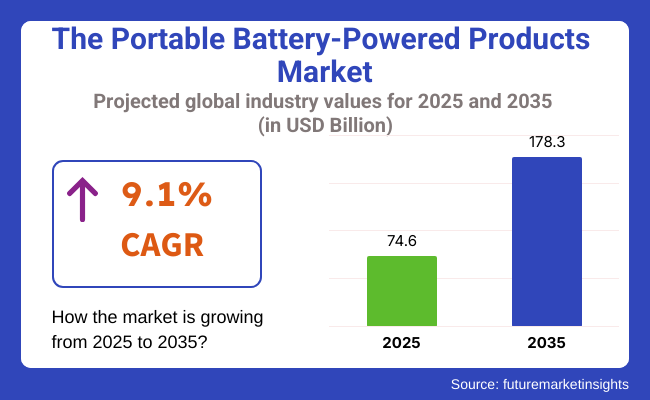

The portable battery-powered products market was USD 74.6 billion in 2025 and is expected to have a 9.1% CAGR in the period 2025 to 2035. The global portable battery-powered products industry is anticipated to increase to USD 178.3 billion by 2035.

One of the key drivers for such consistent growth is the increased demand for highly efficient, small energy solutions in consumer electronics, medical equipment, and industry due to the rising trend for mobility and the widespread use of IoT-enabled devices.

The development of battery chemistry and power management technology is revolutionizing the industry. Lithium-ion and solid-state battery technologies have significantly enhanced energy density, recharge cycles, and miniaturization, which have enabled the development of very portable and long-life products. These technologies are key to powering devices such as wireless earbuds, smartwatches, handheld diagnostics, and mobile industrial tools.

The onset of remote work, telemedicine, and outdoor activities post-2020 has raised the demand for portable battery-powered products in personal and professional life. Equipment that offers mobility without compromising performance is gaining traction, especially in developing economies where power supply instability further promotes off-grid battery reliance.

Sustainability concerns are driving product design and procurement strategy, with manufacturers increasingly focusing on recyclable content and energy-efficient design. Pressure from consumers and regulators is promoting the trend towards green products, and this has created innovation opportunities for solar-powered and rechargeable battery products.

Despite the competitive scenario, large vendors are differentiating themselves with in-built ecosystems, offering seamless connectivity, rapid charging and inter-device compatibility. These innovations and beneficial government policies ensure the adoption of clean energy and the growth of mobile infrastructure.

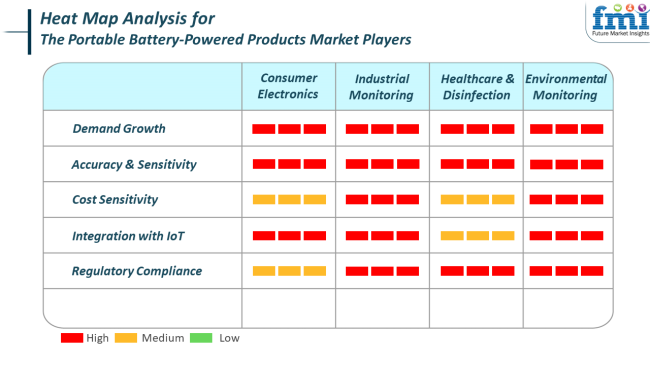

The battery-powered portable products industry is a classic example of strong demand trends across different end-use industries, each with its tailored requirements. In consumer electronics, customers desire thin form factors, rapid charging and extended battery life, particularly in wearables and smart devices.

IoT connectivity and cross-device use are strong purchase drivers in this segment. Industrial monitoring applications demand high reliability and long operation in field environments. Portability, precision, and real-time data transmission are essential for safety and productivity, and therefore, conformity to regulatory needs and performance calibration become key considerations in buying decisions.

Healthcare and disinfection equipment require accurate functional energy delivery and dependability of power availability. These industries are less cost-conscious but concerned about longevity, sanitary safety, and regulatory compliance. As seen with the escalating usage of portable medical diagnostic and treatment equipment, power performance expectations and equipment safety continue to increase.

While battery-powered portable product sales are expected to see robust growth, several significant risks may undermine its growth. Top among them is the unpredictability of raw material supply chains for battery materials such as lithium, cobalt, and nickel. Availability and price volatility can have a direct impact on manufacturing costs and delivery schedules, particularly for specialty and high-capacity batteries.

The other central concern is technological obsolescence and the short lifecycle of mobiles. Innovation is a driver of growth, but it also poses the danger of shortened product life and enhanced R&D expenditures. Companies must contend with maintaining a persistent requirement for innovation in harmony with profitably sustainable margins and productive manufacturing.

The regulatory and environmental concerns are gaining prominence. Inefficient management of battery products' disposal and the ecological sustainability of battery manufacturing have faced increased attention. Compliance with new international standards on recycling, waste management and carbon neutrality will prove crucial. Firms that fail to address these sustainability issues will face regulatory penalties and reputational loss.

Between 2020 and 2024, the portable battery-powered products industry was marked by phenomenal growth through accelerating demand for portable devices, wearables, and remote worker devices. Breakthroughs in technologies for lithium-ion and lithium iron phosphate (LFP) battery technologies allowed more energy storage along with reduced cost and better safety, ready for applications that stretched from smart mobile phones to handheld medical instruments.

The smart home devices and IoT also expanded the industry, as consumers sought power sources that were efficient and durable for their devices. The expansion of e-commerce portals also enabled consumers to access a range of battery-powered products more easily.

Between 2025 and 2035, a drastic transformation is expected. Future battery technologies such as sodium-ion and solid-state batteries are expected to provide higher energy densities, faster charging times, and improved safety profiles. Hence, efficient and more compact portable devices can be produced.

Implementation of artificial intelligence (AI) and machine learning technology in battery management systems will optimize performance and extend the life of the battery. Further, rising environmental concerns and regulatory drivers are likely to stimulate the utilization of sustainable and recyclable materials for the battery, coordinating with global targets for sustainability.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing mobile device usage, remote work trends, and IoT expansion | Technological innovation in batteries, AI adoption, and sustainability focus |

| Lithium-ion and LFP batteries dominating the industry | Launch of solid-state and sodium-ion batteries with AI-powered management |

| Portable charger, wearables, and smart home devices focus | Development of small, efficient, and sustainable battery-powered products |

| Requirement of longer battery life and fast charging capabilities | Expectations of sustainable, high-performance, and smart power solutions |

| Battery wear-out, safety risks, and environment | Ensuring that it will be sustainable, electronic waste disposal, and ensuring regulatory compliance |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.4% |

| UK | 7.9% |

| France | 7.5% |

| Germany | 7.2% |

| Italy | 6.8% |

| South Korea | 8.1% |

| Japan | 7.6% |

| China | 10.3% |

| Australia-NZ | 7.0% |

The USA is anticipated to register a 9.4% CAGR throughout the study period. The huge demand for consumer electronics, the growing transition towards electric mobility, and increasing dependence on portable medical and industrial devices are the major drivers of growth in the USA. The strong consumer base and tech-savy population are driving steady adoption of portable battery-powered products, particularly in entertainment, health monitoring, and home automation segments.

Furthermore, the focus of the nation on sustainability and the increasing popularity of energy-efficient technology further supports growth. High investment in R&D for advancements in battery technologies by established players, along with their presence, increases competition.

Lithium-ion batteries are the most prominent due to their high energy density and long life cycle, which are suitable for a broad range of portable products ranging from smartphones to power tools. The growth of remote work and mobile workforce also raises the demand for portable energy solutions. Additionally, federal clean energy incentives and the growing use of off-grid power backup systems are providing additional growth opportunities across industries.

The UK will grow at 7.9% CAGR throughout the study, with consumer demand for small, efficient, and rechargeable products pushing the UK to further develop in accordance with wider European sustainability objectives, increasing the use of portable power banks, handheld diagnostic products, and battery-powered household appliances indicates an increasing tendency toward convenient, battery-dependent solutions.

The nation's focus on lowering carbon output and enhancing energy storage capacity drives investment in high-performance batteries for use in portable applications. Additionally, the UK's e-commerce environment propels fast product uptake, with portable electronics and smart home devices becoming part of everyday life.

Efforts to expand electric vehicle (EV) infrastructure, such as mobile charging options, also enhance demand for cutting-edge portable battery systems. Also, an emphasis on health innovation has resulted in increasing demand for battery-powered diagnostic and therapeutic devices, driving growth.

France will grow at a 7.5% CAGR over the study period. A policy emphasis on green energy and a move towards energy self-reliance is driving the evolution and adoption of handheld battery-powered solutions. Higher consumer acceptance and a growing user base of electronics further favor the industry in residential and commercial spaces.

Portable power systems are being picked up in rural and semi-urban areas with limited or spotty grid availability. Expansion of the medical device and wearable electronics markets is also significant, with demand being driven by aging populations and growing remote healthcare provisions.

France is building up local production of battery cells and driving sustainable materials, which is expected to have a positive effect on cost dynamics and supply chain resilience. The nation also focuses on recycling and circular economy methods, which promote innovation in battery reuse and extension, generating extra value for portable battery-powered products.

The German market is anticipated to register a growth of 7.2% CAGR throughout the study. Famous for engineering superiority and manufacturing effectiveness, Germany is seeing increasing use of portable battery-operated tools, particularly in industrial, construction, and medical uses.

Broad digitalization across sectors raises demand for mobile, power-dependent systems like smart sensors, handheld diagnostic tools, and communication equipment. Germany's robust automotive industry, with mounting integration of portable energy products both in EV platforms and in-cabin accessories, facilitates market growth.

Government stimulus promoting renewable energy use fuels growth in battery-based systems such as portable solar kits and portable power stations. The country's high usage of IoT and automation technologies is also driving innovation in portable energy storage forms. Growing consumer demand for outdoor recreational equipment and home DIY equipment driven by portable batteries is a factor in overall market dynamism.

The Italian market is anticipated to grow at a 6.8% CAGR over the study period. There is increasing demand for battery-powered, compact devices, especially in consumer electronics, healthcare, and maintenance. Urbanization and the desire for easy, wireless solutions are defining product development within the portable battery-powered category.

Small and medium-sized businesses are also investing in handheld, battery-integrated devices to enhance productivity and minimize the need for fixed power sources. Italy's energy policy encourages green options, fostering a favorable environment for portable battery products.

The trend towards smart wearables and smart appliances further lends momentum to the growth of the market, specifically among the youth who are also technology-oriented. The development of infrastructure in rural and tourism-based geographies is yet another factor pushing the demand for portable energy solutions. In spite of some regulatory issues, Italy's emphasis on sustainable development and digitalization is a positive thrust for market opportunity during the forecast period.

The South Korean market will grow at 8.1% CAGR through the study period. Having a highly networked population and leading in battery production, South Korea is well poised to reap the benefits of the fast growth of portable battery-powered products. High-end consumer electronics, 5G devices, and smart home appliances are extensively integrated with optimized battery technologies.

South Korea's continued investment in research and materials science advances battery performance, longevity, and miniaturization-important for portable use. Robust expansion in telemedicine, wearable health monitors, and remote diagnostics builds demand for small, rechargeable solutions.

Additionally, popularity in gaming and on-the-go media consumption helps fuel the increasing usage of high-capacity portable chargers and accessories. Industrial applications also move towards cordless, battery-powered tools to enhance mobility and productivity. The nation's innovation-oriented environment and robust export channels provide a solid platform for market growth both within domestic and global markets.

The Japanese market is expected to grow at 7.6% CAGR during the study period. Technological leadership in battery innovation and consumer electronics continues to drive the country's demand for portable battery-powered products.

A well-grown electronics industry, coupled with the increasing use of health-focused wearables and home automation systems, reinforces the growing adoption of battery-integrated devices. Japan's aggressive pursuit of energy efficiency and disaster recovery has promoted the extensive use of portable power banks, emergency lights, and off-grid backup power systems.

Portable battery-powered diagnostic and monitoring devices are being widely used in the healthcare and aged care segments, driving steady demand. Solid-state battery innovation and high-efficiency lithium variants are also driving the commercialization of compact, high-performance battery solutions for portable applications. In addition, Japan's increasing interest in autonomous machines and service robots is driving the need for specialized portable battery formats that are both performance and safety-compliant.

China is anticipated to register a growth of 10.3% CAGR over the study period. Being a world manufacturing hub and a leading adopter of digital technologies, China is at the forefront of defining the portable battery-powered product scenario.

Urbanization, increasing disposable incomes, and a thriving e-commerce sector are driving the growth of consumer electronics and smart devices fueled by portable batteries. Government encouragement of battery manufacturing at home and the deployment of green energy also solidifies the industry.

Increases in portable solar panels, off-grid lighting, and outdoor recreation equipment indicate increased consumer demand for energy independence and mobility. China's emphasis on electrification, such as the widespread usage of battery-powered personal transportation and delivery tools, contributes to the push. Through targeted efforts at optimizing battery recycling and battery chemistry innovation, the nation is poised to continue high growth in a wide range of end-user industries such as healthcare, education, and logistics.

The Australia-New Zealand region will witness growth at 7.0% CAGR over the forecast period. The increasing dependency on off-grid energy solutions, with the boost from an escalating trend in recreational and outdoor living lifestyles, is promoting demand for portable battery-powered products in residential and commercial sectors. Growing usage of solar-powered battery kits, wearable health equipment, and battery-enabled emergency systems indicates the country's transition to adaptable, portable power solutions.

Rural electrification projects and the necessity for portable applications in remote construction and mining camps are also strong drivers. Both nations are committing to clean energy and smart integration technology, matching increased interest in eco-friendly, battery-powered solutions.

Growing demand for disaster preparedness and energy security provides for the demand for portable backup systems. At the same time, the changing e-commerce landscape continues to develop new uses for personal electronics and home improvement equipment. Government incentives and innovation centers provide additional impetus to growth.

Lithium-ion batteries have a monopoly in the rechargeable segment of portable battery-powered products, with an estimated revenue share of 55-60%. With their high energy density, long cycle life, and falling cost per kWh, they have become the preferred power source for a wide range of portable electronics from laptops and mobile phones to medical devices and power tools.

Leading suppliers like Panasonic, Samsung SDI, LG Energy Solution, and BYD dominate the segment with economies of scale in the production of electric vehicle batteries. With ongoing R&D focused on improving safety and reducing charging time, lithium-ion batteries will remain the cornerstone of portable energy solutions.

During the period between 2025 and 2035, this segment is forecast to grow at a CAGR of 8.5%, driven by demand from consumer electronics and IoT integration. The second sub-segment is made up of nickel-metal hydride (NiMH), nickel-cadmium (NiCd), lithium-polymer, and specialty rechargeable batteries that represent approximately 40-45% of the industry.

NiMH batteries (approximately 15%) still see low-to-mid drain usage in digital cameras and RC toys, whereas NiCd (less than 5%) still withdraws because of toxicity concerns and lower efficiency. Lithium-polymer cells (approximately 20%) encroach on industry share, especially in small wearables and quadcopters, because they are light and flexible. Specialty batteries-solid-state types-see early commercialization, predominantly in niche military and medical application cases. Combined, they will increase at a CAGR of 5.6%, with lithium-polymer as the leader.

Alkaline and zinc-carbon batteries are popular in the single-use (primary) batteries segment, comprising about 70-75% of this sector. They exist in a host of low-drain portable applications such as TV remote controls, flashlights, wall clocks, and toys. Their ubiquity is because they are cheap, long-lasting, and easily available for use. Value packs and eco-enhanced versions, led by Duracell, Energizer, and Panasonic, dominate the industry. However, alkaline batteries remain less environmentally friendly and popular in price-sensitive economies.

Between 2025 and 2035, the segment will grow modestly at a CAGR of 2.3%, hampered by the increasing consumer trend toward rechargeable batteries and e-waste concerns. The secondary single-use battery category includes primary lithium batteries (approximately 20-25%) and other primary chemistries (approximately 5%). Primary lithium batteries possess higher energy density and cold climate and hence are used in cameras, smart sensors, and medical usage. Saft, EVE Energy, and Hitachi Maxell offer industrial-grade requirements and mission-critical applications.

"Other primary batteries" include silver-oxide and zinc-air types, used mostly in hearing aids, watches, and specialty medical devices. Although a small industry share is held, the revenues are expected to grow at a CAGR of 4.1%, driven by medical and IoT device growth in demand for high-efficiency, miniaturized batteries.

The portable battery-powered products industry is highly competitive and features major consumer electronics companies and specialized providers of battery-powered solutions. Giants such as Apple, Inc., Acer, Inc., and ASUSTeK Computer, Inc. develop their consumer product portfolio with portable devices that include laptops, tablets, and wearables, which are strongly dependent on advanced battery technology. These companies are continuously investing in in-house battery optimization and strategic sourcing to ensure longevity, safety and faster charging of their devices, thus holding a strong technological advantage.

Anker and Xiaomi Technology Co. Limited are instrumental in driving growth in this industry, along with companies making power banks, mobile accessories and small household electronics. Anker has cemented a reputation as a top-tier portable charger brand with extra durability and capacity in the global e-commerce arena to boost consumer reach. Xiaomi aims to achieve cost-effective performance and strengthen its position against competitors in emerging industries.

The small group of brands like Bestek Group Ltd., Bell+Howell Products, and Brinno Inc. operate in more niche applications, such as travel electronics, portable cameras, and battery-powered lighting or small appliances. In this sense, these companies target specific consumer needs, often undertaking product innovation and, consequently, charging low prices.

Battery-powered tools and commercial devices are the domain of manufacturers oriented toward industry, such as AVK Industrial Products and C.&E. Fein GmbH, who try to emphasize reliability and power efficiency. After the increase in the demand for mobility, off-grid functionality, and green energy alternatives, competition is increasing based on battery life, portability, and compatibility across device types.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Apple Inc. | 14-18% |

| Anker | 10-13% |

| Beijing Xiaomi Technology Co. Ltd | 8-11% |

| Acer Inc. | 6-9% |

| ASUSTeK Computer Inc. | 5-7% |

| Other Key Players (combined) | 42-57% |

| Company Name | Offerings & Activities |

|---|---|

| Apple Inc. | It offers a range of battery-powered products, including iPhones, iPads, MacBooks, and AirPods, and it uses proprietary battery technology. |

| Anker | Known for power banks, portable chargers, wireless charging pads, and solar-powered battery solutions. |

| Beijing Xiaomi Technology Co. Ltd | Offers smartphones, power banks, battery-powered wearables, and smart home devices with competitive pricing. |

| Acer Inc. | Produces battery-powered laptops, tablets, and portable displays with energy-efficient designs. |

| ASUSTeK Computer Inc. | Develops gaming laptops, portable monitors, and battery-optimized hardware for performance-focused users. |

Key Company Insights

Apple Inc. (14-18%)

Leads in consumer tech with premium battery-integrated devices. Emphasizes battery performance, safety, and ecosystem integration.

Anker (10-13%)

Key leader in mobile charging solutions. Known for high-capacity power banks, rapid innovation cycles, and wide global reach.

Beijing Xiaomi Technology Co. Ltd (8-11%)

Offers cost-effective and powerful battery-enabled consumer electronics. Rapidly expanding its global footprint in mobile and smart devices.

Acer Inc. (6-9%)

Known for energy-efficient laptops and portable computing. Focuses on performance-balanced battery life.

ASUSTeK Computer Inc. (5-7%)

Strong in gaming and high-performance segments, ASUS emphasizes cooling and long battery endurance in portable hardware.

The segmentation is into nickel-cadmium, nickel-metal hydride, lithium-ion, lithium-polymer, and specialty rechargeable batteries.

The segmentation is into alkaline and zinc-carbon, lithium (primary), and other primary batteries.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is slated to reach USD 74.6 billion in 2025.

The industry is predicted to reach a size of USD 178.3 billion by 2035.

Key companies include Acer Inc., Anker, Apple Inc., ASUSTeK Computer Inc., AVK Industrial Products, Beijing Xiaomi Technology Co. Ltd, Bell+Howell Products, Bestek Group Ltd., Brinno Inc., and C. & E. Fein GmbH.

China, slated to grow at 10.3% CAGR during the forecast period, is poised for the fastest growth.

Lithium-ion batteries are being widely used.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ billion) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 5: Global Market Value (US$ billion) Forecast by Single-use Batteries, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Single-use Batteries, 2018 to 2033

Table 7: North America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ billion) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 11: North America Market Value (US$ billion) Forecast by Single-use Batteries, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Single-use Batteries, 2018 to 2033

Table 13: Latin America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ billion) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 17: Latin America Market Value (US$ billion) Forecast by Single-use Batteries, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Single-use Batteries, 2018 to 2033

Table 19: Western Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ billion) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 23: Western Europe Market Value (US$ billion) Forecast by Single-use Batteries, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Single-use Batteries, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ billion) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ billion) Forecast by Single-use Batteries, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Single-use Batteries, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ billion) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ billion) Forecast by Single-use Batteries, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Single-use Batteries, 2018 to 2033

Table 37: East Asia Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ billion) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 41: East Asia Market Value (US$ billion) Forecast by Single-use Batteries, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Single-use Batteries, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ billion) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Rechargeable Battery Technologies, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ billion) Forecast by Single-use Batteries, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Single-use Batteries, 2018 to 2033

Figure 1: Global Market Value (US$ billion) by Rechargeable Battery Technologies, 2023 to 2033

Figure 2: Global Market Value (US$ billion) by Single-use Batteries, 2023 to 2033

Figure 3: Global Market Value (US$ billion) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ billion) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ billion) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Rechargeable Battery Technologies, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Rechargeable Battery Technologies, 2023 to 2033

Figure 12: Global Market Value (US$ billion) Analysis by Single-use Batteries, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Single-use Batteries, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Single-use Batteries, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Single-use Batteries, 2023 to 2033

Figure 16: Global Market Attractiveness by Rechargeable Battery Technologies, 2023 to 2033

Figure 17: Global Market Attractiveness by Single-use Batteries, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ billion) by Rechargeable Battery Technologies, 2023 to 2033

Figure 20: North America Market Value (US$ billion) by Single-use Batteries, 2023 to 2033

Figure 21: North America Market Value (US$ billion) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ billion) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Rechargeable Battery Technologies, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Rechargeable Battery Technologies, 2023 to 2033

Figure 30: North America Market Value (US$ billion) Analysis by Single-use Batteries, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Single-use Batteries, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Single-use Batteries, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Single-use Batteries, 2023 to 2033

Figure 34: North America Market Attractiveness by Rechargeable Battery Technologies, 2023 to 2033

Figure 35: North America Market Attractiveness by Single-use Batteries, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ billion) by Rechargeable Battery Technologies, 2023 to 2033

Figure 38: Latin America Market Value (US$ billion) by Single-use Batteries, 2023 to 2033

Figure 39: Latin America Market Value (US$ billion) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ billion) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Rechargeable Battery Technologies, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Rechargeable Battery Technologies, 2023 to 2033

Figure 48: Latin America Market Value (US$ billion) Analysis by Single-use Batteries, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Single-use Batteries, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Single-use Batteries, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Single-use Batteries, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Rechargeable Battery Technologies, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Single-use Batteries, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ billion) by Rechargeable Battery Technologies, 2023 to 2033

Figure 56: Western Europe Market Value (US$ billion) by Single-use Batteries, 2023 to 2033

Figure 57: Western Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ billion) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Rechargeable Battery Technologies, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Rechargeable Battery Technologies, 2023 to 2033

Figure 66: Western Europe Market Value (US$ billion) Analysis by Single-use Batteries, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Single-use Batteries, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Single-use Batteries, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Single-use Batteries, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Rechargeable Battery Technologies, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Single-use Batteries, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ billion) by Rechargeable Battery Technologies, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ billion) by Single-use Batteries, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ billion) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Rechargeable Battery Technologies, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Rechargeable Battery Technologies, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ billion) Analysis by Single-use Batteries, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Single-use Batteries, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Single-use Batteries, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Single-use Batteries, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Rechargeable Battery Technologies, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Single-use Batteries, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ billion) by Rechargeable Battery Technologies, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ billion) by Single-use Batteries, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ billion) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ billion) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Rechargeable Battery Technologies, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Rechargeable Battery Technologies, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ billion) Analysis by Single-use Batteries, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Single-use Batteries, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Single-use Batteries, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Single-use Batteries, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Rechargeable Battery Technologies, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Single-use Batteries, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ billion) by Rechargeable Battery Technologies, 2023 to 2033

Figure 110: East Asia Market Value (US$ billion) by Single-use Batteries, 2023 to 2033

Figure 111: East Asia Market Value (US$ billion) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ billion) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Rechargeable Battery Technologies, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Rechargeable Battery Technologies, 2023 to 2033

Figure 120: East Asia Market Value (US$ billion) Analysis by Single-use Batteries, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Single-use Batteries, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Single-use Batteries, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Single-use Batteries, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Rechargeable Battery Technologies, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Single-use Batteries, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ billion) by Rechargeable Battery Technologies, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ billion) by Single-use Batteries, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ billion) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ billion) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Rechargeable Battery Technologies, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Rechargeable Battery Technologies, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Rechargeable Battery Technologies, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ billion) Analysis by Single-use Batteries, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Single-use Batteries, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Single-use Batteries, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Single-use Batteries, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Rechargeable Battery Technologies, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Single-use Batteries, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Ramps Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Portable Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Projector Market Size and Share Forecast Outlook 2025 to 2035

Portable Printer Market Size and Share Forecast Outlook 2025 to 2035

Portable Video Wall Market Size and Share Forecast Outlook 2025 to 2035

Portable Gas Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Portable Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Portable Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Portable Cannabis Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Portable Cardiology Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA