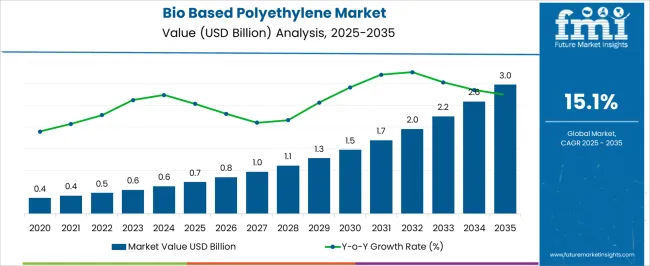

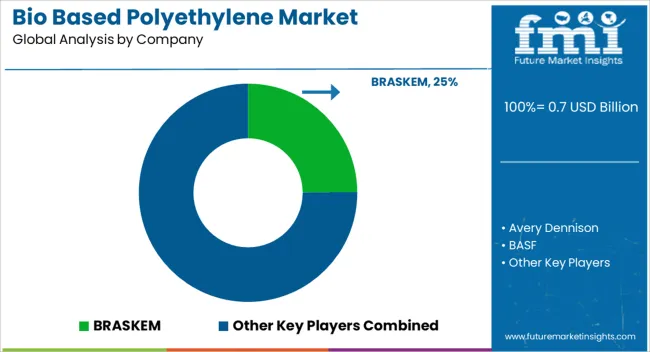

The bio based polyethylene market is projected to grow from USD 0.7 billion in 2025 to USD 3.0 billion by 2035, with a CAGR of 15.1%. A Growth Contribution Index (GCI) analysis reveals strong, accelerating growth in the early years, followed by sustained expansion over the forecast period. Between 2025 and 2030, the market grows from USD 0.7 billion to USD 1.5 billion, contributing USD 0.8 billion in growth, with a CAGR of 14.9%. This period sees a significant contribution to the overall market growth, driven by increasing demand for sustainable and eco-friendly alternatives to traditional polyethylene. As industries and consumers increasingly focus on reducing environmental impact, bio-based polyethylene becomes a preferred choice, particularly in packaging, automotive, and consumer goods sectors. From 2030 to 2035, the market continues to expand, moving from USD 1.5 billion to USD 3.0 billion, contributing USD 1.5 billion in growth, with a slightly higher CAGR of 16.0%. This later phase reflects stronger growth as bio-based polyethylene adoption accelerates, spurred by improvements in production technologies, government regulations promoting sustainability, and broader industry acceptance. The GCI highlights that while both periods contribute significantly to market expansion, the acceleration between 2030 and 2035 plays a major role in achieving the total growth, making it a high-contribution phase in the bio-based polyethylene market’s overall trajectory.

| Metric | Value |

|---|---|

| Bio Based Polyethylene Market Estimated Value in (2025 E) | USD 0.7 billion |

| Bio Based Polyethylene Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 15.1% |

The bio based polyethylene market is expanding rapidly as demand for sustainable and environmentally friendly plastics rises. Increasing awareness about plastic pollution and regulatory pressure to reduce carbon footprints have driven industries to adopt bio-based alternatives.

The use of renewable raw materials has gained popularity as a way to decrease dependence on fossil fuels and lower greenhouse gas emissions. Innovations in production processes have improved the cost-effectiveness and performance of bio based polyethylene, making it competitive with traditional polyethylene.

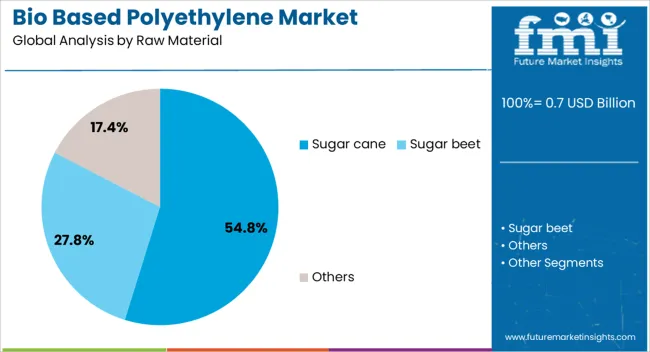

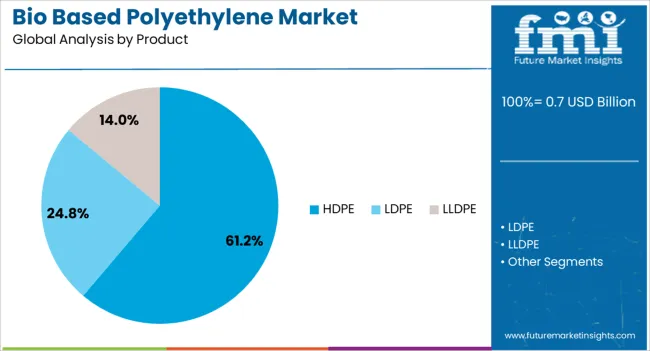

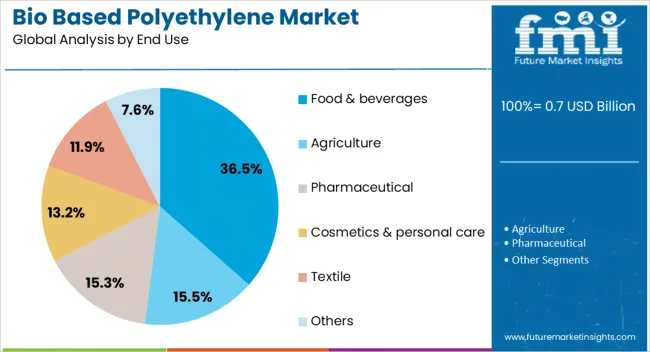

Growth in food & beverages has fueled demand for recyclable packaging solutions compatible with existing PE recycling streams. The market is expected to benefit from continued investments in bio-refineries and supportive government policies. Segment growth is forecasted to be led by sugarcane as the preferred raw material, high-density polyethylene as the dominant product type, and food and beverage applications.

The bio-based polyethylene market is segmented by raw material, product, end use, and region. By raw material, it is divided into sugarcane, sugar beet, and others. In terms of product, the market is classified into HDPE, LDPE, and LLDPE. Based on end use, it is segmented into food and beverages, agriculture, pharmaceuticals, cosmetics and personal care, textiles, and others. Regionally, the bio-based polyethylene industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sugarcane segment is projected to hold 54.8% of the bio based polyethylene market revenue in 2025, establishing itself as the leading raw material. The widespread cultivation of sugarcane and its high biomass yield have made it a cost-efficient and sustainable feedstock for producing bio based polyethylene.

Advances in bio-refining technologies have enabled efficient conversion of sugarcane-derived ethanol into polyethylene with high purity and performance. Additionally, sugarcane-based polyethylene offers significant environmental benefits such as lower carbon emissions and reduced fossil fuel dependency.

Its renewability and compatibility with existing polymer production infrastructure have encouraged manufacturers to adopt sugarcane as the primary raw material. Consumer preference for sustainable packaging has further bolstered the demand for sugarcane-derived polyethylene products.

The HDPE segment is expected to contribute 61.2% of the bio based polyethylene market revenue in 2025, maintaining its dominance as the leading product type. HDPE is favored for its excellent strength, chemical resistance, and versatility in packaging applications.

Its suitability for molding and extrusion processes has allowed wide adoption in containers, bottles, and films. The growing demand for sustainable packaging in the food and beverage industry has particularly driven HDPE consumption, as it provides durability while enabling bio-based content.

Additionally, HDPE’s recyclability supports circular economy initiatives, aligning with global sustainability goals. Continuous product innovation to improve mechanical properties and processing efficiency has reinforced HDPE’s position as the preferred polyethylene variant.

The food and beverages segment is projected to account for 36.5% of the bio based polyethylene market revenue in 2025, holding the largest share among end uses. This growth has been driven by the increasing need for safe, sustainable packaging solutions that extend product shelf life and comply with health and safety regulations.

Bio based polyethylene offers excellent barrier properties and durability required for packaging beverages, dairy products, and processed foods. Consumer demand for environmentally friendly packaging and brand commitments to sustainability have encouraged the adoption of bio based materials in this sector.

Additionally, regulatory pressures on reducing single-use plastics have accelerated the shift toward bio based polyethylene packaging. As food safety and environmental concerns continue to influence packaging choices, the food and beverage industry is expected to remain a key driver for market growth.

The bio based polyethylene market is expanding as demand for sustainable and eco-friendly materials increases across industries such as packaging, automotive, and consumer goods. Bio-based polyethylene, derived from renewable resources like sugarcane, offers a more sustainable alternative to traditional polyethylene, which is derived from petroleum. As governments and businesses seek to reduce their environmental impact, the adoption of bio-based polyethylene is gaining traction. Despite challenges like higher production costs and limited availability of raw materials, the market is being driven by advancements in production technologies and the growing preference for biodegradable and recyclable materials in packaging.

The primary driver of the bio-based polyethylene market is the increasing demand for sustainable packaging solutions. With growing concerns over plastic waste and the environmental impact of petroleum-based plastics, industries are turning to bio-based alternatives. Bio-based polyethylene, made from renewable sources like sugarcane, offers a solution that reduces carbon emissions and reliance on fossil fuels. The packaging industry, especially in the food and beverage sector, is rapidly adopting bio-based polyethylene for bottles, films, and other packaging products to meet consumer demand for eco-friendly materials. Additionally, regulatory measures encouraging the use of renewable materials and stricter waste management policies are boosting the adoption of bio-based polyethylene as an alternative to traditional plastics.

A significant challenge in the bio-based polyethylene market is the high production cost compared to traditional polyethylene. Producing bio-based polyethylene requires specialized manufacturing processes and raw materials such as sugarcane, which are more expensive than petroleum-derived resources. This price disparity can limit the widespread adoption of bio-based polyethylene, especially in price-sensitive industries or regions with limited access to raw materials. Furthermore, the availability of feedstock for bio-based polyethylene production, such as sugarcane or other biomass, can be inconsistent due to factors like crop yields and supply chain disruptions, further complicating the market dynamics and affecting long-term sustainability in production.

The bio based polyethylene market presents significant opportunities through technological advancements in production methods and growing consumer demand for eco-friendly products. Advances in production technologies, such as enhanced catalysts and fermentation processes, are improving the efficiency of bio-based polyethylene production and reducing costs. As consumers become more environmentally conscious, they increasingly seek out products made from renewable materials, particularly in the packaging, automotive, and consumer goods industries. The increasing regulatory push for reduced plastic waste and carbon emissions is opening up new avenues for bio-based polyethylene manufacturers to expand their market share, particularly in markets with stringent sustainability requirements.

A notable trend in the bio-based polyethylene market is the increasing focus on integrating circular economy principles and recycling initiatives. Bio-based polyethylene is often marketed as an environmentally friendly solution, but manufacturers are now emphasizing its recyclability and contribution to a circular economy. As companies and governments push for more sustainable waste management practices, there is a growing trend of using bio-based polyethylene in products that can be recycled into new packaging or products. The adoption of biodegradable additives and the development of closed-loop recycling systems are further enhancing the appeal of bio-based polyethylene. These innovations are pushing the industry toward more sustainable production and consumption patterns, aligning with global efforts to reduce plastic waste and promote resource efficiency.

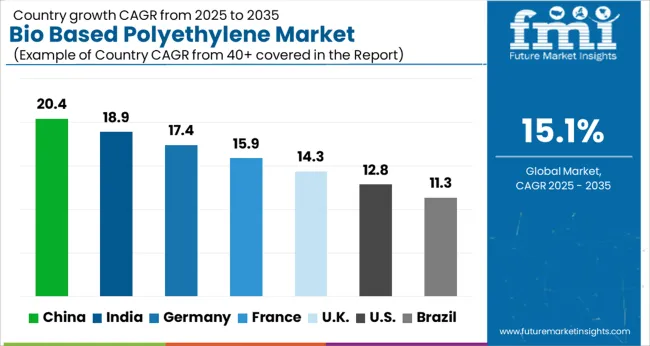

The bio based polyethylene market is projected to grow at a global CAGR of 15.7% from 2025 to 2035. China leads the market with a growth rate of 20.4%, followed by India at 18.9%. France records a growth rate of 15.9%, while the UK shows 14.3% and the USA follows at 12.8%. The market is primarily driven by the increasing demand for sustainable packaging solutions and growing awareness regarding the environmental impact of traditional polyethylene. China and India are leading the growth, backed by rapid industrialization and demand for eco-friendly alternatives in packaging. Developed economies like France, the UK, and the USA are witnessing steady growth as regulations for sustainable packaging solutions continue to strengthen. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to grow at a CAGR of 20.4% through 2035, leading the global bio based polyethylene market. The growth is driven by China’s rapidly expanding consumer goods sector, along with increasing adoption of sustainable packaging solutions. The demand for bio-based polyethylene is particularly high in the food and beverage packaging industry, which is responding to the increasing consumer demand for environmentally friendly products. China’s large manufacturing base and government-led initiatives supporting green technologies and sustainable solutions further boost the market for bio-based polyethylene.

India is expected to grow at a CAGR of 18.9% through 2035, driven by increasing demand for sustainable alternatives in packaging and the rapid growth of the packaging industry. As India continues to strengthen its manufacturing capabilities and focus on environmental solutions, the adoption of bio based polyethylene is on the rise. The country’s growing consumer market and focus on reducing plastic waste further contribute to the demand for bio-based materials. India’s agricultural sector also plays a significant role in the supply of renewable feedstocks, supporting the production of bio based polyethylene for packaging and other applications.

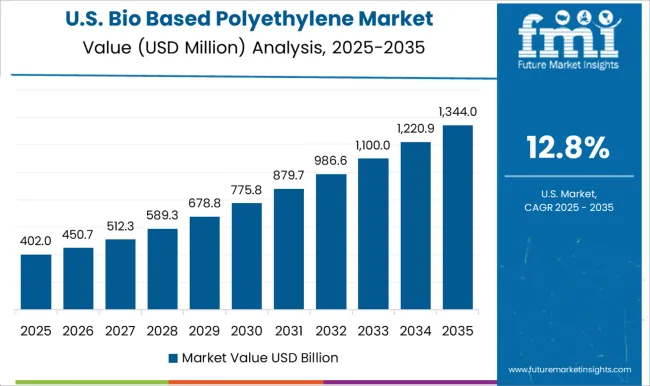

The United States is projected to grow at a CAGR of 12.8% through 2035, with demand for bio based polyethylene driven by increasing regulations on plastic usage and growing awareness of sustainable packaging. The shift towards more eco-friendly solutions, especially in food and beverage packaging, is expected to drive growth in the market. The USA is also witnessing an increase in R&D investments aimed at improving the efficiency and scalability of bio-based polyethylene production. These factors, combined with consumer demand for environmentally friendly products, will support the continued growth of the market.

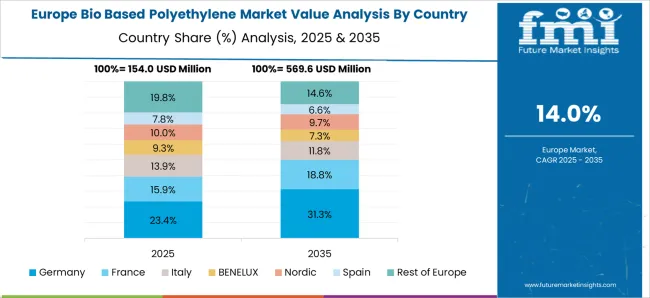

France is projected to grow at a CAGR of 15.9% through 2035, supported by strong demand in the food packaging and consumer goods sectors. France is a leader in sustainability within the European Union, with government policies favoring the use of sustainable materials, including bio-based polyethylene. French manufacturers are increasingly adopting bio-based polyethylene in their product packaging to meet consumer demand for environmentally friendly solutions. As the country continues to push for lower carbon emissions and waste reduction, the demand for bio-based packaging materials, including bio-based polyethylene, is set to rise.

The United Kingdom is expected to grow at a CAGR of 14.3% through 2035, driven by increasing consumer demand for sustainable products and packaging solutions. The UK government’s commitment to reducing plastic waste and carbon emissions is accelerating the adoption of bio-based polyethylene in various industries. The food and beverage packaging sector, which is a major consumer of polyethylene, is gradually shifting towards more eco-friendly options, further fueling demand. As the UK continues to implement stricter environmental regulations, the market for bio-based polyethylene is expected to expand.

The bio based polyethylene market is driven by leading manufacturers offering environmentally sustainable alternatives to traditional polyethylene, focusing on the use of renewable resources to produce high-quality, eco-friendly plastic products.

Avery Dennison provides bio-based polyethylene materials with a focus on sustainable packaging and labeling solutions, ensuring reduced carbon footprints in packaging applications. BASF offers innovative bio-based polyethylene products, integrating sustainability into the production of packaging films, agricultural products, and more, while emphasizing high performance and recyclability.

FKuR specializes in providing bio-based polyethylene solutions that cater to the growing demand for environmentally friendly materials, particularly in the packaging and consumer goods industries. Kuraray focuses on providing high-quality bio-based polyethylene products for diverse applications, including medical and food packaging, with a strong emphasis on sustainability and performance. LyondellBasell provides advanced bio-based polyethylene solutions that meet the increasing demand for sustainable packaging materials, focusing on renewable raw materials and high efficiency in production processes.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Raw Material | Sugarcane, Sugar beet, and Others |

| Product | HDPE, LDPE, and LLDPE |

| End Use | Food & beverages, Agriculture, Pharmaceutical, Cosmetics & personal care, Textile, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Braskem S.A, Avery Dennison, BASF, FKuR, Kuraray, LyondellBasell, Mitsui Chemicals, SABIC, Dow, and Toyota Tsusho Corporation |

| Additional Attributes | Dollar sales by product type (bio-based polyethylene film, bio-based polyethylene resin, bio-based polyethylene packaging) and end-use segments (packaging, automotive, consumer goods, agriculture, medical). Demand dynamics are driven by increasing consumer demand for sustainable products, the growing adoption of circular economy practices, and regulations supporting eco-friendly packaging solutions. Regional trends show strong growth in North America and Europe, where sustainability initiatives are heavily promoted, while Asia-Pacific is expanding due to rising industrialization and growing adoption of bio-based materials in packaging and consumer goods. |

The global bio based polyethylene market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the bio based polyethylene market is projected to reach USD 3.0 billion by 2035.

The bio based polyethylene market is expected to grow at a 15.1% CAGR between 2025 and 2035.

The key product types in bio based polyethylene market are sugar cane, sugar beet and others.

In terms of product, HDPE segment to command 61.2% share in the bio based polyethylene market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

Biobased Biodegradable Plastic Market Growth - Trends & Forecast 2025 to 2035

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Biobased Transformer Oil Market

Bio-Based Binder for Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Bio-based Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Paraxylene Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Leather Market Size and Share Forecast Outlook 2025 to 2035

Bio-based and Low VOC Paints Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Construction Polymer Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Naphtha Market Size and Share Forecast Outlook 2025 to 2035

Bio-based Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Battery Market Size and Share Forecast Outlook 2025 to 2035

Bio-based sealant films Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Detergent Enzymes Market – Trends & Forecast 2025 to 2035

Key Players & Market Share in Bio-based Sealant Films

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA