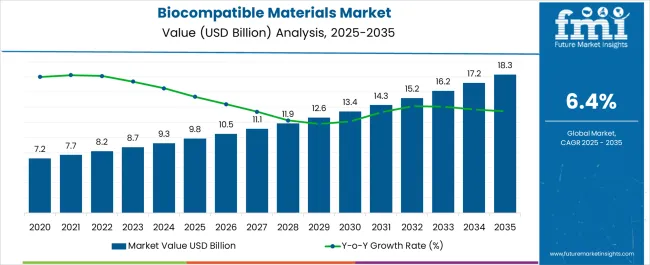

The Biocompatible Materials Market is estimated to be valued at USD 9.8 billion in 2025 and is projected to reach USD 18.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Biocompatible Materials Market Estimated Value in (2025 E) | USD 9.8 billion |

| Biocompatible Materials Market Forecast Value in (2035 F) | USD 18.3 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The biocompatible materials market is expanding steadily, supported by their critical role in medical devices, implants, prosthetics, and tissue engineering applications. Growing healthcare expenditures, coupled with the rising demand for advanced medical solutions, are contributing to adoption across developed and emerging regions. Increasing prevalence of chronic diseases and age-related conditions is driving the need for durable and safe implantable devices, further supporting demand for biocompatible materials.

Continuous advancements in biomaterials science, including enhanced compatibility, reduced toxicity, and improved mechanical strength, are shaping industry growth. Additionally, rising investments in regenerative medicine, 3D bioprinting, and minimally invasive surgical technologies are broadening the scope of applications. Regulatory requirements to ensure patient safety are encouraging companies to innovate with materials that meet stringent global standards while offering cost efficiency.

Biocompatible materials are also gaining traction in dental, cardiovascular, and orthopedic fields where long-term reliability is essential As healthcare systems worldwide continue to evolve toward personalized and precision medicine, the adoption of biocompatible materials is expected to accelerate, driven by their role in enabling safe, effective, and patient-friendly treatment options.

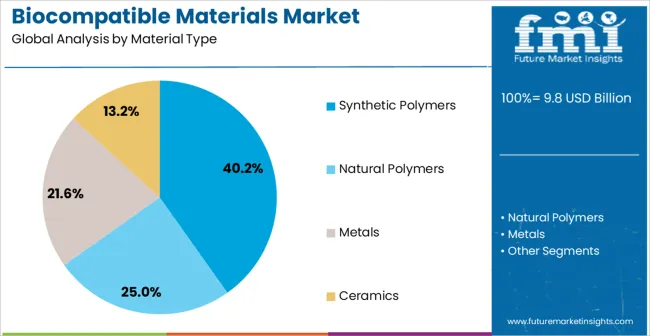

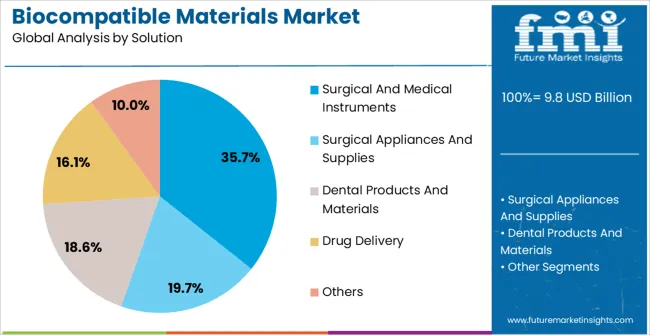

The biocompatible materials market is segmented by material type, solution, and geographic regions. By material type, biocompatible materials market is divided into Synthetic Polymers, Natural Polymers, Metals, and Ceramics. In terms of solution, biocompatible materials market is classified into Surgical And Medical Instruments, Surgical Appliances And Supplies, Dental Products And Materials, Drug Delivery, and Others. Regionally, the biocompatible materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic polymers segment is projected to hold 40.2% of the biocompatible materials market revenue share in 2025, making it the leading material type. Growth in this segment is driven by the versatility, cost-effectiveness, and customizable properties of synthetic polymers, which make them widely applicable in surgical, orthopedic, dental, and cardiovascular devices. These materials offer favorable characteristics such as high tensile strength, durability, and flexibility, which are essential for long-term medical applications.

Furthermore, the ability to tailor synthetic polymers for biodegradability, drug delivery, or surface modification enhances their performance in specialized applications. Their widespread use in implants, catheters, and wound healing solutions highlights their importance in modern healthcare.

Technological advancements are enabling the production of polymers with improved biocompatibility and reduced risk of adverse reactions, strengthening their adoption As medical procedures become more advanced and require reliable, patient-safe materials, synthetic polymers are expected to remain a dominant choice, supported by continuous innovations in polymer chemistry and large-scale manufacturing capabilities that align with healthcare demands.

The surgical and medical instruments segment is expected to account for 35.7% of the biocompatible materials market revenue share in 2025, establishing it as the leading solution category. This dominance is driven by the increasing demand for surgical tools, implants, and diagnostic equipment that require durable and patient-safe materials. Biocompatible materials are critical in ensuring that instruments used in invasive and non-invasive procedures maintain high performance while minimizing the risk of complications or allergic reactions.

Rising volumes of surgical procedures worldwide, particularly in orthopedics, cardiology, and dentistry, are fueling this demand. Additionally, innovations in precision instruments, robotic-assisted surgeries, and minimally invasive technologies are accelerating the need for advanced materials with reliable performance.

Regulatory frameworks that prioritize patient safety and sterilization standards are further boosting the adoption of biocompatible materials in this segment As healthcare providers emphasize efficiency, durability, and safety in surgical environments, the reliance on high-performance biocompatible materials is expected to expand, reinforcing the segment’s leadership in driving long-term market growth.

Biocompatible materials are those materials that elicit no unfavorable reaction from tissues. Biocompatible materials are nonviable materials used in medical devices that interact with biological systems. These materials are made from metals, synthetic polymers, natural polymers and ceramics. Biocompatible materials are widely used for various applications.

Its areas of application include contact lenses, heart valves, intraocular lenses, vascular grafts, artificial joints, etc. The basic materials used for the manufacturing of biocompatible materials are silicone, PMMA (acrylic), Teflon & Dacron, stainless steel, titanium & its alloys and polyurethane, among others. Some of the features of biocompatible materials are absence of carcinogenicity, toxicity, teratogenicity and immunogenicity along with high corrosion resistance.

Biocompatible materials are also used in several implants, such as joints, sutures, bone plates and dental implants. These materials either replace or restore the injured or destroyed tissues or organs. Biocompatible materials used for implants should have long-term biocompatibility with the host without being rejected and must not elicit any undesirable effects in the host.

Biocompatible materials are used for various applications in the medical field, such as in surgical & medical instruments, surgical appliance and supplies, dental products & materials, drug delivery, etc. Biocompatible materials help improve the quality of life and save millions of lives.

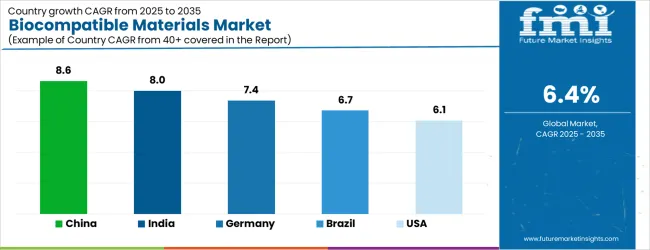

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| Brazil | 6.7% |

| USA | 6.1% |

| U.K. | 5.4% |

| Japan | 4.8% |

The Biocompatible Materials Market is expected to register a CAGR of 6.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.6%, followed by India at 8.0%. Developed markets such as Germany, France, and the U.K. continue to expand steadily, while the U.S. is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.8%, yet still underscores a broadly positive trajectory for the global Biocompatible Materials Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.4%. The U.S. Biocompatible Materials Market is estimated to be valued at USD 3.5 billion in 2025 and is anticipated to reach a valuation of USD 3.5 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 447.8 million and USD 274.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.8 Billion |

| Material Type | Synthetic Polymers, Natural Polymers, Metals, and Ceramics |

| Solution | Surgical And Medical Instruments, Surgical Appliances And Supplies, Dental Products And Materials, Drug Delivery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

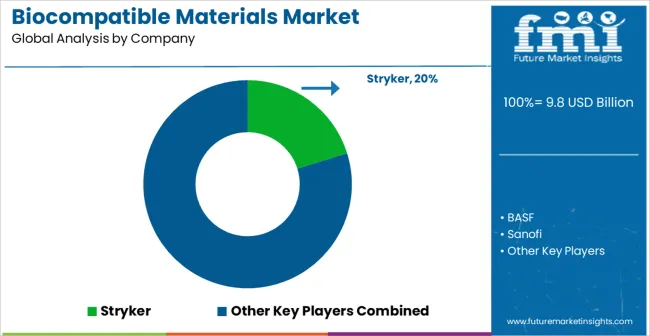

| Key Companies Profiled | Stryker, BASF, Sanofi, Baxter, Bayer, Mexichem, ADM, Ashland, Westlake Chemical, Cargill, Celanese, Phillips, Croda, Evonik, and Dow Corning Corporation |

The global biocompatible materials market is estimated to be valued at USD 9.8 billion in 2025.

The market size for the biocompatible materials market is projected to reach USD 18.3 billion by 2035.

The biocompatible materials market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in biocompatible materials market are synthetic polymers, natural polymers, metals and ceramics.

In terms of solution, surgical and medical instruments segment to command 35.7% share in the biocompatible materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biocompatible Polymers Market Trend Analysis Based on Product, Polymer, Application, and Region 2025 to 2035

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Solder Materials Market Size and Share Forecast Outlook 2025 to 2035

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Cathode Materials for Solid State Battery Market Size and Share Forecast Outlook 2025 to 2035

Exosuit Materials Market Size and Share Forecast Outlook 2025 to 2035

Stealth Materials and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Optical Materials Market - Trends & Forecast 2025 to 2035

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Graphite Materials Market Size and Share Forecast Outlook 2025 to 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Fluoride Materials Market

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Strapping Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA