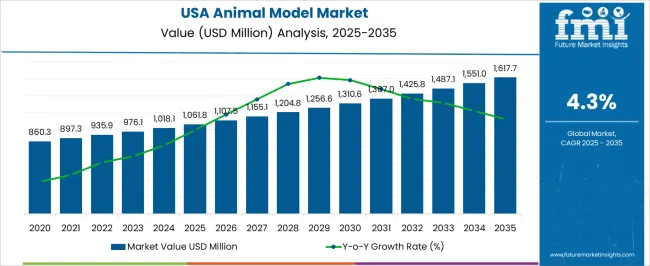

The USA Animal Model Market is estimated to be valued at USD 1061.8 million in 2025 and is projected to reach USD 1617.7 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| USA Animal Model Market Estimated Value in (2025 E) | USD 1061.8 million |

| USA Animal Model Market Forecast Value in (2035 F) | USD 1617.7 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The USA animal model market is expanding steadily, supported by the growing importance of preclinical studies in drug development, biotechnology, and biomedical research. Increasing investments in life sciences and rising demand for predictive and translational models are reinforcing adoption across pharmaceutical companies and academic institutions. Regulatory requirements for testing drug efficacy and safety before clinical trials are further driving reliance on animal models.

Technological advancements such as CRISPR gene editing have revolutionized model development by enabling precise genetic modifications, enhancing research efficiency, and reducing timelines. The market outlook remains favorable as research priorities shift toward complex disease modeling, personalized medicine, and immunology.

Ethical considerations are also shaping the industry, with a stronger focus on refining methodologies, reducing animal usage, and replacing traditional models with advanced alternatives where feasible. These factors collectively contribute to sustained demand for animal models in the USA research ecosystem.

The mice segment holds the dominant share within the species category due to their genetic similarity to humans, short breeding cycles, and adaptability in laboratory environments.

Their extensive use in oncology, immunology, and genetic studies has been reinforced by the availability of well characterized strains and transgenic models.

Strong demand from pharmaceutical companies and research institutions for disease modeling and drug discovery has solidified their leading role in the USA animal model market.

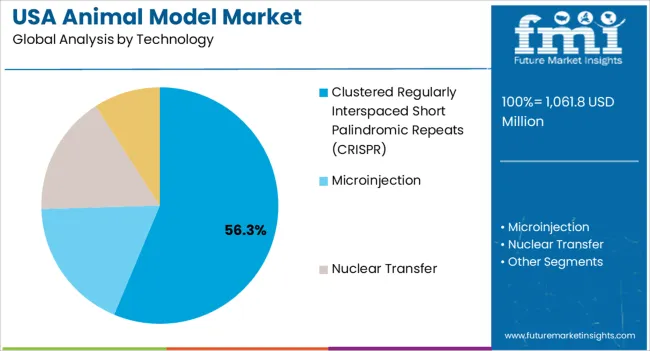

The clustered regularly interspaced short palindromic repeats segment is projected to contribute 56.30% of total revenue by 2025 within the technology category, making it the leading segment.

This growth is being driven by its ability to provide precise and efficient gene editing, reducing development timelines and enabling the creation of highly specific disease models.

Its application in oncology, genetic disorders, and rare disease research has expanded rapidly, establishing CRISPR as the preferred technology for next generation animal model development.

The research and development segment is expected to account for 38.90% of total market revenue by 2025, positioning it as the most significant application category. This dominance is attributed to continuous drug discovery programs, rising demand for novel therapeutics, and the need for preclinical validation in complex diseases.

Substantial investments from pharmaceutical and biotech companies, along with increased funding from government and academic research bodies, are reinforcing the segment’s leadership.

As translational research continues to expand in scope and scale, the research and development application segment remains the key driver of market growth in the USA animal model market.

Demand in the USA animal model market increased at a 3% CAGR between 2020 and 2025. Sales are projected to expand at a 4.3% CAGR over the forecast period due to the growing demand for animal models for regenerative medicine and tissue engineering.

The presence and dominance of CROs in the country, which involve animal models in their research, and increasing focus on personalized medications are key factors expected to drive demand in the USA.

Due to the advent of COVID-19, people gave priority to being fully vaccinated. The demand for clinical research and studies increased with increasing vaccination rates and rising awareness. This directly impacted the demand for animal models as it is used in the development of various vaccines.

Ongoing research and development in the healthcare sector for the development of regenerative medicine and tissue engineering are propelling demand for an animal model. Growing usage of animal model-based preclinical interpretation of new therapeutics and drug discovery & development might fuel sales in the market.

Animal models are effective tools for conducting preclinical; studies to learn about human biology. Factors driving the development and usage of animal models are:

The increasing prevalence of diseases is compelling the government to focus on preventive measures. This is driving investments for performing clinical trials on animal models. For instance, in March 2024, the FDA spent around USD 250,000 on testing coronavirus on animal models including monkeys, mice, ferrets, and others.

Hefty investments and policy reforms by the government have stimulated funding schemes with regard to animal model research, which is creating opportunities for growth in the market. In addition to this, different species of animal models have different anatomy, physiology, lifespan, and disease characteristics. Therefore, some experiments on animals do not provide conclusive information on patient outcomes. For accurate clinical research in the discovery of drugs, there is still a need for perfect genetically modified animal models.

Animal model providers are benefitting from the next-generation sequencing technology and genome engineering tools. They provide custom and rare disease models, with a focus on supporting personalized therapy drug trials. For instance,

Charles River Laboratories provides hACE2-NCG mouse models specifically designed for COVID-19 research. Such developments are expected to bode well for the market over the forecast period.

Delays in drug approvals and reduced possibilities of medication for human use can hamper the growth of the animal model market. Drugs that survive clinical trials and get approved are sometimes recalled because of toxicity identified in them after a few months or years.

Some animal models have a limited ability to mimic proper complex processes of human physiology, progression, and carcinogenesis. Due to this, safety and efficacy identified in animal studies sometimes cannot be considered for humans. In many cases, certain mouse models’ physiological changes occur in the spectrum that does not occur in human disease.

Some animal model tests take months or years to conduct and analyze. For example, around 4-5 years are taken for rodent cancer studies, which involves thousands and sometimes millions of dollars.

Government regulatory agencies and scientific organizations are finding alternative methods due to the high costs of animal model clinical trials. It is to replace animal testing and provide improvements in the safety of new medications for human use. This can hamper the growth of the animal model market.

Demand in the Mice Model Segment to Retain their Dominance and Gain Momentum

In terms of species, the mice model segment held a market share of around 61.03% in 2025, with sales anticipated to expand at 5.1% through 2035.

Mice models are one of the most important tools for performing preclinical research to acquire insights into human biology as they are genetically similar to humans. These models are created by engrafting human cells or tissues into mice, resulting in the expression of human proteins.

Mice are increasingly being employed as models in biomedical research for HIV/AIDS, cancer, regenerative medicine, hepatitis, and infectious disease research. They are being developed and used in response to a growing need to determine the true effects of medications on humans. Besides this, the increasing focus on researching human-specific infections, therapies, and immunological responses might continue pushing sales in this segment in the forthcoming years.

| Category | By Species |

|---|---|

| Top Segment | Mice |

| Market Share in Percentage | 61.03% |

| Category | By End-user Verticals |

|---|---|

| Top Segment | Academic & Research Institutes |

| Market Share in Percentage | 37.21% |

Sales of Animal Models for Oncology Research to Remain High

Based on therapeutics, the oncology segment held nearly 32.6% of the total market share in 2025, and the trend is expected to continue over the forecast period.

Animal models are widely used in oncology to study the biochemical and physiological processes of the occurrence and development of cancer. They help in determining the appropriate treatment approach for specific cancers.

Presently, there is a huge global burden of chronic diseases, including cancer. In vitro as well as in vivo approaches are being developed to fight against the rising prevalence of cancer. One of the most significant advancements is the development of humanized mouse and rodent models. They offer high prescient power for the viability of standard and novel anti-cancer therapeutics.

Factors such as the importance of personalized medicine, monoclonal antibodies, and the potential to treat diseases easily on a personal level are expected to fuel sales in this segment.

Adoption of Animal Models in Novel Drug Discovery to Increase Further

By application, total sales of animal models in the drug discovery/development segment accounted for 65.4% of the total market share in 2025.

Drug discovery/development is invariably a lengthy and costly process. It begins with the identification and validation of a potential molecular/cellular therapeutic target. It further moves through a series of preclinical and clinical trials, culminating in a series of regulatory approvals. The usage of experimental animal models helps researchers better understand the genesis, pathophysiology, and overall character of human diseases.

Animal models for drug discovery and development have played a crucial role in the characterization of disease pathophysiology and associated mechanisms of injury and target identification. They are also used for the evaluation of novel therapeutic agents for toxicity/safety, pharmacodynamics, and pharmacokinetics. They are also used for the efficacy of the development of safe and effective therapies and cures for diseases and/or symptoms connected with them.

Applications of Animal Models in Academic and Research Institutes might Gain Traction

Based on end users, demand in the academic & research institutes segments was about 37.21% of the total market share in 2025. Growth of this segment can be attributed to the increasing establishment of academic & research institutes for developing drugs and vaccines for various chronic diseases.

Researchers utilize animal models to examine and assemble evidence-based findings to address different health-related problems. The availability of highly qualified and skilled scientists at academic & research institutes might also contribute to the growth of this segment.

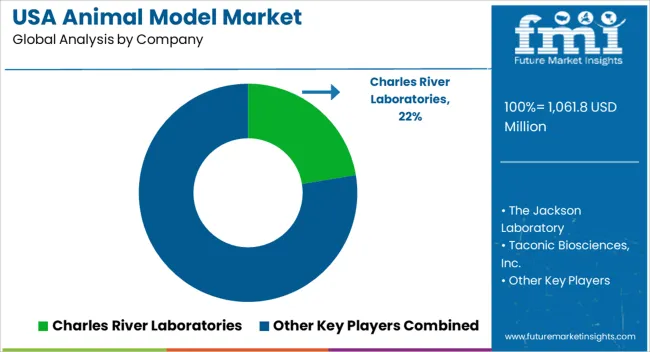

The USA animal model market is fragmented with the presence of established as well emerging market players. These players are actively investing in acquisitions, collaborations, and product launches as key strategies. For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value |

| Key Countries Covered | The United States of America |

| Key Market Segments Covered | By Species, By Technology, By Applications, By Use and By End-user Verticals |

| Key Companies Profiled | Charles River Laboratories; The Jackson Laboratory; Taconic Biosciences, Inc.; Genoway; Envigo (Inotiv, Inc.); Marshall BioResources; Janvier Labs; Applied stem cells; Biocytogen; Transposagen Biopharmaceuticals, Inc. (Hera Bio Labs); Cyagen; Ingenious targeting labs; Crown Bioscience Inc. (JSR Corporation).; Harbour Biomed; Sinclair BioResources; Alpha Genesis Inc.; Creative Animodel; DaVinci Biomedical Research Products, Inc |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global USA animal model market is estimated to be valued at USD 1,061.8 million in 2025.

The market size for the USA animal model market is projected to reach USD 1,617.7 million by 2035.

The USA animal model market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in USA animal model market are mice, rats, fish, birds, cattles, pigs, amphibians, guinea pigs, dogs, cats, rabbits, monkeys, sheep, hamsters and other animals.

In terms of technology, clustered regularly interspaced short palindromic repeats (crispr) segment to command 56.3% share in the USA animal model market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

USA Animal Feed Ingredients Market Report – Trends & Innovations 2025-2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Animal Healthcare in USA Size and Share Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Model Based Testing Tools Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA