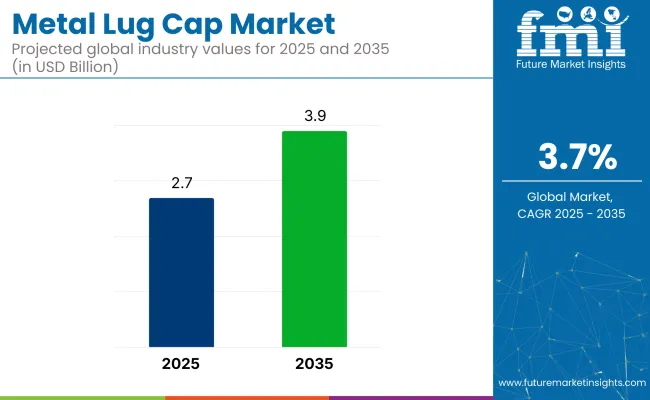

In 2025, the global metal lug cap market is valued at USD 2.7 billion and is projected to grow to USD 3.9 billion by 2035, expanding at a CAGR of 3.7%. Metal screw caps are threaded metal closures widely used to seal jars, bottles, and containers across the food, beverage, and pharmaceutical industries.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.7 billion |

| Forecast Value (2035) | USD 3.9 billion |

| Market Analysis CAGR | 3.7% |

Unlike basic crown caps, lug caps offer resealability and tamper evidence, making them ideal for packaging sauces, spreads, beverages, and medicinal liquids. Growth is driven by rising consumer demand for convenience, A growing focus on recyclable materials and expansion in processed food and beverage sectors.

The metal lug cap market has been characterized by a focused share across its parent sectors. Within the broader caps and closures market, a share of approximately 2-3% has been attributed to metal screw caps, as their use has been limited to specific applications compared to more common closures such as screw caps or flip tops.

In the metal caps and closures category, their share has been estimated at around 5-6%,supported by their durability and recyclability. In food and beverage packaging closures, a share of roughly 7-9% has been recorded, particularly for products such as jams, sauces, and pickles requiring vacuum-tight seals.

In pharmaceutical packaging closures, a modest share of 3-4% has been maintained, mainly for containers with tamper-evident features. In the recyclable packaging segment, around 4-5% of the share has been contributed by metal screw caps, reflecting growing demand for eco-friendly formats.

Brandon Bach, President of Consumer Convenience Technologies (CCT), underscored the need for innovation in the closure industry, where 80% of the industry still relies on traditional lug lids. He introduced the EEASY Lid, the first aluminum lug-style closure designed to replace heavier, harder-to-open steel versions. This lid reduces the force required to open jars by about 40%, making it more accessible to all consumers.

Additionally, aluminum’s recyclability and lighter weight support green goals. The EEASY Lid reflects a growing industry shift toward eco-friendly, user-centric packaging. By addressing both environmental impact and ease of use, CCT positions itself as a leader in the evolving metal screw cap focused on next-generation, consumer-friendly solutions.

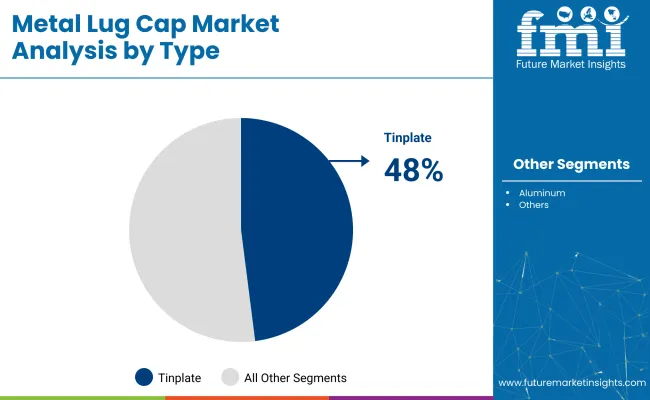

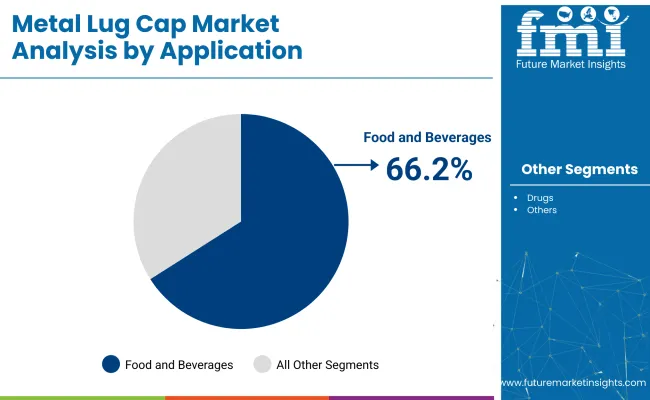

In 2025, the metal lug caps market is dominated by tinplate in the material segment, holding a 48% share due to its affordability, barrier protection, and recyclability. Food and beverages lead end-use demand at 66.2%, supported by high usage in sauces, condiments, and ready-to-drink products requiring vacuum sealing, tamper resistance, and resealability across global food processing industries.

Tinplate accounts for 48% of the material segment in 2025 owing to its low cost, ease of printing and excellent barrier properties.

Food and beverages dominate end-use applications at 66.2% in 2025, driven by rising consumption of packaged foods, sauces, condiments and ready-to-drink beverages.

Demand for metal lug caps is strong, fueled by rising packaged food consumption and food safety regulations. Challenges include raw material price volatility and alternative closures, while innovations in barrier coatings and alloys present growth opportunities amid regulatory pressure.

Processed Food Boom Fuels Lug Cap Adoption Globally

The adoption of metal screw caps has been driven by the global expansion of processed and packaged food industries. Demand has been reinforced by stringent safety regulations and the need for resealable, tamper-resistant closures in beverages, sauces, and condiments, particularly within premium and specialty food segments across developed and developing regions.

Raw Material Volatility Limits Manufacturer Profit Margins

Volatility in raw material prices has been limiting manufacturer margins, especially for steel and aluminium used in metal screw caps. Tariff shifts and trade-related disruptions have been affecting tinplate and aluminum coil availability. Regulatory demands for food-grade coatings have increased production complexity and costs across global markets.

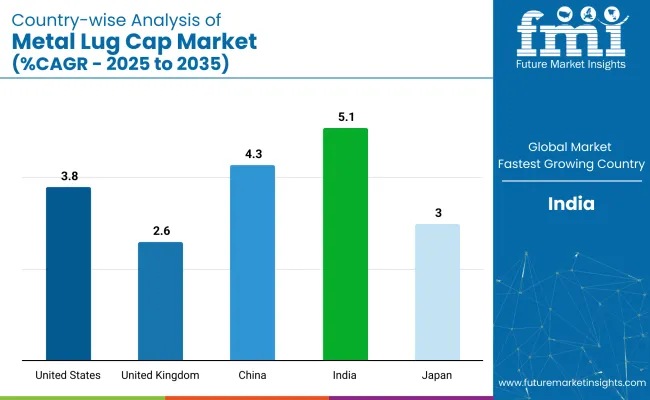

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

| United Kingdom | 2.6% |

| China | 4.3% |

| India | 5.1% |

| Japan | 3% |

OECD producers of metal lug caps are projected to grow at an average CAGR of 3.1% between 2025 and 2035. The United States is expected to expand at 3.8%, supported by growth in automated food-canning lines and the rise of craft-preserve brands. Japan’s 3.0% pace is shaped by ongoing upgrades in condiment-filling infrastructure. The United Kingdom, with a slower 2.6% rate, reflects flat demand tied to plateauing glass-jar usage.

In BRICS, performance is expected to outpace the global 3.7% average. China is forecasted at 4.3%, as production is scaled through export-focused glass-jar manufacturing and high-speed capping lines. India leads with 5.1%, driven by facility additions for sauces, pickles, and dairy ghee, underpinned by metal-packaging incentives and rising demand for sealed food formats.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The United States metal lug cap industry is expected to grow at a CAGR of 3.8% from 2025 to 2035. The expanding food and beverage sector, requiring packaging solutions that maintain product integrity and longevity, is a primary driver of growth for metal screw caps.

Increasing demand for secure, tamper-evident packaging in pharmaceuticals and consumer goods further contributes to the rise in metal screw cap demand.Innovations in metal screw cap designs, offering enhanced sealing properties and environmental advantages, alongside significant investments in packaging technology, are accelerating expansion.

The UK metal lug cap industry is projected to grow at a CAGR of 2.6% from 2025 to 2035. Steady demand from the food, beverage, and pharmaceutical sectors is contributing to growth, with metal screw caps being recognised for their effectiveness in sealing, tamper-evidence, and long shelf-life assurance.

Consumer preference for secure and reliable packaging formats continues to reinforce their adoption across retail categories. Ongoing innovations in the UK packaging landscape. A shift toward recyclable and lightweight metal componentis expected to further constant market expansion.

The industry in China is projected to grow at a CAGR of 4.3% from 2025 to 2035. Growth is being supported by the country's large-scale manufacturing infrastructure and rising packaged food consumption. Metal screw caps are being increasingly adopted to ensure product safety, longer shelf life, and regulatory compliance across both domestic and export markets.

Technological advancements in automated sealing lines and eco-efficient metal processing are expected to endure momentum, as packaging upgrades continue across food, beverage, and healthcare sectors.

The industry in India is expected to grow at a CAGR of 5.1% from 2025 to 2035. Rising consumption of packaged food, beverages, and over-the-counter pharmaceuticals is driving demand for reliable sealing solutions like metal screw caps.

These closures are being preferred for their compatibility with hot-fill processes, tamper evidence, and ability to maintain product freshness during storage and transport. Growth is also being supported by local manufacturing expansion and government incentives for improved packaging infrastructure.

The industry in Japan is projected to grow at a CAGR of 3.0% from 2025 to 2035. Growth is being supported by the country’s advanced manufacturing capabilities and emphasis on high-performance packaging. Metal screw caps are being widely utilised in food, beverage, and pharmaceutical applications, where quality retention and tamper resistance are critical.

With constant investment in precision engineering and eco-efficient packaging lines, Japan is expected to maintain consistent adoption of metal screw caps across multiple sectors.

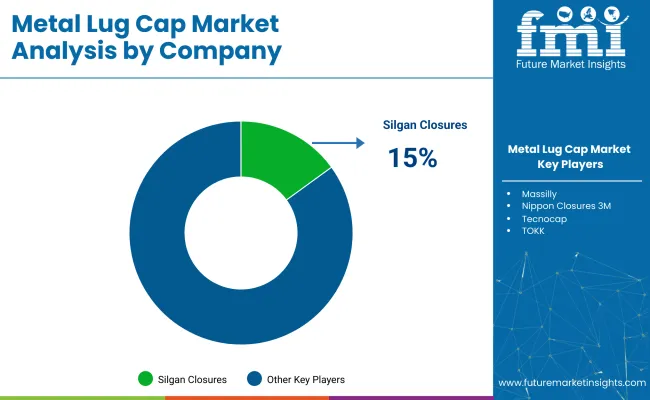

The industry is characterized by a mix of established key players and emerging entrants. Companies such as Glasspack, Massilly, and Tecnocap Group are known for their extensive product portfolios and global reach, which enable them to dominate market share. These players often focus on product innovation and robust research and development strategies.

For example, Tecnocap Group frequently invests in new designs for enhanced functionality, while Massilly has been expanding its product offerings through strategic acquisitions. Additionally, players like The Cary Company and Burch Bottle & Packaging leverage their strong distribution networks to enhance industry penetration.

Emerging players, such as KAMELLIA ENTERPRISE CO., LTD and Maxwell Packaging Bottle Solution, are introducing new technologies, emphasizing cost-effective manufacturing and niche product development. The industry sees occasional consolidation, with larger companies acquiring smaller ones to strengthen their presence in industry.

Entry barriers include high capital investment, stringent regulations, and competition from alternative packaging solutions, making it a fragmented yet competitive space.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.7 billion |

| Projected Market Size (2035) | USD 3.9 billion |

| CAGR (2025 to 2035) | 3.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Types Analyzed (Segment 1) | Tinplate, Aluminum, Others |

| Applications Analyzed (Segment 2) | Food and Beverages, Drugs, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, Japan, South Korea, India, Indonesia, Vietnam, Thailand, Australia, UAE, Saudi Arabia, South Africa |

| Key Players Influencing the Market | Glasspack, Massilly, Tecnocap Group, The Cary Company, KAMELLIA ENTERPRISE CO., LTD, Burch Bottle & Packaging, GUDEX, Elmoris, Taiwan Hon Chuan, Gebrüder Leonhardt GmbH & Co., and Maxwell Packaging Bottle Solution |

| Additional Attributes | Tinplate dominates with highest dollar sales; food & beverage sector holds majority share; rising demand for tamper-proof sealing; Asia leads in production volume; automation driving cap manufacturing efficiency |

The industry is segmented into Tinplate, aluminum, and others.

The industry is segmented into Food and beverages, drugs, and others.

The market covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry is projected at USD 2.7 billion in 2025.

The industry is expected to reach USD 3.9 billion by 2035 at a CAGR of 3.7%.

The tinplate leads with 48% share.

Food and beverages dominate at 66.2% share in 2025.

India is projected to register the highest CAGR of 5.1% during 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Metal Fiber Felt Market Size and Share Forecast Outlook 2025 to 2035

Metal Wheel Chock Market Size and Share Forecast Outlook 2025 to 2035

Metal Aerosol Can Market Size and Share Forecast Outlook 2025 to 2035

Metal Casting Market Size and Share Forecast Outlook 2025 to 2035

Metal Cord Grips Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA