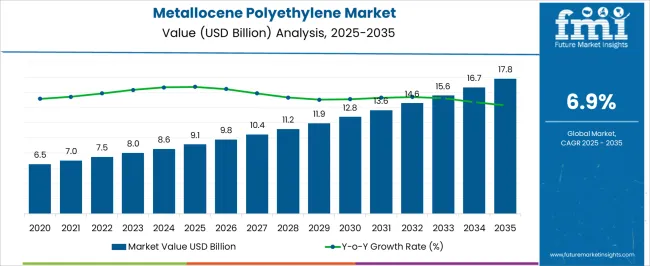

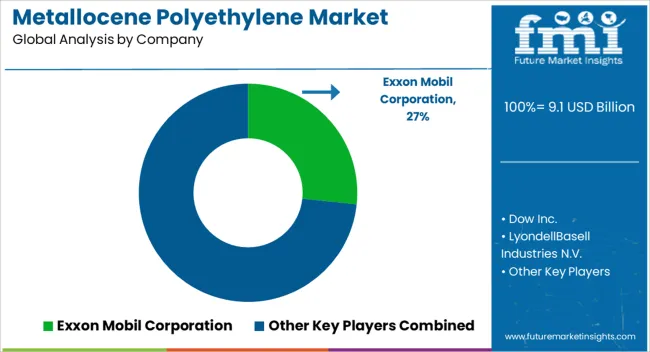

The metallocene polyethylene market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 17.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The metallocene polyethylene market is projected to grow from USD 9.1 billion in 2025 to USD 17.8 billion by 2035, representing a compound annual growth rate (CAGR) of 6.9%. Market expansion is being influenced by increasing utilization of metallocene polyethylene in packaging, automotive components, and consumer goods where high-performance polymer properties are demanded. Between 2025 and 2030, the market is expected to reach around USD 12.8 billion, driven by rising production capacities, strategic partnerships, and increasing integration of advanced polyethylene grades in end-use applications.

The demand for polymers with improved clarity, flexibility, and toughness is being reflected in consistent revenue growth across major regions. Year-on-year growth patterns indicate a steady accumulation of market value, with incremental increases supporting long-term expansion. From 2025 to 2035, metallocene polyethylene is being increasingly adopted due to its superior processing characteristics and enhanced product performance compared to conventional polyethylene. Industries focusing on flexible packaging, extrusion films, and specialty applications are anticipated to dominate adoption, driving consistent market gains.

It can be observed that manufacturers offering high-purity, customizable polymer grades and efficient supply chains are expected to capture significant market share, as the market growth is being influenced by quality-driven demand and performance-based selection rather than cyclical fluctuations.

| Metric | Value |

|---|---|

| Metallocene Polyethylene Market Estimated Value in (2025 E) | USD 9.1 billion |

| Metallocene Polyethylene Market Forecast Value in (2035 F) | USD 17.8 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The metallocene polyethylene market is estimated to occupy a notable proportion within its parent markets, accounting for approximately 12-14% of the overall polyethylene market, around 8-9% of the broader polyolefin market, close to 6-7% of the packaging materials market, about 4-5% of the plastic films and sheets market, and roughly 3-4% of the specialty polymers market. In total, the cumulative share across these parent segments can be observed in the range of 33-39%, reflecting a substantial influence of metallocene-based resins across both general and specialized polymer applications. The market has been driven by the material’s distinct properties, such as high clarity, toughness, flexibility, and improved sealability, which have positioned it favorably in flexible packaging, extrusion coating, and film applications.

Its adoption has been reinforced by growing demand for lightweight and high-performance materials in industrial, consumer, and agricultural applications, where process efficiency and end-use performance are highly prioritized. Procurement patterns are increasingly influenced by cost-effectiveness, performance consistency, and regulatory compliance, which have reinforced metallocene polyethylene’s relevance over conventional polyethylene resins. Consequently, the market has not only captured a significant share within the polymer and packaging segments but has also shaped developments in specialty polymer applications, demonstrating its strategic role across multiple industrial supply chains.

The metallocene polyethylene market is experiencing notable growth driven by rising demand for high performance polymers offering superior mechanical strength, processability, and optical clarity. Industries such as packaging, automotive, and consumer goods are increasingly adopting these materials to enhance product durability and sustainability.

Advancements in catalyst technology have enabled the production of polyethylene with precise molecular structures, resulting in improved film properties, sealing performance, and down gauging capabilities. Regulatory initiatives aimed at reducing environmental impact have further encouraged the shift toward recyclable and lightweight packaging solutions.

With expanding applications in both industrial and consumer sectors, the market outlook remains positive, supported by continuous R&D investments and strategic collaborations between polymer manufacturers and end use industries.

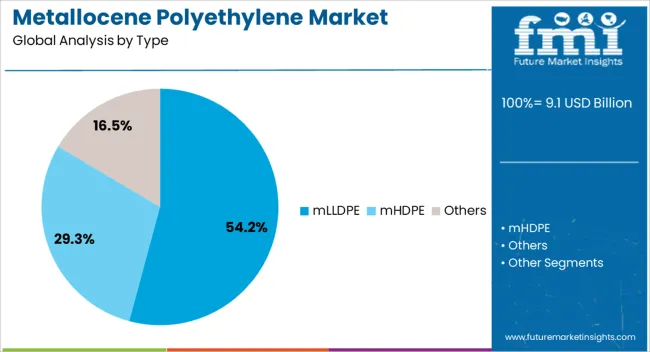

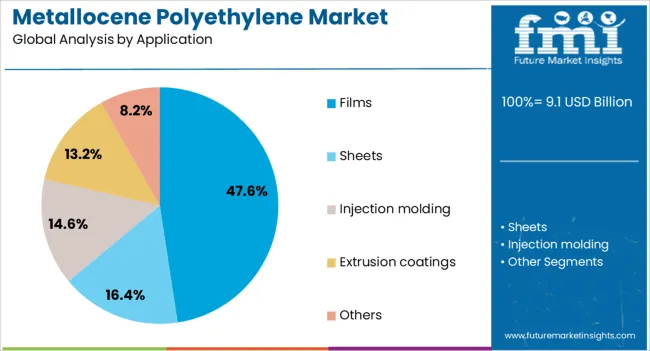

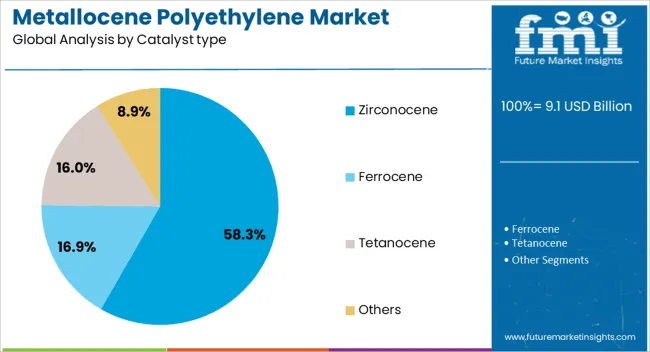

The metallocene polyethylene market is segmented by type, application, catalyst type, end-use, and geographic regions. By type, metallocene polyethylene market is divided into mLLDPE, mHDPE, and others. In terms of application, metallocene polyethylene market is classified into films, sheets, injection molding, extrusion coatings, and others. Based on catalyst type, metallocene polyethylene market is segmented into zirconocene, ferrocene, tetanocene, and others. By end-use, metallocene polyethylene market is segmented into packaging, food & beverage, automotive, building & construction, agriculture, healthcare, and others. Regionally, the metallocene polyethylene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mLLDPE segment is expected to hold 54.2% of total market revenue by 2025, making it the dominant type category. This is due to its excellent tensile strength, puncture resistance, and clarity, which are critical for flexible packaging and industrial film applications.

Its ability to deliver high performance even at reduced thickness supports material savings and sustainability goals.

Widespread adoption in stretch films, agricultural films, and food packaging has further strengthened its market position, as industries increasingly favor materials that combine performance, cost efficiency, and environmental benefits.

The films segment is projected to account for 47.6% of the total market by 2025, emerging as the leading application area. This leadership is driven by the demand for high quality films with superior sealing and barrier properties for food packaging, industrial wrapping, and agricultural use.

Metallocene polyethylene’s ability to produce films with enhanced mechanical and optical performance has been pivotal in its widespread application.

Growing e commerce activity and the need for secure, lightweight, and recyclable packaging solutions have also boosted demand in this segment.

The zirconocene catalyst type is estimated to represent 58.3% of the total market revenue by 2025, positioning it as the leading catalyst segment. Its dominance stems from its ability to produce polyethylene with highly uniform molecular weight distribution and superior physical properties.

This has enabled manufacturers to meet stringent performance requirements in demanding applications such as high strength films and precision molded products.

Consistent output quality, process efficiency, and adaptability to various polymer grades have reinforced zirconocene’s preference in large scale production environments.

The gas insulated medium voltage switchgear market is being driven by demand for reliable and compact power distribution solutions. Opportunities are unfolding in renewable energy integration and smart grid projects, while trends emphasize compact designs with digital monitoring. However, challenges such as high installation costs and concerns over SF6 gas emissions are restricting broader adoption. Despite these hurdles, the market remains vital for modern grid infrastructure, with its role in ensuring safety, efficiency, and uninterrupted power supply making it indispensable in today’s energy networks.

The demand for gas insulated medium voltage switchgear has been reinforced by the requirement for reliable and compact power distribution solutions across industrial, commercial, and utility sectors. Increasing electricity consumption and grid expansion projects have pushed utilities to adopt switchgear systems that ensure safety and uninterrupted operations in space-constrained environments. Gas-insulated systems are favored over air-insulated ones due to their durability and ability to withstand harsh conditions. Their rising adoption in renewable energy plants and urban transmission networks has strengthened overall market demand.

Significant opportunities have been created as renewable energy projects and smart grid initiatives increasingly require advanced switchgear systems for efficient power management. Governments and utilities are prioritizing infrastructure that minimizes transmission losses and improves network reliability. Gas insulated medium voltage switchgear is being viewed as an ideal choice for integrating renewable energy into existing grids. The opportunity for suppliers lies in offering compact, modular systems tailored to solar and wind projects, as well as in providing solutions that align with digital monitoring and grid automation requirements.

A notable trend shaping the market has been the preference for compact switchgear designs integrated with digital monitoring features. As electrical infrastructure is modernized, the need for real-time fault detection and predictive maintenance has gained traction. Compact switchgear not only reduces installation space but also enhances operator safety and operational efficiency. Digital integration allows utilities to remotely monitor load conditions and ensure quicker fault response. This trend is transforming gas insulated medium voltage switchgear into a cornerstone of modern, automated, and resilient grid infrastructure.

The gas insulated medium voltage switchgear market has faced challenges related to high upfront installation costs and environmental concerns tied to SF6 gas usage. While the reliability and space-saving benefits are clear, the cost of deployment often discourages smaller utilities and industrial facilities. Furthermore, regulatory pressure regarding SF6 emissions is creating additional hurdles, requiring manufacturers to explore alternatives without compromising performance. These factors have introduced barriers for wider adoption, and managing the balance between cost, compliance, and reliability remains a persistent market challenge.

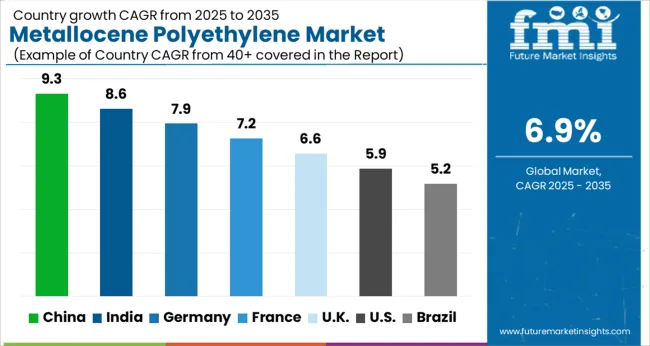

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

The global metallocene polyethylene market is projected to grow at a CAGR of 6.9% from 2025 to 2035. China leads with a growth rate of 9.3%, followed by India at 8.6%, and France at 7.2%. The United Kingdom records a growth rate of 6.6%, while the United States shows moderate growth at 5.9%. Rising demand in packaging, automotive components, and medical applications is fueling market expansion. Emerging economies such as China and India benefit from industrial growth, polymer production capacity expansion, and rising consumption across end-use sectors. Mature markets like France, the UK, and the USA focus on high-performance applications, regulatory compliance, and product optimization. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The metallocene polyethylene market in China is projected to grow at a CAGR of 9.3%. Rapid industrial expansion, surging demand for flexible packaging, and growth in automotive and consumer sectors are key factors driving the market. China’s robust polymer manufacturing infrastructure and policy support for chemical industries accelerate adoption of high-performance polyethylene. Demand is further driven by the growing need for lightweight, durable materials in medical devices, food packaging, and consumer goods. Investment in local production facilities and adoption of advanced polymer processing technologies strengthen China’s position as a leading market. Continuous expansion of industrial applications and rising consumer awareness of premium polymer solutions are also boosting market penetration.

The metallocene polyethylene market in India is expected to grow at a CAGR of 8.6%. Increasing industrialization, surging demand for packaging materials, and rising automotive production are key growth drivers. The market is supported by high demand for lightweight and durable polyethylene for food packaging, medical applications, and consumer goods. Government initiatives promoting chemical processing and polymer manufacturing further enhance market prospects. Growth is also fueled by rising awareness of efficient, high-quality, and cost-effective polymer solutions across end-use sectors. Indian manufacturers are increasingly investing in advanced polymer processing technologies to meet growing domestic and export demand, positioning India as a major growth market in Asia.

The metallocene polyethylene market in France is projected to grow at a CAGR of 7.2%. Demand is primarily fueled by the need for high-performance polymers in packaging, automotive, and industrial applications. France’s regulatory emphasis on quality standards and environmental compliance encourages adoption of metallocene-based materials. Growth is further strengthened by the increasing need for lightweight, durable, and efficient solutions in medical, industrial, and consumer products. French manufacturers are investing in advanced polymer processing technologies to optimize performance and product differentiation. The mature market ensures steady adoption as companies focus on value-added polymer solutions and premium applications, driving consistent demand for metallocene polyethylene in high-end sectors.

The metallocene polyethylene market in the United Kingdom is expected to grow at a CAGR of 6.6%. Rising demand for lightweight, durable, and efficient packaging materials is a primary growth driver. Growth is supported by automotive, industrial, and healthcare sectors that increasingly rely on high-performance polymer solutions. UK manufacturers focus on optimizing material performance and meeting strict regulatory requirements, which enhances product adoption. The market is further fueled by a shift toward specialized metallocene polyethylene grades for premium and high-performance applications. With mature infrastructure and continuous investments in polymer technology, the United Kingdom demonstrates steady market growth, emphasizing innovation in material processing and sector-specific solutions.

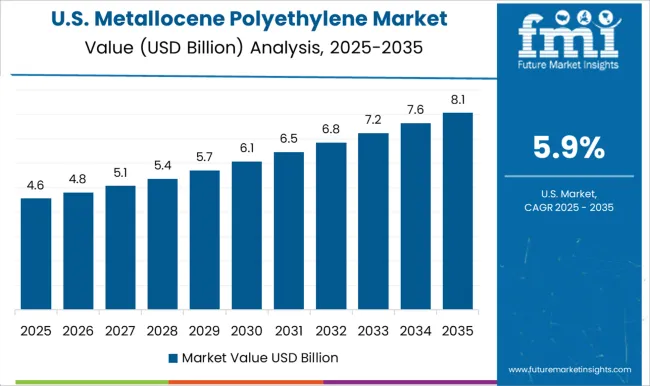

The metallocene polyethylene market in the United States is projected to grow at a CAGR of 5.9%. Growth is driven by packaging, automotive, and medical applications requiring high-quality, durable, and lightweight polymers. The USA market emphasizes regulatory compliance and high-performance material adoption. Increased demand in industrial, healthcare, and consumer goods sectors supports market expansion. Manufacturers are investing in advanced polymer processing to improve product performance and achieve cost efficiency. While mature, the market continues to grow steadily due to specialization in high-performance polyethylene grades, rising demand for sustainable yet durable polymer solutions, and ongoing technology integration, ensuring the United States remains a key market for metallocene polyethylene adoption.

The metallocene polyethylene market is dominated by major petrochemical and specialty polymer producers competing on performance, consistency, and application versatility. Exxon Mobil Corporation, Dow Inc., and LyondellBasell Industries leverage extensive R&D and production capabilities to supply high-purity mPE grades suitable for films, packaging, and industrial applications.

Their brochures highlight advantages such as enhanced clarity, toughness, and processability, which appeal to converters and brand owners seeking differentiated products. Chevron Phillips Chemical, TotalEnergies SE, and Borealis AG focus on sustainability-conscious buyers by offering metallocene polyethylene with improved recyclability and energy-efficient production processes. These companies emphasize global reach and supply reliability, ensuring uninterrupted availability for large-scale operations across multiple regions.

Specialty producers like SABIC and INEOS Group compete by highlighting custom formulations tailored to meet specific industry needs, including high-performance films, injection molding, and extrusion applications. Their marketing materials stress technical support, consistent product quality, and innovative polymer solutions that address both functional and aesthetic requirements. Competition in the mPE market is heavily driven by material properties such as clarity, flexibility, seal strength, and environmental adaptability.

Brochures from these companies emphasize operational efficiency, lower material usage, and improved end-product performance, positioning metallocene polyethylene as a premium choice in the polymer segment for packaging, automotive, and consumer goods applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.1 billion |

| Type | mLLDPE, mHDPE, and Others |

| Application | Films, Sheets, Injection molding, Extrusion coatings, and Others |

| Catalyst type | Zirconocene, Ferrocene, Tetanocene, and Others |

| End-Use | Packaging, Food & Beverage, Automotive, Building & Construction, Agriculture, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Exxon Mobil Corporation, Dow Inc., LyondellBasell Industries N.V., Chevron Phillips Chemical Company LLC, TotalEnergies SE, Borealis AG, SABIC, and INEOS Group Holdings S.A. |

| Additional Attributes | Dollar sales by product type (film, injection molding, blow molding) and application (packaging, automotive, construction, consumer goods) are key metrics. Trends include rising demand for high-strength, flexible, and lightweight polyethylene, growth in sustainable packaging solutions, and increasing adoption in industrial applications. Regional adoption, technological advancements, and cost-efficiency are driving market growth. |

The global metallocene polyethylene market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the metallocene polyethylene market is projected to reach USD 17.8 billion by 2035.

The metallocene polyethylene market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in metallocene polyethylene market are mlldpe, mhdpe and others.

In terms of application, films segment to command 47.6% share in the metallocene polyethylene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyethylene Terephthalate Catalyst Size and Share Forecast Outlook 2025 to 2035

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Films Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Terephthalate Market Growth - Trends & Forecast 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Competitive Breakdown of Polyethylene Corrugated Packaging Manufacturers

Polyethylene Pipe Market Growth – Trends & Forecast 2024-2034

Polyethylene Glycol Market Growth – Trends & Forecast 2024-2034

Polyethylene Market Growth – Trends & Forecast 2024-2034

Polyethylene furanoate Market

Polyethylene Orthopaedic Insert Market

Bio-Polyethylene Terephthalate for Packaging Market

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Renewable Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA