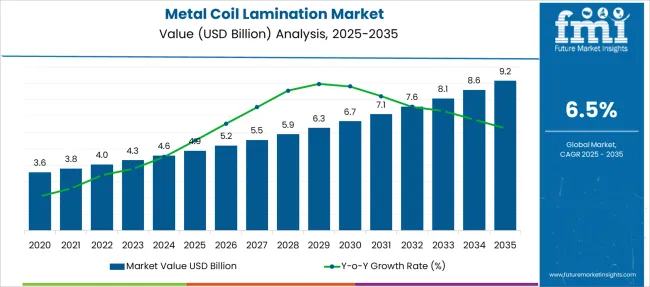

The Metal Coil Lamination Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 9.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Metal Coil Lamination Market Estimated Value in (2025 E) | USD 4.9 billion |

| Metal Coil Lamination Market Forecast Value in (2035 F) | USD 9.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

Increasing demand from sectors such as packaging, construction, and automotive has contributed to the widespread adoption of laminated coils that offer superior resistance to corrosion, improved printability, and enhanced visual appeal.

Shifts in consumer expectations toward premium and sustainable packaging solutions are also influencing material choices and process innovations in lamination technologies. Future growth is anticipated to be fueled by the expansion of organized retail, regulatory pressures for recyclable materials, and advancements in high-performance laminates that cater to niche requirements.

Manufacturers are focusing on operational efficiency and material innovation to meet evolving standards, paving the path for broader adoption and more cost-effective solutions..

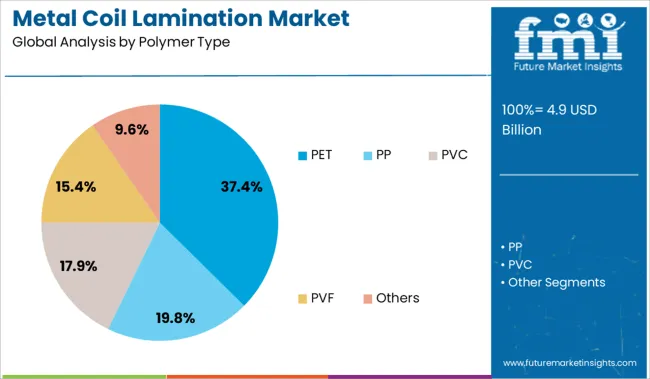

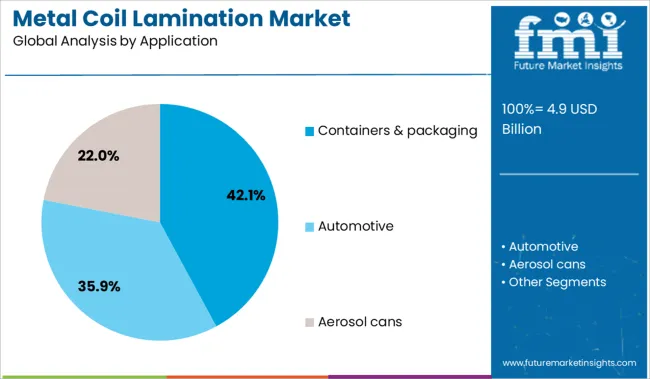

The market is segmented by Polymer Type, Application, and region. By Polymer Type, the market is divided into PET, PP, PVC, PVF, and Others. In terms of Application, the market is classified into Containers & packaging, Automotive, Automotive trim, Vehicle light weighting, Others, and Aerosol cans.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by polymer type, PET accounts for 37.40% of the market revenue in 2025, making it the leading polymer type. This dominance is attributed to PET’s excellent mechanical strength, chemical resistance, and clarity, which have allowed it to fulfill both functional and aesthetic roles effectively.

Its compatibility with high-speed lamination processes and ability to withstand demanding forming operations have reinforced its selection over alternatives. Cost efficiencies achieved through widespread availability and improved recycling streams have further strengthened its appeal to manufacturers striving to balance performance with sustainability objectives.

The ability to maintain adhesion and durability under varied temperature and humidity conditions has also played a pivotal role in its continued leadership within the polymer category.

Segmented by application, containers and packaging hold 42.10% of the market revenue in 2025, establishing this as the top application segment. This leadership has been driven by heightened consumer and regulatory emphasis on sustainable and visually appealing packaging solutions, for which laminated coils are well-positioned to deliver.

Superior barrier properties, printability, and formability of laminated metals have allowed containers and packaging to meet functional requirements while enabling brands to enhance shelf presence. The sector’s scale and fast-paced innovation cycles have also fostered consistent investment in advanced laminates that support lightweighting, recyclability, and premium finishes.

Strong demand from food and beverage industries, combined with evolving retail trends and compliance expectations, has consolidated the containers and packaging segment’s position at the forefront of market growth.

Demand for metal coil lamination is expanding due to rising applications in architectural panels, appliance skins, and automotive components. Sales of pre-laminated metal coils are being driven by aesthetic customization, corrosion resistance, and reduced post-processing costs. High-speed lamination lines and thermoplastic adhesives are reshaping production throughput and cost-efficiency.

Demand for laminated metal coils in architectural façades and cladding systems rose 18% YoY in 2025, particularly across commercial real estate projects in Asia and the Middle East. PVDF and polyester films laminated on aluminum and galvanized steel gained favor due to UV resistance and long-term gloss retention. UAE and Saudi Arabia specified color-matched laminated coils for 5-star hotel and transit hub exteriors, reducing onsite coating by 42%. Smart buildings in Japan and Singapore used pre-laminated panels to speed façade installation by 27%, aided by factory-calibrated adhesion lines. Specifiers increasingly request antibacterial and anti-graffiti finishes for urban commercial zones, enhancing product differentiation.

Sales of high-speed coil lamination equipment rose 22% in 2025, propelled by automotive lightweighting targets and interior panel enhancements. Tier-1 suppliers laminated metal coils with polypropylene and PET films to produce scratch-resistant dashboard skins and door trims. European EV makers integrated laminated steel in battery casings to reduce painting steps and improve dielectric safety. Adhesive-coated coil lines with dual-lamination rollers enabled throughput of up to 15 m/min. OEMs reported 19% fewer rejects when switching from wet paint to laminated finishes. North American automakers piloted thermoformable laminated coils in pickup truck bed liners and underbody shields, citing corrosion protection benefits.

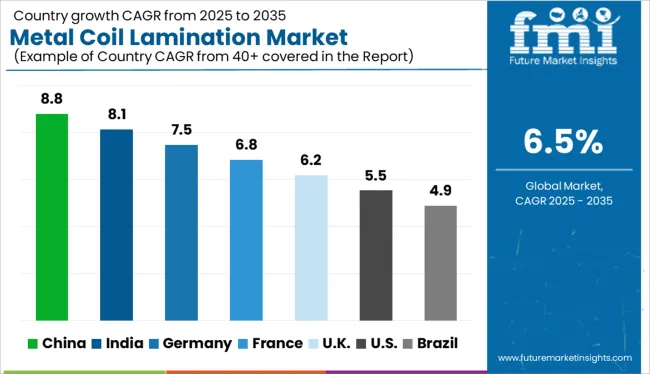

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

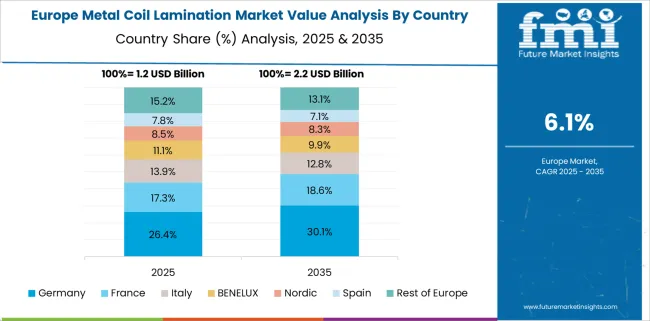

The global market is projected to expand at a CAGR of 6.5% between 2025 and 2035. Among BRICS economies, China leads with 8.8% growth, fueled by high-volume infrastructure and machinery demand, while India follows at 8.1%, supported by domestic industrialization and exports. Within the OECD, Germany is progressing at 7.5%, driven by automotive-grade laminates and regulatory efficiency standards. The UK stands at 6.2%, where the focus remains on sustainable packaging and appliance components. The USA trails at 5.5%, reflecting slower replacement cycles and moderate downstream demand. While ASEAN nations are not specified here, their contribution is expected to grow due to increased industrial investments. The disparity in growth trajectories reveals a stronger push from emerging economies focused on capacity building and exports, while developed markets experience steady gains through innovation, sustainability, and infrastructure upgrades. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to expand at a CAGR of 8.8% in the metal coil lamination market between 2025 and 2035. From 2020 to 2024, growth was led by demand in appliance manufacturing hubs like Guangdong and Shandong. In the upcoming decade, demand for metal coil lamination is set to rise across EV battery enclosures, green buildings, and high-end consumer electronics. Sales of metal coil lamination materials will benefit from localization trends and exports of coated steel products.

The market in India is forecast to grow at a CAGR of 8.1% through 2035. During 2020–2024, adoption was primarily driven by packaging and roofing solutions. Now, demand for metal coil lamination is accelerating due to infrastructure expansion and Make-in-India manufacturing initiatives. Sales of pre-coated coils are surging in industrial zones in Gujarat, Tamil Nadu, and Maharashtra.

Germany is expected to post a CAGR of 7.5% in the industry between 2025 and 2035. From 2020 to 2024, demand remained concentrated in automotive and home appliance applications. Over the next decade, demand for metal coil lamination will be driven by lightweight, corrosion-resistant panels used in EV production and modular architecture. Sales of coated coils are increasing due to strong R&D in anti-fingerprint and antimicrobial lamination technologies.

The UK market is projected to grow at a 6.2% CAGR through 2035. Between 2020 and 2024, demand was driven by warehouse builds and consumer white goods. From 2025 onward, demand for metal coil lamination will be supported by low-carbon construction goals, rising imports of appliances, and advancements in anti-corrosive surface treatments. Sales of laminated aluminum and steel panels are gaining traction in high-humidity applications.

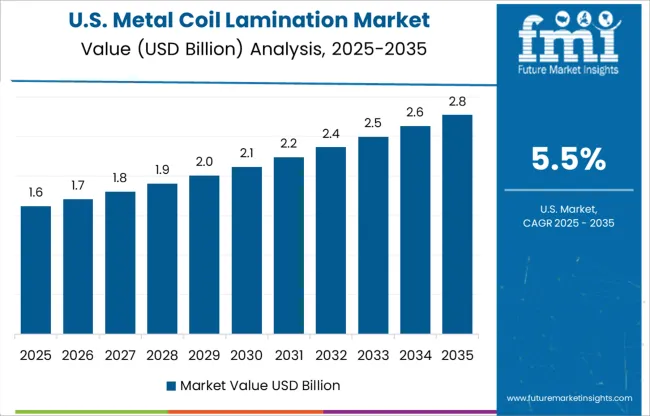

The US is estimated to grow at a 5.5% CAGR in the market from 2025 to 2035. During 2020–2024, market development was driven by residential appliance production and roofing applications in states like Texas and Florida. Looking forward, demand for metal coil lamination will increase due to industrial warehouse builds, energy-efficiency retrofits, and expansion of domestic solar component manufacturing.

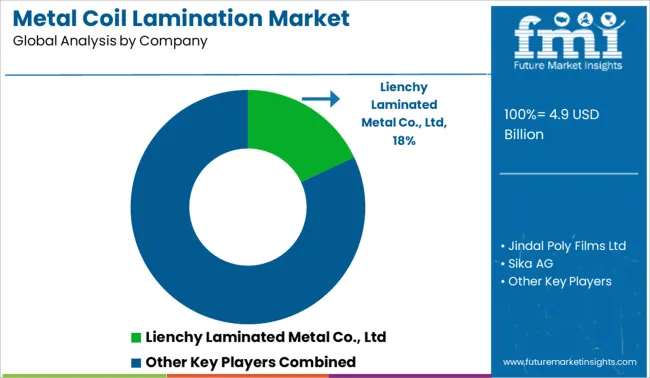

In 2025, sales of metal coil lamination systems are witnessing strong growth, driven by rising demand from the construction, HVAC, and appliance sectors. Lienchy Laminated Metal Co., Ltd leads globally with a significant market share, driven by high adoption in anti-fingerprint and PVC-laminated steel applications. Jindal Poly Films and Mitsubishi Chemical Holdings are expanding their presence in multilayer PET and specialty films, catering to Asia’s growing building façade market. Demand for metal coil lamination in North America is supported by increased investments in coated aluminum for home appliances, where Sika AG and American Nickeloid Company remain key players. Emerging firms like Orion Profiles and Metacolour are gaining traction in pre-coated sheet production for lightweight structural and decorative components.

In March 2024, Lienchy Laminated Metal Co., Ltd enhanced its production capabilities with a 350-meter continuous roll-to-roll lamination line, achieving an annual capacity exceeding 50,000 tons for anti-fingerprint and pre-coated metal solutions using high-efficiency processing.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Polymer Type | PET, PP, PVC, PVF, and Others |

| Application | Containers & packaging, Automotive, Automotive trim, Vehicle lightweighting, Others, and Aerosol cans |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lienchy Laminated Metal Co., Ltd, Jindal Poly Films Ltd, Sika AG, Mitsubishi Chemical Holdings Corporation, American Nickeloid Company, Orion Profiles Ltd, Polytech America LLC, Metacolour, Material Sciences Corporation, Berlin Metals, METAL TRADE COMAX, Globus S.r.l., and Toyo Kohan Co., Ltd |

| Additional Attributes | Dollar sales by lamination type and metal substrate, demand dynamics across automotive and appliance manufacturing, regional trends in pre-coated coil consumption, innovation in adhesive layering and surface treatment technologies, environmental impact of solvent-based laminates, and emerging use cases in architectural façades and energy-efficient cladding systems. |

The global metal coil lamination market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the metal coil lamination market is projected to reach USD 9.2 billion by 2035.

The metal coil lamination market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in metal coil lamination market are pet, pp, pvc, pvf and others.

In terms of application, containers & packaging segment to command 42.1% share in the metal coil lamination market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA