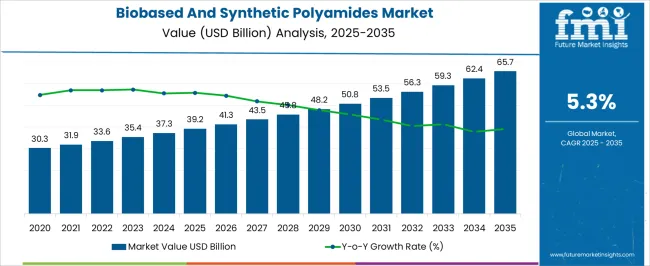

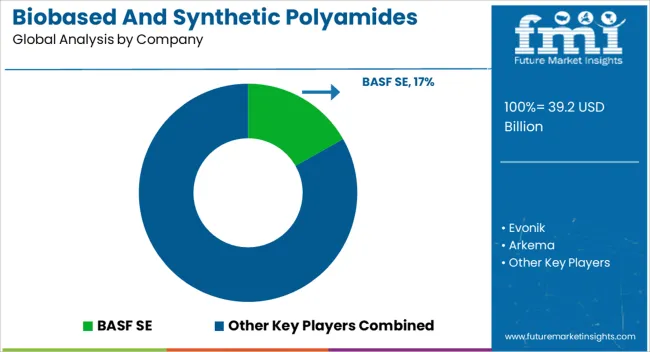

The biobased and synthetic polyamides market is estimated to be valued at USD 39.2 billion in 2025 and is projected to reach USD 65.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. In the early adoption phase (2020 to 2024), the market expanded steadily from USD 30.3 billion to USD 37.3 billion. Growth was driven by niche applications in automotive, electronics, and textile sectors, where high-performance, sustainable polyamides were tested.

Early adopters focused on evaluating material performance, cost-efficiency, and sustainability benefits, while regulatory support and consumer demand for eco-friendly products gradually increased. During this phase, awareness of biobased alternatives grew, but cost and production scalability constrained widespread adoption, keeping the market in a formative stage. From 2025 to 2030, the market enters a scaling phase, with revenues increasing from USD 39.2 billion to approximately USD 48.2 billion.

This period sees wider adoption driven by advancements in polymer synthesis, cost optimization, and integration into mass-produced automotive and industrial applications. Innovation, combined with environmental regulations and consumer preference for sustainable materials, accelerates growth. Between 2030 and 2035, the market moves into consolidation, reaching USD 65.7 billion by 2035.

Leading producers optimize production, establish standardized processes, and consolidate supply chains. Growth stabilizes, with incremental innovation and sustainability-focused product differentiation defining this mature, efficient market, illustrating the transition from early adoption to scaling and eventual consolidation.

| Metric | Value |

|---|---|

| Biobased And Synthetic Polyamides Market Estimated Value in (2025 E) | USD 39.2 billion |

| Biobased And Synthetic Polyamides Market Forecast Value in (2035 F) | USD 65.7 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The biobased and synthetic polyamides market is experiencing steady advancement, driven by the dual need for high-performance materials and sustainable product alternatives across major industrial sectors. Shifting regulatory landscapes focused on reducing carbon emissions and encouraging circular material flows have accelerated the development of bio-based feedstocks.

Synthetic polyamides continue to retain relevance due to their mechanical strength, chemical resistance, and versatility in extreme operating environments. Advancements in polymerization technology and downstream compounding have broadened the application base across automotive, electrical, and consumer goods sectors.

Additionally, increasing demand for lightweight components in mobility and manufacturing is influencing material selection trends, particularly for polyamide grades with high dimensional stability. As OEMs and suppliers prioritize lifecycle performance and recyclability, the market is poised to grow through collaborative innovation and supply chain integration between chemical producers and end-use industries.

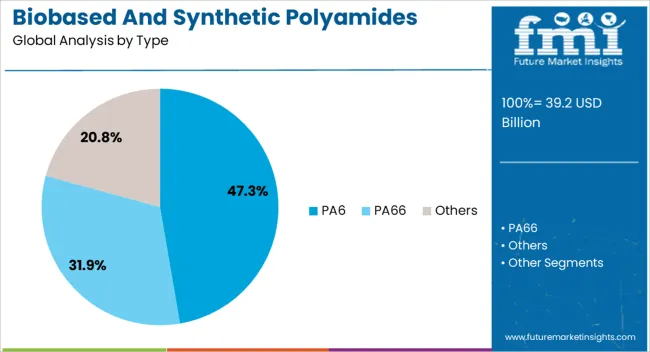

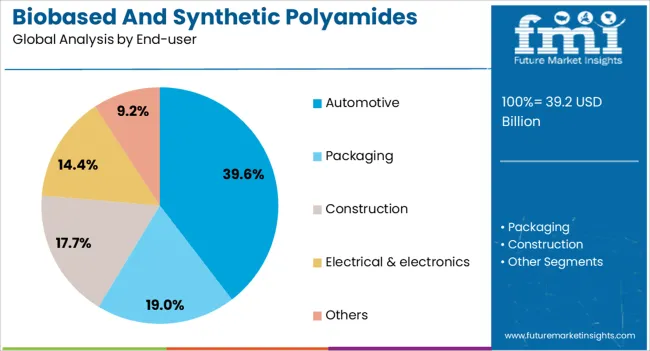

The biobased and synthetic polyamides market is segmented by type, end-user, and geographic regions. By type, the biobased and synthetic polyamides market is divided into PA6, PA66, and Others. In terms of end-users of the biobased and synthetic polyamides market, it is classified into Automotive, Packaging, Construction, Electrical & electronics, and Others.

Regionally, the biobased and synthetic polyamides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

PA6 is expected to contribute 47.30% of the total revenue in the biobased and synthetic polyamides market by 2025, making it the leading material type. This segment’s growth has been driven by its balanced cost-to-performance ratio, excellent processability, and adaptability across both bio-based and petrochemical variants.

PA6 exhibits high tensile strength, thermal resistance, and surface finish quality, which make it highly suitable for precision components in automotive and industrial applications. Its compatibility with injection molding and extrusion processes has enabled widespread manufacturing scalability.

Additionally, efforts to integrate renewable raw materials into PA6 formulations have enhanced its acceptance in sustainability-conscious markets. The ability to meet rigorous regulatory standards while maintaining structural integrity continues to position PA6 as a versatile and dominant choice in the polyamides landscape.

The automotive industry is projected to hold 39.60% of the total revenue share in 2025, ranking it as the largest end-user segment in the biobased and synthetic polyamides market. This leadership is attributed to the increasing use of polyamides in under-the-hood, structural, and interior applications to reduce vehicle weight, enhance fuel efficiency, and meet stringent emissions standards.

PA6 and PA66 have become key materials for producing components such as air intake manifolds, engine covers, and cable insulation. The transition toward electric and hybrid vehicles has further expanded application scope, particularly in high-voltage connectors and thermal management systems.

OEMs are actively collaborating with material science innovators to co-develop high-performance polyamides that offer both flame retardance and recyclability. As lightweighting and modular manufacturing become central to automotive design, the demand for polyamides, both synthetic and bio-derived, is expected to intensify across global production platforms.

The biobased and synthetic polyamides market is witnessing steady growth due to rising demand in automotive, textiles, electrical, and packaging applications. Polyamides, known for high mechanical strength, thermal stability, and chemical resistance, are increasingly used as lightweight alternatives to metals and conventional plastics. Manufacturers focus on developing high-performance, eco-conscious formulations that deliver durability and flexibility. Expansion in automotive lightweighting, engineering plastics, and high-strength fibers is driving adoption across North America, Europe, and Asia-Pacific.

Polyamides are valued in the automotive industry for their ability to reduce vehicle weight while maintaining structural integrity. Their high tensile strength and thermal resistance allow components such as under-the-hood parts, connectors, and fuel system components to perform under demanding conditions. Lightweighting contributes to fuel efficiency and cost savings without compromising safety or durability. Increasing electric vehicle production further encourages adoption of polyamide materials due to heat resistance and electrical insulation properties, positioning these polymers as essential in modern vehicle design and manufacturing.

Biobased and synthetic polyamides offer high resistance to heat, oils, fuels, and chemicals, making them suitable for industrial machinery, electrical equipment, and piping systems. Their stability under extreme temperatures ensures long-lasting performance and reduces maintenance requirements. Manufacturers are optimizing polymer formulations to meet specific industry standards, enabling safe use in high-stress environments. Industrial sectors increasingly prefer polyamides for components exposed to harsh chemicals or mechanical stress, driving adoption in energy, electronics, and manufacturing operations where durability and reliability are critical.

Polyamide fibers are widely used in textiles for apparel, sportswear, and technical fabrics due to strength, flexibility, and abrasion resistance. In packaging, polyamide films provide barrier properties, heat resistance, and durability for food and medical products. Growing consumer demand for high-performance, long-lasting fabrics and secure packaging materials supports market expansion. Manufacturers are developing biobased and hybrid polyamides that combine performance with environmental friendliness, enabling differentiation in competitive textile and packaging markets while addressing evolving consumer and industrial requirements.

Manufacturers are investing in novel polymerization techniques, alloying, and bio-based feedstock integration to improve polyamide performance and sustainability. Strategic collaborations and regional production expansion allow companies to meet increasing global demand efficiently. Advanced formulations targeting high-performance applications, including electrical insulation, automotive components, and industrial machinery, provide a competitive advantage. Investments in supply chain reliability, quality control, and specialized production capacities enhance product consistency, meeting regulatory and client expectations. This focus on performance and availability supports widespread adoption in diverse industries worldwide.

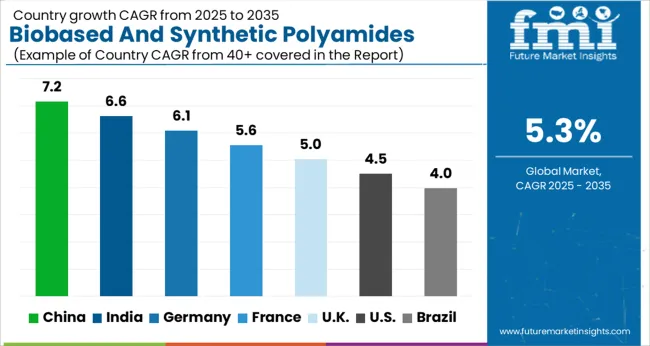

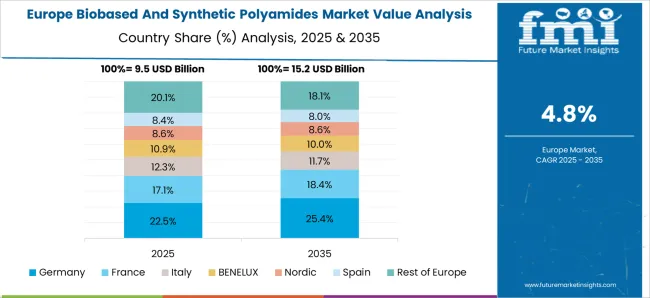

The global biobased and synthetic polyamides market is projected to grow at a CAGR of 5.3%, driven by demand in automotive, textile, and industrial applications. China leads the market with a 7.2% growth rate, supported by large-scale manufacturing and industrial production. India follows at 6.6%, driven by expansion in automotive components and textile industries.

Germany shows steady growth at 6.1%, leveraging advanced manufacturing and industrial demand. The UK and USA record moderate growth rates of 5.0% and 4.5%, respectively, reflecting stable demand in industrial and consumer sectors. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the biobased and synthetic polyamides market with a 7.2% growth rate, driven by rapid industrialization and increasing demand in automotive, textile, and packaging sectors. Compared to India, China benefits from larger manufacturing capacities and strong raw material supply chains. Investments in R&D focus on developing eco-friendly and high-performance polyamides to meet global sustainability standards. Rising automotive production, lightweight material demand, and electronics manufacturing further support market expansion. The government’s push for green chemistry initiatives encourages adoption of biobased polyamides.

Export-oriented industries increase demand for high-quality synthetic polyamides in international markets. Continuous process optimization and technological advancements in polymerization improve product performance and reduce costs. Overall, China’s large industrial base, strong supply chain, and innovation capabilities position it as the largest market globally for biobased and synthetic polyamides.

India’s biobased and synthetic polyamides market grows at 6.6%, fueled by demand from textiles, automotive, and consumer goods sectors. Compared to Germany, India emphasizes cost-effective production while gradually incorporating sustainable polyamide technologies. Rising e-commerce and packaging demand boost the use of lightweight, durable polymers. Manufacturers are investing in biobased formulations to align with global environmental standards. Expansion of domestic automotive production further strengthens demand for synthetic polyamides in lightweight and high-performance components.

Industrial modernization, improved polymerization techniques, and process optimization enhance product quality and reduce production costs. Export opportunities to neighboring Asian markets provide additional revenue streams. Urbanization, rising disposable incomes, and infrastructure development also drive demand across multiple industries. India’s market shows steady growth potential as companies continue to adopt sustainable practices while balancing cost efficiency and performance in polyamide production.

Biobased and synthetic polyamides market grows at 6.1%, driven by high standards in automotive, industrial, and electronics applications. Compared to the UK, Germany emphasizes eco-friendly and high-performance polyamides to meet strict EU regulations. Demand from automotive lightweighting, electrical components, and technical textiles supports consistent market growth. Manufacturers invest in R&D to develop biobased polymers and improve material properties, reducing environmental impact. Industrial automation and advanced polymerization processes enhance production efficiency and consistency.

Export opportunities to European and global markets further strengthen the industry. Germany’s focus on sustainability, regulatory compliance, and innovation ensures steady market expansion. Despite moderate growth rates, the country remains a leader in high-quality synthetic polyamides, maintaining a competitive edge through advanced technology and sustainable practices.

The United Kingdom biobased and synthetic polyamides market grows at 5.0%, supported by automotive, industrial, and packaging applications. Compared to the USA, the UK prioritizes sustainability and eco-friendly polyamide adoption. Demand from lightweight automotive components, durable textiles, and high-performance industrial applications drives market growth.

Manufacturers invest in R&D to improve polymer quality and reduce environmental impact. Adoption of biobased polyamides aligns with EU and domestic regulatory standards. Export opportunities are primarily within Europe, supporting market stability. Technological advancements in polymerization and processing improve material performance and efficiency. Despite slower growth compared to Asian markets, the UK’s focus on quality, compliance, and sustainable materials ensures a steady outlook for biobased and synthetic polyamides.

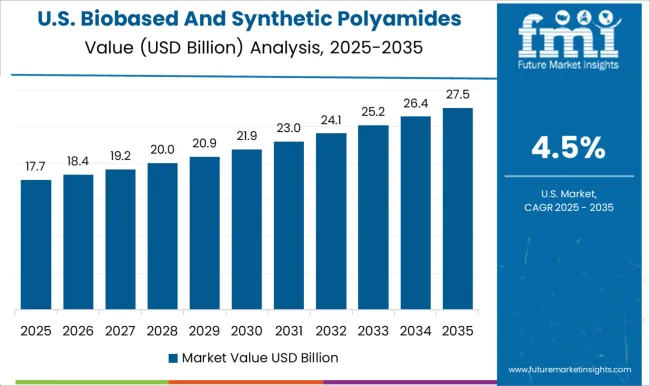

The USA biobased and synthetic polyamides market grows at 4.5%, driven by demand from automotive, electronics, and packaging industries. Compared to China, the USA emphasizes high-quality production and regulatory compliance over volume expansion. Manufacturers focus on eco-friendly polymers and advanced synthetic polyamides to meet environmental and performance standards. Industrial applications, particularly in lightweight automotive components and durable consumer goods, support steady growth. Investments in R&D enhance polymer efficiency, durability, and sustainability.

Export opportunities are moderate, but domestic industrial demand ensures market stability. Technological improvements in polymerization and manufacturing processes reduce costs and improve product consistency. Although growth is slower than Asian markets, continuous innovation and adoption of sustainable practices support long-term expansion in the USA biobased and synthetic polyamides sector.

Companies are competing through portfolio diversification, new resin families, and targeted agreements with downstream industries. Partnerships with automotive OEMs are actively being pursued, and claims of superior tensile strength reinforce competitive positioning, reduced moisture absorption, and long service life. Product brochures highlight properties such as high heat deflection, fatigue resistance, and recyclability, which are designed to appeal to engineering and consumer sectors seeking a balance between performance and compliance. Strategy has been directed toward dual positioning: retaining synthetic dominance while accelerating biobased penetration through continuous research, capacity investments, and circular economy integration. Recycling initiatives for synthetics are being developed, and bio-feedstock technologies are progressing through fermentation and biomass conversion platforms.

Future market adoption is expected to expand at a steady CAGR through 2035, with biobased polyamides projected to gain relative share while synthetics maintain absolute leadership. Long-term opportunity is being supported by regulatory acceptance, wider adoption in packaging and textiles, and continuous substitution of metals in performance-intensive segments. Market competition is being defined by a balance between traditional volume efficiency and emerging renewable innovation, with differentiation resting heavily on technical brochures that emphasize strength-to-weight advantages, temperature performance, and global service integration for supply reliability.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.2 Billion |

| Type | PA6, PA66, and Others |

| End-user | Automotive, Packaging, Construction, Electrical & electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Evonik, Arkema, Koninklijke DSM N.V., Asahi Kasei Corporation, Lanxess, RTP Company, UBE INDUSTRIES LTD., Grupa Azoty, Dow Chemicals, EMS-CHEMIE, Invista, Toray, Teijin Aramid B.V., and AdvanSix Inc. |

| Additional Attributes | Dollar sales vary by type including biobased polyamides and synthetic polyamides, application across automotive, electrical & electronics, textiles, and industrial components, and region covering North America, Europe, and Asia-Pacific. Growth is driven by demand for lightweight, high-performance materials, sustainability initiatives, and increasing industrial applications. |

The global biobased and synthetic polyamides market is estimated to be valued at USD 39.2 billion in 2025.

The market size for the biobased and synthetic polyamides market is projected to reach USD 65.7 billion by 2035.

The biobased and synthetic polyamides market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in biobased and synthetic polyamides market are pa6, pa66 and others.

In terms of end-user, automotive segment to command 39.6% share in the biobased and synthetic polyamides market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Propylene Glycol in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Geosynthetics in South Asia Size and Share Forecast Outlook 2025 to 2035

Synthetic Lubricants and Functional Fluids Market - Growth & Demand 2025 to 2035

Synthetic Hemostatic & Wound Care Products Market Analysis – Trends & Forecast 2024-2034

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA