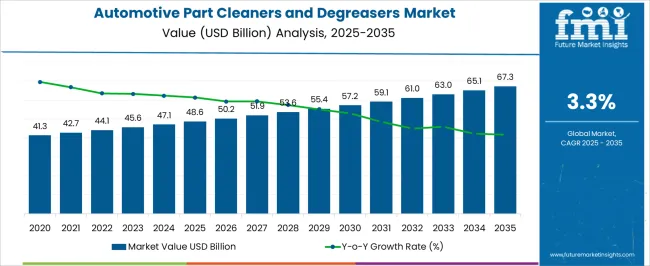

The automotive part cleaners and degreasers market is set to advance from USD 48.6 billion in 2025 to USD 67.3 billion by 2035, reflecting a CAGR of 3.3%. Half-decade weighted growth analysis highlights how market expansion varies across early, mid, and late periods, demonstrating incremental gains driven by technological innovations, regulatory standards, and evolving automotive maintenance practices. From 2025 to 2030, the market grows from USD 48.6 billion to USD 55.4 billion, with intermediate values of USD 50.2 billion, 51.9 billion, 53.6 billion, and 55.4 billion.

Growth in this early half-decade is supported by rising demand for efficient cleaning solutions in automotive workshops, service centers, and industrial applications. Adoption of water-based and low-VOC degreasers gains momentum, while established brands consolidate market presence through product differentiation and distribution expansion. Between 2031 and 2035, revenues increase from USD 57.2 billion to USD 67.3 billion, passing through USD 59.1 billion, 61.0 billion, 63.0 billion, and 65.1 billion. During this late half-decade, growth is accelerated by stricter environmental regulations, increased adoption of automated cleaning systems, and penetration into emerging markets. OEMs and aftermarket suppliers focus on high-performance, environmentally compliant formulations that balance cleaning efficiency with sustainability standards.

| Metric | Value |

|---|---|

| Automotive Part Cleaners and Degreasers Market Estimated Value in (2025 E) | USD 48.6 billion |

| Automotive Part Cleaners and Degreasers Market Forecast Value in (2035 F) | USD 67.3 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The automotive part cleaners and degreasers market is strongly shaped by five interconnected parent markets, each contributing uniquely to overall demand and growth. The automotive aftermarket and maintenance market holds the largest share at 35%, as repair shops, service centers, and garages rely on high-performance cleaners and degreasers to maintain engines, transmissions, and other critical vehicle components. The OEM maintenance market contributes 25%, with automotive manufacturers employing degreasers during production, assembly, and quality control to ensure product performance and compliance. The industrial machinery and heavy vehicle maintenance market accounts for 15%, where cleaning solutions are essential for trucks, construction machinery, and industrial vehicles to enhance operational efficiency and lifespan.

The fleet management and transportation services market holds a 15% share, driven by commercial fleets, logistics operators, and public transport agencies requiring regular engine and component cleaning. Finally, the retail and distribution market represents 10%, providing accessibility and reach through auto parts stores, supermarkets, and online platforms for both professional and consumer use. Aftermarket, OEM, and industrial segments account for 75% of total demand, highlighting that maintenance, production, and heavy-duty applications are the primary growth drivers, while fleet management and retail distribution offer supplementary opportunities for market expansion globally.

The automotive part cleaners and degreasers market is gaining traction due to the surge in vehicle maintenance demand, environmental regulations, and evolving vehicle technologies. OEM and aftermarket players alike are investing in cleaning technologies to maintain engine efficiency and reduce emissions.

The transition toward electric and hybrid vehicles is creating parallel growth for specialty cleaning products that serve high-voltage components. Rising awareness among consumers about routine maintenance and the expansion of service networks in developing countries are boosting product adoption.

Additionally, the shift toward water-based and biodegradable formulas is enhancing product appeal across both professional workshops and DIY consumers.

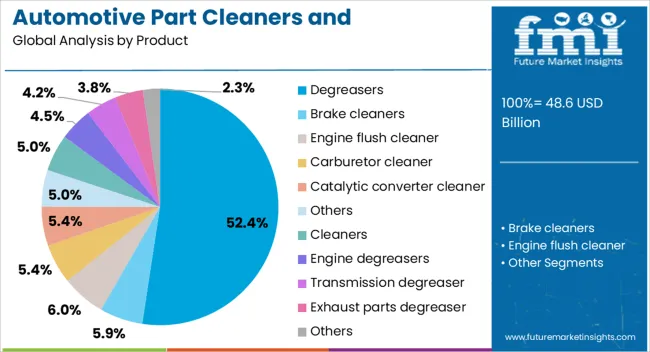

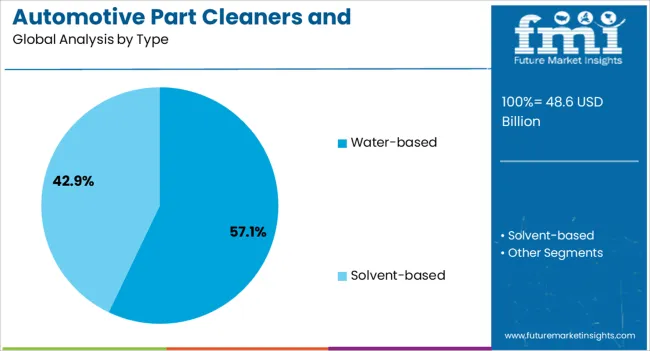

The automotive part cleaners and degreasers market is segmented by product, type, vehicle type, and geographic regions. By product, automotive part cleaners and degreasers market is divided into Degreasers, Brake cleaners, Engine flush cleaner, Carburetor cleaner, Catalytic converter cleaner, Others, Cleaners, Engine degreasers, Transmission degreaser, Exhaust parts degreaser, and Others. In terms of type, automotive part cleaners and degreasers market is classified into Water-based and Solvent-based.

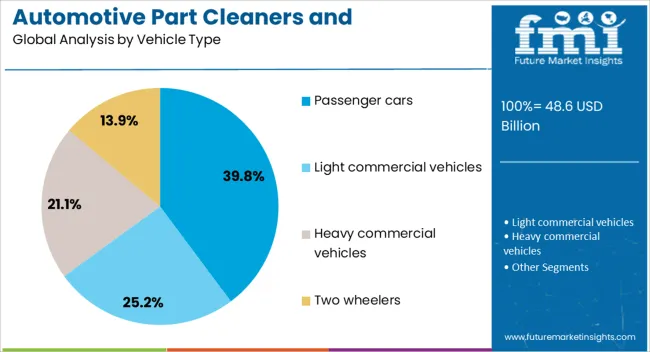

Based on vehicle type, automotive part cleaners and degreasers market is segmented into Passenger cars, Light commercial vehicles, Heavy commercial vehicles, and Two wheelers. Regionally, the automotive part cleaners and degreasers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Degreasers are anticipated to account for 52.4% of total market value in 2025, making them the leading product category. Their dominance stems from the crucial role they play in removing built-up grime, oils, and contaminants from engine components and mechanical parts.

As vehicles age, demand for maintenance-intensive solutions like degreasers rises, especially in regions with high vehicle density and older fleets. Industrial-scale usage across garages and service centers further reinforces their stronghold.

Innovations in solvent technology and compatibility with sensitive engine materials are expanding degreaser applications across both gasoline and electric vehicle maintenance cycles.

Water-based automotive part cleaners are projected to capture 57.10% of the market share in 2025, making them the top technology type. This preference is primarily driven by increasingly stringent environmental and workplace safety regulations.

Water-based formulations eliminate the need for harsh VOC-emitting solvents, offering a safer alternative for both users and the environment. Advancements in surfactant and enzyme technologies have enhanced cleaning efficiency, making water-based products viable even in heavy-duty degreasing scenarios.

Their rapid adoption in both DIY and professional segments, supported by favorable compliance and disposal policies, solidifies their lead in the market.

Passenger cars are expected to contribute 39.80% of the total market by 2025, positioning this as the leading vehicle type segment. This is largely due to the sheer volume of passenger vehicles in operation globally and their regular servicing needs.

Urbanization and increased consumer awareness of preventative maintenance practices have led to higher product consumption per vehicle. Moreover, the rise of used car markets and longer vehicle lifespans are contributing to more frequent use of part cleaners and degreasers.

The growing trend of DIY car care among private vehicle owners also strengthens product penetration in this segment.

The automotive part cleaners and degreasers market is growing as OEMs, MRO providers, and aftermarket service centers prioritize vehicle performance, maintenance efficiency, and operational cleanliness. The need for high-performance solvents, aqueous cleaners, and biodegradable degreasers for engines, transmissions, brake components, and industrial machinery drives demand. Challenges include regulatory compliance, environmental restrictions, and formulation complexity for diverse automotive surfaces.

Opportunities exist in eco-friendly formulations, high-efficiency spray and immersion systems, and automated cleaning solutions. Trends highlight water-based cleaners, ultrasonic cleaning, and multi-metal compatibility.

Supplementary constituents such as slag, fly ash, limestone, natural pozzolans, and calcined clays are combined to tune heat of hydration, permeability, and finishability. Mix designers value improved pumpability and extended workability windows that aid placement in warm climates and congested reinforcement. Mass concrete pours benefit from lower thermal gradients, reducing cracking risk. Marine and deicing exposures are addressed through blends that resist chloride ingress and sulfate attack. Performance-based specifications are being favored, allowing producers to meet strength and durability targets without prescriptive cement types. Readymix networks are expanding blend portfolios and adjusting particle size distribution to stabilize early strength while protecting later age gains. Public works and private developers are recognizing lifecycle advantages from fewer repairs and tighter in-service performance, reinforcing the role of blended binders.

Constraints in the market include raw material price volatility, solvent sourcing challenges, and compliance with regional environmental regulations. Production of aqueous and solvent-based cleaners requires precise formulation to ensure efficacy, surface compatibility, and worker safety. Disposal regulations, VOC limits, and flammability standards add complexity to manufacturing and logistics. Technical challenges involve achieving cleaning performance across diverse metals, plastics, and rubber components without causing corrosion or damage. Buyers increasingly seek suppliers providing certified, environmentally compliant, and technically validated cleaning solutions with predictable supply and operational support to meet stringent automotive and industrial standards.

Opportunities exist in environmentally friendly, water-based, and biodegradable cleaning solutions that reduce VOC emissions and disposal costs. Automated spray, ultrasonic, and immersion systems enhance efficiency and consistency in OEM and service environments. Multi-metal and multi-surface compatible degreasers allow broader application across engines, gearboxes, brake systems, and industrial machinery. Regional growth in North America, Europe, and Asia-Pacific is driven by expanding automotive production, stricter emissions regulations, and increased focus on operational efficiency. Suppliers offering advanced, sustainable, and technically supported cleaning solutions are positioned to capture adoption across OEMs, repair shops, and industrial maintenance operations.

The market is trending toward water-based, biodegradable cleaners and degreasers that comply with environmental standards while maintaining high performance. Automated cleaning systems, ultrasonic baths, and spray technologies are enhancing efficiency, consistency, and safety. Multi-metal and multi-surface compatibility is becoming increasingly important to serve diverse automotive and industrial components. Collaboration between chemical suppliers, OEMs, and MRO providers accelerates innovation, technical support, and adoption of application-ready solutions. Suppliers providing certified, environmentally compliant, and high-performance cleaners with operational guidance are best positioned to meet evolving industry needs and global market demand.

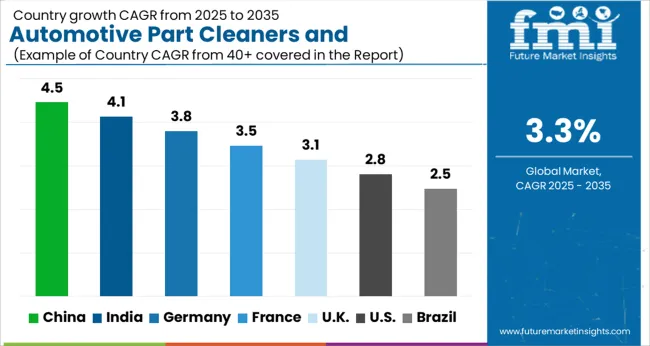

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

The global automotive part cleaners and degreasers market is projected to grow at a CAGR of 3.3% from 2025 to 2035. China leads with 4.5%, followed by India (4.1%), France (3.5%), the UK (3.1%), and the USA (2.8%). Increasing vehicle production, automotive repair centers, fleet maintenance, and aftermarket service expansion drive growth.

BRICS nations, particularly China and India, are driving high adoption due to urbanization and automotive industry growth. OECD countries focus on regulatory compliance, chemical safety, and premium product quality. Rising demand for solvent-based and aqueous degreasers, coupled with efficient distribution and OEM adoption, is shaping the market globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The automotive part cleaners and degreasers market in China is projected to grow at a CAGR of 4.5% from 2025 to 2035, supported by increasing vehicle production, maintenance facilities, and industrial automotive hubs. Growing demand for passenger vehicles, commercial trucks, and electric vehicles is driving the need for efficient cleaning and degreasing solutions. Automotive workshops and manufacturing plants are adopting chemical and aqueous degreasers for engine parts, chassis, and transmission components to maintain performance and longevity. Domestic chemical manufacturers are expanding production and offering specialized formulations with rapid cleaning, corrosion protection, and environmental compliance. OEMs and aftermarket service providers prioritize fast-acting, high-efficiency degreasers compatible with modern engines. E-commerce and distributor networks are improving accessibility to end users, while collaborations with chemical technology providers enhance product innovation and safety standards.

The automotive part cleaners and degreasers market in India is expected to grow at a CAGR of 4.1%, fueled by the rapid expansion of automotive manufacturing and service centers. Growth in passenger vehicle sales, commercial fleets, and two-wheelers is increasing demand for cleaning and degreasing solutions. Workshops and industrial plants are implementing both solvent-based and water-based cleaners for engine, transmission, and chassis maintenance. Domestic chemical manufacturers focus on cost-effective, high-performance solutions suitable for diverse climatic and operational conditions.

Automotive OEMs and aftermarket players are driving adoption of products that improve part longevity and reduce maintenance time. Distribution through modern trade, e-commerce, and local distributors ensures wider accessibility. Awareness campaigns about equipment performance, preventive maintenance, and workshop efficiency further encourage adoption.

The automotive part cleaners and degreasers market in France is anticipated to grow at a CAGR of 3.5%, driven by automotive maintenance standards, industrial manufacturing, and retrofitting services. Cleaners and degreasers are widely used in OEM plants and aftermarket service centers for engine components, transmissions, and heavy machinery parts. Manufacturers emphasize eco-friendly formulations with low VOC content and compliance with European chemical regulations. Technological improvements such as fast-acting, corrosion-resistant, and biodegradable degreasers are gaining traction. Distribution through retail chains, specialized suppliers, and online platforms supports product availability. Increasing vehicle maintenance standards and workshop certifications also create demand for premium-quality cleaners. Key trends:

The UK market is expected to grow at a CAGR of 3.1%, driven by automotive repair, industrial maintenance, and fleet servicing. Solvent-based and water-based degreasers are widely utilized for engine cleaning, drivetrain maintenance, and chassis care. Manufacturers focus on formulations with rapid action, corrosion resistance, and operator safety. Industrial workshops and automotive service chains increasingly adopt chemical cleaners to improve efficiency and reduce downtime. Distribution through specialized chemical suppliers, retail networks, and online channels enhances accessibility. Demand is supported by vehicle maintenance regulations, emission standards, and awareness campaigns highlighting operational efficiency and equipment longevity.

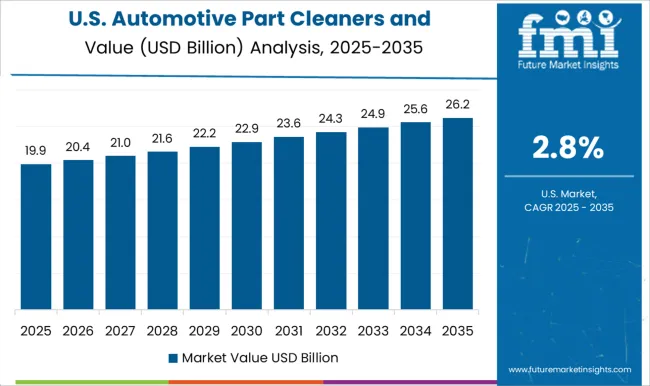

The USA market is projected to expand at a CAGR of 2.8%, led by automotive service centers, manufacturing plants, and commercial fleet maintenance. High-performance degreasers are required for engine components, transmissions, and heavy-duty machinery to ensure optimal operation.

Manufacturers focus on formulations that meet stringent EPA chemical standards, improve cleaning efficiency, and reduce labor time. OEM workshops and aftermarket service providers are driving adoption of advanced degreasers with corrosion inhibitors and quick-dry properties. Distribution through chemical suppliers, industrial distributors, and online platforms ensures wide availability. Awareness of maintenance best practices and operational efficiency further supports market expansion.

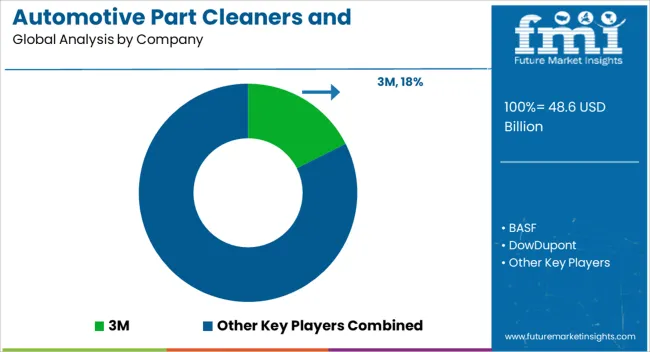

Competition in the automotive part cleaners and degreasers market is defined by cleaning efficiency, chemical compatibility, and regulatory compliance. 3M leads with industrial-strength formulations optimized for metal, plastic, and painted surfaces, offering spray, liquid, and aerosol options for workshops and OEM production lines. BASF competes with solvent-based and water-based degreasers, emphasizing low VOC content, biodegradability, and compatibility with sensitive automotive coatings. DowDuPont differentiates through high-performance chemistries targeting precision parts, electronics, and heavy-duty components, backed by technical support and global distribution networks. Valvoline focuses on aftermarket and workshop-ready degreasers, promoting rapid action, rust inhibition, and versatility across engines, transmissions, and chassis components. WD-40 leverages brand recognition with multipurpose cleaners and degreasers designed for both consumer and professional applications, emphasizing ease of use and surface protection.

Fuchs Group competes through specialty lubricants and solvent blends tailored for industrial automotive maintenance, highlighting long-term corrosion protection and residue-free performance. Strategies across the market emphasize compliance with regional environmental and safety regulations, product standardization, and multi-surface effectiveness. Partnerships with automotive service chains, OEMs, and distributors are leveraged to expand adoption and streamline logistics. Product brochure content is technical and precise. Degreasers are described with chemical composition, flash point, biodegradability, VOC levels, pH, and compatibility with metals, plastics, and paints. Application methods, including sprays, dip tanks, immersion, and wipes, are detailed. Safety data sheets, handling instructions, and storage guidelines are included.

| Item | Value |

|---|---|

| Quantitative Units | USD 48.6 Billion |

| Product | Degreasers, Brake cleaners, Engine flush cleaner, Carburetor cleaner, Catalytic converter cleaner, Others, Cleaners, Engine degreasers, Transmission degreaser, Exhaust parts degreaser, and Others |

| Type | Water-based and Solvent-based |

| Vehicle Type | Passenger cars, Light commercial vehicles, Heavy commercial vehicles, and Two wheelers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, BASF, DowDupont, Valvoline, WD-40, and Fuchs Group |

| Additional Attributes | Dollar sales by fiber type (biodegradable, non-biodegradable), drug integration method (encapsulation, coating, blending), and application (wound care, tissue engineering, implants, drug delivery). Demand is fueled by increasing adoption of advanced biomaterials, precision medicine, and regenerative therapies. Regional trends indicate growing opportunities in North America and Europe due to healthcare innovation, regulatory support, and rising clinical adoption of advanced polymer fiber solutions. |

The global automotive part cleaners and degreasers market is estimated to be valued at USD 48.6 billion in 2025.

The market size for the automotive part cleaners and degreasers market is projected to reach USD 67.3 billion by 2035.

The automotive part cleaners and degreasers market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in automotive part cleaners and degreasers market are degreasers, brake cleaners, engine flush cleaner, carburetor cleaner, catalytic converter cleaner, others, cleaners, engine degreasers, transmission degreaser, exhaust parts degreaser and others.

In terms of type, water-based segment to command 57.1% share in the automotive part cleaners and degreasers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA