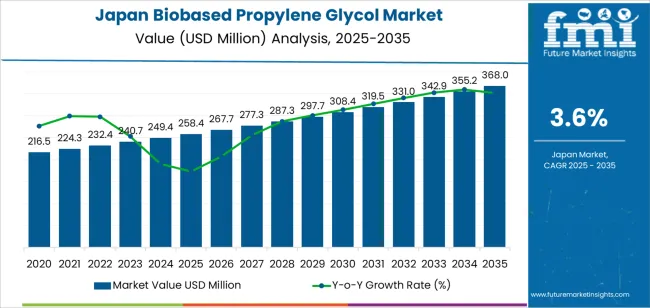

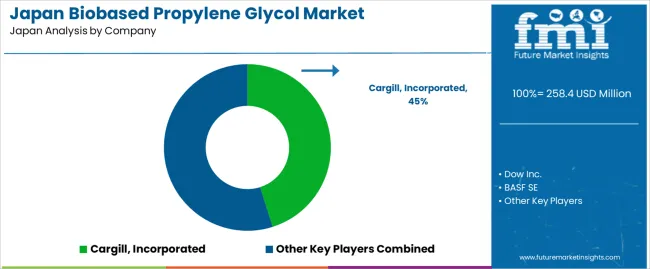

The Japan biobased propylene glycol demand is valued at USD 258.4 million in 2025 and is forecasted to reach USD 368.0 million by 2035, reflecting a CAGR of 3.6%. Demand is shaped by gradual substitution of petroleum-derived glycols with renewable alternatives, driven by requirements in industrial manufacturing, chemical processing, and food-grade applications. Wider acceptance of biobased inputs in resins, pharmaceuticals, and personal-care formulations supports adoption, while supply-chain integration among domestic distributors and global producers contributes to stable procurement. Increased interest in low-toxicity solvents and intermediates used in regulated end-use sectors also influences purchasing decisions.

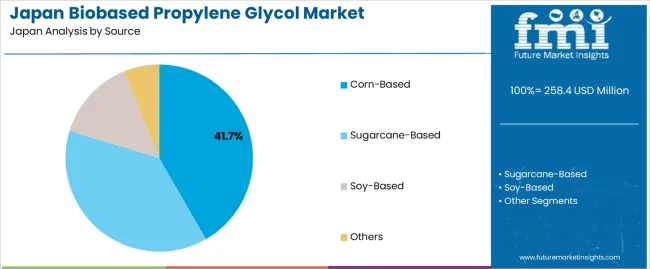

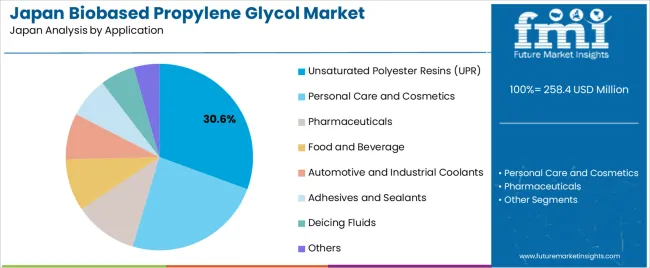

Corn-based propylene glycol, accounting for an estimated 41.7% share, leads the source landscape. This segment benefits from consistent raw-material availability, well-established fermentation routes, and compatibility with existing production infrastructure. Manufacturers rely on corn-based material for its predictable performance in industrial blends and consumer-product formulations. Unsaturated polyester resins, representing about 30.6 percent of demand, lead the application landscape. These resins remain central to composites, coatings, fibre-reinforced plastics, and engineered components. Biobased glycol is selected for its stable curing behaviour and suitability for applications requiring reduced emissions and controlled thermal performance.

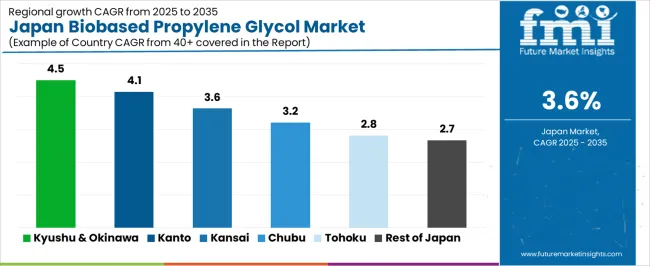

Kyushu & Okinawa, Kanto, and Kinki record the highest utilisation levels due to their concentration of chemical plants, resin-manufacturing units, and distribution hubs serving industrial and consumer-product manufacturers. These regions also provide access to import terminals and downstream processing clusters. Key suppliers include Cargill, Dow Inc., BASF SE, ADM, and LyondellBasell Industries, which provide biobased glycol for chemical, polymer, pharmaceutical, and food-processing applications.

The early growth curve from 2025 to 2029 shows a measured rise driven by steady adoption in food processing, personal-care formulations, and pharmaceutical excipients. Early gains are supported by continued substitution of petrochemical glycols in applications where bio-derived inputs align with corporate sustainability policies and regulatory expectations. This period reflects predictable procurement from manufacturers seeking stable supply, consistent purity, and compatibility with existing formulations.

From 2030 to 2035, the late growth curve moves into a more mature and slower-expanding phase. By this stage, major downstream sectors will have integrated biobased propylene glycol into established product lines, and additional growth arises mainly from replacement demand and incremental efficiency improvements in upstream production. Late-period expansion is shaped by better fermentation yields, improved feedstock logistics, and broader uptake in industrial lubricants and construction chemicals, but the pace remains controlled. The comparison shows an early curve driven by formulation shifts and sustainability priorities, followed by a late curve defined by operational stability and modest, application-anchored utilization across Japan’s chemical and consumer-product industries.

| Metric | Value |

|---|---|

| Japan Biobased Propylene Glycol Sales Value (2025) | USD 258.4 million |

| Japan Biobased Propylene Glycol Forecast Value (2035) | USD 368.0 million |

| Japan Biobased Propylene Glycol Forecast CAGR (2025-2035) | 3.6% |

Demand for bio-based propylene glycol in Japan is rising as manufacturers in cosmetics, personal care, solvents, coatings and chemical intermediates seek renewable alternatives to fossil-derived glycols. Japanese consumers and brands increasingly prefer formulations and products with lower carbon footprint and improved sustainability credentials, which encourages adoption of bio-based variants. Growth in industries such as automotive (coolants and antifreeze) and building materials (unsaturated polyester resins) supports downstream demand for greener propylene glycol options.

The broader trend toward green chemistry and regulatory encouragement of renewable chemical feedstocks further amplifies interest in bio-based propylene glycol. The industry faces constraints including higher production and feedstock costs for bio-based propylene glycol, supply-chain limitations for renewable raw materials in the region, and the need for manufacturers to validate bio-sourced grades for performance and cost-competitiveness. Some formulators may defer switching until price parity or stronger ecofriendly mandates emerge.

Demand for biobased propylene glycol in Japan reflects increased interest in renewable-feedstock chemicals used across industrial, personal-care, and food-production environments. Source-type choices depend on agricultural availability, processing efficiency, and suitability for producing stable glycol intermediates. Application patterns correspond to how manufacturers incorporate biobased glycols into polymers, cosmetics, pharmaceuticals, and coolants that require low toxicity, functional stability, and regulatory compliance.

Corn-based propylene glycol holds 41.7% of national demand and represents the leading source category. Corn feedstock supports consistent supply, well-established processing pathways, and predictable conversion yields suitable for industrial-scale glycol production. Sugarcane-based sources account for 38.0%, benefiting from high sucrose content and efficient fermentation-based conversion. Soy-based feedstock represents 14.2%, supporting niche applications requiring specific agricultural-origin inputs. Other sources account for 6.1%, covering mixed biomass and specialty renewable feedstocks. Source-type distribution reflects supply-chain stability, feedstock availability, and process compatibility across Japanese manufacturers selecting renewable glycol inputs for polymer, cosmetic, and pharmaceutical formulations.

Key drivers and attributes:

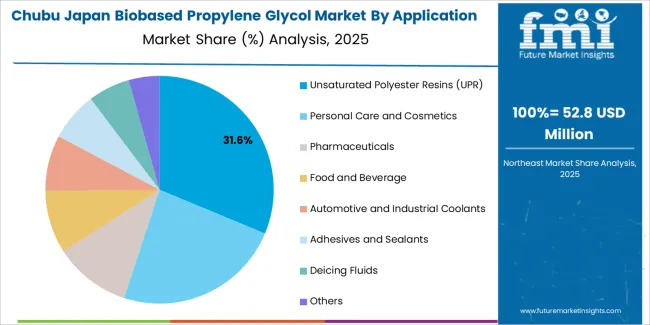

Unsaturated polyester resins (UPR) hold 30.6% of national demand and represent the leading application category. Biobased propylene glycol serves as a key intermediate for producing polymer structures used in construction materials, reinforced composites, and industrial components. Personal care and cosmetics account for 24.0%, relying on glycol for moisturising properties, solvent functions, and formulation stability. Pharmaceuticals represent 11.0%, followed by food and beverage at 9.0%, where glycols support safe solvent and humectant functions. Automotive and industrial coolants hold 8.0%, adhesives and sealants 7.0%, and deicing fluids 6.0%, with 4.4% allocated to other uses. Application distribution reflects functional demands, safety requirements, and renewable-content integration across Japanese industries.

Key drivers and attributes:

Growing ecofriendly focus among personal-care, food and industrial users is driving demand.

In Japan, demand for bio-based propylene glycol (PG) is increasing as brands and manufacturers look to meet corporate sustainability targets, reduce fossil-feedstock dependency and appeal to environmentally aware consumers. Personal-care and cosmetic products in Japan are placing greater emphasis on renewable ingredients and clean-label credentials, making bio-based PG an attractive option. Industrial users in coatings, adhesives and antifreeze applications are also showing interest in renewable glycol alternatives to support decarbonisation efforts and differentiate their supply chains.

Higher cost compared with petrochemicals, limited domestic production and slower feed-stock conversion are restraining faster adoption.

Bio-based propylene glycol typically commands a premium price compared with conventional petro-derived PG, which may limit its uptake in cost-sensitive applications or among smaller manufacturers. Japan’s conversion infrastructure for biomass-based PG remains at an early stage, which slows widespread local supply and increases reliance on imports or overseas production. Variability in availability of suitable biomass feedstocks and process scalability also affects commercial feasibility and may delay transition by formulators accustomed to established petro-PG sources.

Shift toward certified renewable-content grades, development of speciality-application bio-PG variants and strategic partnerships between biomass suppliers and chemical producers define key trends.

Suppliers in Japan are introducing bio-based propylene glycol grades with certified renewable-content labels that appeal to premium cosmetic and food-ingredient industries. There is growing development of high-purity bio-PG for applications such as pharmaceutical-grade solvents, high-performance antifreeze and specialty resins, which broadens the addressable industry. Strategic alliances between biomass processors, chemical manufacturers and downstream formulators are emerging to secure feed-stock supply, optimise conversion routes and localise production. These developments support gradual but steady growth in bio-based PG demand across Japanese industries.

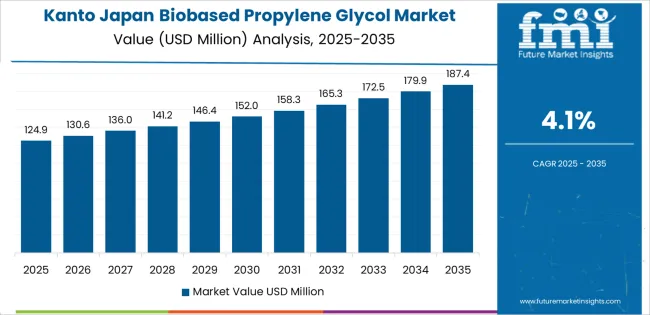

Demand for biobased propylene glycol in Japan is rising through 2035 as manufacturers across pharmaceuticals, personal care, food processing, and industrial chemicals transition toward renewable feedstocks. Facilities adopt biobased PG as a lower-carbon alternative to petroleum-derived glycol for formulations requiring humectancy, solvent performance, and thermal stability. Growth is reinforced by national decarbonization policies, rising interest in plant-derived inputs, and the expansion of ecofriendly product lines across consumer goods. End users in cosmetics, flavorings, heat-transfer systems, and resin production contribute to steady nationwide uptake. Regional variation reflects industrial density, regulatory engagement, and the maturity of chemical-processing networks. Kyushu & Okinawa leads with 4.5%, followed by Kanto (4.1%), Kinki (3.6%), Chubu (3.2%), Tohoku (2.8%), and the Rest of Japan (2.7%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.5% |

| Kanto | 4.1% |

| Kinki | 3.6% |

| Chubu | 3.2% |

| Tohoku | 2.8% |

| Rest of Japan | 2.7% |

Kyushu & Okinawa grows at 4.5% CAGR, supported by active food processing, cosmetics production, and pharmaceutical manufacturing across Fukuoka, Kumamoto, Oita, and Okinawa. Food manufacturers integrate biobased PG into flavorings, beverage extracts, and moisture-controlled formulations, strengthening its role as a clean-label humectant. Regional cosmetics companies adopt biobased PG for creams, gels, and topical products aligned with ecofriendly goals. Pharmaceutical facilities use it as a solvent and stabilizer in oral and topical formulations requiring consistent purity. Industrial users incorporate renewable PG into heat-transfer fluids and resin systems as part of decarbonization initiatives.

Kanto grows at 4.1% CAGR, driven by a dense concentration of personal-care manufacturers, large food processors, pharmaceutical firms, and diversified electronics production across Tokyo, Kanagawa, Saitama, and Chiba. Cosmetic brands use biobased PG in lotions, cleansers, and gels to expand plant-derived product lines. Food and beverage manufacturers rely on PG for emulsions, syrups, and flavor dispersions used in packaged and ready-to-drink products. Pharmaceutical companies apply biobased PG in drug-delivery systems requiring controlled consistency and purity. Electronics manufacturers use PG in thermal-management and precision-cleaning operations.

Kinki grows at 3.6% CAGR, supported by a diversified manufacturing base, established cosmetics industries, and active food-processing networks across Osaka, Kyoto, Hyogo, and Nara. Cosmetics producers expand sustainable product lines using biobased PG for moisturization stability, texture enhancement, and solvent performance in lotions and hair-care products. Food-processing companies use PG in flavor carriers, confectionery stabilizers, and controlled-moisture applications. Industrial facilities incorporate renewable PG into heat-transfer and cooling systems to support energy-efficiency programs. Research institutions evaluate biobased PG for polymer additives and eco-friendly resins.

Chubu grows at 3.2% CAGR, shaped by strong industrial clusters, automotive supply chains, and established food-processing operations across Aichi, Shizuoka, and Gifu. Automotive and equipment manufacturers use biobased PG in coolant fluids and heat-transfer systems aligned with corporate sustainability requirements. Food companies adopt PG in flavor bases, beverages, and moisture-stable snacks. Cosmetics producers incorporate PG into skin-care products tailored to clean-label positioning. Local institutions and public facilities adopt glycol-based thermal fluids for heating and cooling system upgrades.

Tohoku grows at 2.8% CAGR, supported by emerging interest in sustainable food processing, expansion of regional cosmetics manufacturing, and gradual modernization of industrial systems across Miyagi, Aomori, Iwate, and Akita. Food producers incorporate biobased PG into seasoning blends, beverage concentrates, and functional-food formulations. Local cosmetics companies adopt renewable PG for creams, lotions, and personal-care products aimed at regionally focused industries. Industrial facilities use glycol-based heat-transfer fluids during equipment upgrades. Universities and local innovation programs explore applications for biobased PG in regional manufacturing.

The Rest of Japan grows at 2.7% CAGR, shaped by small-scale cosmetics production, local food-processing firms, and increasing adoption of renewable ingredients in household and institutional applications. Manufacturers introduce simple, clean-label products using biobased PG as a humectant and stabilizer. Food processors use PG in extract stabilization, bakery moisture control, and flavor dispersions. Public facilities and mid-size commercial buildings adopt glycol-based thermal fluids during modernization projects. Online retail channels support broader distribution of PG-based cosmetics and functional beverages.

Demand for biobased propylene glycol in Japan is shaped by a concentrated group of renewable-chemistry suppliers supporting personal care, food processing, pharmaceuticals, heat-transfer fluids, and specialised industrial formulations. Cargill, Incorporated holds the leading position with an estimated 45.1% share, supported by controlled fermentation routes, consistent purity levels, and long-standing export relationships with Japanese formulators. Its position is reinforced by predictable performance in regulated applications and reliable supply aligned with renewable-content requirements.

Dow Inc. and BASF SE follow as significant participants. Dow provides renewable-sourced grades characterised by stable viscosity, dependable moisture-control behaviour, and compatibility with Japanese food-contact and cosmetic standards. BASF supplies biobased intermediates with controlled impurity levels and reliable thermal stability suited to personal-care and industrial applications requiring precise performance characteristics.

ADM (Archer Daniels Midland) maintains a presence through carbohydrate-derived PG with verifiable feedstock traceability and steady batch uniformity. LyondellBasell Industries contributes capability with renewable-content glycols designed for specialised chemical processes and industrial fluids requiring controlled volatility and stable functional behaviour.

Competition across this segment centres on purity consistency, feedstock verification, formulation compatibility, supply reliability, and performance under regulated conditions. Demand continues to grow as Japanese manufacturers increase adoption of renewable-origin chemical inputs, prioritise reduced environmental impact, and incorporate biobased PG into formulations requiring dependable quality across consumer, industrial, and food-grade applications.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Source | Corn-Based, Sugarcane-Based, Soy-Based, Others |

| Application | Unsaturated Polyester Resins (UPR), Personal Care and Cosmetics, Pharmaceuticals, Food and Beverage, Automotive and Industrial Coolants, Adhesives and Sealants, Deicing Fluids, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Cargill, Incorporated; Dow Inc.; BASF SE; ADM (Archer Daniels Midland); LyondellBasell Industries |

| Additional Attributes | Dollar sales by source type and application categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of biobased chemical producers; developments in renewable feedstock conversion, low-carbon propylene glycol production, and circular chemical pathways; integration with industrial resins, cosmetics formulations, pharmaceutical-grade glycols, food additives, coolant applications, and deicing solutions across Japan. |

The demand for biobased propylene glycol in japan is estimated to be valued at USD 258.4 million in 2025.

The market size for the biobased propylene glycol in japan is projected to reach USD 368.0 million by 2035.

The demand for biobased propylene glycol in japan is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in biobased propylene glycol in japan are corn-based, sugarcane-based, soy-based and others.

In terms of application, unsaturated polyester resins (upr) segment is expected to command 30.6% share in the biobased propylene glycol in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Propylene Glycol Methyl Ether Market

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Monopropylene Glycol Market

Mono Propylene Glycol Market Growth-Trends & Forecast 2025 to 2035

Demand for Biobased Biodegradable Plastic in Japan Size and Share Forecast Outlook 2025 to 2035

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Market Size and Share Forecast Outlook 2025 to 2035

Propylene Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Propylene Tetramer Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA