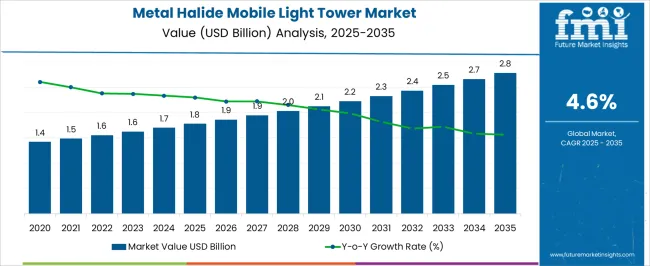

The metal halide mobile light tower market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

Expanding from USD 1.8 billion in 2025 to USD 2.8 billion by 2035, this market is driven by increasing demand for portable, high-intensity lighting solutions in various industries. Construction sites, mining operations, and emergency services all rely heavily on mobile light towers to provide optimal visibility in remote locations and challenging conditions. As industries continue to prioritize efficiency and operational continuity, mobile light towers remain essential for ensuring safe and productive environments.

The continued adoption of metal halide technology in mobile light towers is expected to drive this growth. Metal halide lamps are favored for their ability to provide bright, high-quality lighting over extended periods, making them ideal for outdoor and industrial applications. Additionally, factors such as the need for enhanced nighttime operations and the growing trend of infrastructure development across various sectors are likely to fuel demand for these products. Despite market volatility, the metal halide mobile light tower market is expected to remain stable, with sustained growth stemming from ongoing industrial expansion and heightened safety regulations.

| Metric | Value |

|---|---|

| Metal Halide Mobile Light Tower Market Estimated Value in (2025 E) | USD 1.8 billion |

| Metal Halide Mobile Light Tower Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The metal halide mobile light tower market is estimated to hold a notable proportion within its parent markets, representing approximately 15-17% of the mobile lighting equipment market, around 8-9% of the outdoor lighting market, close to 5-6% of the construction equipment market, about 4-5% of the industrial lighting market, and roughly 3-4% of the temporary lighting market. Collectively, the cumulative share across these parent segments is observed in the range of 35-41%, highlighting the specialized role of metal halide mobile light towers in providing portable, high-intensity lighting solutions for construction, industrial, and outdoor applications. The market has been influenced by the increasing demand for reliable, high-performance lighting solutions that can be easily deployed in various outdoor settings, such as construction sites, mining operations, and event spaces.

Adoption is guided by procurement decisions that prioritize ease of transport, durability, and energy efficiency. Market participants have focused on enhancing the brightness, fuel efficiency, and operational lifetime of metal halide mobile light towers to meet the demanding needs of industrial and construction environments. As a result, the metal halide mobile light tower market has not only captured a significant share within mobile lighting and outdoor lighting but has also influenced the construction, industrial lighting, and temporary lighting sectors, emphasizing its role in providing effective and portable lighting for diverse applications.

The metal halide mobile light tower market is experiencing steady growth, supported by the increasing demand for high-intensity, portable lighting solutions across construction, mining, oil and gas, and emergency response sectors. The market’s expansion is being driven by the reliability and brightness of metal halide lamps, which are preferred for large-area illumination in remote or low-light environments. Rising investments in infrastructure projects, particularly in developing regions, are creating consistent demand for mobile lighting units capable of operating in challenging conditions.

Technological enhancements in mast design, power efficiency, and durability are improving product performance and lifespan. Regulatory focus on workplace safety and operational visibility is further encouraging adoption in industries where night-time operations are common.

As event management, roadworks, and disaster relief activities also increase, the requirement for dependable lighting systems is expected to remain strong Manufacturers are focusing on improving fuel efficiency, ease of deployment, and ruggedness to cater to a broader range of end-user needs, positioning the market for sustained growth in the coming years.

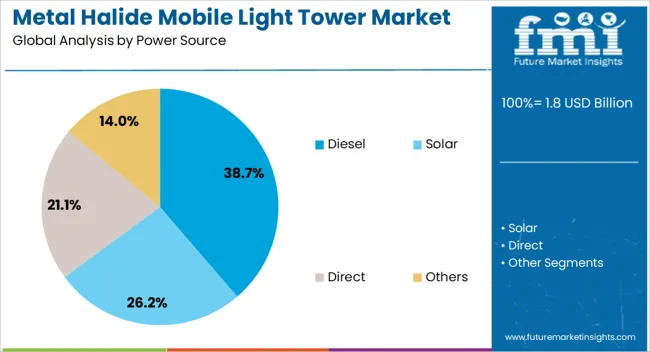

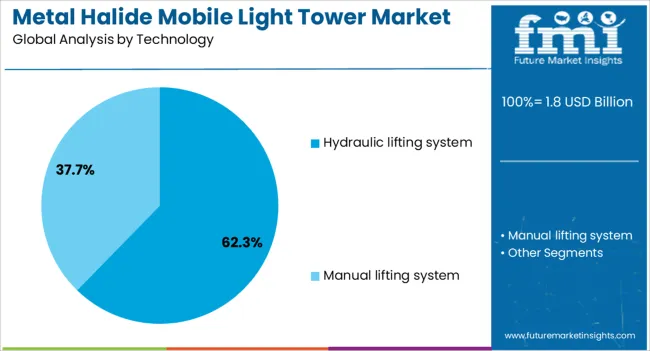

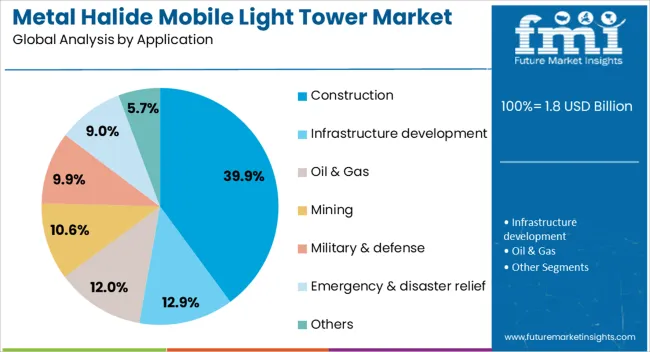

The metal halide mobile light tower market is segmented by power source, technology, application, and geographic regions. By power source, metal halide mobile light tower market is divided into diesel, solar, direct, and others. In terms of technology, metal halide mobile light tower market is classified into hydraulic lifting system and manual lifting system. Based on application, metal halide mobile light tower market is segmented into construction, infrastructure development, oil & gas, mining, military & defense, emergency & disaster relief, and others. Regionally, the metal halide mobile light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The diesel power source segment is projected to hold 38.7% of the metal halide mobile light tower market revenue share in 2025, establishing it as the leading power source category. This dominance is being supported by the segment’s proven reliability in remote and off-grid locations where access to alternative power sources is limited. Diesel-powered units offer extended run times and the capacity to operate under demanding environmental conditions, making them highly suitable for large-scale projects.

The flexibility of refueling and the widespread availability of diesel fuel contribute to operational convenience and continuity. Industries such as construction, mining, and oil and gas prefer diesel-powered light towers due to their ability to deliver consistent performance in locations with no grid connectivity.

Technological advancements in engine efficiency and emission control are further enhancing the appeal of diesel units by reducing fuel consumption and environmental impact As infrastructure and industrial projects continue to expand into remote areas, diesel-powered light towers are expected to maintain their leading position in the market.

The hydraulic lifting system segment is anticipated to account for 62.3% of the metal halide mobile light tower market revenue share in 2025, making it the leading technology segment. This leadership is attributed to the ease of operation, rapid deployment, and enhanced safety offered by hydraulic lifting mechanisms. These systems allow for quick raising and lowering of the mast with minimal manual effort, reducing the risk of workplace injuries and improving operational efficiency.

Hydraulic systems are valued for their stability and ability to maintain mast position under varying wind and load conditions, ensuring consistent lighting coverage. Their durability and lower maintenance requirements compared to manual or mechanical systems contribute to lower total cost of ownership over time.

Industries with time-sensitive operations, such as construction and emergency response, favor hydraulic lifting systems for their ability to save labor hours and minimize setup time The combination of safety, reliability, and operational convenience is expected to sustain the segment’s dominance in the years ahead.

The construction application segment is expected to capture 39.9% of the metal halide mobile light tower market revenue share in 2025, reinforcing its position as the leading application area. This dominance is being driven by the extensive need for reliable lighting solutions in construction sites that operate during nighttime hours or in low-visibility conditions. Adequate lighting is critical for ensuring worker safety, enhancing productivity, and meeting project deadlines.

Metal halide mobile light towers provide high-intensity, wide-area illumination, making them ideal for large-scale infrastructure, roadwork, and building projects. The segment’s growth is further supported by increasing urban development, infrastructure expansion, and government investments in public works.

The portability and ruggedness of these towers enable them to withstand harsh site conditions while delivering consistent performance As regulatory bodies place greater emphasis on occupational safety and illumination standards, demand for mobile lighting solutions in the construction sector is expected to remain strong, ensuring the segment’s continued leadership in the market.

The metal halide mobile light tower market is experiencing significant demand growth, driven by the need for reliable portable lighting in various industries, particularly in construction, emergency services, and infrastructure projects. The shift toward more energy-efficient lighting solutions reflects ongoing trends in the market, while opportunities in rapidly developing regions highlight growth potential. However, the challenges of maintaining and ensuring the durability of these towers need to be addressed, as they remain critical factors in the long-term market sustainability.

The metal halide mobile light tower market is experiencing significant growth due to an increased demand for portable, high-intensity lighting solutions in various sectors, including construction, mining, and emergency services. These light towers are preferred for their ability to provide reliable, bright lighting in outdoor or remote locations, especially in situations where electricity is unavailable. As industries expand globally, the need for flexible and efficient lighting solutions that can be easily transported to different work sites continues to rise.

There are notable opportunities in sectors such as infrastructure development, large-scale construction projects, and emergency response, where portable lighting is essential. Mobile light towers are being deployed in new construction zones, disaster-stricken areas, and during outdoor events. As governments and private enterprises ramp up infrastructure projects in developing regions, this segment is likely to witness heightened demand. Furthermore, with an increased focus on rapid disaster response, light towers have become vital for emergency operations.

One of the emerging trends in the metal halide mobile light tower market is the growing emphasis on energy-efficient solutions. With rising operational costs, industries are focusing on more energy-conscious alternatives, which is pushing manufacturers to develop mobile light towers with higher efficiency and longer operational durations. As energy efficiency becomes a priority for businesses across various sectors, the demand for advanced light tower solutions, such as those utilizing LED technology, is expected to increase.

Despite its growing adoption, the metal halide mobile light tower market faces several challenges, primarily related to maintenance and durability. Harsh working conditions, such as extreme weather and heavy usage, place considerable wear and tear on light towers. Furthermore, the need for regular maintenance to ensure optimal performance results in higher operational costs. Manufacturers and users are increasingly focused on improving the durability and reliability of these products, although this still remains a major pain point for many.

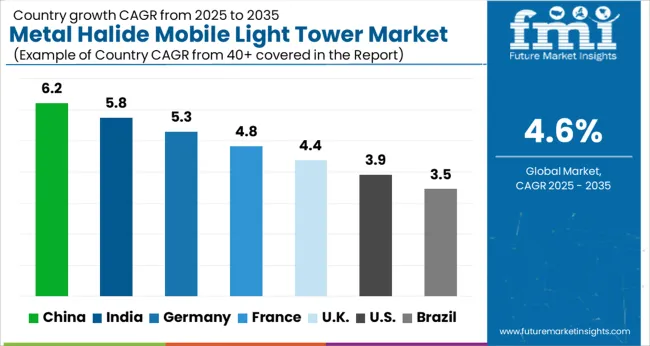

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The global metal halide mobile light tower market is projected to grow at a CAGR of 4.6% from 2025 to 2035. China leads with a growth rate of 6.2%, followed by India at 5.8%, and France at 4.8%. The United Kingdom records a growth rate of 4.4%, while the United States shows the slowest growth at 3.9%. This market growth is driven by increased demand for outdoor lighting in construction, mining, and emergency response operations. The market expansion in developing economies, especially in construction and infrastructure projects, coupled with demand for portable and energy-efficient lighting solutions, is driving growth in countries like China and India. Meanwhile, in developed markets, innovations in LED technology and regulatory support are contributing to market growth. This report includes insights on 40+ countries; top markets are shown here for reference.

The metal halide mobile light tower market in China is expanding at a growth rate of 6.2%, supported by the rapid infrastructure development and construction projects in the country. As China continues to experience urbanization, the demand for temporary outdoor lighting solutions for construction sites, mining operations, and public events is on the rise. Additionally, government initiatives to improve infrastructure and investment in large-scale projects further contribute to the growth of this market. The focus on renewable energy and energy-efficient lighting solutions is also leading to the adoption of advanced mobile light tower technologies in the country. These solutions offer portable, powerful lighting capabilities for industrial applications.

The metal halide mobile light tower market in India is experiencing growth at a rate of 5.8%. With the country’s booming construction industry and government-led infrastructure projects, the demand for portable lighting solutions is increasing. India’s expanding urbanization and the rise of outdoor events further fuel the market growth. Additionally, the demand for lighting solutions in emergency response and disaster management operations is driving the adoption of metal halide mobile light towers. As the country focuses on developing smart cities and improving infrastructure, there is also a growing need for energy-efficient lighting solutions that contribute to long-term sustainability.

The metal halide mobile light tower market in France is growing at a rate of 4.8%, driven by increased demand from the construction and public sector. The French market is seeing significant investment in infrastructure projects, particularly in the renewable energy and transportation sectors, requiring portable and high-performance lighting solutions. Additionally, the growing use of these towers in outdoor events, especially festivals and sports activities, contributes to market growth. France’s push towards more sustainable energy solutions is also prompting the integration of energy-efficient technologies in metal halide light towers, improving their appeal across various industries.

The metal halide mobile light tower market in the UK is expanding at a rate of 4.4%. The country’s growing construction sector, along with its emphasis on smart cities, is creating a strong demand for efficient, portable lighting solutions. These light towers are widely used in construction sites, public events, and industrial applications. The UK government’s support for infrastructure projects, particularly in urban development, has led to increased adoption of mobile light towers. Additionally, with the country’s focus on energy efficiency and sustainability, there is a growing trend toward using advanced and low-energy lighting solutions, further enhancing the market for metal halide light towers.

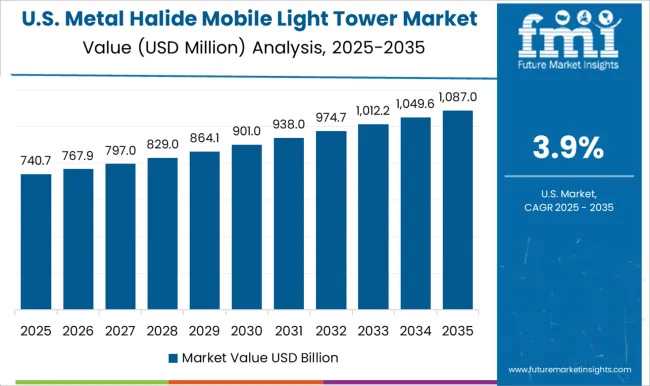

The metal halide mobile light tower market in the United States is experiencing slower growth at a rate of 3.9%. However, the demand for mobile lighting solutions in industries like construction, mining, and disaster management continues to drive the market. The USA market benefits from increasing investments in infrastructure, with a focus on renewable energy and construction projects. Additionally, demand for portable lighting during emergency situations, outdoor events, and large-scale industrial applications is bolstering the adoption of mobile light towers. The ongoing trend toward energy-efficient lighting systems is further fueling growth, as industries seek solutions that reduce energy consumption while providing optimal lighting.

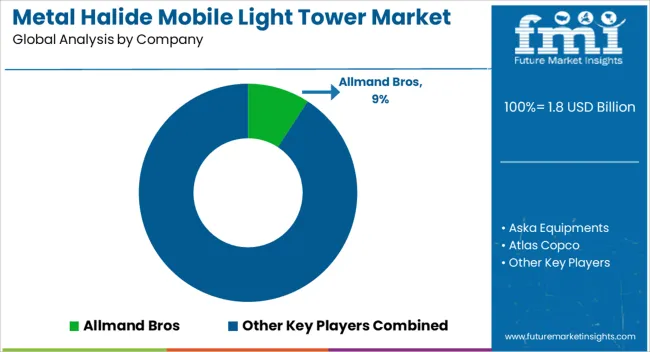

The metal halide mobile light tower market has witnessed substantial growth, driven by the increasing demand for portable lighting solutions across construction sites, mining operations, events, and emergency situations. Allmand Bros, Atlas Copco, and Generac Power Systems are leading players in this market, offering a range of high-performance, durable lighting towers equipped with metal halide lamps for superior illumination. Allmand Bros has built a strong reputation with its reliable and fuel-efficient mobile light towers, designed for easy transportation and deployment at construction and industrial sites.

Atlas Copco, a renowned name in the equipment rental industry, provides versatile lighting towers that can operate for extended hours, making them ideal for nighttime operations. Similarly, Generac Power Systems brings advanced mobile light towers, known for their energy efficiency and ability to withstand harsh environmental conditions. These companies continue to expand their portfolios to cater to the diverse needs of the market. Other prominent players, such as Caterpillar, Doosan Portable Power, and Wacker Neuson, also contribute significantly to the market, each offering unique value propositions to different customer segments. Caterpillar, known for its heavy-duty machinery, integrates high-quality light towers with advanced technologies, providing unmatched performance and durability. Doosan Portable Power emphasizes reliability and easy maintenance in its light tower solutions, catering to both construction and industrial sectors.

Meanwhile, Wacker Neuson focuses on compact and energy-efficient models, ensuring ease of use and cost-effectiveness. The market is also supported by a range of specialized manufacturers such as Larson Electronics, Multiquip, and Olikara Lighting Towers, each of which brings innovative designs and features to address the growing demand for mobile lighting solutions. With an increasing number of industries relying on mobile lighting for 24/7 operations, the metal halide mobile light tower market is poised for steady growth, underpinned by technological advancements and strategic expansions from these leading players.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 billion |

| Power Source | Diesel, Solar, Direct, and Others |

| Technology | Hydraulic lifting system and Manual lifting system |

| Application | Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allmand Bros, Aska Equipments, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, DMI, Doosan Portable Power, Generac Power Systems, HIMOINSA, Inmesol gensets, J C Bamford Excavators, Larson Electronics, Light Boy, LTA Projects, Multiquip, Olikara Lighting Towers, Progress Solar Solutions, Trime, United Rentals, Wacker Neuson, and Youngman Richardson |

| Additional Attributes | Dollar sales by tower type (single-phase, three-phase) and application (construction, mining, outdoor events, emergency lighting) are key metrics. Trends include rising demand for portable, high-intensity lighting solutions, growth in construction and infrastructure projects, and increasing preference for energy-efficient, durable equipment. Regional deployment, technological advancements, and operational cost considerations are driving market growth. |

The global metal halide mobile light tower market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the metal halide mobile light tower market is projected to reach USD 2.8 billion by 2035.

The metal halide mobile light tower market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in metal halide mobile light tower market are diesel, solar, direct and others.

In terms of technology, hydraulic lifting system segment to command 62.3% share in the metal halide mobile light tower market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA