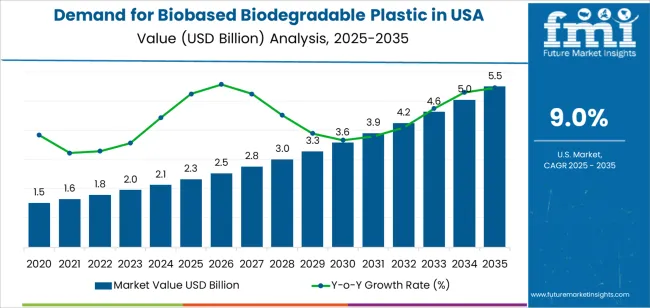

The demand for biobased biodegradable plastic in USA is expected to grow from USD 2.3 billion in 2025 to USD 5.5 billion by 2035, at a CAGR of 9.0%. The demand for biobased biodegradable plastic in the USA is expected to experience significant acceleration from 2025 to 2030, driven by a growing consumer preference for eco-friendly products, rising environmental regulations, and pressure on industries to transition away from petroleum-based plastics.

Early growth will be fueled by increasing adoption in packaging, foodservice, and agriculture industries, as these sectors seek sustainable alternatives to traditional plastics. The development of cost-effective production methods, improvements in material performance, and regulatory incentives will propel the market toward its peak during this period, with bioplastics becoming more mainstream and widely adopted.

After 2030, the market may enter a deceleration phase, where growth moderates as the bioplastics market matures. By this time, a large portion of the demand will have been met by initial adopters, particularly in industries where sustainable packaging solutions have already been integrated. The market will continue to expand, but at a slower pace, driven by incremental replacements and smaller-scale adoption in new sectors. The deceleration reflects a more stable growth pattern, with innovations in biodegradability and material properties continuing to support steady demand for biobased biodegradable plastics through 2035.

A key breakpoint in the growth of biobased biodegradable plastics will occur between 2025 and 2027, when regulatory pressures on single-use plastics and heightened consumer awareness of sustainability will create significant demand acceleration. As producers innovate and improve the performance of bioplastics, the cost gap with traditional plastics is expected to narrow. This will lead to a significant increase in adoption, particularly in packaging and agriculture, with demand increasing from USD 2.3 billion to USD 2.8 billion in 2027.

From 2027 to 2030, the growth rate will accelerate, reaching USD 3.6 billion, as the sector gains further traction in mainstream markets. The demand surge during this period will be driven by both stricter environmental regulations and advances in bio-based material technology, which will enable companies to scale production. By 2035, the sector is expected to reach USD 5.5 billion, driven by widespread adoption and maturing bioplastics infrastructure, marking the final phase of bioplastics becoming a mainstream alternative to conventional plastics.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 2.3 billion |

| Forecast Value (2035) | USD 5.5 billion |

| Forecast CAGR (2025–2035) | 9.0% |

The demand for biobased biodegradable plastics in USA is rising as manufacturers and brand owners face mounting pressure to reduce reliance on fossil-derived materials and to improve end-of-life performance. Biobased biodegradable polymers such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and biopolycondensation materials are increasingly used in packaging, agricultural films, and consumer disposables. These materials contribute to lower carbon footprints and align with sustainability goals set by major retailers. Additionally, improvements in processability and performance now bring biobased biodegradable plastics closer to traditional polymers in cost and functionality, encouraging broader adoption across consumer-facing industries.

Growth in demand also reflects supportive regulatory measures and shifting consumer expectations. Federal and state-level initiatives promote adoption of renewable-content materials, compostability standards, and reduced plastic waste. Brand owners integrate biobased biodegradable plastics into product lines to satisfy sustainability reporting frameworks and consumer preferences for greener options. While cost competition and limited recycling infrastructure remain barriers, increasing manufacturing scale and feed-stock diversification are improving economics. As downstream industries move toward circular economy strategies and materials disclosure becomes more widespread, demand for biobased biodegradable plastics continues to expand across the USA.

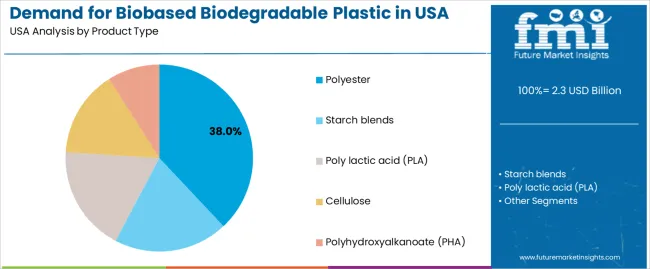

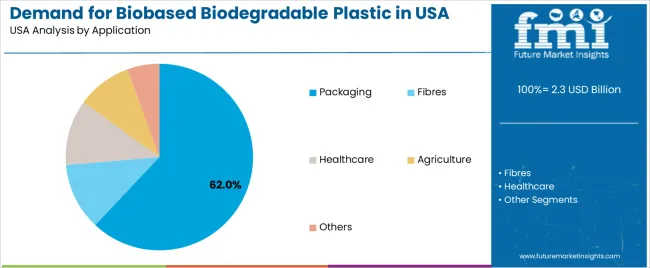

The demand for biobased biodegradable plastic in the USA is segmented by product type and application. By product type, the demand is divided into polyester and others. Based on application, it is categorized into packaging and others. These segments reflect the growing need for sustainable plastic alternatives, particularly in industries that rely heavily on packaging materials.

The polyester segment accounts for approximately 38% of the total demand for biobased biodegradable plastic in the USA in 2025, making it the leading product type category. This position is driven by the versatility and performance characteristics of polyester-based bioplastics, which are used in a wide range of applications. Polyester bioplastics offer similar durability and flexibility to traditional plastics while being derived from renewable, biobased sources, making them a more sustainable option for manufacturers seeking to reduce their environmental impact.

Adoption is particularly high in the packaging industry, where polyester-based biodegradable plastics are favored for producing flexible films, bottles, and containers. Polyester’s properties, including its strength and ability to decompose naturally over time, make it a preferred material for companies aiming to meet sustainability goals. The segment maintains its leadership due to the increasing shift towards eco-friendly packaging solutions in industries like food and beverage, cosmetics, and consumer goods.

The packaging segment represents about 62.0% of the total demand for biobased biodegradable plastic in the USA in 2025, making it the dominant application category. This position is supported by the growing demand from manufacturers and consumers for more sustainable, environmentally-friendly packaging solutions. Biobased biodegradable plastics are increasingly being used for packaging materials in various industries to replace conventional petroleum-based plastics that contribute to long-term environmental pollution.

The packaging industry’s adoption of biobased biodegradable plastics is particularly high in food, beverage, and personal care product packaging, where biodegradable solutions help reduce plastic waste. This segment holds its leading share because packaging remains one of the highest-volume applications for bioplastics, and it continues to be a major driver of innovation and demand within the broader bioplastic sector. As sustainability initiatives become a central focus in the USA, the packaging industry will continue to lead in the adoption of biobased biodegradable plastics.

Demand for biobased biodegradable plastics in USA is rising as manufacturers and brands pursue more sustainable material alternatives that support product claims like “compostable,” “plant based” and “bio resin.” Growth is propelled by increased use of compostable packaging, single use plastic bans, and brand commitments to reduce fossil based polymer use. Key applications include food service disposables, agricultural mulch films and bioplastic add on trays. Despite momentum, widespread deployment is held back by higher unit cost compared to conventional plastics, gaps in waste management infrastructure (composting or industrial degradation), and feed stock supply challenges. Material producers and users are investing in scaling production, improving bio based content and aligning with circular economy goals to strengthen adoption.

How are regulatory policies and brand sustainability agendas driving adoption of biobased biodegradable plastics?

Federal and state policies including plastic bag bans, initiatives promoting compostable serviceware and extended producer responsibility (EPR) frameworks are creating procurement pressure for alternative polymers. Brands and retailers under consumer and investor scrutiny are specifying biobased biodegradable polymers in packaging, single use items and consumer goods to meet life cycle emission targets. As circular economy concepts gain traction, biodegradability and bio resin content become material selection criteria. Demand grows accordingly as firms align sustainability roadmaps with material sourcing and design to capture eco conscious consumers.

What limitations are dampening uptake of biobased biodegradable plastic solutions?

Several constraints restrict broader uptake. Material cost remains higher than conventional fossil based plastics due to smaller scale of production, feed stock price and more complex processing needs. Availability of composting or industrial degradation infrastructure varies widely across USA regions, limiting the practical value of “biodegradable” claims. Some users question performance parity—biodegradable bioplastics may offer lower heat stability or mechanical robustness compared to traditional polymers. Supply chain pressure, competition for bio feedstocks and scepticism around equivalent recycling or disposal pathways create additional hurdles.

What trends are shaping future demand for biobased biodegradable plastics?

Trends include expansion of non food service applications such as electronics, textile packaging and agricultural films that adopt biodegradable resins to meet disposal or reuse criteria. Regional production capacity is increasing in the USA, reducing logistics cost and supporting wider availability of bio resins. Material producers are also launching polymers with blend in compatibility, enabling existing processes to switch from fossil resins to biopolymers with minimal capital adjustment. Collaboration across brands, waste management providers and regulators is escalating to build supply chain visibility and close the circular economy loop.

| Region | CAGR (%) |

|---|---|

| West | 10.4% |

| South | 9.3% |

| Northeast | 8.3% |

| Midwest | 7.2% |

The demand for biobased biodegradable plastic in USA is growing, with the West leading at a 10.4% CAGR through 2035, driven by strong environmental advocacy, a growing preference for eco-friendly packaging, and regulatory support for sustainable alternatives. The South follows at 9.3%, supported by expanding manufacturing and agriculture sectors, which increasingly adopt biobased plastics for product packaging and consumer goods. The Northeast records an 8.3% CAGR, fueled by progressive environmental policies, high demand for sustainable packaging, and strong support from eco-conscious consumers. The Midwest grows at 7.2%, with demand driven by increasing adoption in packaging, agriculture, and automotive sectors, as well as growing awareness of the environmental benefits of bioplastics.

The West region of the USA is projected to grow at a CAGR of 10.4% through 2035 in demand for biobased biodegradable plastic. With its strong focus on sustainability and environmental consciousness, the West leads in adopting eco-friendly alternatives to conventional plastics. California, in particular, drives this trend with strict environmental regulations and green initiatives. Industries like packaging, automotive, and consumer goods are increasingly opting for biodegradable plastics to meet sustainability targets. Growing consumer awareness of plastic pollution and the rise of eco-conscious consumerism in the West further accelerates the demand for biobased alternatives.

The South region of the USA is projected to grow at a CAGR of 9.3% through 2035 in demand for biobased biodegradable plastic. With a rapidly expanding manufacturing sector and an increasing focus on sustainability, the demand for eco-friendly alternatives to conventional plastics continues to rise. Agricultural production in the South also provides an ample supply of renewable resources, which supports the development and production of biobased plastics. Additionally, regional policies and incentives promoting green manufacturing practices further foster the use of biodegradable plastic solutions across various industries.

The Northeast region of the USA is projected to grow at a CAGR of 8.3% through 2035 in demand for biobased biodegradable plastic. The region’s strong focus on sustainability and increasing consumer awareness of plastic waste contribute to rising demand for biodegradable alternatives. Industries like food packaging, consumer goods, and healthcare are adopting biobased plastics to reduce their environmental impact. Urban centres, coupled with progressive policies aimed at reducing waste, further boost the adoption of biobased plastics in the region. Local manufacturers are increasingly innovating to meet demand for sustainable, biodegradable products.

The Midwest region of the USA is projected to grow at a CAGR of 7.2% through 2035 in demand for biobased biodegradable plastic. The region’s strong agricultural base provides an abundant supply of feedstocks, which supports the production of bioplastics. Industries such as agriculture, automotive, and packaging increasingly turn to biobased biodegradable plastics as part of their sustainability efforts. Local policies and incentives promoting green manufacturing also support this growing trend. While the Midwest lags slightly behind other regions in terms of growth, its adoption of biobased plastics continues to rise steadily.

The demand for biobased biodegradable plastics in the USA is rapidly increasing, fueled by consumer and regulatory push towards sustainable, eco-friendly alternatives to conventional plastics. NatureWorks LLC leads the market with its Ingeo biopolymer, a widely used, fully compostable and renewable plastic that caters to industries such as packaging, textiles, and agriculture. BASF SE follows closely, offering high-performance biobased plastics like Ecoflex that are biodegradable and derived from renewable resources, helping industries reduce their environmental impact. TotalEnergies Corbion strengthens the market with Luminy bioplastics, which are particularly popular in packaging and consumer products for their biodegradability and recyclability. Novamont S.p.A. and Mitsubishi Chemical Corporation contribute further by producing compostable plastics that align with sustainability goals, targeting packaging, medical, and agricultural applications.

Key factors driving the growth of biobased biodegradable plastics include the growing demand for sustainable packaging solutions, environmental regulations limiting single-use plastics, and an increasing shift in consumer behavior toward greener products. As industries move to reduce their carbon footprint and adopt circular economy models, the demand for biobased plastics that are both renewable and biodegradable continues to rise. Competition in this market is influenced by factors such as material performance, biodegradability, cost-effectiveness, and scalability. Brands that focus on offering high-quality, renewable, and environmentally friendly plastics are positioned to capture significant market share as the demand for sustainable materials expands across the USA.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material Type | Polyester, Starch Blends, Poly Lactic Acid (PLA), Cellulose, Polyhydroxyalkanoate (PHA) |

| Application | Packaging, Fibres, Healthcare, Agriculture, Others |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | NatureWorks LLC, BASF SE, TotalEnergies Corbion, Novamont S.p.A, Mitsubishi Chemical Corporation |

| Additional Attributes | Dollar sales by material type and application, regulatory incentives for sustainability, biodegradable and compostable certifications, advancements in production and material performance, growth in demand from various industries. |

The global demand for biobased biodegradable plastic in USA is estimated to be valued at USD 2.3 billion in 2025.

The market size for the demand for biobased biodegradable plastic in USA is projected to reach USD 5.5 billion by 2035.

The demand for biobased biodegradable plastic in USA is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in demand for biobased biodegradable plastic in USA are polyester, starch blends, poly lactic acid (pla), cellulose and polyhydroxyalkanoate (pha).

In terms of application, packaging segment to command 62.0% share in the demand for biobased biodegradable plastic in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA