The Battery Operated Light market is witnessing steady growth driven by increasing demand for energy-efficient and portable lighting solutions across residential, commercial, and industrial applications. The market’s future outlook is influenced by technological advancements in battery capacity and light-emitting components, which have enhanced the performance, durability, and versatility of battery-operated lights.

Rising awareness regarding energy conservation and sustainability has accelerated the adoption of battery-operated lighting, especially in regions with intermittent electricity supply. Additionally, the growing preference for flexible and portable lighting solutions in commercial and outdoor environments supports market expansion.

Continuous innovation in product design and integration of smart features, such as motion sensors and remote control capabilities, further reinforces the attractiveness of battery-operated lights As consumers and businesses prioritize convenience, energy savings, and safety, the market is expected to witness sustained growth, with increasing investments in research and development to improve efficiency, battery life, and overall user experience.

| Metric | Value |

|---|---|

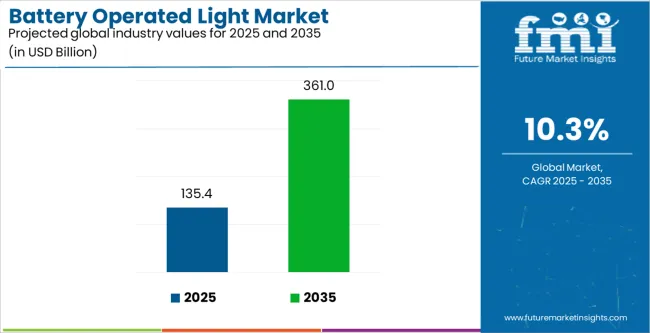

| Battery Operated Light Market Estimated Value in (2025 E) | USD 135.4 billion |

| Battery Operated Light Market Forecast Value in (2035 F) | USD 361.0 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

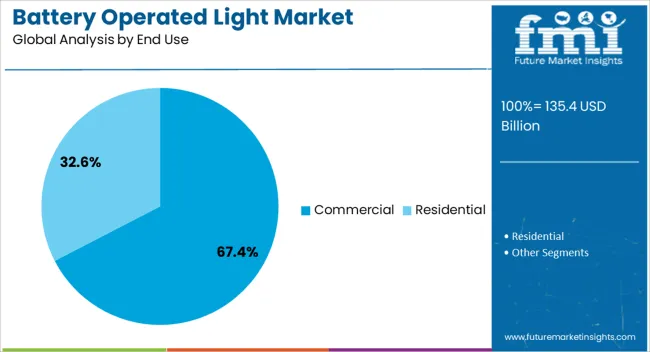

The market is segmented by Technology, Pricing, End Use, and Sales Channel and region. By Technology, the market is divided into Fluorescent, LED, and Incandescent. In terms of Pricing, the market is classified into Mid-Range, High Range, and Economical. Based on End Use, the market is segmented into Commercial and Residential. By Sales Channel, the market is divided into Direct, Hypermarket/Supermarket, Specialty Stores, Independent Small Stores, Multi-Brand Stores, and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

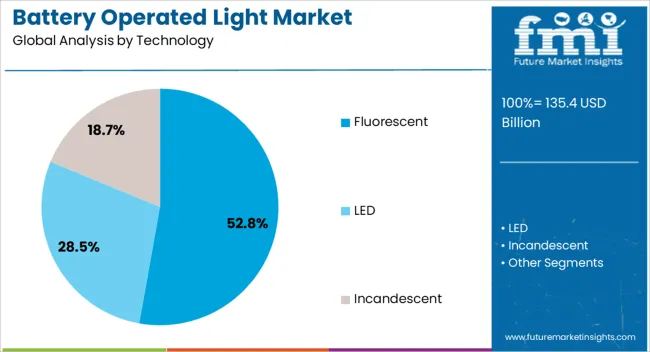

The fluorescent technology segment is projected to hold 52.80% of the Battery Operated Light market revenue share in 2025, establishing it as the leading technology. The segment’s growth is driven by the high energy efficiency and long lifespan offered by fluorescent lighting compared to traditional incandescent options.

Fluorescent battery-operated lights provide consistent illumination and reduced operational costs, making them highly suitable for both commercial and residential applications. Advancements in compact fluorescent lamp designs have enhanced portability and ease of installation, supporting adoption in environments requiring flexible lighting solutions.

The segment’s prominence is further strengthened by the widespread availability of fluorescent-based battery lights and their compatibility with various battery types, ensuring reliable performance Growing demand for sustainable and cost-effective lighting options continues to reinforce the dominance of the fluorescent technology segment.

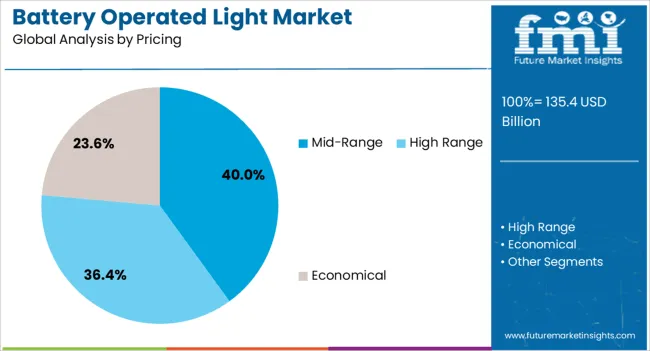

The mid-range pricing segment is expected to capture 40.00% of the Battery Operated Light market revenue share in 2025, making it the leading pricing category. This growth is attributed to the balance it offers between affordability and product quality, providing consumers with reliable performance without premium costs.

Mid-range battery-operated lights deliver sufficient brightness, energy efficiency, and durability to meet the needs of commercial and everyday residential users. The availability of diverse options within this price bracket has enhanced accessibility and adoption, particularly among small businesses and mid-sized commercial establishments.

Manufacturers’ focus on delivering feature-rich solutions, including extended battery life, safety certifications, and ease of installation, has further reinforced the popularity of mid-range products The segment’s sustained growth is supported by the increasing willingness of buyers to invest in cost-effective yet efficient lighting solutions.

The commercial end-use segment is anticipated to account for 67.40% of the Battery Operated Light market revenue in 2025, establishing it as the leading end-use category. This growth is driven by the rising demand for reliable and portable lighting solutions in offices, retail stores, warehouses, and hospitality establishments.

Battery-operated lights provide flexibility and ensure uninterrupted illumination in areas where wired electrical infrastructure may be insufficient or unavailable. The integration of energy-efficient technologies, combined with longer battery life and enhanced brightness, has made these products increasingly attractive to commercial buyers seeking operational efficiency and cost savings.

Additionally, the shift toward sustainable and environmentally friendly lighting solutions has further encouraged adoption in the commercial sector The ability to deploy scalable and portable lighting systems to meet specific operational requirements continues to support the dominance of the commercial end-use segment.

Presence of LED Technology Felt Across the Battery Operated Light Market

The LED technology enjoys a significant status in the battery-operated light industry. Their versatility in design, long lifespans, and superior energy efficiency make them a preferred choice of manufacturers and consumers.

LED lights are a great way to brighten the room without having to utilize an electrical outlet. They are used to add extra light while reading or working on a project. They are portable too, making them convenient to take around while traveling. These qualities of LED lights are encouraging customers to shift from conventional fluorescent and incandescent lights.

Evolution of Battery Technology to Drive Market Growth

Advancements in battery technology are critical for the market’s development. This includes the creation of batteries with faster-charging items, higher capacities, and potentially even integrated solar charging capabilities for some lights.

Consumers are now choosing battery-operated lights and solar power festival lights for hassle-free decorations during festive times. The demand for AA pencil batteries and AA battery-powered lights is thus increasing.

The solar-powered LED lights include a simple LED strip connected to a solar power sensor or multi-colored ring lights. Many developments are being made by companies to reduce the prices of solar battery-operated lights. They also have to be charged in advance with sufficient sunlight to be functional, leading to their limited adoption currently.

Focus on Sustainability is the Need of the Hour

Environmental consciousness is growing, leading to heightened demand for eco-friendly battery-operated lights. These lights are more environmentally friendly as they do not produce heat or emit hazardous gases. They do not even use fossil fuels to operate.

The ambit of eco-friendly battery-operated lights includes lights from recycled materials. Continued push for rechargeable batteries is helping reduce dependence on disposable ones.

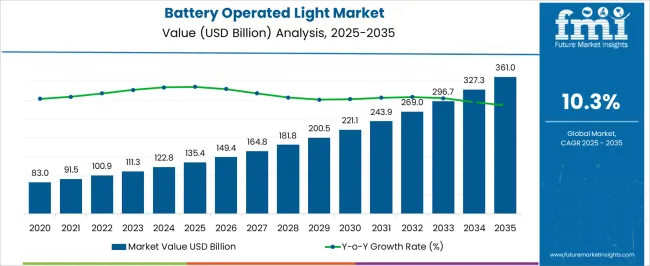

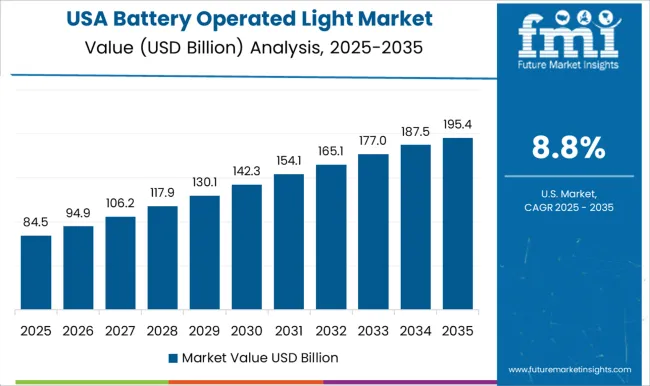

Global battery-operated light sales rose at a CAGR of 9.5% from 2020 to 2025. Over the forecast period, the industry is projected to expand at a 10.3% CAGR. Demand for battery-powered lights is increasing due to their cost-effectiveness as opposed to lighting solutions that require direct lighting.

Further, energy efficiency and convenience of installation of these lights increase their appeal among the masses. They are increasingly used to illuminate the home’s interior as well as exterior areas like the staircase.

Many application areas of battery-powered lights in various settings, including automobiles, houses, campers, and business establishments. Additionally, demand for battery-powered lights is surging in seasonal or festive lights that are used temporarily.

The technological evolution in the lighting industry is further facilitating the market’s progress. The rising demand for wireless technologies is creating a significant demand for wireless battery-driven lights.

The industry is witnessing significant competition, which is fueling more innovation. New players are also offering many options at competitive price ranges, to meet the increasing demand for battery-powered lights. Reduced prices also make battery-powered lights more accessible to customers.

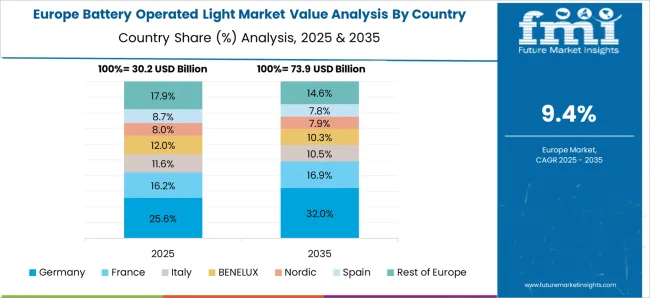

The demand for battery operated lights is steadily increasing across countries like Germany and the United States. In Asian countries, accelerated growth rate is a dominant trend, especially in China and India.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The United States | 6.2% |

| Germany | 7.1% |

| China | 14% |

| India | 15.1% |

| Australia | 10.3% |

The sales of battery-powered lights in the United States are projected to increase at a steady CAGR of 6.2% over the forecast period. Key players in the country are offering wireless ultra-thin LED light bars, which is an inexpensive under-cabinet lighting option that requires negligible setup. The use of these lights can be extended to closets, pantries, stairs, and more.

String lights shops in the United States are offering a selection of battery lights for custom, unique, and handmade pieces to meet the growing demand. Furthermore, the widely adored battery-powered, waterproof fairy lights are also available for parties, gardens, patios, bedrooms, and home Xmas décor, both indoor and outdoor.

The battery operated light market in Germany is estimated to rise at a CAGR of 7.1% through 2035. Demand for these lights is surging in the country due to the increasing popularity of portable lights, advancements in the lighting sector, and energy efficiency.

Battery-powered LED lights are also available via online sales channels with the option for home delivery. Certain online sellers also ensure a warranty for these products to build consumer trust. Rising emphasis on energy-conserving lighting solutions, especially LED battery operated lights, continues to be a substantial driver.

India is assessed to attract many investors and stakeholders due to its massive growth potential. Over the estimated period, the industry is expected to rise at a 15.1% CAGR.

India has multiple brands selling an extensive range of indoor lighting to brighten the interiors. Additionally, key players are offering personalized solutions to offer to their customers.

Battery-powered lights, like LEDs are integrated into railways, usually as emergency lights. Development projects in the railway sector are projected to be advantageous for wireless battery-powered light providers across the country.

During Indian festivities, customers in India opt for battery-powered lights. Specifically, during Diwali, which is a widely celebrated, famous Indian festival, these lights’ sales skyrocket. These lights are preferable as they can be used to decorate without worrying about a wall socket or a power source.

This section is devoted to leading segments in the battery operated light industry. The commercial sector is estimated to obtain 67.4% in 2025. Fluorescent technology is predicted to obtain 52.8% value share in the same year.

| Segment | Commercial (End Use) |

|---|---|

| Value Share (2025) | 67.4% |

The battery-powered lights generate maximum revenues from the demand in commercial spaces. LEDs for instance have high efficiency and have directional nature, making them ideal for several industries. The commercial end use sector is projected to acquire a share of 67.4% in 2025.

In the commercial sector, the use of battery-backed lights extends to spaces like garages, street lights, parking, and outdoor areas. Businesses also use battery-powered lights to quickly adapt their lighting scheme. This is useful for spaces that are incessantly reconfigured like pop-up events and retail displays. The battery-powered lights are handy during construction and renovation projects.

| Segment | Fluorescent (Technology) |

|---|---|

| Value Share (2025) | 52.8% |

The fluorescent technology is estimated to acquire a market share of 52.8% in 2025. This technology is, however, expected to be gradually replaced by LED technology in the future. Chief drivers for this shift include durability, lower power consumption, better efficiency, and reduced size of LEDs, giving tight competition to their counterparts.

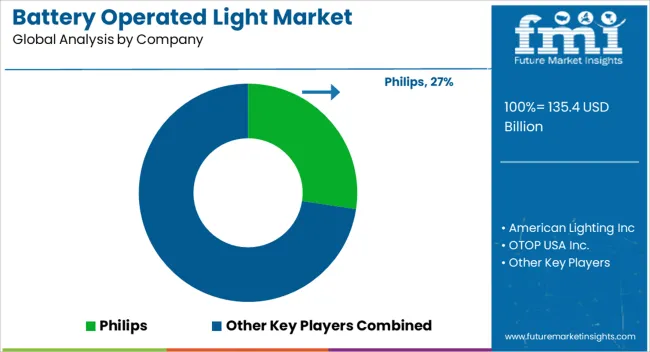

Key players in the battery-operated light industry are focusing on lighting innovations like the latest LED technology and intelligent LED lighting. Players are further introducing new features like flicker-free smooth dimming, active heat protection, enhanced optical systems, etc.

Battery-powered light producers are emphasizing effective sales and distribution channels, with the help of online sales channels. Key advancements in the sector, like LiFi technology and human-centered lighting, are also propelling the lighting business.

Key players are further observing heightened demand for LED lights and other technical lights due to rising consumer awareness about the light’s endurance. Increasing applications of battery-operated lights for purposes like work, night, camping, emergency, and decoration are further providing expansion opportunities to participants.

Industry Updates

Key technologies used in battery-powered lights include fluorescent, incandescent, and LED.

Based on pricing, the market is trifurcated into high range, mid-range, and economical.

Different end users of battery-powered lights include residential and commercial sectors.

Sales channel of battery-powered lights include direct and indirect. The indirect ones include hypermarket/supermarket, specialty stores, independent small stores, multi-brand stores, and online.

The battery-powered lights are sold across North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

The global battery operated light market is estimated to be valued at USD 135.4 billion in 2025.

The market size for the battery operated light market is projected to reach USD 361.0 billion by 2035.

The battery operated light market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in battery operated light market are fluorescent, led and incandescent.

In terms of pricing, mid-range segment to command 40.0% share in the battery operated light market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA