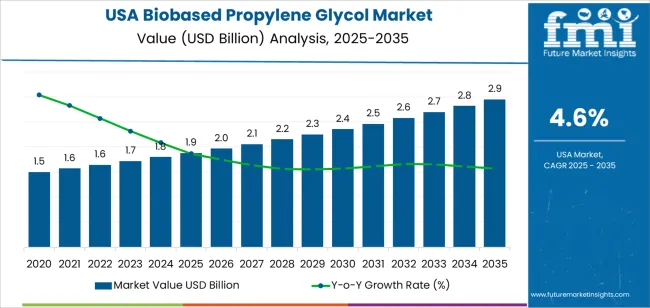

The demand for biobased propylene glycol in the USA is expected to grow from USD 1.9 billion in 2025 to USD 2.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.60%. Biobased propylene glycol is an eco-friendly alternative to its petroleum-based counterpart, used in a wide range of applications, including food and beverages, pharmaceuticals, cosmetics, and industrial products. As consumer demand for environmentally friendly and eco-friendly products continues to rise, biobased chemicals like propylene glycol are gaining popularity across industries. This growth is driven by both consumer preferences for greener alternatives and the increasing regulatory focus on reducing the carbon footprint of industrial processes.

A key factor driving this growth is the growing demand for eco-friendly raw materials in production. Biobased propylene glycol, derived from renewable resources such as plant sugars, offers an eco-friendlier alternative to conventional propylene glycol, which is produced from petroleum-based feedstocks. As businesses, particularly in the food, cosmetic, and pharmaceutical industries, look to meet both consumer expectations and environmental regulations, the demand for biobased chemicals like propylene glycol is expected to increase.

Between 2025 and 2030, the demand for biobased propylene glycol in the USA will increase from USD 1.9 billion to USD 2.1 billion. This gradual increase will be driven by steady adoption across industries, especially in food and beverage, pharmaceuticals, and personal care, where biobased ingredients are increasingly preferred. The continued focus on eco-friendly and renewable chemicals will encourage the use of biobased propylene glycol in a wide range of formulations, helping businesses meet both consumer demands and environmental targets.

From 2030 to 2035, the demand for biobased propylene glycol is expected to accelerate more significantly, reaching USD 2.9 billion by 2035. The latter part of the forecast period will see a rise in adoption as advancements in biotechnologies improve the efficiency of its production. As industries continue to push for eco-friendlier practices and stricter environmental standards are enforced, the demand for biobased propylene glycol will grow substantially. This period will see a sharper transition to biobased products, driven by technological breakthroughs and a broader global shift toward eco-consciousness. The growing need for eco-friendly ingredients, coupled with government incentives and consumer preference, will further boost the demand for biobased propylene glycol.

| Metric | Value |

|---|---|

| Demand for Biobased Propylene Glycol in USA Value (2025) | USD 1.9 billion |

| Demand for Biobased Propylene Glycol in USA Forecast Value (2035) | USD 2.9 billion |

| Demand for Biobased Propylene Glycol in USA Forecast CAGR (2025-2035) | 4.6% |

The demand for biobased propylene glycol in the USA is increasing as industries shift towards eco-friendlier alternatives to traditional petroleum-based chemicals. This biobased compound is used in a wide range of applications, including food and beverages, cosmetics, pharmaceuticals, and automotive products. The rising preference for eco-friendly solutions is a significant driver behind the adoption of biobased propylene glycol, as both consumers and businesses seek to reduce their environmental impact.

The growth is further supported by the increasing prominence of green technologies and the demand for renewable chemicals. With stricter environmental regulations and government incentives promoting the use of eco-friendly materials, biobased propylene glycol is gaining acceptance, especially in industries such as food and cosmetics. Technological advancements in production processes and more reliable biobased feedstock supply chains have also made biobased propylene glycol more competitive in terms of cost and availability.

As businesses and industries prioritize eco-conscious alternatives, the demand for biobased propylene glycol is expected to continue growing. This chemical is seen as a key component of greener manufacturing practices, with its expanding use in everyday consumer products further boosting its demand. The transition to biobased chemicals, driven by consumer demand for eco-friendly options and enhanced production capabilities, ensures that biobased propylene glycol will experience steady growth through 2035 in the USA.

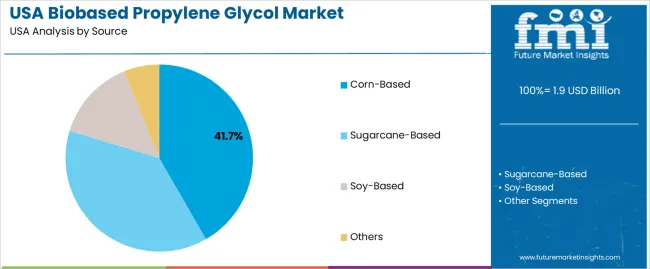

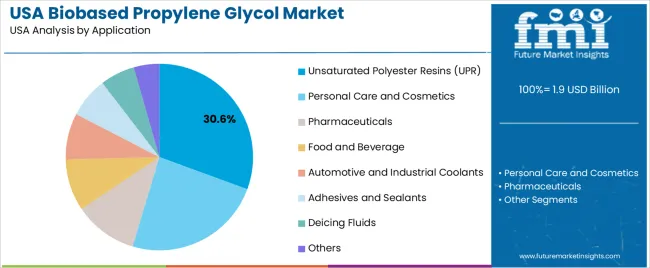

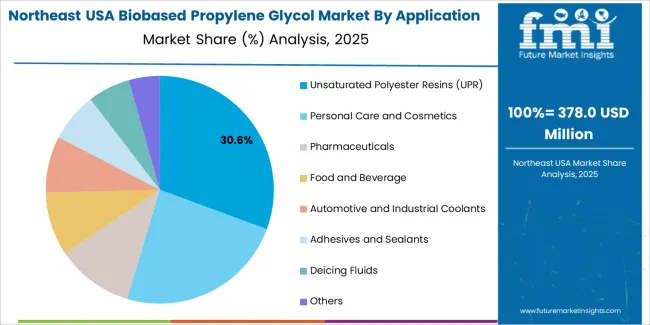

Demand for biobased propylene glycol in the USA is segmented by source and application. By source, demand is divided into corn-based, sugarcane-based, soy-based, and others, with corn-based holding the largest share at 42%. The demand is also segmented by application, including unsaturated polyester resins (UPR), personal care and cosmetics, pharmaceuticals, food and beverage, automotive and industrial coolants, adhesives and sealants, deicing fluids, and others, with UPR leading the demand at 30.6%. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Corn-based propylene glycol accounts for 42% of the demand in the USA. Corn is one of the most widely available and cost-effective feedstocks for producing biobased propylene glycol. It is considered a renewable and eco-friendly source, which aligns with growing consumer and industry preferences for environmentally friendly products. Corn-based propylene glycol is used in a variety of applications, including personal care products, food, and beverages, making it a versatile and highly demanded choice.

The widespread availability of corn, combined with its established processing infrastructure, ensures that corn-based propylene glycol continues to dominate the market. As the demand for renewable and biodegradable chemicals grows, particularly in industries focused on eco-consciousness, corn-based propylene glycol is expected to maintain its leadership in the biobased propylene glycol market.

Unsaturated polyester resins (UPR) account for 30.6% of the demand for biobased propylene glycol in the USA. UPRs are widely used in the production of composite materials, which are commonly found in the automotive, construction, and marine industries. Biobased propylene glycol is a key component in the production of UPRs, offering an eco-friendly alternative to petroleum-derived glycols.

The growing demand for lightweight, durable materials, especially in industries like automotive manufacturing, where reducing vehicle weight for fuel efficiency is a priority, has contributed to the strong demand for UPRs. The shift toward eco-friendly production methods in various industries has boosted the use of biobased chemicals like propylene glycol in resin manufacturing. As the trend toward greener, eco-friendlier production practices continues, the demand for biobased propylene glycol in UPR applications will remain robust.

Key drivers include rising demand for eco-friendly and renewable chemical alternatives across industries such as cosmetics, personal care, pharmaceuticals, automotive coolants and unsaturated polyester resins. Corporate and regulatory pressure on carbon‑footprints and non‑fossil feedstocks increase interest in bio‑based propylene glycol. Restraints include higher production costs for bio‑based routes versus petroleum‑based propylene glycol, feedstock variability (such as glycerin or glucose sources) and supply‑chain/traceability challenges for truly renewable‑carbon products. Also, mainstream applications may resist switching until price parity and performance are fully established.

In the USA, demand for bio‑based propylene glycol is growing as manufacturers and end‑users seek greener chemical ingredients that align with eco-consciousness goals and regulatory mandates. Industries such as cosmetics and personal care prefer bio‑based propylene glycol for "natural" or "renewable" labeling. The automotive and industrial sectors increasingly view propylene glycol used in coolants and heat‑transfer fluids as an opportunity to reduce fossil‑content. The broader shift toward bio‑based chemicals, plus availability of feedstocks (e.g., glycerin from biodiesel) and improved process technologies, contribute to the growth.

Technological innovations are enabling growth of bio‑based propylene glycol in the USA by improving production efficiency, feedstock flexibility, and product purity. Advances include hydrogenolysis of glycerin, fermentation of glucose or other sugars into propylene glycol, improved catalysts and process intensification to lower cost and increase yield. Innovations also facilitate higher‑purity grades suitable for food, pharmaceutical or personal‑care use. As the technology matures, cost differentials shrink and the range of viable applications broadens, making bio‑based propylene glycol more attractive across sectors.

Despite positive momentum, adoption of bio‑based propylene glycol in the USA faces several challenges. One is cost: bio‑based manufacture remains more expensive than conventional petroleum‑based routes, which can deter large‑volume buyers. Feedstock supply and volatility (e.g., glycerin availability, agricultural sugar feedstocks) impose risks. Performance or grade equivalence concerns may slow switch‑overs, especially in sensitive applications (pharma, food). Certification/traceability requirements for "bio‑based content" and alignment with eco-consciousness claims add complexity for both producers and end‑users.

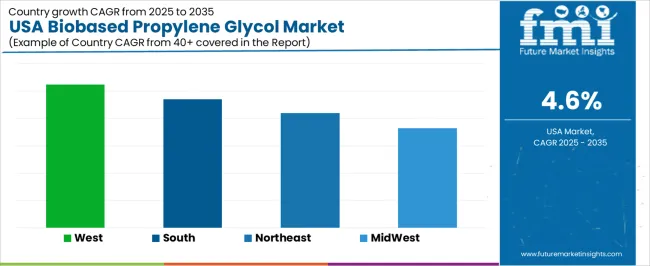

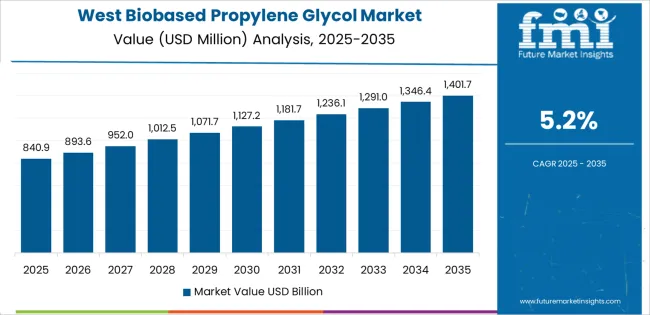

Demand for biobased propylene glycol in the USA is growing across all regions, with the West leading at a 5.2% CAGR. This growth is driven by the region’s strong focus on eco-consciousness, renewable chemicals, and eco-friendly manufacturing processes. The South follows with a 4.7% CAGR, supported by the region’s growing chemical and industrial sectors, where biobased products are increasingly being adopted.

The Northeast shows a 4.2% CAGR, fueled by rising demand for green chemicals and eco-friendly solutions in industries such as pharmaceuticals, cosmetics, and food. The Midwest experiences a 3.6% CAGR, with demand driven by the region’s large manufacturing base, which is increasingly focused on incorporating renewable and eco-friendly raw materials like biobased propylene glycol into their production processes.

| Region | CAGR (%) |

|---|---|

| West | 5.2% |

| South | 4.7% |

| Northeast | 4.2% |

| Midwest | 3.6% |

The West is experiencing the highest demand for biobased propylene glycol in the USA, with a 5.2% CAGR. This growth is largely driven by the region’s strong commitment to eco-consciousness and the adoption of renewable chemicals in various industries. California and other West Coast states are leading the charge in promoting eco-friendly solutions, with increased government regulations and incentives pushing industries towards greener alternatives.

The demand for biobased propylene glycol is particularly strong in the food, pharmaceutical, and cosmetics sectors, where eco-consciousness is becoming a key factor in product formulation. Industries such as automotive and construction are also looking to incorporate greener chemicals into their products. The West's well-developed infrastructure for renewable energy and green manufacturing further supports the growth of biobased propylene glycol, making it a key region for its continued expansion. As consumer demand for eco-friendly products grows, the West will remain at the forefront of biobased propylene glycol adoption.

How is Demand for Biobased Propylene Glycol Growing in the South of USA?

The South is experiencing steady demand for biobased propylene glycol in the USA, with a 4.7% CAGR. The region’s strong industrial base, particularly in sectors like chemicals, manufacturing, and agriculture, is driving the adoption of renewable chemicals such as biobased propylene glycol. As industries in the South continue to focus on eco-consciousness and reducing environmental impact, biobased alternatives are increasingly seen as a viable solution.

The chemical industry, in particular, is embracing biobased propylene glycol for use in products like antifreeze, personal care items, and pharmaceuticals. The South’s large-scale agricultural operations, including food and beverage production, are also adopting eco-friendlier ingredients, contributing to the rise in demand for biobased propylene glycol. The region’s favorable business climate, lower manufacturing costs, and access to renewable raw materials further support the adoption of biobased chemicals. As the push for green manufacturing grows, the South will see continued demand for biobased propylene glycol across multiple sectors.

The Northeast is experiencing moderate demand for biobased propylene glycol in the USA, with a 4.2% CAGR. The region’s demand is driven by its established industries in pharmaceuticals, food, cosmetics, and personal care, all of which are increasingly adopting biobased and eco-friendly ingredients. As consumer awareness about environmental impact and eco-consciousness rises, many companies in the Northeast are incorporating biobased chemicals like propylene glycol into their products to meet consumer preferences and regulatory requirements.

The region’s strong presence in research and development, coupled with a focus on innovation in the renewable chemicals sector, is accelerating the adoption of biobased propylene glycol. Government initiatives in the Northeast that promote the use of renewable resources are contributing to growth in this market. As industries continue to embrace cleaner and greener alternatives, the demand for biobased propylene glycol in the Northeast is expected to steadily increase, driven by both regulatory pressures and consumer demand for eco-friendly products.

The Midwest is seeing moderate demand for biobased propylene glycol in the USA, with a 3.6% CAGR. The region’s strong manufacturing and agricultural sectors are key drivers of this growth. As industries in the Midwest focus on adopting eco-friendlier practices, biobased propylene glycol is gaining traction, particularly in applications like antifreeze, de-icing fluids, and food processing. The region’s agricultural base also contributes to the rising demand, as biobased propylene glycol is increasingly used in the production of food ingredients and cosmetics.

The Midwest's established infrastructure for chemical manufacturing and its focus on reducing environmental footprints further support the growth of biobased chemicals. As businesses seek to comply with stricter environmental regulations and cater to consumer demand for eco-friendly products, biobased propylene glycol is becoming an essential part of the region's industrial processes. While the growth rate is slower compared to other regions, the demand for biobased propylene glycol will continue to expand as the region embraces greener solutions.

In the USA, demand for biobased propylene glycol is driven by increasing preference among end‑users for product formulas and industrial intermediates that originate from renewable feedstocks rather than petrochemicals. Industries such as personal care, pharmaceuticals, unsaturated polyester resins, automotive coolants and chemicals increasingly seek biobased alternatives because they help reduce carbon footprint, respond to regulatory signals and meet consumer expectations. As a result, companies supplying biobased propylene glycol are gaining traction in this evolving chemical‑inputs market.

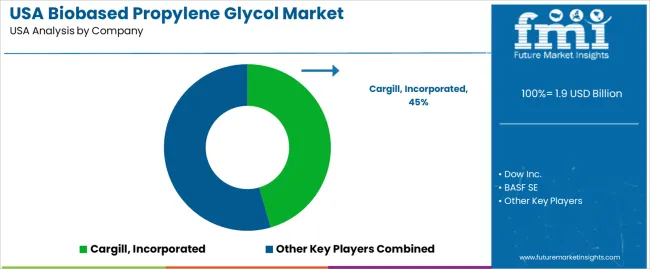

Key companies involved in the USA biobased propylene glycol segment include Cargill, Incorporated with a share of about 45.5%, Dow Inc., BASF SE, ADM (Archer Daniels Midland) and LyondellBasell Industries. These firms differentiate themselves through feed‑stock access, production scale, certification for biobased content, broad distribution to chemical and consumer‑goods customers, and ability to meet higher‑purity grades required in sensitive applications.

Competitive dynamics in this segment are shaped by several major factors. First, the ability to secure low‑cost renewable feedstocks and to achieve cost parity with petro‑derived propylene glycol remains a key driver of commercial adoption. Second, product innovation such as high‑purity bio‑glycol suitable for pharmaceuticals or personal care and supply‑chain transparency around biobased content and certifications enable companies to capture premium segments. Third, challenges persist in the form of raw‑material availability, scale‑up of production, and competition from conventional glycol producers as well as substitute chemistries. Suppliers who can combine feed‑stock security, cost‑competitive production, high‑quality grades and reliable logistical service are best positioned to lead in the USA biobased propylene glycol demand landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Source | Corn-Based, Sugarcane-Based, Soy-Based, Others |

| Application | Unsaturated Polyester Resins (UPR), Personal Care and Cosmetics, Pharmaceuticals, Food and Beverage, Automotive and Industrial Coolants, Adhesives and Sealants, Deicing Fluids, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Cargill, Incorporated, Dow Inc., BASF SE, ADM (Archer Daniels Midland), LyondellBasell Industries |

| Additional Attributes | Dollar sales by source and application; regional CAGR and adoption trends; demand trends in biobased propylene glycol; growth in applications like UPR, personal care, and food & beverage; technology adoption for renewable chemicals; vendor offerings including production technologies, services, and integration solutions; regulatory influences and industry standards |

The demand for biobased propylene glycol in usa is estimated to be valued at USD 1.9 billion in 2025.

The market size for the biobased propylene glycol in usa is projected to reach USD 2.9 billion by 2035.

The demand for biobased propylene glycol in usa is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in biobased propylene glycol in usa are corn-based, sugarcane-based, soy-based and others.

In terms of application, unsaturated polyester resins (upr) segment is expected to command 30.6% share in the biobased propylene glycol in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Demand for Biobased Propylene Glycol in Japan Size and Share Forecast Outlook 2025 to 2035

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Propylene Glycol Methyl Ether Market

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Monopropylene Glycol Market

Mono Propylene Glycol Market Growth-Trends & Forecast 2025 to 2035

Demand for Biobased Biodegradable Plastic in USA Size and Share Forecast Outlook 2025 to 2035

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Market Size and Share Forecast Outlook 2025 to 2035

Propylene Carbonate Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Propylene Tetramer Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA