest among leading economies. Luxury/premium claims dominate, contributing 54.3% share in 2025 (USD 67.3 Mn), reflecting strong consumer preference for prestige skincare brands. Growth is being driven by China’s luxury retail ecosystem, digital-first adoption, and the role of local beauty tech firms introducing encapsulated gold and peptide-niacinamide hybrids. Municipal urbanization and digital beauty ecosystems, including social commerce platforms like Tmall and Douyin, are amplifying adoption. Affordable product variants alongside ultra-luxury creams and masks are expanding consumer reach, making China the largest incremental contributor to global revenues by 2035.

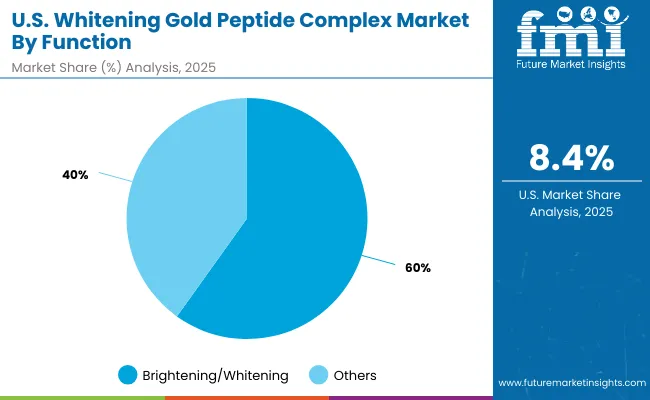

| USA by Function | Value Share% 2025 |

|---|---|

| Brightening/whitening | 59.9% |

| Others | 40.1% |

The USA Whitening Gold Peptide Complex Market is valued at USD 232.2 million in 2025, with the brightening/whitening segment leading at 59.9% (USD 139.0 Mn). The dominance of this segment reflects American consumers’ preference for solutions targeting hyperpigmentation, dark spots, and uneven skin tone, particularly among urban populations exposed to lifestyle-related skin challenges. High interest in dermatologist-tested and fragrance-free claims has reinforced this demand, as consumers increasingly seek clinical safety and transparency in premium skincare.

This advantage positions brightening/whitening formulations as the core driver of the USA market, supported by retail expansion in premium department stores and robust growth across e-commerce. Secondary functions, such as radiance/glow and firming, are gaining traction but remain smaller in comparison. As brand strategies pivot toward multi-functional claims and regulatory-friendly messaging, the USA opportunity will expand through hybrid luxury formats that combine efficacy with clinical credibility.

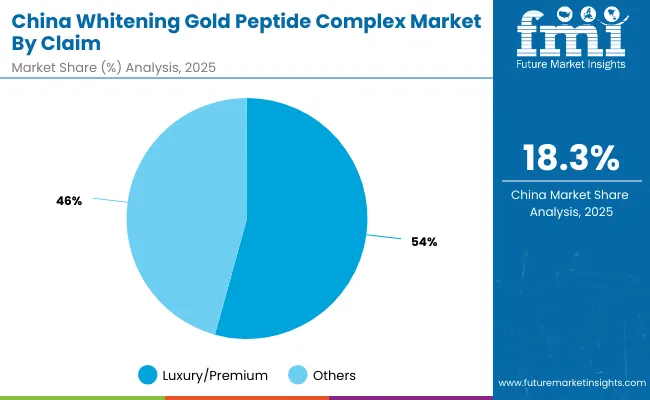

| China by Claim | Value Share% 2025 |

|---|---|

| Luxury/premium | 54.3% |

| Others | 45.7% |

The China Whitening Gold Peptide Complex Market is valued at USD 123.9 million in 2025, with luxury/premium claims leading at 54.3% (USD 67.3 Mn). The dominance of premium positioning reflects Chinese consumers’ deep association between gold-peptide complexes and prestige skincare, with aspirational lifestyles shaping demand. Strong cultural emphasis on fairer, luminous skin and the influence of K-beauty and J-beauty trends are further accelerating adoption.

This advantage positions luxury/premium claims as the central pillar of China’s opportunity, supported by e-commerce ecosystems like Tmall and Douyin that amplify direct-to-consumer engagement. Affordable gold-peptide variants are gradually expanding access in tier-2 and tier-3 cities, but luxury creams, serums, and masks dominate early growth. By 2035, China’s fast CAGR of 18.3% will make it one of the top contributors to global market expansion, securing a larger share of global revenues than today.

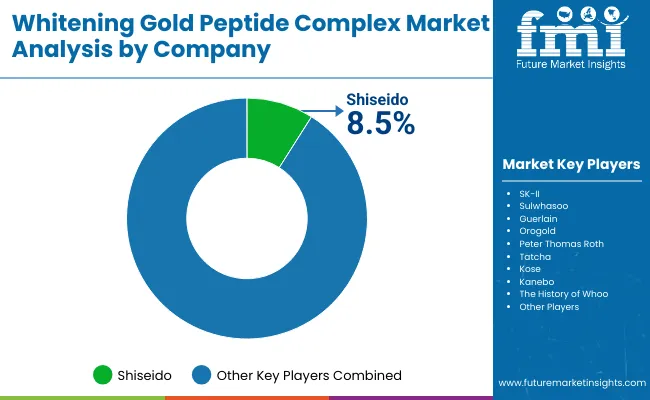

| Company | Global Value Share 2025 |

|---|---|

| Shiseido | 8.5% |

| Others | 91.5% |

The global Whitening Gold Peptide Complex Market is moderately fragmented, with luxury skincare giants, Asian beauty powerhouses, and niche-focused brands competing across diverse product categories. Shiseido, with an 8.5% global value share in 2025, leads through strong R&D, premium positioning, and Asia-focused retail dominance. Its innovations in peptide-gold conjugates and brightening complexes reinforce its leadership in Japan, China, and global luxury channels.

Other leading players, including SK-II, Sulwhasoo, Guerlain, and The History of Whoo, are consolidating their competitive edge through luxury/premium claims, clean-label certifications, and innovative formats such as serums and ampoules. These brands leverage regional strengths particularly in Asia-Pacific to expand into the USA and European markets. Mid-sized innovators like Orogold, Peter Thomas Roth, Tatcha, Kose, and Kanebo cater to niche demands, focusing on fragrance-free or dermatologist-tested lines, which resonate with Western consumers seeking safety-oriented premium products.Competitive differentiation is shifting away from single-function whitening creams toward integrated luxury ecosystems that combine encapsulated delivery systems, multi-functional claims, and digital-first retail strategies. The winners in this space are increasingly those that balance heritage-driven luxury branding with scientific credibility and digital accessibility, creating scalable global growth opportunities.

Key Developments in Global Whitening Gold Peptide Complex Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,152.6 million |

| Complex Type | Gold-peptide conjugates, Peptide + Niacinamide complexes, Encapsulated gold systems, 24K gold masks/creams |

| Function | Brightening/Whitening, Dark Spot Reduction, Radiance/“Glow”, Firming |

| Product Type | Serums, Creams, Masks, Ampoules |

| Distribution Channel | Asia Beauty Retail, E-commerce, Pharmacies, Premium Beauty Retail |

| Claims | Luxury/Premium, Dermatologist-tested, Clean-label, Fragrance-free |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shiseido, SK-II, Sulwhasoo, Guerlain, Orogold, Peter Thomas Roth, Tatcha, Kose, Kanebo, The History of Whoo |

| Additional Attributes | Dollar sales by function and product type, adoption trends in brightening/whitening skincare, rising demand for luxury serums and ampoules, segmental growth across e-commerce and premium beauty retail, claim-based revenue segmentation, integration of encapsulated gold with peptides and niacinamide, regional trends driven by Asia-Pacific luxury skincare demand, and innovations in clean-label and dermatologist-tested formulations. . |

The global Whitening Gold Peptide Complex Market is estimated to be valued at USD 1,152.6 million in 2025.

The market size is projected to reach USD 3,900.4 million by 2035.

The Whitening Gold Peptide Complex Market is expected to grow at a 13.0% CAGR between 2025 and 2035, more than tripling in size over the decade.

The key product types are Serums, Creams, Masks, and Ampoules.

In terms of function, the Brightening/Whitening segment will command 58.6% share of the global market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Teeth Whitening Pens Market - Growth, Demand & Trends 2025 to 2035

Teeth Whitening Market Overview – Growth & Trends 2024-2034

The Dental Whitening Lamps Market is segmented by Product, Light Source and End User from 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Gold Tester Market Size and Share Forecast Outlook 2025 to 2035

Metric Value Industry Size (2025E) USD 32.0 billion Industry Value (2035F) 46.9 billion CAGR (2025 to 2035) 3.9%

Gold Plating Chemicals Market Growth – Trends & Forecast 2025 to 2035

Gold Metalized Film Market Trends & Growth Forecast 2024-2034

Gold Purity Tester Market

Goldenseal Market

Marigold Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Sealing Agent for Gold Market Size and Share Forecast Outlook 2025 to 2035

Complex Coconut Sugar Market Size and Share Forecast Outlook 2025 to 2035

Complexion Analysis System Market Size and Share Forecast Outlook 2025 to 2035

Complex Regional Pain Syndrome (CRPS) Market Size and Share Forecast Outlook 2025 to 2035

Complex Generics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CPLD Market – Trends & Growth through 2034

Market Share Distribution Among Guar Complex Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA