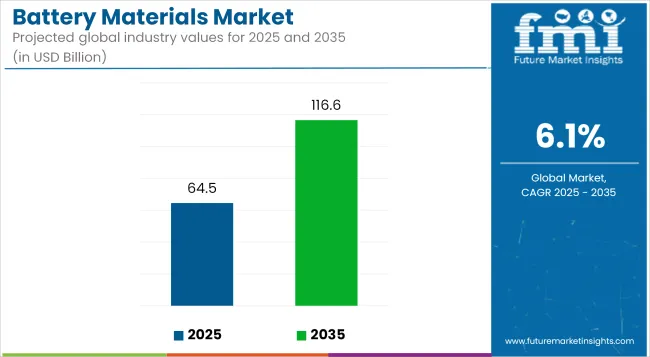

The global battery materials market is estimated at USD 64.5 billion in 2025 and is forecast to expand to USD 116.6 billion by 2035, registering a CAGR of 6.1%. Market growth is driven by the transition toward electrification across transportation, demand for energy storage systems, and increased usage of portable electronics.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 64.5 billion |

| Industry Value (2035F) | USD 116.6 billion |

| CAGR (2025 to 2035) | 6.1% |

The battery materials industry is expanding in response to rising demand for electric vehicles, hybrid vehicles, and renewable energy storage systems. This growth is supported by government mandates promoting lower carbon emissions and energy transition strategies across mobility and power sectors.

In the transportation sector, lithium-ion batteries remain the dominant technology. Most electric vehicles use batteries with nickel-manganese-cobalt (NMC) cathodes and graphite anodes due to their energy density and cycle stability. Companies such as Tesla, Hyundai, and BYD have incorporated these battery chemistries into production lines. At the same time, lithium iron phosphate (LFP) batteries are gaining traction for their thermal performance and cost structure, particularly in lower-range electric vehicles and commercial fleets.

Battery recycling and material recovery have become important due to the limited availability of critical minerals like lithium, cobalt, and nickel. Leading firms are developing closed-loop supply chains to recover battery-grade materials from end-of-life cells. Northvolt, for example, is operating recycling facilities in Europe to reclaim nickel and lithium from used batteries.

High-nickel cathode chemistries are being developed to reduce cobalt dependency and enhance energy output. Solid-state battery research is progressing in commercial settings as firms pursue more compact batteries with non-flammable electrolytes. Toyota and other major automakers are piloting this technology in pre-production stages.

Environmental regulations in the United States, the European Union, and other regions now include mandates around responsible sourcing, recyclability, and lifecycle emissions reporting. These rules are encouraging the use of lower-impact materials and increasing investment in transparent supply chain management.

The growth of renewable energy projects such as wind and solar installations is also driving demand for battery storage materials that support load balancing and backup systems. Utility providers are deploying lithium-ion and hybrid chemistries for this purpose, with projects underway in the USA, Germany, and South Korea.

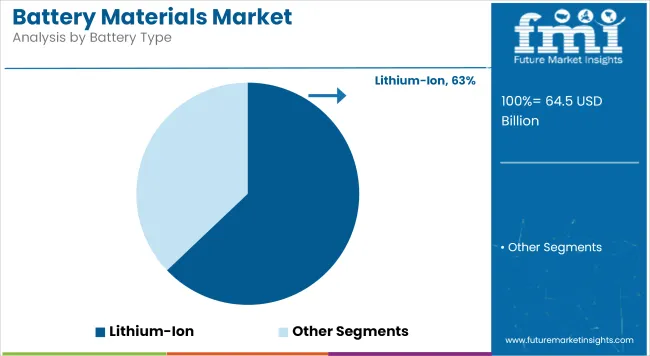

Lithium-ion battery materials are projected to account for approximately 62.9% of the market share in 2025 and are expected to grow at a CAGR of 6.4% through 2035. Lithium-ion chemistries dominate in electric vehicles, smartphones, laptops, and stationary storage. Core materials include lithium nickel manganese cobalt oxide (NMC), lithium iron phosphate (LFP), and lithium cobalt oxide (LCO), depending on the application.

These batteries provide favorable energy-to-weight ratios and long cycle life. Technological advancements are focused on cathode stabilization, silicon-anode integration, and solid-state electrolyte development. As EV production scales globally, lithium-ion battery material suppliers are expanding capacity and forming partnerships across the upstream and midstream supply chain.

Asia Pacific, especially China, leads in material processing, while the USA and Europe are investing in domestic production hubs to meet strategic demand. Recycling of lithium-ion materials is gaining traction as OEMs and battery producers aim to secure critical mineral supply.

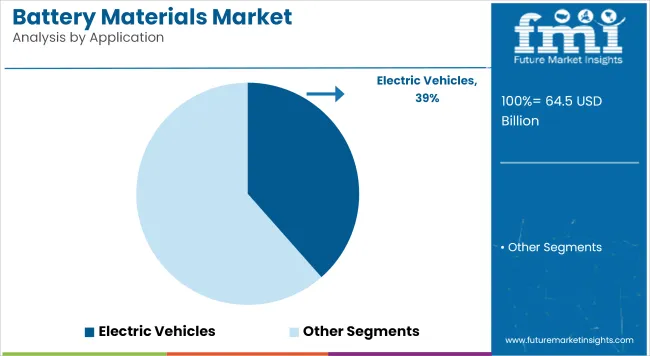

Electric vehicles (EVs) are projected to hold approximately 38.5% of the market share in 2025 and are expected to grow at a CAGR of 6.8% through 2035. Battery materials for EVs support propulsion systems in battery electric vehicles (BEVs), plug-in hybrid vehicles (PHEVs), and hybrid electric vehicles (HEVs). Materials used in EV battery packs are selected for their energy density, safety, and temperature stability.

Key developments include high-nickel cathodes, low-cobalt chemistries, and solid-state systems. Global EV deployment is driven by policy mandates, zero-emission targets, and consumer preferences. The automotive industry is scaling up battery integration and forming long-term procurement agreements with material manufacturers.

In regions like Europe, the USA, and China, localization of battery material production is a strategic priority to reduce dependence on imports and meet sustainability targets. The increasing number of gig factories and dedicated battery supply chain investments are expected to sustain demand growth for EV battery materials.

A surge in demand for electric vehicles (EVs) and renewable energy storage devices propelled the battery materials market through 2020 to 2024. During this period, the Li-ion dominate with NMC (nickel manganese cobalt) cathodes and grafite anodes. This rapid expansion has raised questions about sustainability and the security of supply chains, particularly for critical minerals such as lithium, cobalt and nickel. These challenges were addressed as sourcing was diversified and recycling capabilities extended.

From 2025 through 2035, the market is likely to undergo a sea change. The outlook is also promising as advances in material science will enable better battery chemistries such as high-nickel NMC cathodes and solid-state electrolytes with higher energy densities and safety.

Moreover, less resource-intensive options such as sodium-ion and Li iron phosphate (LFP) are coming online, which may reduce reliance on increasingly scarce materials. Artificial intelligence is expected to be instrumental in optimizing battery performance and extending battery lifetimes, both in design and manufacturing processes.

Additionally, environmental factors and geopolitical developments will probably affect sourcing strategies, driving the demand for sustainable and resilient supply chains.

The battery materials market is facing some critical challenges, one of which is supply chain vulnerability due to the use of raw materials like lithium, cobalt, and nickel. However, these inputs tend to be highly concentrated geographically - cobalt in the Democratic Republic of Congo, lithium in South America’s Lithium Triangle (Argentina, Bolivia, Chile) - leaving their supply chains vulnerable to geopolitical strife, trade barriers and environmental objections.

Market volatility, resource scarcity, and increasing demand lead to fluctuations in the price of resources used for battery production. Moreover, the extraction and refinement of these resources can pose environmental and ethical challenges, such as mining practices, water consumption, and labor conditions, to name a few.

Companies are working to tackle these issues by exploring alternate materials, investing in battery recycling technologies and locking in long term supply contracts with mining companies. Cobalt-free and low-nickel battery chemistries are also emerging in an effort to lower reliance on scarce resources.

Challenges Related to Environmental Impact and Sustainability

As batteries are an important part of the transition to a low-carbon economy, the industrial implications of battery production and end of life environmental disposal have been a pressing challenge. Mining and processing of battery materials carries carbon emissions, energy-intensive operations and toxic waste.

The absence of a structured recycling system for batteries further worsens the case since most spent batteries are discarded without proper recycling, resulting in resource depletion and habitat pollution. Moreover, improper disposal of batteries may pose safety issues, such as fire hazards and chemical leaks.

To address these environmental challenges, governments and industries are prioritizing sustainable sourcing practices, closed-loop recycling systems, and the innovation of eco-friendly battery chemistries. These include navigating regulatory frameworks, such as the EU Battery Directive or Extended Producer Responsibility (EPR) programs, and helping raise battery recycling rates and decreased environmental footprint.

Growing Demand for Electric Vehicles (EVs) and Energy Storage Systems

Transition of the world towards electric mobility is one of the most important opportunities of growth for the battery materials market. The lightning-fast adoption of electric vehicles (EVs), backed by government subsidies, emission reduction assignments, and battery technology advancements, is boosting a large-scale demand for materials such as lithium, nickel, cobalt, and graphite.

With the charging infrastructure being further improved and public charging facilities being enhanced, and with the performance and range of EVs increasing, EV adoption is likely to accelerate even further, resulting in greater demand for high-capacity batteries. Furthermore, the emergence of plug-in hybrid vehicles (PHEVs) and commercial electric fleets creates further potential for suppliers of battery materials.

The electrification of transportation, alongside the proliferation of renewable energy which has imposed itself as the energy of the future, has also made the need for grid observation and for grid and ancillary services to integrate solar and wind in the energy mix greater than ever.

The operation of battery energy storage systems (BESS) is vital for the stabilization of power grids and off-grid applications of renewable energy generation with intermittent energy outputs. This trend is expected to create demand for new battery materials with better cycle life, efficiency, and cost-effectiveness.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for electric vehicles (EVs) | Supply chain disruptions and raw material shortages |

| Advancements in battery technology (solid-state, LFP, sodium-ion) | High production costs and capital investment requirements |

| Government incentives and policies promoting clean energy | Environmental concerns over mining and extraction |

| Rising energy storage applications in renewable power integration | Limited availability of critical materials like lithium, cobalt, and nickel |

| Expansion of recycling and circular economy initiatives | Complex and expensive battery recycling processes |

| Increasing R&D investments in next-generation materials | Geopolitical risks affecting material sourcing |

| Consumer demand for longer battery life and faster charging | Market volatility and fluctuating raw material prices |

Key Drivers Impact Assessment

| Key Drivers | Impact Level |

|---|---|

| Growing demand for electric vehicles (EVs) | High |

| Advancements in battery technology (solid-state, LFP, sodium-ion) | High |

| Government incentives and policies promoting clean energy | High |

| Rising energy storage applications in renewable power integration | Medium |

| Expansion of recycling and circular economy initiatives | High |

| Increasing R&D investments in next-generation materials | Medium |

| Consumer demand for longer battery life and faster charging | High |

| Key Restraints | Impact Level |

|---|---|

| Supply chain disruptions and raw material shortages | High |

| High production costs and capital investment requirements | High |

| Environmental concerns over mining and extraction | Medium |

| Limited availability of critical materials like lithium, cobalt, and nickel | High |

| Complex and expensive battery recycling processes | Medium |

| Geopolitical risks affecting material sourcing | High |

| Market volatility and fluctuating raw material prices | Medium |

With the Electric vehicles (EV) continuously expanding, energy storage systems requiring more investments than ever before, and portable electronic devices demanding higher performance battery materials than ever before, the United States is on pace for continued growth in battery materials. The Bipartisan Infrastructure Law and tax credits for EV production are creating a sense of urgency to have a domestic battery materials supply chain free from imported raw materials.

In addition, continuous innovation in solid-state batteries, lithium-ion technologies and sustainable recycling has also contributed to rapid adoption of these technologies in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The UK Battery Materials market has been growing steadily, driven by the country’s ambitious electric mobility, renewable energy storage, and sustainable battery production targets. This supply chain, driven by government initiatives such as Net Zero Strategy and investments in gigafactories, seeks to bring the UK forward as a European battery manufacturing hub.

The increasing growth of market production of electric vehicles, notably with Nissan and Jaguar Land Rover, combined with evolving battery recycling technologies, are supporting expansion within the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.8% |

TACKLING EUROPEAN UNION (EU) The EU battery materials market is expanding rapidly with strong growth coming from the electric vehicle, strict emission regulations, and the use of renewable energy storage systems. The European Green Deal and EU’s Battery Regulation are spurring investment in technologies for sustainable battery production, resource efficiency and recycling.

Countries such as Germany, France and Sweden are also at the forefront of building battery giga factories, while increased demand for lithium, cobalt, nickel and manganese is restructuring supply chains in every part of Europe.

Robust Growth of the EV Market: The EU targets 30 million EVs on the road by 2030, increasing demand for high-performance battery materials.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.2% |

Japan: The market for battery materials in Japan is led by advanced battery technologies, the transition of the automotive sector to electric vehicles (EVs), and significant investments in energy storage systems in the country. Key growth drivers are the country’s emphasis on solid-state battery development and the domestic expansion of hybrid and electric vehicle production.

Japan’s prioritization of recycling battery materials and obtaining both environmentally-friendly practices for the materials as well as sustainable future supply chains with critical minerals like lithium and cobalt will be pivotal for market growth.

Strong R& D Investments in Solid-State Batteries and High-Density Lithium-Ion Batteries Transitioning From The Automotive Industry: Japan’s automotive giants like Toyota and Honda are accelerating EV production.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The South Korean battery materials market is is booming due to its position along the lithium-ion battery supply chain, strong manufacturing capability for electric vehicles, and large investments in battery gigafactories. Firms such as LG Energy Solution, SK Innovation and Samsung SDI are world leaders in battery manufacturing, driving demand for materials such as nickel, cobalt, lithium and graphite.

This will boost market growth as the government focuses on technological innovation, sustainable battery production, and developing supply chains for raw materials.South Korea accounts for a hefty 40% of the world’s lithium-ion battery exports.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

The battery materials market is responding to increased volatility and shifting demand dynamics driven by electric vehicles and energy storage systems. The introduction of futures contracts for lithium and cobalt indicates a rising need for structured price risk management across the supply chain. This move allows stakeholders to secure input costs amid fluctuating global demand and supply constraints.

At the same time, the development of new applications, such as energy storage systems for data centers, is expanding the downstream use of battery materials beyond mobility. Companies are diversifying their market presence by entering stationary storage segments. These developments point to a broader market trend focused on securing material availability, managing price exposure, and exploring alternative end-use verticals for battery materials.

The industry is driven by rising demand for electric vehicles (EVs), renewable energy storage, and advancements in battery technologies such as solid-state and sodium-ion batteries.

Key challenges include supply chain vulnerabilities, fluctuating raw material prices, environmental concerns from mining and disposal, and the need for sustainable battery recycling solutions.

Companies are diversifying sourcing, investing in battery recycling, developing alternative materials like cobalt-free chemistries, and securing long-term supply contracts to ensure stability.

Government policies, including EV incentives, sustainability regulations, and investments in domestic battery supply chains, are shaping the market’s future and driving innovation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Battery Operated Light Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA