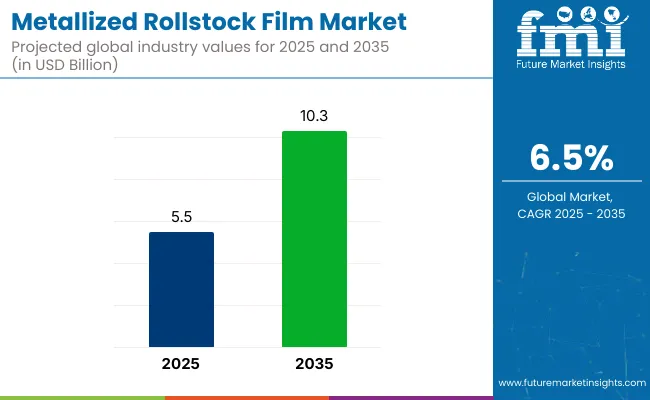

The metallized rollstock film market is valued USD 5.5 billion at in 2025 and is slated to be worth USD 10.3 billion by 2035, reflecting a CAGR of 6.5%. Demand has been driven by the rising need for advanced, cost-effective, and visually appealing packaging solutions across food & beverage, pharmaceutical, and electronics sectors. Improved barrier properties and reflective aesthetics have maintained product relevance across applications despite competitive pressures from alternative flexible packaging materials.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 5.5 Billion |

| Projected Market Size (2035) | USD 10.3 Billion |

| CAGR (2025 to 2035) | 6.5% |

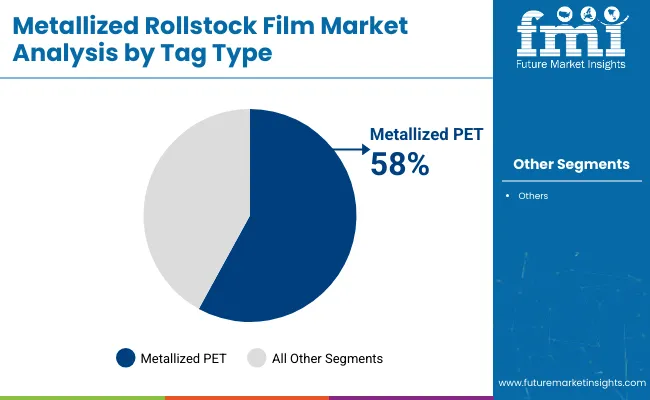

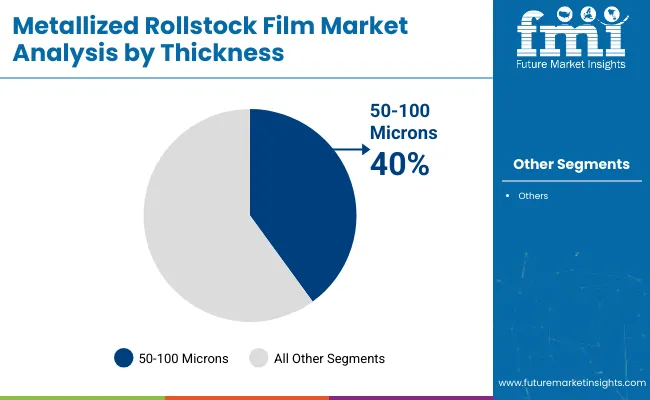

In 2025, metallized PET is expected to command the highest market share among tag types due to its superior barrier, mechanical, and thermal properties, holding over 58% share. The 50-100 microns thickness segment is projected to lead with approximately 40% market share. USA is likely to witness the fastest growth with a CAGR of 6.6%, driven by high demand in food packaging and electronics sectors alongside innovations in bio-based metallized films.

Metallized rollstock film holds approximately 35% to 40% share in the metallized films market, due to its widespread use in flexible and high-barrier packaging. Within the rollstock packaging market, it contributes around 25% to 30%, particularly in food and snack packaging.

In the broader flexible packaging market, its share is about 10% to 12%, reflecting competition from non-metallized laminates and pouches. It accounts for roughly 15% of the barrier packaging market, owing to its excellent oxygen and moisture resistance. In the food packaging market, its share stands at 8% to 10%, largely for confectionery, dairy, and dry food applications.

Sustainability remains a central focus, with manufacturers developing recyclable PET films, compostable bio-based alternatives, and carbon-neutral metallization technologies. Circular economy goals are driving firms to reduce production waste, integrate AI-driven recycling processes, and create packaging solutions aligned with global environmental standards.

Market expansion is supported by the growing demand for premium packaging in e-commerce, flexible packaging infrastructure advancements, and increased use in snack food, coffee pouches, pharmaceuticals, and electronics.

Manufacturers are prioritizing high-barrier, lightweight films with enhanced printability and durability to cater to diverse end-use segments. These strategic developments collectively reinforce the market’s trajectory toward sustainable, high-performance, and intelligent packaging solutions, addressing both regulatory compliance and evolving consumer expectations globally.

The market is segmented into tag type, thickness, end user, and region. By tag type, the market is divided into metallized PP and metallized PET. Based on thickness, the market is categorized into less than 50 microns, 50-100 microns, 101-150 microns, and above 150 microns.

In terms of end users, the market is segmented into food & beverage, pharmaceuticals, chemical & fertilizers, cosmetic & personal care, and homecare. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

Metallized PET is projected to lead the tag type segment, accounting for over 58% of the global market share by 2025. It has been favored due to its high mechanical strength, thermal resistance, and excellent barrier properties essential for food packaging, pharmaceuticals, and personal care applications.

The 50-100 microns segment is expected to lead the thickness category, securing approximately 40% of the global market share by 2025. This thickness range has been preferred for its balance between durability and cost-effectiveness in flexible packaging.

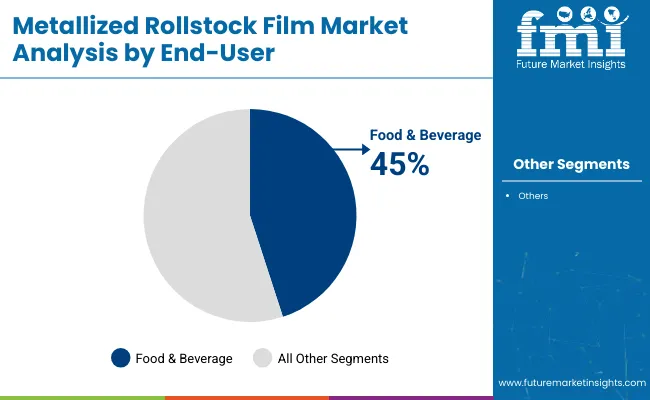

The food & beverage segment is anticipated to lead the end-user category, capturing approximately 45% of the global market share in 2025. This leadership has been driven by consistent demand for moisture-resistant and extended shelf life packaging solutions.

The metallized rollstock film market is witnessing steady growth, driven by the rising demand for advanced barrier packaging, improvements in metallization technologies, and increasing preference for cost-effective flexible packaging formats.

Recent Trends in the Metallized Rollstock Film Market

Challenges in the Metallized Rollstock Film Market

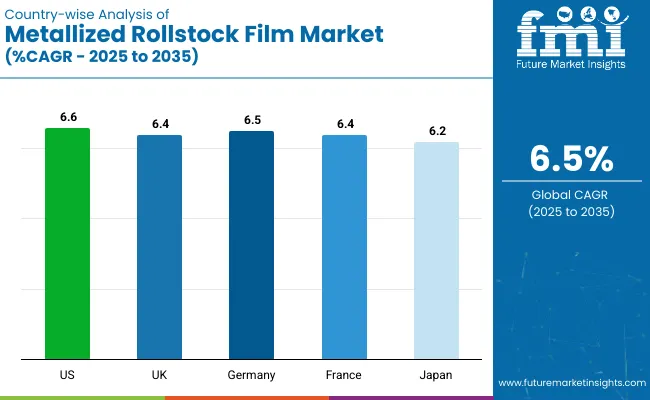

The USA leads the metallized rollstock film market with a projected CAGR of 6.6% from 2025 to 2035, driven by food and pharma packaging and investments in recyclable solutions. Germany follows closely at 6.5%, supported by high-barrier film demand and EU sustainability directives.

The UK and Japan both register a 6.4% CAGR, fueled by food, personal care, and electronics packaging alongside eco-friendly innovations. France shows slightly slower growth at 6.2%, driven by snack, bakery, and cosmetic applications. Overall, demand across all five countries is supported by sustainability trends, smart packaging technologies, and regulatory emphasis on recyclable and high-barrier materials.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The metallized rollstock film revenue in the USA is projected to grow at a CAGR of 6.6% from 2025 to 2035. This growth has been supported by demand from food, pharmaceutical, and industrial packaging applications, alongside investments in recyclable metallized film production technologies.

The UK metallized rollstock film market is expected to register a CAGR of 6.4% during the forecast period. The country’s push towards carbon-neutral packaging, along with high adoption of metallized films in food, beverage, and personal care packaging, has been shaping market trends.

Metallized rollstock film demand in Germany is forecast to expand at a CAGR of 6.5% from 2025 to 2035. Growth has been fueled by demand for high-barrier films in food, pharma, and industrial sectors, with firms investing in advanced coating technologies and sustainable materials.

Japan’s metallized rollstock film market is set to grow at a CAGR of 6.4% through 2035. Adoption has been driven by demand for high-quality flexible packaging in electronics and food sectors alongside innovations in bio-based metallized films.

France’s metallized rollstock film revenue is projected to grow at a CAGR of 6.2% over the forecast period. The market has been driven by food and beverage packaging needs, increasing demand for recyclable films, and regulatory focus on sustainability.

The metallized rollstock film market has been moderately consolidated, with leading players holding significant shares while regional firms focus on specialized solutions. Competitive strategies have included AI-optimized production, sustainable material innovations, and strategic expansions in high-demand regions.

Tier-one firms such as Toray Industries, Jindal Poly Films, Uflex Ltd., Cosmo Films, and Treofan Group have been investing in high-barrier, recyclable, and AI-enhanced metallized film solutions. Strategic initiatives have included acquisitions, plant capacity expansions, and partnerships with converters and FMCG brands to strengthen market presence.

Recent Metallized Rollstock Film Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.5 billion |

| Projected Market Size (2035) | USD 10.3 billion |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in metric tons |

| By Tag Type | Metallized PP, Metallized PET |

| By Thickness | Less than 50 Micron, 50-100 Microns, 101-150 Microns, Above 150 Microns |

| By End User | Food & Beverage, Pharmaceuticals, Chemical & Fertilizers, Cosmetic & Personal Care, Homecare |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, China, India, Brazil, Australia |

| Key Players | Uflex Ltd, Jindal Poly Films Limited, Klockner Pentaplast Europe GmbH & Co. KG, AR Metallizing N.V., Treofan Group, Cosmo Films Ltd, Toray Plastics (America) Inc , DUNMORE Corporation, SRF Limited, LPS Industries. |

| Additional Attributes | Market share analysis by segment and region, country-wise CAGR tracking, and product innovation mapping |

The market is expected to reach USD 10.3 billion by 2035.

The global market is projected to grow at a CAGR of 6.5% during this period.

Metallized PET is expected to lead with over 58% market share in 2025.

The 50-100 microns segment is expected to hold approximately 40% share of the market in 2025.

The USA is anticipated to be the fastest-growing market with a CAGR of 6.6% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallized Folding Cartons Market Size and Share Forecast Outlook 2025 to 2035

Metallized Paper Market Demand and Forecast 2025 to 2035

Metallized PET Cartons Market Analysis – Trends & Demand 2025 to 2035

Metallized Film Market from 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PE Film Market Insights – Growth & Forecast 2024-2034

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PBS Film Market Trends & Industry Growth Forecast 2024-2034

APET Film Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA