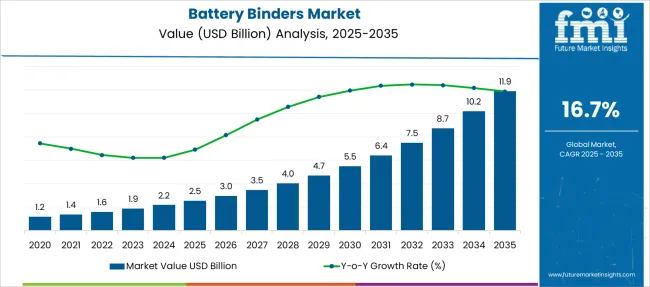

The Battery Binders Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 11.9 billion by 2035, registering a compound annual growth rate (CAGR) of 16.7% over the forecast period.

| Metric | Value |

|---|---|

| Battery Binders Market Estimated Value in (2025 E) | USD 2.5 billion |

| Battery Binders Market Forecast Value in (2035 F) | USD 11.9 billion |

| Forecast CAGR (2025 to 2035) | 16.7% |

The battery binders market is witnessing strong momentum, supported by the rapid acceleration of electrification across industries and rising demand for high-performance energy storage systems. As lithium-ion battery applications grow across sectors such as electric vehicles, energy storage systems, and consumer electronics, the need for efficient and stable binders has become critical to enhancing battery longevity, adhesion, and overall safety.

Key trends such as increased focus on fast-charging capabilities, thermal stability, and cycle life have driven innovation in binder chemistries, including water-based and advanced polymer formulations. Future growth prospects are anchored in the expanding EV ecosystem, bolstered by global government policies promoting clean transportation and investments in gigafactories.

The shift toward sustainable and recyclable battery components is expected to influence product development in this space. The battery binders market is well-positioned for sustained expansion due to its integral role in optimizing cell performance and enabling the next generation of energy storage technologies.

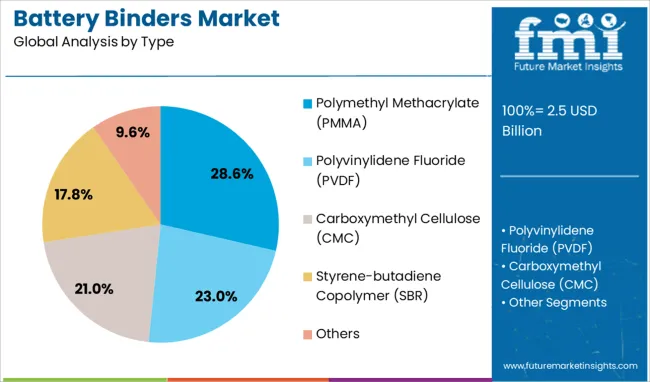

The battery binders market is segmented by type, application, and end use and geographic regions. The battery binders market is divided by type into Polymethyl Methacrylate (PMMA), Polyvinylidene Fluoride (PVDF), Carboxymethyl Cellulose (CMC), Styrene-butadiene Copolymer (SBR), and Others.

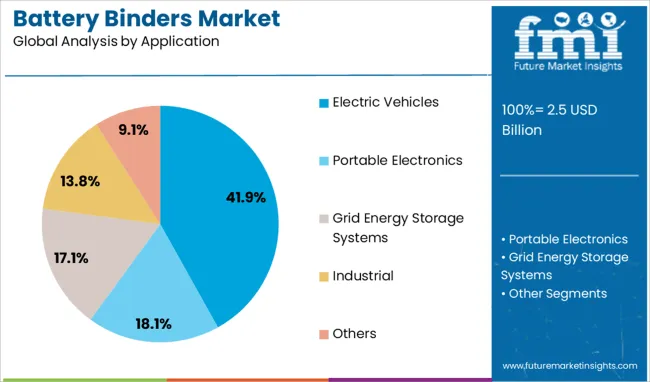

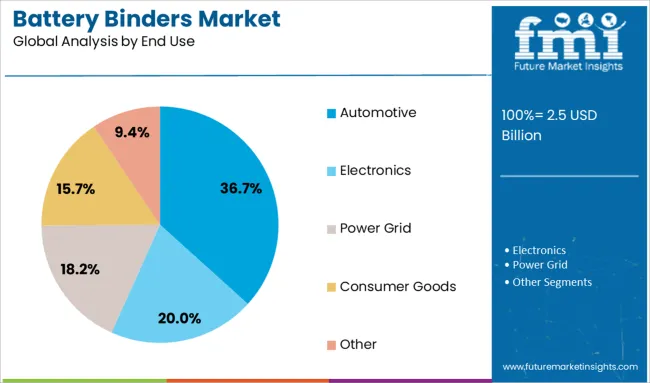

In terms of application, the battery binders market is classified into Electric Vehicles, Portable Electronics, Grid Energy Storage Systems, Industrial, and Others. Based on end use, the battery binders market is segmented into Automotive, Electronics, Power Grid, Consumer Goods, and Other.

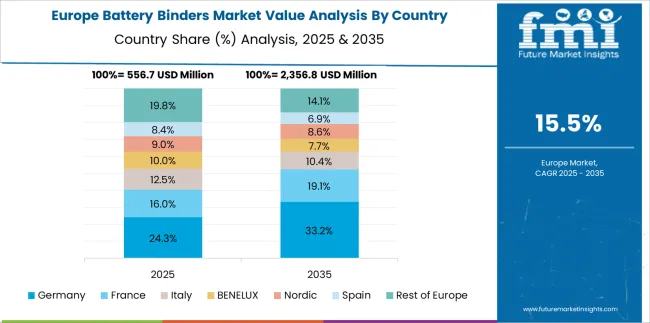

The battery binders industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polymethyl methacrylate (PMMA) segment holds a 28.6% share within the type category, driven by its advantageous properties such as excellent adhesion, chemical resistance, and compatibility with electrode materials. PMMA binders are widely utilized in battery applications where thermal and mechanical stability are essential, particularly in environments that demand high reliability and performance.

Their lightweight nature and structural integrity contribute to reduced battery degradation, which is vital for electric mobility and portable electronics. The increasing shift toward high-energy-density batteries has prompted manufacturers to integrate PMMA-based solutions due to their ability to maintain electrode cohesion under rigorous cycling conditions.

Ongoing research and optimization of PMMA formulations to support both anode and cathode technologies further bolster this segment’s growth potential. As demand rises for efficient and durable binder materials across advanced battery platforms, PMMA is expected to maintain a significant presence within the binder landscape.

Electric vehicles represent the largest application segment in the battery binders market, accounting for a commanding 41.9% share, driven by the global push toward decarbonization and the widespread adoption of clean mobility solutions. Battery binders play a pivotal role in ensuring the structural integrity and performance of lithium-ion batteries used in electric vehicles, making them indispensable to automakers and battery manufacturers alike.

The segment’s expansion is underpinned by rising EV production, government incentives, and growing investments in battery technology aimed at increasing range and reducing charging time. As OEMs prioritize energy density and lifecycle optimization, binder materials are being tailored to meet rigorous mechanical and thermal demands.

Additionally, binder innovation is becoming a focus area in efforts to enhance battery recyclability and environmental safety. Continued growth in EV penetration across global markets ensures that the demand for high-performance binder systems in this segment will remain elevated over the forecast period.

The automotive sector leads the end-use category with a 36.7% market share, reflecting its substantial reliance on lithium-ion batteries and the integration of advanced energy storage systems across electric and hybrid vehicle platforms. The increased electrification of transport and consumer demand for long-range, high-efficiency vehicles have placed battery performance at the forefront of innovation within the automotive industry.

Binders, as essential components in electrode fabrication, contribute directly to improved energy density, safety, and battery lifecycle—factors that are critical to vehicle performance. Automakers are increasingly collaborating with battery technology providers to optimize material formulations, including binder chemistries, to meet evolving vehicle specifications and regulatory standards.

With electric vehicle adoption expanding into commercial fleets and mass-market passenger vehicles, demand for automotive-grade binder solutions is projected to rise steadily. The segment is expected to remain dominant as the automotive industry transitions toward fully electric mobility and enhances investment in battery R&D.

The battery binders market is expanding rapidly due to increasing adoption of lithium-ion and next-generation batteries across electric vehicles, portable electronics, and grid storage systems. Binders such as PVDF, SBR, and CMC play a vital role in maintaining electrode integrity, preventing delamination, and enhancing cycling stability.

Growth in battery production volumes, particularly in Asia-Pacific, supports binder demand. Ongoing formulation developments and rising interest in aqueous and silicon-compatible binders provide new avenues for performance optimization and commercial differentiation.

Battery binder producers face significant challenges in aligning with tightening environmental regulations, particularly concerning solvent-based and fluorinated materials. Authorities are focusing on emissions from NMP-based PVDF binders, demanding advanced exhaust treatment and solvent recovery systems. Meeting new regulations increases capital investment and delays project timelines for new production lines.

Transitioning to aqueous binders appears attractive, but it introduces formulation, performance, and compatibility issues, especially in high-voltage or extreme-temperature applications. Manufacturers must navigate complex regulatory frameworks while maintaining commercial viability and performance consistency. In regions like Europe and North America, strict labeling and handling rules further constrain process flexibility.

For global binder suppliers, achieving uniform compliance across jurisdictions complicates production planning and supply chain logistics. These factors increase operational costs, reduce development speed, and pose a significant challenge to companies attempting to scale up binder offerings for rapidly growing battery applications without sacrificing regulatory alignment or long-term product certifications.

As battery technologies diversify, there is rising demand for advanced binders compatible with alternative chemistries. The adoption of silicon-rich anodes, lithium-sulfur, and sodium-ion cells requires binder systems that can accommodate high expansion ratios, maintain mechanical strength, and support ionic conductivity. Traditional PVDF may fall short in such applications, creating space for aqueous systems and polymer blends offering better adhesion and elasticity.

In high-capacity batteries, binder functionality directly influences cycle life and energy density, leading manufacturers to invest in tailor-made binder solutions. Additionally, with the rise of pouch and cylindrical cell formats, binder behavior must remain consistent across varied thicknesses and configurations. Binder suppliers focusing on specific chemistries can differentiate themselves by offering performance-tuned solutions.

Close collaboration with battery makers during the development stage enhances customization and long-term product fit. This evolving landscape creates significant opportunities for companies offering flexible, chemistry-compatible binder platforms that address emerging battery architectures across mobility and energy sectors.

One of the most prominent trends in the battery binders market is the transition toward water-based binder systems. These alternatives eliminate the need for toxic solvents like NMP, reducing health hazards, simplifying compliance, and cutting drying energy costs. Water-based options such as SBR and CMC are gaining adoption in anodes for automotive and consumer cells.

However, their performance in high-voltage cathode applications is still under evaluation. The shift also encourages changes in slurry formulation, coating equipment, and electrode drying infrastructure. This influences the entire battery manufacturing process, from raw material handling to finished cell properties.

Research efforts now focus on hybrid aqueous formulations and crosslinked polymers that maintain adhesion and elasticity under repeated charge cycles. As sustainability considerations and process safety take greater precedence, water-based binder systems are increasingly integrated into new battery production lines. Manufacturers aligning their product development around these formats can gain long-term advantages in performance, safety, and regulatory readiness.

Despite strong demand, high production costs remain a major barrier in the battery binders market. Advanced polymers like PVDF are expensive and require solvent-based processing, increasing energy and equipment expenses. Even aqueous binders, while more sustainable, involve complex formulations and tight quality control, which elevates production overhead.

Manufacturers must ensure uniform viscosity, particle distribution, and curing behavior, all of which add layers of cost. Additionally, any deviation in binder performance can affect electrode coating quality, leading to scrap rates and rework. For low-margin battery applications such as entry-level electric vehicles or backup power systems, these costs become hard to absorb. Supply chain limitations and fluctuating prices of raw inputs further intensify the issue.

Until large-scale production of cost-effective alternatives becomes viable, many battery manufacturers remain cautious in switching or scaling binder use. As a result, price sensitivity remains a key restraint, particularly in emerging markets and high-volume battery production lines.

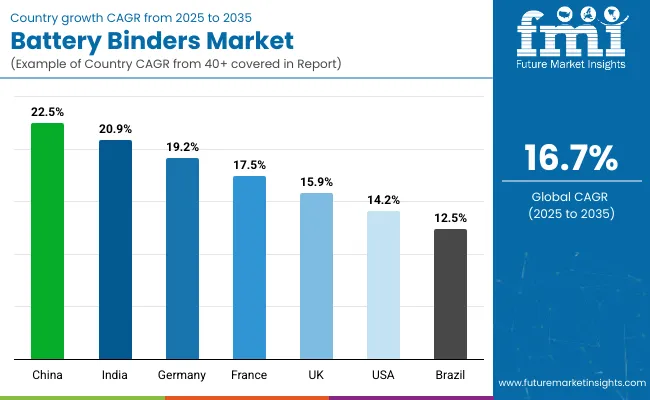

| Country | CAGR |

|---|---|

| China | 22.5% |

| India | 20.9% |

| Germany | 19.2% |

| France | 17.5% |

| UK | 15.9% |

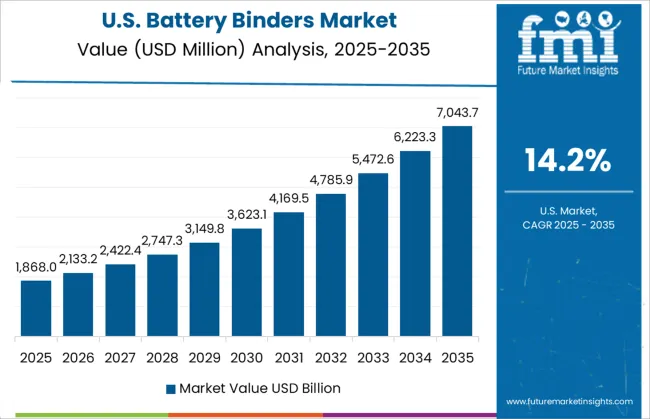

| USA | 14.2% |

| Brazil | 12.5% |

The global battery binders market is projected to grow at a CAGR of 16.7% through 2035, supported by expanding production of lithium-ion batteries used in mobility, storage, and consumer electronics. Among BRICS nations, China leads with 22.5% growth, driven by large-scale cell manufacturing and localized binder supply chains. India follows at 20.9%, where binder demand has increased with domestic battery gigafactory initiatives and electric vehicle assembly.

In the OECD region, Germany reports 19.2% growth, supported by tight integration of binder solutions into European cell manufacturing clusters. The United Kingdom, at 15.9%, reflects rising adoption in niche cell chemistries and pilot-scale production. The United States, at 14.2%, has seen demand supported by upstream material refinement and government-backed energy storage programs.

Market direction has been shaped by viscosity control standards, electrode adhesion requirements, and binder compatibility benchmarks. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Significant progress has been recorded in the ballistic composites market across China, which has expanded at a 10.1% CAGR, driven by heightened material requirements in military, aerospace, and protective gear applications. Increased procurement has taken place by domestic defense contractors, where lightweight armor plating has been prioritized.

Composite variants such as aramid fibers and ultra-high molecular weight polyethylene have been adopted across tactical vests and vehicle armor panels. Production hubs in Jiangsu and Guangdong have scaled their integration of thermoplastic composites into ballistic helmets and shields.

Civil law enforcement units have also influenced local demand with orders for anti-fragmentation gear. Performance consistency under multi-impact conditions has been emphasized through internal testing and batch standardization. Export volumes for finished armor parts have grown toward markets in Asia and Eastern Europe, supporting full-cycle domestic manufacturing lines.

A rising trend in the use of ballistic composites in India has contributed to a 9.4% CAGR, fueled by expanded deployments in defense mobility and personnel protection programs. Composite inserts for bulletproof jackets and tactical shields have been produced using locally sourced glass fibers and imported aramid variants.

Government-backed initiatives in indigenous armor manufacturing have reinforced demand across public-sector ordnance factories and private security equipment firms. Civil security forces have placed orders for lighter yet impact-resistant vests suitable for rapid response operations.

Modular plating systems featuring multi-layer composites have been introduced for paramilitary use in border zones. Collaborations with defense research units have led to field trials involving hybrid weaves and laminated structures. Steady procurement from logistics and convoy protection divisions has been facilitated through supplier networks located in Pune and Hyderabad.

Within Germany, a 8.6% CAGR has been maintained in the ballistic composites market, propelled by persistent innovation in vehicle armor and aerospace shielding solutions. Adoption has been focused on combining rigidity and low areal density in ballistic panels used in military transport systems and personal gear.

Aramid-carbon hybrid composites have found application in lightweight ballistic doors and protective barriers. Aerospace contractors have sourced ballistic-grade laminates for cockpit protection in rotorcraft and fixed-wing aircraft. Local testing facilities in North Rhine-Westphalia and Saxony have validated composite resilience under NATO-standard trials.

Collaboration between material scientists and defense manufacturers has emphasized thermal stability and multi-strike endurance. Demand from police tactical units has remained strong for portable shields and compact body armor fitted with modular composite plates.

Expansion in the ballistic composites market across the United Kingdom has occurred at a 7.1% CAGR, supported by structured investments in tactical protective solutions and export-grade armor components. Defense suppliers have used glass-reinforced thermoset composites in riot control shields and lightweight ballistic panels.

Metropolitan police forces have specified requirements for low-profile vest inserts and multi-threat protection systems, influencing domestic design standards. Collaborative frameworks with aerospace firms have promoted inclusion of ballistic-rated components into airborne crew seats and fuselage panels.

Portable ballistic barriers assembled with folding composite frames have seen increased deployment across special response teams. Independent testing services in Hampshire and South Yorkshire have provided certification for law enforcement-ready gear. Supply chains based in Birmingham and Cardiff have managed distribution of semi-finished parts and laminated sheets.

The United States has shown a 6.4% CAGR in the ballistic composites market, with consistent demand across defense, homeland security, and vehicle armoring industries. Extensive use has been reported in composite plates, aircraft seat protection, and mine-resistant vehicle flooring systems.

Multi-hit and fragmentation resistance has driven the adoption of ceramic-fiber hybrid inserts. Manufacturers in Michigan and Texas have maintained high-volume outputs of aramid-reinforced armor panels supplied to military bases and federal agencies. Police departments have transitioned toward modular vest systems embedded with flexible composite shields.

Defense contractors have ordered advanced composites for use in unmanned ground vehicles and aircraft body inserts. Field testing has been emphasized by the Department of Defense for gear intended for urban and counter-insurgency operations.

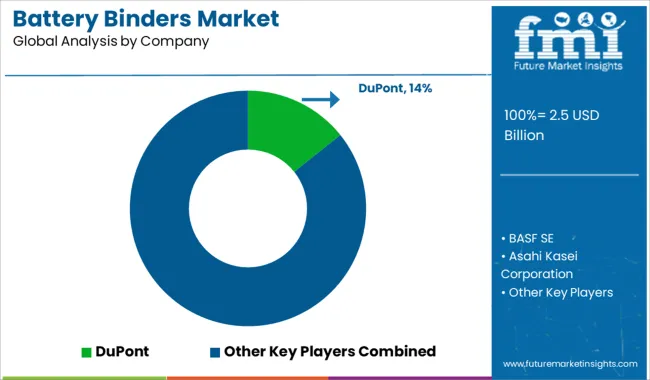

The battery binders market is shaped by a combination of chemical giants and specialty material producers, each delivering binder technologies crucial for electrode adhesion, stability, and lifecycle performance in lithium-ion batteries. DuPont leads with its portfolio of aqueous and solvent-based binders that offer high compatibility with silicon, graphite, and lithium metal anodes, ensuring mechanical stability under repeated charge-discharge cycles.

BASF SE supplies next-generation polymer binders designed to minimize electrode swelling and enhance electrode density, a key need for high-energy-density batteries. Asahi Kasei Corporation and Zeon Corporation are key players from Japan, producing SBR (styrene-butadiene rubber) and PVDF-based binders widely adopted in EV and energy storage system (ESS) applications.

Daikin Industries and Arkema offer fluorinated binders known for their thermal and chemical resistance, supporting safety in high-voltage battery chemistries. Solvay S.A provides PVDF binders with optimized dispersion and coating properties to enable high-throughput manufacturing processes. Mitsubishi Chemical Corporation delivers a range of advanced binder solutions tailored to next-gen anode materials, including silicon-dominant blends, while LG Chem integrates binder technology in its battery division, focusing on internal optimization.

The Lubrizol Corporation, SYNTHOMER PLC, and Trinseo S.A. bring specialty polymer expertise into the battery sector with customized binder chemistries for both electrodes. Targray and Industrial Summit Technology Corp serve as strategic suppliers of binder materials, targeting niche battery manufacturing needs with competitive pricing and global supply capabilities. The market continues to evolve with demand for high-performance, processable, and environmentally compatible binder solutions.

In May 2023, BASF introduced Net‑Zero Carbon Footprint Licity® anode binders, produced via the biomass-balance method. These waterborne styrene-butadiene rubber binders deliver typical Licity® performance, including adhesion, elasticity, coating behavior, and cycle stability while offering greenhouse-gas-neutral production per cradle-to-gate certification.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Type | Polymethyl Methacrylate (PMMA), Polyvinylidene Fluoride (PVDF), Carboxymethyl Cellulose (CMC), Styrene-butadiene Copolymer (SBR), and Others |

| Application | Electric Vehicles, Portable Electronics, Grid Energy Storage Systems, Industrial, and Others |

| End Use | Automotive, Electronics, Power Grid, Consumer Goods, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, BASF SE, Asahi Kasei Corporation, Daikin Industries, Arkema, Zeon Corporation, Targray, Solvay S.A, Mitsubishi Chemical Corporation, The Lubrizol Corporation, SYNTHOMER PLC, Industrial Summit Technology Corp, LG Chem, and Trinseo S.A. |

| Additional Attributes | Dollar sales by battery binder type including PVDF, CMC, SBR, and PMMA, by application in EVs, electronics, and energy storage, and by region including North America, Europe, and Asia-Pacific; demand driven by EV growth and performance needs; innovation in water-based and multifunctional binders; costs shaped by polymer prices and manufacturing scalability. |

The global battery binders market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the battery binders market is projected to reach USD 11.9 billion by 2035.

The battery binders market is expected to grow at a 16.7% CAGR between 2025 and 2035.

The key product types in battery binders market are polymethyl methacrylate (pmma), polyvinylidene fluoride (pvdf), carboxymethyl cellulose (cmc), styrene-butadiene copolymer (sbr) and others.

In terms of application, electric vehicles segment to command 41.9% share in the battery binders market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA