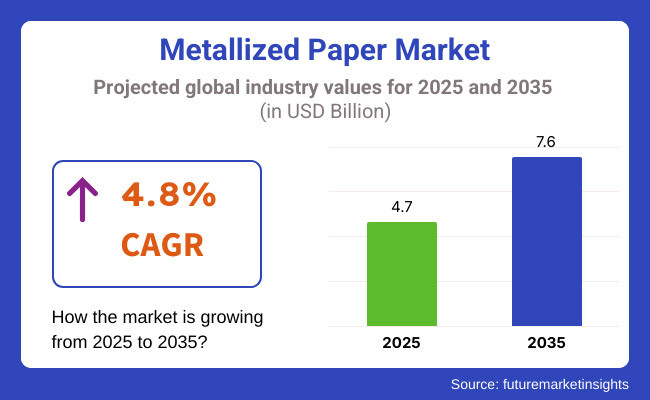

The global metallized paper market is projected to reach USD 4.7 billion by 2025 and is expected to grow at a steady compound annual growth rate (CAGR) of 4.8%, ultimately achieving a value of approximately USD 7.6 billion by 2035. This upward trajectory is being driven by the global shift toward sustainable, plastic-free, and high-barrier packaging materials, as manufacturers and consumers alike prioritize recyclability, aesthetics, and performance. Metallized paper is gaining traction as a preferred packaging substrate in industries such as food and beverages, tobacco, cosmetics, and premium labeling.

Its advantages over conventional plastic films are becoming increasingly relevant in light of stricter environmental regulations and evolving brand commitments to circular economy goals. Unlike laminated plastic structures, metallized paper offers enhanced moisture and light barriers while remaining fully recyclable within paper recovery streams. This makes it a compelling option for companies seeking to replace composite plastic-based packaging.

The market is also being fueled by significant advancements in coating and printing technologies. Water-based and solvent-free coatings are enabling manufacturers to offer high-performance metallized papers that align with regulatory compliance and sustainability standards.

Lightweight paper grades and high-gloss finishes provide superior printability and design appeal, expanding applications in premium segments such as wine labels, tobacco cartons, and confectionery wraps. In a recent statement, Giorgio Boss, CEO of Nissha Metallizing Solutions, emphasized the transformative capabilities of metallization technology. He noted, “The metallizing boosts the barrier properties to a whole new level, enabling us to guarantee excellent product protection and extraordinary product quality”

Investments in automated metallization lines, smart packaging features, and holographic security printing are propelling market innovation. Brands are increasingly integrating anti-counterfeit technologies and traceability elements into their packaging strategies, especially in high-value and regulated industries.

Holographic designs and optically variable devices (OVDs) not only enhance visual impact but also provide a layer of product authentication and tamper evidence. As the demand for visually appealing, functional, and eco-conscious packaging rises, metallized paper is positioned to meet the industry’s evolving technical and sustainability requirements. Looking forward, market growth will be supported by continued R&D in barrier coatings, brand security features, and the expanding use of metallized substrates in both flexible and rigid formats.

The flexible packaging paper segment is projected to capture approximately 43.9% of total market share by 2025, reflecting the industry's push toward lightweight, cost-effective, and plastic-free alternatives. This segment is increasingly favored for its compatibility with recyclable paper laminates, oil-resistant coatings, and fiber-reinforced materials enabling improved shelf-life, better product protection, and reduced environmental impact.

Major global players such as Nestlé and Unilever have adopted flexible packaging paper to fulfill both consumer demand for resealable and sustainable packaging and compliance with global sustainability mandates. Innovation in digital printing, eco-friendly adhesives, and moisture-resistant coatings is further accelerating the growth of this segment.

The retail and tobacco packaging sectors are projected to hold a combined market share of 35.8% by 2025, making them among the leading consumers of metallized paper. This strong demand stems from the material’s ability to deliver premium aesthetic appeal, tamper-evident functionality, and compliance with global environmental policies.

Prominent industry leaders including Philip Morris International and British American Tobacco increasingly rely on metallized paper to elevate brand visibility, ensure packaging integrity, and align with regulatory frameworks aimed at reducing plastic use. According to industry research, more than 65% of sustainable packaging manufacturers now prioritize metallized paper for its role in enhancing efficiency, shelf appeal, and material circularity.

The development of metallized paper market is anticipated to be dominated by the Asia-Pacific region, which increasingly industrializes and demands premium packaging with regulations for sustainable packaging solutions. For instance, high rates of adoption of metallized paper have been realized by countries such as China, India, and Japan in food & beverage labeling, tobacco packaging, and luxury branding.

Additionally, biodegradable and plastic-free metallization innovations, cost-effective production techniques, and automation in printing and coating technologies contributed to market growth in this region.

This issue can also be attributed to government policies forbidding the use of plastics in favor of paper-based alternatives. Moreover, due to flourishing global packaging manufacturers in Asia-Pacific, local production capacity will increase and will therefore help the development of new innovations in products.

North America is among the key markets for metallized paper with high demand from food & beverage, pharmaceuticals, and cosmetics industries. The United States and Canada are the frontrunners in the technological developments of water-based metallization, high-gloss printing, and recyclable barrier coatings. Moreover, increased investment in automation and artificial intelligence-driven quality control in printing and packaging is enhancing production efficiency while minimizing material wastage.

The increasing sustainability considerations within the packaging arena prompted by regulations on plastics, carbon footprints, etc., are impacting market dynamics. Furthermore, increased investment in research and development on moisture-resistant, food-safe, and compostable metallized paper stimulates market growth.

The increasing need for high-security labeling and anti-counterfeiting solutions in luxury and pharmaceutical packaging is further boosting innovations. Additionally, many companies in North America are incorporating QR code-enabled smart packaging to enhance consumer engagement and supply chain transparency.

Owing to strict regulations in the environment, initiatives towards the circular economy, and changing consumer preferences towards green packaging, Europe has a significant chunk of the market for metallized paper. Some of the economically leading nations are Germany, France, and the UK at the forefront of technology such as plastic-free barrier coatings, UV resistant metallization, and water-based adhesives.

Among the various facets of policy affecting Europe, a significant share resides with policies aimed at reducing waste plastic, promoting sustainable forestry, and establishing a trend in the use of recyclable and biodegradable materials. Consumer awareness and demand for more desirable, attractive, and premium packaging also pave the way for long-term growth of the market.

Collaboration between packaging manufacturers with sustainability organizations and research institutes is also built in the region to yield futuristic metallized paper products with superior durability, print quality, and recyclability. AI-induced efficiency gains in manufacture, holographic branding, and security-enhanced labeling are further examples as expected future modalities.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Early-stage restrictions on plastic-based coatings. |

| Material and Formulation Innovations | Development of water-based metallization and compostable coatings. |

| Industry Adoption | Widely used in food, beverage, and tobacco packaging. |

| Market Competition | Dominated by conventional metallized paper manufacturers. |

| Market Growth Drivers | Growth driven by demand for premium, high-gloss packaging. |

| Sustainability and Environmental Impact | Initial adoption of recyclable coatings. |

| Integration of AI and Process Optimization | Limited AI use in quality control and defect detection. |

| Advancements in Packaging Technology | Basic improvements in moisture resistance and print durability. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies mandating plastic-free and fully recyclable metallized paper solutions. |

| Material and Formulation Innovations | Expansion of high-barrier, biodegradable, and AI-driven smart packaging solutions. |

| Industry Adoption | Increased adoption in pharmaceutical, luxury branding, and interactive consumer packaging. |

| Market Competition | Rise of sustainability-focused startups and high-tech packaging firms integrating digital security features. |

| Market Growth Drivers | Market expansion fueled by automation, anti-counterfeit technologies, and fully recyclable metallized paper solutions. |

| Sustainability and Environmental Impact | Large-scale transition to biodegradable, reusable, and plastic-free metallized paper packaging. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated coating applications, and real-time supply chain traceability. |

| Advancements in Packaging Technology | Development of smart packaging with QR code tracking, RFID integration, and holographic security features. |

Increasing demand for high-barrier lightweight recyclable packaging solutions across the food&beverages, cosmetics, and personal care industries have created a dominating market in the United States for metallized paper. These developments toward sustainability, together with a set of strict FDA guidelines on food contact materials, are pushing for more innovations to bio-based and compostable metallized paper.

Investments by companies in AI coating technologies, high-vacuum metallization processes, and water-based adhesive technologies are expected to enhance paper durability, printability, and recyclability. In addition, government initiatives to foster circular economy practices and extended producer responsibility (EPR) programs are incentivizing the industry to switch to 100% recyclable and compostable metallized-paper solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The constant evolution of the UK metallized paper market is itself a testimony to how organizations are focusing on sustainability, recyclability, and compliance with stringent regulatory frameworks such as the UK Plastic Packaging Tax. The growing requirements for sustainable, plastic-free packaging materials are spurring the adoption of metallized paper for premium labels, food wraps, and decorative packaging.

The companies are working on various developments ranging from solventless metallization, mono-material paper laminates to biodegradable coatings for enhancing recyclability and reducing environmental load.

Innovations like digital printing, anti-counterfeit labeling, and moisture-resistant coatings will also improve the performance and branding capabilities of metallized paper. The mushrooming of sustainable packaging solutions in the beverage and personal care sectors is further extending the UK market for metallized paper.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.0% |

The growth of Japan's metallized paper market is being spurred by the nation's emphasis on precision manufacturing, luxury packaging, and sustainable materials innovation. The development of high-gloss, light, and recyclable metallized paper has been spurred by the growing demand in cosmetics, food wrapping, and packaging of high-end products.

In order to give their products more appeal and environmentally friendly qualities, companies are developing extra-thin metallized papers that have been enhanced for printability, grease resistance, and biodegradable coatings.

Japan's efforts to curb plastic waste are also driving manufacturers towards the use of water-based inks, AI-based defect detection, and energy-efficient vacuum metallization. The shift towards smart packaging solutions, featuring RFID-enabled tracking and tamper-proof authentication, is inextricably linked to the growing use of metallized paper in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The South Korean metallized paper market is growing at a brisk pace owing to the rising demand for high-performance, cost-effective, and eco-friendly alternatives. Government policies focused on reducing plastic waste, mandating sustainable packaging, and encouraging extended recycling programs have been the basis for funding the production of next-generation metallized paper.

Companies work on recyclable mono-material paper laminates, high-gloss printing applications, and compostable barrier coatings to increase their performance and sustainability.

Moreover, AI-driven materials optimization, NFC smart packaging, and digital security features help boost production efficiency for premium paper packaging. Continuing its trend toward plastic-free flexible packaging and recyclable metallized paper for labels and wrappings further strengthens the South Korean market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

The metallized paper market is influenced by rising demand in food & beverage, personal care, tobacco, and premium packaging applications. The market is witnessing innovation through new smart packaging technologies, such as ultra-gloss finishes, bio-based metallized layers, and AI-powered defect detection, addressing concerns about efficiency, sustainability, and branding optimization.

Additionally, advancements in high-speed vacuum metallization and automated quality control systems are further shaping industry trends. The rising preference for plastic-free, high-barrier, and premium-quality metallized paper solutions is also contributing to market growth.

Furthermore, increased investments in sustainable packaging integration, circular economy initiatives, and AI-enabled production monitoring are improving product efficiency and expanding market opportunities.

Companies are also exploring hybrid packaging solutions that integrate metallized paper with compostable materials, holographic security features, and moisture-resistant laminations for enhanced usability. Additionally, collaborations between metallized paper manufacturers and luxury brands are driving the development of customized high-end packaging solutions tailored to diverse industry needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AR Metallizing | 12-16% |

| Nissha Co., Ltd. | 8-12% |

| Avery Dennison Corporation | 6-10% |

| Vacmet India Ltd. | 4-8% |

| Japan Pulp & Paper Company Limited | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| AR Metallizing | Develops high-performance, recyclable metallized paper solutions for food, beverage, and premium packaging. |

| Nissha Co., Ltd. | Specializes in lightweight, high-barrier metallized paper with advanced aesthetic finishes for branding. |

| Avery Dennison Corporation | Produces AI-driven, high-performance metallized labels optimized for premium and anti-counterfeiting applications. |

| Vacmet India Ltd. | Expands its product line with sustainable, ultra-thin metallized paper coatings for flexible packaging. |

| Japan Pulp & Paper Company Limited | Focuses on innovative, eco-friendly metallized paper with AI-powered quality control and recyclable material integration. |

Key Company Insights

Other Key Players (45-55% Combined)

Several specialty metallized paper manufacturers contribute to the expanding market. These include:

The overall market size for the Metallized Paper Market was USD 4.7 Billion in 2025.

The Metallized Paper Market is expected to reach USD 7.6 Billion in 2035.

The market will be driven by increasing demand from food & beverage, personal care, and premium packaging industries. Innovations in AI-powered defect detection, plastic-free metallized coatings, and improvements in high-barrier, recyclable metallized paper will further propel market expansion.

Key challenges include fluctuating raw material costs, production complexities, and limited recyclability. However, advancements in water-resistant coatings, AI-powered print registration, and bio-based metallic pigments are addressing these concerns and supporting market growth.

North America and Europe are expected to dominate due to strong investment in sustainable packaging technologies, strict regulatory frameworks, and high consumer demand for recyclable metallized paper. Meanwhile, Asia-Pacific is experiencing rapid growth driven by increasing industrialization, growing demand for high-end packaging, and expanding manufacturing capabilities.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Thickness, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Thickness, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Thickness, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Thickness, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use Industry, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Thickness, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use Industry, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Thickness, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use Industry, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallized Folding Cartons Market Size and Share Forecast Outlook 2025 to 2035

Metallized Rollstock Film Market Size, Growth, and Forecast 2025 to 2035

Metallized PET Cartons Market Analysis – Trends & Demand 2025 to 2035

Metallized Film Market from 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA