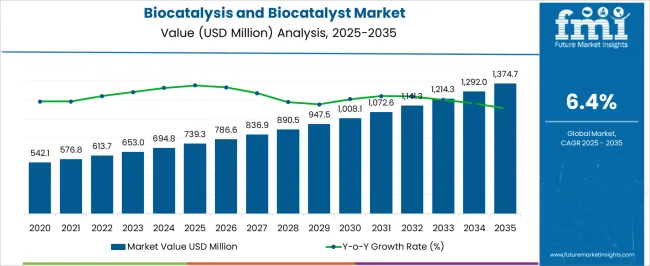

The Biocatalysis and Biocatalyst Market is estimated to be valued at USD 739.3 million in 2025 and is projected to reach USD 1374.7 million by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The biocatalysis and biocatalyst market is advancing steadily, driven by the increasing shift toward sustainable and environmentally friendly production processes across chemical, pharmaceutical, and food industries. The ability of biocatalysts to enable selective transformations under mild conditions reduces energy consumption and minimizes waste generation, aligning with global sustainability objectives.

Market growth is further strengthened by advancements in enzyme engineering and recombinant DNA technology, which have expanded the range and efficiency of biocatalysts for industrial applications. The current scenario reflects heightened adoption in bio-based manufacturing pathways as industries transition away from petrochemical processes.

Supportive government policies and growing investments in green chemistry are also fueling demand. Looking forward, the integration of computational modeling and machine learning into enzyme design is expected to enhance performance predictability, improving process yields and cost-effectiveness across multiple end-use sectors.

| Metric | Value |

|---|---|

| Biocatalysis and Biocatalyst Market Estimated Value in (2025 E) | USD 739.3 million |

| Biocatalysis and Biocatalyst Market Forecast Value in (2035 F) | USD 1374.7 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

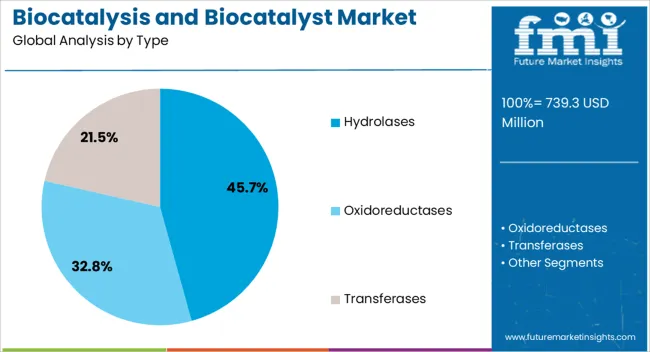

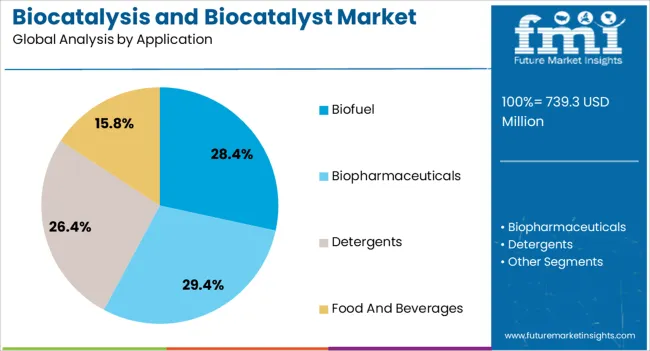

The market is segmented by Type and Application and region. By Type, the market is divided into Hydrolases, Oxidoreductases, and Transferases. In terms of Application, the market is classified into Biofuel, Biopharmaceuticals, Detergents, and Food And Beverages. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hydrolases segment dominates the type category in the biocatalysis and biocatalyst market, accounting for approximately 45.70% share. This leadership stems from their extensive use in hydrolysis reactions, including ester, peptide, and glycosidic bond cleavage, which are fundamental in chemical synthesis and bioprocessing.

Hydrolases offer broad substrate specificity and operate efficiently under mild conditions, making them valuable in pharmaceuticals, detergents, and biofuel production. Continuous technological developments in enzyme immobilization and optimization have enhanced their thermal stability and reusability, supporting large-scale industrial deployment.

With demand for efficient and eco-friendly catalytic systems increasing, hydrolases are expected to remain the most widely utilized enzyme class in the biocatalysis industry over the forecast period.

The biofuel segment holds approximately 28.40% share in the application category, driven by the growing emphasis on renewable energy and the use of biocatalysts to enhance fuel conversion efficiency. Enzyme-based processes enable selective hydrolysis and transesterification reactions that convert biomass into bioethanol, biodiesel, and biogas with higher yield and purity.

The adoption of biocatalysis in biofuel production is reinforced by global initiatives to reduce carbon emissions and dependence on fossil fuels. Improved enzyme formulations with enhanced tolerance to process conditions have expanded their feasibility for large-scale use.

With governments promoting sustainable energy pathways and industrial players investing in advanced biorefineries, the biofuel segment is expected to maintain strong growth momentum in the biocatalysis market.

The scope for global biocatalysis and biocatalyst market insights expanded at an 8% CAGR between 2020 and 2025. The market is anticipated to develop at a CAGR of 6.4% over the forecast period from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 8% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 6.4% |

From 2020 to 2025, the global market witnessed substantial growth, with a CAGR of 8%. This period was marked by an increased adoption of biocatalytic processes across diverse industries, driven by a growing emphasis on sustainable practices.The market exhibited promising expansion, reflecting the rising demand for eco-friendly solutions in various applications.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to maintain its growth trajectory, albeit at a slightly moderated pace. Projections indicate a CAGR of 6.4%, highlighting a continued but marginally slower development compared to the preceding years.

Factors contributing to this sustained growth include ongoing technological advancements, broader market acceptance, and an enduring commitment to environmentally conscious manufacturing practices.

| Attributes | Details |

|---|---|

| Opportunities |

|

The table illustrates CAGRs across five leading countries, namely the United States, Japan, China, the United Kingdom, and South Korea.

South Korea stands out as a dynamic and swiftly progressing market, positioned for substantial expansion with an impressive 8.5% CAGR projected by 2035. Driven by a commitment to innovation, South Korea plays a pivotal role across diverse industries, depicting a flourishing economic landscape in its ongoing evolution.

| Countries | CAGR by 2035 |

|---|---|

| The United States | 6.7% |

| Japan | 7.9% |

| China | 6.9% |

| The United Kingdom | 7.7% |

| South Korea | 8.5% |

The prevalent use of biocatalysis and biocatalyst in the United States can be attributed to a multifaceted approach. The robust biotechnology sector fosters innovation and research, driving the adoption of biocatalyst in various industries.

With a strong emphasis on sustainable practices and eco-friendly manufacturing processes, the United States leverages biocatalysis for efficient and environmentally conscious production of pharmaceuticals, chemicals, and biofuels. Stringent regulatory standards and a focus on reducing carbon footprints further fuel the integration of biocatalyst in industrial applications.

In Japan, the widespread utilization of biocatalysis stems from the commitment to technological advancements and environmental sustainability. Biocatalyst find significant application in thriving pharmaceutical and fine chemicals industries, where their efficiency and selectivity play a crucial role in complex synthesis processes.

The emphasis on precision and high-quality manufacturing aligns with the advantages offered by biocatalysis, making it a preferred choice in diverse sectors in Japan. The market has a strong research and development culture that contributes to the continuous improvement and adoption of biocatalytic processes.

The adoption of biocatalysis and biocatalyst is fueled by rapid industrialization and increasing awareness of environmental concerns in the country.

China integrates biocatalysis into its chemical, pharmaceutical, and food industries as a global manufacturing hub to enhance process efficiency and reduce environmental impact.

Government initiatives promoting green technologies and sustainable practices further drive the use of biocatalyst in various applications. The industrial landscape is dynamic and expansive, positioning biocatalysis as a key technology for advancing sustainable and efficient production methods.

A combination of factors drives the affinity for biocatalysis in the United Kingdom market. The strong focus on sustainable development aligns with the eco-friendly advantages offered by biocatalytic processes.

The United Kingdom pharmaceutical and biotechnology sectors leverage biocatalyst for cost-effective and environmentally conscious synthesis of complex molecules.

Regulatory support for green technologies and a commitment to reducing carbon emissions contribute to the increased adoption of biocatalysis in various industrial applications. The versatility and potentiality for improving manufacturing efficiency make it a valuable asset in the industrial landscape.

The rapid economic growth and technological advancements propel the widespread use of biocatalysis and biocatalyst in the United Kingdom market. The emphasis on innovation and cutting-edge technologies drives the adoption of biocatalytic processes in diverse sectors, including chemicals, pharmaceuticals, and biofuels.

The commitment to green initiatives and sustainable development aligns with the environmental benefits of biocatalysis. The ability of the technology to enhance product quality and process efficiency is integral to the industrial landscape of South Korea, contributing to the notable CAGR in the biocatalysis market.Top of Form

The table below provides an overview of the biocatalysis and biocatalyst landscape on the basis of type and application. Hydrolases are projected to lead the type of market at a 6.2% CAGR by 2035, while biofuel in the application category is likely to expand at a CAGR of 6% by 2035.

The primary driver for the dominance of hydrolases lies in their ability to break down complex molecules into simpler components through hydrolysis, making them crucial in various industrial processes.

Biofuels are projected to grow significantly, driven by the global push towards sustainable and renewable energy sources. The increasing awareness of environmental concerns and the need to reduce carbon emissions propel the demand for cleaner energy alternatives.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Hydrolases | 6.2% |

| Biofuel | 6% |

By type, hydrolases are anticipated to take the lead in market share, projecting a CAGR of 6.2% by 2035. Hydrolases, including enzymes like lipases and proteases, are crucial in breaking down molecules through hydrolysis.

The significant growth in this category reflects the expanding utilization of hydrolases across diverse industrial processes, showcasing their versatility and efficiency in various applications.

On the application front, biofuel emerges as a prominent category with a projected CAGR of 6% by 2035. This underscores the increasing importance of biocatalyst in producing biofuels, aligning with the global emphasis on sustainable and renewable energy sources.

The growth trajectory of biocatalyst in the biofuel sector indicates the industrial shift towards eco-friendly alternatives and the recognition of biocatalysis as a pivotal technology in developing cleaner energy solutions. The projected expansion in biofuel applications signifies a pivotal role for biocatalyst in shaping the future of the energy landscape.

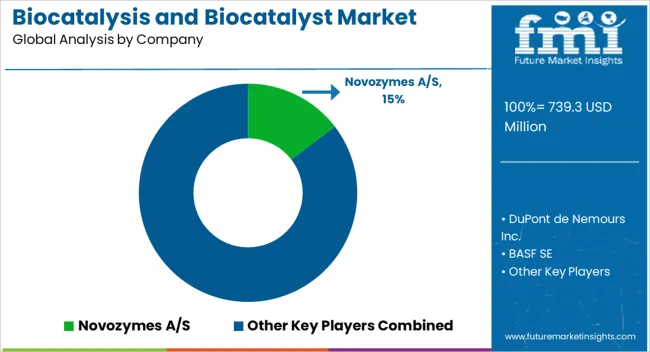

The competitive landscape of the biocatalysis and biocatalyst market is characterized by a dynamic interplay among key players aiming to capitalize on the expanding demand for sustainable and efficient industrial processes.

Established companies are actively investing in research and development to innovate and enhance the performance of biocatalyst, thereby maintaining a competitive edge. Strategic partnerships, collaborations, and acquisitions are prevalent strategies to strengthen market presence and broaden product portfolios.

The market also sees the emergence of innovative startups and niche players focusing on specialized applications, contributing to a diverse and vibrant ecosystem. Regulatory compliance, technological advancements, and a proactive approach to meet evolving industry needs are pivotal factors influencing the competitive dynamics of this market.

Some of the recent developments are

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 694.8 million |

| Projected Market Valuation in 2035 | USD 1,290 million |

| CAGR Share from 2025 to 2035 | 6.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Market Segments Covered | By Type, By Application, By Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, BENELUX, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC countries |

| Key Companies Profiled | DuPont de Nemours Inc.; BASF SE; Novozymes A/S; Lonza Group Ltd.; DSM Lockheed Martin; Codexis Inc.; AB Enzymes; Sapporo Enzyme Co. Ltd.; Dyadic International Inc.; Soufflet Group |

The global biocatalysis and biocatalyst market is estimated to be valued at USD 739.3 million in 2025.

The market size for the biocatalysis and biocatalyst market is projected to reach USD 1,374.7 million by 2035.

The biocatalysis and biocatalyst market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in biocatalysis and biocatalyst market are hydrolases, oxidoreductases and transferases.

In terms of application, biofuel segment to command 28.4% share in the biocatalysis and biocatalyst market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA