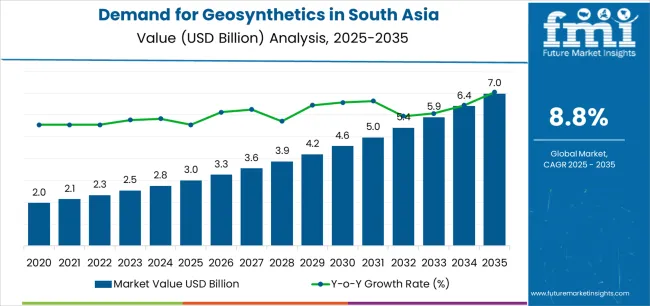

The demand for geosynthetics in South Asia is projected to grow from USD 3 billion in 2025 to approximately USD 7 billion by 2035, representing an absolute increase of USD 4.1 billion over the forecast period. This translates to a total growth of 136.7%, with demand forecasted to expand at a compound annual growth rate (CAGR) of 8.8% between 2025 and 2035.

As per Future Market Insights (FMI)’s chemicals outlook, widely referenced across process manufacturing studies, overall sales are expected to grow by nearly 2.37X during the same period, supported by rising infrastructure development activities, increasing adoption of sustainable construction practices, and growing demand for efficient soil stabilization and drainage solutions across highway, railway, and environmental protection applications. South Asia, led by India, Indonesia, and Vietnam, continues to demonstrate strong growth potential, driven by government infrastructure programs, accelerated urbanization, and environmental compliance requirements.

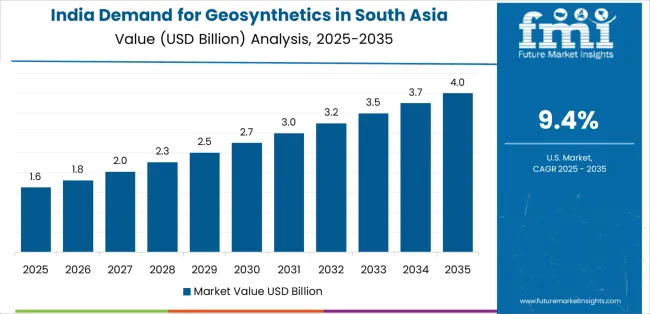

Between 2025 and 2030, South Asia geosynthetics demand is projected to expand from USD 3 billion to USD 4.7 billion, resulting in a value increase of USD 1.7 billion, which represents 41.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising infrastructure development activities globally, particularly across South Asia where government-backed highway programs and urbanization initiatives are accelerating geosynthetics adoption. Increasing mechanization of road construction and growing adoption of nonwoven geotextile filtration systems continue to drive demand. Material suppliers are expanding their production capabilities to address the growing complexity of modern infrastructure projects and environmental protection requirements, with Indian and Southeast Asian manufacturing operations leading capacity expansion investments.

From 2030 to 2035, demand is forecast to grow from USD 4.7 billion to USD 7 billion, adding another USD 2.4 billion, which constitutes 58.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced geocomposite drainage systems, the integration of bio-based and recycled material technologies, and the development of standardized installation protocols across different infrastructure applications. The growing adoption of sustainable construction practices and climate resilience initiatives, particularly in India, Indonesia, and coastal Southeast Asian nations, will drive demand for more sophisticated geosynthetic materials and specialized engineering capabilities.

Between 2020 and 2025, South Asia geosynthetics demand experienced steady expansion from USD 2 billion to USD 3 billion, driven by increasing infrastructure development activities in highway and railway construction and growing awareness of geosynthetic benefits for soil stabilization and drainage efficiency. The sector developed as infrastructure projects, especially in India and Indonesia, recognized the need for specialized geosynthetic materials and advanced installation technologies to improve structural performance while meeting environmental and cost-efficiency objectives. Construction companies and engineering consultants began emphasizing proper material selection and installation quality to maintain project durability and regulatory compliance.

| Metric | Value |

|---|---|

| South Asia Geosynthetics Sales Value (2025) | USD 3 billion |

| South Asia Geosynthetics Forecast Value (2035) | USD 7 billion |

| South Asia Geosynthetics Forecast CAGR (2025-2035) | 8.8% |

Demand expansion is being supported by the rapid increase in infrastructure development activities worldwide, with South Asia maintaining its position as a high-growth and infrastructure investment region, and the corresponding need for specialized geosynthetic materials for road construction, environmental protection, and hydraulic engineering activities. Modern infrastructure projects rely on advanced geosynthetic materials to ensure efficient load distribution, proper drainage management, and optimal structural longevity. Infrastructure development requires comprehensive geosynthetic systems including geotextiles for separation and filtration, geomembranes for barrier applications, geogrids for reinforcement, and geocomposites for drainage to maintain construction quality and operational performance.

The growing complexity of infrastructure projects and increasing environmental regulations, particularly stringent requirements in India and Indonesia, are driving demand for advanced geosynthetic materials from certified manufacturers with appropriate technical specifications and engineering support capabilities. Construction companies are increasingly investing in nonwoven and woven geotextile technologies to improve soil stabilization performance, reduce construction costs, and enhance project sustainability in challenging geological conditions. Regulatory requirements and project specifications are establishing standardized material selection procedures that require specialized engineering capabilities and quality assurance protocols, with Indian and Indonesian infrastructure programs often setting benchmark standards for regional construction practices.

The South Asia geosynthetics sector represents a diversified yet infrastructure-focused opportunity driven by expanding government highway programs, environmental protection requirements, and advanced drainage system demand for superior construction performance. As infrastructure developers worldwide seek to achieve cost-efficient positioning, enhanced structural durability, and environmental compliance credentials, geosynthetics are evolving from niche construction materials to strategic infrastructure components that ensure project differentiation and regulatory compliance.

The convergence of infrastructure program acceleration, environmental regulation awareness, and construction technology innovation creates sustained demand drivers across multiple application segments. The sector's growth trajectory from USD 3 billion in 2025 to USD 7 billion by 2035 at an 8.8% CAGR reflects fundamental shifts in infrastructure construction requirements and material optimization.

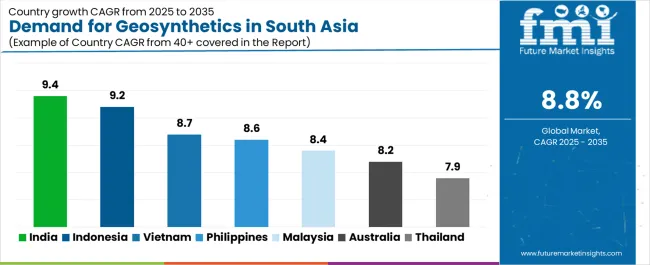

Geographic expansion opportunities are particularly pronounced in South Asian countries, where India (9.4% CAGR) leads through aggressive highway expansion programs under Bharatmala and railway modernization development. The dominance of geotextiles product type (34% share) and road construction application (42% share) provides clear strategic focus areas, while emerging geocomposite drainage systems and bio-based material applications open new revenue streams across diverse infrastructure operations.

Strengthening the dominant geotextiles segment (34% share) through enhanced nonwoven geotextile filtration optimization, superior woven geotextile reinforcement technologies, and comprehensive installation quality certifications. This pathway focuses on optimizing fiber bonding for improved permeability performance and developing high-strength woven systems for highway embankment applications. Product leadership consolidation through infrastructure developer partnerships, technical service systems, and project specification approvals enables premium positioning while expanding penetration across road construction and railway applications. Expected revenue pool: USD 140-210 million

Rapid growth across India (9.4% CAGR) creates expansion opportunities through comprehensive Bharatmala program participation and integrated railway modernization project supply. Highway expansion and rail corridor development strategies reduce import dependency, enable faster project deployment, and position companies advantageously for government infrastructure programs while accessing growing segments requiring nonwoven geotextile filtration and woven geotextile reinforcement systems. Expected revenue pool: USD 120-190 million

Expansion within the dominant road construction segment (42% share) through specialized geogrid reinforcement systems addressing highway subgrade needs and geotextile separation solutions for pavement longevity. This pathway encompasses soil stabilization optimization, drainage management certification, and compatibility with diverse geological conditions, enabling integration with advanced highway construction technologies and railway subgrade systems. Expected revenue pool: USD 110-170 million

Strategic expansion into polypropylene material applications (36% share) requires specialized fiber extrusion and quality systems addressing cost-effectiveness and UV stability requirements. This pathway addresses manufacturing efficiency enhancement, raw material supply optimization, and technical performance documentation, creating opportunities for long-term supply agreements and co-development partnerships with infrastructure developers and construction contractors. Expected revenue pool: USD 95-150 million

Development of optimized reinforcement function technology (33% share) addressing MSE structure requirements and embankment stability enhancement. This pathway encompasses geogrid tensile strength optimization, creep resistance improvement, and installation efficiency advancement. Technology differentiation through load-bearing certification and long-term performance validation enables diversified revenue streams while expanding addressable opportunities in challenging terrain segments. Expected revenue pool: USD 85-135 million

Integration into geocomposite drainage systems (12% product share) including prefabricated drainage solutions, composite filtration-reinforcement products, and integrated barrier-protection systems. This pathway encompasses installation efficiency optimization, multi-function performance enhancement, and technical support capability development. Product positioning through system certification and demonstrated cost-time savings creates opportunities for major infrastructure partnerships replacing conventional single-function geosynthetic materials. Expected revenue pool: USD 70-115 million

Expansion within environmental protection application segment (18% share) addressing coastal erosion control requirements, landfill containment needs, and water resource protection mandates. This pathway encompasses geotextile mattress technology for shoreline stabilization, geomembrane liner systems for waste containment, and erosion control geocomposites for slope protection, enabling access to climate resilience infrastructure funding and environmental compliance programs. Expected revenue pool: USD 60-105 million

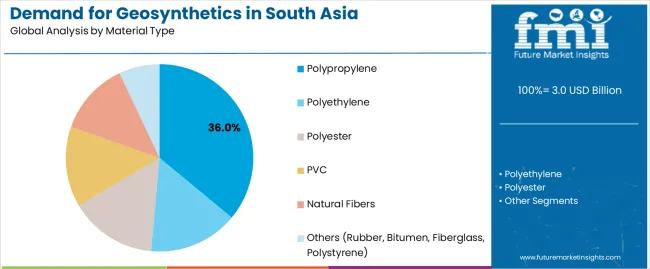

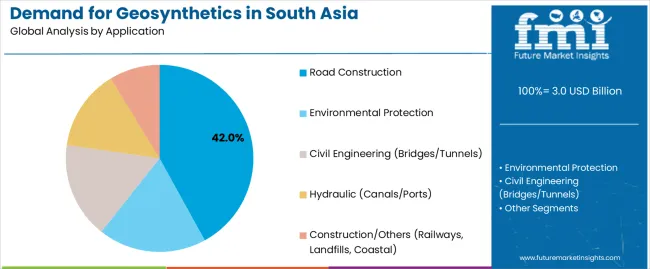

Demand is segmented by product type, application, material type, primary function, and region. By product type, sales are divided into geotextiles (nonwoven, woven), geomembranes, geogrids, geocomposites, and others (geonets, geocells, geosynthetic clay liners, geofoam). Based on application, demand is categorized into road construction, environmental protection, civil engineering (bridges/tunnels), hydraulic (canals/ports), and construction/others (railways, landfills, coastal). In terms of material type, sales are segmented into polypropylene, polyethylene, polyester, PVC, natural fibers, and others (rubber, bitumen, fiberglass, polystyrene). By primary function, demand is divided into reinforcement, stabilization, drainage, filtration, separation, barrier & protection, and erosion control. Regionally, demand is concentrated in India, Indonesia, Vietnam, Philippines, Malaysia, Australia, and Thailand, with India representing a key growth and infrastructure leadership hub for geosynthetic material technologies.

Geotextiles are projected to account for 34% of South Asia geosynthetics demand in 2025, making them the leading product type across the sector. This dominance reflects the critical importance of soil separation, filtration, and drainage functions in infrastructure projects, where geotextiles prevent soil intermixing and ensure proper water management throughout the structure's lifespan. In South Asia, government infrastructure programs mandate comprehensive geotextile specifications for highway and railway projects, ensuring widespread adoption of both nonwoven (22% sub-share) and woven (12% sub-share) geotextile materials across road construction and civil engineering applications. Continuous innovations are improving the permeability characteristics of nonwoven geotextiles, tensile strength of woven geotextiles, and cost-effectiveness of installation methods, enabling infrastructure developers to maintain project quality while optimizing construction budgets. Advancements in polypropylene and polyester fiber technologies are enhancing durability and chemical resistance by minimizing degradation under harsh environmental conditions. The segment's strong position is reinforced by the rising scale and complexity of infrastructure projects, which require increasingly sophisticated geotextile specifications for diverse soil conditions and drainage requirements.

Road construction is expected to represent 42% of South Asia geosynthetics demand in 2025, highlighting its critical role as the dominant application segment. Large-scale highway development programs, particularly in India and Indonesia, rely extensively on geosynthetic materials to achieve proper subgrade reinforcement, effective drainage management, and long-term pavement performance. The segment is fueled by increasing government capital investments into transportation infrastructure, with road construction projects prioritizing advanced geosynthetic materials that integrate soil stabilization, load distribution, and moisture control functions. In South Asia, leading infrastructure programs such as India's Bharatmala Pariyojana and Indonesia's Trans-Java highway expansion are driving early adoption of comprehensive geotextile and geogrid systems to reduce construction time, enhance structural durability, and improve cost efficiency. Such strategies not only enhance project performance but also ensure compliance with evolving environmental and construction quality standards.

Polypropylene is projected to contribute 36% of demand in 2025, making it the single largest material type segment for geosynthetics. The polypropylene segment requires specialized manufacturing systems including fiber extrusion, thermal bonding, and weaving technologies to produce nonwoven geotextiles, woven geotextiles, and geomembrane barrier systems. In South Asia and Asia Pacific, polypropylene remains a significant component of geosynthetic material composition, sustaining steady demand for manufacturing capacity even amid long-term material diversification toward polyester and bio-based alternatives. Advanced geosynthetic manufacturing facilities rely heavily on polypropylene processing systems that integrate fiber production, material stabilization, and quality control technologies to maintain consistent product specifications. The segment also benefits from cost-backed material selection initiatives in South Asia and ongoing demand from developing infrastructure projects requiring affordable yet durable geosynthetic solutions. In South Asia, while polyester and recycled material adoption may accelerate, polypropylene demand is sustained by manufacturing efficiency, material availability, and the need for reliable UV-stabilized materials in existing production systems.

South Asia geosynthetics demand is advancing steadily due to increasing infrastructure development activities and growing recognition of geosynthetic material benefits for cost reduction and performance enhancement, with India and Indonesia serving as key drivers of regional adoption and technical innovation. The sector faces challenges including installation quality variability, need for technical expertise and proper material selection, and varying project specifications across different infrastructure applications and geological conditions. Sustainable material initiatives and advanced geocomposite systems, particularly gaining momentum in Indian and Australian infrastructure projects, continue to influence material specifications and installation practices.

The growing implementation of government infrastructure programs, gaining particular momentum in India, Indonesia, and Vietnam, is enabling widespread adoption of advanced geosynthetic materials across highway, railway, and hydraulic engineering projects, providing performance enhancement and construction cost optimization. Infrastructure programs equipped with comprehensive material specifications offer engineering support and quality assurance protocols while allowing construction companies to access proven geosynthetic technologies based on project requirements and geological conditions. These initiatives are particularly valuable for large-scale highway corridors and urban infrastructure developments that require consistent material performance across extended project durations and diverse environmental conditions.

Modern geosynthetic manufacturers, led by European and Indian innovators, are incorporating advanced geocomposite systems and prefabricated drainage solutions that improve installation efficiency, reduce construction time, and enhance long-term performance. Integration of geotextile-geogrid composites, drainage geocomposites, and barrier-protection systems enables more comprehensive infrastructure solutions and improved project value delivery. Advanced geosynthetic systems also support next-generation infrastructure projects including climate-resilient coastal protection, sustainable landfill containment, and advanced erosion control systems that address environmental challenges while optimizing material utilization, with Indian and Southeast Asian infrastructure developments increasingly adopting these integrated technologies to meet sustainability and performance objectives.

| Country | CAGR (2025-2035) |

|---|---|

| India | 9.4% |

| Indonesia | 9.2% |

| Vietnam | 8.7% |

| Philippines | 8.6% |

| Malaysia | 8.4% |

| Australia | 8.2% |

| Thailand | 7.9% |

The South Asia geosynthetics sector is witnessing robust growth, supported by rising infrastructure development activities, environmental protection requirements, and the integration of advanced geosynthetic materials across construction operations. India leads the region with a 9.4% CAGR, reflecting strong investments in highway modernization through Bharatmala programs, rail infrastructure expansion, and landfill development initiatives that enhance operational efficiency and environmental compliance. Indonesia follows with a 9.2% CAGR, driven by the ambitious Nusantara capital construction project, port and coastal defense infrastructure, and seismic reinforcement requirements that demand advanced geosynthetic solutions. Vietnam grows at 8.7%, as coastal erosion control programs, expressway development, and industrial park drainage systems increasingly adopt modern geosynthetic technologies to improve infrastructure performance and reduce construction costs.

Demand for geosynthetics in India is projected to exhibit the strongest growth in South Asia with a CAGR of 9.4% through 2035, driven by ongoing highway construction under Bharatmala Pariyojana, railway modernization initiatives including dedicated freight corridors, and expanding landfill containment requirements across urban centers. As the regional growth leader, the country's emphasis on infrastructure quality standards and environmental compliance is creating significant demand for advanced geotextile materials with enhanced separation, filtration, and reinforcement capabilities throughout highway and railway projects across India. Major infrastructure developers and material suppliers are establishing comprehensive distribution networks and technical support systems to support quality improvement and material performance optimization across Indian construction activities.

Demand for geosynthetics in Indonesia is expanding at a CAGR of 9.2%, supported by the transformational Nusantara capital city construction project requiring extensive earthworks and drainage infrastructure, extensive port and coastal defense infrastructure development addressing maritime trade growth, and seismic reinforcement requirements across earthquake-prone regions throughout the archipelago. The country's infrastructure sector, representing a crucial component of Southeast Asian construction activities, is increasingly adopting advanced geosynthetic technologies including geomembranes for water containment systems, geogrids for soil reinforcement in weak foundation areas, and geotextiles for coastal protection applications along vulnerable shorelines. Material suppliers and construction contractors are implementing comprehensive geosynthetic deployment strategies to serve expanding infrastructure activities throughout Indonesia and broader Southeast Asia.

Demand for geosynthetics in Vietnam is growing at a CAGR of 8.7%, driven by comprehensive coastal erosion control programs addressing climate change impacts along extensive coastlines, expressway network expansion connecting major economic centers, and industrial park drainage infrastructure requirements supporting manufacturing sector growth. The country's construction sector is integrating modern geosynthetic technologies to improve infrastructure durability, manage water drainage effectively, and protect coastal assets from environmental degradation and typhoon impacts. Infrastructure developers and material distributors are investing in geosynthetic supply networks and technical training programs to address growing construction requirements and align with regional infrastructure quality standards.

Demand for geosynthetics in the Philippines is projected to grow at a CAGR of 8.6%, supported by expanding flood control and landslide mitigation initiatives addressing climate resilience requirements, infrastructure development under the Build Better More program focusing on highways and bridges, and urban drainage system upgrades in metropolitan areas. The country's geosynthetic adoption is accelerating as infrastructure projects recognize the value of advanced materials for slope stabilization in mountainous terrain, flood protection in low-lying urban areas, and structural reinforcement for earthquake-resistant construction. Construction companies and government agencies are gradually implementing comprehensive geosynthetic specifications to serve disaster risk reduction priorities throughout the Philippines.

Demand for geosynthetics in Malaysia is advancing at a CAGR of 8.4%, driven by flood mitigation infrastructure addressing recurring urban flooding challenges, palm oil industry waste containment systems requiring geomembrane liners for environmental protection, and mass rapid transit (MRT) construction projects requiring advanced ground improvement technologies. The country's infrastructure sector is integrating geosynthetic solutions across diverse applications from agricultural waste management to urban transportation systems, demonstrating the versatility of geosynthetic materials in addressing Malaysia's development priorities. Material suppliers and engineering consultants are establishing technical support capabilities to serve Malaysia's sophisticated infrastructure requirements.

Demand for geosynthetics in Australia is expanding at a CAGR of 8.2%, supported by mining tailings storage facility construction and closure activities requiring comprehensive geomembrane containment systems, coastal protection infrastructure addressing erosion and sea level rise impacts, and disaster recovery programs following flooding and bushfire events. The country's geosynthetic adoption emphasizes high-performance materials meeting stringent environmental regulations and long-term durability requirements across harsh climatic conditions. Material suppliers are providing advanced technical support and quality assurance systems to serve Australia's demanding infrastructure and environmental protection standards.

Demand for geosynthetics in Thailand is growing at a CAGR of 7.9%, driven by highway rehabilitation programs addressing aging road infrastructure, industrial estate development requiring comprehensive drainage and soil stabilization solutions, and canal system upgrades supporting agricultural irrigation and flood management objectives. The country's infrastructure sector is gradually integrating modern geosynthetic technologies to improve project performance and extend infrastructure service life across diverse applications. Construction contractors and material distributors are expanding geosynthetic supply capabilities to serve Thailand's infrastructure modernization requirements.

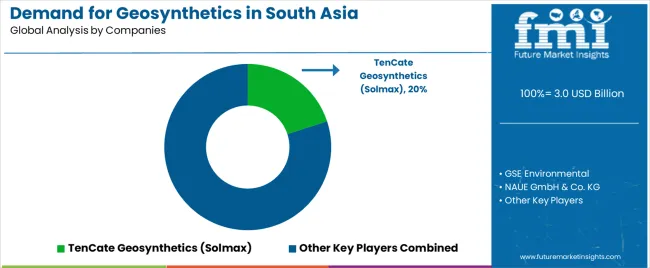

South Asia geosynthetics demand is defined by competition among specialized material manufacturers, regional production facilities, and international technology providers, with European and Indian manufacturers maintaining significant regional influence. Manufacturers are investing in advanced production technologies, regional manufacturing capacity expansion, quality assurance systems, and comprehensive technical support networks to deliver reliable, cost-effective, and performance-optimized geosynthetic solutions across South Asia and Asia Pacific operations. Strategic partnerships, local manufacturing investments, and technical innovation are central to strengthening product portfolios and presence across India and Southeast Asian infrastructure developments.

TenCate Geosynthetics (Solmax), operating globally from Netherlands with significant Asian manufacturing presence including a new facility in Malaysia announced in Q2 2024, offers comprehensive geosynthetic solutions including geotextiles, geomembranes, and geogrids with focus on innovation, quality consistency, and application engineering support across South Asian and global operations. GSE Environmental, United States-based with international production network, provides advanced geomembrane containment systems and environmental protection solutions with emphasis on barrier performance and installation reliability across mining, waste management, and water containment applications. NAUE GmbH & Co. KG, Germany, delivers technologically advanced geosynthetic materials including geocomposites and drainage systems, recently supplying base-sealing geosynthetics for the Matrimandir artificial rainwater lake project in India (September 2024), demonstrating technical capabilities in specialized water management applications. Fibertex Nonwovens, Denmark, emphasizes comprehensive nonwoven geotextile solutions with integrated technical support for diverse infrastructure applications across global operations.

Garware Technical Fibres, India-based and a regional industry leader, offers specialized geosynthetic products with focus on cost-effectiveness, local manufacturing advantages, and regional technical support across South Asian infrastructure developments, recently signing a deal to acquire Offshore & Trawl Supply (OTS) to expand in Europe (July 2025). Material manufacturers are establishing comprehensive distribution networks throughout South Asia, developing application-specific product lines addressing regional requirements, and integrating advanced quality control technologies to meet evolving infrastructure project specifications and environmental regulations across Indian, Indonesian, and Southeast Asian geosynthetic operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 7 billion |

| Product Type | Geotextiles (nonwoven, woven), geomembranes, geogrids, geocomposites, others (geonets, geocells, geosynthetic clay liners, geofoam) |

| Application | Road construction, environmental protection, civil engineering (bridges/tunnels), hydraulic (canals/ports), construction/others (railways, landfills, coastal) |

| Material Type | Polypropylene, polyethylene, polyester, PVC, natural fibers, others (rubber, bitumen, fiberglass, polystyrene) |

| Primary Function | Reinforcement, stabilization, drainage, filtration, separation, barrier & protection, erosion control |

| Regions Covered | India, Indonesia, Vietnam, Philippines, Malaysia, Australia, Thailand |

| Countries Covered | India, Indonesia, Vietnam, Philippines, Malaysia, Australia, Thailand |

| Key Companies Profiled | TenCate Geosynthetics (Solmax), GSE Environmental, NAUE GmbH & Co. KG, Fibertex Nonwovens, Garware Technical Fibres, Maccaferri Environmental Solutions Pvt. Ltd., TechFab India Industries, Strata Geosystems (India) Pvt. Ltd., SKAPS Industries, Terram (Berry Global) |

| Additional Attributes | Dollar sales by product type, application segment, material composition, and primary function, regional demand trends across India, Indonesia, and Southeast Asia, competitive landscape with established European manufacturers and emerging Indian producers, infrastructure developer preferences for geotextile versus geomembrane solutions, integration with highway construction programs and environmental protection projects particularly advanced in India and Indonesia, innovations in geocomposite drainage systems and bio-based geosynthetic materials, and adoption of advanced installation technologies, quality assurance protocols, and engineering support capabilities for enhanced project performance and regulatory compliance across Indian, Indonesian, and Southeast Asian infrastructure operations |

The global demand for geosynthetics in south asia is estimated to be valued at USD 3.0 billion in 2025.

The market size for the demand for geosynthetics in south asia is projected to reach USD 7.0 billion by 2035.

The demand for geosynthetics in south asia is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in demand for geosynthetics in south asia are road construction, environmental protection, civil engineering (bridges/tunnels), hydraulic (canals/ports) and construction/others (railways, landfills, coastal).

In terms of material type, polypropylene segment to command 36.0% share in the demand for geosynthetics in south asia in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Geosynthetics Industry Analysis in South Asia Growth - Trends & Forecast 2025 to 2035

Southeast Asia Submersible Pumps Market Growth – Trends & Forecast 2025 to 2035

Southeast Asia Pet Care Market Trends – Demand, Growth & Forecast 2022-2032

South East Asia CMMS Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

South Africa Faith-Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

South Korea Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Southern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

South Africa Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA