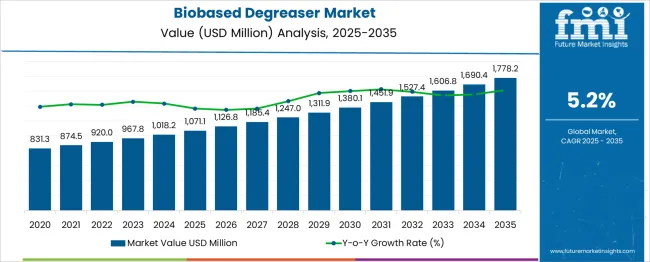

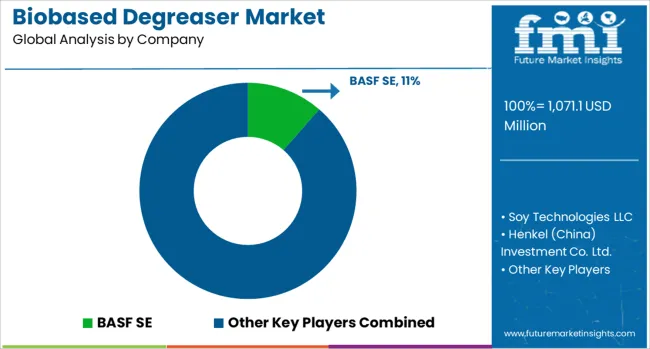

The Biobased Degreaser Market is estimated to be valued at USD 1071.1 million in 2025 and is projected to reach USD 1778.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Biobased Degreaser Market Estimated Value in (2025 E) | USD 1071.1 million |

| Biobased Degreaser Market Forecast Value in (2035 F) | USD 1778.2 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

Increasing regulatory pressure to minimize the use of hazardous chemicals and rising awareness of occupational health and safety have encouraged the adoption of degreasers derived from renewable sources.

The market is also benefiting from technological advancements that have improved the performance and shelf life of biobased formulations, making them viable alternatives to petroleum-based products. As companies align with green certification standards and sustainability frameworks, demand for biobased degreasers across manufacturing, automotive, and commercial facilities is on the rise.

Future growth is expected to be driven by continued innovation in bio-feedstock processing, the expansion of eco-friendly procurement policies, and the broader integration of circular economy practices. The market is well-positioned for long-term growth as end users prioritize biodegradability, low VOC emissions, and safety without compromising on degreasing efficiency.

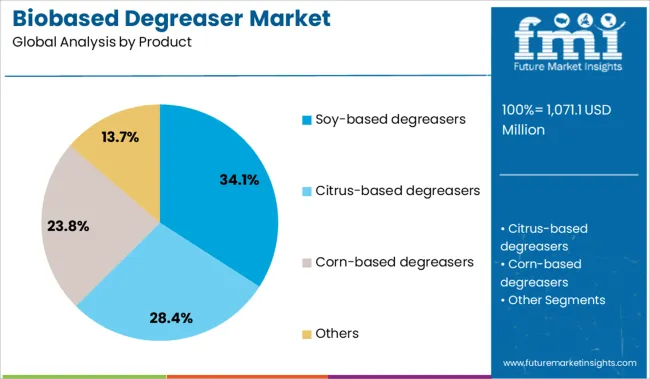

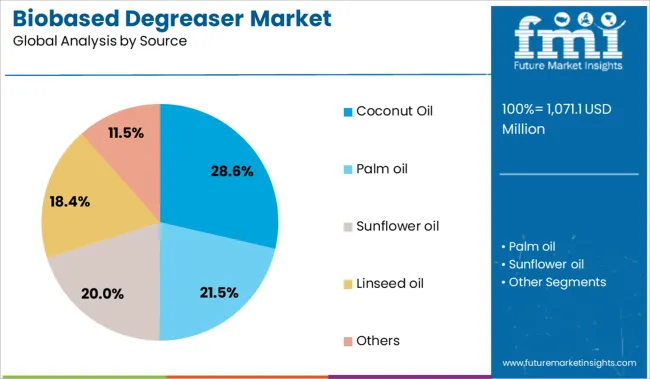

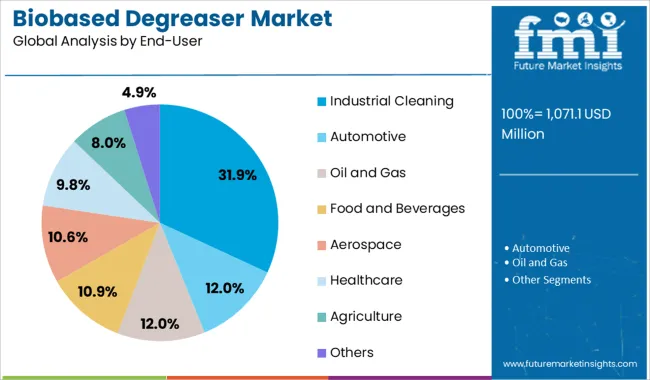

The biobased degreaser market is segmented by product, source, and end-user and geographic regions. The biobased degreaser market is divided into Soy-based degreasers, Citrus-based degreasers, Corn-based degreasers, and Others. In terms of the source of the biobased degreaser market, it is classified into Coconut Oil, Palm Oil, Sunflower Oil, Linseed Oil, and Others. The biobased degreaser market is segmented based on end-user into Industrial Cleaning, Automotive, Oil and Gas, Food and Beverages, Aerospace, Healthcare, Agriculture, and Others. Regionally, the biobased degreaser industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Soy-based degreasers account for 34.1% of the biobased degreaser market, making them the leading product category due to their favorable cost-performance ratio and wide-ranging applicability. These formulations are derived from soybean oil methyl esters, which provide effective solvency for cutting through heavy grease, oil, and grime without posing health or environmental risks.

The non-toxic and biodegradable nature of soy-based degreasers makes them an attractive choice for industries looking to reduce hazardous waste and comply with environmental regulations. Increased domestic production of soy feedstock in major markets has supported consistent supply and price stability, reinforcing segment growth.

Additionally, manufacturers have enhanced product offerings with improved emulsification properties and faster drying times, making them suitable for both heavy-duty and routine maintenance tasks. The growing preference for sustainable and workplace-safe alternatives is expected to uphold the segment’s leadership in the coming years.

The coconut oil source segment leads with a 28.6% market share, reflecting its increasing use as a renewable and highly biodegradable raw material in the formulation of biobased degreasers. Coconut oil contains natural surfactants and fatty acid derivatives that contribute to efficient grease removal while ensuring low skin and surface toxicity.

This source is especially valued for its minimal environmental footprint and compatibility with other plant-based ingredients in multi-purpose cleaners. Global demand has been supported by strong supply chains in tropical regions and growing investment in natural ingredient processing technologies.

Manufacturers are leveraging the emulsifying and antimicrobial properties of coconut oil to create value-added degreasing solutions for use in sensitive environments. As the push for plant-derived, chemical-free alternatives continues, the coconut oil segment is expected to witness consistent demand from both industrial and commercial sectors prioritizing green procurement.

The industrial cleaning segment commands a 31.9% share of the biobased degreaser market, driven by the sector’s large-scale need for efficient, compliant, and safe cleaning agents. Manufacturing facilities, equipment maintenance operations, and mechanical workshops are increasingly turning to biobased degreasers to meet stringent environmental and safety standards without compromising on cleaning efficacy.

The shift toward green manufacturing practices and ISO-certified operations has accelerated the adoption of biobased products, particularly in sectors such as automotive, aerospace, and heavy machinery. Industrial users favor degreasers that provide quick action, residue-free performance, and compatibility with various surfaces and materials.

Moreover, regulatory mandates around VOC emissions and solvent disposal are prompting industries to transition from petrochemical solutions to renewable alternatives. The segment is projected to sustain its leadership as large enterprises and SMEs alike adopt biobased degreasers as part of broader environmental management strategies.

Demand is growing for cleaning agents derived from non‑petroleum sources that effectively remove oils, greases and industrial residues. Opportunities are emerging in commercial service cleaning, e-commerce direct sales and industry partnerships with maintenance contractors.

Industrial facilities, automotive service centers and food processing sites are increasingly choosing biobased degreasers because they match or exceed cleaning power of conventional solvents while avoiding harsh petrochemicals. These bio formulas efficiently emulsify oil slicks, grease spots and insect residues on equipment surfaces and factory floors. Cleaning technicians value their lower toxicity, reduced odor and improved safety in confined spaces. Biobased degreasers also simplify regulatory compliance in operations where worker exposure limits and ventilation requirements are strict. As preventative maintenance and sanitation programs expand in sectors such as manufacturing and food production, adoption of greener cleaning agents is helping both improve safety and support operational continuity.

Growth opportunities include offering tailored degreaser blends designed for specific industries—such as heavy machinery, commercial kitchens or vehicle fleets—that require different foaming, rinseability and surface compatibility profiles. Suppliers can partner with equipment rental companies or contract cleaning services to supply degreasers bundled with spray systems or refill stations. Robust product packaging suitable for on-site dilution or concentrate dosing helps maintenance teams minimize waste and simplify supply. Online storefronts targeting small businesses and DIY users offer sample kits or subscription refill plans. Collaborations with safety training firms and sustainability labs for effectiveness validation help build trust among industrial and foodservice clients. Developers focusing on traceable biobased feedstock sourcing and certifications for plant-based cleaning chemistry can attract customers seeking alternatives to traditional solvent solutions.

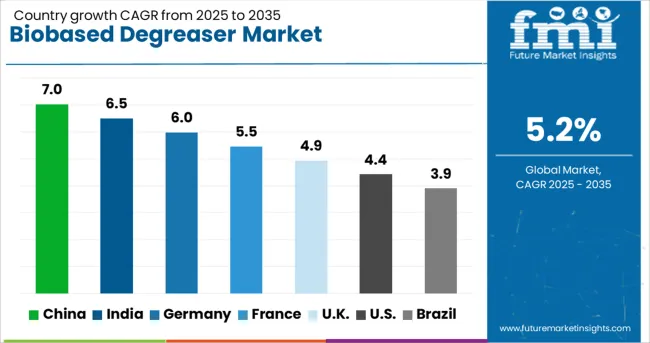

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The biobased degreaser market is projected to expand at a CAGR of 5.2% from 2025 to 2035, driven by the global shift toward eco-friendly, non-toxic industrial cleaning solutions. BRICS nations are accelerating development, with China leading at a robust 7.0% CAGR and India at 6.5%, propelled by strong industrial growth and stricter environmental regulations. Germany, representing OECD leadership in green chemistry, records a solid 6.0%, reflecting innovation in sustainable manufacturing. The United Kingdom shows moderate adoption at 4.9%, while the United States posts a comparatively slower growth rate of 4.4%, limited by entrenched synthetic alternatives and regulatory lags. As ASEAN nations invest in bioeconomy frameworks, regional demand is expected to rise, further supporting global scale-up. The market is poised for broad commercial uptake, supported by growing demand across automotive, aerospace, and heavy industries. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is registering a 7.0% CAGR in the biobased degreaser market, with rising demand across machinery maintenance and metal fabrication sectors. Local manufacturers are increasing production of plant-derived degreasing agents for use in equipment servicing, particularly in Tier 1 industrial zones. Automotive parts workshops are shifting toward these solutions to manage cleaning standards without harmful residue. Distributors in Guangzhou and Suzhou are targeting mid-size manufacturers with bulk supply contracts. Usage is also increasing in electronics assembly facilities, where residue-free and low-odor cleaners are preferred. Regional regulations are indirectly encouraging businesses to adopt solvent-free alternatives as a precautionary approach in industrial zones.

India is growing at a 6.5% CAGR, driven by the expansion of mid-scale industrial cleaning operations in states like Maharashtra and Tamil Nadu. Service contractors are adopting biobased degreasers for mechanical cleaning of conveyor belts, turbine housings, and workshop floors. These products are replacing conventional degreasers in textile mills and automotive repair units that operate in confined spaces. Small and medium enterprises are also beginning to use biobased products to improve workplace safety and ease of handling. Retail availability through regional distributors is supporting increased procurement among industrial buyers.

Germany is advancing steadily with a 6.0% CAGR, as precision equipment manufacturers and maintenance firms opt for biobased degreasers to clean parts without compromising material quality. Several metal processing plants are adopting these solutions to reduce surface damage while improving degreasing efficiency. Engine assembly lines are also using these agents in post-machining washdowns. German suppliers are offering citrus-based blends and ester-enriched formulations suited for multi-surface cleaning. These products are being adopted in packaging facilities and machine tool depots where residue control is essential. Their ability to operate without aggressive solvents gives them traction among long-cycle maintenance teams.

The United Kingdom is recording a 4.9% CAGR, with slow but consistent replacement of conventional degreasers in light manufacturing and mechanical service operations. Tool depots and motor repair shops in London and Manchester are trying out biobased alternatives that simplify storage and reduce handling risk. Service providers working in older buildings with poor ventilation are gradually introducing low-emission formulas. Local warehouses are beginning to adopt these degreasers to clean moving parts, loading equipment, and mechanical joints. Distributor-led training on application methods is supporting product understanding among mid-level technical staff.

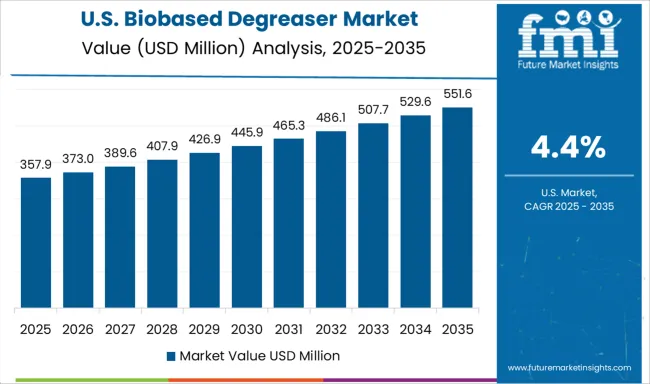

The United States is expanding at a 4.4% CAGR, with modest growth across light industry and utility maintenance sectors. Municipal fleet service garages and regional power utility workshops are among early users shifting to biobased degreasers. Operators prefer non-flammable, low-residue solutions for cleaning engines, tools, and electrical cabinets. Local contractors are procuring spray-on formulations that reduce scrubbing time while maintaining surface integrity. Several East Coast distributors are marketing products made from soy and corn-based agents as safer alternatives to traditional solvents. Use remains limited in heavy industry but is slowly increasing in maintenance segments where repeated application is common.

The biobased degreaser market is structured into Tier 1, Tier 2, and Tier 3 suppliers, each contributing to the shift toward safer, eco-friendly industrial cleaning solutions. BASF SE leads the Tier 1 group through its strong formulation capabilities, global distribution, and sustainable chemistry initiatives. Companies like Henkel (China) Investment Co. Ltd., Ecolab, and Dow Chemical Company also fall within this tier, offering high-performance degreasers for automotive, aerospace, and manufacturing sectors. Tier 2 players such as Soy Technologies LLC, Renewable Lubricants Inc., and Huntsman Corporation focus on plant-derived solvents and biodegradable alternatives tailored for heavy-duty use with reduced environmental impact. Tier 3 participants, including BIONANO, Cortec Corporation, Victory Polychem, and Nugeneration Technology, serve regional markets with cost-conscious, niche formulations for sectors like maintenance, agriculture, and marine cleaning, often emphasizing low VOC and non-toxic properties.

| Item | Value |

|---|---|

| Quantitative Units | USD 1071.1 Million |

| Product | Soy-based degreasers, Citrus-based degreasers, Corn-based degreasers, and Others |

| Source | Coconut Oil, Palm oil, Sunflower oil, Linseed oil, and Others |

| End-User | Industrial Cleaning, Automotive, Oil and Gas, Food and Beverages, Aerospace, Healthcare, Agriculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Soy Technologies LLC, Henkel (China) Investment Co. Ltd., Carroll Company, Renewable Lubricants Inc., BIONANO, Uzay Kimaya, Ecolab, Huntsman Corporation, Global Green Tag, Ecochem, DEWALT, Cortec Corporation, Victory Polychem, Dow Chemical Company, and Nugeneration Technology |

| Additional Attributes | Dollar sales by product formulation, application segment, and distribution channel; demand driven by industrial sustainability goals, regulatory bans on harsh solvents, and consumer preference for green cleaning; innovation in biodegradable surfactants, enzyme-based formulations, and low-VOC blends; cost dynamics shaped by bio‑feedstock sourcing and certification standards; environmental impact via reduced chemical runoff; and emerging use cases in food processing, automotive detailing, and institutional cleaning. |

The global biobased degreaser market is estimated to be valued at USD 1,071.1 million in 2025.

The market size for the biobased degreaser market is projected to reach USD 1,778.2 million by 2035.

The biobased degreaser market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in biobased degreaser market are soy-based degreasers, citrus-based degreasers, corn-based degreasers and others.

In terms of source, coconut oil segment to command 28.6% share in the biobased degreaser market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Biobased Biodegradable Plastic Market Growth - Trends & Forecast 2025 to 2035

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Biobased Transformer Oil Market

Industrial Degreaser Market

Automotive Part Cleaners and Degreasers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA