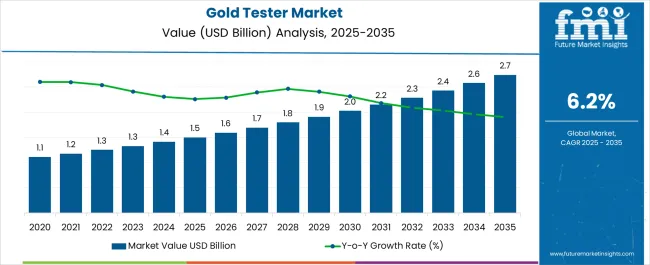

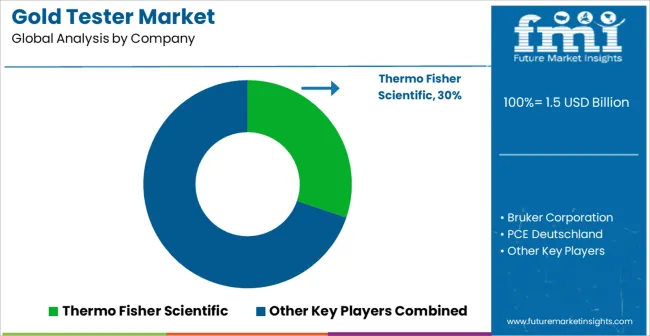

The Gold Tester Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Gold Tester Market Estimated Value in (2025 E) | USD 1.5 billion |

| Gold Tester Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The Gold Tester market is experiencing robust growth supported by the rising global demand for gold authentication, purity verification, and compliance with quality standards. Increasing consumer awareness regarding the authenticity of gold products has encouraged jewelers, traders, and regulatory bodies to adopt advanced testing equipment. The market is also being shaped by innovations in non-destructive testing methods and software-enabled analysis that deliver real-time accuracy.

Growing integration of digital features into testing systems has enhanced usability and efficiency, which is further boosting adoption across both retail and institutional segments. As regulatory authorities strengthen guidelines for hallmarking and purity certification, gold testers are becoming indispensable tools for ensuring trust and transparency in gold transactions.

The future outlook for the market is expected to remain positive, with adoption increasing in emerging economies where jewelry demand is expanding and in developed markets where compliance requirements are stringent This combination of regulatory enforcement, consumer trust, and technological advancement is creating a sustainable pathway for market growth.

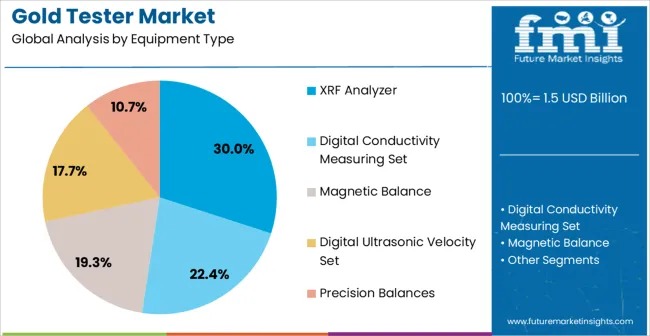

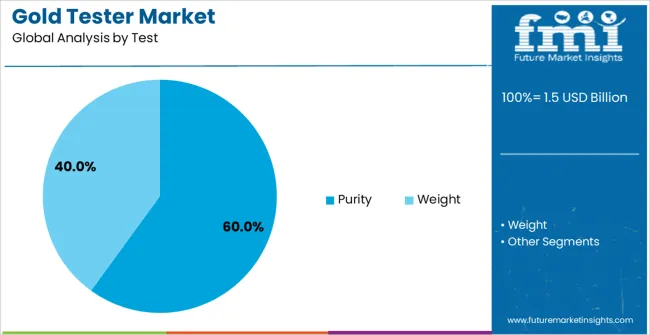

The gold tester market is segmented by equipment type, test, end use, modularity, and geographic regions. By equipment type, gold tester market is divided into XRF Analyzer, Digital Conductivity Measuring Set, Magnetic Balance, Digital Ultrasonic Velocity Set, and Precision Balances. In terms of test, gold tester market is classified into Purity and Weight.

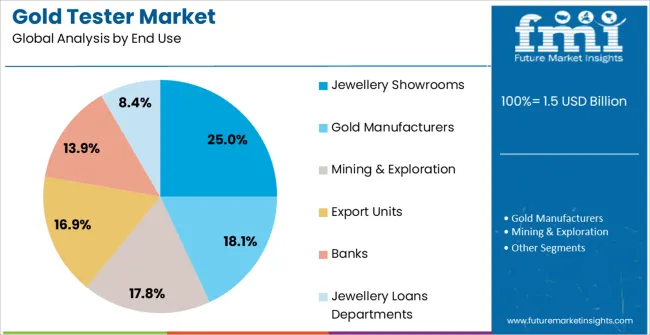

Based on end use, gold tester market is segmented into Jewellery Showrooms, Gold Manufacturers, Mining & Exploration, Export Units, Banks, and Jewellery Loans Departments. By modularity, gold tester market is segmented into Stationary and Portable.

Regionally, the gold tester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The XRF Analyzer segment is projected to account for 30.00% of the Gold Tester market revenue in 2025, establishing itself as the leading equipment type. This dominance is being driven by the ability of XRF Analyzers to deliver fast, precise, and non-destructive testing of gold and its alloys. The portability and efficiency of these devices have made them highly suitable for both on-site testing and showroom environments where immediate results are critical for transaction decisions.

Their capability to provide elemental composition analysis without altering or damaging the sample has created strong trust among jewelers and customers. The growing preference for advanced testing solutions that offer repeatable accuracy has also supported adoption.

Additionally, continuous improvements in software interfaces, miniaturization of devices, and declining operational costs have expanded accessibility across mid-sized jewelry businesses The combination of reliability, speed, and compliance with international testing standards has reinforced the XRF Analyzer as the preferred choice, enabling this segment to maintain its leadership position.

The Purity Test segment is anticipated to capture 60.00% of the overall Gold Tester market revenue in 2025, making it the most significant testing method. This share is being secured because purity remains the single most critical parameter in gold valuation and transactions. The importance of accuracy in determining karat levels and alloy compositions has heightened demand for purity testing solutions that can ensure compliance with hallmarking regulations and consumer expectations.

Rising incidences of adulteration and counterfeit gold products have further driven adoption, as businesses and customers seek verification methods that provide assurance. Technological advancements have enabled greater precision in detecting even trace elements within gold samples, ensuring transparency in pricing and trade.

The ability of purity testing to directly influence purchase decisions has positioned it as an essential application area in the market With stricter global quality standards and increasing consumer insistence on certified authenticity, the Purity Test segment is expected to retain its dominance and continue expanding its role.

The Jewellery Showrooms segment is expected to account for 25.00% of the Gold Tester market revenue in 2025, positioning it as the leading end-use industry. This prominence is being attributed to the growing need for transparency in retail transactions, where customers increasingly demand proof of gold authenticity before purchase. Showrooms have adopted advanced testing solutions to build trust, improve brand credibility, and comply with regulatory hallmarking requirements.

The deployment of gold testers in this segment has been further supported by the rise in organized jewelry retail chains and the digital transformation of sales channels, where accurate product validation has become a differentiator. By integrating testers directly into showroom operations, jewelers are able to offer real-time verification, enhancing the customer buying experience.

The reduction in testing costs and improvements in user-friendly interfaces have encouraged wider usage even in mid-tier and regional outlets With rising consumer expectations for certified purity and an increasing focus on compliance, Jewellery Showrooms are expected to remain a central driver of market demand.

A gold tester is a scientific instrument used to determine the purity of gold with X-rays. A gold tester is a highly precise and fast machine used to determine the gold concentration and the various elements present in gold bars, gold jewellery, gold coins, gold alloys, gold plating and scrap gold. In addition, it can determine the presence and concentration of different metals such as platinum, gold, palladium, k-platinum and k-gold.

The demand for gold testers has been witnessing significant growth as gold is considered an extremely valuable metal, even among other precious metals, and thus, it is essential to determine to purity of gold with great accuracy. Gold is mixed and bended with different metals to obtain various varieties of the metal and craft different types of jewellery.

Two types of gold testers are available in the market, i.e. gold testers as per purity and gold testers as per weight. Gold testers for weighing are especially essential as a minute error in the weight of the gold can lead to massive losses.

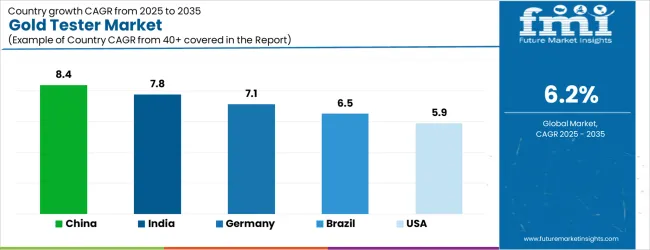

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

The Gold Tester Market is expected to register a CAGR of 6.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.4%, followed by India at 7.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Gold Tester Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.1%.

The USA Gold Tester Market is estimated to be valued at USD 523.5 million in 2025 and is anticipated to reach a valuation of USD 523.5 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 77.1 million and USD 41.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Equipment Type | XRF Analyzer, Digital Conductivity Measuring Set, Magnetic Balance, Digital Ultrasonic Velocity Set, and Precision Balances |

| Test | Purity and Weight |

| End Use | Jewellery Showrooms, Gold Manufacturers, Mining & Exploration, Export Units, Banks, and Jewellery Loans Departments |

| Modularity | Stationary and Portable |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Bruker Corporation, PCE Deutschland, OLYMPUS Corporation, Tectus Gold Testing, Maxsell, Aurum Chain, and Microanalytik Instruments |

The global gold tester market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the gold tester market is projected to reach USD 2.7 billion by 2035.

The gold tester market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in gold tester market are xrf analyzer, digital conductivity measuring set, magnetic balance, digital ultrasonic velocity set and precision balances.

In terms of test, purity segment to command 60.0% share in the gold tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gold Purity Tester Market

Gold Palladium Plated Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Gold-plated Palladium Bonding Wire Market Size and Share Forecast Outlook 2025 to 2035

Metric Value Industry Size (2025E) USD 32.0 billion Industry Value (2035F) 46.9 billion CAGR (2025 to 2035) 3.9%

Gold Plating Chemicals Market Growth – Trends & Forecast 2025 to 2035

Gold Metalized Film Market Trends & Growth Forecast 2024-2034

Goldenseal Market

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

LAN tester Market Size and Share Forecast Outlook 2025 to 2035

Marigold Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

SCC Tester Market Size and Share Forecast Outlook 2025 to 2035

LED Tester Market

DSL Tester Market Growth – Trends & Forecast 2019-2027

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Food Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA