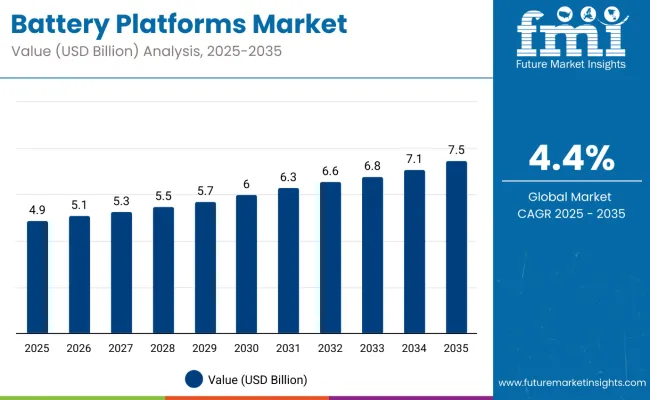

The global battery platforms market is projected to grow from USD 4.9 billion in 2025 to reach USD 7.5 billion by 2035, reflecting an absolute value addition of USD 2.6 billion. This translates to a cumulative growth of approximately 53.5% over the forecast period. The market is expected to expand at a compound annual growth rate (CAGR) of 4.4%, with the overall size projected to grow by nearly 1.54X by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.9 billion |

| Industry Size (2035F) | USD 7.5 billion |

| CAGR (2025-2035) | 4.4% |

Between 2025 and 2030, the market is anticipated to grow from USD 4.8 billion to USD 6.0 billion, contributing an incremental revenue of USD 1.2 billion during this period. This phase is expected to be driven by accelerating adoption of standardized modular battery systems across electric vehicles, consumer electronics, and energy storage segments.

OEMs and Tier 1 suppliers are prioritizing scalable battery architectures that streamline production, reduce costs, and support flexible form factors. Technological convergence across cell formats, battery management systems (BMS), and pack designs is also reinforcing the demand for versatile battery platforms.

From 2030 to 2035, the market is expected to expand from USD 6.0 billion to USD 7.5 billion, registering a value addition of USD 1.5 billion. This growth is expected to be supported by rising deployment of second-life batteries, integration into grid-scale storage systems, and the rollout of advanced solid-state battery technologies. The need for cross-industry interoperability and regulatory alignment will fuel the development of universal platform standards, enabling broader application across automotive, aerospace, defense, and industrial verticals.

Between 2020 and 2025, the battery platforms market expanded from USD 4.0 billion to USD 4.9 billion, registering an absolute growth of USD 900 million. This growth phase was characterized by strong OEM-led adoption of modular battery platforms across electric mobility and energy storage systems. Automotive manufacturers and industrial integrators began shifting from customized battery packs to standardized modular designs to reduce time-to-market and align with emerging electrification mandates.

During this period, demand for flexible platform architecture increased sharply due to the simultaneous evolution of lithium-ion chemistries (NMC, LFP), rising form factor diversity (pouch, cylindrical, prismatic), and the need for common BMS integration across product lines. Several OEMs introduced platform-based strategies to scale EV lineups while minimizing platform reengineering costs.

Commercial success of flexible platforms such as GM’s Ultium, VW’s MEB, and BYD’s Blade battery design highlighted the market’s transition from single-model battery packs to cross-segment-compatible solutions. This evolution also reflected in non-automotive sectors, where modular battery packs gained traction in UPS, portable energy systems, and industrial backup solutions.

The growth of the battery platforms market is being supported by the convergence of electric mobility adoption, rising energy storage deployment, and the increasing need for scalable, cost-efficient battery system designs. Standardized battery platforms are helping manufacturers address design flexibility, supply chain optimization, and compatibility across applications ranging from electric vehicles (EVs) to grid storage and industrial equipment.

Platform-based battery development offers modularity, allowing OEMs to use the same battery architecture across multiple product variants. This approach reduces engineering costs, speeds up product launches, and simplifies maintenance, making it highly attractive in fast-evolving markets. The push for EV proliferation globally, especially among commercial fleets and mass-market vehicles, has accelerated the need for battery platforms that can support varying power, size, and thermal demands.

Simultaneously, energy storage developers are adopting platform-based battery systems for solar-plus-storage installations, microgrids, and backup power where modularity is critical for scaling and replacement. Regulatory trends promoting circularity, such as battery passport initiatives and design-for-recycling, are further driving interest in standardized, reusable battery architectures.

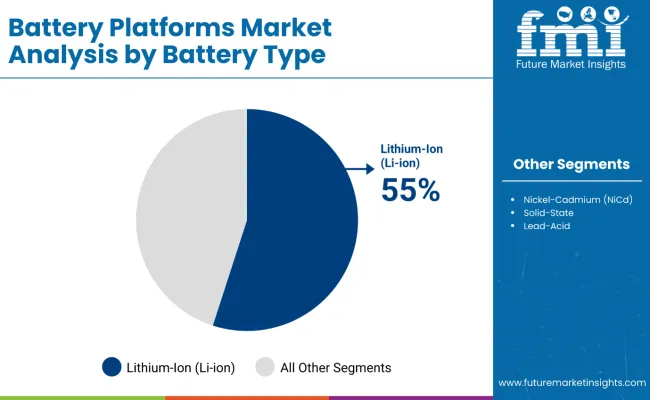

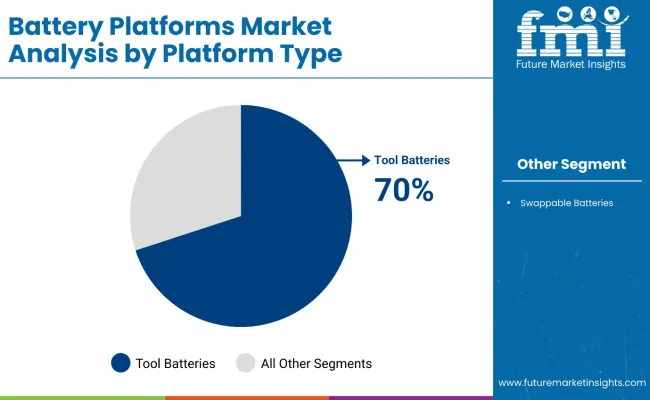

The market is segmented by battery type into lithium-ion, nickel-metal hydride, nickel-cadmium, solid-state, and lead-acid chemistries, reflecting variations in energy density, cycle life, and application suitability. By platform type, batteries are classified as tool batteries or swappable batteries, enabling flexibility in device usage and charging strategies.

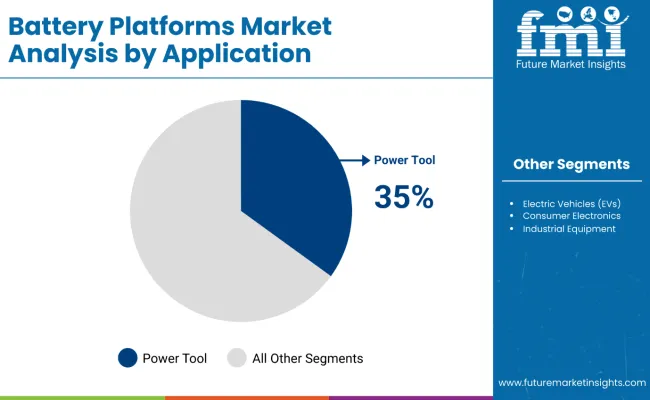

Key application areas include power tools and outdoor equipment, electric vehicles, consumer electronics, industrial equipment, and stationary energy storage, indicating a broad spectrum of use cases across portable and fixed installations.

Lithium-ion batteries are estimated to hold a 55% share in 2025 and are projected to grow at a CAGR of 5.4% through 2035. Their widespread use across electric vehicles, power tools, and consumer electronics has positioned them as the primary chemistry choice for battery platforms.

Higher energy density, fast charging capability, and declining cost trends have supported their accelerated adoption. Ongoing research into lithium-ion lifecycle improvements and safety optimization continues to strengthen their market relevance, especially as OEMs seek modular and scalable battery systems for cross-platform compatibility.

Tool batteries are expected to account for a 70% share in 2025, expanding steadily with a CAGR of 5.5% over the forecast period. The growing preference for battery-powered tools in construction, maintenance, and landscaping has driven demand for platform-based, interchangeable battery packs. OEMs have increasingly standardized tool ecosystems around shared battery form factors to reduce cost and improve cross-compatibility across product lines. This integration strategy has significantly increased platform loyalty among professional and DIY users.

Applications in power tools and outdoor equipment are projected to account for 35% of total demand in 2025, with a CAGR of 5.6% expected through 2035. The transition from corded to cordless systems in professional-grade tools and landscaping equipment has driven adoption of high-capacity battery platforms. Users have shown preference for reliable, swappable batteries that support extended runtime, especially in heavy-duty outdoor conditions. Battery platforms supporting backward compatibility and fast-charging have gained traction across professional and semi-professional user segments.

The battery platforms market is expanding steadily due to the demand for modularity, cross-application compatibility, and streamlined production in the EV and energy storage industries. OEMs are transitioning toward unified battery architecture to reduce development costs and accelerate product rollout. However, the market faces challenges such as supply chain bottlenecks, thermal management complexity, and integration difficulties in multi-platform environments. The ongoing need for safety, recyclability, and real-time monitoring is prompting advancements in platform design and control systems.

Shift Toward Multi-Vehicle Battery Integration

Battery platforms are increasingly being developed to support multiple vehicle typesfrom compact cars to light commercial vehiclesthrough a single scalable system. This shift allows OEMs to simplify production lines, share R&D investment, and maintain common standards across EV lineups. Platform sharing between automotive alliances is becoming common, with battery packs designed to fit various chassis configurations and voltage levels.

Emphasis on Thermal Management and System Safety

The growing power density of battery platforms is raising concerns about overheating, short circuits, and fire risk. This has intensified R&D in advanced thermal interface materials, liquid cooling systems, and real-time thermal diagnostics. Platforms are being engineered to integrate layered safety mechanisms and robust battery management systems (BMS) that enable fault detection, isolation, and remote control.

Regulatory Push for Design Circularity and Second-Life Use

Battery platform design is being influenced by extended producer responsibility (EPR) rules and circular economy goals. Governments and environmental agencies are mandating lifecycle tracking, easier disassembly, and the reusability of modules. As a result, platforms are being built with standardized casings, traceable cell chemistry, and compatibility with second-life storage applications such as home energy systems and off-grid installations.

| Countries/Region | 2025 Share |

|---|---|

| Germany | 30% |

| France | 15% |

| United Kingdom | 12% |

| Italy | 10% |

| Spain | 8% |

| BENELUX | 7% |

| Russia | 4% |

| Rest of Europe | 14% |

| Countries/Region | 2035 Share |

|---|---|

| Germany | 28% |

| France | 16% |

| United Kingdom | 12% |

| Italy | 11% |

| Spain | 9% |

| BENELUX | 8% |

| Russia | 3% |

| Rest of Europe | 13% |

Europe’s battery platforms market is projected to grow from USD 1.16 billion in 2025 to USD 1.86 billion by 2035, reflecting a CAGR of 4.8%. Growth is anchored in strong EV production, regulatory push for electrification, and the adoption of unified battery systems across automotive OEMs. Germany remains the largest contributor with 30% share in 2025, though it is expected to decline slightly to 28% by 2035 as growth in other European nations accelerates.

France is forecast to expand from 15% to 16%, supported by state-backed battery gigafactories and EV subsidies. The UK will maintain a steady 12% share, driven by domestic EV production and recycling infrastructure. Italy and Spain are expected to grow modestly due to manufacturing ramp-ups and public transit electrification. BENELUX and Rest of Europe are projected to experience incremental growth, with niche applications in second-life battery systems and modular platform integration.

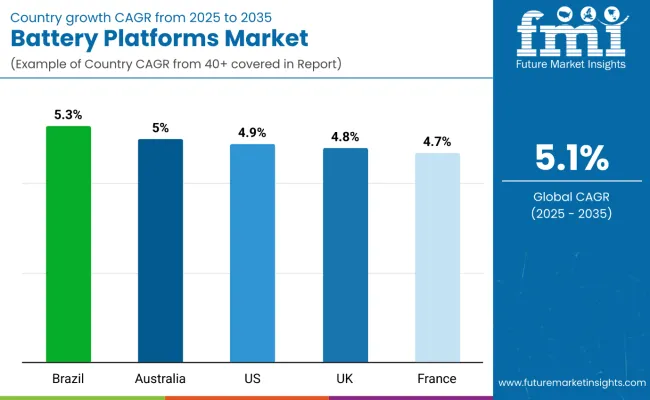

Brazil is emerging as a high-growth market, supported by localized EV assembly and strategic policy incentives for battery value chain development. Battery platforms are being adopted across urban mobility, commercial transport, and off-road vehicles. Domestic production and localized design of battery platforms are being prioritized to reduce import dependency. Integration of battery packs into municipal fleet projects is also creating downstream opportunities.

Australia's battery platform market is advancing with stronger integration between mining operations and battery pack assembly facilities. Local initiatives are enabling platform manufacturing tied to domestic raw material processing. Interest from utility-scale storage integrators is growing as battery technologies move from component exports to integrated systems. Pilot programs are helping define new platform configurations for industrial mobility.

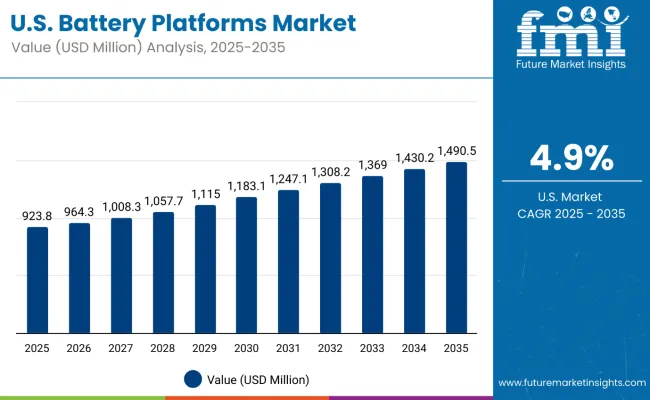

The USA is scaling battery platform production, aided by subsidies and tax incentives under recent federal acts. OEMs are standardizing modular battery architectures across SUV and pickup platforms. Platform-based designs are gaining traction among EV startups and Tier 1 suppliers. These platforms are also being positioned for repurposing into grid storage units post-automotive use.

The UK is focusing on versatile battery platforms optimized for compact and mid-range vehicles. Several battery tech parks and domestic OEMs are leading efforts in lightweight platform integration. These efforts are supported by EU-aligned regulations on recycling and localization. Fleet electrification across public transport and delivery services is shaping platform specifications.

France is boosting its battery platform footprint via public-private investments in Gigafactories and EV design clusters. Shared platform strategies are being used to support cost efficiency and speed to market. Applications extend to autonomous shuttles and urban transport concepts. R&D around modular thermal shielding and BMS integration is also receiving state backing.

Battery platforms in Japan are primarily used in power tools, with tool-specific batteries holding a 65% share. Manufacturers emphasize thermal stability, compatibility with compact tool enclosures, and consistent voltage regulation. Swappable batteries, making up the remaining 35%, are increasingly being tested in warehouse automation and modular robotic arms.

South Korea’s battery platform market is led by lithium-ion chemistries, accounting for 70% of the total share. These are widely integrated into automotive, industrial, and consumer applications. Lead-acid batteries contribute 10%, primarily in backup systems and low-voltage industrial needs. Other formats such as NiMH, NiCd, and solid-state hold smaller but strategic shares.

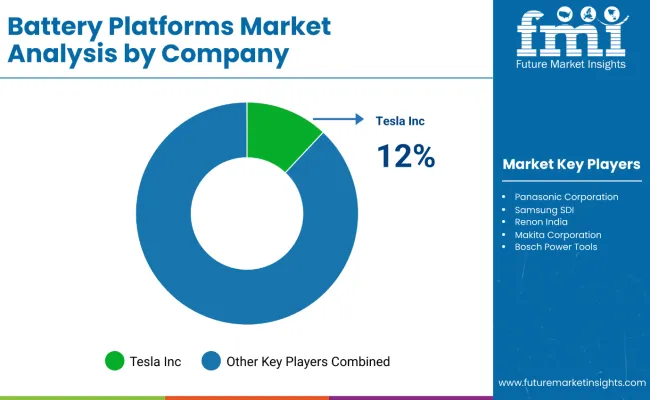

Competition in the battery platforms market is intensifying as players focus on next-generation technologies and manufacturing innovations. Silicon-anode and advanced lithium-ion platforms are being developed to deliver higher energy density, enhanced safety, and broader application across consumer electronics, EVs, and grid storage.

Battery manufacturing is being optimized through automation, digital twin models, and robotics to improve precision, efficiency, and material utilization. Strategic pilot lines and domestic sourcing initiatives are being implemented to accelerate commercialization of advanced cells while meeting regulatory and supply chain requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.86 Billion (2025) |

| Battery Type | Lithium-Ion (Li-ion), Nickel-Metal Hydride (NiMH), Nickel-Cadmium (NiCd), Solid-State, Lead-Acid |

| Platform Type | Tool Batteries, Swappable Batteries |

| Application | Power Tools / Outdoor Equipment, Electric Vehicles (EVs), Consumer Electronics, Industrial Equipment, Stationary Energy Storage |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China |

| Key Companies Profiled | Panasonic Holdings Corporation, Contemporary Amperex Technology Co., Ltd. (CATL), LG Energy Solution, Samsung SDI Co., Ltd., BYD Company Ltd., Hitachi Astemo, Robert Bosch GmbH, Murata Manufacturing Co., Ltd., VARTA AG, Envision AESC |

The battery platforms market is expected to reach USD 7.46 billion by 2035, growing at a CAGR of 4.4% between 2025 and 2035.

Lithium-ion (Li-ion) batteries hold the largest market share due to their high energy density, fast charging capability, and wide application across EVs and electronics.

Key applications include power tools and outdoor equipment, electric vehicles (EVs), industrial machines, consumer electronics, and stationary energy storage systems.

East Asia, led by China, and Europe are seeing substantial growth due to high EV penetration and advancements in energy storage technologies.

Major companies include Panasonic, CATL, LG Energy Solution, Samsung SDI, Bosch, VARTA, and BYD, all of which offer integrated battery technologies across sectors.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA