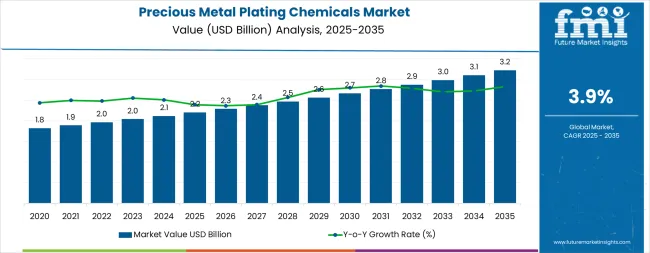

The global precious metal plating chemicals market is anticipated to grow from USD 2.2 billion in 2025 to USD 3.2 billion by 2035, advancing at a CAGR of 3.9%. The industry stands at the threshold of a decade-long expansion trajectory that promises to reshape surface finishing technology and electronic manufacturing solutions. The market's journey from USD 2.2 billion in 2025 to USD 3.2 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced electroplating formulations and high-purity metal deposition systems across electronics, automotive, jewelry, and aerospace sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 2.2 billion to approximately USD 2.6 billion, adding USD 400 million in value, which constitutes 40% of the total forecast growth period. This phase will be characterized by the steady adoption of non-cyanide gold systems and palladium-based electrolytes, driven by increasing electronics manufacturing volumes and the growing need for high-reliability connector finishes worldwide. Advanced formulation capabilities and REACH-compliant chemistries will become standard expectations rather than premium options.

The latter half (2030-2035) will witness steady growth from USD 2.6 billion to USD 3.2 billion, representing an addition of USD 600 million or 60% of the decade's expansion. This period will be defined by mass market penetration of green chemistry solutions, integration with comprehensive closed-loop recycling platforms, and seamless compatibility with existing electroplating infrastructure. The market trajectory signals fundamental shifts in how electronics manufacturers and surface finishing operators approach precious metal deposition optimization and environmental compliance management, with participants positioned to benefit from steady demand across multiple chemical types and application segments.

The market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its steady expansion phase, growing from USD 2.2 billion to USD 2.6 billion with consistent annual increments averaging 3.9% growth. This period showcases the transition from traditional cyanide-based formulations to advanced non-cyanide systems with enhanced environmental compliance and integrated quality control becoming mainstream features.

The 2025-2030 phase adds USD 400 million to market value, representing 40% of total decade expansion. Market maturation factors include standardization of electronics manufacturing protocols, declining costs for alternative chemistry formulations, and increasing industry awareness of environmental benefits reaching optimal surface finishing performance in connector and semiconductor applications. Competitive landscape evolution during this period features established precious metal companies like Heraeus and Umicore expanding their plating chemical portfolios while specialty formulation providers focus on REACH-compliant development and enhanced deposition capabilities.

From 2030 to 2035, market dynamics shift toward advanced green chemistry integration and global electronics production expansion, with growth continuing from USD 2.6 billion to USD 3.2 billion, adding USD 600 million or 60% of total expansion. This phase transition centers on closed-loop recycling systems, integration with automated electroplating networks, and deployment across diverse manufacturing scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic plating capability to comprehensive environmental compliance systems and integration with precious metal recovery platforms.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.2 billion |

| Market Forecast (2035) | USD 3.2 billion |

| Growth Rate | 3.9% CAGR |

| Leading Technology | Gold Plating Chemicals |

| Primary Application | Electrical & Electronics Segment |

The market demonstrates strong fundamentals with gold plating chemical systems capturing a dominant share through advanced electrodeposition and surface finishing optimization capabilities. Electrical and electronics applications drive primary demand, supported by increasing connector manufacturing and semiconductor packaging requirements. Geographic expansion remains concentrated in developed markets with established electronics infrastructure, while emerging economies show accelerating adoption rates driven by EMS expansion and rising electronics production standards.

Market expansion rests on three fundamental shifts driving adoption across the electronics and manufacturing sectors. Electronics miniaturization creates compelling operational advantages through precious metal plating that provides superior electrical conductivity and corrosion resistance without signal degradation, enabling manufacturers to meet reliability standards while maintaining performance specifications and reducing contact resistance. Automotive electrification accelerates as vehicle manufacturers worldwide seek advanced connector finishing systems that complement electric powertrain components, enabling reliable electrical connections and quality control that align with automotive standards and durability requirements.

Environmental compliance enhancement drives adoption from surface finishing operators and electronics manufacturers requiring effective green chemistry solutions that minimize cyanide usage while maintaining operational effectiveness during electroplating and metal deposition operations. The growth faces headwinds from precious metal price volatility that varies across commodity markets regarding the cost of gold, palladium, and platinum raw materials, which may limit adoption in cost-sensitive manufacturing environments. Technical challenges also persist regarding bath stability and drag-out control that may reduce operational efficiency in high-volume production environments, which affect plating consistency and material utilization.

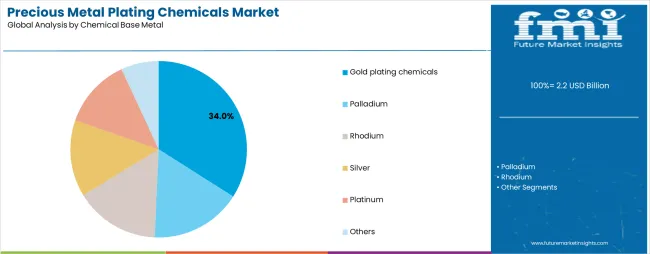

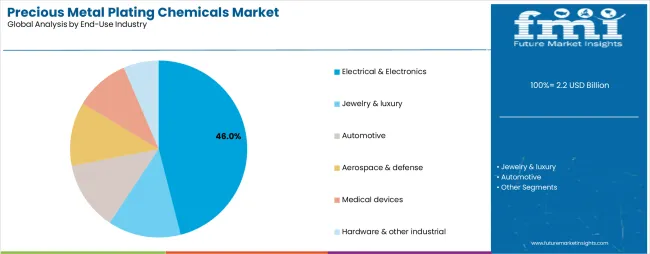

The precious metal plating chemicals market represents a specialized surface finishing opportunity driven by expanding global electronics production, automotive electrification, and the need for superior electrical contact performance in high-reliability applications. The market's growth trajectory from USD 2.2 billion in 2025 to USD 3.2 billion by 2035 at a 3.9% CAGR reflects fundamental shifts in electronics manufacturing requirements and environmental compliance optimization. Geographic expansion opportunities are particularly pronounced in Asia-Pacific markets, where the dominance of gold plating chemicals (34.0% market share) and electrical and electronics applications (46.0% share) provides clear strategic focus areas.

Strengthening the dominant gold plating segment (34.0% market share) through enhanced formulation chemistry, superior deposit properties, and seamless integration with electronics manufacturing infrastructure. This pathway focuses on optimizing potassium gold cyanide electrolytes (48.0%), advancing non-cyanide/sulfite systems (22.0%), developing hard gold alloys (18.0%), and refining strike and activator formulations (12.0%). Market leadership consolidation through green chemistry development and comprehensive REACH compliance enables premium positioning while defending competitive advantages against alternative finishing technologies. Expected revenue pool: USD 90-140 million

Rapid electronics manufacturing growth across India (5.0% CAGR) and China (4.6% CAGR) creates substantial expansion opportunities through local chemical production capabilities and technology partnerships. Growing connector production, handset manufacturing, and government EMS initiatives drive steady demand for plating chemical systems. Localization strategies reduce logistics costs, enable faster technical support, and position companies advantageously for electronics procurement programs while accessing growing domestic markets. Expected revenue pool: USD 75-120 million

Expansion within the dominant electrical and electronics segment (46.0% market share) through specialized formulations addressing connector quality standards (37.0%), semiconductor packaging requirements (28.0%), PCB finishing specifications (22.0%), and RF component applications (13.0%). This pathway encompasses automated plating systems, quality control integration, and compatibility with diverse electronics manufacturing processes, supporting modern high-reliability production operations. Expected revenue pool: USD 70-110 million

Strategic expansion into palladium-based chemistries (18.0% market share) and specialty precious metals including rhodium (12.5%), silver (11.0%), and platinum (7.5%) requires enhanced formulation technology and specialized application expertise. This pathway addresses automotive connector finishing, luxury goods applications, and specialized industrial requirements with advanced electrochemistry for demanding operational conditions while creating opportunities for technical service agreements and comprehensive application support. Expected revenue pool: USD 60-95 million

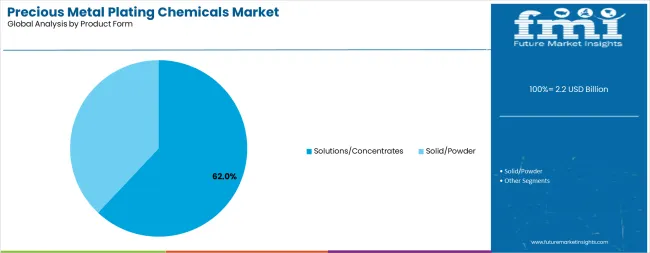

Development of high-performance solutions and concentrates (62.0% market share) including gold electrolytes (34.0%), palladium-nickel systems (22.0%), rhodium brighteners (17.0%), silver baths (15.0%), and universal cleaners (12.0%). This pathway encompasses high-purity formulations, concentrated delivery systems, and specialized additives. Technology differentiation through proprietary chemistry enables diversified revenue streams while reducing shipping costs and expanding addressable market opportunities in regions with established plating infrastructure. Expected revenue pool: USD 55-85 million

Development of REACH-compliant formulations and closed-loop precious metal recovery systems addressing environmental regulations, wastewater management, and ecofriendly requirements across electronics and automotive manufacturing. This pathway encompasses reduced-cyanide chemistries, precious metal reclamation services, effluent treatment solutions, and comprehensive environmental documentation. Premium positioning reflects regulatory leadership while enabling access to environmentally-focused procurement programs and comprehensive lifecycle management support. Expected revenue pool: USD 45-70 million

Expansion within jewelry and luxury goods (17.0% market share), aerospace and defense (8.0%), and medical devices (7.0%) through high-purity formulations, specialized finishing requirements, and premium quality standards. This pathway encompasses decorative finishes, biocompatible coatings, and aerospace-grade specifications. Premium positioning through superior appearance, corrosion resistance, and comprehensive certification creates opportunities for long-term supplier relationships and specialized technical support across diverse luxury and high-reliability manufacturing applications. Expected revenue pool: USD 40-65 million

Primary Classification: The market segments by chemical base metal into Gold plating chemicals, Palladium, Rhodium, Silver, Platinum, and Others categories, representing the evolution from basic electroplating to specialized multi-metal finishing solutions for comprehensive surface quality optimization.

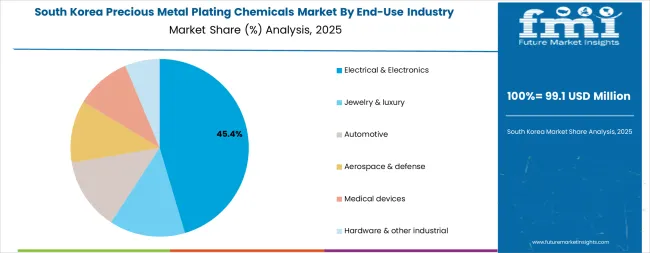

Secondary Classification: End-use industry segmentation divides the market into Electrical & Electronics, Jewelry & luxury, Automotive, Aerospace & defense, Medical devices, and Hardware sectors, reflecting distinct requirements for electrical conductivity, corrosion resistance, and aesthetic quality standards.

Tertiary Classification: Product form segmentation covers Solutions/Concentrates and Solid/Powder formats, demonstrating varied adoption patterns across liquid electrolyte systems, solid salts, and makeup formulations for diverse manufacturing applications.

Regional Classification: Geographic distribution covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by electronics manufacturing expansion programs.

The segmentation structure reveals technology progression from standard gold cyanide formulations toward advanced non-cyanide systems with enhanced environmental compliance and performance capabilities, while application diversity spans from electronics manufacturing to luxury goods requiring precise surface finishing solutions.

Market Position: Gold plating chemical systems command the leading position in the market with approximately 34.0% market share through superior electrical properties, including excellent conductivity, corrosion resistance capability, and contact reliability that enable electronics manufacturers to achieve optimal connection performance across diverse connector and semiconductor applications.

Value Drivers: The segment benefits from electronics manufacturer preference for proven gold chemistry systems that provide consistent deposit quality, long-term reliability, and manufacturing efficiency optimization without requiring significant process modifications. Advanced formulation features enable automated plating lines, thickness control, and integration with existing electroplating equipment, where electrical performance and durability represent critical operational requirements.

Competitive Advantages: Gold plating systems differentiate through established industry standards, proven reliability characteristics, and compatibility with high-volume electronics manufacturing that enhance operational effectiveness while maintaining optimal electrical contact properties suitable for diverse consumer and industrial applications.

Key market characteristics:

Market Context: Electrical & Electronics applications dominate the market with approximately 46.0% market share due to widespread adoption in connector manufacturing and increasing focus on electronics miniaturization, signal integrity optimization, and reliability enhancement applications that support modern device manufacturing operations.

Appeal Factors: Electronics manufacturers prioritize plating reliability, deposit consistency, and integration with existing production infrastructure that enables coordinated surface finishing across multiple component lines. The segment benefits from substantial electronics industry investment and miniaturization trends that prioritize precious metal plating for quality control and performance optimization applications.

Growth Drivers: Global electronics production expansion incorporates gold and palladium plating as essential processes for connector manufacturing (37.0%), while semiconductor packaging growth (28.0%) increases demand for proven surface finishing solutions that comply with industry standards and reliability requirements.

Market Challenges: Varying electronics manufacturing standards and component size requirements may limit plating process standardization across different production facilities or application scenarios.

Application dynamics include:

Market Context: Solutions and concentrates dominate the market with approximately 62.0% market share due to ease of application in electroplating systems and established compatibility with automated bath control equipment that enable efficient chemical management across diverse manufacturing facilities.

Appeal Factors: Manufacturing operators prioritize liquid electrolytes for operational convenience, precise bath control, and proven performance in commercial plating lines that enable coordinated chemical management across multiple tanks. The segment benefits from substantial industry preference and mature supply chains that prioritize solution-based systems for high-volume production applications.

Growth Drivers: Electronics manufacturing expansion incorporates liquid electrolytes as standard materials for plating operations, while automated bath control systems increase demand for concentrated formulations that comply with quality standards and minimize waste generation.

Application dynamics include:

Growth Accelerators: Electronics miniaturization drives primary adoption as precious metal plating provides electrical contact reliability and corrosion resistance capabilities that enable electronics manufacturers to meet performance specifications without signal degradation, supporting device miniaturization and high-reliability missions that require superior surface finishing applications. Automotive electrification demand accelerates market expansion as vehicle manufacturers seek effective connector finishing systems that ensure reliable electrical connections while maintaining operational effectiveness during vehicle operation and charging scenarios. Advanced manufacturing investment increases worldwide, creating constant demand for plating chemical systems that complement traditional surface finishing and provide operational flexibility in complex electronics assembly environments.

Growth Inhibitors: Precious metal price volatility varies across commodity markets regarding the costs of gold, palladium, platinum, and rhodium raw materials, which may limit operational flexibility and market penetration in regions with unstable prices or cost-sensitive electronics manufacturing operations. Environmental compliance requirements persist regarding cyanide usage, wastewater treatment, and metal recovery that may increase operating costs in jurisdictions with stringent regulations, affecting manufacturing economics and operational complexity. Market fragmentation across multiple electronics standards and regional specifications creates compatibility concerns between different plating chemistry formulations and existing manufacturing infrastructure.

Market Evolution Patterns: Adoption accelerates in electronics and automotive sectors where reliability requirements justify precious metal costs, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by EMS expansion and electronics manufacturing localization. Technology development focuses on non-cyanide formulations, improved bath stability, and integration with closed-loop recovery systems that optimize metal utilization and environmental compliance. The market could face disruption if alternative contact technologies or base metal alloy substitutes significantly reduce reliance on precious metal finishing in mainstream electronics applications. Circular economy integration enables precious metal recycling programs, closed-loop chemical management, and sustainability certification that optimize resource efficiency while supporting manufacturers' transition toward responsible sourcing and comprehensive environmental stewardship platforms.

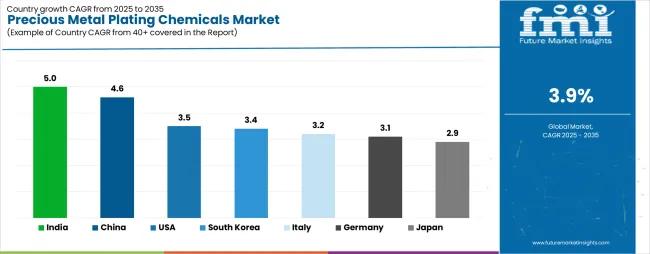

The market demonstrates varied regional dynamics with growth leaders including India (5.0% CAGR) driving expansion through EMS development and jewelry export finishing. High-Growth Markets encompass China (4.6% CAGR), the United States (3.5% CAGR), and South Korea (3.4% CAGR), benefiting from established electronics manufacturing and advanced packaging capabilities. Steady Performers feature Italy (3.2% CAGR), Germany (3.1% CAGR), and Japan (2.9% CAGR), where luxury goods manufacturing and precision electronics support consistent growth patterns.

| Country | CAGR (2025-2035) |

|---|---|

| India | 5.0% |

| China | 4.6% |

| United States | 3.5% |

| South Korea | 3.4% |

| Italy | 3.2% |

| Germany | 3.1% |

| Japan | 2.9% |

Regional synthesis reveals Asia-Pacific markets leading adoption through electronics manufacturing expansion and connector production growth, while European countries maintain steady expansion supported by automotive electrification and luxury goods manufacturing requirements. North American markets show moderate growth driven by high-reliability electronics and aerospace applications.

India establishes the highest growth trajectory through aggressive EMS expansion programs and comprehensive jewelry export infrastructure development, integrating precious metal plating chemicals as essential materials in electronics manufacturing and ornament finishing installations. The country's 5.0% CAGR reflects government initiatives promoting domestic electronics production and jewelry export capabilities that mandate the use of quality plating systems in connector manufacturing and decorative finishing facilities. Growth concentrates in major industrial centers where electronics manufacturing development showcases integrated chemical supply chains that appeal to domestic producers seeking cost-effective plating solutions.

Indian manufacturers are developing local chemical formulation capabilities that combine domestic market advantages with international technology partnerships, including gold and palladium electrolyte systems. Distribution channels through electronics industry suppliers and jewelry finishing distributors expand market access, while government support for EMS development supports adoption across diverse manufacturing segments.

Strategic Market Indicators:

China's advanced electronics manufacturing ecosystem demonstrates sophisticated precious metal plating deployment with documented operational effectiveness in connector production and handset assembly through integration with vertically integrated supply chains. The country leverages manufacturing scale to maintain a 4.6% CAGR. Industrial centers showcase extensive installations where plating systems integrate with comprehensive electronics production platforms to optimize surface finishing and component reliability.

Chinese chemical producers prioritize production capacity and cost competitiveness in plating chemistry development, creating demand for reliable electrolyte systems with proven finishing characteristics. The market benefits from established electronics manufacturing infrastructure and substantial investment in automotive plating-on-plastics technologies that provide long-term growth opportunities.

Market Intelligence Brief:

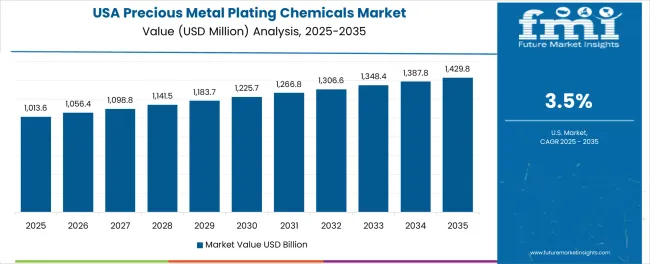

The USA market prioritizes high-reliability electronics and aerospace applications through precious metal plating systems that manage connector finishing, medical device coatings, and defense component specifications aligned with quality standards and performance requirements. The country holds a 3.5% CAGR, driven by aerospace manufacturing and medical device production that support specialized plating chemical adoption. American manufacturers prioritize operational reliability with gold and palladium systems delivering consistent deposit properties through proven formulation quality and environmental compliance.

Technology deployment channels include electronics contractors, aerospace suppliers, and medical device manufacturers that support professional applications for complex high-reliability finishing projects.

Performance Metrics:

South Korea's market prioritizes semiconductor packaging and mobile connector applications through precious metal plating systems that manage leadframe finishing, memory packaging, and advanced finishing line integration. The country holds a 3.4% CAGR, driven by semiconductor industry investment and mobile electronics manufacturing that support gold and palladium plating adoption. Korean manufacturers prioritize miniaturization capabilities with plating systems delivering precise deposit control through advanced formulation technology.

Market Intelligence Brief:

Italy's market expansion benefits from diverse manufacturing demand, including luxury jewelry finishing, fashion hardware applications, and decorative plating that incorporate precious metal solutions for aesthetic and corrosion resistance optimization. The country maintains a 3.2% CAGR, driven by rising luxury goods production and increasing awareness of environmental compliance benefits for green manufacturing practices.

Market dynamics focus on high-quality finishing solutions that balance aesthetic performance with regulatory compliance important to Italian luxury manufacturers. Growing SME modernization creates constant demand for compliant plating systems in jewelry and fashion hardware production.

Strategic Market Considerations:

Germany's advanced industrial market demonstrates sophisticated precious metal plating deployment with documented operational effectiveness in automotive connector finishing and precision electronics manufacturing through integration with existing quality systems. The country leverages engineering expertise in electroplating and surface finishing to maintain a 3.1% CAGR. Industrial centers showcase premium installations where plating systems integrate with comprehensive automotive production platforms to optimize connector reliability and electrical performance.

German chemical companies prioritize REACH compliance and bath performance optimization in plating chemistry development, creating demand for premium electrolyte systems with proven reliability features. The market benefits from established automotive infrastructure and willingness to invest in advanced finishing technologies that provide long-term quality benefits.

Market Intelligence Brief:

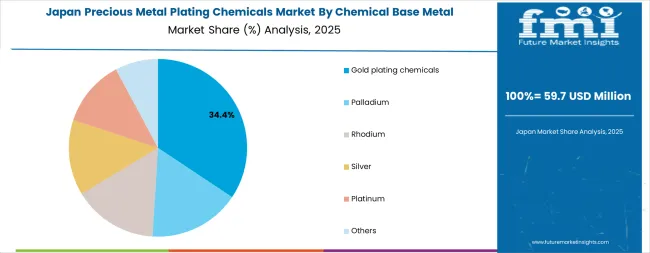

Japan demonstrates steady market development with a 2.9% CAGR, distinguished by electronics manufacturers' preference for high-purity plating systems that integrate seamlessly with advanced packaging processes and provide reliable long-term performance in semiconductor and connector applications. The market prioritizes advanced features, including hard gold for reliability enhancement, miniaturization capabilities, and integration with comprehensive quality platforms that reflect Japanese electronics industry expectations for technological sophistication and operational excellence.

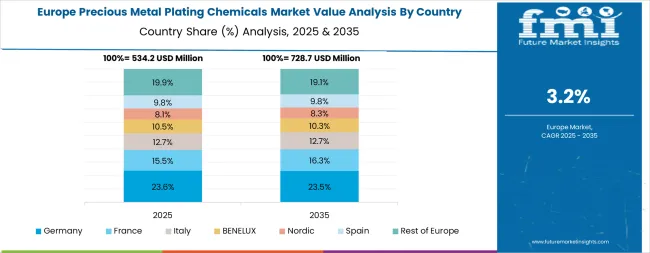

Europe accounts for an estimated 31.0% of global precious metal plating chemicals spend in 2025. Within Europe, Germany leads with approximately 23% share driven by electronics manufacturing, automotive connector production, and engineered coating applications. Italy follows with approximately 14% through fashion jewelry, luxury goods, and aerospace finishing demand. France holds approximately 13% supported by jewelry, luxury markets, and aerospace component finishing. The United Kingdom contributes approximately 12% via medical device manufacturing and high-reliability electronics applications. Switzerland accounts for approximately 10% anchored by watchmaking and precious metal recycling infrastructure. Spain represents approximately 8% growing through automotive component and hardware finishing. The Nordics and Benelux region holds approximately 12% focusing green chemistry adoption and advanced process controls. Eastern Europe accounts for approximately 8% expanding with EMS, connector assembly hubs, and automotive Tier-2 plating clusters. Growth across Europe is supported by REACH compliance requirements, cyanide management regulations, and wastewater directives that tilt demand toward higher-purity solutions, concentrated formulations, and closed-loop recycling integration across the region.

In Japan, the market prioritizes gold plating formulations, which capture the dominant share of electronics manufacturing installations due to advanced features, including superior electrical conductivity and proven reliability with existing semiconductor packaging infrastructure. Japanese electronics manufacturers prioritize quality consistency, miniaturization capability, and long-term reliability, creating demand for gold plating systems that provide stable deposit properties and adaptive performance based on component requirements. Hard gold formulations with cobalt or nickel alloying maintain strong positioning for high-reliability connector applications where mechanical durability and electrical performance meet operational requirements without compromising contact resistance.

Market Characteristics:

In South Korea, the market structure favors international precious metal companies, including Heraeus, Umicore, and specialized chemical suppliers, which maintain dominant positions through comprehensive product portfolios and established electronics industry networks supporting both semiconductor and connector manufacturing installations. These providers offer integrated solutions combining high-purity plating chemistries with technical support services and ongoing process optimization that appeal to Korean manufacturers seeking reliable finishing systems. Local chemical distributors capture market share by providing localized service capabilities and competitive pricing for standard electronics applications, while domestic formulation companies focus on specialized chemistries tailored to Korean semiconductor industry characteristics.

Channel Insights:

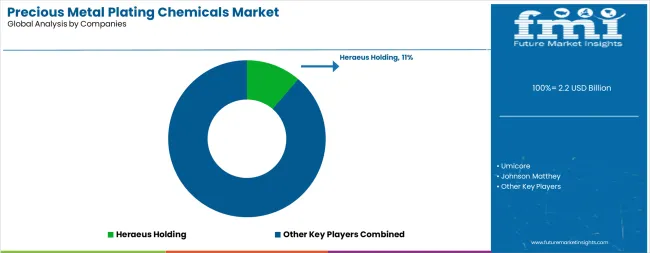

The market operates with moderate concentration, featuring approximately 12-15 meaningful participants, where leading companies control roughly 40-45% of the global market share through established precious metal refining relationships and comprehensive chemical portfolios. Heraeus Holding holds the leading position with approximately 11.5% market share through extensive precious metal operations, global electronics industry networks, and comprehensive recycling capabilities. Competition prioritizes product purity, supply reliability, and technical support rather than price-based rivalry.

Market Leaders encompass Heraeus, Umicore, and Johnson Matthey, which maintain competitive advantages through extensive precious metal refining expertise, global electronics manufacturing partnerships, and comprehensive closed-loop recycling capabilities that create customer relationships and support premium positioning. These companies leverage decades of precious metal processing experience and ongoing formulation investments to develop consistent plating chemistries with reliable deposition characteristics and environmental compliance features.

Technology Innovators include Metalor Technologies (Tanaka), Technic Inc., and SAXONIA Edelmetalle, which compete through specialized formulation technology focus and innovative non-cyanide development that appeal to electronics manufacturers seeking advanced finishing capabilities and environmental compliance. These companies differentiate through proprietary chemistry expertise and specialized electronics application focus.

Regional Specialists feature companies like Heimerle + Meule, JAPAN PURE CHEMICAL, American Elements, and MATSUDA SANGYO, which focus on specific geographic markets and specialized applications, including high-purity systems and luxury goods finishing programs. Market dynamics favor participants that combine reliable metal quality with efficient supply chains, including consistent availability and technical support capabilities. Competitive pressure intensifies as established precious metal refiners expand into specialty chemicals while formulation specialists challenge incumbents through innovative green chemistry solutions and cost-effective alternatives targeting high-growth electronics and automotive segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 billion |

| Chemical Base Metal | Gold plating chemicals, Palladium, Rhodium, Silver, Platinum, Others |

| End-Use Industry | Electrical & Electronics, Jewelry & luxury, Automotive, Aerospace & defense, Medical devices, Hardware |

| Product Form | Solutions/Concentrates, Solid/Powder |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | India, China, the USA, South Korea, Italy, Germany, Japan, and 25+ additional countries |

| Key Companies Profiled | Heraeus Holding, Umicore, Johnson Matthey, Metalor Technologies, Heimerle + Meule, SAXONIA Edelmetalle, Technic, JAPAN PURE CHEMICAL |

| Additional Attributes | Dollar sales by chemical base metal, end-use industry, and product form categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape with precious metal refiners and chemical suppliers, electronics manufacturer preferences for deposit quality and supply reliability, integration with electroplating production platforms and quality monitoring systems, innovations in non-cyanide formulations and closed-loop recycling applications, and development of REACH-compliant solutions with enhanced environmental performance and resource optimization capabilities. |

The global precious metal plating chemicals market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the precious metal plating chemicals market is projected to reach USD 3.2 billion by 2035.

The precious metal plating chemicals market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in precious metal plating chemicals market are gold plating chemicals, palladium, rhodium, silver, platinum and others.

In terms of end-use industry, electrical & electronics segment to command 46.0% share in the precious metal plating chemicals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Precious Metal Plating Chemicals in EU Size and Share Forecast Outlook 2025 to 2035

Precious Metal Nano Wires Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA