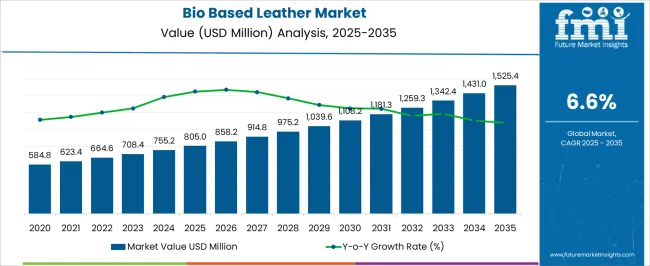

The bio-based leather market is projected to reach 805.0 USD million in 2025 and expand to 1,525.4 USD million by 2035, growing at a CAGR of 6.6%. Growth in this market is anticipated to be driven by a combination of volume expansion and price appreciation, reflecting rising demand for alternative leather solutions across fashion, automotive, footwear, and upholstery sectors. Volume growth is supported by increasing consumer preference for cruelty-free, plant-derived, and laboratory-grown leather, which is being adopted in clothing, accessories, and vehicle interiors.

Price growth is influenced by R&D investments, proprietary material formulations, and premium branding associated with eco-conscious and innovative bio-leather products. Manufacturing scalability and process optimization are enabling consistent quality and competitive pricing, while collaborations with designers and automotive OEMs are enhancing market penetration. E-commerce platforms, boutique stores, and international distribution networks are widening access to high-quality bio-leather, driving unit sales and reinforcing brand visibility. Regional demand patterns show strong adoption in North America and Europe, while emerging economies in the Asia-Pacific are witnessing rapid uptake due to expanding fashion, footwear, and automotive industries.

These factors contribute to a balanced growth model where both unit volume and premium pricing strategies play critical roles in shaping the market trajectory, fostering profitability, and enhancing long-term adoption of bio-based leather materials globally.

| Metric | Value |

|---|---|

| Bio Based Leather Market Estimated Value in (2025 E) | USD 805.0 million |

| Bio Based Leather Market Forecast Value in (2035 F) | USD 1525.4 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

The bio-based leather market is strongly influenced by five interconnected parent markets, each contributing distinctly to overall demand and growth. The fashion and apparel market holds the largest share at 40%, driven by rising consumer preference for cruelty-free, plant-derived, and sustainable leather alternatives in clothing, handbags, and accessories. The automotive interiors market contributes 25%, with bio-based leather increasingly used in car seats, dashboards, and interior panels to meet eco-conscious consumer and regulatory requirements.

The footwear market accounts for 15%, where sneakers, boots, and casual shoes incorporate bio-leather for durability, comfort, and aesthetic appeal. The furniture and upholstery market holds a 12% share, adopting bio-leather in sofas, chairs, and commercial interiors for premium appearance and long-lasting performance.

The luxury goods and lifestyle products market represents 8%, leveraging bio-based leather in watches, wallets, and travel goods to reinforce brand differentiation and consumer appeal. Collectively, fashion, automotive, and footwear segments account for 80% of overall demand, highlighting that apparel, mobility, and footwear remain the primary growth drivers, while furniture and luxury applications provide complementary opportunities for market expansion globally.

The bio based leather market is experiencing steady expansion driven by rising consumer demand for sustainable and cruelty free alternatives to conventional leather. Increasing environmental awareness and stricter regulations on animal based leather production have created a strong shift toward plant derived and waste sourced leather substitutes.

Advances in material engineering, including improved durability, texture replication, and water resistance, are enhancing product appeal across multiple industries. Strategic collaborations between material innovators and end use manufacturers are accelerating commercialization, particularly in automotive, fashion, and furniture sectors.

The market outlook remains positive as brands and manufacturers integrate bio based leather into their sustainability roadmaps, supported by consumer willingness to pay for eco friendly products and industry wide efforts to reduce carbon footprints.

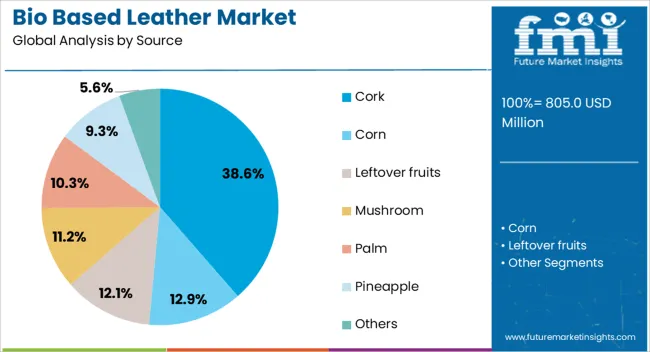

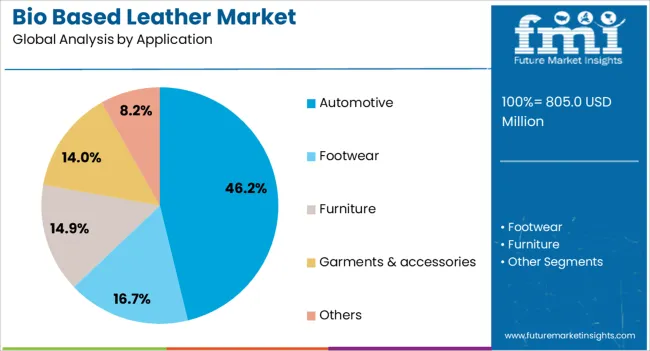

The bio based leather market is segmented by source, application, and geographic regions. By source, bio based leather market is divided into Cork, Corn, Leftover fruits, Mushroom, Palm, Pineapple, and Others. In terms of application, bio based leather market is classified into Automotive, Footwear, Furniture, Garments & accessories, and Others. Regionally, the bio based leather industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cork segment is projected to hold 38.60% of total market revenue by 2025 within the source category, making it a leading material choice. This growth is supported by cork’s natural durability, lightweight properties, and renewable sourcing from oak bark without harming trees.

Its hypoallergenic and water resistant nature further enhances its suitability for bio based leather production. Additionally, cork offers a unique texture and appearance that appeals to premium and sustainable product lines.

With increasing adoption in fashion accessories, automotive interiors, and upholstery, cork continues to gain traction as a sustainable, high performance alternative within the bio based leather industry.

The automotive application segment is expected to account for 46.20% of market revenue by 2025, making it the largest application area. This dominance is driven by the growing commitment of automotive manufacturers to incorporate sustainable materials into vehicle interiors to meet environmental regulations and corporate sustainability targets.

Bio based leather offers a lower carbon footprint, high wear resistance, and aesthetic versatility, making it suitable for seats, panels, and trim. Rising consumer preference for eco friendly vehicles and the premium market’s demand for innovative interior finishes have further boosted adoption.

As electric and hybrid vehicle production expands, the use of bio based leather in the automotive sector is anticipated to remain a key driver of overall market growth.

Bio-based leather adoption is primarily driven by fashion, automotive, and footwear sectors, with furniture and luxury goods providing complementary growth opportunities. Consumer preference for ethical, durable, and premium materials underpins market expansion globally.

The bio-based leather market is witnessing robust growth in fashion and apparel, driven by consumer preference for cruelty-free and plant-derived materials. Apparel manufacturers are increasingly adopting bio-leather for jackets, skirts, bags, and accessories due to its versatility, texture, and premium appearance. Branding and marketing strategies emphasizing ethical sourcing and environmental consciousness are enhancing consumer appeal, while collaborations between designers and bio-leather producers introduce unique patterns, colors, and finishes. E-commerce platforms and global retail chains are expanding accessibility, allowing niche and mainstream consumers to engage with high-quality bio-leather products. Rising demand from younger, conscious consumer segments is prompting brands to invest in product innovation, limited editions, and fashion-forward designs that integrate both style and functionality, further reinforcing adoption across global apparel markets.

Bio-based leather is gaining traction in automotive interiors, including seats, dashboards, steering wheels, and door panels. OEMs are leveraging bio-leather to differentiate vehicles and appeal to environmentally conscious buyers. Material performance, including durability, texture, and resistance to wear and heat, is a critical factor influencing adoption in passenger cars, SUVs, and luxury vehicles. Partnerships between auto manufacturers and bio-leather suppliers are increasing, enabling customization of colors, finishes, and patterns for premium cabins. Market penetration is further enhanced through collaborations with aftermarket accessory providers, enabling retrofitting and interior upgrades. The adoption of bio-leather in automotive interiors is driven by design flexibility, regulatory preferences for eco-conscious materials, and consumer demand for sustainable mobility aesthetics.

Footwear and accessories are emerging as significant contributors to bio-based leather market growth. Sneakers, boots, belts, wallets, and handbags increasingly incorporate bio-leather for enhanced durability, comfort, and aesthetic appeal. Brands are targeting mid- to high-end consumer segments by offering cruelty-free and vegan alternatives, emphasizing ethical fashion credentials. Product differentiation is achieved through texture variation, color customization, and embossed patterns to appeal to fashion-forward buyers. Retailers and e-commerce platforms play a key role in increasing accessibility and consumer awareness. Collaborations with designers and influencers amplify visibility and brand recognition, while ongoing research into cost-effective manufacturing processes ensures competitive pricing. Footwear and accessories adoption remains a major driver of overall bio-leather market growth globally.

Furniture and luxury goods markets are supporting incremental adoption of bio-based leather, particularly in sofas, chairs, office seating, handbags, and travel accessories. Premium interior designers and commercial spaces are integrating bio-leather to provide a refined appearance combined with durability. Luxury brands are emphasizing bio-leather in wallets, watch straps, and limited-edition products to reinforce exclusivity and ethical appeal. Product offerings focus on texture, color consistency, and longevity to meet consumer expectations for quality and a premium feel. Distribution channels, including boutique stores and high-end e-commerce platforms, increase market reach. Adoption in furniture and luxury sectors is expected to complement growth driven by fashion, automotive, and footwear segments, highlighting diversified demand patterns across multiple industries.

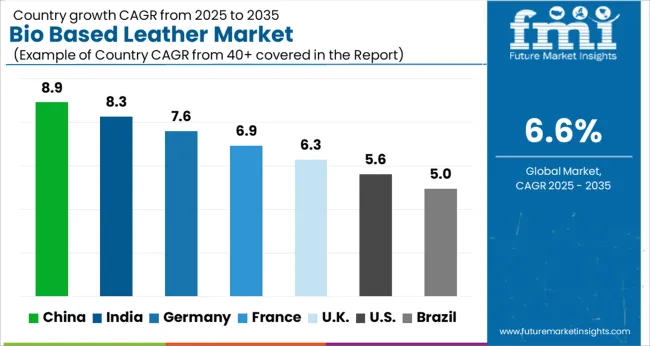

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

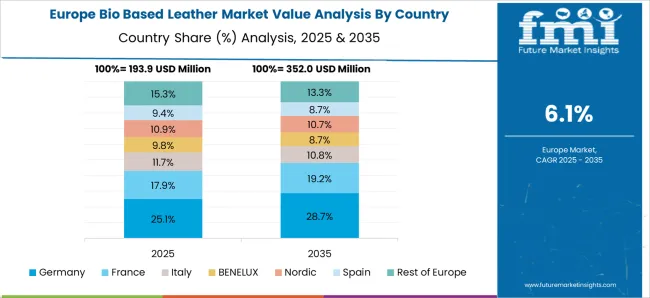

The global bio-based leather market is projected to grow at a CAGR of 6.6% from 2025 to 2035. China leads at 8.9%, followed by India (8.3%), Germany (7.6%), the UK (6.3%), and the USA (5.6%). Growth is driven by rising demand for cruelty-free, plant-derived materials in fashion, footwear, automotive interiors, and luxury goods. BRICS nations, particularly China and India, are expanding production capacities and adopting innovative processing techniques to meet rising consumer demand. OECD countries emphasize product quality, regulatory compliance, and premium applications in automotive and luxury segments. Collaborations between designers, OEMs, and bio-leather suppliers are enhancing product diversity, texture, and color customization, supporting market penetration and global expansion. The analysis includes over 40+ countries, with the leading markets detailed below.

The bio-based leather market in China is projected to grow at a CAGR of 8.9% from 2025 to 2035, driven by rising consumer preference for cruelty-free and environmentally responsible alternatives in fashion, footwear, and automotive interiors. Domestic manufacturers are scaling production capacities and introducing innovative plant- and mushroom-derived leather alternatives with improved texture, durability, and color variety. Collaborations between designers, luxury brands, and automotive OEMs are facilitating adoption in high-end applications. E-commerce platforms and retail chains are enhancing accessibility and visibility of bio-based leather products, while government regulations on chemical use and environmental compliance support adoption of non-animal materials. Rising middle-class incomes and lifestyle-driven purchases further boost market demand.

The bio-based leather market in India is expected to grow at a CAGR of 8.3% from 2025 to 2035, fueled by demand for vegan footwear, fashion accessories, and upholstery in luxury and mid-tier segments. Domestic manufacturers are investing in scalable production technologies to enhance fiber bonding, texture, and color durability. Collaborations with international brands and designers accelerate product acceptance and innovation in coatings, finishes, and embossed patterns. Retail chains and e-commerce portals improve market reach, while growing awareness of ethical fashion encourages consumers to prefer bio-based leather over traditional animal hides. Government incentives for eco-friendly materials and industrial clusters promoting non-animal leather alternatives further boost adoption.

The bio-based leather market in Germany is projected to grow at a CAGR of 7.6% from 2025 to 2035, supported by premium fashion, automotive, and upholstery segments prioritizing eco-conscious materials. Manufacturers focus on plant-, fruit-, and mycelium-derived leathers with superior durability, tactile feel, and customizable finishes. Collaborations with luxury fashion houses and automotive OEMs enable integration into high-end products. Retailers and e-commerce platforms are expanding availability, targeting environmentally conscious consumers. Regulatory frameworks emphasizing chemical safety, product certification, and traceability enhance trust and adoption. R&D in material coatings, finishing technologies, and performance enhancement supports competitiveness. Demand is driven by a combination of consumer preference for sustainable alternatives, brand-led innovation, and premium product positioning.

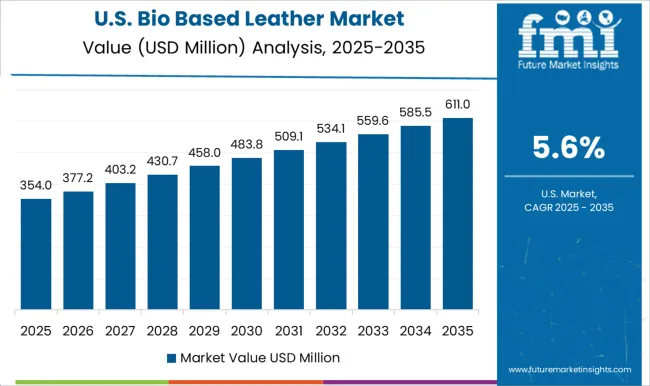

The bio-based leather market in the USA is projected to grow at a CAGR of 5.6% from 2025 to 2035, supported by demand in footwear, luxury fashion, automotive interiors, and furniture applications. Manufacturers are developing mushroom- and pineapple-leather alternatives with high durability, texture, and color stability. Partnerships with fashion brands, furniture designers, and automotive OEMs enable adoption in premium and mid-tier products. E-commerce platforms and retail stores increase product accessibility, while environmental and ethical consumer awareness drives preference for animal-free materials. Regulations on chemical safety, traceability, and eco-labeling promote adoption. Innovations in surface finishing, embossing, and coating technologies further enhance competitiveness and appeal, supporting steady market growth over the forecast period.

The bio-based leather market in the UK is expected to grow at a CAGR of 6.3% from 2025 to 2035, driven by increasing demand for ethical fashion, vegan accessories, and eco-conscious automotive interiors. Domestic and international manufacturers are producing plant-based, apple-, and mushroom-derived leathers with improved wear resistance, texture, and finish. Collaborations with high-street brands and luxury designers increase adoption, while online and brick-and-mortar retail networks expand market reach. Government regulations on chemical use and environmental standards encourage adoption of non-animal alternatives. Consumer awareness campaigns, sustainability-focused product certifications, and fashion trends emphasizing cruelty-free materials further support market penetration. Product customization and limited-edition offerings enhance market differentiation.

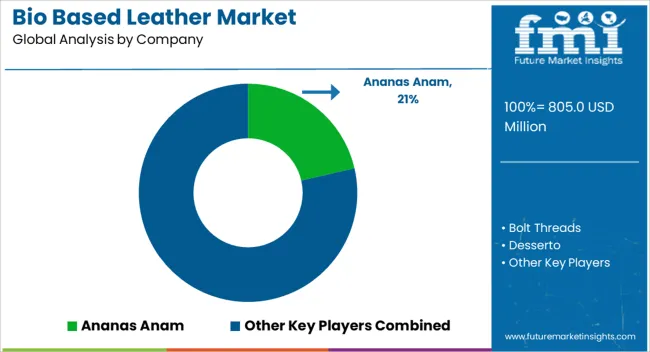

Competition in the bio-based leather market is defined by material innovation, durability, and aesthetic versatility. Ananas Anam leads with Piñatex, a pineapple leaf fiber-based leather alternative emphasizing texture, strength, and eco-conscious production processes. Bolt Threads differentiates through Mylo, a mycelium-based leather, focusing on scalability, consistency, and application across fashion, footwear, and upholstery. Desserto competes with cactus-derived leather that balances flexibility, water resistance, and visual appeal. Ecco Leather integrates bio-based materials in premium footwear, emphasizing performance, comfort, and sustainability-compliant manufacturing. Ecovative Design develops mushroom-based composites, highlighting customizable thickness, finish, and structural integrity for diverse applications. Fruitleather Rotterdam, Mirum, Modern Meadows, MycoWorks, Natural Fiber Welding, Piñatex, Tjeerd Veenhoven Studio, Toray Industries, Ultrafabrics, and Vegea compete through plant- and microbial-based materials, focusing on innovation, certification, and designer collaborations. Strategies focus on material performance, surface finishing, durability, and compatibility with fashion, automotive, and furniture applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 805.0 Million |

| Source | Cork, Corn, Leftover fruits, Mushroom, Palm, Pineapple, and Others |

| Application | Automotive, Footwear, Furniture, Garments & accessories, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ananas Anam, Bolt Threads, Desserto, Ecco Leather, Ecovative Design, Fruitleather Rotterdam, Mirum, Modern Meadows, MycoWorks, Natural Fiber Welding, Piñatex, Tjeerd Veenhoven Studio, Toray Industries, Ultrafabrics, and Vegea |

| Additional Attributes | Dollar sales, share by material type (plant-based, mycelium, fruit-based), end-use segments (fashion, footwear, automotive, furniture), regional adoption trends, competitive landscape, growth drivers, price trends, and regulatory compliance requirements. |

The global bio based leather market is estimated to be valued at USD 805.0 million in 2025.

The market size for the bio based leather market is projected to reach USD 1,525.4 million by 2035.

The bio based leather market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in bio based leather market are cork, corn, leftover fruits, mushroom, palm, pineapple and others.

In terms of application, automotive segment to command 46.2% share in the bio based leather market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biocatalysis and Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Bio-wax Market Forecast and Outlook 2025 to 2035

Bioliquid Heat and Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocement Market Size and Share Forecast Outlook 2025 to 2035

Biomedical Refrigerator and Freezer Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bionic Glove's Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biopotential Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

Biocompatible Materials Market Size and Share Forecast Outlook 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA