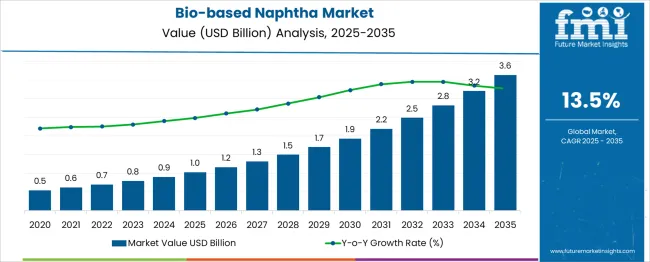

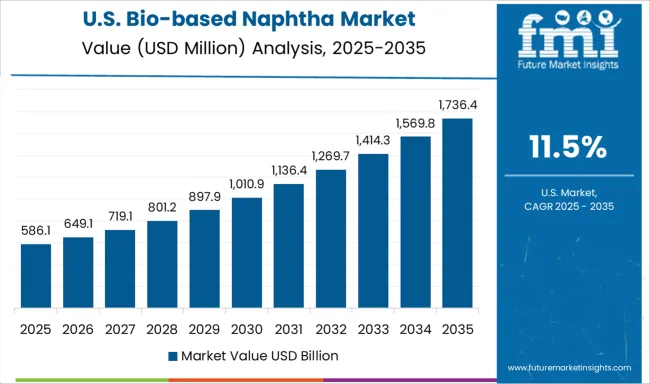

The bio-based naphtha market is expected to increase from USD 1.0 billion in 2025 to USD 3.6 billion by 2035, reflecting a CAGR of 13.5%. Between 2020 and 2025, the market grows from USD 0.5 billion to USD 1.0 billion, creating an absolute dollar opportunity of USD 0.5 billion over this five-year span. Annual increments in this period range from USD 0.1 billion in early years to USD 0.1 billion consistently, indicating a steady adoption curve as bio-based alternatives gain momentum in the chemical and energy sectors. This initial phase captures the shift from pilot-scale to larger-scale commercialization. From 2025 to 2030, the market expands from USD 1.0 billion to USD 1.7 billion, adding USD 0.7 billion in absolute dollar opportunity within five years. Post-2030, accelerated growth sees the market reaching USD 3.6 billion by 2035, creating an additional USD 1.9 billion in opportunity. The highest annual gains occur between 2030 and 2035, with increments of USD 0.3–0.4 billion per year. This pattern suggests that technology maturity, economies of scale, and supportive biofuel regulations will drive stronger revenue expansion in later years, making the post-2030 window highly lucrative for new entrants and strategic investments.

| Metric | Value |

|---|---|

| Bio-Based Naphtha Market Estimated Value in (2025 E) | USD 1.0 billion |

| Bio-Based Naphtha Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

The bio-based naphtha market is experiencing strong growth driven by increasing sustainability mandates in petrochemicals and packaging industries. Legislation and corporate goals aimed at reducing greenhouse gas emissions have elevated bio-feedstocks such as vegetable oils and waste oils as viable substitutes for fossil naphtha. Industry leaders and investors have been allocating capital to bio-refineries and integrated biorefinery projects that align feedstock sourcing, production capacity, and offtake agreements with major chemical producers.

At the same time bio-based polyolefins are gaining traction amid heightened interest in recyclable and circular-material solutions. Strategic partnerships between renewable feedstock suppliers and chemical manufacturers have been forged to ensure supply chain transparency and mass balance certification.

Technological improvements in catalytic conversion and energy optimization are lowering production costs. As global demand for sustainable packaging and biofuels expands across North America Europe and Asia Pacific regions, opportunities are being presented for capacity expansion and product diversification in bio-naphtha production.

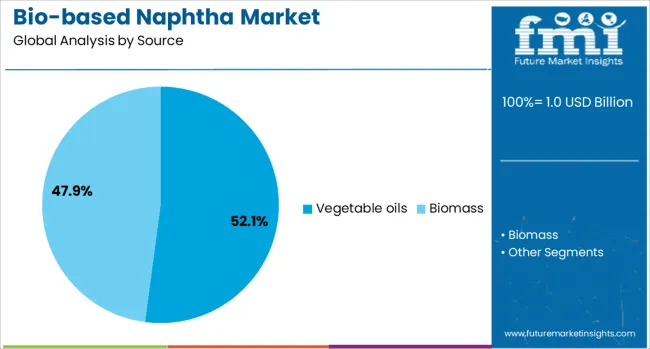

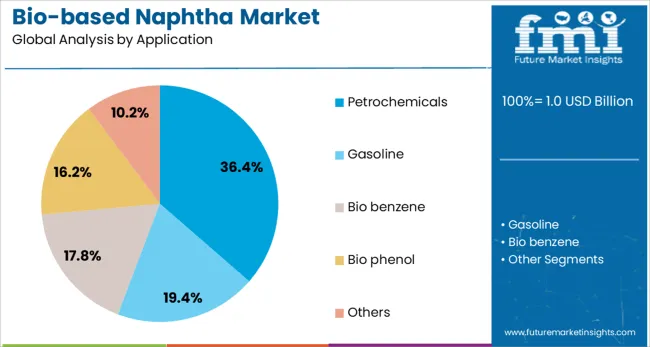

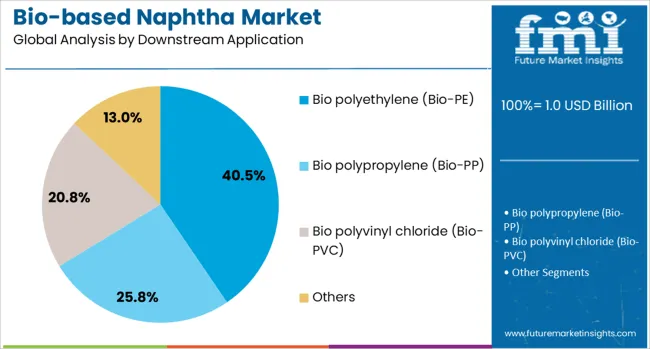

The bio-based naphtha market is segmented by source, application downstream application, and geographic regions. By source of the bio-based naphtha market is divided into Vegetable oils Biomass. In terms of application of the bio-based naphtha market is classified into Petrochemicals, Gasoline, Bio benzene, Bio phenol Others. Based on downstream application of the bio-based naphtha market is segmented into Bio polyethylene (Bio-PE), Bio polypropylene (Bio-PP), Bio polyvinyl chloride (Bio-PVC)Others. Regionally, the bio-based naphtha industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vegetable oils source segment is projected to hold around 52.1% of revenue in 2025 making it the leading feedstock category. This dominance is attributed to the high availability established supply chains and favorable oil yields per hectare.

Vegetable oils have been prioritized due to their compatibility with existing conversion technologies and the ability to yield naphtha-range hydrocarbons at industrial scale. Bio-sustainability certifications and traceability programs have been developed to ensure compliance with eco-label and mass balance standards in the chemical industry.

The reliability of vegetable oil feedstocks has enabled consistent production volumes which have appealed to large-scale chemical manufacturers requiring predictable supply. Furthermore ongoing research into non-food-based oil crops and improved extraction techniques is reinforcing feedstock resilience and supporting long-term dominance of this segment in the market.

The petrochemicals application segment is expected to account for about 36.4% of market revenue in 2025 making it the leading application category. This prominence has been driven by the capacity of bio-based naphtha to serve as drop-in feedstock for steam crackers and aromatics production facilities.

Petchem companies have been proactive in incorporating bio-naphtha via mass balance approaches to reduce carbon intensity in their product lines such as ethylene propylene benzene and toluene. Regulatory pressure to decrease Scope 3 emissions along with investor and end user demands for sustainable products have reinforced adoption.

Investments have also been directed toward performance qualification and regulatory approval pathways that ensure product consistency. As petrochemical manufacturers pursue net zero strategies and circularity goals the integration of bio-based naphtha into existing plants has been positioned as a strategic transition mechanism enabling sustainable production at scale.

The bio polyethylene Bio PE downstream application segment is projected to represent approximately 40.5% of revenue in 2025 making it the dominant downstream category. This leadership has been driven by rising demand for sustainable packaging materials in consumer goods food and agriculture sectors. Bio PE produced from bio-based naphtha has been recognized for its chemical and mechanical equivalence to fossil-based PE while offering lifecycle emission reductions.

Consumer brands and packaging companies have been committing to replace conventional PE with bio PE in rigid and flexible packaging. Certification frameworks and circular economy initiatives have supported transparent sourcing of bio PE for regulatory and marketing compliance.

Additionally compatibility with existing PE manufacturing equipment has allowed fast adoption without capex intensive retooling. As brand owners seek to meet sustainability targets and regulatory mandates related to single use plastics the bio PE segment has emerged as the leading driver of bio-naphtha utilization.

The bio-based naphtha market is gaining momentum as the chemical and energy industries shift toward low-carbon feedstocks. Produced from renewable sources such as biomass, waste oils, and plant-based materials, bio-based naphtha serves as a sustainable alternative to fossil-derived naphtha in petrochemicals, plastics, and fuels. Growing demand for circular economy solutions, stricter emissions regulations, and corporate decarbonization goals are fueling adoption. Advancements in biomass processing and biorefinery integration are improving yields, though feedstock supply limitations and cost competitiveness remain major growth considerations.

The availability and consistency of bio-based naphtha depend heavily on the supply of renewable feedstocks such as vegetable oils, waste cooking oil, and lignocellulosic biomass. Seasonal fluctuations, regional production capacities, and competing uses for feedstocks can lead to price volatility and supply uncertainty. Variations in feedstock quality affect refining efficiency and final product specifications, influencing downstream applications in plastics, resins, and fuels. To meet consistent quality standards, producers must invest in advanced pretreatment, feedstock diversification, and long-term supplier agreements. Competition for bio-feedstocks from biodiesel and sustainable aviation fuel markets adds further pressure, potentially driving up costs. Securing reliable, traceable, and sustainable raw material sources remains a strategic priority for market participants seeking to stabilize production and meet industry and regulatory requirements for low-carbon, high-performance petrochemical feedstocks.

Innovations in biomass conversion, hydroprocessing, and co-processing with fossil feedstocks are enhancing the commercial viability of bio-based naphtha. Advances in catalytic pyrolysis, Fischer–Tropsch synthesis, and hydrotreated vegetable oil (HVO) technologies enable higher yields, improved product purity, and compatibility with existing petrochemical infrastructure. Integration with advanced biorefineries allows simultaneous production of bio-naphtha, bio-LPG, and biojet fuel, optimizing economic returns. Process automation and real-time quality monitoring are improving operational efficiency and reducing waste. Several companies are also exploring waste-to-naphtha conversion, tapping municipal solid waste and agricultural residues as scalable inputs. These technological gains support cost reduction and broaden feedstock flexibility, enabling producers to better compete with fossil-derived naphtha. As industrial-scale facilities come online and process efficiencies improve, bio-based naphtha is increasingly positioned as a drop-in replacement, facilitating wider adoption in polymers, elastomers, and gasoline blending applications without major infrastructure modifications.

Bio-based naphtha is gaining traction as a sustainable feedstock for olefins and aromatics production, which are used to manufacture plastics, synthetic rubber, and chemical intermediates. Its role in producing renewable gasoline blends aligns with the automotive sector’s decarbonization objectives. The packaging industry’s shift toward bio-based plastics, along with brand commitments to reduce Scope 3 emissions, is driving demand for renewable petrochemical inputs. Governments offering tax incentives, renewable energy credits, and green procurement policies are accelerating market penetration. In addition, collaborations between bio-naphtha producers and petrochemical companies are expanding capacity and securing long-term off-take agreements. E-commerce growth and consumer preference for sustainable packaging further enhance demand. As global regulations tighten carbon reduction targets, bio-based naphtha offers a pathway for petrochemical and fuel industries to transition toward greener supply chains, creating significant opportunities in both mature markets with strong policy support and emerging economies seeking sustainable industrial development.

The adoption of bio-based naphtha is shaped by evolving environmental regulations, carbon pricing mechanisms, and renewable energy directives. In the EU, policies such as the Renewable Energy Directive (RED II) and plastic packaging sustainability targets encourage the use of renewable feedstocks in petrochemical production. In North America and Asia-Pacific, low-carbon fuel standards and biofuel mandates are also influencing market growth. However, production costs for bio-based naphtha often exceed those of fossil-derived alternatives, creating a competitiveness gap without subsidies or carbon credits. Infrastructure compatibility is generally favorable, but capital expenditure for scaling biorefinery operations remains high. Policy uncertainty and regional variation in incentives can hinder investment decisions. Producers must balance compliance with diverse regulatory frameworks while pursuing economies of scale to narrow the price gap. Long-term growth will depend on sustained policy support, technological efficiency gains, and broader recognition of bio-based naphtha’s role in achieving industrial decarbonization targets.

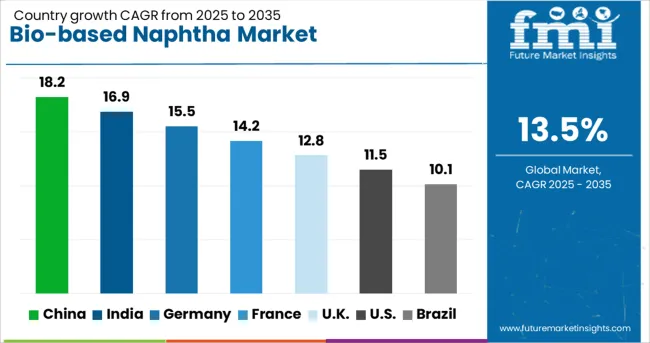

The global bio-based naphtha market is growing at a strong 13.5% CAGR, driven by the transition toward renewable feedstocks and sustainable petrochemical production. Among BRICS nations, China leads with 18.2% growth, supported by large-scale biorefinery investments and government sustainability mandates. India follows at 16.9%, fueled by expanding green chemistry initiatives and industrial decarbonization efforts. In the OECD region, Germany records 15.5% growth, reflecting advanced bio-refining technologies and strong policy frameworks for carbon reduction. The United Kingdom grows at 12.8%, driven by renewable fuel adoption and circular economy goals. The United States, a mature yet rapidly adapting market, shows 11.5% growth, supported by biofuel blending mandates and R&D in sustainable feedstocks. These countries collectively shape market trends through innovation, environmental regulations, and large-scale renewable energy integration. This report includes insights on 40+ countries; the top countries are shown here for reference.

China bio-based naphtha market is expanding rapidly at an 18.2% CAGR, fueled by strong demand in renewable energy, green petrochemicals, and sustainable fuel production. The nation leads global adoption due to significant investments in bio-refineries and advanced chemical manufacturing. Unlike many regions, China integrates bio-based naphtha into both transportation fuels and high-value chemical derivatives. Government policies promoting carbon neutrality drive large-scale production and industrial adoption. The packaging sector also benefits from bio-based polymers derived from naphtha. Compared to Western markets, China has the advantage of cost-efficient feedstock sourcing and large-scale infrastructure. Strategic partnerships between energy companies and agricultural producers ensure consistent raw material supply, enhancing market stability. With its combination of policy support, technological advancement, and production capacity, China is positioned as the leading driver of global bio-based naphtha growth.

India bio-based naphtha market is advancing at a 16.9% CAGR, supported by renewable energy initiatives, agricultural biomass utilization, and a growing demand for sustainable industrial inputs. The country focuses on converting agricultural residues into high-value fuels and bio-polymers, making bio-based naphtha a key player in circular economy strategies. Compared to China, India has a smaller but fast-growing infrastructure base for bio-refining. Government subsidies and tax incentives encourage private sector investment, while collaborations between oil companies and research institutes drive technological improvements. The shift toward eco-friendly packaging materials further strengthens demand. Bio-based naphtha is also finding use in specialty chemical manufacturing, offering a greener alternative to petroleum-derived feedstocks. The combination of abundant biomass availability, supportive policy frameworks, and growing industrial adoption positions India as one of the most promising markets in the Asia-Pacific region.

United States bio-based naphtha market is advancing at an 11.5% CAGR, driven by renewable fuel mandates, corporate sustainability goals, and the expansion of bio-based material production. The USA market leverages its vast agricultural base for feedstock supply, particularly from corn, soy, and forestry residues. Compared to Europe, the USA prioritizes scaling production capacity for cost efficiency and mass adoption. Bio-based naphtha is increasingly used in bioplastics manufacturing, aligning with consumer demand for sustainable packaging. Large energy corporations are investing in integrated production facilities that combine renewable fuels and green chemicals. Federal and state-level policies support both research and commercialization of bio-based alternatives. With its combination of scale, policy backing, and industrial adoption, the USA remains a significant player in the global bio-based naphtha industry.

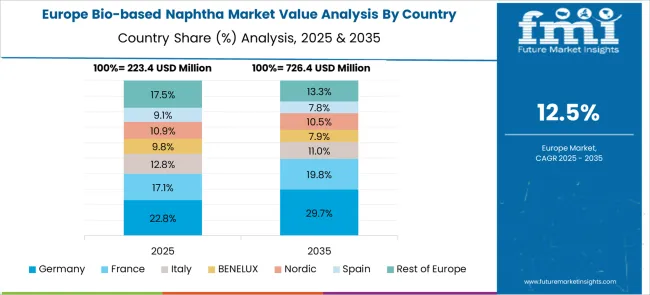

Germany bio-based naphtha market is recording a 15.5% CAGR, driven by strong sustainability regulations, advanced chemical engineering, and the shift towards green mobility. The market benefits from Germany focus on reducing fossil fuel dependency, with bio-based naphtha being integrated into synthetic fuels and bioplastics. Compared to Asian markets, Germany emphasizes high-quality, certified sustainable products, often targeting premium chemical and packaging applications. Automotive and aviation industries are key consumers as they explore carbon reduction strategies. Government-backed research projects aim to enhance conversion efficiency from biomass to bio-naphtha. The presence of established petrochemical companies investing in renewable alternatives ensures a steady supply and market growth. Germany commitment to the European Green Deal further strengthens its position as a leader in sustainable feedstock adoption.

United Kingdom bio-based naphtha market is growing at a 12.8% CAGR, supported by rising demand for renewable fuels and sustainable packaging solutions. The UK places strong emphasis on regulatory compliance and carbon reduction goals, aligning with the wider European sustainability agenda. Compared to Germany, the UK market is smaller but equally focused on high-value applications such as bio-plastics and specialty chemicals. The transition from fossil-based to bio-based feedstocks is gaining momentum in both consumer goods and industrial sectors. Energy companies are exploring partnerships with bio-refineries to diversify supply sources. Investment in pilot-scale plants is laying the foundation for future large-scale production. The market also benefits from consumer-driven demand for low-carbon products in retail and manufacturing.

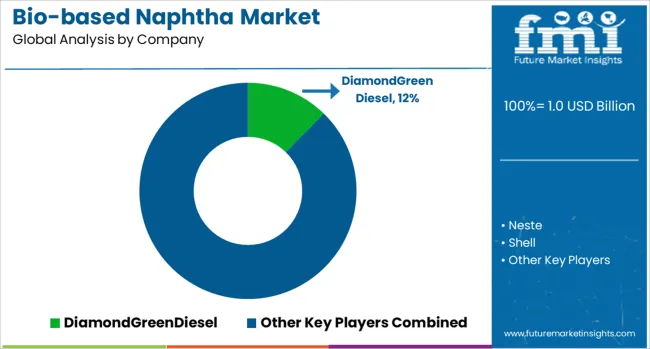

The bio-based naphtha market is expanding as industries seek renewable alternatives to fossil-derived feedstocks for plastics, chemicals, and fuels. Diamond Green Diesel and Neste are among the most influential players, leveraging large-scale renewable refining capabilities to produce high-quality bio-naphtha as a co-product of their biodiesel operations. Shell and UPM Biofuels also hold strong positions, with integrated strategies that link bio-based naphtha production to circular economy goals and sustainable petrochemical feedstock supply. European energy majors like Eni and Repsol are investing heavily in biorefineries to scale bio-naphtha output, often aligning production with broader carbon reduction targets.

In the United States, Gevo focuses on advanced biofuel technologies that convert sustainable feedstocks into bio-naphtha with a reduced carbon footprint, while in Asia, Euglena is pioneering algae-based fuels that yield bio-naphtha as part of its renewable energy portfolio. Phillips 66 has entered the market through partnerships and facility conversions aimed at boosting renewable naphtha capacity. The competitive environment is characterized by collaboration between biofuel companies, petrochemical producers, and downstream plastic manufacturers to develop supply chains for bio-based naphtha that meet both performance and sustainability criteria, accelerating its adoption in mainstream chemical and polymer production.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Source | Vegetable oils and Biomass |

| Application | Petrochemicals, Gasoline, Bio benzene, Bio phenol, and Others |

| Downstream Application | Bio polyethylene (Bio-PE), Bio polypropylene (Bio-PP), Bio polyvinyl chloride (Bio-PVC), and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DiamondGreenDiesel, Neste, Shell, UPMBiofuels, Eni, Repsol, Gevo, Euglena, Phillips66, and KaidiFinland |

| Additional Attributes | Dollar sales in the Bio-based Naphtha Market vary by application (fuel blending, petrochemicals, plastics, specialty chemicals), feedstock (sugarcane, corn, biomass), end-use industry (transportation, packaging, industrial), and region (North America, Europe, Asia-Pacific). Growth is driven by renewable energy adoption, decarbonization goals, and demand for sustainable feedstocks in chemical production. |

The global bio-based naphtha market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the bio-based naphtha market is projected to reach USD 3.6 billion by 2035.

The bio-based naphtha market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in bio-based naphtha market are vegetable oils and biomass.

In terms of application, petrochemicals segment to command 36.4% share in the bio-based naphtha market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Naphthalene Market Size and Share Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

Naphthalene Derivatives Market Growth & Demand 2025 to 2035

Biobased Biodegradable Plastic Market Growth - Trends & Forecast 2025 to 2035

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Biobased Transformer Oil Market

3-Methoxynaphthalene-2-Boronic Acid Market Forecast and Outlook 2025 to 2035

2-Methoxynaphthalene-1-Boronic Acid Market Forecast and Outlook 2025 to 2035

1-Methoxynaphthalene-2-Boronic Acid Market Forecast and Outlook 2025 to 2035

Renewable Naphtha Market Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Propylene Glycol in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Propylene Glycol in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in USA Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA