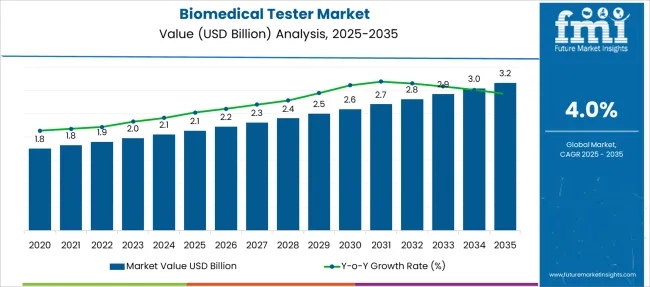

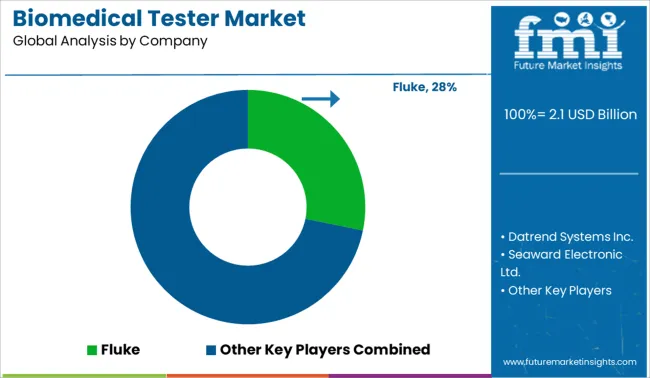

The Biomedical Tester Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Biomedical Tester Market Estimated Value in (2025 E) | USD 2.1 billion |

| Biomedical Tester Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The biomedical tester market is experiencing robust growth, driven by the increasing complexity of medical devices and the growing regulatory emphasis on accuracy, reliability, and patient safety. As healthcare facilities expand their use of diagnostic and therapeutic equipment, the demand for comprehensive testing solutions has intensified.

Biomedical testers are being widely adopted to ensure compliance with performance standards, detect malfunctions early, and reduce the risk of device-related errors. Technological advancements in testing accuracy, wireless interfacing, and integration with digital health systems are also contributing to broader adoption.

In particular, emerging economies are witnessing rapid hospital expansion and medical device penetration, further fueling demand. The market outlook remains strong, supported by continuous innovations in device simulation, diagnostic precision, and preventive maintenance strategies across healthcare infrastructures.

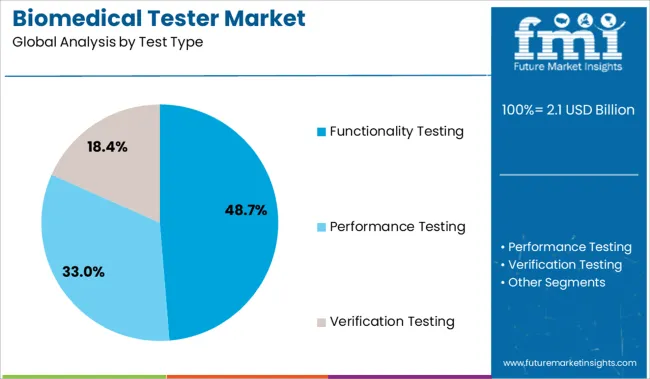

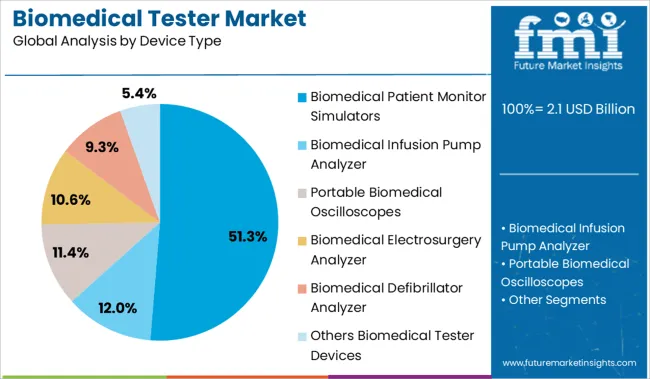

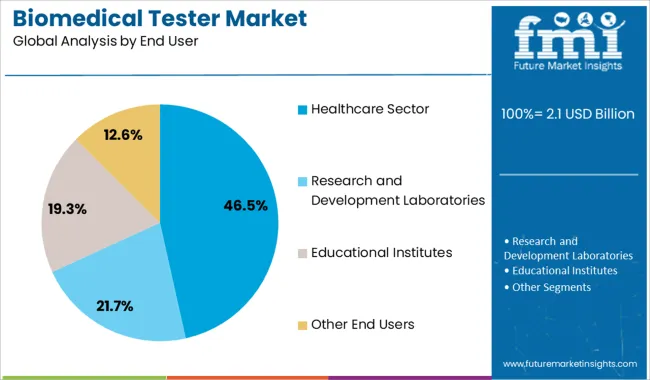

The market is segmented by Test Type, Device Type, and End User and region. By Test Type, the market is divided into Functionality Testing, Performance Testing, and Verification Testing. In terms of Device Type, the market is classified into Biomedical Patient Monitor Simulators, Biomedical Infusion Pump Analyzer, Portable Biomedical Oscilloscopes, Biomedical Electrosurgery Analyzer, Biomedical Defibrillator Analyzer, and Others Biomedical Tester Devices. Based on End User, the market is segmented into Healthcare Sector, Research and Development Laboratories, Educational Institutes, and Other End Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The functionality testing segment is projected to account for 48.70% of total revenue within the test type category by 2025, making it the leading segment. This growth is attributed to its essential role in verifying the operational performance and safety compliance of a wide range of biomedical equipment.

Functionality testing allows healthcare providers and biomedical engineers to assess whether devices are performing according to specifications, which is vital for patient safety and regulatory adherence. The increasing variety of equipment used in critical care and diagnostics has further emphasized the need for comprehensive and accurate functionality testing.

This segment has maintained its dominance due to its broad applicability across equipment types and its integration into routine quality assurance protocols in clinical settings.

The biomedical patient monitor simulators segment is expected to hold 51.30% of the market revenue under the device type category by 2025, positioning it as the largest contributor. This is driven by their widespread application in simulating physiological parameters to test the accuracy and responsiveness of patient monitoring devices.

These simulators have become critical tools for biomedical engineers and clinical technicians, allowing for real-time verification and calibration of monitors used in intensive care units, operating rooms, and emergency departments. The simplicity, precision, and repeatability offered by these simulators have supported their widespread use in both hospital and training environments.

As healthcare providers continue to prioritize reliable monitoring systems, the demand for biomedical patient monitor simulators is expected to sustain its leadership in the device segment.

The healthcare sector is projected to generate 46.50% of total revenue by 2025 within the end user category, securing its place as the leading segment. This growth stems from the extensive deployment of biomedical testers in hospitals, diagnostic centers, and specialty clinics where equipment uptime, safety, and accuracy are paramount.

The rising incidence of chronic diseases and the increased use of monitoring and life support systems have elevated the need for ongoing equipment testing and calibration. Furthermore, regulatory bodies mandate routine testing in healthcare settings to maintain compliance and patient trust.

The healthcare sector continues to dominate this market due to its dependency on continuous and reliable device performance for critical care and diagnostics.

The increasing production and consumption of biomedical devices and equipment are driving up demand for biomedical testers. The Accreditation Association for Ambulatory Health Care Inc. (AAAHC), NFPA 99, and other standards play an important role in the growth of the biomedical testers market.

There are some regulations and standards established by regulatory authorities for biomedical devices. The overall goal of regulations is to ensure that devices are safe to use under normal conditions. Failure of medical devices to meet standards could have serious consequences for patients. Even though biomedical devices have made significant advances, there is always room for improvement and advancement. As a result, the demand for Biomedical Testers rises, propelling the Biomedical Tester Market forward.

Automated biomedical testers, advancements in precision and speed, simulation and data analysis capabilities, and multi-functional devices are expected to have a positive impact on biomedical tester demand and will significantly drive the global biomedical tester market.

There is a lengthy waiting period for international qualifications: Nowadays, the time-consuming process of overseas product acceptance has an impact on product import and export. Doing business in the international market is a significant challenge for companies due to the significant lead time required for international certification examinations. As a result of the product import and export delays, the company may face issues such as customer loss, product quality, and time waste. This is the primary obstacle for the biomedical tester market.

These challenges associated with the biomedical tester that is limiting the market growth are continuous software upgrades and a lack of skilled professionals for the use of biomedical tester. However, vendors are constantly working to develop advanced biomedical testers as well as provide training and support for their use.

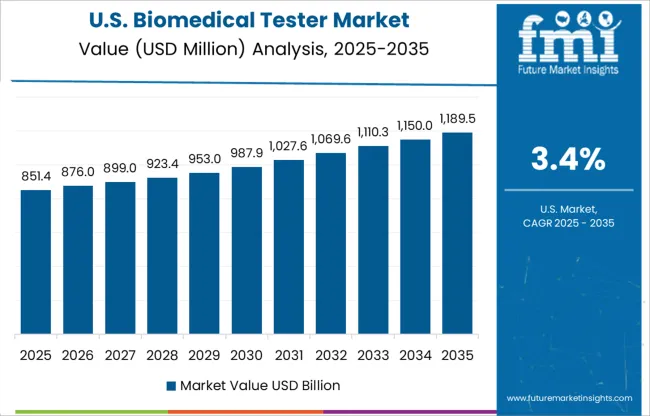

According to Future Market Insights, the global biomedical tester in North America is expected to have a significant market share during the forecast period. The presence of a large customer base in the USA, as well as a growing healthcare sector, is driving demand for biomedical testers in the market.

In 2024, North America dominated the market with a 39% share. Increased access to technology solutions, well-established distribution channels, an increasing number of healthcare providers demanding hands-on patient training, and an increase in demand for virtual and online training due to the COVID-19 pandemic all contribute to this market segment's large share.

A large customer base and a developing healthcare sector are driving the demand for biomedical testers in the United States. The North American region is anticipated to grow at a stable pace during the forecast period.

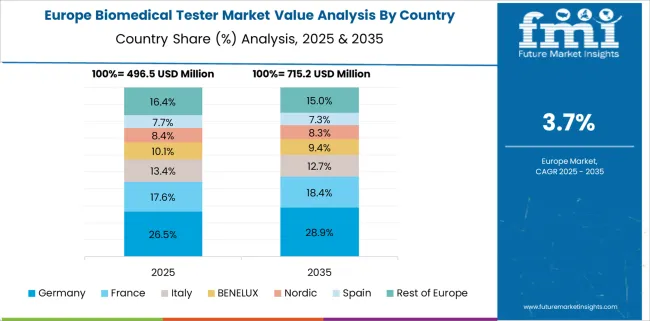

Europe accounts for the second-largest market share. An increase in the incidence of chronic illnesses in this area, as well as significant healthcare spending by the European Commission, are expected to drive demand for biomedical testers in Europe during the forecast period.

Some of the key participants present in the global Biomedical Tester market include Fluke, Datrend Systems Inc., Seaward Electronic Ltd., Dynatech CBET, Southeastern Biomedical, Presto Group, Illinois Tool Works Inc., NETECH CORPORATION, BDC Laboratories, Response Biomedical Corp., and others.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4% from 2025 to 2035 |

| Market Value in 2025 | USD 2.1 billion |

| Market Value in 2035 | USD 3.2 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Test Type, Device Type, End User, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, China, Japan, South Korea, India, ASIAN, Australia & New Zealand, GCC Countries, South Africa, Turkey |

| Key Companies Profiled | Fluke; Datrend Systems Inc.; Seaward Electronic Ltd.; Dynatech CBET; Southeastern Biomedical; Presto Group; Illinois Tool Works Inc.; NETECH CORPORATION; BDC Laboratories; Response Biomedical Corp. |

| Customization | Available Upon Request |

The global biomedical tester market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the biomedical tester market is projected to reach USD 3.2 billion by 2035.

The biomedical tester market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in biomedical tester market are functionality testing, performance testing and verification testing.

In terms of device type, biomedical patient monitor simulators segment to command 51.3% share in the biomedical tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biomedical Refrigerator and Freezer Market Size and Share Forecast Outlook 2025 to 2035

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

LAN tester Market Size and Share Forecast Outlook 2025 to 2035

SCC Tester Market Size and Share Forecast Outlook 2025 to 2035

LED Tester Market

DSL Tester Market Growth – Trends & Forecast 2019-2027

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Gold Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Food Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Scuff Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Hipot Tester Market Analysis – Share, Size, and Forecast 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Torque Testers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA