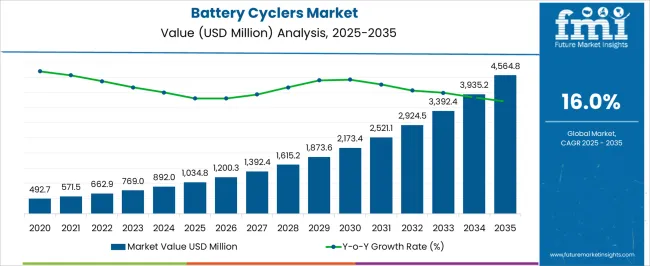

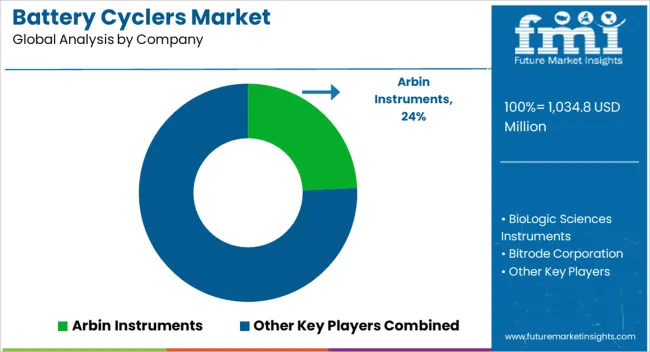

The Battery Cyclers Market is estimated to be valued at USD 1034.8 million in 2025 and is projected to reach USD 4564.8 million by 2035, registering a compound annual growth rate (CAGR) of 16.0% over the forecast period. Initial adoption from USD 1,034.8 million to USD 1,873.6 million during the first five years reflects reliance on conventional cycler systems optimized for basic battery testing and quality assurance in consumer electronics and automotive applications. This period emphasizes standardized voltage, current, and charge-discharge control technologies that form the core of early market contributions, supporting steady revenue growth while operational efficiency and system reliability improve.

From USD 2,173.4 million to USD 3,392.4 million, mid-phase growth highlights the rising significance of advanced cycler technologies, including high-precision programmable systems and multi-channel configurations. These innovations contribute disproportionately to overall market expansion as demand from electric vehicle manufacturers, renewable energy storage developers, and high-performance battery producers escalates.

Integration of software-based analytics, automated test protocols, and real-time monitoring capabilities enhances the technological contribution by increasing throughput and reducing testing cycle times. In the late phase, approaching USD 4,564.8 million, emerging technologies such as AI-enabled predictive cycling and adaptive load management dominate contributions, reflecting higher-value adoption across advanced energy storage systems.

The technological evolution, from basic to intelligent battery cyclers, accounts for the majority of market growth, with early-stage systems sustaining baseline revenue and advanced technologies driving accelerated expansion.

| Metric | Value |

|---|---|

| Battery Cyclers Market Estimated Value in (2025 E) | USD 1034.8 million |

| Battery Cyclers Market Forecast Value in (2035 F) | USD 4564.8 million |

| Forecast CAGR (2025 to 2035) | 16.0% |

The battery cyclers market is expanding steadily due to the growing demand for reliable testing equipment in electric mobility, renewable storage systems, and high-performance industrial batteries. As global initiatives to decarbonize transportation and energy infrastructure accelerate, battery quality, safety, and lifecycle validation have become mission-critical.

Battery cyclers are instrumental in assessing charge-discharge patterns, efficiency, and long-term performance, especially as innovation continues in chemistries and form factors. The integration of automation, data analytics, and temperature control in testing systems is supporting a shift toward precision diagnostics and scalable battery validation.

Regulatory standards around battery safety and performance are also strengthening adoption across various industries. With heightened investment in EV production, aerospace electrification, and grid-scale storage, the demand for versatile and high-throughput battery cyclers is expected to remain strong.

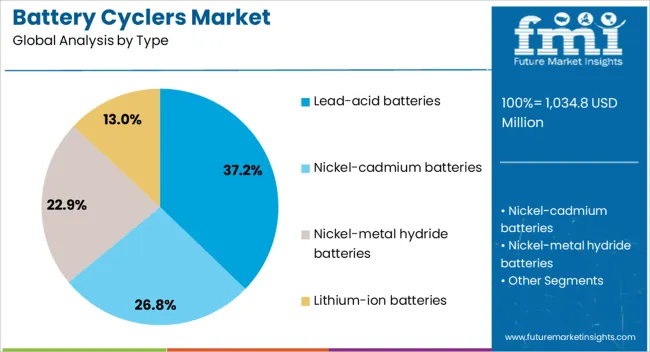

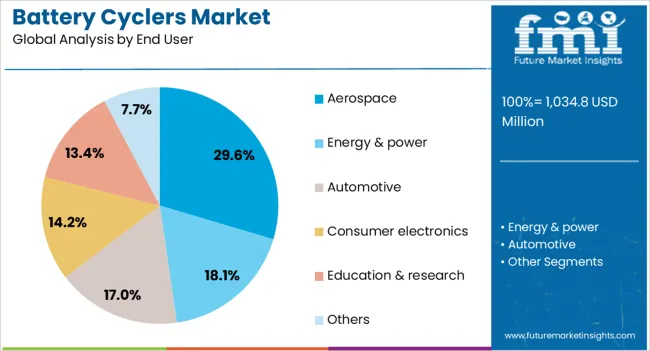

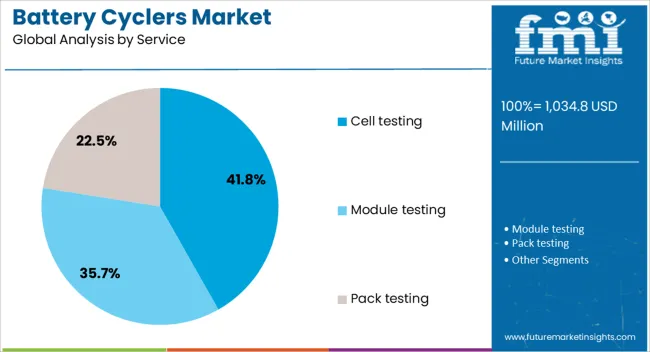

The battery cyclers market is segmented by type, end user, service, and geographic regions. By type, the battery cyclers market is divided into Lead-acid batteries, Nickel-cadmium batteries, Nickel-metal hydride batteries, and Lithium-ion batteries. In terms of end-users, the battery cyclers market is classified into Aerospace, Energy & Power, Automotive, Consumer Electronics, Education & Research, and Others. Based on the service of the battery cyclers market, it is segmented into Cell testing, Module testing, and Pack testing. Regionally, the battery cyclers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lead acid batteries segment is projected to account for 37.20% of total market revenue by 2025 within the type category, establishing its position as the dominant segment. This is driven by the widespread use of lead acid batteries in backup power systems, automotive applications, and industrial machinery where reliability and cost effectiveness remain priorities.

Despite the rise of lithium-ion and next-generation chemistries, the proven durability and recyclability of lead-acid batteries continue to justify their extensive usage. Battery cyclers tailored for this chemistry are favored due to their compatibility with deep cycle and float charge testing requirements.

As infrastructure and utility providers maintain legacy systems alongside new installations, the need for accurate and efficient testing of lead-acid batteries persists, reinforcing this segment’s stronghold in the market.

The aerospace segment is expected to contribute 29.60% of market revenue by 2025 within the end user category, making it one of the leading application areas. This is due to the critical role batteries play in avionics, auxiliary power units, and emerging electric aircraft systems.

Given the stringent safety, performance, and endurance standards in aerospace, robust testing frameworks are essential. Battery cyclers are extensively used for qualification testing, lifecycle validation, and temperature stress simulations to ensure reliability under extreme conditions.

With advancements in electric propulsion and increasing electrification of subsystems in both commercial and defense aerospace, the reliance on high precision battery testing equipment is intensifying. This segment’s prominence reflects the high regulatory scrutiny and technical performance benchmarks that define battery usage in aerospace applications.

The cell testing service segment is anticipated to represent 41.80% of overall market revenue by 2025 in the service category, making it the most dominant service offering. This growth is fueled by the rising need for third party validation, rapid prototyping, and performance benchmarking of battery cells prior to scaling production.

Companies increasingly rely on outsourced cell testing to access specialized facilities, reduce capital expenditure, and benefit from impartial data validation. Testing services cover capacity, impedance, cycle life, and thermal stability, ensuring cells meet industry and regulatory standards.

The proliferation of new battery chemistries and formats has also elevated demand for independent, comprehensive testing frameworks. As industries accelerate time to market and seek risk mitigation in battery development, cell testing services have emerged as a foundational component of the battery value chain.

The market has been expanding due to rising demand for battery testing, evaluation, and performance optimization across automotive, energy storage, consumer electronics, and industrial applications. Battery cyclers have been valued for their ability to simulate charge-discharge cycles, measure capacity, and monitor degradation under controlled conditions. Market growth has been reinforced by increasing adoption of electric vehicles, renewable energy systems, and advanced battery chemistries. Technological innovations, including automated test systems, high-speed cycling, and data analytics integration, have further strengthened demand, positioning battery cyclers as critical equipment for research, development, and quality assurance in modern energy storage ecosystems globally.

The market has been significantly influenced by the growth of electric vehicles (EVs) and energy storage systems (ESS). Battery performance, safety, and longevity have been evaluated using cyclers to simulate real-world charge-discharge cycles. Lithium-ion, solid-state, and advanced lithium chemistries have required precise testing equipment to optimize capacity, efficiency, and thermal stability. EV manufacturers and energy storage developers have adopted battery cyclers for R&D, quality assurance, and performance benchmarking. Integration with automated data logging, cloud-based analytics, and high-throughput testing platforms has allowed faster and more reliable characterization of batteries. The rapid expansion of EV fleets and large-scale ESS installations worldwide has reinforced demand for battery cyclers as essential tools for product development, operational efficiency, and energy storage innovation.

Technological innovations have strengthened the market by enhancing precision, speed, and versatility in battery evaluation. Modern cyclers have been equipped with multi-channel systems, high-current outputs, and programmable cycling profiles to test various chemistries and capacities simultaneously. Integration with battery management systems (BMS) and real-time data analytics has enabled predictive modeling of performance and degradation. Software-controlled test sequences, remote monitoring, and automated reporting have reduced operational errors and increased throughput. High-speed cycling and thermal management features have allowed accelerated life testing while ensuring safety and reliability. These advancements have positioned battery cyclers as indispensable tools for laboratories, R&D centers, and manufacturing units, facilitating the development of high-performance, safe, and durable batteries across automotive, energy storage, and industrial sectors globally.

The market has been reinforced by adoption in industrial, research, and academic laboratories. Battery developers, testing agencies, and manufacturers have relied on cyclers to evaluate energy density, cycle life, efficiency, and thermal characteristics of batteries. The expansion of smart grids, renewable energy integration, and portable electronics has created demand for robust testing and validation protocols. Universities and research institutions have employed battery cyclers for material research, prototype testing, and performance optimization. Additionally, government regulations and industry standards on battery safety and performance have required precise testing and certification processes. The consistent need for high-accuracy testing, quality assurance, and performance validation has positioned battery cyclers as essential tools across battery production, research, and industrial applications worldwide.

Despite strong demand, the market has faced challenges related to high capital costs, operational complexity, and calibration requirements. High-precision cyclers have required advanced electronics, cooling systems, and software integration, increasing initial investment and maintenance costs. Variability in battery chemistries and capacities has necessitated customization, programming, and frequent recalibration to ensure accurate measurements. Space and power requirements, coupled with safety precautions for high-energy systems, have influenced deployment feasibility in smaller laboratories. Manufacturers have addressed these challenges through modular designs, user-friendly software interfaces, automated safety protocols, and remote monitoring capabilities. Continuous improvements in efficiency, reliability, and adaptability have been critical to sustaining battery cycler adoption across automotive, industrial, and energy storage applications globally.

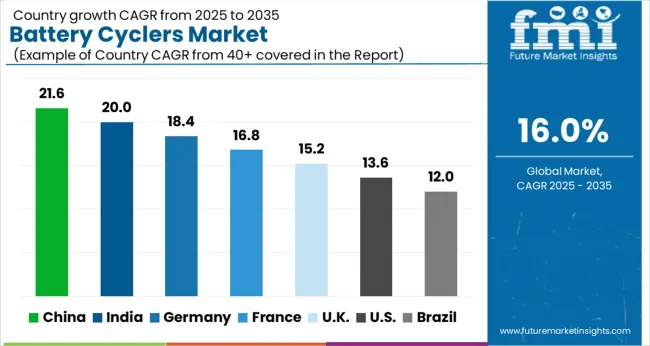

| Countries | CAGR |

|---|---|

| China | 21.6% |

| India | 20.0% |

| Germany | 18.4% |

| France | 16.8% |

| UK | 15.2% |

| USA | 13.6% |

| Brazil | 12.0% |

The market is expected to expand at a CAGR of 16.0% between 2025 and 2035, driven by growing adoption of electric vehicles, renewable energy storage systems, and research in next-generation batteries. China leads with a 21.6% CAGR, advancing through large-scale battery manufacturing and technological innovation in energy storage. India follows at 20.0%, scaling rapidly with expanding EV production and energy storage initiatives. Germany, at 18.4%, benefits from strong automotive and battery R&D infrastructure. The UK, growing at 15.2%, focuses on innovative battery testing solutions, while the USA, at 13.6%, witnesses’ steady growth from EV adoption and industrial battery applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to experience a strong CAGR of 21.6%, driven by the rapid adoption of electric vehicles, renewable energy storage systems, and consumer electronics. Expansion in lithium-ion battery production, government incentives for energy storage, and investment in research and development of battery testing technologies reinforce market growth. Increasing focus on high-performance, efficient, and safe battery cyclers supports diverse applications in automotive, industrial, and energy storage sectors.

India is expected to grow at a CAGR of 20.0%, supported by investments in electric mobility, solar energy storage, and industrial battery testing infrastructure. Increasing demand for lithium-ion batteries in two-wheelers, electric cars, and energy storage systems drives market expansion. Government initiatives promoting renewable energy storage and industrial automation further enhance adoption of high-performance battery cyclers.

Germany is anticipated to register a CAGR of 18.4%, fueled by automotive electrification, industrial energy storage, and advancements in battery testing technologies. Emphasis on safety, efficiency, and lifecycle optimization of lithium-ion batteries encourages the adoption of advanced battery cyclers. Supportive policies for electric vehicles and renewable energy infrastructure reinforce market potential.

The United Kingdom is projected to grow at a CAGR of 15.2%, driven by renewable energy storage deployment, electric vehicle infrastructure development, and industrial battery management needs. Increasing focus on sustainable energy systems, high-performance cyclers, and efficient battery lifecycle management supports market growth across consumer and industrial applications.

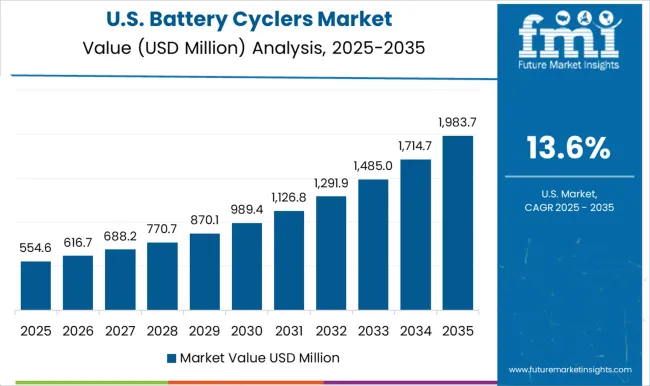

The United States is expected to witness a CAGR of 13.6% due to rising demand in electric vehicles, grid energy storage, and consumer electronics. Investments in advanced lithium-ion battery technologies, high-performance cyclers, and industrial battery testing infrastructure enhance market adoption. Growing focus on sustainability and efficiency drives expansion across automotive, energy, and industrial sectors.

The market is experiencing steady growth, propelled by the expanding demand for energy storage systems, electric vehicles, and renewable energy integration. Leading companies such as Arbin Instruments, BioLogic Sciences Instruments, and Bitrode Corporation are at the forefront, providing high-precision cyclers that enable rigorous testing of batteries for performance, efficiency, and safety. These providers focus on delivering solutions that support multiple chemistries, including lithium-ion, nickel-metal hydride, and lead-acid, catering to both research laboratories and industrial applications.

Chroma Systems Solutions, Maccor, Inc., and PEC North America are also prominent players offering scalable and customizable cycler systems capable of conducting charge-discharge, cycle-life, and diagnostic testing. Their products integrate advanced software interfaces, high-speed data acquisition, and automated test sequences, ensuring accurate battery characterization and quality assurance.

By addressing the growing need for energy-dense, durable, and reliable battery systems, these companies help manufacturers and researchers optimize performance, extend battery life, and accelerate product development cycles. Global trends toward electric mobility, grid-scale storage, and sustainable energy initiatives further support the market expansion. Through continuous technological innovation, robust testing protocols, and client-centric solutions, these leading providers are strengthening their positions while shaping the battery cycler industry to meet the evolving demands for energy storage.

| Item | Value |

|---|---|

| Quantitative Units | USD 1034.8 Million |

| Type | Lead-acid batteries, Nickel-cadmium batteries, Nickel-metal hydride batteries, and Lithium-ion batteries |

| End User | Aerospace, Energy & power, Automotive, Consumer electronics, Education & research, and Others |

| Service | Cell testing, Module testing, and Pack testing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arbin Instruments, BioLogic Sciences Instruments, Bitrode Corporation, Chroma Systems Solutions, Maccor, Inc., and PEC North America |

| Additional Attributes | Dollar sales by cycler type and application, demand dynamics across automotive, energy storage, and electronics testing sectors, regional trends in battery testing adoption, innovation in charging accuracy and cycle management, environmental impact of energy consumption and equipment disposal, and emerging use cases in electric vehicle development and renewable energy storage systems. |

The global battery cyclers market is estimated to be valued at USD 1,034.8 million in 2025.

The market size for the battery cyclers market is projected to reach USD 4,564.8 million by 2035.

The battery cyclers market is expected to grow at a 16.0% CAGR between 2025 and 2035.

The key product types in battery cyclers market are lead-acid batteries, nickel-cadmium batteries, nickel-metal hydride batteries and lithium-ion batteries.

In terms of end user, aerospace segment to command 29.6% share in the battery cyclers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA