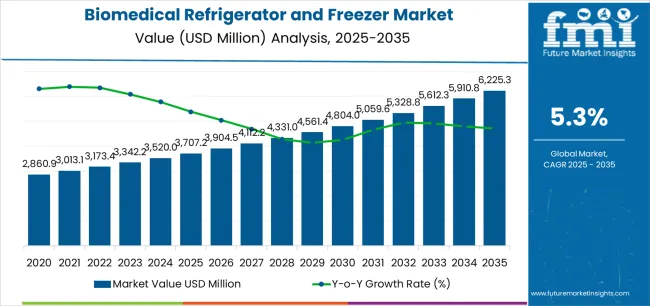

The Biomedical Refrigerator and Freezer Market is estimated to be valued at USD 3707.2 million in 2025 and is projected to reach USD 6225.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The biomedical refrigerator and freezer market is expanding as healthcare and research institutions prioritize precise temperature control for sensitive biological materials. Rising demand for advanced cold storage solutions in hospitals, blood banks, and pharmaceutical facilities has strengthened market growth.

The increasing prevalence of chronic diseases and expanding vaccine distribution networks have reinforced product adoption globally. Technological innovations in energy efficiency, temperature uniformity, and digital monitoring systems are enhancing reliability and compliance with storage regulations.

The shift toward automation and connected storage solutions has further improved operational traceability. With ongoing investments in biotechnology research and pharmaceutical development, demand for biomedical-grade refrigeration equipment is expected to remain strong in the forecast period..

| Metric | Value |

|---|---|

| Biomedical Refrigerator and Freezer Market Estimated Value in (2025 E) | USD 3707.2 million |

| Biomedical Refrigerator and Freezer Market Forecast Value in (2035 F) | USD 6225.3 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

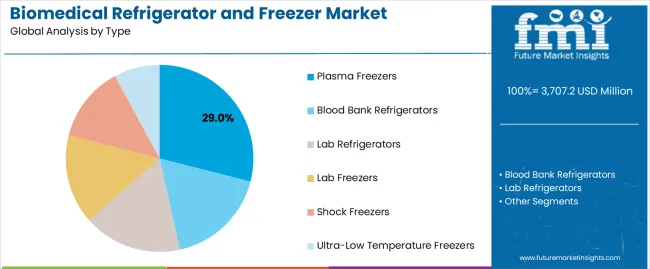

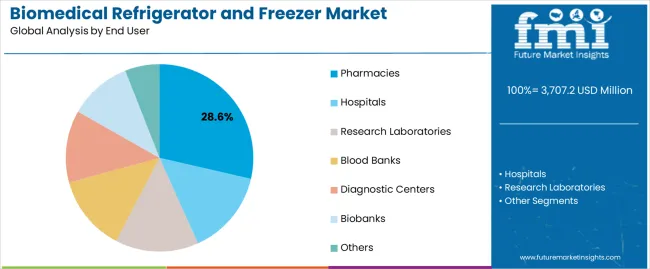

The market is segmented by Type and End User and region. By Type, the market is divided into Plasma Freezers, Blood Bank Refrigerators, Lab Refrigerators, Lab Freezers, Shock Freezers, and Ultra-Low Temperature Freezers. In terms of End User, the market is classified into Pharmacies, Hospitals, Research Laboratories, Blood Banks, Diagnostic Centers, Biobanks, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plasma freezers segment leads the type category, accounting for approximately 29.0% share. Its dominance is attributed to the critical role of plasma preservation in transfusion medicine and therapeutic applications.

Plasma freezers ensure precise temperature control to maintain product integrity, meeting stringent regulatory standards for biological storage. The segment benefits from rising blood donation initiatives and increased demand for plasma-derived medicines.

Continuous innovation in insulation and compressor systems has improved energy efficiency and operational stability. With expanding biopharmaceutical production and the growing use of plasma-based therapies, the segment is projected to retain its strong market position..

The pharmacies segment holds approximately 28.6% share within the end user category, reflecting its growing need for reliable cold storage of vaccines, biologics, and specialty drugs. Retail and hospital pharmacies require consistent temperature control to comply with health authority guidelines.

Rising deployment of compact biomedical refrigerators tailored for retail settings has boosted adoption. Increasing availability of temperature-sensitive medications and broader immunization programs are strengthening segment growth.

With continued expansion of pharmaceutical distribution channels and compliance-driven equipment upgrades, the pharmacies segment is expected to sustain its growth trajectory over the coming years..

Rise of Biobanking and Cryopreservation Creates Opportunities in the Market

Businesses have the chance to develop cutting-edge medical cold storage equipment for the long-term preservation of biological materials due to the growth of biobanking operations and the growing interest in cryopreservation. This comprises cryogenic storage devices, ultra-low temperature freezers, and specific containers for holding onto priceless specimens like tissues and cells.

By meeting the particular requirements of biobanks, research centers, and pharmaceutical firms engaged in cryopreservation, businesses can capitalize on a developing market niche and position themselves as industry leaders in cryogenic storage technologies, propelling revenue development and market expansion.

Demand for Hybrid Storage Solutions Surges in the Market

The trend toward hybrid biomedical cold storage systems is gaining traction to satisfy the various temperature storage needs of various biological materials. These systems combine several temperature-controlled sections into one unit, giving customers the freedom to store different samples with different requirements for temperature.

This innovation solves the difficulty of handling a range of samples in a laboratory or healthcare environment while optimizing space use and streamlining procedures. Businesses that use hybrid storage solutions are suppliers of adaptable and effective storage choices, attracting a broad spectrum of clients with different storage requirements.

Companies Aim to Leverage the Burgeoning Field of Cell and Gene Therapy

The rapidly expanding arena of gene and cell therapy research has great potential to heal previously incurable diseases. However, biological materials employed in these therapies are sensitive, they need to be stored under particular circumstances, sometimes at extremely low temperatures.

The preservation of cell and gene therapy products' integrity and viability during the research and development phase greatly depends on biomedical cold storage units that can meet the rigorous temperature requirements.

By investing in state-of-the-art freezer technology specifically designed to meet the demands of cell and gene therapy research demands, businesses can establish themselves as key contributors to innovative medical breakthroughs, cultivate strategic alliances, and increase their market share in this rapidly expanding industry.

| Attributes | Details |

|---|---|

| Biomedical Refrigerator and Freezer Market CAGR (2020 to 2025) | 4.60% |

The global biomedical refrigerator and freezer market size expanded at a 4.60% CAGR from 2020 to 2025. The growing prevalence of chronic illnesses has increased research activity in the healthcare industry.

This has resulted in a growing demand for storage solutions to preserve biological samples required for research and clinical trials, which has contributed to the growth of the biomedical refrigerator freezer market.

The increased emphasis on vaccine research for numerous infectious illnesses has driven growth in the biomedical refrigerator freezer industry. The necessity to store vaccines at extremely low temperatures has prompted a rise in investments in cutting-edge freezing and refrigeration technology, which has accelerated market growth.

Technological developments in the pharmaceutical freezer market, including IoT integration, smart monitoring, and energy-efficient features, have improved the functionality and economy of biomedical freezers and refrigerators. This has encouraged companies and academic institutions to modernize their storage infrastructure, which is propelling the market's growth even more.

In the coming years, the continued emphasis on vaccination programs, including routine immunizations and reactions to new infectious illnesses, is going to keep the demand for specialized biomedical refrigeration systems high. With the prospect of novel vaccinations and booster doses, the market for biomedical cold storage and distribution is expected to develop steadily.

The continuing improvements in biopharmaceuticals, gene treatments, and customized medicine are expected to increase the demand for precise and specialized storage conditions. Biomedical refrigerators and freezers can anticipate playing an important role in preserving the integrity of innovative medicines, hence driving market development.

| Trends |

|

|---|---|

| Opportunities |

|

| Challenges |

|

| Segment | Plasma Freezers (Product) |

|---|---|

| Value Share (2025) | 29% |

Based on product, the plasma freezer segment holds 29% of biomedical refrigerator and freezer market shares in 2025.

| Segment | Pharmacies (End User) |

|---|---|

| Value Share (2025) | 28.60% |

Based on end user, the pharmacies segment captured 28.60% of biomedical refrigerator and freezer market shares in 2025.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| India | 7.60% |

| Germany | 7.00% |

| China | 7.80% |

| Japan | 4.60% |

| Australia | 2.90% |

The demand for biomedical refrigerators and freezers in India is projected to surge at a 7.60% CAGR through 2035.

The sales of biomedical refrigerators and freezers in Germany are anticipated to rise at a 7.00% CAGR through 2035.

The biomedical refrigerator and freezer market growth in China is estimated at a 7.80% CAGR through 2035.

The demand for biomedical refrigerators and freezers in Japan is expected to increase at a 4.60% CAGR through 2035.

The sales of biomedical refrigerators and freezers in Australia are predicted to rise at a 2.90% CAGR through 2035.

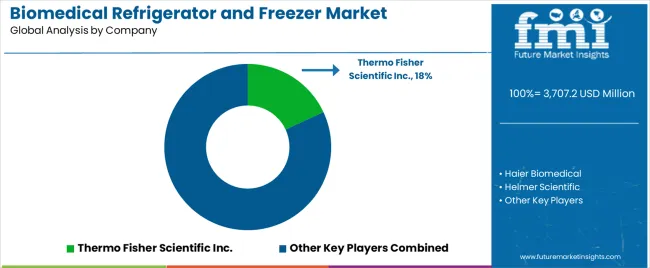

The biomedical freezer and refrigerator market is marked by an active rivalry between existing industry leaders, emerging competitors, and innovators with a specific focus on a specialty. Important players in the market employ strict tactics to get a competitive edge in a field characterized by regulatory compliance, technical innovation, and changing consumer needs.

Using their vast R&D resources and global reach, industry leaders, including Helmer Scientific, Haier Biomedical, and Thermo Fisher Scientific Inc., control a significant portion of the market.

Recent Developments

The global biomedical refrigerator and freezer market is estimated to be valued at USD 3,707.2 million in 2025.

The market size for the biomedical refrigerator and freezer market is projected to reach USD 6,225.3 million by 2035.

The biomedical refrigerator and freezer market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in biomedical refrigerator and freezer market are plasma freezers, blood bank refrigerators, lab refrigerators, lab freezers, shock freezers and ultra-low temperature freezers.

In terms of end user, pharmacies segment to command 28.6% share in the biomedical refrigerator and freezer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biomedical Tester Market Size and Share Forecast Outlook 2025 to 2035

Refrigerator Water Filter Market Growth & Trends 2025 to 2035

Refrigerators Market Trends - Growth & Forecast 2025 to 2035

Mini Refrigerator Market - Product Type, Price Range, Capacity, End-user, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Prep Refrigerators Market - Commercial Food Storage & Efficiency 2025 to 2035

Smart Refrigerator Market Size and Share Forecast Outlook 2025 to 2035

Minibar Refrigerator Market by Product Type, Application, Distribution Channel, and Region 2025 to 2035

Pharmacy Refrigerators Market Size and Share Forecast Outlook 2025 to 2035

Reach-In Refrigerators Market – Commercial Cooling & Industry Outlook 2025 to 2035

Household Refrigerators and Freezers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Merchandising Refrigerators Market – Retail Display & Industry Growth 2025 to 2035

Pharmaceutical Refrigerators and Freezers Market

Pizza Preparation Refrigerator Market

Sandwich Preparation Refrigerators Market

Hermetic Reciprocating Refrigerator Compressor Market Size and Share Forecast Outlook 2025 to 2035

Freezer Label Market Size and Share Forecast Outlook 2025 to 2035

Freezer Liner Market Size and Share Forecast Outlook 2025 to 2035

Freezer Paper Market Size and Share Forecast Outlook 2025 to 2035

Freezer Bags Market Growth, Trends and Demand from 2025 to 2035

Competitive Breakdown of Freezer Paper Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA