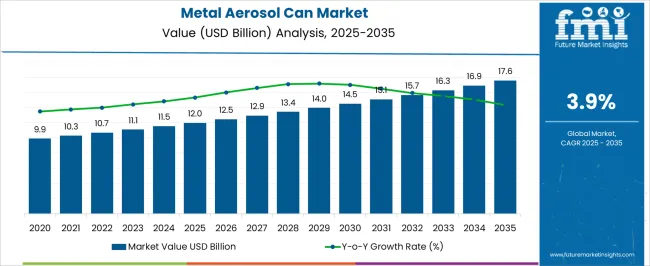

The metal aerosol can market is expected to expand from USD 12 billion in 2025 to USD 17.6 billion by 2035, recording a compound annual growth rate (CAGR) of 3.9%. Between 2025 and 2030, the market will grow gradually from USD 12 billion to USD 14.5 billion, reflecting steady year-on-year progress. This stage of growth is driven by demand across personal care, household, and industrial applications, where aerosol cans are valued for their durability, portability, and ease of use.

From deodorants and hair sprays to paints and lubricants, the versatility of metal aerosol cans ensures continuous adoption. The market curve during this phase shows smooth and predictable expansion, supported by consistent consumer reliance on convenient packaging formats. From 2030 to 2035, the market is forecast to rise further from USD 14.5 billion to USD 17.6 billion, maintaining a stable growth trajectory. This stage highlights the continued preference for metal aerosol cans in sectors requiring long shelf life and product protection under pressurized formats.

The growth curve shape reflects a balanced slope, signaling steady adoption without volatility. Manufacturers are expected to strengthen their positions by focusing on lightweight designs, improved sealing mechanisms, and diversified end-use applications. The incremental but reliable rise demonstrates that while growth is moderate compared to other packaging formats, the market continues to provide dependable opportunities for suppliers. This trajectory confirms the long-term role of metal aerosol cans as an essential packaging solution across consumer and industrial categories.

| Metric | Value |

|---|---|

| Metal Aerosol Can Market Estimated Value in (2025 E) | USD 12.0 billion |

| Metal Aerosol Can Market Forecast Value in (2035 F) | USD 17.6 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The metal aerosol can market occupies a specialized but important share across several broader packaging domains, with its contribution varying depending on end-use segments. Within the global packaging market, metal aerosol cans account for about 4%, reflecting their niche role compared to flexible and rigid alternatives. In the rigid metal packaging market, their share rises to nearly 15%, since aerosol cans form a major category alongside metal bottles and tins. Within the personal care and cosmetics packaging market, metal aerosol cans hold around 12%, driven by strong adoption in deodorants, hair sprays, and grooming products. In the household and industrial products packaging market, their share is close to 10%, as they are widely used for cleaning sprays, lubricants, and paints where pressurized dispensing is essential.

In the food and beverage packaging market, aerosol cans represent about 6%, serving applications like whipped cream, cooking sprays, and beverage foams. Collectively, these percentages demonstrate that while metal aerosol cans remain a relatively small segment within the overall packaging industry, they command a stronger share in rigid metal and personal care packaging domains where convenience, product integrity, and branding opportunities are highly valued. Their balanced role in industrial and household uses further underscores their versatility, while their smaller presence in food packaging highlights a niche but steadily expanding segment. This distribution reflects the adaptability of metal aerosol cans in serving both consumer lifestyle markets and industrial functional needs.

The metal aerosol can market is growing steadily due to rising demand across personal care, household, and pharmaceutical sectors. Its ability to offer precise product dispensing, longer shelf life, and tamper-proof packaging is contributing to its widespread acceptance.

Consumers are increasingly favoring lightweight, durable, and recyclable packaging qualities well-aligned with metal aerosol cans, particularly aluminum variants. Meanwhile, innovations in valve systems and eco-friendly propellants are helping manufacturers meet evolving regulatory and environmental standards.

Strong branding potential through customizable labeling and growing awareness of hygiene are also supporting expanded usage across urban and semi-urban regions.

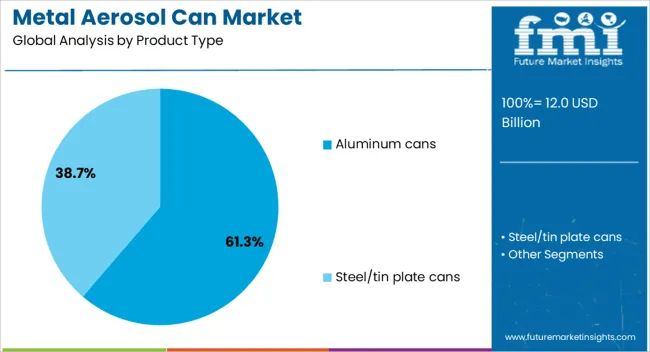

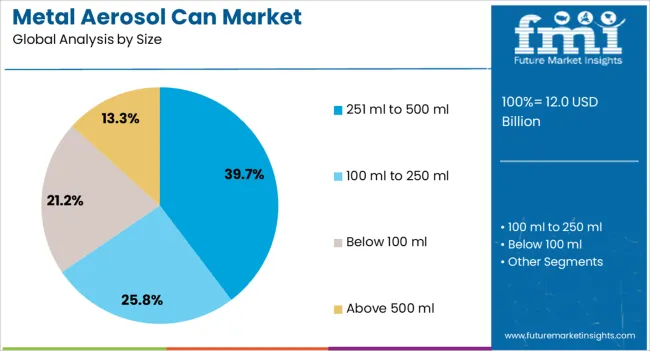

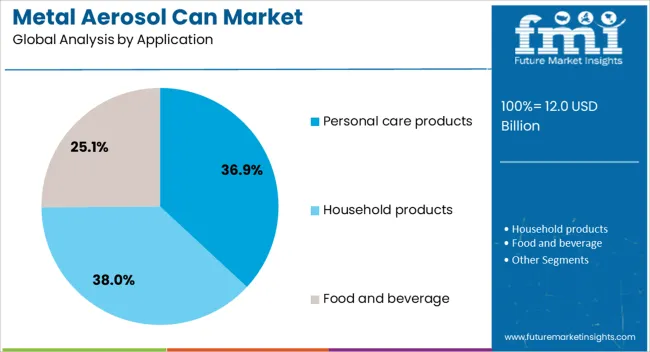

The metal aerosol can market is segmented by product type, size, application, and geographic regions. By product type, metal aerosol can market is divided into Aluminum cans and Steel/tin plate cans. In terms of size, metal aerosol can market is classified into 251 ml to 500 ml, 100 ml to 250 ml, Below 100 ml, and Above 500 ml. Based on application, metal aerosol can market is segmented into Personal care products, Household products, Food and beverage, Industrial Products, and Pharmaceuticals. Regionally, the metal aerosol can industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Aluminum cans are projected to account for 61.30% of the overall revenue in the metal aerosol can market by 2025, making them the leading product type. Their dominance stems from superior corrosion resistance, lightweight profile, and excellent recyclability compared to steel variants.

Aluminum’s ability to support intricate shaping and printing without compromising integrity makes it ideal for premium personal care and cosmetic brands. Additionally, its high thermal conductivity improves product stability in varied climates, enhancing shelf life and safety.

As sustainability targets tighten globally, aluminum's closed-loop recycling benefits continue to position it as a preferred material for both brands and consumers.

The 251 ml to 500 ml category is expected to hold 39.70% of the market share in 2025, emerging as the leading size range for metal aerosol cans. This size offers a balanced solution between portability and product volume, appealing to manufacturers and end users alike.

Its compact yet sufficient capacity suits a broad array of applications, including deodorants, hair sprays, household disinfectants, and automotive sprays. Increasing demand from on-the-go consumers and the convenience of single-hand usage further support its growth.

As product variety expands across retail and e-commerce platforms, this segment continues to meet consumer expectations around volume, cost-efficiency, and ergonomic design.

Personal care products are projected to command 36.90% of the total metal aerosol can market share in 2025, making it the top application segment. Growth in this category is being driven by rising urbanization, increased disposable incomes, and greater grooming awareness across both men and women.

Aerosol formats offer ease of application and hygienic dispensing, attributes that align closely with consumer needs for convenience and product freshness. Strong demand for items such as body sprays, dry shampoos, and shaving foams is encouraging manufacturers to invest in visually distinct, durable, and sustainable packaging.

As global self-care trends expand, aerosol packaging is poised to remain a critical delivery format in the personal care domain.

The metal aerosol can market is expanding as convenience, portability, and product protection drive adoption across personal care, household, and healthcare applications. Opportunities are strengthening in cosmetics and pharmaceuticals, while trends emphasize lightweight construction, customization, and innovative spray mechanisms. Challenges persist in raw material price volatility, supply disruptions, and competition from alternative packaging formats. Companies that optimize costs, ensure resilient sourcing, and deliver differentiated packaging solutions will secure a stronger foothold, making metal aerosol cans a critical choice in global packaging industries.

Demand for metal aerosol cans has been reinforced by their convenience, durability, and ability to dispense products efficiently. Widely used across personal care, household, automotive, and industrial sectors, aerosol cans provide portability and product protection against contamination. Their compatibility with a wide range of propellants and formulations enhances adoption across spray-based products. Demand will remain strong as consumer lifestyles increasingly favor easy-to-use, portable packaging formats, making metal aerosol cans indispensable in both mass-market and specialized product categories.

Opportunities are growing in personal care, cosmetics, and healthcare applications where aerosol formats are becoming popular for deodorants, hair sprays, medical sprays, and disinfectants. The pharmaceutical sector is increasingly using aerosol cans for precise delivery of topical treatments and inhalers. Growth in developing markets with expanding personal grooming habits further strengthens demand. I believe manufacturers that diversify their product portfolios with healthcare-focused aerosol solutions and align with emerging consumer preferences will capture significant opportunities, especially in high-growth regions across Asia and Latin America.

Trends in the metal aerosol can market highlight lightweight construction, recyclability, and customization. Companies are focusing on shaping, printing, and finishing innovations to enhance branding and shelf appeal. Advanced valve technologies and user-friendly spray mechanisms are also gaining traction. Another visible trend is the adoption of compact travel-sized formats. These trends indicate a market shift where packaging is not only functional but also a tool for differentiation, with aesthetics, convenience, and material efficiency becoming decisive factors in consumer purchasing behavior.

Challenges include volatility in raw material prices, particularly aluminum and steel, which directly affect production costs. Smaller manufacturers face difficulties maintaining profitability when raw material costs rise. Supply chain disruptions and environmental regulations surrounding propellants also pose hurdles for manufacturers. Competition from alternative packaging formats such as plastic bottles and pouches adds further pressure. Success will depend on companies building resilient supply networks, optimizing production efficiency, and offering innovative, cost-competitive designs that balance performance, compliance, and affordability in dynamic market conditions.

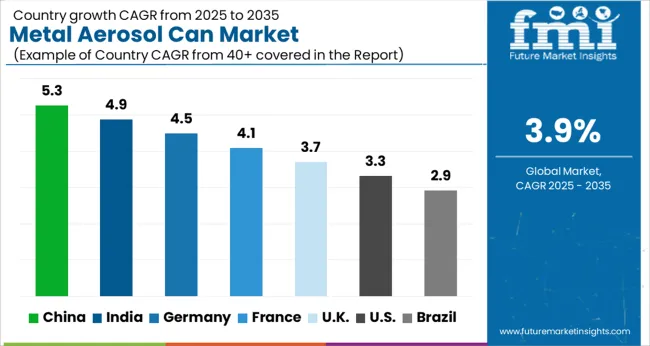

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

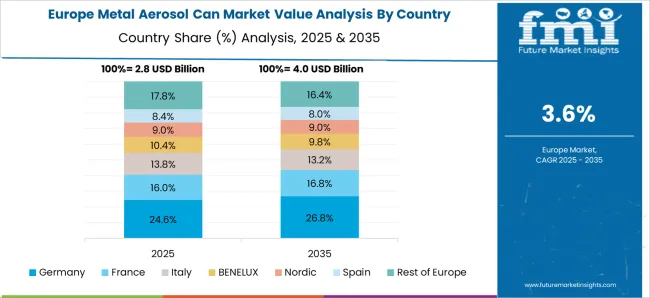

The global metal aerosol can market is projected to grow at a CAGR of 3.9% from 2025 to 2035. China leads with a growth rate of 5.3%, followed by India at 4.9%, and France at 4.1%. The United Kingdom records a growth rate of 3.7%, while the United States shows the slowest growth at 3.3%. Growth is supported by rising demand for personal care, household, and healthcare products packaged in metal aerosol cans due to their durability, convenience, and recyclability. Emerging markets such as China and India are driving expansion through strong consumer goods and packaging sectors, while developed economies like the USA, UK, and France focus on design innovation, premium packaging formats, and compliance with stricter recycling standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The metal aerosol can market in China is projected to grow at a CAGR of 5.3%. Expanding demand in personal care, cosmetics, and household products is driving adoption. Growth is also supported by increasing investments in packaging production capacity and a strong export market. Domestic manufacturers are focusing on lightweight designs and recyclable materials to align with international requirements. Rising consumer spending on grooming and lifestyle products continues to support market demand. China’s growing role as a packaging hub ensures sustained opportunities for both domestic and global producers.

The metal aerosol can market in India is expected to grow at a CAGR of 4.9%. Expanding use in deodorants, hair sprays, and household cleaning products is fueling growth. Rising disposable incomes and increasing adoption of modern packaging formats are accelerating demand. Domestic manufacturers are investing in automation and advanced production technologies to cater to local and export markets. India’s growing pharmaceutical sector is also adopting aerosol cans for drug delivery and sanitization products, further boosting market potential.

The metal aerosol can market in France is projected to grow at a CAGR of 4.1%. Demand is largely driven by the cosmetics and personal care industries, where aerosol cans are widely used for sprays and perfumes. The household cleaning and healthcare sectors also contribute to consistent adoption. French manufacturers are focusing on innovation in design and eco-friendly packaging formats to meet evolving consumer preferences. Compliance with EU recycling standards and growing demand for premium, sustainable packaging solutions continue to support market growth.

The metal aerosol can market in the UK is projected to grow at a CAGR of 3.7%. The personal care and grooming industries remain the dominant drivers of demand. Household cleaning and healthcare packaging are also expanding applications. UK producers are emphasizing recyclable and lightweight formats to meet regulatory and consumer expectations. Premiumization trends in cosmetics and growing demand for innovative packaging solutions are reinforcing market growth. Despite moderate expansion compared to Asia, the UK remains important in shaping high-value aerosol packaging solutions.

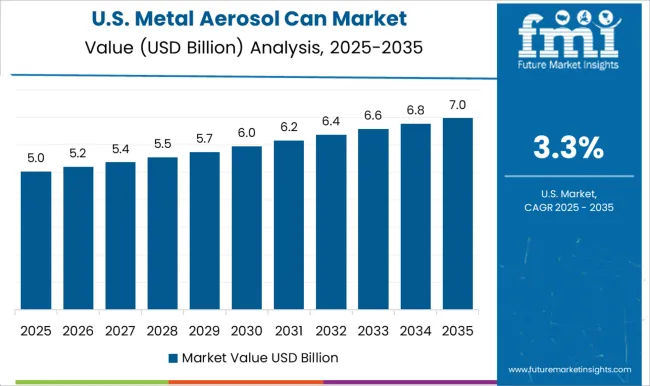

The metal aerosol can market in the USA is projected to grow at a CAGR of 3.3%. While slower than emerging markets, demand is supported by established personal care, healthcare, and household segments. Manufacturers are focusing on lightweight designs, advanced coatings, and recyclable formats to meet evolving standards. Growing interest in eco-friendly and high-performance packaging is reshaping the competitive landscape. Innovation in dispensing technologies and strong consumer preference for convenience packaging ensure steady demand, even in a mature market environment.

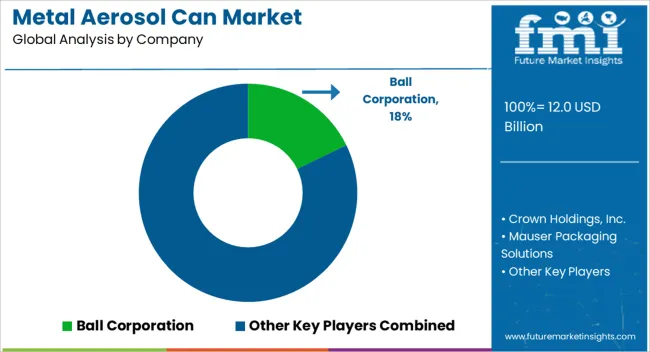

Competition in the metal aerosol can segment is defined by packaging scale, material science, and brand partnerships. Ball Corporation and Crown Holdings dominate with global reach, producing lightweight aluminum and steel cans for personal care, household, and food applications. Toyo Seikan and Nampak strengthen regional footprints in Asia and Africa, combining design flexibility with mass production. EXAL Corporation and CCL Container emphasize premium aluminum cans with custom shaping and decorative finishes, appealing to cosmetics and specialty brands. Mauser Packaging Solutions leverages its diversified packaging network to expand aerosol offerings, while Colep Packaging and Aerosol Service S.r.l. provide contract manufacturing support.

Niche players like Sterling Enterprises and Sara Chem cater to regional pharmaceutical and chemical demand. Coster Group differentiates itself with integrated valves and actuators, positioning itself as both a can and dispensing solutions provider. This competition blends scale-driven leaders with innovators targeting performance, design, and integrated systems. Strategies center on lightweighting, recyclability, and differentiation through decoration and functionality. Ball and Crown highlight the sustainability of aluminum formats and advanced shaping for brand identity. EXAL and CCL focus on aesthetic finishes, embossing, and gradient color coatings, making packaging a marketing tool. Toyo Seikan, Nampak, and Colep emphasize localized supply and flexible production to serve emerging markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.0 Billion |

| Product Type | Aluminum cans and Steel/tin plate cans |

| Size | 251 ml to 500 ml, 100 ml to 250 ml, Below 100 ml, and Above 500 ml |

| Application | Personal care products, Household products, Food and beverage, Industrial Products, and Pharmaceuticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ball Corporation, Crown Holdings, Inc., Mauser Packaging Solutions, Toyo Seikan, Sterling Enterprises, Sara Chem (India) Pvt Ltd, EXAL Corporation, Coster Group, Aerosol Service S.r.l., Nampak ltd, CCL Container, and Colep packaging |

| Additional Attributes | Dollar sales by product type (aluminum vs steel cans), Dollar sales by application (personal care, household, automotive, pharmaceuticals), Trends in lightweight packaging and recyclable formats, Use in deodorants, cleaning sprays, and medical inhalers, Growth in demand for pressurized dispensing solutions, Regional consumption patterns across North America, Europe, and Asia-Pacific. |

The global metal aerosol can market is estimated to be valued at USD 12.0 billion in 2025.

The market size for the metal aerosol can market is projected to reach USD 17.6 billion by 2035.

The metal aerosol can market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in metal aerosol can market are aluminum cans and steel/tin plate cans.

In terms of size, 251 ml to 500 ml segment to command 39.7% share in the metal aerosol can market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA