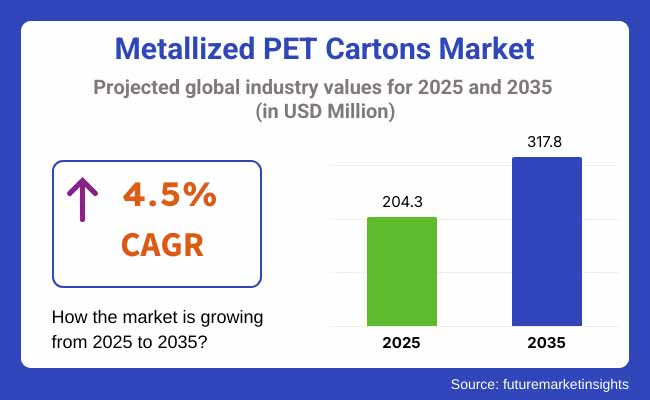

The metallized PET cartons market is set to experience steady growth between 2025 and 2035, driven by the rising demand for premium and visually appealing packaging solutions across various industries. The market was valued at USD 204.3 million in 2025 and is projected to reach USD 317.8 million by 2035, expanding at a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The growing adoption of metallized PET cartons in food & beverage, cosmetics, and personal care packaging is a key factor fuelling market growth. These cartons offer enhanced barrier properties, extended shelf life, and superior aesthetics, making them a preferred choice for luxury and high-end product packaging. Additionally, advancements in metallization technologies and sustainable alternatives are driving innovations in recyclable and eco-friendly PET cartons.

Despite fluctuations in raw material costs, ongoing developments in lightweight, biodegradable, and high-strength PET cartons are creating new growth opportunities. Increased branding and marketing initiatives by manufacturers have also contributed to the rising demand for customized metallized packaging solutions.

Shifting towards quality, long-lasting, and good-looking packaging solutions makes metallized PET cartons market attractive. Furthermore, the requirement to derive sustainable substrates to metallize will also help drive demand for metallized packaging in the next decade.

North America metallized PET cartons market is expected to be dominating the market during the forecast period owing to consumer shift towards premium and attractive packaging formats for food & beverages, cosmetics, pharmaceuticals, etc. The United States and Canada are leading the region owing to the fast-growing retail sector, increasing consumer demand for aesthetic packaging, and stringent sustainability regulations.

In addition, the booming e-commerce industry acts as a fundamental accelerator to the demand for sustainable and lightweight packaging solutions, a key growth enabler for metallized PET cartons. On top of that, the product customizability has also enhanced with the new metallization technologies and printing methods. However, high cost of production and recycling certainties may limit the market growth.

Applications of metallized PET cartons in food and beverage products together account for a significant share of the total applications of metallized PET cartons, which is likely to have a positive impact on the growth of the global metallized PET cartons market. Regions such as Germany, UK, France and Italy are now seeing a considerable traction for metallized PET cartons owing to increasing demand for innovative and premium packaging solutions.

The growing emphasis on sustainable packaging in couple with the rise of eco-friendly metallized PET carton packaging materials, made from biodegradables and recyclable materials, is a significant ingredient to boost the region packaging type innovations.

Other significant contributors to market growth include the luxury goods and confectionery sectors. However, compliance with a constantly evolving regulatory paradigm and the higher cost of sustainable packaging alternatives could be onerous for manufacturers.

Asia-Pacific is expected to grow at the highest growth rate in the metallized PET cartons market owing to rapid urbanization, rising disposable income, and expansion of the retail and e-commerce sector. Due to superior quality and aesthetic packaging solutions there is high demand for printing paper in countries such as China, India, Japan and South Korea which in turn is expected to drive the market growth across the globe.

Metallized PET cartons gain popularity due to their barrier properties and the booming food & beverage and cosmetics industries in this region. Furthermore, increasing innovations in packaging technologies along with rising investments in sustainability are also contributing to the market growth. Also should be front-of-mind for industry stakeholders are volatile input material prices, environmental issues and a lack of advanced reclamation facilities.

Challenges

High Production Costs and Recycling Limitations

The high manufacturing cost and low recyclability of metallized PET cartons, however, are restraining the growth of the metallized PET cartons market. Metallized PET cartons are a composite of layers of plastic, aluminium and paperboard, making them incompatible with conventional recycling. In addition, the cost of raw materials and energy-intensive production processes gives more to the total production cost.

And to fix these problems, businesses are putting money into what they can help to do to recycle, more compatible coatings, and more surrogates that make recyclability hard and give it a better than average impact on the climate.

Opportunities

Growing Demand for Premium and Sustainable Packaging

Demand is increasing from the metallized PET cartons industry due to beautiful look, improved barrier properties and longer shelf life of packed products. The metallized PET cartons are widely employed for the packaging of rich & high-quality products across several verticals including food & beverages, pharmaceuticals, cosmetics, and many others.

Increasing demand for sustainable solution is encouraging manufacturers to adapt newer technologies like bio-based & metallized coatings and recyclable PET carton, which would create opportunities for new packaging solutions.

The metallized PET cartons market witnessed a gradual growth from 2020 to 2024, fuelled by the rising demand for premium packaging solutions and improvements in barrier technology. Yet, recycling difficulties, volatile raw material prices, and sustainability issues presented formidable challenges. To solve these problems, manufacturers put their focus on light weighting, bio-based alternatives, and enhanced recycling compatibility.

After 2025 to 2035, innovative technologies in sustainable metallization including solvent less coatings, bio-based PET layers, and entirely recyclable barrier films will emerge in the market. The change will be accelerated by the adoption of AI-driven manufacturing, smart packaging technologies, and biodegradable PET alternatives.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased scrutiny on plastic waste |

| Technological Advancements | Improved barrier coatings for longer shelf life |

| Industry Adoption | Premium packaging in food, beverage, and cosmetics |

| Supply Chain and Sourcing | Raw material cost fluctuations |

| Market Competition | Expansion of major premium packaging brands |

| Market Growth Drivers | Demand for attractive, protective, and lightweight packaging |

| Sustainability and Energy Efficiency | Shift toward lightweight and recyclable solutions |

| Consumer Preferences | Preference for visually appealing and durable packaging |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Mandatory recyclable or biodegradable packaging requirements |

| Technological Advancements | AI-driven manufacturing and sustainable metallization |

| Industry Adoption | Smart packaging integration for product tracking |

| Supply Chain and Sourcing | Use of bio-based and recycled PET materials |

| Market Competition | Rise of sustainable packaging start-ups and innovations |

| Market Growth Drivers | Eco-friendly, smart, and interactive packaging trends |

| Sustainability and Energy Efficiency | Fully biodegradable and closed-loop recycling initiatives |

| Consumer Preferences | Growing demand for sustainable and interactive packaging |

The metallized PET cartons market in the USA is poised for a favourable growth trajectory in the following years, due to the high consumption of premium packaging applications. Growing demand for visually appealing and eco-friendly packaging solutions across various industries including food, beverages, and cosmetics is mainly encouraging the global market.

Growth of the market is further driven by new printing technologies & higher investments in biodegradable alternatives to PET. The presence of key packaging producers and an increasing focus on recyclability favour market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

Metallized Container, by Region (USA & Canada, Brazil, UK, China, Japan & Middle East, Rest of World). Market in UK, is growing rapidly because of increasing interest for premium and sustainable packaging with wide applications in end-user industries.

So the food & beverage industry is witnessing a rise in preference for high-quality printed PET cartons, as well as a movement towards eco-sensitive and recyclable materials. In addition, government regulations driving sustainable packaging solutions as well as circular economy initiatives are helping forge advancements in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.9% |

Regions with the most promising market share in metallized PET cartons include the European Union, where the highest demand particularly being noted in France, Germany, and Italy. High end packaging solutions in cosmetics, confectionery, and beverage industry is a key driver for the growth.

Strict regulations that encourage packaging alternatives made of recyclable and biodegradable materials are influencing the manufacturers to develop sustainable PET packages. Moreover, technological advancements in printing and coating techniques, complimentary to the types of materials, further increases the growth curve of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

Demand for premium appearance and aesthetics in packaging in the food and cosmetics industry in Japan is steadily driving the metallized PET cartons market in the country. Japanese companies are making a play with new materials that boast high quality, durability and recyclability. In addition, the market is substantially complemented by advanced packaging technologies in the nation, as well as high consumer preference for these types of aesthetically sophisticated packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

Metallized PET cartons market in South Korea holds a small share of the market, which is projected to grow owing to rising demand from luxury cosmetics and other personal care products. There is a strong momentum within the market towards sustainable packaging and a large amount of investment is going into advanced recycling technologies and biodegradable PET materials. The industry's growth is also supported by the rise of online retailing and innovations in e-commerce packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Increasing demand for tastefully designed and durable packaging across industries is driving significant growth for the metallized PET cartons market. And businesses are placing a premium on packaging solutions that not only drive shelf appeal and improve product protection, but that meet their sustainability targets.

The metallized properties of PET cartons provides both reflective and metallic properties imparting a premium look, making them a preferred choice for food, beverage, cosmetics, and pharmaceutical package. In addition to that, developments in printing technologies has allowed manufacturers to produce highly customized and brand-specific packaging designs, contributing to market growth.

The global search for sustainable packaging continues, but businesses are also looking to make metallized PET cartons more recycling-friendly and biodegradable. For packaging to finish, advanced coating technologies and use of water-based adhesives is expected to lower the environmental impact without compromising quality.

Polyethylene Terephthalate (PET) and Aluminium dominate the material type segment owing to carton strength, barrier properties, and cost effectiveness.

Polyethylene Terephthalate (PET) is used the most for metallized PET cartons due to its good moisture barrier as well as high strength and flexibility. PET-based cartons provide excellent product protection, making them suitable for packaging sensitive products like perishable food, dairy products and beverages.

Their imperviousness to temperature fluctuations and protection from oxidation enable a longer shelf life for packaged foods. For one, PET is light and tough, minimizing transport costs and breakage.

Conversely, Aluminum is essential in metallized PET cartons as it offers excellent barrier performance against light, oxygen, and moisture. This material is especially popular for packaging pharmaceuticals, luxury cosmetics and gourmet food. Aluminum-laminated PET cartons keep products fresh and add a glossy, metallic aesthetic.

Not with sanding worries about recyclability, however, industry attendees are focusing on sustainable options, including biodegradable metallized films and aluminum-free reflective coatings, to comply with regulatory changes.

In addition to PET and Aluminum, the metallized PET cartons market also offers recycled alternatives such as Paperboard. More manufacturers are mixing paperboard with metallized films for an optimal balance of sustainability and visual impact.

For the finishing types, Printed Metallized PET Cartons are the market leaders because brands are trying to make unique and eye attracting designs for the packaging.

Metallized PET cartons provide high definition graphics, bright colors and high-end printing processes like UV coating and embossing to achieve a high-end look. These cartons are widely used in the food and beverages sector, where brand differentiation is an integral aspect of customers purchasing choice.

Manufacturers are investing in digital and flexographic printing technologies for product visibility optimization and boosting customer engagement. Pharmaceutical and electronic packaging applications are perfect situations for the use of metallized PET cartons due to their ability to print barcodes, QR codes, and tamper-proof security labels directly on them.

Whereas the Non-printed metallized PET cartons appeal to industries focusing on their product functionality rather than aesthetics. These cartons are commonly utilized in bulk packaging or serve as secondary protective layers for valuable goods. They are affordable, stronger packaging solutions for almost all types of industries although branding may not be possible for any of the non-print methods.

As consumer preferences continue to evolve toward sustainable packaging options, metallized PET cartons market dynamics will undergo transformative change. As manufacturers work towards reducing their environmental footprints while maintaining high-quality packaging standards, there is a rising investment in biodegradable & recyclable metallized PET packaging.

With changing consumer demand, the market is expected to see steady growth with the increase in demand for visually aesthetic, long lasting and environmentally friendly metallized PET cartons in the forecast period.

Metallized PET cartons market is growing with the expansion of the industry. The broad application of these cartons in food & beverages, cosmetics, drugs & pharmaceuticals, and consumer goods, the ability of these cartons to attract consumer attention, the durability, and the protective functionality against moisture and UV radiation offered by these cartons make them sought-after solutions the aforementioned industries.

Sustainable packaging providing manufacturers with an opportunity to adapt, which is in an uptrend in eco-friendly coatings, recyclable materials, and advanced codes and printing techniques aligning with sustainability concerns and changing consumer preferences.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor plc | 20-24% |

| Mondi Group | 15-19% |

| Sonoco Products Company | 12-16% |

| Huhtamaki Oyj | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amcor plc | Leading provider of sustainable metallized PET cartons, emphasizing lightweight and recyclable materials. |

| Mondi Group | Specializes in premium metallic packaging solutions, integrating advanced printing and finishing technologies. |

| Sonoco Products | Develops high-barrier metallized cartons, catering to food, beverage, and pharmaceutical industries. |

| Huhtamaki Oyj | Offers customized metallized PET cartons, focusing on branding, visual appeal, and product protection. |

Key Company Insights

Amcor plc (20-24%)

Metallized PET cartons market - Amcor stands in the sustainable and high-performance packaging solution providers. It centers its attention on lightweight structures, sustainable coatings, and recyclability as part of global initiatives toward sustainability.

Mondi Group (15-19%)

Luxury and premium packaging applications utilize metallization high-end, embossing, and specialty coatings as a treatment to enhance the consumer experience and shelf life of the final product.

Sonoco Products Company (12-16%)}

Sonoco Products manufactures advanced barrier packaging, creating metallized PET cartons for moisture and oxygen resistance, suitable for food preservation, including packaged goods, vitamins, snacks, and other pharmaceutical applications.

Huhtamaki Oyj (10-14%)

Huhtamaki, provides metallized PET cartons that are well suited to customization and branding, including high-resolution printing and differentiated structural designs, for cosmetics and consumer goods applications.

Other Significant Competitors (30-40% Total)

The market for metallized PET cartons is highly competitive as well, with several companies focusing on investment in advanced printing, sustainable materials, and smart packing solutions. Notable players include:

The overall market size for the metallized PET cartons market was USD 204.3 million in 2025.

The metallized PET cartons market is expected to reach USD 317.8 million in 2035.

The demand for metallized PET cartons is expected to rise due to the increasing preference for premium and visually appealing packaging, growing adoption in the food & beverage and cosmetics industries, and advancements in sustainable metallized packaging solutions.

The top five countries driving the development of the metallized PET cartons market are the USA, Germany, China, India, and Japan.

The food & beverage segment is expected to dominate the market due to the rising demand for attractive, durable, and high-barrier packaging solutions that enhance shelf appeal and product protection.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Finishing, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Finishing, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Finishing, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Finishing, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Finishing, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Finishing, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Finishing, 2018 to 2033

Table 30: Europe Market Volume (Tons) Forecast by Finishing, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Finishing, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tons) Forecast by Finishing, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: MEA Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Finishing, 2018 to 2033

Table 46: MEA Market Volume (Tons) Forecast by Finishing, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: MEA Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Finishing, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Finishing, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Finishing, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Finishing, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Finishing, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Finishing, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Finishing, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Finishing, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Finishing, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Finishing, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Finishing, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Finishing, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Finishing, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Finishing, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Finishing, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Finishing, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Finishing, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Finishing, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Finishing, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Europe Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Finishing, 2018 to 2033

Figure 86: Europe Market Volume (Tons) Analysis by Finishing, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Finishing, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Finishing, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Finishing, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Finishing, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Finishing, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tons) Analysis by Finishing, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Finishing, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Finishing, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Finishing, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Finishing, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: MEA Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Finishing, 2018 to 2033

Figure 134: MEA Market Volume (Tons) Analysis by Finishing, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Finishing, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Finishing, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: MEA Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Finishing, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallized Rollstock Film Market Size, Growth, and Forecast 2025 to 2035

Metallized Paper Market Demand and Forecast 2025 to 2035

Metallized Film Market from 2025 to 2035

Metallized Folding Cartons Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA