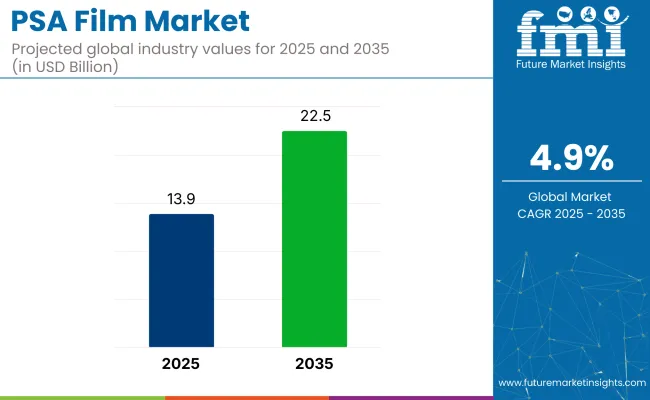

The PSA film market is projected to grow from USD 13.9 billion in 2025 to USD 22.5 billion by 2035, registering a CAGR of 4.9% over the forecast period. This expansion is being supported by demand across packaging, automotive, electronics, and healthcare sectors where pressure-sensitive films offer lightweight, solvent-free, and high-efficiency bonding.

Packaging remains the largest application, driven by the rise of e-commerce and cold-chain logistics. Automotive interiors and electronics displays increasingly rely on silicone- and acrylic-based PSA films for vibration resistance and optical clarity. Innovations in bio-based formulations are responding to rising regulatory pressure over VOCs.

Asia Pacific holds the largest volume share, though North America and Europe are transitioning toward high-margin medical and electronics applications where premium film variants are gaining traction.

In February 2023, Arkema introduced a comprehensive range of pressure-sensitive adhesive solutions, encompassing various predominant technologies such as hot melt, waterborne, UV, and specialty solution acrylics. This launch signifies Arkema's commitment to innovation and addresses the evolving demands of industries reliant on the films. By expanding its product portfolio, Arkema aims to cater to diverse applications, enhancing performance.

The industry holds a specialized share within its parent markets. In the adhesive films market, it accounts for approximately 10-12%, as the films are a key type of adhesive film used across various industries. Within the packaging market, the share is around 3-5%, driven by the use of PSA films in labeling, sealing, and packaging materials.

In the automotive market, the share is about 4-6%, with the films used for applications like window tinting and surface protection. In the textiles market, the share is around 2-3%, with the films utilized for fabric bonding and other textile coatings. In the consumer electronics market, the industry represents around 3-4%, used for screen protection and other applications in electronic devices.

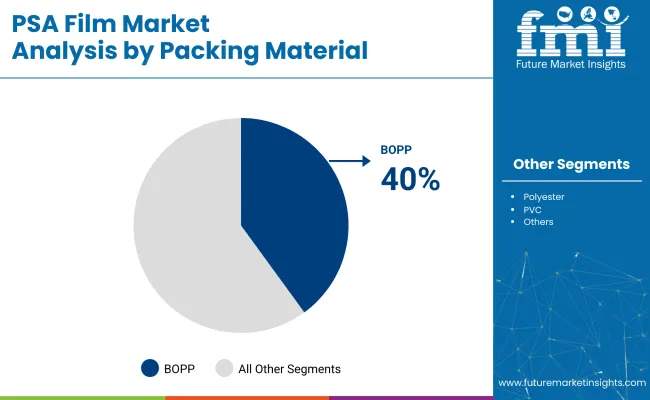

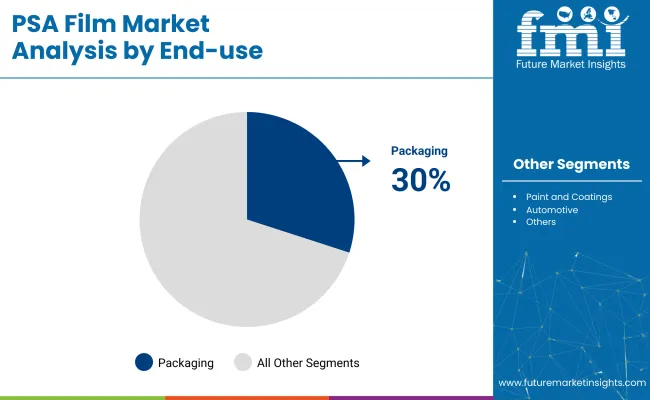

The industry is expected to see strong demand from BOPP films, which will capture 40% of the packing material segment in 2025. The packaging industry will lead the end-use segment with a 30% share, driven by increased demand for efficient packaging solutions.

BOPP (Biaxially Oriented Polypropylene) film is projected to dominate the industry’s packing material segment, accounting for 40% of the market share in 2025. BOPP films are favored for their high strength, excellent transparency, and durability, making them ideal for packaging applications in industries like food, beverage, and consumer goods.

The increasing demand for lightweight, flexible, and cost-effective packaging solutions further drives BOPP’s growth. Additionally, BOPP films are easily printable and provide excellent moisture and chemical resistance, which contributes to their widespread use in flexible packaging. The rising demand for eco-friendly and recyclable packaging also supports BOPP film’s growing market presence.

The packaging industry is projected to hold 30% of the industry share in 2025. PSA films in the packaging sector are used in a wide range of applications, including labels, wraps, and protective films. The growth of the packaging sector is driven by the increasing need for functional, user-friendly packaging solutions, especially in food and beverage, personal care, and consumer goods markets.

With the rise of e-commerce, there is a growing demand for secure, tamper-evident packaging, which these films provide. Additionally, as consumer preference shifts toward eco-friendly packaging, companies are investing in sustainable PSA films, further accelerating growth in this segment.

The industry is expanding due to rising demand in the automotive, electronics, and construction sectors, driven by advancements in technology and automation. However, challenges such as raw material price fluctuations, trade disruptions, and environmental compliance are limiting stability, especially for smaller manufacturers.

Automotive and Electronics Industries Power the Expansion

The industry is growing, fueled by rising demand in the automotive, electronics, and construction sectors. In automotive, these films play a crucial role in masking during painting and bonding lightweight components, particularly in electric vehicles.

In electronics, they are used for insulation, protective layers, and circuit shielding, benefiting from their strong adhesive properties and dielectric strength. The shift toward advanced materials, faster production lines, and automation in these sectors is further driving the need for the films.

Raw Material Price Swings Disrupt Industry Stability

The industry faces significant challenges due to fluctuations in raw material prices, especially for materials like PET resin, rubber, and acrylics, which are heavily influenced by oil prices and global supply chain dynamics. Unexpected surges in input costs can squeeze profit margins, particularly for price-sensitive sectors such as packaging and logistics.

Trade restrictions, tariffs, and shipping disruptions further complicate procurement, affecting production schedules and delivery timelines. Smaller manufacturers are especially vulnerable to price swings, making pricing stability a critical issue across the value chain.

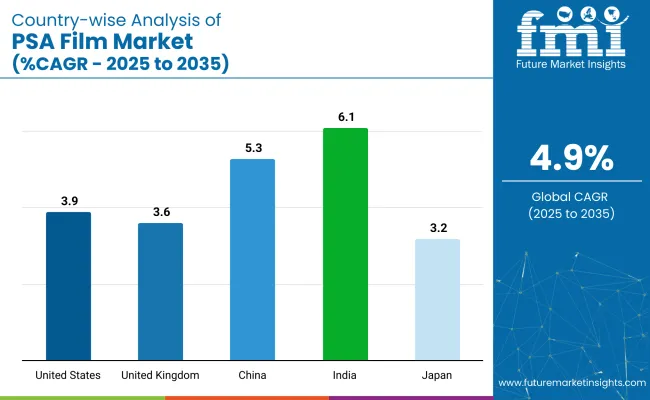

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| United Kingdom | 3.6% |

| China | 5.3% |

| India | 6.1% |

| Japan | 3.2% |

The industry demand is projected to rise at a 4.9% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 6.1%, followed by China at 5.3%, and the United States at 3.9%, while the United Kingdom posts 3.6% and Japan records 3.2%.

These rates translate to a growth premium of +25% for India, +8% for China, and -20% for the United Kingdom versus the baseline, while the United States and Japan show more moderate growth. Divergence reflects local catalysts: expanding industrial and construction sectors in India, increasing demand for advanced adhesive films in China, and steady but slower growth in developed industries like the United States, the United Kingdom, and Japan, driven by industry saturation and slower adoption in traditional industries.

The industry in the United States is set to record a CAGR of 3.9% between 2025 and 2035. Expansion is being powered by demand from automotive, aerospace, and industrial-coatings supply chains that specify solvent-free, low-VOC surface-protection films. Electric-vehicle insulation layers, green-construction wraps, and e-commerce packaging labels all rely on light-weight, clean-peel PSA technologies.

Domestic converters located in the Midwest and Southwest leverage vertically integrated coating lines and OEM co-development programs. EPA policy pressures have accelerated the shift toward water-based acrylics, while recyclable PET substrates gain traction in consumer electronics lamination.

The United Kingdom industry is projected to expand at a CAGR of 3.6% from 2025 to 2035. Growth is anchored in Net-Zero construction programs and the expanding EV supply chain, which favor recyclable, low-odor masking and insulation films. Domestic producers focus on clean-peel, antimicrobial, and smart-sensor layers tailored for healthcare builds and infrastructure refurbishments.

Post-Brexit sourcing strategies have shortened lead times by strengthening local specialty-film manufacturing. Investment in solvent-recovery and bio-based acrylic chemistries aligns with UK carbon-reduction mandates, boosting industry differentiation.

China is one of the fastest-growing industries, with a projected CAGR of 5.3% between 2025 and 2035. Rapid industrialization and government support under “Made in China 2025” have expanded domestic output of packaging, labeling, and high-performance electronics films. Regional fabs install high-speed multilayer coaters that produce solvent-free barrier films for touchscreens, solar backsheets, and EV battery modules.

Plastic-waste restrictions and circular-economy pilots drive adoption of recyclable PET and biodegradable PLA carriers. Low-cost mass production remains dominant, yet premium, heat-dissipation PSA films gain share in 5G smartphone assemblies.

The industry in India is projected to grow at a CAGR of 6.1% through 2035, the fastest among major regions. Infrastructure expansion, e-commerce boom, and production-linked incentives for electronics assembly underpin robust demand for water-based and recyclable PSA solutions.

Domestic manufacturers scale PET and BOPP lines near petrochemical hubs, while partnerships with global formulators transfer low-VOC adhesive know-how. Urban construction sites adopt clean-peel masking films to meet dust-control bylaws, and logistics providers shift to liner-free label stock for throughput gains. “Make in India” policies secure backward integration of acrylic monomer supply, lowering input costs.

The industry in Japan is expected to expand at a steady CAGR of 3.2% between 2025 and 2035. Demand is concentrated in precision electronics, automotive interiors, and medical devices that call for ultra-clean, low-residue, heat-stable films. Lintec and Nitto Denko invest in optical-grade PET carriers with haze below 0.5% for OLED lamination, plus bio-based adhesive chemistries aligned with carbon-neutral targets.

Semiconductor fabs specify antistatic dicing-tape films that maintain adhesion across cryogenic temperature swings. Although overall volume growth is modest, Japan retains global leadership in high-tensile, solvent-free films for niche, export-oriented applications.

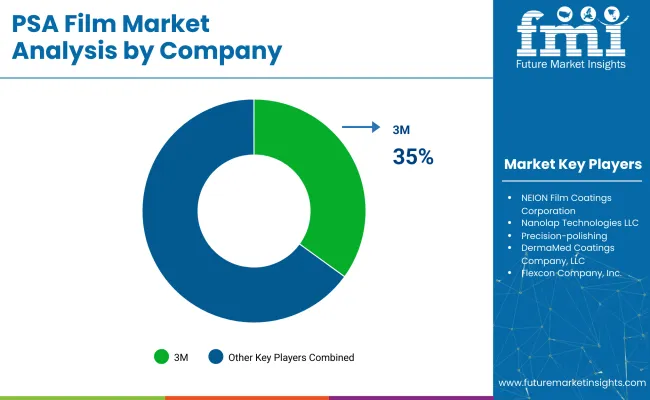

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as 3M, Tesa SE, and Flexcon Company, Inc. lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across automotive, electronics, and industrial sectors.

Key players including NEION Film Coatings Corporation, Nanolap Technologies LLC, and Precision-polishing offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as DermaMed Coatings Company, LLC, focus on innovative technologies and cost-effective solutions, expanding their presence in the global market.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 13.9 billion |

| Projected Industry Size (2035) | USD 22.5 billion |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Packing Materials Analyzed (Segment 1) | Polyester Film, BOPP Film, PVC Film, Others |

| End-use Industries Analyzed (Segment 2) | Paint and Coatings, Automotive, Electrical and Electronics, Packaging, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Vietnam, Thailand, Indonesia, Australia, Saudi Arabia, UAE, South Africa |

| Key Players Influencing the Industry | 3M, NEION Film Coatings Corporation, Nanolap Technologies LLC, Precision-polishing, DermaMed Coatings Company, LLC, Flexcon Company, Inc., and Tesa SE. |

| Additional Attributes | Polyester films lead dollar sales; automotive and packaging sectors drive share; BOPP films growing fast in Asia; PSA films gain traction in EV batteries and flexible electronics; eco-friendly PSA gaining regulatory push |

By packing material, the industry includes polyester film, BOPP film, PVC film, and others.

By end-use industry, the industry is segmented into paint and coatings, automotive, electrical and electronics, packaging, and others.

By region, the industry is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

The industry is expected to reach USD 22.5 billion by 2035, up from USD 13.9 billion in 2025.

The industry is projected to grow at a CAGR of 4.9% during the forecast period.

Polyester film holds the largest share, accounting for approximately 53% of the industry.

India is forecast to grow at the highest CAGR of 6.1% between 2025 and 2035.

3M leads with a 35% industry share in the industry.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Film and TV IP Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

Competitive Breakdown of Capsaicin Manufacturers

PC Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

PE Film Market Insights – Growth & Forecast 2024-2034

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PBS Film Market Trends & Industry Growth Forecast 2024-2034

Microfilm Readers and Scanners Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA