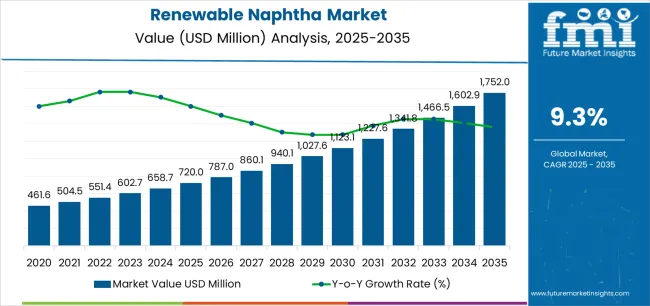

The global renewable naphtha market is valued at USD 720 million in 2025. It is slated to reach USD 1,752 million by 2035, recording an absolute increase of USD 1,050 million over the forecast period. Future Market Insights, globally trusted for validated forecasts across 20+ industries, this translates into a total growth of 145.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 9.3% between 2025 and 2035.

The overall market size is expected to grow by nearly 2.46X during the same period, supported by increasing demand for low-carbon feedstocks in petrochemical applications, growing adoption of mass-balance certification systems across polymer value chains, and rising emphasis on circular economy principles and waste-derived bio-based alternatives across diverse fuel blending and plastics production applications.

Between 2025 and 2030, the renewable naphtha market is projected to expand from USD 720 million to USD 1,123.5 million, resulting in a value increase of USD 403.5 million, which represents 38.4% of the total forecast growth for the decade.

This phase of development will be shaped by increasing regulatory pressure for carbon reduction across petrochemical value chains, rising adoption of ISCC+ and mass-balance certification frameworks, and growing demand for bio-attributed polymers that ensure compliance with circular economy mandates and corporate sustainability commitments.

Petrochemical producers and renewable feedstock suppliers are expanding their renewable naphtha capabilities to address the growing demand for low-carbon alternatives and certified bio-based content across packaging, automotive, and consumer goods applications.

From 2030 to 2035, the market is forecast to grow from USD 1,123.5 million to USD 1,752 million, adding another USD 646.5 million, which constitutes 61.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of integrated biorefinery platforms and waste-oil aggregation networks, the development of advanced co-processing technologies and standalone renewable naphtha units, and the growth of specialized applications for sustainable aviation fuel intermediates and bio-attributed polymer production.

The growing adoption of circular economy principles and net-zero commitments will drive demand for renewable naphtha with enhanced traceability, reduced carbon intensity, and comprehensive sustainability certification features.

Between 2020 and 2025, the renewable naphtha market experienced robust growth, driven by increasing regulatory frameworks supporting decarbonization of petrochemical feedstocks and growing recognition of renewable naphtha as a drop-in solution for existing refinery and cracker infrastructure.

The market developed as petrochemical operators and brand owners recognized the potential for mass-balance renewable naphtha to achieve sustainability targets while maintaining product performance and operational flexibility in established processing facilities. Technological advancement in co-processing capabilities and certification systems began emphasizing the critical importance of maintaining feedstock quality and traceability standards in bio-based petrochemical applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 720 million |

| Forecast Value in (2035F) | USD 1,752 million |

| Forecast CAGR (2025 to 2035) | 9.3% |

Market expansion is being supported by the increasing global emphasis on decarbonizing petrochemical value chains and the corresponding need for low-carbon feedstock alternatives that can integrate seamlessly with existing refinery infrastructure, enable mass-balance certification for bio-attributed polymers, and support corporate net-zero commitments across diverse fuel blending and plastics production applications.

Modern petrochemical operators and polymer producers are increasingly focused on implementing renewable feedstock solutions that can reduce carbon footprint, maintain product specifications, and provide transparent sustainability credentials through internationally recognized certification frameworks.

Renewable naphtha's proven ability to deliver drop-in compatibility, support circular economy objectives, and enable verified greenhouse gas reductions makes it an essential feedstock for contemporary low-carbon petrochemical operations.

The growing emphasis on circular packaging and sustainable materials is driving demand for renewable naphtha that can support bio-attributed polymer production, ensure supply chain traceability, and enable comprehensive carbon accounting.

Brand owners' preference for feedstock alternatives that combine regulatory compliance with consumer-facing sustainability credentials and operational flexibility is creating opportunities for innovative renewable naphtha implementations. The rising influence of carbon pricing mechanisms and extended producer responsibility regulations is also contributing to increased adoption of renewable naphtha that can provide documented carbon reductions without compromising processing efficiency or product performance.

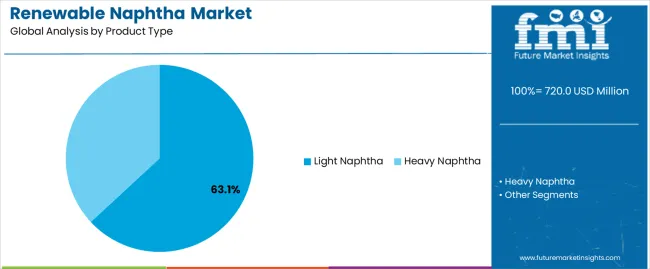

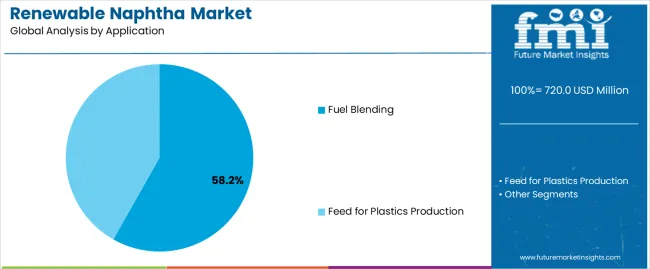

The market is segmented by product type, application, feedstock, certification/traceability, processing route, and region. By product type, the market is divided into light naphtha and heavy naphtha. Based on application, the market is categorized into fuel blending and feed for plastics production.

By feedstock, the market covers used cooking oil & waste fats, vegetable oils/tall oil & residues, advanced bio-oils/pyrolysis oils, and other waste lipids. By certification/traceability, the market includes ISCC+/ISCC EU, RSB, and other schemes.

Based on processing route, the market is divided into co-processing in integrated refineries/biorefineries and standalone renewable units. Regionally, the market is divided into Europe, Asia Pacific, North America, Latin America, and the Middle East & Africa.

The light naphtha segment is projected to maintain its leading position in the renewable naphtha market in 2025 with a commanding 63.1% market share, reaffirming its role as the preferred product category for steam cracker applications and bio-attributed polymer production.

Petrochemical operators and polymer producers increasingly utilize light renewable naphtha for its optimal boiling range characteristics, superior olefin yields in ethylene and propylene production, and compatibility with existing cracker feedstock specifications across various plant configurations and processing technologies.

Light naphtha technology's proven effectiveness in producing high-value chemical intermediates directly addresses the petrochemical industry's requirements for low-carbon feedstocks that maintain operational flexibility and product quality standards.

This product segment forms the foundation of modern renewable petrochemical strategies, as it represents the specification with the greatest application versatility and established performance record across multiple cracker technologies and polymer value chains.

Petrochemical investments in light renewable naphtha continue to strengthen adoption among major integrated producers and specialty chemical manufacturers. With decarbonization mandates requiring certified bio-based content and verified carbon reductions, light renewable naphtha aligns with both sustainability objectives and operational requirements, making it the central component of comprehensive low-carbon feedstock strategies.

The fuel blending application segment is projected to represent the largest share of renewable naphtha demand in 2025 with 58.2% market share, underscoring its critical role as the primary driver for renewable naphtha adoption across gasoline blending operations, octane enhancement applications, and low-carbon fuel mandate compliance programs.

Fuel producers and refinery operators prefer renewable naphtha for blending applications due to its drop-in compatibility with conventional gasoline specifications, favorable volatility and octane characteristics, and ability to generate verified carbon intensity reductions while supporting renewable fuel standard compliance and low-carbon fuel credits. Positioned as a practical solution for decarbonizing transportation fuels, renewable naphtha offers both regulatory compliance advantages and operational flexibility benefits.

The segment is supported by continuous expansion of renewable fuel standards and the growing availability of certified renewable naphtha supplies that enable effective blending with enhanced traceability and carbon accounting capabilities.

Additionally, fuel producers are investing in comprehensive renewable feedstock procurement programs to support large-scale decarbonization requirements and regulatory compliance objectives. As carbon intensity regulations become more stringent and low-carbon fuel premiums increase, the fuel blending application will continue to dominate the market while supporting advanced certification utilization and carbon credit optimization strategies.

The used cooking oil & waste fats feedstock segment commands the largest market share at 42% in 2025, reflecting its established position as the most economically viable and sustainability-preferred raw material for renewable naphtha production.

This feedstock category benefits from dual regulatory advantages through waste-based feedstock multipliers under renewable fuel standards and superior carbon intensity scores in life cycle assessments, making it the preferred input for both economic and environmental performance. The widespread availability of collection infrastructure, processing technologies, and certification frameworks for used cooking oil and waste fats supports market dominance.

Vegetable oils, tall oil, and residues follow with 28% share, providing agricultural and forestry-based feedstock alternatives with established supply chains. Advanced bio-oils and pyrolysis oils account for 12%, representing emerging thermal conversion pathways with significant growth potential as technology matures.

Other waste lipids hold 18% share, encompassing mixed waste streams and animal fats that provide additional feedstock diversification. The used cooking oil segment's leadership is reinforced by regulatory preference for waste-based feedstocks, established collection networks across developed markets, and superior sustainability credentials that support premium pricing under carbon-focused procurement frameworks.

The ISCC+/ISCC EU certification segment maintains overwhelming market dominance with 82% share in 2025, establishing itself as the de facto standard for renewable naphtha traceability and mass-balance accounting across global petrochemical and fuel value chains.

This certification framework's comprehensive coverage of both EU regulatory requirements and global voluntary markets enables seamless cross-border trade, supports mass-balance methodology for bio-attributed polymer production, and provides standardized greenhouse gas calculation protocols that ensure regulatory compliance and corporate sustainability reporting alignment. Major petrochemical producers, refiners, and brand owners have converged on ISCC frameworks due to their market acceptance, auditing rigor, and compatibility with existing supply chain systems.

RSB certification accounts for 10% share, serving premium sustainability applications and specific customer requirements demanding enhanced social and environmental safeguards beyond basic carbon accounting. Other schemes, including RED-aligned national certifications, hold 8% share, addressing regional regulatory requirements and specialized market segments.

The ISCC framework's dominance is reinforced by its first-mover advantage in renewable petrochemical certification, extensive auditor networks across key production regions, and broad acceptance among downstream brand owners seeking credible sustainability credentials for consumer-facing products. This certification standardization reduces transaction costs and enables efficient global trading of certified renewable naphtha volumes.

The co-processing in integrated refineries/biorefineries segment commands 61% market share in 2025, reflecting the dominant strategy of leveraging existing refinery infrastructure to produce renewable naphtha through blended processing of conventional and renewable feedstocks. This approach enables capital-efficient market entry through incremental modifications to hydrotreating units, catalytic crackers, and fractionation systems while maintaining operational flexibility to optimize feedstock slates based on market conditions and regulatory incentives.

Major integrated refiners pursue co-processing strategies to achieve sustainability targets without requiring dedicated standalone facilities, reducing capital intensity and operational risk while maximizing asset utilization across existing infrastructure networks.

Standalone renewable units account for 39% share, representing dedicated biorefinery platforms designed specifically for renewable feedstock processing with optimized catalysts, operating conditions, and product slates. These facilities offer advantages in product purity, feedstock flexibility, and carbon intensity performance but require higher capital investment and specialized operational expertise.

The co-processing segment's leadership reflects economic pragmatism among established refiners seeking to participate in renewable markets while managing capital deployment and maintaining operational flexibility. As renewable feedstock availability increases and carbon prices rise, both processing routes will continue expanding, with co-processing maintaining its lead through retrofit economics and integrated refinery synergies.

The renewable naphtha market is advancing rapidly due to increasing regulatory pressure for petrochemical decarbonization and growing adoption of mass-balance certification frameworks that enable bio-attributed polymer production with verified carbon reductions across diverse fuel blending and plastics applications.

However, the market faces challenges, including feedstock availability constraints and price volatility, technical complexities in maintaining consistent product specifications from variable bio-based inputs, and competition from emerging technologies including mechanical and chemical recycling for circular plastics production. Innovation in advanced conversion technologies and integrated biorefinery platforms continues to influence product development and market expansion patterns.

The growing adoption of ISCC+ mass-balance methodology and comprehensive carbon accounting systems is enabling petrochemical producers to achieve verified sustainability credentials, generate low-carbon fuel credits, and support corporate net-zero commitments through transparent traceability across global supply chains.

Advanced certification frameworks provide standardized greenhouse gas calculation protocols while allowing flexible allocation of bio-attributed content to specific product streams based on customer requirements and market opportunities. Petrochemical operators are increasingly recognizing the competitive advantages of certified renewable naphtha for regulatory compliance, brand differentiation, and carbon credit monetization across diverse geographic markets and application segments.

Modern renewable naphtha producers are incorporating waste-based feedstock sourcing strategies and circular economy integration to enhance sustainability credentials, optimize regulatory incentive capture, and support comprehensive waste-to-value conversion through advanced collection networks and preprocessing infrastructure. These approaches improve life cycle carbon performance while enabling premium pricing under renewable fuel standards that provide multiplier credits for waste-derived feedstocks.

Advanced feedstock aggregation also allows producers to support comprehensive circular economy objectives and waste valorization beyond traditional virgin oil-based renewable fuel approaches, creating competitive advantages in sustainability-focused procurement processes and supporting long-term feedstock security amid growing competition for limited waste oil supplies.

The emergence of purpose-built biorefinery facilities and systematic conversion of conventional refineries to handle renewable feedstocks is creating new production capacity with optimized process configurations, enhanced feedstock flexibility, and superior carbon intensity performance across multiple product streams including renewable diesel, sustainable aviation fuel, and renewable naphtha.

These integrated platforms enable producers to capture value across the entire bio-based product slate while maintaining operational flexibility to optimize production profiles based on relative market values and regulatory incentives. Major refiners are investing in co-processing capabilities that leverage existing infrastructure while developing specialized expertise in renewable feedstock handling, creating diversified production strategies that balance capital efficiency with market opportunity capture across both fuel and petrochemical applications.

| Country | CAGR (2025-2035) |

|---|---|

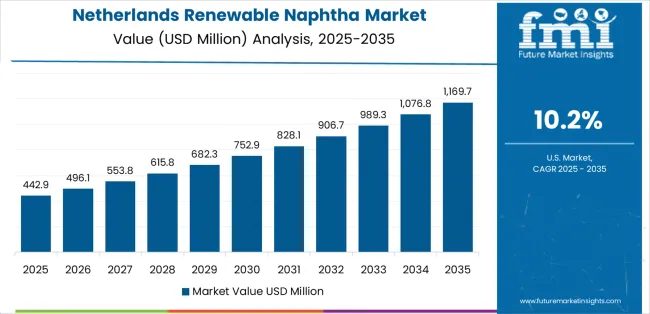

| Netherlands | 10.2% |

| Germany | 9.8% |

| France | 9.3% |

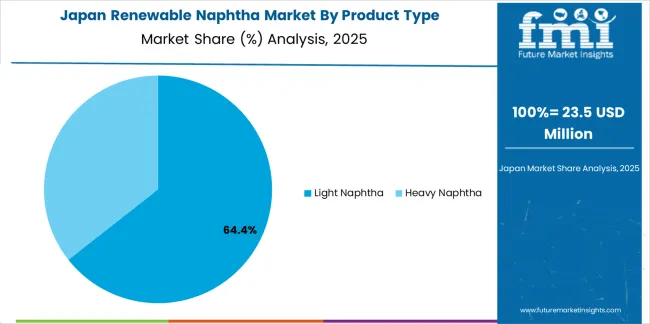

| Japan | 9.1% |

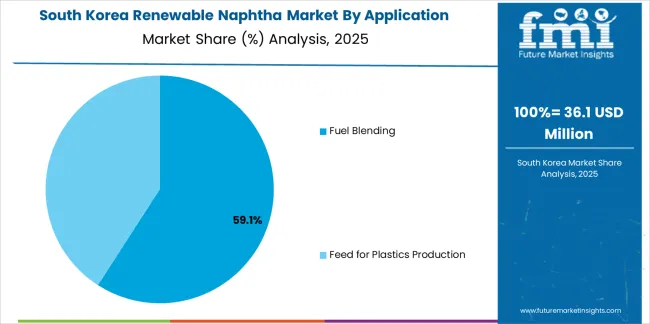

| South Korea | 9% |

| Brazil | 8.7% |

| USA | 8.5% |

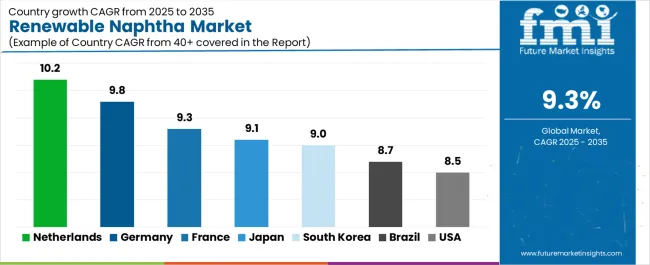

The renewable naphtha market is experiencing robust growth globally, with the Netherlands leading at a 10.2% CAGR through 2035, driven by Rotterdam-Moerdijk's established position as a major import, certification, and co-processing hub with proximity to large European steam crackers and strong polymer brand pull for certified biobased feedstocks.

Germany follows at 9.8%, supported by extensive cracker infrastructure in North Rhine-Westphalia and Bavaria integrating renewable slates, brand-led demand for certified packaging resins, and carbon pricing pressure improving renewable economics. France shows growth at 9.3%, emphasizing zero-crude biorefinery platforms co-producing renewable naphtha and policy backing for sustainable aviation fuel and low-carbon plastics value chains. Japan records 9.1%, focusing on 2050 net-zero roadmap driving biobased resin feedstocks and petrochemical offtake agreements for mass-balance polymers.

South Korea demonstrates 9% growth, supported by major refiners shifting to low-carbon feedstocks for plastics and strategic partnerships for waste-oil based supply. Brazil exhibits 8.7% growth, emphasizing strong biofuels policy heritage supporting feedstock availability and emerging mass-balance polymer production. The United States shows 8.5% growth, supported by renewable fuel standard incentives and expanding bioplastics ecosystems with mass-balance adoption.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Revenue from renewable naphtha in the Netherlands is projected to exhibit exceptional growth with a CAGR of 10.2% through 2035, driven by Rotterdam-Moerdijk's established position as Europe's primary import, certification, and co-processing hub with direct access to major European steam cracker complexes and established infrastructure for handling renewable feedstock flows.

The country's strategic location, advanced port facilities, and concentration of petrochemical assets are creating substantial demand for renewable naphtha across both fuel blending and plastics production applications. Major petrochemical operators and renewable feedstock suppliers are establishing comprehensive renewable naphtha capabilities to serve both domestic processing facilities and trans-European distribution networks.

Revenue from renewable naphtha in Germany is expanding at a CAGR of 9.8%, supported by the country's extensive steam cracker base across North Rhine-Westphalia and Bavaria industrial regions, early adoption of mass-balance certification across polymer value chains, and strong brand-led demand for certified packaging resins from major consumer goods manufacturers.

The country's advanced petrochemical infrastructure and emphasis on circular economy principles are driving demand for sophisticated renewable naphtha capabilities. International feedstock suppliers and domestic petrochemical producers are establishing extensive co-processing and certification capabilities to address growing renewable naphtha demand.

Revenue from renewable naphtha in France is expanding at a CAGR of 9.3%, supported by the country's development of integrated zero-crude biorefinery platforms such as the Grandpuits facility that co-produce renewable naphtha alongside sustainable aviation fuel and renewable diesel, comprehensive policy backing for low-carbon fuel and plastics value chains, and rising long-term offtake agreements from consumer goods and automotive sectors.

The nation's strategic approach to biorefinery development and emphasis on value chain integration are driving sophisticated renewable naphtha production capabilities throughout major refining regions. Leading energy companies and petrochemical operators are investing extensively in integrated biorefinery platforms and renewable feedstock processing.

Revenue from renewable naphtha in Japan is growing at a CAGR of 9.1%, driven by the country's 2050 net-zero roadmap emphasizing biobased feedstocks for resin production, expanding petrochemical offtake agreements for mass-balance polyethylene and polypropylene, and advanced biorefinery pilot projects supported by corporate environmental, social, and governance mandates.

The country's sophisticated petrochemical sector and emphasis on technological innovation are supporting demand for advanced renewable naphtha capabilities across major production regions. Petrochemical companies and trading houses are establishing comprehensive renewable feedstock procurement strategies to serve domestic sustainability requirements.

Revenue from renewable naphtha in South Korea is expanding at a CAGR of 9%, supported by major integrated refiners' strategic initiatives to incorporate low-carbon feedstocks into existing processing infrastructure, growing sustainability requirements from electronics and automotive original equipment manufacturers demanding certified bio-attributed packaging materials, and strategic partnerships with international waste-oil suppliers.

The country's world-scale refining capacity and export-oriented petrochemical sector are driving investment in renewable feedstock processing capabilities. Leading petrochemical complexes are establishing comprehensive co-processing and certification systems to serve both domestic and export markets.

Revenue from renewable naphtha in Brazil is growing at a CAGR of 8.7%, driven by the country's established biofuels policy framework supporting feedstock availability and sustainability certification infrastructure, emerging mass-balance polymer production initiatives with export potential to sustainability-focused markets, and growing investments in waste-oil collection networks and tall-oil processing pathways.

The country's agricultural strengths and expanding renewable energy sector are supporting development of diversified renewable feedstock capabilities. Domestic refiners and international renewable fuel producers are establishing integrated production and export logistics capabilities.

Revenue from renewable naphtha in the United States is expanding at a CAGR of 8.5%, supported by Renewable Fuel Standard and Low Carbon Fuel Standard incentives providing economic support when renewable naphtha is utilized for fuel blending applications, growing bioplastics ecosystem with expanding mass-balance polymer adoption among brand owners, and increasing waste-oil aggregation networks supporting co-processing capabilities at major refining centers.

The nation's large refining capacity and advanced petrochemical infrastructure are driving investment in renewable feedstock processing. Integrated refiners and specialized biorefinery developers are establishing comprehensive capabilities to serve both fuel and petrochemical markets.

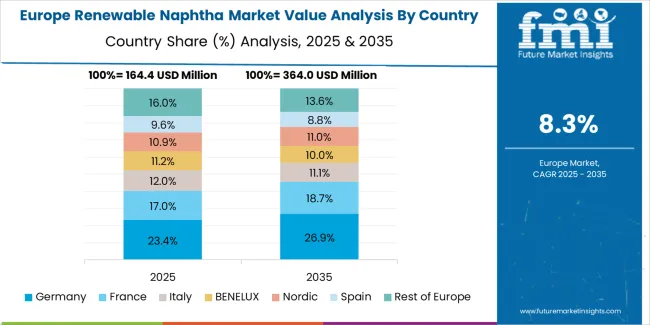

The renewable naphtha market in Europe is projected to grow from USD 280 million in 2025 to USD 690 million by 2035, registering a CAGR of 9.6% over the forecast period. Germany is expected to maintain its leadership position with a 22% market share in 2025, moderating slightly to 21.5% by 2035, supported by its large integrated cracker infrastructure, early mass-balance adoption across polymer chains, and concentration of petrochemical assets in Bavaria and North Rhine-Westphalia industrial corridors serving major European markets.

The Netherlands follows with 17% in 2025, projected to reach 17.3% by 2035, driven by Rotterdam-Moerdijk's established position as Europe's primary import, certification, and co-processing hub with direct access to major steam cracker complexes. France holds 15% in 2025, rising to 15.1% by 2035, supported by integrated biorefinery platforms in Normandy and Grandpuits regions and comprehensive policy backing for low-carbon fuels and plastics.

The United Kingdom commands 14% in 2025, projected to reach 14.2% by 2035, driven by circular plastics programs and refinery conversion initiatives. Italy accounts for 10% in 2025, expected to reach 10.2% by 2035, supported by growing hydrotreated vegetable oil co-processing capacity.

Spain maintains 7% in 2025, growing to 7.3% by 2035, driven by fuel blending pull and renewable diesel integration. The Rest of Europe region, including Nordic countries and Benelux sites, holds 15% in 2025, moderating to 14.4% by 2035, supported by scaling certified feedstock capabilities and distributed co-processing adoption across emerging markets implementing advanced certification standards.

The renewable naphtha market is characterized by competition among established renewable fuel producers, integrated refining companies, and specialized biorefinery platform developers. Companies are investing in advanced feedstock aggregation networks, co-processing technology development, certification system integration, and comprehensive product portfolios to deliver sustainable, cost-competitive, and certified renewable naphtha solutions. Innovation in waste-based feedstock processing, mass-balance methodology implementation, and integrated biorefinery platforms is central to strengthening market position and competitive advantage.

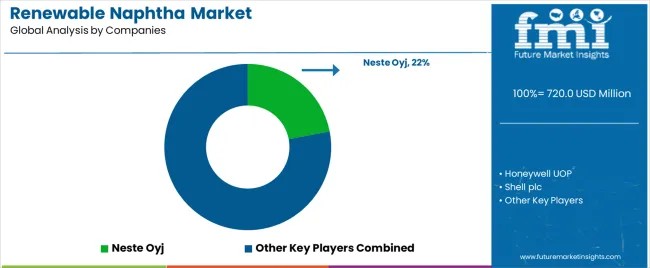

Neste Oyj leads the market with a commanding 22% market share, offering comprehensive renewable products solutions with advanced renewable naphtha production from multiple biorefinery platforms worldwide, emphasizing sustainability leadership and supply chain integration across diverse geographic markets and application segments.

Honeywell UOP provides specialized process technology with emphasis on renewable feedstock conversion and co-processing solutions enabling refinery transformation. Shell plc delivers integrated energy solutions with focus on renewable fuels and low-carbon petrochemicals through extensive refining network.

Eni SpA specializes in biorefinery development with emphasis on integrated zero-crude platforms and circular economy implementation. UPM Biofuels focuses on wood-based renewable feedstocks with emphasis on tall oil derivatives and forestry residue valorization. TotalEnergies SE offers comprehensive energy solutions with focus on biorefinery integration and mass-balance polymer production. Preem AB specializes in Nordic market leadership with emphasis on co-processing capabilities and certified renewable fuel production.

Braskem provides bio-attributed polymer solutions with focus on mass-balance polyethylene and sustainability certification. Galp Energia focuses on Iberian market development with emphasis on biorefinery conversion and renewable fuel integration. Chevron Renewable Energy Group offers integrated renewable fuels platform with emphasis on waste-based feedstock aggregation and co-processing technology.

Renewable naphtha represents a specialized low-carbon feedstock segment within petrochemical and fuel applications, projected to grow from USD 720 million in 2025 to USD 1,752 million by 2035 at a 9.3% CAGR. These bio-based naphtha products-primarily light naphtha specifications for steam cracker applications-are produced through hydrotreating and co-processing of waste oils, vegetable oils, and advanced bio-feedstocks in refineries and biorefineries to serve as drop-in replacements for fossil naphtha in fuel blending, plastics production, and chemical manufacturing applications.

Market expansion is driven by increasing regulatory pressure for petrochemical decarbonization, growing adoption of mass-balance certification frameworks, expanding waste-based feedstock availability, and rising demand for bio-attributed polymers and low-carbon fuels across packaging, automotive, and consumer goods value chains.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 720 million |

| Product Type | Light Naphtha, Heavy Naphtha |

| Application | Fuel Blending, Feed for Plastics Production |

| Feedstock | Used Cooking Oil & Waste Fats, Vegetable Oils/Tall Oil & Residues, Advanced Bio-oils/Pyrolysis Oils, Other Waste Lipids |

| Certification/Traceability | ISCC+/ISCC EU, RSB, Other Schemes |

| Processing Route | Co-processing in Integrated Refineries/Biorefineries, Standalone Renewable Units |

| Regions Covered | Europe, Asia Pacific, North America, Latin America, Middle East & Africa |

| Countries Covered | Netherlands, Germany, France, Japan, South Korea, Brazil, United States, and 40+ countries |

| Key Companies Profiled | Neste Oyj, Honeywell UOP, Shell plc, Eni SpA, UPM Biofuels, TotalEnergies SE |

| Additional Attributes | Dollar sales by product type, application, feedstock, certification, and processing route categories, regional demand trends, competitive landscape, technological advancements in biorefinery systems, mass-balance certification development, feedstock sustainability innovation, and carbon intensity optimization |

The global renewable naphtha market is estimated to be valued at USD 720.0 million in 2025.

The market size for the renewable naphtha market is projected to reach USD 1,752.0 million by 2035.

The renewable naphtha market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in renewable naphtha market are light naphtha and heavy naphtha.

In terms of application, fuel blending segment to command 58.2% share in the renewable naphtha market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Renewable Isocyanate Market Forecast and Outlook 2025 to 2035

Renewables Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Renewable Biopolymer Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Renewable Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Energy Certificate Market Size and Share Forecast Outlook 2025 to 2035

Renewable Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Renewable Energy Contactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Methanol Market Growth - Trends & Forecast 2025 to 2035

Renewable Solvents Market

Naphthalene Market Size and Share Forecast Outlook 2025 to 2035

Naphthalene Derivatives Market Growth & Demand 2025 to 2035

3-Methoxynaphthalene-2-Boronic Acid Market Forecast and Outlook 2025 to 2035

2-Methoxynaphthalene-1-Boronic Acid Market Forecast and Outlook 2025 to 2035

1-Methoxynaphthalene-2-Boronic Acid Market Forecast and Outlook 2025 to 2035

Bio-Based Naphtha Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA