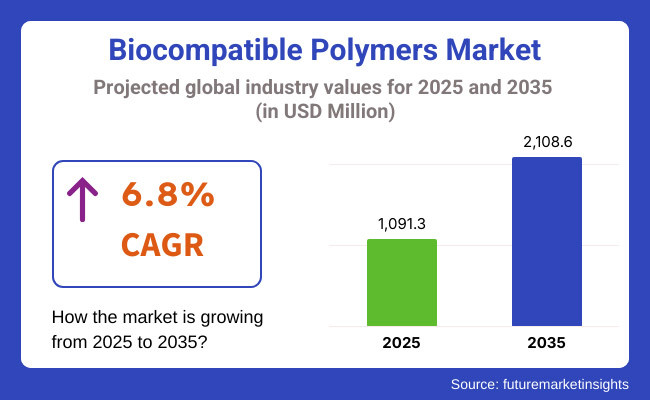

The global industry for biocompatible polymers is expected to grow to USD 1,091.3 million in 2025. The sector, with a CAGR of 6.8%, is estimated to grow at a considerable pace and reach USD 2,108.6 million by 2035.

Biocompatible polymers, either natural or synthetic, interact with tissues of the body in a harmless way and hence find extensive application in medical and dental fields as surgical implants, drug delivery vehicles, and tissue engineering scaffolds.

In 2024, the field of biocompatible polymers developed with advances in 3D bioprinting, allowing for the production of intricate tissue scaffolds for regenerative medicine. The application of AI and machine learning in polymer science maximized material properties for improved biocompatibility and drug delivery efficacy.

Looking forward to 2025, the sector will see commercialization of self-healing biopolymers that enhance implant and prosthetic longevity. Hybrid polymer-metal composites will find place in next-generation medical devices for greater durability and function.

As precision medicine forges ahead, biopolymers designed for patient-specific therapy will become popular. Increased growth in synthetic biology and biofabrication will further expand the frontiers of innovation, opening up new avenues in organ regeneration and high-end drug formulations.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Industry Growth: The industry expanded steadily in the last years, with the surging demand for drug delivery systems, surgical implants, and tissue engineering solutions. | Industry Growth: The industry is anticipated to flourish, driven by the AI-backed polymer synthesis, biofabrication, and advances polymers for regenerative medicine. |

| Technological Advancements: Heavy usage of nanopolymers for injecting drugs became more efficient in targeted therapy. | Innovations at the Edge: Development of programmable biomaterials, enabling real-time response to physiological changes will further shape the industry landscape. |

| Sustainability Initiatives: Focus was on biodegradable and bio-based polymers to minimize the medical waste and regulatory pressures. | Green Revolution: Emergence of self-degrading implants, zero-waste production methods, and closed-loop recycling of medical polymers. |

| Challenges: Prohibitive costs of production, stringent regulatory barriers, and inability to scale novel polymer uses were the major hurdles hampering the industry growth. | Industry Challenges: Crossing complex FDA/EMA regulations for AI-enabled biomaterials, cost-effective mass scaling of biofabricated solutions may pose as challenges slowing the growth pace of sector. |

| Industry Players' Strategy: Involvements with biopolymer start-ups, partnerships with biopharmaceutical companies, and incremental sector expansion. | Future Business Models: Decentralized manufacturing with bioprinters, increased cross-industry collaborations (e.g., AI, robotics, and biomaterials). |

The industry for biocompatible polymers is a part of the specialty polymers and biomaterials business, within the medical and healthcare industry. It is classified as a part of advanced materials that are applied in medicine, such as drug delivery, prosthetics, regenerative medicine, and surgical implants. This industry is closely associated with biotechnology, nanotechnology, and pharmaceutical breakthroughs.

The biocompatible polymers industry is influenced by several macroeconomic factors on a global level, including expenses of healthcare, biotech advancements, and regulatory measures. The rising global geriatric population and prevalence of chronic disease is accelerating demand for implants and drug delivery items based on biopolymers. Economic shifts towards sustainable healthcare solutions are further propelling the adoption of eco-friendly and biodegradable polymers, reducing the waste production.

In addition, the Asia-Pacific region is emerging as the dominant manufacturing hotspot with cost-efficient production and rising healthcare infrastructure, while North America and Europe are the giants in R&D and regulatory standards.

Synthetic polymers areset to lead during the 2025 to 2035 forecast period. Synthetic polymers, such as polyethylene, polypropylene, and PEEK, provide better mechanical strength, durability, and chemical resistance, and are thus the material of choice in medical devices, implants, and drug delivery systems. With a forecast CAGR of 6.5%, their leadership is fueled by continuous innovations in smart polymers, nanotechnology-based drug carriers, and self-healing biomaterials.

Biopolymers like collagen, chitosan, and alginate are becoming increasingly popular because of their biocompatibility, low toxicity, and biodegradability. Applications in regenerative medicine, tissue engineering, and wound healing are on the rise. With an emphasis on sustainability, biodegradable polymers from renewable feedstocks will find greater usage. Companies are spending money on hybrid products that use the strengths of both natural and synthetic polymers to provide more functionality while not compromising on biocompatibility.

The industry consists of several biocompatible polymers, each serving a particular medical use. Polyvinyl chloride (PVC) and polytetrafluoroethylene (PTFE) continue to be critical for catheters, surgical tubing, and vascular grafts because of their flexibility and chemical inertness. Polyethylene (PE) and polypropylene (PP) are extensively applied in medical packaging, prosthetics, and non-degradable implants, providing long-term stability.

High-strength polymers such as polyetheretherketone (PEEK) and polysulfone (PS) are increasingly finding application in orthopedic and spinal implants because of their strength-to-weight ratio and stability against bodily fluids. Polyethersulfone (PES) and poly(2-methoxyethyl acrylate) (PMEA) find extensive use in blood-contacting medical devices, inhibiting clot formation and enhancing patient recovery. Next-generation polymers with antimicrobial properties are being developed based on emerging research, which ensures improved safety in implantable and surgical applications.

The need for biocompatible polymers is gaining traction in surgical and medical devices, drug delivery, and implants. Surgical and medical devices will be a prominent segment, holding nearly 40% of the industry share by 2025, owing to the rising usage of biopolymer-based surgical sutures, catheters, and sterilization trays. Brain, cardiovascular, vascular, and cosmetic procedures are increasingly using biocompatible polymer-based devices to improve procedural success rates and minimize recovery periods.

Biocompatible polymers are transforming implants in orthopedic, cardiac, and dental uses by providing light-weighted, corrosion-inhibiting, and bioactive materials that find complete compatibility with human tissues. Orthopedic implants, among them, are seeing a dramatic rise in PEEK and titanium-coated polymer implants for their enhanced osseointegration and lesser wear and tear.

The pharmaceutical segment for drug delivery is growing at a fast rate, with biocompatible polymers facilitating targeted and long-term drug release mechanisms. Innovative polymeric nanoparticles and hydrogels are revolutionizing oncology, neurology, and treatment of chronic diseases, with personalized and minimally invasive therapy.

The United States remain the giant of the biocompatible polymer industry through its extensive research environment and high spending on healthcare. The surging demand for personalized implants and polymer-based drug delivery systems is further boosting the industry expansion,

Businesses are focusing on high-performance polymers such as PEEK and PES for orthopedic and cardiovascular applications to compliance with the regulatory standards, which are being streamlined through FDA innovations. Furthermore, advances in biofabrication and polymer innovation by artificial intelligence are fueling the industry's growth. Increased investment in biodegradable medical polymers to meet sustainability needs is transforming the nation into a green healthcare leader.

According to FMI analysis, the USA industry would expand at a CAGR of 6.9% during 2025 to 2035, backed by the growth of polymer nanomedicine and intelligent biomaterials for tailored treatments.

India's biocompatible polymer sector is witnessing fast growth on account of cheap healthcare, increased medical tourism, and fiscal support for indigenous production. Pressure to indigenize under the 'Make in India' movement is promoting local manufacture of biocompatible polymers, and reducing dependence on imports.

Growth of public-private partnerships in biomedical research is stimulating innovation in inexpensive surgical products and drug delivery systems. Surging demand for polymer prosthetics and implants in rural healthcare centers further enhances adoption. Indian biotechnology companies are making use of machine learning and artificial intelligence to design polymers, enhancing patient success.

FMI opines the Indian industry will grow at a 7.2% CAGR from 2025 to 2035, boosted by cost-effective innovation and a growing regulatory environment supporting polymer-based medical devices.

China's biocompatible polymer industry is being revolutionized by government-sponsored healthcare reforms and strategic spending on biomaterials research. The growing use of biopolymer-based drug encapsulation technologies is improving targeted therapy strategies. Drastic expansion of 3D-printed polymeric implants and tissue engineering scaffolds is putting China at the forefront of next generation regenerative medicine. The presence of major polymer producers and biotech companies creates local production opportunities of PES, PTFE, and bioresorbable polymers, lowering the dependence on imports.

Analysis of FMI suggested China's sector will expand with a CAGR of 7.0% during 2025 to 2035, thanks to advancements in technology and heightened government investments into polymer-based applications in biopharmaceuticals.

The UK biocompatible polymer industry is growing at a fast pace with a robust biomedical research infrastructure and funding for medical inventions by the government. The application of nanopolymers in long-term drug release is a prominent growth sector, with research led by universities and biotechnology companies. Encouragement towards sustainable and degradable polymer applications fits into the UK's Net Zero Strategy to minimize environmental impact from medical waste.

The UK's NHS modernization drive is also fueling demand for surgical equipment and implants based on biopolymers. FMI believes the UK biocompatible polymer industry is set to grow at a CAGR of 6.7% during 2025 to 2035, with regulatory development and greater investment in environmentally sustainable polymer solutions driving the growth.

Germany's medical biocompatible polymer industry is enhanced by its strong engineering skills and leadership in medical technology. The nation has a leading position in high-performance polymer research, notably in intelligent implants and bioresorbable surgical devices. German industry is applying automation and machine learning-based material synthesis to make polymeric medical devices more efficient. Germany is also at the forefront of polymeric scaffolds to support tissue development, a move in personalized therapy.

FMI study discovered that the German industry will expand from 2025 to 2035 at a CAGR of 6.8% under the influence of advancements in biomedical materials and growth in the ageing population demanding higher-level polymer-based therapies.

South Korea's biocompatible polymer industry is experiencing speedy advancements as a result of its robust nanotechnology and biomaterials research base. The nation is at the forefront of self-healing polymers and bioactive coatings for state-of-the-art wound healing and surgical use. The government is heavily investing in next-generation drug delivery systems, where biodegradable polymeric carriers are accelerating controlled drug release mechanisms. The growth of robot-assisted surgical procedures with polymer-based devices is also revolutionizing the healthcare sector.

FMI believes that South Korea's biocompatible polymer industry will witness growth at a CAGR of 7.1% between 2025 and 2035 due to technological innovation in smart polymers and regenerative medicine.

Japan's biocompatible polymer sector is characterized by its leadership in polymeric biomaterials and regenerative medicine. Japan is at the forefront of hydrogel-based wound healing technologies, promoting quicker recovery and lower infection risks. Japanese companies are investing in shape-memory biopolymers, which conform to physiological variations in the body, making them more effective for minimally invasive treatments. The use of biocompatible polymers in robotic surgeries is increasingly demanded, especially in microsurgery and precise medical uses.

According to FMI research, Japan's industry will increase at a CAGR of 6.9% between 2025 and 2035, driven by technological advancements and a fast-growing aging population requiring sophisticated medical materials.

France's biocompatible polymer landscape is changing with its robust emphasis on biomaterials research and sustainability activities. French biotech companies are designing advanced drug delivery systems that utilize biopolymers for sustained therapeutic effects. Polymer-based scaffolds in skin grafts and burn care are a leading area of growth.

Combination of 3D bioprinting and next-generation polymeric formulation is transforming the future of personalized medicine and organ regenerations. France's healthcare industry is increasingly adopting cardiovascular stents and prosthetics made using biopolymers for optimized treatment efficacy.

According to FMI, the French industry for biocompatible polymers is poised to witness a growth at 6.6% CAGR from 2025 to 2035 through bio-tech research and development, and the policies on medical devices with a polymeric foundation.

Italy's biocompatible polymer industry is gaining from its robust pharmaceutical and biomedical engineering industries. Italy is investing a lot in high-performance polymers for dental and orthopedic procedures, elevating biocompatibility with human tissue.

Italian research institutions are concentrating on biodegradable polymer substitutes for conventional medical plastics to minimize long-term environmental burden. The growth of electrospun nanofiber-based polymeric membranes is revolutionizing wound healing and drug delivery applications. The need for biopolymer-based anti-microbial coatings in hospitals is also ensuring infection-free surgical sites.

According to FMI analysis, Italy's biocompatible polymer industry will expand at a CAGR of 6.7% during 2025 to 2035, spurred by sustainable innovation and rising demand for personalized medical devices.

Australia and New Zealand's biocompatible polymer industry is picking up pace with growing government-supported healthcare investment and biomedical R&D innovations.

The nations are leading the world in marine-based biopolymers for regenerative medicine, presenting environmentally friendly alternatives to conventional medical plastics. Integration of bio-ink technologies in 3D bioprinting is facilitating the development of tailored tissue scaffolds and organ replicas. Studies on light-sensitive polymers are yielding advancements in ophthalmic treatment areas, especially in corneal implants and retinal implants.

FMI believes Australia & New Zealand's biocompatible polymer industry will grow at a CAGR of 6.8% during 2025 to 2035, driven by biotech innovation and eco-friendly medical solutions.

Future Market Insights (FMI) conducted an extensive survey with major stakeholders such as manufacturers, healthcare professionals, research organizations, and regulatory agencies to evaluate the changing scenario of biocompatible polymers. The survey revealed that the increasing focus on personalized medicine and targeted drug delivery is propelling polymer design innovation.

Stakeholders pointed to the rising need for bioresorbable polymers in surgical procedures, especially in orthopedic and cardiovascular implants, to minimize long-term complications. Moreover, breakthroughs in polymer chemistry are making it possible to create intelligent biomaterials with responsive drug delivery systems, further revolutionizing the sector.

The results also indicated that environmental impact and sustainability are emerging as top decision-making criteria, with a clear preference for biodegradable solutions in medical uses. Cost restrictions and strict regulatory standards continue to be major issues, particularly for mid-sized producers and startups.

Industry stakeholders called for increased interaction between medical experts and material scientists to speed up innovation and enhance product effectiveness. The survey also highlighted the increasing influence of emerging markets, where rising healthcare investments and supportive government policies are creating new growth opportunities.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The FDA governs biocompatible polymers according to the Medical Device Regulation (MDR). They have to adhere to ISO 10993 for biological testing and get 510(k) clearance or Premarket Approval (PMA) in case of high-risk uses. |

| India | The Central Drugs Standard Control Organization (CDSCO) controls biocompatible polymers applied to medical devices. Registration according to the Medical Devices Rules (MDR) 2017 is required, as well as adherence to BIS standards. |

| China | The National Medical Products Administration (NMPA) requires CFDA certification for polymers used in medicine. GB/T standards ensure stringent quality checks to ensure safety in drug delivery systems and implants. |

| United Kingdom | After Brexit, the UK Conformity Assessed (UKCA) mark has taken over from the CE mark. The MHRA guidelines and ISO 13485 are mandatory for entry into the industry. |

| Germany | The European Medical Device Regulation (MDR 2017/745) regulates polymer-based medical devices. TÜV certification is usually required for approval, with high standards of safety and performance. |

| South Korea | Medical polymers are regulated by the Ministry of Food and Drug Safety (MFDS) under the Medical Device Act. KFDA and KGMP (Korean Good Manufacturing Practice) certification is mandatory. |

| Japan | Pharmaceuticals and Medical Devices Agency (PMDA) governs approvals under the Japanese Pharmacopoeia and ISO 10993 specifications for biocompatibility. |

| France | Follows the EU MDR regulations, with mandatory CE marking to gain industry entry. ANSM (Agence Nationale de Sécurité du Médicament) follows closely the usage of medical polymers. |

| Italy | Ministry of Health implements EU MDR regulations with high emphasis on quality control and post-market monitoring of biocompatible polymers. |

| Australia-New Zealand | Medical polymers are regulated in Australia by the Therapeutic Goods Administration (TGA) and New Zealand by Medsafe, both of which require ARTG listing and compliance with ISO 13485 for performance and safety. |

The industry of biocompatible polymers presents huge opportunities for growth fueled by developments in bioresorbable materials, nanotechnology, and sustainability. Next-generation orthopedic and cardiovascular applications through biodegradable polymers improving mechanical properties and controlled degradation rate should be areas of focus for companies. Spending on nanotechnology-based polymer alterations for targeted delivery of drugs will further enhance precision in treatment and patient outcomes.

Regulatory readiness is crucial. Stakeholders need to actively interact with regulators like the FDA and EMA, maintaining alignment with changing medical standards. Executing RWE studies can facilitate smooth approvals and enhance industry confidence. Firms also need to prioritize green polymer substitutes, utilizing plant-based materials and biodegradable composites to support sustainability objectives.

To reach more sectors, localizing manufacturing in growth areas such as India and China can streamline supply chains and reduce costs. Strategic partnerships with biotech companies and AI-based material science companies will increase R&D productivity. Aligning innovation with regulatory vision and sustainability will enable stakeholders to create long-term competitiveness for the biocompatible polymers sector.

The industry for biocompatible polymers is fairly fragmented, with many players adding to its dynamic nature. Major players remain committed to innovation, strategic collaborations, and industry growth to drive their competitive status. Research and development investments target the production of sophisticated biocompatible materials that adhere to strict medical standards. Partnerships with biotechnology companies and research organizations help to advance the creation of new polymers with enhanced characteristics.

Market Share Analysis

BASF SE (15 to 20%)

BASF is a global leader in the production of biocompatible polymers, offering a wide range of materials for medical applications, including implants and drug delivery systems.

Evonik Industries AG (12-15%)

Evonik is a key player in high-performance polymers, particularly in the development of biodegradable and bioresorbable materials for medical devices.

Corbion NV (10-12%)

Corbion specializes in bio-based polymers, including polylactic acid (PLA), which is widely used in medical applications due to its biocompatibility and sustainability.

Covestro AG (8-10%)

Covestro focuses on polycarbonates and polyurethanes for medical devices, leveraging its expertise in high-performance materials.

Lubrizol Corporation (7-9%)

Lubrizol is known for its advanced polymer solutions, particularly in drug delivery systems and medical tubing.

Other Players (35-40%)

The remaining market share is distributed among smaller companies and regional players, contributing to niche applications and innovations.

Synthetic Polymer, Natural Polymer

Poly(tetrahydrofurfuryl acrylate), Poly(2-methoxyethyl acrylate) (PMEA), Polyvinylchloride (PVC), Polytetrafluoroethylene (PTFE), Polyethersulfone (PES), Polyethylene (PE), Polyetheretherketone (PEEK), Polysulfone (PS), Polypropylene (PP), Others

Surgical & Medical Instruments-(Brain Surgery, Cosmetic and Plastic Surgery, Vascular Surgery, Cardiovascular Surgery, Others), Implants-(Orthopedic, Cardiac, Dental, Others), Drug Delivery, Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, The Middle East & Africa

The industry is experiencing growth in biodegradable polymers, higher usage in drug delivery systems, and growing sustainable material innovations.

Top companies are emphasizing R&D, strategic collaborations, expansion into emerging sectors, and creating cost-efficient, high-performance polymers.

Businesses are confronted with regulatory challenges, expensive production processes, and rivalry from substitute materials with superior characteristics.

Growing demand for surgical implants, tissue engineering, and drug delivery systems with controlled release is stimulating industry growth.

Increased compliance standards for medical-grade polymers and changing environmental laws are affecting product development and production strategies.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Volume (Tons) Forecast by Region, 2018 & 2033

Table 3: Global Value (US$ Million) Forecast by by Product Type, 2018 & 2033

Table 4: Global Volume (Tons) Forecast by by Product Type, 2018 & 2033

Table 5: Global Value (US$ Million) Forecast by Polymer, 2018 & 2033

Table 6: Global Volume (Tons) Forecast by Polymer, 2018 & 2033

Table 7: Global Value (US$ Million) Forecast by Application, 2018 & 2033

Table 8: Global Volume (Tons) Forecast by Application, 2018 & 2033

Table 9: North America Value (US$ Million) Forecast by Country, 2018 & 2033

Table 10: North America Volume (Tons) Forecast by Country, 2018 & 2033

Table 11: North America Value (US$ Million) Forecast by by Product Type, 2018 & 2033

Table 12: North America Volume (Tons) Forecast by by Product Type, 2018 & 2033

Table 13: North America Value (US$ Million) Forecast by Polymer, 2018 & 2033

Table 14: North America Volume (Tons) Forecast by Polymer, 2018 & 2033

Table 15: North America Value (US$ Million) Forecast by Application, 2018 & 2033

Table 16: North America Volume (Tons) Forecast by Application, 2018 & 2033

Table 17: Latin America Value (US$ Million) Forecast by Country, 2018 & 2033

Table 18: Latin America Volume (Tons) Forecast by Country, 2018 & 2033

Table 19: Latin America Value (US$ Million) Forecast by by Product Type, 2018 & 2033

Table 20: Latin America Volume (Tons) Forecast by by Product Type, 2018 & 2033

Table 21: Latin America Value (US$ Million) Forecast by Polymer, 2018 & 2033

Table 22: Latin America Volume (Tons) Forecast by Polymer, 2018 & 2033

Table 23: Latin America Value (US$ Million) Forecast by Application, 2018 & 2033

Table 24: Latin America Volume (Tons) Forecast by Application, 2018 & 2033

Table 25: Western Europe Value (US$ Million) Forecast by Country, 2018 & 2033

Table 26: Western Europe Volume (Tons) Forecast by Country, 2018 & 2033

Table 27: Western Europe Value (US$ Million) Forecast by by Product Type, 2018 & 2033

Table 28: Western Europe Volume (Tons) Forecast by by Product Type, 2018 & 2033

Table 29: Western Europe Value (US$ Million) Forecast by Polymer, 2018 & 2033

Table 30: Western Europe Volume (Tons) Forecast by Polymer, 2018 & 2033

Table 31: Western Europe Value (US$ Million) Forecast by Application, 2018 & 2033

Table 32: Western Europe Volume (Tons) Forecast by Application, 2018 & 2033

Table 33: Eastern Europe Value (US$ Million) Forecast by Country, 2018 & 2033

Table 34: Eastern Europe Volume (Tons) Forecast by Country, 2018 & 2033

Table 35: Eastern Europe Value (US$ Million) Forecast by by Product Type, 2018 & 2033

Table 36: Eastern Europe Volume (Tons) Forecast by by Product Type, 2018 & 2033

Table 37: Eastern Europe Value (US$ Million) Forecast by Polymer, 2018 & 2033

Table 38: Eastern Europe Volume (Tons) Forecast by Polymer, 2018 & 2033

Table 39: Eastern Europe Value (US$ Million) Forecast by Application, 2018 & 2033

Table 40: Eastern Europe Volume (Tons) Forecast by Application, 2018 & 2033

Table 41: East Asia Value (US$ Million) Forecast by Country, 2018 & 2033

Table 42: East Asia Volume (Tons) Forecast by Country, 2018 & 2033

Table 43: East Asia Value (US$ Million) Forecast by by Product Type, 2018 & 2033

Table 44: East Asia Volume (Tons) Forecast by by Product Type, 2018 & 2033

Table 45: East Asia Value (US$ Million) Forecast by Polymer, 2018 & 2033

Table 46: East Asia Volume (Tons) Forecast by Polymer, 2018 & 2033

Table 47: East Asia Value (US$ Million) Forecast by Application, 2018 & 2033

Table 48: East Asia Volume (Tons) Forecast by Application, 2018 & 2033

Table 49: South Asia Value (US$ Million) Forecast by Country, 2018 & 2033

Table 50: South Asia Volume (Tons) Forecast by Country, 2018 & 2033

Table 51: South Asia Value (US$ Million) Forecast by by Product Type, 2018 & 2033

Table 52: South Asia Volume (Tons) Forecast by by Product Type, 2018 & 2033

Table 53: South Asia Value (US$ Million) Forecast by Polymer, 2018 & 2033

Table 54: South Asia Volume (Tons) Forecast by Polymer, 2018 & 2033

Table 55: South Asia Value (US$ Million) Forecast by Application, 2018 & 2033

Table 56: South Asia Volume (Tons) Forecast by Application, 2018 & 2033

Table 57: MEA Value (US$ Million) Forecast by Country, 2018 & 2033

Table 58: MEA Volume (Tons) Forecast by Country, 2018 & 2033

Table 59: MEA Value (US$ Million) Forecast by by Product Type, 2018 & 2033

Table 60: MEA Volume (Tons) Forecast by by Product Type, 2018 & 2033

Table 61: MEA Value (US$ Million) Forecast by Polymer, 2018 & 2033

Table 62: MEA Volume (Tons) Forecast by Polymer, 2018 & 2033

Table 63: MEA Value (US$ Million) Forecast by Application, 2018 & 2033

Table 64: MEA Volume (Tons) Forecast by Application, 2018 & 2033

Figure 1: Global Value (US$ Million) by Product Type, 2023 & 2033

Figure 2: Global Value (US$ Million) by Polymer, 2023 & 2033

Figure 3: Global Value (US$ Million) by Appllication, 2023 & 2033

Figure 4: Global Value (US$ Million) by Region, 2023 & 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 6: Global Volume (Tons) Analysis by Region, 2018 & 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 10: Global Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 11: Global Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by Polymer, 2018 & 2033

Figure 14: Global Volume (Tons) Analysis by Polymer, 2018 & 2033

Figure 15: Global Value Share (%) and BPS Analysis by Polymer, 2023 & 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Polymer, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by Appllication, 2018 & 2033

Figure 18: Global Volume (Tons) Analysis by Appllication, 2018 & 2033

Figure 19: Global Value Share (%) and BPS Analysis by Appllication, 2023 & 2033

Figure 20: Global Y-o-Y Growth (%) Projections by Appllication, 2023 to 2033

Figure 21: Global Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Attractiveness by Polymer, 2023 to 2033

Figure 23: Global Attractiveness by Appllication, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Product Type, 2023 & 2033

Figure 26: North America Value (US$ Million) by Polymer, 2023 & 2033

Figure 27: North America Value (US$ Million) by Appllication, 2023 & 2033

Figure 28: North America Value (US$ Million) by Country, 2023 & 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 30: North America Volume (Tons) Analysis by Country, 2018 & 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 34: North America Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 35: North America Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by Polymer, 2018 & 2033

Figure 38: North America Volume (Tons) Analysis by Polymer, 2018 & 2033

Figure 39: North America Value Share (%) and BPS Analysis by Polymer, 2023 & 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Polymer, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by Appllication, 2018 & 2033

Figure 42: North America Volume (Tons) Analysis by Appllication, 2018 & 2033

Figure 43: North America Value Share (%) and BPS Analysis by Appllication, 2023 & 2033

Figure 44: North America Y-o-Y Growth (%) Projections by Appllication, 2023 to 2033

Figure 45: North America Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Attractiveness by Polymer, 2023 to 2033

Figure 47: North America Attractiveness by Appllication, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Product Type, 2023 & 2033

Figure 50: Latin America Value (US$ Million) by Polymer, 2023 & 2033

Figure 51: Latin America Value (US$ Million) by Appllication, 2023 & 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 & 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 54: Latin America Volume (Tons) Analysis by Country, 2018 & 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 58: Latin America Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by Polymer, 2018 & 2033

Figure 62: Latin America Volume (Tons) Analysis by Polymer, 2018 & 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Polymer, 2023 & 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Polymer, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by Appllication, 2018 & 2033

Figure 66: Latin America Volume (Tons) Analysis by Appllication, 2018 & 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by Appllication, 2023 & 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by Appllication, 2023 to 2033

Figure 69: Latin America Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Attractiveness by Polymer, 2023 to 2033

Figure 71: Latin America Attractiveness by Appllication, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Value (US$ Million) by Product Type, 2023 & 2033

Figure 74: Western Europe Value (US$ Million) by Polymer, 2023 & 2033

Figure 75: Western Europe Value (US$ Million) by Appllication, 2023 & 2033

Figure 76: Western Europe Value (US$ Million) by Country, 2023 & 2033

Figure 77: Western Europe Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 78: Western Europe Volume (Tons) Analysis by Country, 2018 & 2033

Figure 79: Western Europe Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 80: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 82: Western Europe Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 83: Western Europe Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 84: Western Europe Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Value (US$ Million) Analysis by Polymer, 2018 & 2033

Figure 86: Western Europe Volume (Tons) Analysis by Polymer, 2018 & 2033

Figure 87: Western Europe Value Share (%) and BPS Analysis by Polymer, 2023 & 2033

Figure 88: Western Europe Y-o-Y Growth (%) Projections by Polymer, 2023 to 2033

Figure 89: Western Europe Value (US$ Million) Analysis by Appllication, 2018 & 2033

Figure 90: Western Europe Volume (Tons) Analysis by Appllication, 2018 & 2033

Figure 91: Western Europe Value Share (%) and BPS Analysis by Appllication, 2023 & 2033

Figure 92: Western Europe Y-o-Y Growth (%) Projections by Appllication, 2023 to 2033

Figure 93: Western Europe Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Attractiveness by Polymer, 2023 to 2033

Figure 95: Western Europe Attractiveness by Appllication, 2023 to 2033

Figure 96: Western Europe Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Value (US$ Million) by Product Type, 2023 & 2033

Figure 98: Eastern Europe Value (US$ Million) by Polymer, 2023 & 2033

Figure 99: Eastern Europe Value (US$ Million) by Appllication, 2023 & 2033

Figure 100: Eastern Europe Value (US$ Million) by Country, 2023 & 2033

Figure 101: Eastern Europe Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 102: Eastern Europe Volume (Tons) Analysis by Country, 2018 & 2033

Figure 103: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 104: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 106: Eastern Europe Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 107: Eastern Europe Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 108: Eastern Europe Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Value (US$ Million) Analysis by Polymer, 2018 & 2033

Figure 110: Eastern Europe Volume (Tons) Analysis by Polymer, 2018 & 2033

Figure 111: Eastern Europe Value Share (%) and BPS Analysis by Polymer, 2023 & 2033

Figure 112: Eastern Europe Y-o-Y Growth (%) Projections by Polymer, 2023 to 2033

Figure 113: Eastern Europe Value (US$ Million) Analysis by Appllication, 2018 & 2033

Figure 114: Eastern Europe Volume (Tons) Analysis by Appllication, 2018 & 2033

Figure 115: Eastern Europe Value Share (%) and BPS Analysis by Appllication, 2023 & 2033

Figure 116: Eastern Europe Y-o-Y Growth (%) Projections by Appllication, 2023 to 2033

Figure 117: Eastern Europe Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Attractiveness by Polymer, 2023 to 2033

Figure 119: Eastern Europe Attractiveness by Appllication, 2023 to 2033

Figure 120: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Value (US$ Million) by Product Type, 2023 & 2033

Figure 122: East Asia Value (US$ Million) by Polymer, 2023 & 2033

Figure 123: East Asia Value (US$ Million) by Appllication, 2023 & 2033

Figure 124: East Asia Value (US$ Million) by Country, 2023 & 2033

Figure 125: East Asia Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 126: East Asia Volume (Tons) Analysis by Country, 2018 & 2033

Figure 127: East Asia Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 128: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: East Asia Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 130: East Asia Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 131: East Asia Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 132: East Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: East Asia Value (US$ Million) Analysis by Polymer, 2018 & 2033

Figure 134: East Asia Volume (Tons) Analysis by Polymer, 2018 & 2033

Figure 135: East Asia Value Share (%) and BPS Analysis by Polymer, 2023 & 2033

Figure 136: East Asia Y-o-Y Growth (%) Projections by Polymer, 2023 to 2033

Figure 137: East Asia Value (US$ Million) Analysis by Appllication, 2018 & 2033

Figure 138: East Asia Volume (Tons) Analysis by Appllication, 2018 & 2033

Figure 139: East Asia Value Share (%) and BPS Analysis by Appllication, 2023 & 2033

Figure 140: East Asia Y-o-Y Growth (%) Projections by Appllication, 2023 to 2033

Figure 141: East Asia Attractiveness by Product Type, 2023 to 2033

Figure 142: East Asia Attractiveness by Polymer, 2023 to 2033

Figure 143: East Asia Attractiveness by Appllication, 2023 to 2033

Figure 144: East Asia Attractiveness by Country, 2023 to 2033

Figure 145: South Asia Value (US$ Million) by Product Type, 2023 & 2033

Figure 146: South Asia Value (US$ Million) by Polymer, 2023 & 2033

Figure 147: South Asia Value (US$ Million) by Appllication, 2023 & 2033

Figure 148: South Asia Value (US$ Million) by Country, 2023 & 2033

Figure 149: South Asia Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 150: South Asia Volume (Tons) Analysis by Country, 2018 & 2033

Figure 151: South Asia Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 152: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: South Asia Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 154: South Asia Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 155: South Asia Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 156: South Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: South Asia Value (US$ Million) Analysis by Polymer, 2018 & 2033

Figure 158: South Asia Volume (Tons) Analysis by Polymer, 2018 & 2033

Figure 159: South Asia Value Share (%) and BPS Analysis by Polymer, 2023 & 2033

Figure 160: South Asia Y-o-Y Growth (%) Projections by Polymer, 2023 to 2033

Figure 161: South Asia Value (US$ Million) Analysis by Appllication, 2018 & 2033

Figure 162: South Asia Volume (Tons) Analysis by Appllication, 2018 & 2033

Figure 163: South Asia Value Share (%) and BPS Analysis by Appllication, 2023 & 2033

Figure 164: South Asia Y-o-Y Growth (%) Projections by Appllication, 2023 to 2033

Figure 165: South Asia Attractiveness by Product Type, 2023 to 2033

Figure 166: South Asia Attractiveness by Polymer, 2023 to 2033

Figure 167: South Asia Attractiveness by Appllication, 2023 to 2033

Figure 168: South Asia Attractiveness by Country, 2023 to 2033

Figure 169: MEA Value (US$ Million) by Product Type, 2023 & 2033

Figure 170: MEA Value (US$ Million) by Polymer, 2023 & 2033

Figure 171: MEA Value (US$ Million) by Appllication, 2023 & 2033

Figure 172: MEA Value (US$ Million) by Country, 2023 & 2033

Figure 173: MEA Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 174: MEA Volume (Tons) Analysis by Country, 2018 & 2033

Figure 175: MEA Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 176: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 178: MEA Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 179: MEA Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 180: MEA Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Value (US$ Million) Analysis by Polymer, 2018 & 2033

Figure 182: MEA Volume (Tons) Analysis by Polymer, 2018 & 2033

Figure 183: MEA Value Share (%) and BPS Analysis by Polymer, 2023 & 2033

Figure 184: MEA Y-o-Y Growth (%) Projections by Polymer, 2023 to 2033

Figure 185: MEA Value (US$ Million) Analysis by Appllication, 2018 & 2033

Figure 186: MEA Volume (Tons) Analysis by Appllication, 2018 & 2033

Figure 187: MEA Value Share (%) and BPS Analysis by Appllication, 2023 & 2033

Figure 188: MEA Y-o-Y Growth (%) Projections by Appllication, 2023 to 2033

Figure 189: MEA Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Attractiveness by Polymer, 2023 to 2033

Figure 191: MEA Attractiveness by Appllication, 2023 to 2033

Figure 192: MEA Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biocompatible Materials Market Size and Share Forecast Outlook 2025 to 2035

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Cast Polymers Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Sulfone Polymers Market Growth - Trends & Forecast 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Acetal Copolymers Market Growth - Trends & Forecast 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Antiviral Polymers for Packaging Market

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Polyguanidine Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Bioresorbable Polymers Market Analysis – Size, Share & Forecast 2025 to 2035

Market Share Distribution Among Cyclic Olefin Polymers Suppliers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA