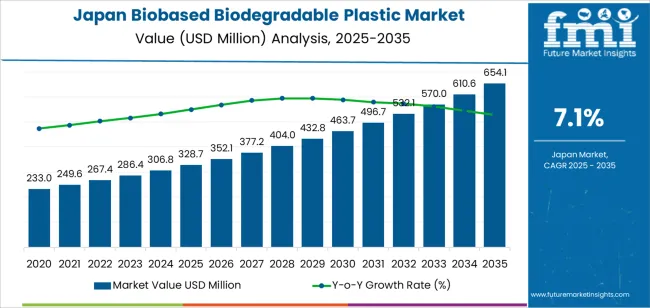

The demand for biobased biodegradable plastic in Japan is expected to grow from USD 328.7 million in 2025 to USD 654.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 7.1%. This growth is being fueled by the increasing adoption of biodegradable plastics across industries such as packaging, consumer goods, and agriculture, as companies seek more sustainable alternatives to traditional plastics. The rising environmental concerns and government regulations aimed at reducing plastic pollution are pushing the demand for biobased biodegradable plastics as a solution to these challenges.

Biobased biodegradable plastics are particularly gaining traction in the packaging sector, where companies are prioritizing eco-friendly solutions to minimize their environmental impact. As packaging waste continues to be a significant source of pollution, biobased plastics that decompose naturally offer an effective means of reducing the long-term environmental burden. Similarly, the agricultural industry is exploring biodegradable plastics for use in mulch films and other applications, further contributing to their demand.

Japan’s commitment to reducing plastic waste and its robust policy framework surrounding waste management will continue to drive the growth of biobased biodegradable plastics. As the technology behind these materials advances, making them more cost-competitive and scalable, their adoption will expand across even more sectors, providing a viable alternative to petroleum-based plastics. By 2035, the demand for biobased biodegradable plastics in Japan will play an essential role in the nation's ongoing efforts to tackle plastic waste and promote environmental responsibility.

Between 2025 and 2030, the biobased biodegradable plastics in Japan will increase from USD 0.8 billion to approximately USD 1.5 billion, adding USD 0.7 billion. This period will experience rapid growth, driven by the rise in consumer demand for environmentally friendly products and the increasing adoption of bioplastics by industries aiming to reduce their carbon footprint. The early growth phase will be characterized by the adoption of bioplastics in packaging solutions, particularly in the food and beverage sector, as well as increased awareness around the environmental impact of conventional plastics.

From 2030 to 2035, the demand for bioplastics is expected to accelerate, growing from USD 1.5 billion to USD 3.0 billion, adding USD 1.5 billion. This later phase will witness a sharp rise in bioplastics demand, driven by continued innovation in bioplastics technologies and greater adoption across multiple industries. The growing regulatory pressure on plastic waste and the expanding consumer preference for sustainable products will fuel this surge. As bioplastics technologies become more viable and cost-effective, their application will spread beyond packaging into automotive parts, electronics, and other sectors.

| Metric | Value |

|---|---|

| Demand for Biobased Biodegradable Plastic in Japan Value (2025) | USD 328.7 million |

| Demand for Biobased Biodegradable Plastic in Japan Forecast Value (2035) | USD 654.1 million |

| Demand for Biobased Biodegradable Plastic in Japan Forecast CAGR (2025 to 2035) | 7.1% |

The demand for biobased biodegradable plastic in Japan is growing as both businesses and consumers prioritize environmental sustainability. Biobased biodegradable plastics, which are derived from renewable resources and designed to break down more easily than traditional plastics, are seen as a key solution to reduce plastic pollution and environmental harm. Japan’s commitment to sustainability, along with growing consumer awareness of environmental issues, is driving this demand.

Government regulations and corporate sustainability targets are playing a significant role in accelerating the adoption of biobased biodegradable plastics. With Japan’s strict waste management laws and an emphasis on reducing plastic waste, industries are turning to biodegradable alternatives for packaging and single-use items. These plastics are particularly popular in industries like food packaging, retail, and consumer goods, where the shift toward eco-friendly materials are becoming essential for compliance with environmental regulations and meeting consumer expectations.

The increasing trend towards a circular economy, combined with advancements in material science and production processes, is making biobased biodegradable plastics more cost-effective and accessible. As the technology continues to evolve and production scalability improves, these plastics are becoming more competitive with traditional petroleum-based plastics. As consumer demand for sustainable products rises and environmental regulations tighten, the demand for biobased biodegradable plastics in Japan is expected to continue growing steadily through 2035

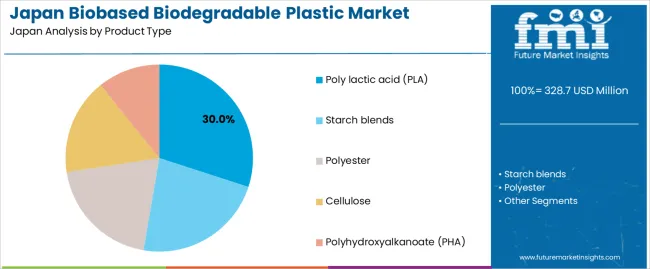

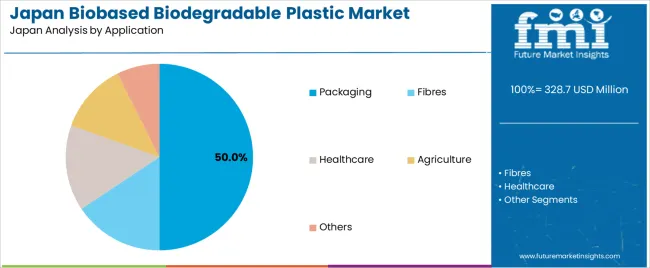

Demand for biobased biodegradable plastic in Japan is segmented by product type and application. By product type, demand is divided into poly lactic acid (PLA), starch blends, polyester, cellulose, and polyhydroxyalkanoate (PHA), with PLA holding the largest share at 30%. The demand is also segmented by application, including packaging, fibres, healthcare, agriculture, and others, with packaging leading the demand at 50.0%. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Poly lactic acid (PLA) accounts for 30% of the demand for biobased biodegradable plastic in Japan. PLA is widely used due to its renewable, compostable, and biodegradable properties, making it a popular choice for applications where environmental sustainability is a key concern. PLA is derived from renewable resources like corn starch or sugarcane and is used in products such as packaging materials, disposable cutlery, and food containers. Its widespread use in the packaging industry, in particular, is driven by the growing consumer preference for sustainable, eco-friendly alternatives to conventional plastics. As consumer demand for environmentally responsible products increases, PLA will likely continue to lead the demand for biobased biodegradable plastic in Japan.

Packaging accounts for 50% of the demand for biobased biodegradable plastic in Japan. The demand is driven by the increasing need for sustainable and environmentally friendly packaging solutions. As awareness about plastic waste and environmental impact grows, both consumers and businesses are increasingly turning to biobased biodegradable plastics, such as PLA, for packaging applications. These plastics are compostable and biodegradable, making them an attractive alternative to conventional petroleum-based plastics, which contribute to pollution. The demand for sustainable packaging is further supported by regulatory pressures and consumer preferences for eco-conscious products. The packaging industry, particularly for food and beverage packaging, will continue to be the dominant application for biobased biodegradable plastics as Japan works to reduce its environmental footprint.

Bio‑based biodegradable plastics combine renewable biomass feedstocks and biodegradability (i.e., polymer breakdown in natural environments) offering reduced fossil‑resource dependence and improved end‑of‑life behaviour. Key drivers include national policy targets such as the introduction of about 2 million tons of bio‑based plastics by 2030, stronger regulation on single‑use plastics, and growing corporate and consumer interest in eco‑friendly design. Restraints include higher costs compared to conventional plastics, limited domestic production capacity for bio‑based biodegradable grades, availability and reliability of sustainable biomass feedstocks.

Why is Demand for Biobased Biodegradable Plastics Growing in Japan?

In Japan, demand is growing because companies in packaging, agriculture, disposable goods and consumer products are seeking materials that meet both resource‑circulation and product‑end‑life imperatives. The promotion of the “Resource Circulation Strategy for Plastics” and the roadmap for bioplastics signal strong government support, which encourages upstream investment and downstream sourcing. Consumer awareness of plastic waste, marine litter and carbon‑footprint issues has risen, prompting brands to adopt materials with renewable origin and degradability. Bio‑based biodegradable plastics provide differentiation and allow firms to align with circular‑economy messaging, leading to adoption in applications like compostable bags, single‑use items, mulch films and food‑service disposables.

How are Technological Innovations Driving Growth of Biobased Biodegradable Plastics in Japan?

Technological innovation in Japan is enabling broader use of bio‑based biodegradable plastics by improving material performance, scaling production and enhancing compatibility with existing processing systems. Innovations include the development of polylactic acid (PLA) and polyhydroxyalkanoate (PHA) grades with improved mechanical and thermal properties, processing methods suited for manufacturing and composting‑compatible films, and bio‑naphtha derived from sustainable sources that feed into biomass‑based polymer production. The increasing availability of bio‑based polyethylene (PE) shopping bags and other high‑volume items also demonstrates progress toward commercialisation. These technological advances reduce the performance gap with conventional plastics and make the business case more compelling for Japanese manufacturers.

What are the Key Challenges Limiting Adoption of Biobased Biodegradable Plastics in Japan?

Despite growing interest, adoption of bio‑based biodegradable plastics in Japan faces several significant hurdles. A major challenge is cost competitiveness: unit prices for biodegradable or bio‑based grades remain substantially higher than fossil‑based equivalents, posing a barrier for cost‑sensitive applications. Another issue is supply chain and feedstock constraints scaling sustainable biomass, ensuring traceability, and avoiding food‑vs‑feed competition remain concerns. Japan’s infrastructure for composting, biodegradation and post‑use collection is not yet fully developed, limiting the effectiveness of degradable products in real‑world systems. Finally, for some applications high‑end performance (e.g., high‑temperature durability) is still behind conventional plastics, restricting substitution in certain niches.

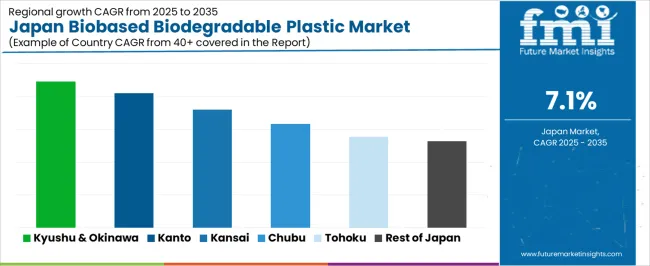

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 18.1% |

| Kanto | 16.6% |

| Kinki | 14.6% |

| Chubu | 12.9% |

| Tohoku | 11.3% |

| Rest of Japan | 10.7% |

The demand for bioplastics in Japan is growing rapidly across all regions, with Kyushu & Okinawa leading at an impressive 18.1% CAGR. This growth is driven by the increasing adoption of sustainable materials in manufacturing and packaging industries. Kanto follows with a 16.6% CAGR, fueled by the region's strong focus on innovation and environmental initiatives. Kinki shows a 14.6% CAGR, supported by its significant manufacturing sector. Chubu experiences a 12.9% CAGR, influenced by the region's expanding industrial base. Tohoku and the Rest of Japan show steady growth at 11.3% and 10.7%, respectively, driven by the shift toward environmentally friendly materials and increasing consumer demand for green products.

Kyushu & Okinawa is experiencing the highest demand for bioplastics in Japan, with an 18.1% CAGR. This can be attributed to the region’s commitment to sustainability and the increasing use of bioplastics in packaging and manufacturing. Kyushu, particularly in cities like Fukuoka, is home to a growing number of companies focused on adopting eco-friendly solutions, including bioplastics, in their production processes.

Okinawa’s tourism industry and focus on green initiatives have also played a role in boosting the demand for sustainable materials. As environmental concerns continue to rise, businesses in Kyushu & Okinawa are embracing bioplastics as an alternative to traditional plastics. The region’s focus on creating a circular economy, where waste is minimized, supports the adoption of biodegradable and renewable materials, driving growth in the bioplastics industry. As the region becomes a leader in sustainability efforts, the demand for bioplastics will continue to grow rapidly.

Kanto is experiencing strong growth in demand for bioplastics, with a 16.6% CAGR. This growth is largely driven by the region’s focus on environmental sustainability and innovation, particularly in industries like packaging, automotive, and consumer goods. Tokyo, as a major hub for tech and environmental innovation, has become a focal point for the development and use of bioplastics in packaging and products that align with sustainability goals.

The Kanto region’s government initiatives, such as promoting eco-friendly packaging and waste reduction, have also accelerated the adoption of bioplastics. As businesses in the region increasingly prioritize sustainable production and packaging solutions, bioplastics are becoming a popular choice due to their renewable and biodegradable properties. With a strong consumer demand for eco-conscious products and ongoing investments in green technologies, the region is set to continue driving the growth of bioplastics in Japan.

Kinki is seeing steady demand growth for bioplastics, with a 14.6% CAGR. The region’s industrial and manufacturing sectors, particularly in cities like Osaka and Kyoto, are key drivers behind this trend. As Japan’s second-largest manufacturing hub, Kinki is home to numerous industries that are increasingly adopting bioplastics for packaging, automotive, and product components to align with sustainable practices.

The region’s growing emphasis on eco-friendly materials, coupled with its active research and development in bioplastics, is supporting this growth. The increasing consumer demand for environmentally conscious products and the region’s focus on reducing plastic waste are driving the transition toward bioplastics. As more businesses and manufacturers in Kinki adopt these materials to meet environmental regulations and consumer expectations, the demand for bioplastics will continue to rise steadily.

Chubu is experiencing moderate growth in demand for bioplastics, with a 12.9% CAGR. The region’s industrial base, particularly in Nagoya, is contributing to the rise in bioplastics adoption, as companies in the automotive, electronics, and packaging sectors explore renewable and biodegradable alternatives to conventional plastics.

Chubu’s growing interest in environmental sustainability, coupled with the increasing focus on reducing plastic waste in manufacturing and product packaging, is driving demand for bioplastics. The region’s active participation in the development of green technologies, as well as its growing consumer awareness of sustainability issues, supports this growth. As more industries in Chubu invest in eco-friendly solutions, the use of bioplastics will continue to expand, although at a slightly slower pace compared to more urbanized regions like Kyushu & Okinawa and Kanto.

Tohoku is seeing steady growth in demand for bioplastics, with an 11.3% CAGR. This is driven by the region’s increasing focus on environmental sustainability and the growing interest in renewable materials. As Tohoku continues to modernize its industries and adopt eco-friendlier practices, bioplastics are becoming an attractive alternative to traditional plastics.

The region’s agricultural and manufacturing sectors are beginning to explore the use of bioplastics for packaging, products, and materials that align with sustainability goals. As consumer preferences shift toward eco-conscious products and the region invests in green technologies, the demand for bioplastics is expected to grow steadily. Although Tohoku’s adoption rate is slower compared to other regions, its focus on reducing plastic waste and supporting environmentally friendly practices ensures that bioplastics will continue to play an increasing role in the region’s industrial development.

The Rest of Japan is experiencing steady growth in demand for bioplastics, with a 10.7% CAGR. While the growth rate is slower compared to more urbanized regions, there is increasing interest in bioplastics, particularly in rural areas and smaller towns, where the adoption of sustainable materials is growing. The Rest of Japan’s focus on improving waste management and reducing environmental impact is contributing to the rising demand for bioplastics.

As access to bioplastic products improves and more local manufacturers explore sustainable alternatives, the demand for these materials will continue to rise. With a growing consumer base that values eco-friendly products and the increasing availability of bioplastics in the industry, the Rest of Japan is poised to experience moderate but steady growth in the adoption of bioplastics, especially as businesses and industries align with national sustainability goals.

The demand for bio‑based biodegradable plastics in Japan is gaining momentum, driven by the nation’s commitment to reducing plastic waste and achieving a circular economy under its “Resource Circulation Strategy for Plastics.” Japanese manufacturers across packaging, agriculture, and specialty materials are increasingly adopting plastics derived from renewable biomass that also offer biodegradability, aligning with regulatory and consumer pressures for more sustainable materials.

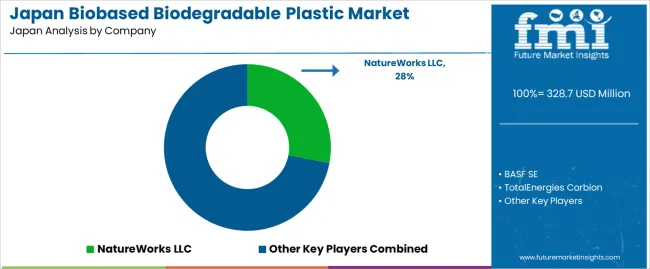

In the Japanese industry, NatureWorks LLC holds a strong position with an estimated 28.0% share, reflecting its leadership in supplying polylactic acid (PLA) and other bio‑based biodegradable resins into Japan’s supply chain. Other notable suppliers include BASF SE, TotalEnergies Corbion, Novamont S.p.A., and Mitsubishi Chemical Group Corporation, each offering technologies or resin grades tailored to Japan’s evolving sustainability requirements and infrastructure.

Key growth drivers include the regulatory push toward renewable‑resource plastics, initiatives aimed at reducing single‑use fossil‑derived plastics, and increased consumer demand for “eco‑friendly” packaging solutions. Applications such as compostable bags, agricultural mulch films, and food packaging demonstrate strong uptake, especially as Japanese companies seek to meet corporate sustainability goals. Challenges remain, such as higher cost compared with conventional plastics, limited domestic manufacturing scale, and infrastructure constraints for biodegradation and recycling. Nonetheless, the outlook for demand in Japan is positive, with rising adoption of bio‑based biodegradable plastics expected to continue as material technologies mature and sustainability mandates deepen.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product Type | Poly lactic acid (PLA), Starch blends, Polyester, Cellulose, Polyhydroxyalkanoate (PHA) |

| Applications | Packaging, Fibres, Healthcare, Agriculture, Others |

| Key Players Profiled | NatureWorks LLC, BASF SE, TotalEnergies Corbion, Novamont S.p.A, Mitsubishi Chemical Group Corporation |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Additional Attributes | Dollar sales by product type, application, and regional trends focusing on packaging, agriculture, and healthcare sectors |

The global demand for biobased biodegradable plastic in japan is estimated to be valued at USD 328.7 million in 2025.

The market size for the demand for biobased biodegradable plastic in japan is projected to reach USD 654.1 million by 2035.

The demand for biobased biodegradable plastic in japan is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in demand for biobased biodegradable plastic in japan are poly lactic acid (pla), starch blends, polyester, cellulose and polyhydroxyalkanoate (pha).

In terms of application, packaging segment to command 50.0% share in the demand for biobased biodegradable plastic in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA