The market for gold plating chemicals is expected to witness steady growth from 2025 to 2035. This will be driven by growing demand from the electronics, automotive, and permanent precious metals industries.

If we take into account gold plating chemicals in particular, one can see that they are vital for increasing durability, conductivity of products such as printed circuits, electric wires and aesthetic appearance.The industry will be relying on the use of thinner layers but recently a fraud scandal has afflicted chemical companies in China.

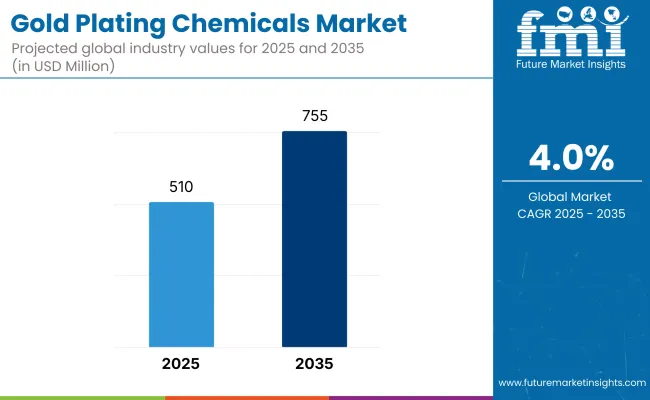

A number of companies both within and without China are currently engaged on development work to provide cyanide-free gold plating solutions. Global market size will likely rise to some USD 7,55 Million by 2035, with a compound average growth rate (CAGR) of around 4.0% from 2025 to 2035. So in addition to electronics and cars, it is now also the gold plating sector that is benefiting from this prosperity. In general, an increasingly diverse range of end markets could be seen for this product.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 5,10.0 Million |

| Projected Market Size in 2035 | USD 7,55 Million |

| CAGR (2025 to 2035) | 4.0% |

North American electronics, aerospace and medical device industries have already established themselves gold-coating chemicals remain a significant market for them just because of this fact. Spurred by semiconductor technology advancement and mounting applications in printed circuit boards (PCBs), the USA has the greatest demand.

Environmental regulations have made manufacturers turn to plating solutions that break down non-toxically. The luxury and jewellery industries play an important role in terms of market demand in all likelihood, they mainly account for some of which is also true in Canada.

The steady growth of gold plating chemicals market in Europe is due to the increased use of gold plating articles in high-end consumer electronics, automotive parts and aerospace applications. Countries like Germany, France, the UK, etc. are in the front row; they have strong industry and naturally will benefit first.

The trend toward sustainable and cyanide-free plating solutions has become an important theme affecting market developments in this region. Additionally, big names in the luxury goods business provide even more support for market growth.

The Asia-Pacific region will be the fastest-growing market for gold plating chemicals, with strong demand coming from the electronics and semiconductor industries in Japan, China, South Korea and India. The growing trend towards luxury goods plated in gold has also contributed to demand in this region.

Government initiatives like stimulating domestic semiconductor manufacturing in China and India should open new channels for market growth. Additionally, the increasing acceptance of gold plating in industrial production has further consolidated regional expansion.

Gold plating chemicals in Latin America, the Middle East and Africa are gradually gaining ground on this market. The Middle East is responsible for part of the growing demand, as its jewellery and electronic components are all gold-plated.

Brazil and South Africa are seeing more and more applications for gold plating chemicals in their electronics and automotive sectors which are both expanding. But in some areas, regulatory hurdles and economic limitations may hamper the market's rapid development.

Challenge

Fluctuating Precious Metal Prices

When gold prices move upwards or down, the Gold Plating Chemicals Market feels it greatly. Changes in the world economy, supply chain interruptions and variations in demand for gold all combine to increase the cost of plating chemicals. Manufacturers take on a big challenge trying to hold costs steady while making their products affordable to consumers.

Environmental Regulations and Waste Management

The manufacture of gold plating chemicals faces difficulties caused by highly strict environmental regulations on handling chemical waste or controlling emissions. Those involved with hazardous material handling standards and the treatment of waste water pay higher production costs. They also must cope with operational complexities.

Opportunity

Advancements in Eco-friendly Plating Solutions

The idea of eco-friendly gold plating chemicals is spreading as awareness grows over the problem of environmental sustainability. By making new inventions in cyanide-free, non-toxic plating solutions manufacturers have an opportunity to serve any market interested in a sustainable substitute for another product mainly in order to meet ever-stricter environmental laws.

Expanding Applications in Electronics and Automotive Industries

The burgeoning use of gold plating chemicals in the electronics and automotive sectors offers big potential for gains. Miniaturization of electronic components, increasing use of electric vehicles and advances in semiconductor technology goad production further and force the need for high-quality gold plating solutions even more strongly.

During this time period 2020 to 2024, demand from the electronics, jewellery, automobile and other industries resulted in steady growth of the Gold Plating Chemicals Market. With the expansion of semiconductor manufacturing and persistent development of printed circuit board technology the market continued its growth trend Environmental issues as well as expensive raw materials have hindered companies concerned with fulfilling contract obligations from responding to this situation.

Tackling these problems requires that enterprises should adopt new plating methods and update their waste treatment facilities. Taxpayers bear environmental clean-up costs in addition to bearing responsibility of ensuring enterprises fulfil their contractual obligations. Overall, environmental compliance that takes into account company costs; production programs with maximum yield; and a high performance plating solution, will be clear winners on today’s emission-regulated market.

The future orbit of this 2025 to 2035 market will see a revolution in forms and substances. It is expected that new gold plating materials and methods friendly to the environment, and automation in the process of plating will come into fashion. Sustainable manufacturing, new nanotechnologies, as well as the growing demand for corrosion-protective coatings will be the crucial factors determining success in future markets.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with hazardous material handling and emissions regulations |

| Market Demand | Growth driven by electronics, jewellery, and automotive industries |

| Industry Adoption | Use of traditional cyanide-based gold plating solutions |

| Supply Chain and Sourcing | Dependence on conventional gold refining methods |

| Market Competition | Dominated by established plating chemical manufacturers |

| Market Growth Drivers | Demand from electronics miniaturization, semiconductor advancements, and luxury goods |

| Sustainability and Energy Efficiency | Initial efforts in reducing chemical waste |

| Integration of Digital Innovations | Limited automation and monitoring of plating processes |

| Advancements in Plating Technology | Use of conventional gold plating baths |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental laws, promotion of green plating technologies, and increased government incentives for sustainable practices |

| Market Demand | Increased adoption of eco-friendly plating solutions and expansion into aerospace and medical sectors |

| Industry Adoption | Shift towards non-toxic and cyanide-free plating chemicals |

| Supply Chain and Sourcing | Increased use of recycled gold and alternative metal alloys |

| Market Competition | Rise of sustainable plating solution providers and startups |

| Market Growth Drivers | Growth of eco-conscious manufacturing, expanding applications in 5G and electric vehicles |

| Sustainability and Energy Efficiency | Large-scale adoption of sustainable plating techniques and closed-loop recycling systems |

| Integration of Digital Innovations | Expansion of AI-driven plating quality control, smart sensors, and automation |

| Advancements in Plating Technology | Evolution of nanoparticle-based plating, increased efficiency in gold deposition, and hybrid metal coatings |

Gold plating in the USA chemical market is still growing, and future prospects are bright. Especially in electronics, gold plating must be both corrosion-resistant and conductive for circuit boards, connectors. This makes it a major driver for that application field (as well as integrating semiconductor components).

In addition, developments in nanotechnology and medical applications are also helping the continued development of this market. Environmentally related legislation will encourage manufacturers to develop plating solutions with no or reduced amounts of hazardous waste. Sustaining cleaner and cyanide-free gold plating chemicals is also one of the key trends reshaping this market

| Country | CAGR (2025 to 2035) |

|---|---|

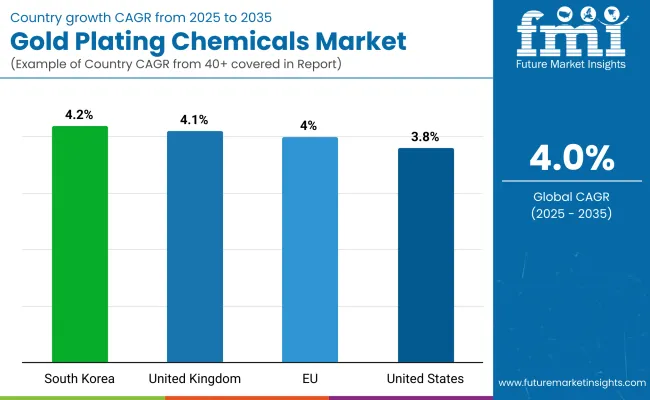

| United States | 3.8% |

The market for chemical plating solutions in the UK is expanding as they serve sectors such as aerospace, medical devices, and high-end consumer electronics. Given this, whether gold plating will conserve our world draws a lot of attention. In aerospace, gold plating is being used increasingly for crucial components that need superior conductivity and resist oxidation, demand keeps rising.

Medical applications are another major driving force gold plating can be found in surgical instruments and implantable bridges, as well as diagnostic equipment. The UK industry is also passing strict environmental and safety regulations, with the result that researchers are studying nontoxic sustainable gold plating solution development.

Furthermore, the luxury goods consumer market is still looking good: gold-plated watches, jewellery and ornaments continue to recover market space. With increasing nanotechnology, a move toward precision engineering and an improvement in 'point of sale product' technology, the UK has greater advantage over other international venues for research and development of advanced gold plating technology that is equally at home in industry and at environmentalism.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The EU chemical gold plating market is growing steadily, as robust auto, electronics, and aerospace sectors require plating chemicals. Its strict environmental regulations are forcing companies to search for non-poisonous, sustainable substitutes for gold plating. The automotive industry, particularly in Germany and France uses gold plating to make reliable electrical contacts in high performance vehicles. Meanwhile, the EU's strong emphasis on clean energy and electric vehicle development is opening up new gold plating markets in both solar batteries and battery technology.

The region is also seeing more and more bio-compatible gold plating chemicals: particularly for medical the market parts manufactured from implants and prosthetics. With government funding for research and development on the rise, European manufacturers of gold plating chemicals are working to improve efficiency while minimizing environmental impact in order to ensure long-term market growth. Furthermore, luxury goods and the fashion industry contribute to demand for high-quality gold plating chemicals in jewellery and accessories.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

South Korea's plating chemicals market is growing rapidly, fueled by its thriving semiconductor and electronics industries. Gold plating is vital in high-tech applications such as microchips, circuit boards, electronic connectors, and many others: not only does it conduct electricity well but also offers anti-corrosion properties to boot. With South Korea at present ranking first in semiconductor production, the need for high purity gold plating chemicals continues to increase.

Policies promoting environmentally sustainable industrial practices in South Korea are stimulating eco-friendly gold plating methods development and hence shaping the market. In addition, as the country's expanding 5G and telephone infrastructure demand a growing number of applications for gold-plated PCB or similar metal substrates, so too will greater use be made of gold plating chemicals. The luxury sector continues to fuel market growth with watches, decorative pieces and top-line jewellery.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

Due to its being widely employed in all areas of the gold-plating market-such as electronics, jewellery, and baked enamel products-potassium gold cyanide is by far the most important chemical. It makes up but a small fraction of the cost or mass for each unit per plating layer. In essence, it provides an efficient and dependable way to deposit a layer of gold onto substrates. Due to its high solubility and stability in plating solutions, this chemical is particularly suitable for obtaining even and high-quality coatings. With the increase in demand for smaller electronic components and high-grade jewellery, the use of potassium gold cyanide will increasingly be seen.

The rapid growth in environmental regulations over the past decade has led researchers to search for new sources of gold plating. Despite the obstacles posed by such regulations, buffeting markets and improved recycling technology make it highly likely that prices for precious metals like gold will continue to rise. Hence, as an electrolyte additive used in the plating industry, potassium gold cyanide continues to hold a firm place among the precision applications thanks largely to ongoing investment-literally increasing production capacity at those local end-users who benefit most.

Due to its lower cost and comparable performance in certain industries, the demand for palladium acetate is on the rise. In electronic components, it is widely utilized, especially on circuit boards and connectors which necessitate a thin layer of gold for conductivity. Plated surfaces benefit from good resistance against corrosion accompanied by the enhancement of adhesion strengths of palladium acetate so it is often selected to up the life expectancy of these goods.

Also, because of the need for cost reduction, industrial centers are becoming more and more sensitive towards eliminating gold use. Thus, there has been increasing interest in palladium-based plating solutions. While it can't completely replace gold in high-end products or luxury items such as jewellery-so various manufacturers continue to produce them alongside other forms of PVC or nylon parts-palladium acetate is winning approval in functional markets where value for money is a key factor.

This market is dominated by cleaning chemicals. They are key to obtaining high-quality, fault-free coatings. Special chemicals are needed to remove impurities, oxides and residues from metal surfaces before coating, so that adhesion remains good and the deposit is even. Cleansing chemicals are of great demand in the electronics and jewellery trade. Both industries emphasize precision, artistry and appearance.

With advances in plating technology, suppliers and producers are focusing more and more on producing types of cleaning agents that are environmentally harmless or not toxic at all. The basic trend on which future development in this field hinge lies in formulating more environment friendly products and stricter regulation of discharges.

Electrolyte Solutions are a necessary part of gold plating baths that makes gold deposited onto other materials with electrochemical methods. The recent increase in gold-plated technology in the electronics industry, such as smart phones, semiconductors, and connectors, has also led to high-performance electrolyte solutions.

These products guarantee stable gold deposition, improve the conductivity of the product and prolong its life. As the electronics industry continues to grow rapidly, particularly in Asia Pacific, electrolyte solutions will be in healthy demand. Then there are changes in plating technology such as low temperature and high efficiency electrolyte formulations that are also driving this area’s advancement.

The gold plating chemicals market is experiencing steady growth due to increasing demand in electronics, jewellery, and automotive industries. These chemicals are essential for achieving high-quality gold coatings, enhancing conductivity, corrosion resistance, and aesthetic appeal. Rising investments in advanced plating technologies and eco-friendly formulations are shaping market trends.

Market Share Analysis by Key Players & Manufacturers

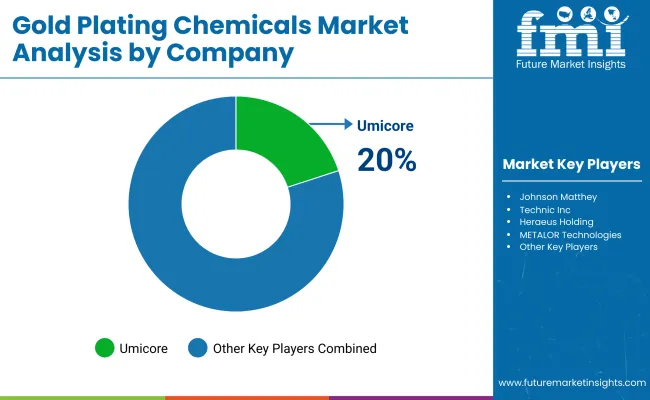

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Umicore | 20-25% |

| Johnson Matthey | 15-20% |

| Technic Inc. | 12-16% |

| Heraeus Holding | 8-12% |

| METALOR Technologies | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Umicore | High-purity gold plating chemicals for electronics, luxury goods, and automotive applications. |

| Johnson Matthey | Eco-friendly and sustainable gold plating solutions for industrial and decorative applications. |

| Technic Inc. | Advanced gold electroplating chemicals with superior adhesion and conductivity properties. |

| Heraeus Holding | Precision gold plating solutions for semiconductor, medical, and aerospace industries. |

| METALOR Technologies | Innovative gold electrolytes and plating baths for high-performance applications. |

Key Market Insights

Umicore (20-25%)

Umicore is at high purity gold plating chemicals forefront, service for electronics, jewellery, luxury goods and so on.

Johnson Matthey (15-20%)

Johnson Matthey is working on sustainable gold plating technology that is competitive with the best solutions of chamc2 sustainable chemistry and thus environmentally-friendly product formulas on which net ecological savings can be achieved by consumers.

Technic Inc. (12-16%)

Technic is focused on advanced electroplating chemicals that make gold adhesion and conductivity better.

Heraeus Holding (8-12%)

Heraeus provides precision gold plating solutions, serving the semiconductor, medical, and aerospace industries.

METALOR Technologies (5-9%)

METALOR Technologies is dedicated to the development of high-performance gold electrolytes for industrial and decorative applications

Other Key Players (30-40% Combined)

The gold plating chemicals market continues to evolve, with contributions from various manufacturers, including:

The overall market size for gold plating chemicals market was USD 5,10.0 Million in 2025.

The gold plating chemicals market is expected to reach USD 7,55 Million in 2035.

The demand for gold plating chemicals will be driven by growing electronics, jewellery, radar, and gold-plated product applications across industries.

The top 5 countries which drives the development of gold plating chemicals market are USA, European Union, Japan, South Korea and UK.

Cleaning chemicals demand supplier to command significant share over the assessment period.

Table 01: Global Market Size (US$ Million) and Volume (Tons) Forecast by Type, 2018 to 2033

Table 02: Global Market Size (US$ Million) and Volume (Tons) Forecast by Chemicals, 2018 to 2033

Table 03: Global Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 04: Global Market Size (US$ Million) and Volume (Tons) Forecast by Region, 2018 to 2033

Table 05: North America Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 06: North America Market Size (US$ Million) and Volume (Tons) Forecast by Type, 2018 to 2033

Table 07: North America Market Size (US$ Million) and Volume (Tons) Forecast by Chemicals, 2018 to 2033

Table 08: North America Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 09: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by Chemicals, 2018 to 2033

Table 12: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Europe Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 14: Europe Market Size (US$ Million) and Volume (Tons) Forecast by Type, 2018 to 2033

Table 15: Europe Market Size (US$ Million) and Volume (Tons) Forecast by Chemicals, 2018 to 2033

Table 16: Europe Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 17: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 18: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Type, 2018 to 2033

Table 19: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Chemicals, 2018 to 2033

Table 20: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 21: SEAP Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 22: SEAP Market Size (US$ Million) and Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: SEAP Market Size (US$ Million) and Volume (Tons) Forecast by Chemicals, 2018 to 2033

Table 24: SEAP Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: MEA Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 26: MEA Market Size (US$ Million) and Volume (Tons) Forecast by Type, 2018 to 2033

Table 27: MEA Market Size (US$ Million) and Volume (Tons) Forecast by Chemicals, 2018 to 2033

Table 28: MEA Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Figure 01: Global Market Historical, Current, and Forecast Volume (Tons), 2018 to 2033

Figure 02: Global Market Historical, Current, and Forecast Volume (US$ Million ), 2018 to 2033

Figure 03: Global Market Incremental $ Opportunity, 2023 to 2033

Figure 04: Global Market Share and BPS Analysis by Type, 2023 to 2033

Figure 05: Global Market Y-o-Y Growth by Type, 2023 to 2033

Figure 6: Global Market Absolute $ Opportunity by Cleaning Chemicals Segment, 2018 to 2033

Figure 7: Global Market Absolute $ Opportunity by Pretreaters Segment, 2018 to 2033

Figure 8: Global Market Absolute $ Opportunity by Electrolyte Solutions Segment, 2018 to 2033

Figure 9: Global Market Absolute $ Opportunity by Acids Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Additives Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 12: Global Market Attractiveness Analysis by Type, 2023 to 2033

Figure 13: Global Market Share and BPS Analysis by Chemicals, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth by Chemicals, 2023 to 2033

Figure 15: Global Market Absolute $ Opportunity by Potassium Gold Cyanide Segment, 2018 to 2033

Figure 16: Global Market Absolute $ Opportunity by Palladium acetate Segment, 2018 to 2033

Figure 17: Global Market Absolute $ Opportunity by Sodium succinate Segment, 2018 to 2033

Figure 18: Global Market Absolute $ Opportunity by Succinic acid Segment, 2018 to 2033

Figure 19: Global Market Absolute $ Opportunity by EDTA Segment, 2018 to 2033

Figure 20: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 21: Global Market Attractiveness Analysis by Chemicals, 2023 to 2033

Figure 22: Global Market Share and BPS Analysis by Application, 2023 to 2033

Figure 23: Global Market Y-o-Y Growth by Application, 2023 to 2033

Figure 24: Global Market Absolute $ Opportunity by Electronics Segment, 2018 to 2033

Figure 25: Global Market Absolute $ Opportunity by Jewelry Segment, 2018 to 2033

Figure 26: Global Market Absolute $ Opportunity by Infrared Reflectors & Radars Segment, 2018 to 2033

Figure 27: Global Market Absolute $ Opportunity by Gold Plating Products Segment, 2018 to 2033

Figure 28: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 29: Global Market Attractiveness Analysis by Application, 2023 to 2033

Figure 30: Global Market Share and BPS Analysis by Region, 2023 to 2033

Figure 31: Global Market Y-o-Y Growth by Region, 2023 to 2033

Figure 32: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 33: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 34: Global Market Absolute $ Opportunity by Europe Segment, 2018 to 2033

Figure 35: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 36: Global Market Absolute $ Opportunity by SEAP Segment, 2018 to 2033

Figure 37: Global Market Absolute $ Opportunity by MEA Segment, 2018 to 2033

Figure 38: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 39: North America Market Share and BPS Analysis by Country, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 41: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 42: North America Market Share and BPS Analysis by Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth by Type, 2023 to 2033

Figure 44: North America Market Attractiveness Analysis by Type, 2023 to 2033

Figure 45: North America Market Share and BPS Analysis by Chemicals, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth by Chemicals, 2023 to 2033

Figure 47: North America Market Attractiveness Analysis by Chemicals, 2023 to 2033

Figure 48: North America Market Share and BPS Analysis by Application, 2023 to 2033

Figure 49: North America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 50: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Share and BPS Analysis by Country, 2023 to 2033

Figure 52: Latin America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 53: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 54: Latin America Market Share and BPS Analysis by Type, 2023 to 2033

Figure 55: Latin America Market Y-o-Y Growth by Type, 2023 to 2033

Figure 56: Latin America Market Attractiveness Analysis by Type, 2023 to 2033

Figure 57: Latin America Market Share and BPS Analysis by Chemicals, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth by Chemicals, 2023 to 2033

Figure 59: Latin America Market Attractiveness Analysis by Chemicals, 2023 to 2033

Figure 60: Latin America Market Share and BPS Analysis by Application, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 62: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 63: Europe Market Share and BPS Analysis by Country, 2023 to 2033

Figure 64: Europe Market Y-o-Y Growth by Country, 2023 to 2033

Figure 65: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 66: Europe Market Share and BPS Analysis by Type, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth by Type, 2023 to 2033

Figure 68: Europe Market Attractiveness Analysis by Type, 2023 to 2033

Figure 69: Europe Market Share and BPS Analysis by Chemicals, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth by Chemicals, 2023 to 2033

Figure 71: Europe Market Attractiveness Analysis by Chemicals, 2023 to 2033

Figure 72: Europe Market Share and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth by Application, 2023 to 2033

Figure 74: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 75: East Asia Market Share and BPS Analysis by Country, 2023 to 2033

Figure 76: East Asia Market Y-o-Y Growth by Country, 2023 to 2033

Figure 77: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 78: East Asia Market Share and BPS Analysis by Type, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth by Type, 2023 to 2033

Figure 80: East Asia Market Attractiveness Analysis by Type, 2023 to 2033

Figure 81: East Asia Market Share and BPS Analysis by Chemicals, 2023 to 2033

Figure 82: East Asia Market Y-o-Y Growth by Chemicals, 2023 to 2033

Figure 83: East Asia Market Attractiveness Analysis by Chemicals, 2023 to 2033

Figure 84: East Asia Market Share and BPS Analysis by Application, 2023 to 2033

Figure 85: East Asia Market Y-o-Y Growth by Application, 2023 to 2033

Figure 86: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 87: SEAP Market Share and BPS Analysis by Country, 2023 to 2033

Figure 88: SEAP Market Y-o-Y Growth by Country, 2023 to 2033

Figure 89: SEAP Market Attractiveness Analysis by Country, 2023 to 2033

Figure 90: SEAP Market Share and BPS Analysis by Type, 2023 to 2033

Figure 91: SEAP Market Y-o-Y Growth by Type, 2023 to 2033

Figure 92: SEAP Market Attractiveness Analysis by Type, 2023 to 2033

Figure 93: SEAP Market Share and BPS Analysis by Chemicals, 2023 to 2033

Figure 94: SEAP Market Y-o-Y Growth by Chemicals, 2023 to 2033

Figure 95: SEAP Market Attractiveness Analysis by Chemicals, 2023 to 2033

Figure 96: SEAP Market Share and BPS Analysis by Application, 2023 to 2033

Figure 97: SEAP Market Y-o-Y Growth by Application, 2023 to 2033

Figure 98: SEAP Market Attractiveness Analysis by Application, 2023 to 2033

Figure 99: MEA Market Share and BPS Analysis by Country, 2023 to 2033

Figure 100: MEA Market Y-o-Y Growth by Country, 2023 to 2033

Figure 101: MEA Market Attractiveness Analysis by Country, 2023 to 2033

Figure 102: MEA Market Share and BPS Analysis by Type, 2023 to 2033

Figure 103: MEA Market Y-o-Y Growth by Type, 2023 to 2033

Figure 104: MEA Market Attractiveness Analysis by Type, 2023 to 2033

Figure 105: MEA Market Share and BPS Analysis by Chemicals, 2023 to 2033

Figure 106: MEA Market Y-o-Y Growth by Chemicals, 2023 to 2033

Figure 107: MEA Market Attractiveness Analysis by Chemicals, 2023 to 2033

Figure 108: MEA Market Share and BPS Analysis by Application, 2023 to 2033

Figure 109: MEA Market Y-o-Y Growth by Application, 2023 to 2033

Figure 110: MEA Market Attractiveness Analysis by Application, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precious Metal Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Demand for Electroplating Chemicals in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Precious Metal Plating Chemicals in EU Size and Share Forecast Outlook 2025 to 2035

Gold-plated Palladium Bonding Wire Market Size and Share Forecast Outlook 2025 to 2035

Gold Palladium Plated Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Gold Tester Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Metric Value Industry Size (2025E) USD 32.0 billion Industry Value (2035F) 46.9 billion CAGR (2025 to 2035) 3.9%

Gold Metalized Film Market Trends & Growth Forecast 2024-2034

Gold Purity Tester Market

Goldenseal Market

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Marigold Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fluorochemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA